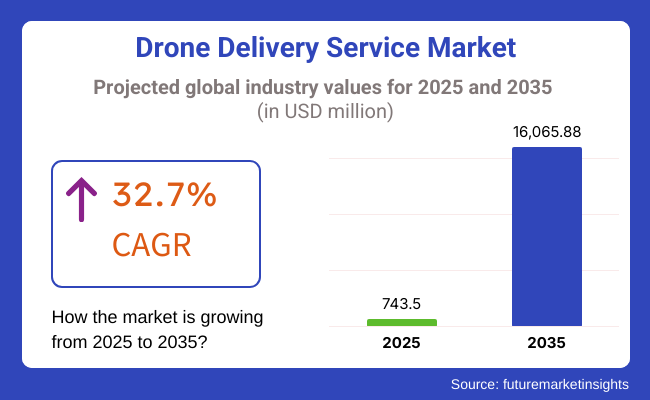

The global drone delivery service market is expected to see enormous development in the future from 2025 to 2035 based on the increasing utilization of drones within logistics, increasing advancements in drone technology, and mounting demand for faster and more economical means of transportation. The industry would increase from USD 743.5 million in 2025 to a 32.7% CAGR of approximately become worth around USD 16.07 billion in 2035.

The rising need for speed and efficiency of last-mile delivery options in metropolitan and rural areas is one of the main stimulants behind this growth. Drones are also endowed with benefits like faster delivery time, price, and access availability across challenging terrain and traffic.

The regulation of evolutionary developments and investment in drone technology is also enhancing the use of drone-based delivery solutions in a range of sectors, including eCommerce, healthcare, and emergency services. Increasing integration of AI, machine learning, and GPS technologies into drone navigation platforms is also enhancing the reliability and accuracy of the delivery solutions by drone, fastening deployment.

Companies are employing drone technology to address the last-mile delivery challenges, particularly in densely populated urban areas and far-flung rural regions. Increasing consumer interest in fast and touchless delivery services, particularly due to the COVID-19 pandemic, has fueled the growth of drone delivery services. Innovations in autonomous flight systems, batteries, and lightweight materials are improving the efficiency of flight, payload, and distance of drones.

Initial investment expenses and technical problems relating to payload carrying capacity, weather, and battery life can further limit expansion. Security and public safety concerns involving drone crashes and data privacy are some of the other factors counter to growth. However, continuous innovation in drone technology in the areas of flight stability, collision avoidance technology, and real-time data processing will counter such impediments.

Secure network-based communication and enhanced security features will also facilitate the secure and effective deployment of drone delivery services. Expansion of smart city infrastructure and development of 5G communication technology are opening up new avenues for observation of drone traffic and city delivery services.

Moreover, strategic partnerships among drone manufacturers, logistics businesses, and government agencies are fueling innovation and facilitating improved regulatory compliance. The increasing application of AI and machine learning to self-navigating and predictive repair is expected even further to enhance the reliability and efficiency of drone deliveries, putting the industry on a good growth path through the next decade.

Explore FMI!

Book a free demo

During 2020 to 2024, the industry grew at a strong growth rate, with technological advancements, a regulatory environment, and increased demand for low-cost logistics driving the industry. The COVID-19 pandemic saw an upsurge in the utilization of drone deliveries of essentials such as medical supplies, foodstuffs, and parcels from online shopping, with companies demanding contactless delivery.

Business entities such as Amazon Prime Air, Wing, and Zipline sent autonomous drones to carry light payloads across cities and rural regions. Improvements in battery life, AI navigation, and real-time monitoring enhanced the reliability and efficiency of drones. Governments such as the FAA and EASA launched guidelines for Beyond Visual Line of Sight (BVLOS) operations to allow higher-distance autonomous flight. Players in the industry resolved these by 2024 using AI-powered collision avoidance, geofencing, and quieter propulsion systems, setting the stage for further expansion.

From 2025 to 2035, drone delivery will continue to evolve with AI-powered traffic management, next-generation batteries, and autonomous fleet networks. Large drones with the capability to transport larger payloads, such as industrial equipment and emergency supplies, will become commercially available. Solid-state batteries, hydrogen fuel cells, and solar-powered power systems will support longer flight endurance and higher energy efficiency.

AI-driven air traffic control systems will manage drone movements and optimize delivery routes in real-time, linking with passenger air taxis and urban air mobility networks. Governments will create dedicated drone highways that self-manage traffic to make bulk operations available. Autonomous drone terminals will be online and store locations for deliveries under 30 minutes, and medical drones will be a lifesaver for emergency transport, with blood supplies, vaccines, and organs being transported. Sophisticated security features such as blockchain-based tracking and biometric authentication will ensure delivery integrity and confidentiality.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| BVLOS clearances, early drone regulations | Regulated drone highways, urban air mobility integration |

| AI-guided navigation, battery optimization | Hydrogen fuel cells, solar-powered UAVs, AI-powered ATM |

| E-commerce, medical supply chain delivery | Industrial logistics, autonomous drone hubs, intercity deliveries |

| Real-time tracking, geofencing | Blockchain-based package security, biometric authentication |

| Electric drones lower carbon emissions | Completely recyclable drone parts, energy-efficient engines |

| Flight optimization based on AI | Dynamic routing in real-time, predictive maintenance by AI |

| Disrupted supply chains, lower payloads | Large-scale drone production, low-cost AI-led fleets |

| E-commerce boom, contactless delivery demand | Full-scale integration of AI-powered logistics, rapid medical response networks |

The industry is experiencing significant and rapid growth, primarily due to breakthroughs in autonomous flight technology, regulatory approvals, and the rising demand for efficient last-mile logistics. E-commerce and logistics companies aim to boost customer satisfaction through the adoption of high payload capacity, speed, and adherence to aviation regulations.

The healthcare sector's primary interest is in the urgent delivery of medical supplies, which is made possible only with minimal failure, additional environmental resources, and accuracy. Wizzy Foods underscores its competitive pricing with additional incentives like quicker service, thus making cost sensitivity a crucial purchasing element.

Retailers tap into the potential of drones to make same-day delivery possible, with the main attention on autonomous navigation and scalability. In logistics and supply chain management, drones serve as the eyes and hands in stock level control and rush orders, needing in-depth coupling with navigating systems that rely on AI.

Parallelly, more and more urban areas heated with traffic issues and mistakes in customer product handling are turning to drone delivery, which is made possible by more technological advances in drone capacity, such as longer battery lives, improved security, and more efficient air traffic management systems.

| Company | Contract Value (USD Million) |

|---|---|

| Zipline | Approximately USD 30 - 40 |

| Wing (Alphabet) | Approximately USD 45 - 55 |

| Amazon Prime Air | Approximately USD 60 - 70 |

| UPS Flight Forward | Approximately USD 40 - 50 |

| DHL Express | Approximately USD 50 - 60 |

In late 2024 and early 2025, there was significant growth driven by the need for faster, more efficient last-mile logistics and the increasing emphasis on sustainability. Major players like Zipline, Wing, Amazon Prime Air, UPS Flight Forward, and DHL Express have secured pivotal contracts that underscore the industry’s commitment to integrating cutting-edge drone technology into their delivery networks, marking a transformative shift in supply chain and logistics operations.

Regulatory complications are one of the main risks of drone delivery. The stringent aviation regulations, air traffic management requisites, and operational permits, depending on the countries, throw out obstacles to mass deployment. Airspace regulations can cause service restrictions, legal fines, and operational shutdowns, thereby affecting scalability in business.

Technical limitations are also a source of risk. Low battery levels, payload, and bad weather can compromise the performance of the drone. The low-speed flight range and navigation issues of the urban environment render the reliability of drones uncertain. Firms should invest most of their capital in R&D to increase autonomy, AI-based navigation, and battery technologies, thereby increasing the cost of operations.

Public sentiment and security threats may pose obstacles to the process of adoption. The invasion of personal privacy, the possibility of the malfunction of drones, and cybersecurity risks can create resistance from consumers and regulatory bodies. The pilots that use the drone control systems may gain access to that information directly, which could result in accidental events and/or security breaches, thus making stringent cybersecurity measures and contingency planning essential for safe operations.

Cost construction is the biggest problem. High initial liabilities of a drone fleet, coupled with maintenance costs and compliance expenses, increase operation costs. The expense of insurance costs, safety features, and infrastructure building further places financial burdens. Companies will still have issues making profits at the startup level despite a lack of adequate demand and correct delivery routes, though they will be transporting goods aided by drones.

| Segment | Value Share (2025) |

|---|---|

| Close range | 43.2% |

The close range delivery segment is anticipated to dominate the global industry by accounting for 43.2% of the share in 2025 due to growing needs for ultra-fast deliveries, curbside pickups, and autonomous last-mile solutions. As hyperlocal logistics networks capable of delivering goods in mere minutes become necessary for the rising Q-commerce (quick-commerce) platforms like GoPuff, DoorDash, and Instacart, Companies are investing in every possible form of AI for better route optimization, drone deliveries, and robotic couriers stars with its autonomous ground delivery robots, which led to reduced operations costs and delivery times significantly.

Meanwhile, retailers such as Walmart and Target are scaling their micro-fulfillment centers to improve distances between them and the consumer.

In 2025, the short range delivery segment is expected to contribute 41.8% to the global share and is aided by the increasing availability of same-day and next-day shipping services. We get into detail about how the proliferation of e-commerce leaders, such as Amazon, Walmart, and Shopify, and the emergence of micro-warehouses and dark stores are creating efficiencies in short-range logistics to satisfy the consumer demand for speed and reliability.

Businesses like FedEx and UPS are adopting AI for demand forecasting, predictive analytics, and electric delivery vehicles in their quests to boost efficiency, a case in which they are reducing their carbon footprint. As urbanization and eCommerce penetration are set to keep increasing rapidly, close-range & short-distance delivery will pave the way for sustainable & fast last-mile logistics of the future.

| Segment | Value Share (2025) |

|---|---|

| E-commerce | 42.6% |

The E-Commerce segment is expected to lead and will account for 42.6% of the global share by 2025, driven by the increasing number of online shoppers, same-day delivery services, and AI-based logistics solutions. The trend is particularly obvious in the last-mile supply chain due to the growing incorporation of automated warehouses, autonomous drone deliveries, and real-time tracking technologies.

Major players, including Amazon, Alibaba, and Shopify, are pouring money into robotic fulfillment centers and autonomous delivery networks to satisfy consumers’ increasing demand for speedy and affordable shipping. Another factor caveat is that the growing direct-to-consumer (DTC) and Q-commerce (GoPuff, Instacart) are pushing further innovations on e-commerce logistic.

Increasing demand for real-time climate data for aviation, agricultural management, disaster response, and smart city planning are the major contributing factors to the high share of the Weather Monitoring segment; the segment is anticipated to account for 38.9% of the global share in 2025. IoT-based sensors, AI-based forecasting models, and robot-based weather innovation are making forecasts more accurate.

Making use of satellite-based weather monitoring systems and ground based sensor networks, governments and private organizations are working towards improve early warning systems for hurricanes, wildfires, and extreme weather events. Firms like Vaisala, The Weather Company (part of IBM), and Raytheon Technologies are at the forefront of deploying AI forecasting at scale in order to manage climate risk better and prepare for emergencies.

| Country | CAGR (2025 to 2035) |

|---|---|

| The USA | 24.8% |

| The UK | 26.5% |

| France | 25% |

| Germany | 28% |

| Italy | 23.5% |

| South Korea | 27% |

| Japan | 26% |

| China | 36.7% |

| Australia | 29% |

| New Zealand | 22% |

The USA drone delivery market is expected to grow at a CAGR of 24.8% from 2025 to 2035. Companies like Amazon Prime Air, UPS Flight Forward, and Alphabet's Wing are increasingly investing in the growth of drone deliveries. The Federal Aviation Administration (FAA) is relaxing limits on Beyond Visual Line of Sight (BVLOS) flights, which is expected to accelerate commercial mass adoption. Increasing demands for rapid e-commerce delivery and the delivery of medical supplies are compelling logistics firms to integrate drone technology into their value chain.

There is a well-established tech ecosystem in the USA. and robust government support for integrating drones. Companies such as Zipline, having delivered millions of drones, are at the forefront. Large retailing and logistics companies are also collaborating with drone service providers to provide last-mile service efficiently. Rising fuel prices and crowded city centers are placing economic and environmental pressure that is making drone delivery a cost-effective and environmentally friendly solution for logistics players.

The UK drone delivery services market will be at a 26.5% CAGR from 2025 to 2035. The government is accelerating approvals for BVLOS flights, opening doors for mass-scale drone delivery services. Firms such as Skyports and Royal Mail are experimenting with drone deliveries to enhance logistics in remote areas, especially offshore islands and far-flung regions. The UK's emphasis on carbon emission cuts in logistics has also made last-mile delivery through drones a viable option.

Technological progress and the increasing popularity of the masses towards drone logistics are fueling growth. Autonomous drone specialists such as Tekever are being capitalized to establish larger business ventures. Merging drones with routes calibrated through AI is making deliveries easier. The legal framework is evolving, with the Civil Aviation Authority (CAA) actively involved in bringing in safe management of airspace for drone flights.

The French market for drone delivery operations will expand at a CAGR of 25.0% in 2025 to 2035. The government has presented a set of regulations to ease drone logistics, such as pilot schemes for urban and suburban areas. Airbus and Delair are leading commercial drone networks. E-commerce players are funding drone delivery to cut down operational expenditures and minimize delivery times.

The nation's strong aerospace industry is also among the key growth drivers of drone technology. Smart city projects, particularly in Paris and Lyon, are integrating drones into logistics networks to enable urban mobility. Drone deliveries are also supported by the government so that the medical supply chain can deliver quickly to hospitals and pharmacies. The increasing need for green logistics solutions is compelling companies to employ drones as a green delivery solution.

The German drone delivery market is anticipated to grow at a CAGR of 28.0% during 2025 to 2035. DHL has been a leader in drone delivery in Germany, employing autonomous drones for express parcel delivery to rural areas. The government is actively supporting drone infrastructure development, with research institutions based in Berlin and Munich focusing on autonomous flight technology.

Germany's strong engineering and technological landscape is powering rapid development in drone technology. Companies like Wingcopter are developing electrically powered delivery drones with low carbon emissions. Logistics operators are adding drones to their supply networks to offset labor shortages and reduce reliance on traditional transport. Urban air mobility projects in major cities are likewise enabling fresh prospects for drone logistics.

Italy will grow at a CAGR of 23.5% between 2025 to 2035. Italy's Civil Aviation Authority has built regulations in a bid to facilitate the growth of drone-based logistics so that businesses may carry out test flights for business deliveries. Organizations such as Leonardo and FlyingBasket are producing drones, with the companies interested in cargo and emergency medical deliveries.

Italy's diverse geography, including mountainous and island regions, is driving the demand for drone logistics. Healthcare supply chains and food delivery are increasingly using drones to deliver products to remote areas. The use of AI and IoT in drone logistics is improving efficiency, and drone deliveries are becoming a viable alternative to traditional last-mile delivery channels.

South Korea is anticipated to register a growth of 27.0% CAGR through 2025 to 2035. South Korea itself is a center for automation and robotics, and Hyundai and Samsung have also heavily invested in autonomous drone delivery technology. The government has started programs that combine drones with urban air mobility projects to boost logistics efficiency.

South Korea's elevated urbanization and e-commerce penetration are propelling the need for faster and more convenient delivery. Seoul and Busan's urban smart growth is incorporating drone utilization to transport parcels to ease traffic congestion and delivery time. Changes in the regulations are also promoting the country-wide expansion of companies' use of drones.

Japan will grow at a CAGR of 26.0% from 2025 to 2035. Japan is leveraging drone technology to replace the labor shortage in the logistics industry. Companies like Rakuten and ANA Holdings are establishing drone delivery networks for rural and mountainous areas. The government is promoting the use of drones through policy reforms permitting BVLOS flights.

Japan's advanced robotics and automation sector is one of the major impetuses for developing the industry of drone deliveries. The boom in online grocery shopping and e-commerce websites is compelling logistics operators to employ drones to speed up deliveries. Tokyo and Osaka, major cities, are piloting the application of drones in city logistics networks.

China's commercial industry is anticipated to grow with a huge CAGR of 36.7% during 2025 to 2035. China enjoys a monopoly in the global scenario, and companies like DJI, JD.com, and Alibaba are making huge investments in commercial drone logistics. JD Logistics is already testing autonomous drones for last-mile delivery in rural areas, reducing delivery time significantly.

China's regulatory landscape is evolving rapidly to support drone delivery services. Govt-sponsored smart logistics and AI-driven automation projects are inducing firms to take up drones. The vast e-commerce market and strong local production capabilities for drones make China the fastest-growing industry.

Australia is projected to post a CAGR of 29.0% between 2025 and 2035. Alphabet's Wing and Swoop Aero are leading players in Australia's drone delivery, focusing on the delivery of medical supplies in addition to e-commerce parcels. Commercial approval for drone flight has been obtained from the government, enabling companies to expand operations.

Australia's vast geography and thinly populated settlements make drone delivery a practical choice to enhance logistics efficiency. Drilling and emergency services are already adopting drone technology for particular uses. Increased investment in autonomous flight technology will drive growth.

New Zealand will grow at a CAGR of 22.0% from 2025 to 2035. Testing and commercialization of drones is being actively promoted by the government, with leaders like Aeronavics propelling the growth of drone technology. New Zealand's small yet technologically sophisticated industry is compelling innovation in autonomous drone logistics.

Drone deliveries in rural and remote areas are increasing, particularly for agricultural supply chains and health products. Regulation is evolving towards commercial drone support, and therefore, New Zealand is highly appealing to operators of drone services. Green modes of delivery and low carbon footprint drive growth in New Zealand.

The drone-delivery service industry is transforming the last-mile logistics equation with faster, more efficient, and cheaper means of product delivery. The sector is growing at a rate fueled by innovation in autonomous flight ability, AI-patented routes, and various approval permits received from regulatory authorities. The giant corporations of the industry are profiting from the use of a fleet of drones to distribute medical essentials, online shopping supplies, and eating-out meals, transforming the logistical market.

Zipline has a 20-25% share as a key leader in medical supply delivery.

UPS Flight Forward (10-14%) is leading the way in drone healthcare and commercial delivery, and DHL Parcelcopter (6-10%) is testing autonomous delivery to rural areas. The remaining 30-40% belongs to the small operators and startups within the industry.

With new regulations and new technology, those providers are growing operations, creating strategic partnerships, and designing improved drone delivery services. The widespread commercial use of drones for delivery will further upset conventional logistics and make drone delivery a mainstream force in the very near future.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Zipline | 20-25% |

| Amazon Prime Air | 15-20% |

| Wing (Alphabet Inc.) | 12-16% |

| UPS Flight Forward | 10-14% |

| DHL Parcelcopter | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Zipline | Expert in medical supply drone deliveries with autonomous long-range. |

| Amazon Prime Air | Offers speedy, secure, and effective drone-based delivery for online shoppers. |

| Wing (Alphabet Inc.) | Emphasizes AI-driven route planning as well as green drone delivery solutions. |

| UPS Flight Forward | Innovates in drone logistics for healthcare and emergency-response deliveries. |

| DHL Parcelcopter | Offers automated drone parcel delivery in rural and urban regions. |

Key Company Insights

Zipline (20-25%)

Zipline dominates the medical drone delivery space with autonomous, high-altitude drones that deliver life-saving packages to isolated communities, significantly improving emergency access to healthcare.

Amazon Prime Air (15-20%)

Amazon is revolutionizing last-mile transportation with Prime Air, using high-speed autonomous drones to reduce delivery times and improve the e-commerce order customer experience.

Wing (Alphabet Inc.) (12-16%)

The wing is disrupting traditional drone logistics with AI-optimized flight and eco-friendly drone fleets that enable rapid delivery in urban and suburban environments.

UPS Flight Forward (10-14%)

UPS is leveraging drone technology to increase logistics for mission-critical shipments, especially in the healthcare industry, where speed and precision are essential.

DHL Parcelcopter (6-10%)

DHL is at the forefront of autonomous drone delivery, enhancing its ability to deliver parcels effectively to urban and rural regions and reducing carbon emissions.

Other Key Players (30-40% Combined)

These include:

The overall market size was USD 743.5 million in 2025.

The Drone Delivery Service Market is expected to reach USD 16.07 Billion in 2035.

The demand will grow due to increasing e-commerce activities, advancements in drone technology, and growing demand for last-mile delivery solutions.

The top 5 countries driving the Drone Delivery Service Market are the USA, China, Germany, Japan, and the UK.

Autonomous drone delivery and on-demand parcel delivery services are expected to command a significant share over the assessment period.

By delivery distance, the market is segmented into close range, short range, mid-range, and endurance drone.

By propellers, the market is segmented into tricopter drones, quadcopter drones, hexacopter drones, and octocopter drones.

By end user, the market is segmented into eCommerce, weather monitoring, emergency aids, and other end users.

By region, the market is segmented into North America, Latin America, Europe, Asia Pacific, and Middle East & Africa.

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Mobility as a Service Market - Demand & Growth Forecast 2025 to 2035

Infrared Sensors Market Analysis – Growth & Trends 2025 to 2035

Laser Marking Market Insights - Growth & Forecast 2025 to 2035

Laser Hair Removal Devices Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.