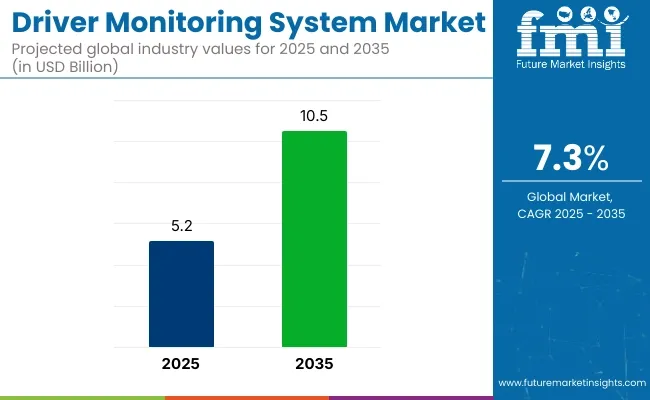

The global Driver Monitoring System (DMS) market is expected to register a CAGR of 7.3%, with its total valuation projected to rise from USD 5.2 billion in 2025 to USD 10.5 billion by 2035. Growth is being propelled by rising regulatory pressure, the escalation of road safety mandates, and a growing volume of fatigue-related traffic incidents. Driver inattention and drowsiness have continued to be cited among the top causes of critical vehicle crashes, prompting the adoption of DMS solutions across commercial fleets and passenger vehicles alike.

In 2024, Smart Eye introduced the industry’s first DMS capable of detecting alcohol impairment by analyzing real-time eye movement and behavioral patterns. The innovation was designed to trigger automated safety responses in collaboration with ADAS platforms. “This innovation brings us one step closer to eliminating preventable accidents caused by impaired driving,” stated Martin Krantz, CEO of Smart Eye, in the company’s press release.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 5.2 billion |

| Industry Value (2035F) | USD 10.5 billion |

| CAGR (2025 to 2035) | 7.3% |

Advanced image sensing technology has also been introduced by OmniVision Technologies, which unveiled a high-resolution RGB-IR global shutter sensor optimized for in-cabin monitoring under both bright and low-light conditions. The sensor has been incorporated into automotive-grade platforms for Level 2 and Level 3 autonomous vehicles to ensure consistent detection of head movement, eyelid closure, and gaze direction.

AI-based advancements were reflected in FEV Group’s launch of Cognisafe, a driver monitoring solution designed to assess cognitive and emotional states through biometric sensor fusion. Deep learning models have been applied to classify distraction, alertness, and stress levels, with OEM pilot programs initiated in both luxury and utility segments during 2024.

In India, Novus Hi-Tech developed a proprietary DMS for Eicher Trucks, aimed at enhancing commercial fleet safety through drowsiness and distraction detection. Real-time alerts were configured to be transmitted to centralized control centers for immediate response.

As global automation levels advance and human-machine interaction becomes more sophisticated, DMS adoption is anticipated to play a foundational role in minimizing human error and ensuring regulatory compliance in the next generation of intelligent vehicles.

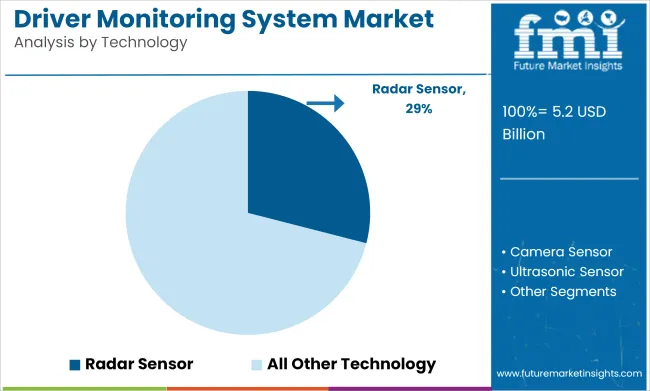

Radar sensors accounted for 29% of the global market in 2025 and are projected to grow at a CAGR of 7.8% through 2035. Adoption was supported by their critical role in adaptive cruise control, forward collision warning, and blind-spot detection systems.

In 2025, short-range and mid-range radar modules were widely integrated into mass-market and premium vehicles to meet rising safety requirements. Automakers in Europe and North America prioritized radar-based technologies to comply with regulatory mandates such as Euro NCAP and NHTSA safety assessments.

Dual and tri-mode radar configurations were increasingly adopted to improve object detection in complex driving environments. Suppliers focused on reducing form factor, power consumption, and cost, enabling broader usage across compact vehicle platforms and commercial fleets.

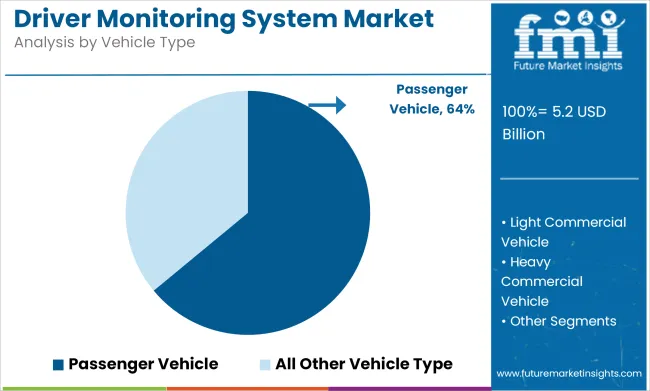

Passenger vehicles contributed 64% of the total sensor demand in 2025 and are projected to grow at a CAGR of 7.6% through 2035. Growth was driven by the increasing adoption of advanced driver assistance systems across sedans, hatchbacks, and compact SUVs. In 2025, multi-sensor fusion-including radar, camera, and ultrasonic sensors-was adopted across both ICE and electric passenger vehicle models.

OEMs prioritized feature expansion in mid-tier trims to enhance driver safety and user experience while meeting regional regulatory compliance. Sensor content per vehicle increased due to standardization of features like lane departure warning, park assist, and autonomous emergency braking. Vehicle programs across China, India, South Korea, and Germany focused on ADAS readiness, contributing to stable sensor demand within the passenger vehicle segment.

Challenge

High Implementation Costs and Integration Complexity

From another perspective, from a driver monitoring system (DMS) market, there are challenges like the high cost of implementation and complexity of integrating these systems into the vehicle. Unobtrusive driver monitoring systems, in particular, depend on advanced components like infrared cameras, facial recognition software, and other sophisticated algorithms to register driver drowsiness, distraction, or inattention.

Also, these devices considerably drive up vehicle production costs, particularly for entry-level and mid-range models, and therefore, restrict its mass adoption amongst budget-conscious consumers. In addition, automakers face a technical conundrum in how to integrate driver monitoring systems with existing infrastructure in cars.

Real-time response with precise data interpretation, its output, and alerts with minimal false positives, reducing system redundancy is essential to help improve safety for drivers.

One of the key barriers to the implementation of driver monitoring systems at scale remains the lack of uniformity in regulatory requirements across markets. Automotive manufacturers struggle to meet the diverse requirements of differing regulatory frameworks, rendering implementations of universally adopted solutions involving DMS solutions as not feasible.

Furthermore, privacy concerns regarding the collection of facial data, driver behaviour, and in-cabin surveillance have created apprehension among consumers about data misuse and cybersecurity risks, which has further constrained wide-spread adoption.

The main focus shall be on building cost-effective driver monitoring solutions that don't contribute significantly to the vehicle's overall production cost. As automakers, technology providers, and regulators work together, they can help establish standardized safety protocols and ensure that regulatory compliance is achieved.

Additionally, building consumer awareness about the potential for driver monitoring systems to save lives can also help mitigate any privacy concerns and encourage acceptance and adoption. Also, modular and scalable DMS solutions that fit into new and existing models can increase their penetration in the market and, at the same time, offer a cost-effective solution for the manufacturers.

Opportunity

Growing Adoption of Advanced Driver Assistance Systems (ADAS) and Road Safety

The growing adoption of advanced driver assistance systems (ADAS) and the increased emphasis on road safety are the factors that are creating demands for the driver monitoring system market. As the number of road accidents due to driver fatigue, distraction, and inattention increases, driver safety is being promoted by automakers and regulatory authorities as being backed by the use of driver monitoring systems.

As per global reports on road safety, driver fatigue, and distraction makeup about 30% of road accidents incurred, which has resulted in increased regulatory mandates to deploy driver monitoring systems in vehicles. This increasing focus on road safety is likely to promote the deployment of DMS in both commercial and passenger vehicles.

The increasing adoption of semi-autonomous and autonomous vehicles is another area that offers major growth opportunities as driver monitoring systems help keep human-vehicle collaboration a priority. Semi-autonomous vehicles, especially Level 2 and Level 3 cars, need to have aware monitoring on the driver to transition smoothly between human and automated driving.

With the evolution of a higher level of autonomy in vehicles, the need for sophisticated driver monitoring systems is expected to grow exponentially.

Moreover, the growing demand for driver monitoring systems is attributed to the increasing adoption of stringent safety regulations by the governments & transportation authorities. Indeed, organizations like the European New Car Assessment Programme (Euro NCAP) and the National Highway Traffic Safety Administration (NHTSA) are making the inclusion of driver monitoring systems for new car models mandatory.

Furthermore, insurance companies are using DMS solutions to lower the cost of accident-related claims, which is another factor contributing to the market's growth. We anticipate that manufacturers who focus on providing cost-effective and scalable DMS solutions as part of a broader set of tools including real time monitoring, eye-tracking, and driver behaviour analysis are likely to be successfully positioned against the competitive landscape in the future.

Hence, the United States Driver Monitoring System Market is growing significantly due to the growing demand for advanced driver-assistance systems (ADAS) and the increasing government norms to ensure better road safety. The National Highway Traffic Safety Administration (NHTSA) has been putting serious pressure on car companies to adopt driver monitoring systems (DMS) in an effort to reduce road accidents and keep drivers safe.

More details why: Leading automotive manufacturers such as Tesla, General Motors, and Ford are integrating driver monitoring systems into their vehicles to improve road safety, driving the market growth in the USA. Furthermore, the increasing adoption of electric vehicles (EVs) and autonomous vehicles is augmenting the demand for driver-monitoring systems in the country.

Increasing awareness of driver fatigue detection, distracted driving monitoring, and road safety has driven automotive manufacturers to deploy advanced driver monitoring systems in their vehicles. Moreover, the growing penetration of semi-autonomous and autonomous vehicles along with government mandates for advanced safety features are likely to fuel the growth of the market.

North America stands among the leading segments in the driver monitoring system market owing to the growing requirement for facial recognition, eye-tracking, and driver behaviour detection systems.

| Country | CAGR (2025 to 2035) |

|---|---|

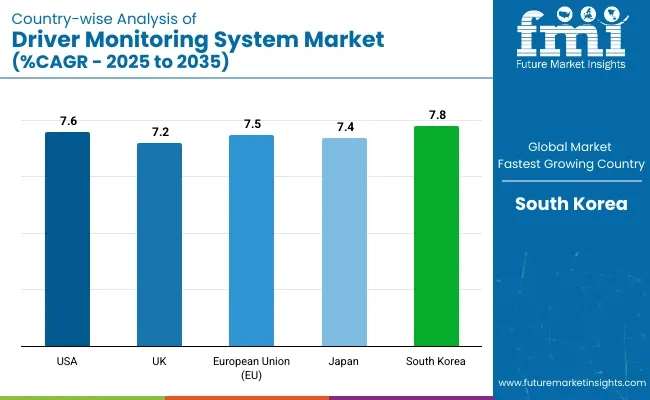

| USA | 7.6% |

The United Kingdom Driver Monitoring System Market is growing at a steady rate, prominently supported by growing government regulations to improve vehicle safety and prevent road accidents. Market demand is greatly fuelled by the enhanced driver monitoring systems mandate for all new vehicles in transit under the General Safety Regulation (GSR) laid by the European Union.

Moreover, the increasing adoption of electric vehicles and semi-autonomous vehicles in the UK has been a key factor driving the growth of driver monitoring systems. The market is expected to grow at a greater pace due to increasing vehicle safety system integrations of technologies such as DMS, by the key automotive manufacturers, including Jaguar Land Rover, Vauxhall, Nissan and so on.

Increasing focus on monitoring the fatigue, attention, and distraction levels of drivers is playing a key role in driving the demand for advanced driver monitoring systems in the UK Furthermore, demand in the market has been further driven by government-backed road safety initiatives aimed at reducing road fatalities. Furthermore, the increasing adoption of electric vehicles, along with the rising trend of connected and autonomous vehicles, are estimated to boost the demand for driver monitoring systems in the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.2% |

The European automobile sector is likely to witness significant growth due to strict vehicle safety policies. Beginning in 2024, all new vehicles will now be required to have driver monitoring systems, as part of the General Safety Regulation (GSR), which was approved by the European Commission (to increase the demand in the market).

Now, larger automotive markets such as Germany, France, and Italy are rapidly adopting driver monitoring systems to enhance road safety in an effort to eliminate fatigue-based accidents. In the EU, growth in the adoption of EVs, AVs, and high-end luxury vehicles, among others, is also contributing to the growing requirement for advanced driver monitoring systems.

Also, prominent European automakers, including Volkswagen, BMW, and Mercedes-Benz, have begun incorporating driver monitoring systems into their line-up to enhance safety and the in-vehicle experience of the driver. Among some key growth drivers for the market in the region are growing demand for eye-tracking systems, facial recognition technology, and behaviour analysis features in vehicles.

Additionally, increasing government expenditure, alongside collaborations with tech firms for the creation of advanced surveillance systems, are expected to boost the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.5% |

Several factors are driving the growth of the Driver Monitoring System Market in Japan, with a key one being the increasing need for advanced vehicle safety features, which is helped by the growing adoption for autonomous and semi-autonomous vehicles.

With an aim to reduce road accidents due to driver fatigue and inattentiveness, the Japanese government, together with leading automotive manufacturers such as Toyota, Nissan, and Honda, has been integrating driver monitoring systems. The demand for Japan advanced battery management system market is also boosted by the increasing penetration of hybrid vehicles and electro-mobility.

The rising implementation of driver attention monitors, drowsiness detectors, and real-time driver behavior monitors in vehicles has enhanced the market expansion. Moreover, the rise in the adoption of advanced driver monitoring technology for public transport, commercial vehicles, and the high-end passenger car industries has also supplemented the expansion of the market.

In addition, the safety regulations of the Japanese government, which require the use of advanced driver-assistance systems (ADAS), have also driven the demand for driver monitoring systems in the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.4% |

The South Korea Driver Monitoring System Market is on a high growth trajectory owing to the increasing demand for vehicle safety solutions and growing investments in autonomous driving technology. Other major automakers like Hyundai, Kia, and Genesis are embedding driver monitoring systems in recent models to help ensure driver safety and awareness.

Market growth has been especially bolstered by the increasing penetration of electric vehicles (EVs), and autonomous vehicles in South Korea.

There has been an increased adoption of advanced driver monitoring systems in South Korea due to the government laying more emphasis on road safety and accident fatalities. The increasing demand for semi-autonomous vehicles and features such as facial recognition, fatigue detection, and driver behaviour analysis is also pushing the market demand.

Furthermore, rising road accident rates caused by driver distraction have further propelled the demand for real-time driver monitoring systems in South Korea.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.8% |

With the rise of regulatory mandates for vehicle safety, growing demand for advanced driver assistance systems (ADAS), and increasing concerns regarding road safety, the driver monitoring system (DMS) market is growing at an unprecedented growth rate.

Driver monitoring systems help the driver stay safe and ensure the safe operation of the vehicle by keeping track of fatigue, distraction, drowsiness, or impairment of the driver via this facial recognition, eye-tracking, and behavior-monitoring technologies. The rising penetration of semi-autonomous and autonomous vehicles has boosted the growth of DMS in passenger and commercial vehicles.

DMS offerings will likely transform in essential directions for the market AI-based driver monitoring, real-time behavioural analysis and DMS integration with other advanced safety systems like adaptive cruise control and lane departure warning systems. The need for improved road safety and the reduction of accident rates has led major automotive manufacturers to join forces with DMS solution providers, which, in turn, is precisely driving the market.

Valeo S.A. (20-24%)

As a major player in the DMS market, Valeo S.A. offers highly advanced driver monitoring systems with facial recognition, drowsiness detection, and real-time driver alertness monitoring. The company also focuses on integrating DMS with advanced driver assistance systems (ADAS) for enhanced vehicle safety.

Denso Corporation (16-20%)

Denso Corporation is a leading supplier of driver monitoring systems with AI-powered technology that detects fatigue, distraction, and driver inattention. The company collaborates with major automotive manufacturers to integrate DMS into new-generation vehicles.

Bosch Group (12-16%)

Bosch offers robust driver monitoring systems that combine facial recognition, heart rate detection, and fatigue monitoring for passenger and commercial vehicles. The company is also investing in advanced driver monitoring solutions for autonomous and semi-autonomous vehicles.

Seeing Machines Ltd. (10-14%)

Seeing Machines specializes in AI-powered driver monitoring technologies designed to enhance driver safety and reduce accident rates. The company's DMS solutions are widely used in commercial fleet vehicles, heavy trucks, and passenger vehicles.

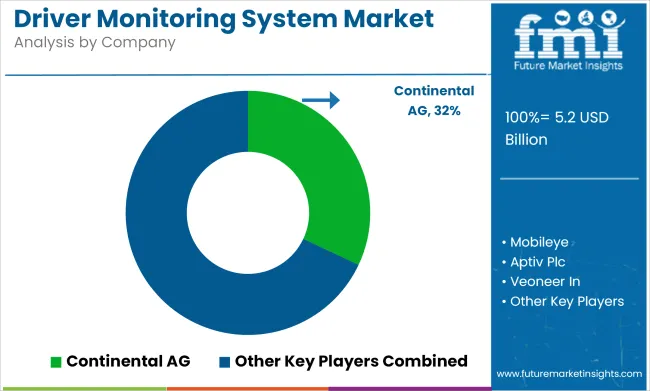

Continental AG (8-12%)

Continental AG offers advanced driver monitoring systems integrated with in-cabin monitoring, real-time drowsiness detection, and driver alertness analysis. The company also focuses on developing next-generation DMS for fully autonomous and semi-autonomous vehicles.

Other Key Players (25-35% Combined)

Several other companies are significantly contributing to the driver monitoring system market by offering AI-powered, behaviour-monitoring, and fatigue-detection solutions for vehicles. These include:

The overall market size for the Driver Monitoring System Market was USD 5.2 billion in 2025.

The Driver Monitoring System Market is expected to reach USD 10.5 billion in 2035.

The increasing focus on road safety, growing adoption of advanced driver-assistance systems (ADAS), and rising government regulations mandating driver monitoring systems in vehicles fuel the Driver Monitoring System Market during the forecast period. Additionally, the increasing integration of these systems in passenger and commercial vehicles to detect driver fatigue and distraction further accelerates market growth.

The top 5 countries driving the development of the Driver Monitoring System Market are the United States, Germany, China, Japan, and South Korea.

On the basis of application, Camera-Based Monitoring Systems are expected to command a significant share over the forecast period, driven by their ability to provide real-time driver behaviour analysis, prevent accidents caused by drowsiness or inattention, and enhance overall road safety.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA