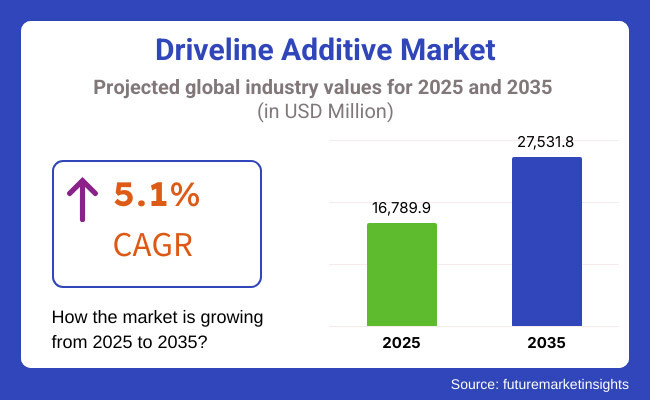

The Driveline Additive Market is projected to grow steadily over the next decade, with its value increasing from USD 16,789.9 million in 2025 to USD 27,531.8 million by 2035, reflecting a CAGR of 5.1%. Driveline additives are essential components in transmission fluids, gear oils, and axle lubricants, enhancing performance, durability, and efficiency in automotive, industrial, and off-road vehicles.

The market is driven by the rising demand for fuel-efficient vehicles, advancements in transmission technologies, and stricter emission regulations. The transition to electric and hybrid vehicles (EVs and HEVs) is shaping new opportunities for next-generation driveline additives.

The growing embrace of cutting-edge transmission systems, such as dual-clutch transmissions (DCTs), continuously variable transmissions (CVTs), and automatic transmissions, is accentuating the demand for top-notch driveline additives. These barytes increase the ability of lubricating oils to prevent wear, save thermal energy, and thus keep the vehicle in a running condition.

The automotive industry’s moving force behind the introduction of low-emission, high-efficiency lubricants is also a key factor. By conforming to the new stringent global environmental regulations, producers have started experimenting with low-viscosity lubricants along with advanced additive formulations, which aid in energy loss reduction and fuel economy enhancement.

The development of electric and hybrid automobiles is driving the demand for specialized driveline fluids with additives that tackle the problems of thermal management, oxidation resistance, and material compatibility. As the demand for electric cars sees a dramatic rise, producers are strategizing to come up with specialized additive solutions for optimal performance of the drivetrain and, in this way, are extending the life of the component.

Explore FMI!

Book a free demo

The North American driveline additive market is experiencing rapid growth owing to the soaring demand for high-performance lubricants, fuel efficiency, and environmental sustainability. The USA spearheads the region with EPA regulations pushing the manufacturers down the road of adopting low-friction and energy-efficient additives.

The embrace of electric and hybrid cars is yet again an important factor in the progression of the industry, calling for specialized driveline fluids. The off-highway vehicle industries like agricultural, mining, and construction are moving towards increasing demand for tough and heavy bearing lubricants.

But, impediments such as raw materials price volatility, environmental legislation, and complicated regulatory compliance may obstruct growth. In spite of these challenges, innovation in synthetic and bio-based driveline additives is one that will support the North American market further creating new opportunities.

Driveline additive market in Europe is characterized by strict carbon emission targets, rising EV production, and a focus on sustainable lubrication solutions. Germany, France, and the UK are at the forefront of automotive advancements, leading the development of specialized transmission fluids for electric and hybrid drivetrains.

The European Union’s environmental policies are pushing manufacturers to the limits of biodegradable and low-toxicity additives, ensuring compliance with eco-friendly lubricant standards. Although these regulations represent hurdles in reformulating driveline additives, they also foster the study of high-performance, long-lasting lubricant solutions.

As the adoption of EVs grows, the demand for thermal management and efficiency-enhancing additives will continue to expand, thus guaranteeing a sustained market growth.

Asia-Pacific is holding the title of not just the largest but also the fasted growing market for driveline additives because of certain factors such as vehicle production, industrial expansion, and the increasing rate of EV adoption. China, Japan, and India which are the dominating countries introduce automotive manufacturing hubs, and cooperate in infrastructure projects which increase the demand for advanced transmission fluids.

The surge of hybrid and electric vehicles in the market is paving the way for new generations of driveline lubricants that offer superior thermal conductivity and wear resistance. The region’s strong foothold in the construction, mining, and agricultural machinery sectors has resulted in ever-increasing demand for heavy-duty lubricant solutions.

Regardless of the fact that there have been challenges such as the supply chain disruptions and shifting environmental regulations, the ongoing research and development in driveline additives are going to keep the market on a steady growth course.

The Latin American driveline additive market is currently expanding owing to the rise in auto sales, infrastructure projects, and industrialization. Brazil and Mexico are the key players in launching the latest project such as the development of commercial vehicle lubricants, construction equipment fluids, and agricultural machinery additives.

The drive towards low carbon and high-performance lubricants has also taken the driver seat in the market as it is especially seen in industries where long-lasting transmission and gear oil additives are crucial. But, economic instability, the shifting of fuel policies, and unclear regulations result in bottlenecks in the market.

Besides these challenges, the consumers’ consciousness on fuel economy and vehicle longevity is increasing drastically which has given a push to the adoption of premium synthetic and bio-based driveline additives, thus, paving the way for a steady market development.

The Middle East & African (MEA) market is gaining traction because of the investments in the automotive, mining, and industrial sectors. Saudi Arabia and the UAE are leading the way in infrastructure and manufacturing expansions, thus, the crawling demand for high-performance driveline lubricants has increased. The distribution of the area’s harsh climate makes it critical for the manufactures to have temperature-resistant and oxidation-stable additives in their lubricants used in transmission and axle.

Nevertheless, displaced local productions and the reliance on imports create challenges for the manufacturers, in addition to the problem with environmental policies. However, with industrial diversification driven by governments and the newly found focus on the energy-efficient lubricants, there will be a significant demand for synthetic and specialized driveline additives in the upcoming years.

Environmental Regulations & Sustainability

Stricter global environmental regulations are putting heavy limits on the lubricant emissions, the chemical compositions, and the disposal practices. For example, the USA’s EPA and Europe’s ECHA regulatory bodies are limiting volatile organic compounds (VOC), heavy metals, and environmental damaging additives in driveline fluids from being used. The sustainability issues are also increasing R&D costs, as manufacturers have to reformulate the additives in order to comply with eco-friendly standards.

Moreover, the movement towards biodegradable and renewable lubricants is associated with investment in research, testing, and certification of not merely money but also human resources. Thereby, the firms that bring forth premium quality, low-impact driveline additives would have a greater share of the market in the upcoming eco-friendly and green lubricant age.

Raw Material Price Volatility

The driveline additive market is extremely sensitive to the fluctuations in the raw material prices, interests in oil, and supply chain disruptions. For instance, base oils, synthetic lubricants, and chemical additives have all been challenged by trade restrictions and the rise of production costs due to geopolitical tensions. Additionally, the COVID-19 pandemic, labor shortages, and transportation bottlenecks were added torpedoes in the middle of the supply chains, which led to a severe price instability.

Therefore, producers are searching for alternative sources of supply, whether through cost-effective synthetic formulations or supply chain optimizations to counter the price surge. Bio-based and recycled lubricant materials are being prominently used to hedge inflation and assure the sustainability of product development.

Rising Demand for Electric Vehicle (EV) Driveline Fluids

The shift of the majority of the vehicle production into electric and hybrid vehicles is creating an opportunity for the driveline additive manufacturers. The reason for the difference is that the electric vehicle (EV) driveline requires different oil types, which have additional functionalities - like thermal stability, electrical insulation, and wear protection. The exponential growth of electric vehicle manufacturers means that the demand for low-viscosity, high-performance transmission fluids is constantly on the rise.

Moreover, the breakthroughs in battery chilling technologies and braking systems that recover energy are the main drivers of innovation in next-gen driveline additives. Companies tailoring their product lines towards this sector, permitting longer drain intervals and meiri efficiency are better positioned to take advantage of this fast-growing part of the market.

The preference for synthetic and bio-based driveline lubricants is growing exponentially and this constitutes a significant market opportunity. Such lubricants are characterized by high oxidation resistance, long service life, and low environmental effects, thus they are very attractive choices for automotive and industrial applications. Additionally, long drain intervals and increased efficiency reduce maintenance costs, thus these lubricants are becoming popular in commercial fleets, heavy-duty vehicles, and industrial machines.

With sustainability issues coming to the fore, the manufacturers are embarking on the quest for the next generation of driveline additives that will improve viscosity performance, anti-wear properties, and thermal efficiency. Companies that will be successful in the integration of both bio-based additives and synthetic technologies into their products will achieve a competitive advantage in the dynamically changing lubricant market.

Manual: In the last few years, the driveline additive market has continued to grow steadily, due to the escalating demand for high-performance lubricants in automotive and industrial applications. From 2020 to 2024, the main reasons for the expansion of this market were the increase in car production, on-going emissions control, and innovation in transmission fluid technologies.

The market is expected to expand from USD 16,789.9 million to USD 27,531.8 million by 2035, which means a compound annual growth rate (CAGR) of 5.1%. Future growth will be underpinned by vehicle electrification, stricter fuel efficiency targets, and fluid formulation innovation to comply with ongoing evolving requirements in the industry.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Framework | More stringent norms for fuel efficiency and emissions are causing changes in lubricant formulations. |

| Technological Progress | Creation of the latest anti-wear and friction modifiers for internal combustion engines. |

| Sectoral Demand | High request from traditional auto categories, as well as heavy equipment. |

| Environmental Sustainability & Circular Economy | Introduction of biodegradable driveline additives. |

| Market Development Drivers | Increase in automobile production and industrial machinery sectors. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Framework | Continuation of sustainability initiatives with a priority on biodegradable and low-viscosity additives. |

| Technological Progress | Proliferation of e-driveline additives specifically designed for hybrid and electric vehicles. |

| Sectoral Demand | Growth of the electric vehicle niche along with lubricant and fluid additives. |

| Environmental Sustainability & Circular Economy | Manufacturer's formal transition to sustainability through the use of environmentally friendly raw materials and longer-lasting lubricant lifecycles. |

| Market Development Drivers | Adoption of EVs, which are f complex in the design of the transmission, and the need for better lubricants as a result are the three factors driving the growth. |

The automotive lubricants market is driven by factors such as the implementation of efficiency regulations, the rise in vehicle production, and strong aftermarket sales of automotive lubricants. The Environmental Protection Agency (EPA) has made it mandatory for the automakers to use first-grade lubricants and driveline fluids that are designed to transmit power more effectively, as such regulations on fuel economy and carbon emissions.

Moreover, electric and hybrid vehicles are becoming a significant driver in the relevant market for alternative e-axle lubricants and specialized EV transmission fluids. The industrial and heavy machinery sector is raising the use of performance additives for driveline by means of high-performance driveline additives.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.9% |

Owing to the increasing adoption of electric vehicles (EV), the strict regulations governing fuel efficiency, and the need for high-performance lubricants, the UK driveline additive market is moderately flourishing. The United Kingdom Parliament's transformative project to displace internal combustion engine (ICE) vehicles by 2035 is a strong force behind the triggering of the innovation in e-driveline fluids and advanced synthetic lubricants.

The country's target of drastically reducing carbon emissions is effectively steering the auto industry to the utilization of low-viscosity and friction-reducing additives in the transmission and axle fluids. The substantial market of the luxurious car and premium car segment is the additional reason for the parallel increase in the high-performance driveline additives demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.7% |

The European driveline additive market is on the upswing with the help of stringent EU emissions standards, innovative lubricant technologies, and robust automotive production. The new Euro 7 regulations, which are going to come into force and lower CO₂ emissions, are thus fueling the demand for high-efficiency transmission and axle lubricants.

Germany, France, and Italy are the leaders in automotive research and development and have been working on new driveline fluids for hybrid and electric powertrains. The rise of industrial automation and heavy machinery sectors is also propelling market growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.8% |

The Japanese driveline additive sector thrives chiefly because of high-tech automotive manufacturing, the growing uptake of hybrid vehicles, and the inventive lubricant technology. Intense competition in hybrid and electric vehicle production serves Japan with the necessity of specific transmission fluids as well as axle lubricants.

Mastery in high-precision engineering by the nation has been instrumental in evolving products such as friction-reducing and wear-resistant driveline additives. Besides, the induction of robotic and automated machinery is responsible for the demand of superior lubricants.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.6% |

The South Korean driveline additive market is witnessing rapid growth, fueled by the expansion of EV and hybrid vehicle production, advancements in transmission technology, and growing industrial applications. The major players in the automobile industry of South Korea, such as Hyundai and Kia, are putting lots of resources in the electrical power drive lubricants to increase efficiency and avoid friction.

On top of that, the increase in the use of machinery for industrial automation and smart manufacturing engineering is being fed by high-performance synthetic lubricants. The state refreshes the market with eco-friendly drives of motors in addition to the driveline additives first released.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

Transmission Fluid Additives Lead Due to Demand for Enhanced Performance

Transmission fluid additives are an essential component in the functioning of both automatic and manual transmissions by dealing with problems of friction, wear and heat loss. The ongoing trend towards fuel-efficient and electric vehicles (EVs) is giving an impulse to the development of the new generation of transmission fluids with better thermal stability.

North America and Europe have been recorded as the biggest markets because of the binding fuel economy and emission regulations. Whereas, the advent of EVs moving with fewer components is the long-term struggle for this section. The innovations seen in low viscosity fluids and anti-shudder additives are to be the backbone of the market.

Gear Oil Additives See Growth in Heavy-Duty and Off-Highway Applications

Gear oil additives are chemical agents used to improve the properties of the lubricant which makes it work better. Gear oil additives increase lubricity, load-carrying capacity, and oxidation-resistance in differentials, transfer cases, and manual transmissions. High-demand applications like commercial and off-highway vehicles are the strong drivers for the enabling of high-spec gear oils such as gear oil additives.

Asia-Pacific is leading this segment because of its industrial and logistics boom. The main threat to the market's progress is the protracted lifespan of applied oils and the rise of synthetic oils which refers to a set of the stay additive being consumed. Nevertheless, the emphasis on the bio-based and environmentally lubricants, which presents the opportunity for the gear oil additive firms.

Passenger Cars Drive Market Demand with Focus on Fuel Efficiency

Passenger cars take an enormous part of the driveline additive market due to the increased sales of automatic and hybrid vehicles. The strive for unnoticeable shifting, higher durability, and longer functional oil are stimulating the growth of high-quality transmission and gear oil additives. The European Union and North American Governments are allocated the lubricant tasks to the automobile manufacturers which are therefore the final push for the business.

Nevertheless, the transition to EVs having fewer and fewer transmission components things could over the time affect the market. The additive manufacturers are peering into the hybrids vehicle-complementary formulas to avoid outpacing.

Commercial Vehicles Require High-Performance Driveline Additives for Heavy Loads

Driveline additives are an integral part of business buses and trucks are very much in demand by companies today. Heavy trucks/ buses need a highly effective driveline additive to keep the optimum gear protection and the thermal stability eyes longer than other cargo. The notable improvement of the dispensing low-viscosity synthetic lubricants and the related environment impacts cause the segregation of the additives in the formulation area.

The Asia-Pacific region and North America, with their vast and handing logistics and transportation networks, exceed other regions in this aspect. The break-through formulas containing the opposite characters, wear, extrepression, and oxidation inhibitors are fundamental to retaining the growth of the market.

The Driveline Additive Market is a very important shoulder in the automotive and industry lubricants segment, heading due to the aim of making vehicles that consume less fuel, emit less, and are improved in general. Driveline additives are major components of the transmission fluids, gear oils and axle lubricants systems, providing benefits such as friction modification, wear protection, thermal stability, and oxidation resistance.

Global chemical manufacturers, as well as specialty lubricant producers comprise the leading players in the market, with the competition being focused on technological innovations, sustainability projects, and adherence to the strict emissions policies. The increase in the number of electric vehicles on the road has also caused the need for develop specialized additives for e- transmission fluids.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Lubrizol Corporation | 22-26% |

| Afton Chemical Corporation | 18-22% |

| Infineum International Ltd. | 12-16% |

| Chevron Oronite Company LLC | 8-12% |

| BASF SE | 6-10% |

| Other Companies (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Lubrizol Corporation | Global leader in driveline additives, offering anti-wear, friction modifiers, and oxidation inhibitors. Focus on e-fluid technology for EVs. |

| Afton Chemical Corporation | Specializes in high-performance additives for transmissions and axles, with a focus on fuel economy and durability. |

| Infineum International Ltd. | Joint venture between ExxonMobil and Shell, providing innovative driveline additive solutions for automatic and manual transmissions. |

| Chevron Oronite Company LLC | Supplies gear oil and transmission fluid additives, focusing on thermal stability and anti-foaming technology. |

| BASF SE | Develops next-gen driveline additives, emphasizing sustainability and low-friction formulations. |

| Other Companies | Includes regional manufacturers and niche suppliers developing cost-effective and customized additive solutions. |

Key Company Insights

Lubrizol Corporation

Lubrizol is the foremost company in the sector of driveline additives, providing; advanced anti-wear, friction modifiers, and oxidation inhibitors. Its core aim is to create low-viscosity, high-performance solutions that are not only environmentally friendly but also help increase the service life of machinery. Respectively, Lubrizol is also at the front of the line, introducing EV-specific driveline fluids facilitating the problem of electric powertrains' unique cooling and lubrication.

Its global network of production facilities, as well as its strong R&D pipeline, are the pretexts for Lubrizol's ongoing and decisive role in the innovation and development of the driveline additive sector through the establishment of strategic partnerships.

Afton Chemical Corporation

Afton Chemical is in the business of manufacturing and blending transmission and axle additives, which it sells directly to original Equipment Manufacturers (OEMs) for all cars. The company pursues a dual philosophy of economy and environmental concerns, thus it recognizes its contributions to emissions reductions and fuel savings.

The introduction of a new additive formulation has been Afton's major milestone which, among other benefits, promotes the life span and functionality of automatic transmissions. Through clear global supply chain collaborations and strong relationships with OEMs, Afton has proven to be the go-to player this year in the driveline additives trade.

Infineum International Ltd.

As a collaboration between ExxonMobil and Shell, Infineum is a powerful supplier of driveline additives, particularly for manual and automatic transmissions. Known for their cutting-edge friction-reducing technologies and oxidation inhibitors, they also provide unique formulations such as those that can extend the fluid life of the application and improve its efficiency.

Infineum is also making strides in the e-mobility domain by coming up with specific lubricants for hybrid and electric vehicles. Their global footprint, technical skills, and industry qualifications continue to place them as a major competitor.

Chevron Oronite Company LLC

Chevron Oronite has strongly established itself as the main supplier of gear oil and transmission fluid additives due to its notable thermal stability, oxidation resistance, and anti-foaming characteristics. It caters to heavy-duty applications, especially in commercial vehicles, construction equipment, and industrial machinery. Chevron Oronite is focusing on its R&D in the area of EV lubrication and aims to expand its product line with novel driveline fluids for e-transmissions.

BASF SE

BASF is one of the world's top players in manufacturing the chemicals, with a remarkable portfolio of driveline additives that stand out for their sustainability focus. Their low-friction formulations not only save energy but also help with the lifetime of the parts. BASF is also working on bio-based and synthetic additives, thus becoming an ally to environmental trends and regulations.

The global Driveline Additive market is projected to reach USD 16,789.9 million by the end of 2025.

The market is anticipated to grow at a CAGR of 5.1% over the forecast period.

By 2035, the Driveline Additive market is expected to reach USD 27,531.8 million.

The transmission fluid additives segment is expected to dominate due to increasing demand for enhanced fuel efficiency, improved thermal stability, and smoother gear shifting in modern vehicles.

Key players in the market include The Lubrizol Corporation, Afton Chemical Corporation, BASF SE, Chevron Oronite, and Infineum International Ltd.

Industrial Pipe Insulation Market Trends 2025 to 2035

Phosphate Conversion Coatings Market 2025 to 2035

Colloidal Silica Market Demand & Trends 2025 to 2035

Technical Coil Coatings Market Growth 2025 to 2035

Perfluoropolyether (PFPE) Market Size & Trends 2025 to 2035

Cold Rolling Oils/Lubricants Market Size & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.