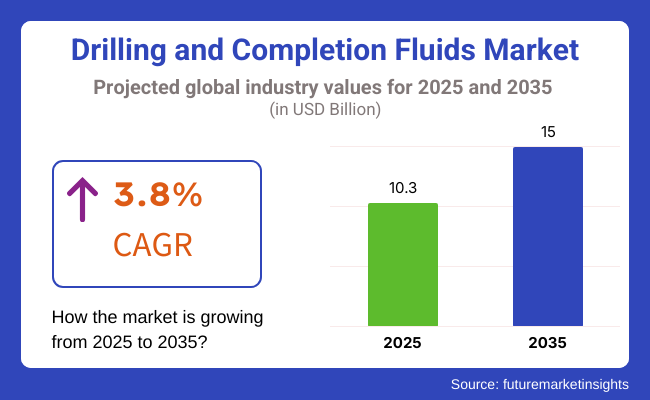

The market for drilling and completion fluids is predicted to witness substantial growth from USD 10.3 billion in the year 2025 to USD 15 billion by the year 2035 at a CAGR of 3.8% during the period of prediction. The growth is driven by increased global energy demands, development of new ultra-deep-water and deep-water drilling activities, and the significant demand for performance drilling fluid solutions.

The drilling and completion fluids market is responding to the environmental regulations relative to the environmentally green transitions in connection with the stringent regulations by mandating the least possible environmental impact.

The sector is increasing by the new drilling technologies such as horizontal drilling and managed pressure drilling (MPD), which are diminishing operational costs, and consequently, the demand for specialized fluids is going up. This rising concern about sustainability is leading the sector to research alternative materials that do not compromise the environment and keep the same performance level.

Drilling and completion fluids are mostly dependent on oil and gas exploration and production (E&P) activities. The increase in the crude oil prices along with the rise in investments in offshore drilling; especially in the Gulf of Mexico, North Sea, and the offshore drilling in Brazil, is resulting in the increased need for high-performance drilling fluids.

Even though there have been improvements, the industry has to deal with significant difficulties, particularly due to the stringent environmental regulations. Countries all over the globe are putting in place severe restrictions on oil-based drilling fluids, driving companies to put aside large amounts of money for the research and development of environmentally safe alternatives.

While water-based and synthetic-based fluids are carving their path, they tend to lack the competitiveness in terms of performance against traditional oil-based fluids. This, combined with drilling efficiency and regulatory compliance, is a contributing factor for the outcome.

Yet, the road ahead is filled with expansive spaces. The appeal for the eco-fluids has risen steadily since regulators and companies are beginning to back the usage of bio-based and biodegradable drilling fluids. The businesses that will invest money and resources in the research and development of such environmentally friendly products will be able to establish themselves as the leading companies in this aspect of sustainable drilling.

The offshore and deep-water drilling continues to spread in such areas as North Sea, the Gulf of Mexico, and offshore Africa; hence, bringing lucrative prospects to specialty fluid manufacturers. The need for the stabilization and the self-heating of the wellbore, together with contamination control is an important factor driving the adoption of advanced fluids.

Explore FMI!

Book a free demo

The drilling and completion fluids market has seen dramatic changes between 2020 and 2024 due to fluctuating crude oil prices, geopolitical tensions, and greater emphasis on environmentally friendly drilling solutions. Furthermore, advancements in water-based and synthetic-based fluids led to the demand for more environmentally friendly alternatives. Organizations have put more capital into research to enhance fluid efficiency, reduce environmental impacts, and boost stability. Automation and online monitoring have also gained momentum.

Operations are occurring more effectively and downtime has decreased. In the years 2025 to 2035, the industry will be driven by rising regulatory pressure, digital technology adoption in fluid management, and growing drilling activity in unconventional oil and gas reservoirs. Nanotechnology application in drilling fluids will improve performance and reduce costs. Sustainability and circular economy strategies will be crucial, due to which developments will take place in drilling fluids that are recyclable and biodegradable, reducing the environmental footprint.

A Comparative Landscape Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Tighter environmental regulations came into effect, compelling the industry to use lower-toxicity drilling fluids. | Governments will implement zero-discharge systems and low-carbon, biodegradable formulations. |

| Launch of high-performance products. | Predictive analytics AI, IoT-enabled sensors, and nanotechnology will lead to performance enhancement. |

| Surging demand from offshore oil & gas and shale gas operations. | Deepwater, Arctic drilling, geothermal, and CCS well growth. |

| Transition to non-toxic, biodegradable fluids, conserving freshwater use. | Complete lifecycle fluid management, closed-loop recycling, and bio-based hybrid fluids. |

| COVID-19 and geopolitical tensions disrupted raw material supply, which increased costs. | Localized production and AI-supported inventory optimization to limit risks. |

| Expansion fueled by demand for oil, deepwater search, and need for efficiency. | Future growth spurred by alternative energy drilling, sustainability, and innovation. |

Drilling Activity and Fluid Production Trends

The growth of shale, offshore, deepwater, and HPHT (high-pressure, high-temperature) wells, plays a major role in the industry need in the field of drilling and completion fluids. Shale development, with a focus on North America, has caused a significant increase in fluid consumption as a result of the high water based and oil based mud requirements of horizontal drilling and hydraulic fracturing.

Ideal synthetic-based fluids that provide thermal, shear stability, and high-pressure stability are also needed in offshore and deepwater wells. Conditions associated with HPHT wells, now widespread in areas such as the North Sea, Gulf of Mexico, and deepwater Brazil, require the use of thermal-stable fluids capable of handling the extremes of the reservoir environment and preventing wellbore instability.

Since horizontal drilling and extended-reach wells are becoming more common, there is increasing demand for lubricating and high-performance fluids that minimize torque and drag as well as provide wellbore stability through long lateral sections. Moreover, complex completion techniques including multistage fracturing, managed pressure drilling (MPD), and underbalanced drilling (UBD) are increasing the need for low-solids and high-performance water-based muds to enhance operational efficiency.

Global drilling fluid demand is being reshaped by regional shifts. The Middle East and Latin America are leading a drilling resurgence, with national oil companies (NOCs) and offshore projects propelling activity. On the other hand, North America is dealing with cost pressures and a slowdown in shale drilling as a result of capital discipline, ESG concerns, and changing oil prices affecting fluid consumption behavior.

| Key Factors | Details |

|---|---|

| Trend toward Argon and Non Circular Fluids | Trend towards low-toxicity, biodegradable, and water-based fluids supporting ESG objectives and mitigating environmental impact. |

| Requirements for Customization & Compatibility | With high-pressure, high-temperature (HPHT) and unconventional reservoirs, operators are asking for tailored-to-well fluid formulations. |

| Effect of Regulatory Compliance | Regulatory changes in fluid disposal, emissions, and how much chemical is used, drive purchasing decisions and demand for sustainable alternatives. |

| Fluid Management Technology & Digital Integration | Real-time monitoring and AI-driven fluid optimization and automated mud systems adoption are also increasing efficiency and limiting unnecessary fluid waste. |

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

| UK | 3.5% |

| European Union | 3.6% |

| Japan | 3.2% |

| South Korea | 3.4% |

The USA is the largest market for drilling and completion fluids, driven by its well-established oil & gas sector, particularly in shale exploration and offshore deepwater drilling in the Gulf of Mexico. The growing adoption of environmentally friendly water-based fluids is reshaping the industry as companies comply with strict EPA regulations.

The USA industry would continue to show stable growth following ongoing investments in hydraulic fracturing, well completions, and the growing employment of sophisticated synthetic-based fluids. FMI is of the opinion that the USA drilling and completion fluids market is set to witness 4.2% CAGR during the study period.

Growth Factors in USA

| Key Factors | Details |

|---|---|

| Shale Boom | Increased shale oil and gas exploration, especially in the Permian Basin. |

| Regulatory Support | Favorable policies supporting offshore and onshore drilling activities. |

| Technological Advancements | Development of eco-friendly drilling fluids to meet sustainability targets. |

| Increased Energy Demand | Rising domestic and industrial energy consumption driving drilling activities. |

The UK drilling and completion fluids market is driven by offshore exploration in North Sea, with severe conditions needing high-performance fluid solutions. Energy security through the government's grant of extended licenses for drilling also fuels demand for innovative completion fluids. Environmental initiatives like net-zero carbon goals also encourage operators to adopt more environment-friendly alternatives. FMI is of the opinion that the UK market is set to witness 3.5% CAGR during the study period.

Growth Factors in UK

| Key Factors | Details |

|---|---|

| North Sea Exploration | Ongoing investments in offshore drilling projects in the North Sea. |

| Government Policies | Supportive tax policies for oil & gas exploration companies. |

| Sustainability Trends | Shift towards biodegradable and water-based drilling fluids. |

| Energy Security Concerns | Efforts to reduce reliance on imported energy. |

The European Union has a blend of onshore and offshore drilling operations, and robust environmental controls influence market trends. Norway, Germany, and the Netherlands are spending on environmentally friendly drilling fluids to ensure REACH compliance. Conventional drilling operations are declining, but the increase in geothermal energy ventures is driving new demand for niche drilling fluids. FMI is of the opinion that the market in European Union is set to witness 3.6% CAGR during the study period.

Growth Factors in European Union

| Key Factors | Details |

|---|---|

| LNG and Natural Gas Expansion | Growth in liquefied natural gas (LNG) projects and natural gas exploration. |

| Stricter Environmental Norms | High adoption of low-toxicity drilling fluids. |

| Offshore Investments | Increased offshore exploration, especially in the North and Baltic Seas. |

| Green Energy Transition | Regulations pushing for eco-friendly and sustainable drilling solutions. |

Japan’s drilling and completion fluids market is relatively niche but is gaining traction due to investments in geothermal energy and offshore methane hydrate extraction. The government’s push for energy self-sufficiency has resulted in the adoption of high-tech drilling fluids designed for deep-sea exploration. Japan’s market remains highly regulated, emphasizing eco-friendly and low-toxicity drilling solutions. FMI is of the opinion that the Japanese market is set to witness 3.2% CAGR during the study period.

Growth Factors in Japan

| Key Factors | Details |

|---|---|

| Limited Domestic Reserves | Heavy investment in deep-sea drilling and gas hydrate exploration. |

| Technological Innovations | Advanced drilling techniques and fluid technologies. |

| Energy Diversification | Strategic shift towards domestic oil & gas sources. |

| Government Support | Policies promoting local energy security and exploration. |

South Korean market is expanding, supported by offshore energy projects and the government's interest in deep-sea natural gas hydrates exploration. The country is advancing LNG import alternatives by developing its own energy resources, leading to an increased need for high-performance drilling fluids.

Additionally, offshore wind farm foundation drilling presents a new market segment for specialized completion fluids. FMI is of the opinion that the South Korean drilling and completion fluids market is set to witness 3.4% CAGR during the study period.

Growth Factors in South Korea

| Key Factors | Details |

|---|---|

| Offshore Exploration | Expanding deep-sea oil & gas projects. |

| LNG and Gas Hydrate Projects | Government-backed initiatives for unconventional energy sources. |

| Industrial Demand | High demand for energy from manufacturing and heavy industries. |

| Technological Advancements | Investments in high-performance drilling fluids. |

Water-Based Drilling Fluids Due to their environmental friendly nature and would be low cost, water based drilling fluids are the most used. Water-based fluids, which contain mostly water with chemicals to improve their efficacy, are the most common choice in areas including North America and Europe, where stringent environmental rules help reduce pollution risks from drilling operations. Innovations in water-based fluids have performed well while complying with ecological standards under difficult drilling conditions.

The net benefit of these fluids is substantial, such as their lower management and disposal costs due to their relatively lower toxicity, leading to safer working and environmental exposure. Water-based fluids are predicted to continue to be the most significant market segment as interest in sustainable drilling technology grows globally. Long-term dominance will be ensured by improved performance measures from newer formulation technologies.

Drilling in high-pressure, high-temperature (HPHT) conditions often requires the use of oil-based fluids, as water-based fluids may lack the necessary properties. These fluids have outstanding lubrication properties, which minimizes the wear and tear on equipment, and they remain stable over a broad band of temperatures, making them ideal for deep water and extended-reach drilling projects. Consequently, due to the harsh environment in offshore drilling locations, including the Gulf of Mexico and the Middle East, oil-based fluids are widely used.

But the use of oil-based fluids comes with issues around contamination and disposal, which are subject to regulation. To address environmental issues, companies are investing more in better treatment and recycling technologies. However, in technically demanding drilling operations where the advantages of oil-based fluids outweigh the environmental disadvantages, demand for such fluids is anticipated to remain stable.

Onshore drilling operations often face heterogeneous geological formations and fluids, which are used to prevent wellbore failure, stabilize formations, aid in cutting transport to surface, and improve drilling efficiency and safety.

Onshore wells are often drilled in extreme environments, including deserts, mountainous regions, and shale deposits. Drilling fluids cool and lubricate the drill bits, reducing wear and tear and increasing penetration rates. However, completion fluids also play an important role in optimizing reservoir productivity, minimizing formation damage, and sustaining wellbore stability during well production. The trend towards the recovery of unconventional oil and gas, like tight oil and shale during onshore operations, reinforces the demand for advanced drilling and completion fluids.

The use of drilling and completion fluids is crucial in offshore oil and gas exploration, where the combination of severe environmental conditions and complex well architecture necessitates advanced fluid management techniques. These offshore wells often include HPHT, Deepwater, and difficult drilling fluid applications, making drilling fluids vital to creating and ensuring wellbore stability, cooling and lubricating drill bits, and managing pressure fluctuations in different formations. These fluids also enable the efficient cleaning of drill cuttings, which is key to maintaining drilling efficiency and operational safety in deep water and ultra-deep water environments.

These offshore drilling operations are often located in difficult environments, like subsea formations and difficult oceanic conditions. Drilling fluids in these settings need to resist high salinity, temperature variations, and geological unease, with minimal influence on the environment. Similar to their role onshore, completion fluids are essential to achieving optimal reservoir performance while reducing formation damage and sustaining wellbore stability in offshore environments.

One of the highly competitive markets is that of drilling and completion fluids. All major industry players compete on different growth strategies in order to gain prominence in the market. The main companies involved in the market include Schlumberger Limited, Halliburton Company, Baker Hughes Company, National Oilwell Varco (NOV Inc.), and Weatherford International Plc. These firms are involved in expansion of their product portfolios as well as forging strategic partnerships and mergers and acquisitions to develop strong standings in the market.

As per instance, Schlumberger, which rebranded as SLB in 2022, has been concerned with strategic acquisitions and joint ventures that expand its technological capabilities. In 2023, SLB welcomed another acquisition in the form of Gyrodata Incorporated, thus beefing up its wellbore positioning and survey technology offerings. SLB has also made a joint venture with Aker Solutions and Subsea 7 in 2022, all aimed at delivering integrated subsea solutions.

Additionally, Baker Hughes has also grown through acquisitions; among these includes the Compact Carbon Capture acquisition in 2020 to drive its energy transition strategy and the 2021 establishment of a joint venture with Akastor ASA's subsidiary, MHWirth AS, to provide global offshore drilling solutions. Such initiatives create innovative maps for expansion down the drilling and completion fluids market through which the companies committed resources.

The sales are poised to be worth USD 10.3 billion in 2025.

The market is predicted to reach a size of USD 15 billion by 2035.

Some of the key companies include Baker Hughes, CES Energy Solutions Corp., Global Drilling Fluids & Chemicals Limited (GDFCL), Halliburton, National Oilwell Varco, Inc., Newpark Resources, Inc., Q'Max Solutions Inc., Sagemines, Schlumberger Ltd., Scomi Group Bhd, Secure Energy Services Inc., Tetra Technologies, Inc., and Weatherford International Ltd.

The USA is set to expand at 4.2% CAGR during the study period and is expected to generate lucrative opportunities for companies.

By fluid system, the segmentation is as water-based, oil-based, synthetic-based, and other fluid systems.

By application, the segmentation is as on-shore and off-shore.

By region, the market is divided into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Road Marking Paint Market - Trends & Forecast 2025 to 2035

Nonwoven Polyester Fabric Market Growth – Trends & Forecast 2025 to 2035

Battery Materials Market: Growth, Trends, and Future Opportunities

Amidoamine Market Trend Analysis Based on Product, End-Use, and Region 2025 to 2035

Algaecides Market Assessment and Forecast for 2025 to 2035

Asia Neopentyl Glycol (NPG) Market Analysis and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.