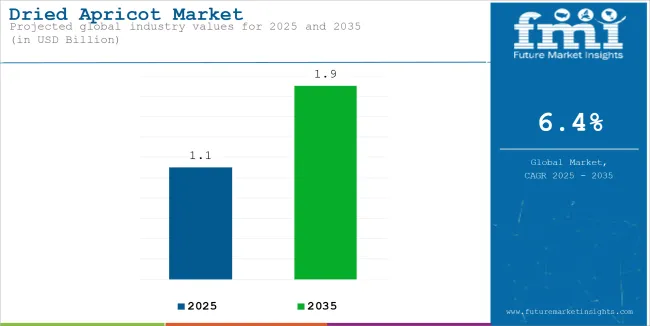

The dried apricot market is estimated to reach USD 1.1 billion by 2025. It is set to rise at a CAGR of 6.4% during the assessment period 2025 to 2035 and reach USD 1.9 billion by 2035.

| Attributes | Description |

|---|---|

| Estimated Dried Apricot Market Size (2025E) | USD 1.1 billion |

| Projected Dried Apricot Market Value (2035F) | USD 1.9 billion |

| Value-based CAGR (2025 to 2035) | 6.4% |

Dried apricots are made by drying fresh apricots and they have a sweet and slightly tart flavor. They make a great on-the-go snack and can be added to muffins, cookies, and cakes. They can also be used in savory dishes such as tagines and stews.

The surging demand for nutritious and delicious snacks along with the wide availability of a broad range of products driven by huge working class population is augmenting market growth.

Growing Innovations in Conventional Dried Apricots to Boost Demand

| Attributes | Details |

|---|---|

| Top Product | Conventional Dried Apricots |

| Market Share in 2025 | 61.5% |

Based on product, the market is divided into conventional dried apricots and organic dried apricots. The conventional dried apricots segment is expected to hold 61.5% market share in 2025.

Conventional dried apricots have a lower cost as compared to organic apricots and are widely available in many supermarkets and hypermarkets easily. Additionally, they have a longer shelf life due to high processing. Moreover, growing innovations in this type of apricots is further fueling their demand.

Wide Availability of Supermarkets/Hypermarkets to Impel Sales

| Attributes | Details |

|---|---|

| Top Distribution Channel | Supermarkets/Hypermarkets |

| Market Share in 2025 | 45.2% |

Based on distribution channel, the market is divided into supermarkets/hypermarkets, online, convenience stores, and others. The supermarkets/ hypermarkets segment is poised to capture 45.2% market share in 2025.

These stores offer a wide range of dried apricots at affordable rates. Additionally, bulk buying in these stores helps buyers get the benefits of huge discounts and even free products. Moreover, the expansion of supermarket and hypermarket chains in big cities is also contributing to the growth of the segment.

Versatility of Whole Dried Apricots to Bolster their Demand

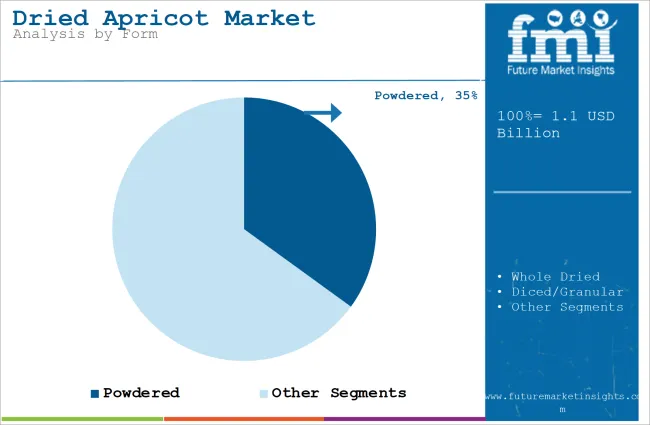

Based on form, the market is divided into powdered, whole dried, and diced/granular. Whole dried apricots are a popular and versatile snack and they preserve the natural shape and presence of the fruit, making them visually attractive.

They can also be added to salads baked goods, or even used in savory dishes. Additionally, they are a good source of fiber, potassium, vitamins A and C, and antioxidants. They are easy to store and transport, making them a convenient snack option.

| Regulation Area | Relevant Authorities/Standards |

|---|---|

| Food Safety Standards | FDA (USA), FSSAI (India), EFSA (Europe), Codex Alimentarius |

| Pesticide Residue Limits | EPA (USA), EU MRL Standards, Codex Alimentarius |

| Organic Certification | USDA Organic (USA), EU Organic, India Organic |

| Labeling Requirements | FDA (USA), FSSAI (India), EU Food Labeling Laws |

| Export/Import Regulations | WTO-SPS Agreement, Customs Authorities, Export Inspection Agencies |

| Additives & Sulfite Levels | FDA (USA), (Europe), FSSAI (India) |

| Environmental Standards | Environmental Protection Agencies (local/national) |

| Fair Trade Certification | Fairtrade International |

Innovations in Dried Apricot Processing & Packaging to Spur Sales

Recent advancements in processing and packaging have emphasized enhancing quality, safety, and sustainability. Composite biopolymer hydrogels have been made by researchers, which are obtained from edible oil by-products, including pumpkin oil cake, coated with paraffin wax.

Water sensitivity can be decreased by this advanced material and it considerably minimizes water vapor transmission rates, which makes it feasible for packaging dried apricot slices under modified environments.

Moreover, modified atmosphere packaging has also been used to preserve the quality of apricots. This type of packaging helps slowdown respiration rates and delays spoilage by making adjustment in the carbon dioxide and oxygen levels within the packaging.

It has also been revealed in some studies that biodegradable films in MAP have the potential to retain the overall quality, firmness, and color of apricots during storage, providing an eco-friendly option to conventional plastic materials.

Thus, these efforts are in line with the growing legislative pressures and consumer awareness of decreasing plastic waste, leading to a more sustainable food packaging sector.

Impact of Climate Change on Dried Apricot Production

Apricot production has significantly been influenced by climate change, especially in locations including Malatya, Turkey, a key apricot-producing region. Recent years have also witnessed extreme weather events, such as heavy rains and droughts, which have resulted in quality issues such as losses of fresh fruit, leading to prolonged upheavals in supply chains.

Moreover, apricot yields have been impacted by the El Niño-Southern Oscillation (ENSO) phenomenon, which led to variability in the production of apricots. This creates hurdles for growers in maintaining and planning constant yield.

Exports and farmers have also witnessed economic issues owing to these issues caused by the climate. To curb the effects of such issues, stakeholders are focusing on strategies, including advanced agricultural practices, climate-resilient apricot varieties, and more. These strategies strive to boost the resilience of apricot production systems.

Rising Safety Concerns in Dried Apricots May Limit Uptake

A considerable issue for exporters and growers of the product is the presence of pesticide residues in dried apricots. These residues come from the usage of pesticides during cultivation, which may stay in the fruit even after drying.

Thus, many importing bodies, including the EU implement tightening Maximum Residue Limits to make sure that pesticide levels in imported food products do not present a risk to human health.

The negligence or non-adherence to these standards can result in critical results, such as financial losses, rejected shipments, and even reputational damage to exporters. Citing an instance, in 2022, many shipments of dried apricots from Turkey, faced rejections in EU nations owing to the presence of pesticide residues beyond permissible limits.

India

India is poised to grow at a CAGR of 9.6% from 2025 to 2035. The growing number of health-conscious consumers in urban regions has impelled the demand for organic and premium varieties of dried apricots in India.

Additionally, this product is being widely consumed as a traditional snack and used in various desserts. However, supply chain issues, such as tighter quality checks and rising import duties have lately influenced the availability of the product.

China

China is slated to expand at a CAGR of 8.3% during the study period. The country’s dried apricot market is growing due to increased health awareness and the inclusion of dried fruits in traditional medicine and snacks.

There is a finite domestic production, which results in considerable imports from Central Asia and Turkey. Additionally, value-added products are being innovated by regional brands. However, recent restrictions on import owing to the presence of pesticide residues have influenced trade, compelling suppliers to comply with tighter quality standards.

Italy

Italy’s dried apricot market is impacted by its culinary traditions, with apricots used widely in desserts and snacks. Turkish imports lead the market, though there is a surging demand for non-sulfurized and organic varieties.

Moreover, local production in southern Italy serves niche markets but cannot cater to the demand throughout the nation. Italian importers are being compelled by tighter EU pesticide regulations to obtain from certified suppliers, adhering to standards and maintaining stability in the market.

Canada

The demand for plant-based and nutrient-dense foods has increased sales of dried apricots in Canada. Health-conscious people have taken up dried apricots in their diets because of their fiber and vitamin content.

The major supplier is Turkey, but importers to Canada are having a tough time due to stringent pesticide residue standards akin to those of the EU. Retailers like Loblaw's and Sobeys sell dried apricots as part of their organic product lines, thereby increasing market penetration.

USA

The USA continues to be one of the top exporting markets for dried apricots, driven by surging demand for more convenient and healthier snack alternatives. The products mainly in demand include organic and sulfur-free dried apricots owing to rising consumer awareness of clean-label products.

Additionally, imports from Turkey continue to dominate the market and domestic companies in California are gaining momentum. Despite this, upheavals in supply chains and tighter regulations on pesticide residues have influenced imports.

Established players in the dried apricot market emphasize heavily maintaining supply chain stability and ensuring compliance with evolving regulatory standards, including the EU's stringent pesticide residue limits.

Companies such as Anatolia and ZIBA Foods are investing in organic certifications and innovative processing technologies to cater to the increasing demand for clean-label products. Additionally, these players leverage their vast distribution networks and partnerships with global retailers to dominate high-value markets such as the USA, EU, and Japan.

| Established Players | Startups |

|---|---|

| Anatolia Dried Fruit | Nature’s Glory Foods |

| ZIBA Foods | Apricot Labs |

| Sun-Maid Growers of California | Dried Delights Co. |

| Mariani Packing Co. | Fresh Apricot Organics |

| Bergin Fruit and Nut Company | Green Apricot Innovations |

Startups such as Nature's Glory Foods and Apricot Labs are setting the market ablaze with advanced providing, such as flavored dried apricots, premium packaging, and the practice of sustainable sourcing. It usually targets niche segments of vegan or health-conscious consumers that also focus on direct-to-consumer sales through e-commerce platforms.

Mergers and acquisitions have also played a role in shaping the competitive landscape. Major players have acquired smaller organic-emphasize brands to diversify their product portfolios and enter new markets. Turkey-based companies have partnered with local producers in emerging markets such as India and China to strengthen their foothold and mitigate export risks posed by stricter regulations in developed economies.

Additionally, innovation continues to be the building block for growth. Innovative products, for example, from established companies include apricot snack bars, apricot blends with nuts, and sugar-free to meet the current consumer trends. Research and development investments in technologies related to sustainable farming and processing help companies stay competitive globally in an environment of rising regulatory pressures.

In terms of product, the dried apricot market is segmented into organic dried apricots and conventional dried apricots.

In terms of form, the market is segmented into powdered, whole-dried, and diced/granular.

In terms of distribution channel, the market is segmented into online, supermarkets/hypermarkets, convenience stores, and others.

In terms of region, the market is divided into Asia Pacific, Europe, North America, Latin America, and the Middle East & Africa.

The market is predicted to reach a size of USD 1.9 billion by 2035.

The market size is poised to reach USD 1.1 billion in 2025.

The prominent companies in the market include King Apricot, Bata Food, Kenko Corporation, and others.

Supermarkets/hypermarkets are the leading distribution channels for dried apricots.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dried Baby Food Market Size and Share Forecast Outlook 2025 to 2035

Dried Herbs Market Size and Share Forecast Outlook 2025 to 2035

Dried Honey Market Size and Share Forecast Outlook 2025 to 2035

Dried Soup Market Size, Growth, and Forecast for 2025 to 2035

Dried Spices Market Analysis by Type, End-Use Industry, Distribution Channel and Others Through 2035

Dried Spent Grain Market Trends – Growth & Industry Forecast 2025 to 2035

Dried Eggs Market Insights – Shelf-Stable Nutrition & Industry Growth 2025 to 2035

Dried Mushrooms Market Analysis – Trends & Forecast 2024-2034

Dried Distillers' Grains with Soluble Market

Air-dried Venison Dog Food Market Size and Share Forecast Outlook 2025 to 2035

Air-dried Fish Dog Food Market Size and Share Forecast Outlook 2025 to 2035

Air-dried Chicken Dog Food Market Size and Share Forecast Outlook 2025 to 2035

Air-Dried Food Market Growth, Forecast, and Analysis 2025 to 2035

Roll-dried Starch Market Size and Share Forecast Outlook 2025 to 2035

Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Spray Dried Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Freeze Dried Fruit Powder Market Size and Share Forecast Outlook 2025 to 2035

Rolled-Dried Starch Market Size and Share Forecast Outlook 2025 to 2035

Freeze-dried Food Market Analysis - Size, Growth, and Forecast 2025 to 2035

Freeze Dried Fruits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA