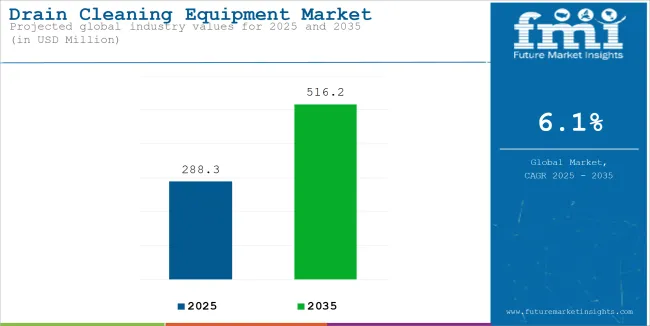

The global sales of Drain Cleaning Equipment are anticipated to reach USD 271.7 million by 2024, with a growing demand increase from end users at 6.1% CAGR over the forecast period. The market value is forecast to grow from USD 288.3 million in 2025 to USD 516.2 million by 2035.

Drain cleaning equipment includes a range of practical tools and machines designed to keep pipes and drains clear of blockages. Whether for a home, a business, or a city’s sewer system, these tools are essential for ensuring water flows smoothly and avoiding plumbing headaches.

The smaller tools, like manual and electric augers- commonly known as plumbing snakes-are used within the home to handle the normal, everyday type of clogs in sinks or showers. The motorized drain augers operate with more power and are very good with removing blockages that are larger in size; a high-pressure water jetter just blows off grease, sediment, and other hard-to-remove materials with water.

| Attributes | Key Insights |

|---|---|

| Market Value, 2024 | USD 271.7 Million |

| Estimated Market Value, 2025 | USD 288.3 Million |

| Projected Market Value, 2035 | USD 516.2 Million |

| Market Value CAGR (2025 to 2035) | 6.1% |

Another handy tool, the sewer inspection camera, is attached to a flexible cable that goes down the pipes, allowing plumbers to locate clogs or damage visually-making it much easier to pinpoint problems. There are also kinetic water rams that use a burst of compressed air to free the clog, and drain rods, which work well for blockages near the drain opening. And for an entirely organic course of action, enzyme-based cleaners actually digest the organic material that lines the pipes and helps prevent future blockages.

This equipment is increasingly popular because urban growth and new infrastructure mean more demand for reliable sanitation and drainage. With the rise in technology, even some of these tools have AI features, making drain maintenance easier and more precise. Leading companies in the market are constantly innovating to create more effective, environmentally friendly tools for both everyday homeowners and large-scale public projects.

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global Drain Cleaning Equipment market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

The below table presents the expected CAGR for the global Drain Cleaning Equipment sales over several semi-annual periods spanning from 2024 to 2034. In the first half (H1) from 2024 to 2034, the business is predicted to surge at a CAGR of 5.7%, followed by a slightly higher growth rate of 6.1% in the second half (H2).

| Particular | Value CAGR |

|---|---|

| H1 | 5.7% (2024 to 2034) |

| H2 | 6.1% (2024 to 2034) |

| H1 | 5.8% (2025 to 2035) |

| H2 | 6.4% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 5.8% in the first half and remain relatively moderate at 6.4% in the second half. In the first half (H1) the market witnessed an increase of 10 BPS while in the second half (H2), the market witnessed an increase of 30 BPS.

This section below examines the value shares of the leading segments in the industry. In terms of Product Type, the power tools category will likely dominate and generate a share of around ~43% in 2024.

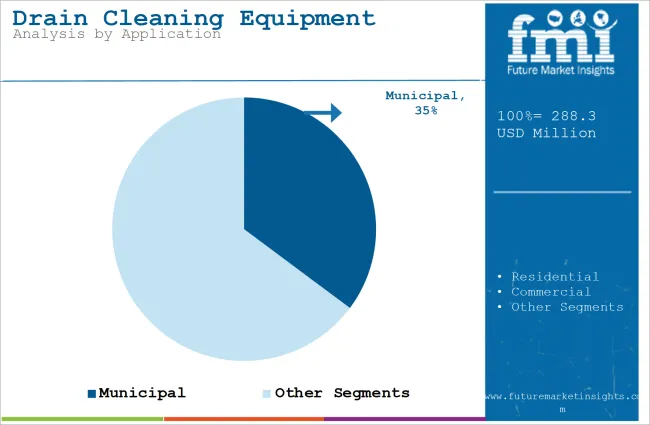

Based on the application type, the Municipal segment is projected to account for a share of 35.2% in 2024. The analysis would enable potential clients to make effective business decisions for investment purposes.

| Segment | Value CAGR (2024) |

|---|---|

| Power tools segment (product type) | 43% |

In the power tool type, most shares exist in the drain cleaning equipment market. Among the various motorized tools available, the market offers electric drain augers, high-pressure water jetters, and sectional machines. All these machines are favored as they can be able to tackle tough blockages which are prevalent in urban and industrial places. These tools are liked for the reason that they can offer efficient and reliable services and thus are suitable for rapidly clearing tougher clogs.

More municipalities, commercial facilities, and even residential users opt for these high-tech tools to maintain and manage drainage systems. With cities growing in size and demands on drainage systems, high-product type, motorized tools are an absolute necessity for keeping everything running smoothly.

This latest advancement, with robotic and AI-equipped tools, has even more appeal to this category, offering precision and easy operation. Thus, in a market where effective, modern solutions for drainage are preferred, power tools are the best option.

| Segment | Value Share (2024) |

|---|---|

| Municipal (Application) | 35.2% |

In the drain cleaning equipment market, the municipal segment is the market leader primarily because of rapid urbanization and immense government investment. With the growth of cities and their increasing populations, more strain is now being placed on drainage infrastructure; therefore, they need efficient, regular maintenance operations. Active investments in the water, wastewater, and sewer operations and maintenance were made by the state and federal governments so as to adequately address the issues of the operational needs.

The municipal authorities have been directing efforts towards using sophisticated equipment in water jetting to clear water passages and ensure free water flow. Among other things, there are now more electric augers and inspection cameras, all these are to keep drainage systems clean and operating at optimal capacities.

This step toward modern, high-performance solutions is a part of raising public health standards and sustainable infrastructure within the national scope. Investment in current technology will have municipalities better prepare for expanding centers and cleaner, safer environments.

Growing Urbanization and Eco-Friendly Innovations Propel Drain Cleaning Equipment Demand

The high demand for energy across the globe is a significant factor that is anticipated to propel the Drain Cleaning Equipments market share in the forthcoming years. Rapid industrialization, favorable regulations on energy efficiency, and a high share of renewables in the power generation sector are likely to augment the market.

As neighborhood density grows, more wastewater will clog more frequently, necessitating the need of dependable drain cleaning solutions for homes. Drain cleaning is essential for daily operations in commercial environments like restaurants and hotels, where waste volume is often high.

On a bigger scale, many cities are grappling with old sewer systems that require ongoing maintenance to avert failure, while governments are increasing their investment in wastewater management operations to support them.

Besides, advancements in environment-friendly advanced technology drain cleaning machines are supplementing the rising demand for efficient and chemical-free solutions. Generally, these factors promote the increasing demand for drain cleaning tools in the residential and commercial sectors and even in public areas.

Sanitation Awareness is Boosting the Demand for Drain Cleaning Equipment

Post COVID-19 there has been increasing awareness about public hygiene and health. More and more, the people and governments are realizing that it is very essential to have effective drainage systems in order to maintain public health.

It has ushered the way for more to be done in ensuring that drainage in homes and public places remains cleared and well managed. People are more hygiene conscious these days, and proper drainage prevents health-related problems to communities brought by standing water and increased bacterial activities. This increased emphasis on sanitation has, in turn, generated a higher demand for superior drain cleaning solutions that are effective and complete.

Innovations in the field of drain cleaning equipment, such as high-power water jetters and environmentally friendly enzyme-based cleaners, are fast gaining favor since they serve both safety and hygiene needs in today's world of sanitation consciousness.

Aging Infrastructure Drives Growing Demand for High-Performance Drain Cleaning Equipment, Boosting Market Innovation and Expansion

In many different areas, water piping and sewers are the old systems coming into age. Usually, these cause many clogs, leaks, and other problematic situations that bother life and become costlier repairs. Pipes and other drainage systems come into constant wear and tear while being used, with the older being even more sensitive to problems in these areas.

To keep these systems functional, routine maintenance has become essential and professional-grade drain cleaning equipment is increasingly in demand to tackle these recurring issues effectively.

Indeed, for municipalities, businesses, and homes alike, the difference between minor upkeep and major repair bills can be effective and reliable drain cleaning tools. For this reason, there has been a constant, growing demand for effective high-performance drain cleaning equipment to support market growth and encourage new innovations that can deal with the needs of an aging infrastructure.

High Costs of Advanced Drain Cleaning Equipment and Their Impact on the Market

Advanced drain cleaning equipment, especially options featuring motorized systems, robotics, or AI technology, often come with a hefty price tag. Though these high tech gadgets are efficient in their work and performance, the initial investment to be incurred is quite a factor.

It presents a big gap between the small-scale enterprise and individual customers. The prices of possessing such machinery are quite high and most likely cannot be afforded by many prospective buyers; they settle for less expensive ones. In addition, there are other available alternatives, such as renting them, in case one requires them, thereby denying quality, yet avoiding the cost burden of owning.

Others may prefer to maintain with the very basic, older style of cleaning tools for small, regular jobs where advanced technology would be overkill. This renting and use of simpler equipment further limits the number of high-end units sold and therefore holds the market potential of the lower scale users captive, as their budgets are just too thin for such purchases.

Between 2020 and 2024, the global drain cleaning equipment market experienced moderate growth, driven by increasing urbanization, aging infrastructure, and rising awareness of proper wastewater management. Residential and commercial sectors, such as hospitality and healthcare, fueled demand due to frequent drain blockages and the need for reliable maintenance solutions.

Governments worldwide also increased investments in sewer system maintenance and wastewater management, further propelling the market. However, the high initial cost of advanced equipment and limited awareness in emerging economies restrained market expansion during this period.

From 2025 to 2035, the market is anticipated to witness robust growth, driven by the integration of advanced technologies and eco-friendly innovations. Smart and chemical-free drain cleaning equipment designed for efficiency and environmental sustainability is expected to gain traction. Expanding urban populations, especially in developing economies, will drive the need for effective drain cleaning solutions to maintain hygiene and public health.

Additionally, advancements in sewer system automation and government initiatives focused on upgrading outdated infrastructure will support market growth. By 2035, the market is projected to achieve significant expansion, with residential, commercial, and industrial applications playing key roles in driving demand across regions.

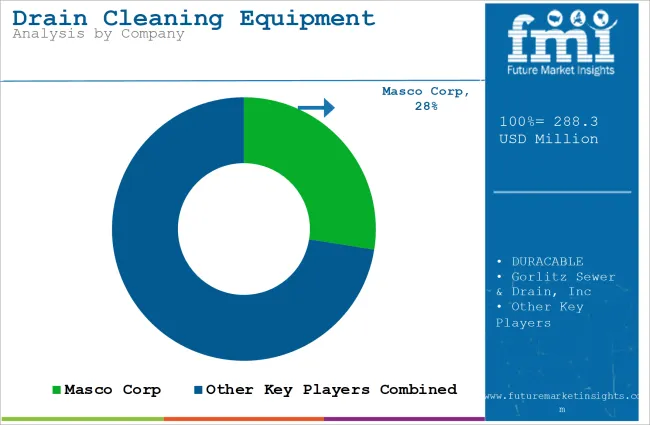

Tier 1 companies include industry leaders with annual revenues exceeding USD 100 Million. These companies are currently capturing a significant share of 45% to 50% globally. These frontrunners are characterized by high production Product type and a wide product portfolio. They are distinguished by extensive expertise in manufacturing and a broad geographical reach, underpinned by a robust consumer base.

These firms provide a wide range of products and utilize the latest technology to meet regulatory standards. Prominent companies within Tier 1 include Masco Corp, DURACABLE, Gorlitz Sewer & Drain, Inc, General Wire Spring Co., Electric Eel Manufacturing Co Inc, Spartan Tools LLC, Duracable Manufacturing CO and others.

Tier 2 includes most of the small-scale companies operating at the local level-serving niche Drain Cleaning Equipment vendors with low revenue. These companies are notably oriented toward fulfilling local demands. They are small-scale players and have limited geographical reach. Tier 2, within this context, is recognized as an unorganized segment, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The section below covers the analysis of the Drain Cleaning Equipment industry in different countries. Demand analysis of key countries in several regions of the globe, including North America, Asia Pacific, Europe, and others, is provided. The USA is anticipated to remain at the forefront in North America, with a value share of 72.7% in 2035. In South Asia, India is projected to witness a CAGR of 7.4% through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| China | 7.8% |

| India | 7.4% |

| USA | 6.2% |

| Brazil | 6.1% |

| Mexico | 5.8% |

The strong demand combined with high production capabilities drives the USA drain cleaning equipment market. Several large-scale manufacturers are based in this country and design very advanced, quality drain cleaning equipment for a variety of applications.

The municipal residential, commercial, and industrial sectors have an especially high need for the country's vast infrastructure, large urban areas, and antiquated plumbing. Regular maintenance is necessary to prevent costly repairs and interference, which, in turn, ensures a constant demand for reliable drain cleaning equipment.

Technological aspects are also envisioned to affect the industry, since there is an immense tendency for motorized, robotic, and AI-enabled machinery that is less maintenance-intensive. All of these high-tech options appeal to the contractors and the municipalities in quest of efficient obstruction and drainage remedies. Eco-friendly and sustainable cleaning instruments are also increasing in the US market, with the general environment trend.

With a reputation of excellent engineering, Germany stands as one of the finest manufacturing countries and is more than capable of producing high-quality drain cleaning equipment. German companies are renowned for precision in manufacture and innovative design; in this case, their tough, efficient drain cleaning tools are certainly up to the tightest standards on quality. It is due to this excellence in engineering that the equipment manufactured by Germany is held in very high esteem in both its homeland and across other borders.

There are the best drain cleaning solutions in manufacturing industries, construction industries, and public utilities within the German market, offered for periodic maintenance and routine infrastructure maintenance. Such high-performance German-made drain cleaning tools and machinery have received notable international status through good reliability with the strict observation of international standards for safety and environmental matters.

Such is the thrust of the country for research and development that its companies can develop continually innovative products such as motorized augers and environmentally friendly cleaning solutions. Germany market will be assured of its competitiveness in the global market for drain cleaning equipment by its reputation concerning quality and innovation.

India's drain cleaning equipment market is on the steady rise as there is growing urbanization and many mega-infrastructure projects in the pipeline. Fast-paced urbanization causes greater density of people within the city limits, creating greater pressure on the drainage network. The chances of getting a clogged drain network due to people shifting from villages to urban centers also rise, creating the demand for proper maintenance of smooth waste and water flow.

Initiatives taken by the Indian government are Smart Cities Mission, which focuses on better sanitation, waste management, and water treatment in cities. All these measures are generating demand for professional drain cleaning equipment for both public and private sectors.

Although demand is on the rise, local production of high-tech equipment is still in its infancy, and India is largely dependent on imports for most high-tech equipment. Domestic manufacturers are now stepping up production with the encouragement of the government's "Make in India" initiative. This growth is expected to bring down costs and make modern drain cleaning technology more accessible throughout the country.

The global drain cleaning equipment market is highly competitive, with players vying to innovate and expand their product offerings to meet diverse customer demands across residential, commercial, and industrial applications. Leading global competitors such as RIDGID, Spartan Tool, and General Pipe Cleaners dominate the market with a focus on advanced technologies, durability, and ease of use. These companies consistently invest in R&D to develop environmentally friendly and efficient equipment, catering to the growing demand for chemical-free solutions.

Mid-sized competitors like Rothenberger, Electric Eel, and Gorlitz Sewer & Drain are carving their niche by offering cost-effective and user-friendly tools. These players are particularly strong in regional markets, addressing localized needs and providing accessible customer support.

The competitive landscape is further shaped by the increasing adoption of IoT and smart technologies, with some companies integrating advanced monitoring systems into their equipment to enhance operational efficiency and predictive maintenance. Partnerships, mergers, and acquisitions are also common strategies employed by market players to strengthen their global footprint and gain a competitive edge.

Industry Updates

In terms of Product Type, the industry is divided into Hand Tools, (Augers, Hand Spinners, Plunger, Sewer Tapes), Power Tools, (Sink Machines, Drum Machines, Sectional Machines, Water Jetter machines, Rodder Machines).

In terms of Application, the industry is divided into Municipal, Residential, Commercial, and Industrial

In terms of Sales Channel, the industry is divided into Distributor, Retail Outlets and Online

Regions considered in the study are North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa.

The industry was valued at USD 271.7 Million in 2024.

The industry is set to reach USD 288.3 Million in 2025.

The industry value is anticipated to rise at 6.1% CAGR through 2035.

The industry is anticipated to reach USD 516.2 Million by 2035.

China accounts for 17.2% of the global Drain Cleaning Equipment market revenue share alone.

India is predicted to witness the highest CAGR of 7.5% in the Drain Cleaning Equipment market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Drain Cleaning Equipment Market Analysis – Size, Share & Trends 2025-2035

Japan Drain Cleaning Equipment Market Report – Trends, Demand & Outlook 2025-2035

China Drain Cleaning Equipment Market Analysis – Size, Trends & Innovations 2025-2035

India Drain Cleaning Equipment Market Report – Demand, Innovations & Forecast 2025-2035

Germany Drain Cleaning Equipment Market Analysis – Size, Share & Outlook 2025-2035

Cable Cleaning Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wafer Cleaning Equipment Market Growth - Trends & Forecast 2025 to 2035

Plumbing Drain Cleaning Service Market Size and Share Forecast Outlook 2025 to 2035

Grain And Seed Cleaning Equipment Market

Cleaning Robot Market Size and Share Forecast Outlook 2025 to 2035

Draining Cellulite Treatments Market Size and Share Forecast Outlook 2025 to 2035

Draining Agents Market Size and Share Forecast Outlook 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Cleaning In Place Market Growth - Trends & Forecast 2025 to 2035

Cleaning and Hygiene Product Market Report – Demand & Trends 2024-2034

Drain Camera Market

Drainage Catheter Market

Drain Sponges Market

Wet Cleaning Ozone Water System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA