The drag reducing agent market is likely to reach a valuation of USD 749.5 million in 2025 and is anticipated to register a valuation of USD 1.3 billion by 2035. Demand is expected to grow at a CAGR of 5.63% during the forecast period. This fastest growth is primarily in relation to the increasing demand in a wide variety of applications, especially oil & gas, chemicals, water treatment, and agriculture, where cost savings and operational excellence are highly dependent on fluid flow efficiency.

Drag reducing agents are chemical additives that help reduce the amount of turbulent flow and frictional pressure losses during the flow process in fluid transportation systems. Altering the flow dynamics of liquids reduces energy during pumping while increasing flow rates and throughput in long-distance pipelines.

They are, therefore, mainly used in pipelines where crude oil, refined product, or natural gas is transferred, and even minute improvements in flow efficiency can lead to huge returns, both financially and operationally. As per the increasing energy consumption all over the world, providing a solution that improves the efficiency of pipeline systems without huge capital expenditure is the factor driving the adoption of DRAs.

Oil and gas are the major sectors contributing to industry growth. This is because the oil and gas industry rely on pipeline networks to transport raw and refined hydrocarbon from the well site to long distances. In view of ongoing concerns about the needed infrastructure investment, environmental regulations, and operating costs, oil and gas companies are considering DRAs as an effective way to enhance throughput without building new pipeline facilities. Therefore, they would be able to transport more fluids within the existing networks and ensure that they still operate in a profitable state and meet energy efficiency standards.

In addition, it is known that the expansion and modernization of pipeline infrastructure throughout developing regions like Asia-Pacific, Latin America, and the Middle East will significantly contribute to growing the industry. Urbanization and industrialization are increasing rapidly in these regions, and therefore, energy demand is rising. This makes investments possible within pipeline transport networks. The ability of DRAs to extend the life and capacity of pipeline systems makes them a necessary tool in developing infrastructure strategies.

Besides the oil and gas industry, the field of application for Drag Reducing Agents would include their uses in water treatment, chemical processing, and agricultural irrigation. DRAs facilitate lower pumping costs and prevent erosion related to high-velocity flows in pipes and open channels in water distribution and sewage systems while improving the efficiency of irrigation systems for agriculture, letting the plants have a uniform supply of water with less energy. All these things will encourage the increasing adoption of non-energy applications, making evident their versatility and broader scope of applicability.

Market Metrics

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 749.5 million |

| Industry Value (2035F) | USD 1.3 billion |

| CAGR (2025 to 2035) | 5.63% |

Explore FMI!

Book a free demo

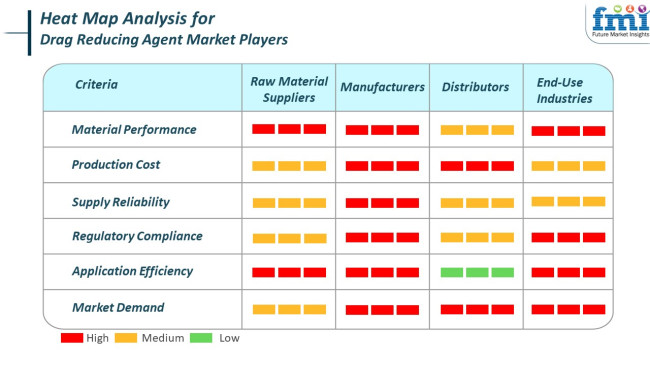

The parameters driving the industry are enhanced pipeline efficiency and lowered operating costs in the oil and gas industries, as well as chemicals and water treatment. Material performance and application efficiency are major concerns with raw material suppliers and manufacturers; producers ensure that additives really work to lower friction losses in pipelines.

Manufacturers are mainly preoccupied with production cost and compliance with the regulations, as these criteria govern scalability and access to the industries. Distributors target production cost and industry demand, intending to keep their supply chain profitable and also meet end-user expectations.

End-use industries such as pipeline operators stress application efficiency, material performance, and regulatory compliance, as they impact flow assurance, energy usage, and environmental safety. This segmentation signifies a performance-and-compliance-driven industry that has a growing need for viable and sustainable DRA solutions.

Between 2020 and 2024, the industry grew substantially, mainly due to the increasing global demand for crude oil and natural gas and the requirement to maximize pipeline throughput. DRAs-particularly polymer-based ones-were extensively applied in oil pipelines to minimize frictional pressure loss and enhance flow efficiency.

The industry also gained increasing use in chemical processing, pipeline refined products, and hydraulic fracturing. Advances in technology brought better DRA formulations with increased stability and compatibility over a range of temperatures and pressures. However, ecological concerns, high-cost products, and performance drawbacks in multi-stage systems restricted application in certain industries.

In the future, up to 2025 to 2035, the industry will move toward next-generation green DRAs such as biodegradable, nanotechnology-based, and AI-developed formulations.Increased focus on the energy efficiency of pipelines, reduced carbon emissions, and safe transportation of hydrogen blends will drive innovation.

DRAs will move out of oil & gas into district cooling, water networks, and agricultural irrigation. Digital twin models and AI will dynamically optimize DRA dosing for improved performance as well as lower costs. The convergence of real-time flow monitoring, predictive maintenance, and adaptive flow enhancement systems will position DRAs as a central part of smart pipeline infrastructure globally.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Crude oil pipelines, refined fuel systems, hydraulic fracturing. | Hydrogen pipelines, water & district cooling systems, smart agriculture, chemical distribution. |

| High-molecular weight polymer-based DRAs ( polyalpha olefins, polysaccharides). | Biodegradable, nano -formulated, AI-optimized, hybrid smart polymer systems. |

| Growing oil production, pipeline optimization, increasing transport demand. | Decarbonization initiatives, energy efficiency, digitization of pipeline infrastructure. |

| Confined to chemical dosing automation and simple SCADA-linked injection. | Real-time AI dosing, IoT sensors, predictive flow modeling, digital twin pipeline simulations. |

| Disposal concerns, restricted biodegradability, high production energy. | Carbon-neutral formulations, zero-residue dispersions, biodegradable and renewable-resource-based DRAs. |

| Oil & gas industry-centric with limited penetration in chemical transport. | Expanded applications in green hydrogen pipelines, water networks, mining slurry transportation, and intelligent urban infrastructure. |

| Emerging phases - some natural polymer substitutes, but small scale. | Completely sustainable DRA life cycles with low-to-zero environmental impact and circular production schemes. |

| Adherence to oil & gas pipeline safety and chemical transport regulations. | Increased global environmental regulation, traceability of DRA, and validation for safety in water and green energy transport systems. |

| Compatibility with multiphase flow, degradation in extreme temps, deployment cost. | High performance with eco-compliance, stability in renewable energy pipelines, and integration with smart systems. |

| Flow augmentation and throughput maximization. | Predictive maintenance, smart flow management, green DRA synthesis, and integrated smart infrastructure solutions. |

Once the circumstances and status of the oil and gas industry favor the DRA, it evolves to be held hostage by various sets of industry and operational risks. Industry dependence on the oil and gas sector places yet another industry risk, wherein some fluctuations like the global oil prices, geopolitical tensions, and a shift towards renewable energy sources could directly decrease the demand for DRAs.

Diversifying the application in other areas, such as chemical processing or water treatment, would be highly desirable to diminish this dependency. Price volatility of raw materials constitutes another of the main concerns, as DRAs largely rely on polymers and surfactants for their formulations. Any sudden spike in the price of these raw materials could squeeze manufacturers' profit margins, especially if they do not have long-term contractual agreements with suppliers or if there are no alternative options with respect to sourcing.

Environmental regulations present serious threats to the DRA industry. Ensuring sustainability may mean that the regulatory authorities start to impose stricter controls upon the manufacture and use of these chemical additives, especially where the substances involved are non-biodegradable or hazardous. Failure to implement eco-friendly formulations would erect barriers to entering environmentally sensitive industries.

On another front, however, innovations in flow improvement technologies may threaten the DRA industry with technological obsolescence. Without research and development, an investment toward this end may not prove a laudable advantage but would rather become a matter of survival. Potentially, another operational challenge is compatibility and performance variability.

DRA effectiveness may vary depending on pipeline material and fluid composition unless thoroughly tested; this could result in reduced efficacy, project inefficiencies, or system failure in the field. To alleviate the situation, producers will be required to supply solutions tailored to the specific project with full application support.

Risk to the uninterrupted supply of raw materials and finished products comes from supply chain viability, as highlighted by recent events, such as the COVID-19 pandemic and geopolitical conflict. Companies should be giving time and support to creating resilient logistics strategies with sufficient stock safety to respond to disruptions.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.9% |

| UK | 4.7% |

| France | 4.3% |

| Germany | 4.9% |

| Italy | 3.8% |

| South Korea | 5.1% |

| Japan | 4.5% |

| China | 6.7% |

| Australia | 4.2% |

| New Zealand | 3.6% |

The USA industry is expected to expand consistently with the increase in pipeline transport operations for the oil and gas sector. Expansion in unconventional oil and gas production, particularly from shale basins, continues to be a major demand driver for efficient flow improvement products. Large pipeline operators' deployment of advanced drag reducing agents to reduce energy costs and increase throughput is likely to propel industry growth.

The industry also benefits from a regulatory emphasis on enhancing pipeline efficiency and safety. Industry leaders are among the most significant contributors, such as leading USA-based companies Baker Hughes, Liquid Power Specialty Products Inc., and Innospec Inc., which are investing in product development and capacity building.

Integration of advanced chemical formulations that are designed to reduce pressure loss in long-haul pipelines will continue to spur adoption. Strategic partnerships between pipeline service companies and chemical producers will be instrumental in optimizing the domestic value chain.

The UK industry is spurred by the growing need for efficiency in offshore pipeline delivery associated with North Sea operations. A maturing oil and gas infrastructure is stimulating investments in flow assurance technology, especially to extend the life of aging assets. Government initiatives towards the modernization of energy infrastructure to meet decarbonization targets also encourage the application of chemical-based drag reduction technology.

Players such as Afton Chemical and Clariant have a presence in this space, providing niche solutions that are unique to the UK's offshore pipeline requirements. Cost reduction and environmental compliance are what fuel the industry growth. Domestic oil and gas production may dip, but maintenance and optimization of efficiency are expected to drive demand for during the forecast period.

The French industry will grow moderately based on the need to enhance the efficiency of petroleum product transportation and chemical processing industries. As France's slow transition towards energy transition is on the cards, existing hydrocarbon infrastructure continues to be essential in order to meet industrial demand. Drag-reducing agents are also being used in the chemical industry to optimize process fluidity, particularly for large-scale fluid handling systems.

Large chemical manufacturers such as Arkema are busy developing complex polymer-based drag reducing agents for multi-phase and product-refined pipelines. Technology adoption is further facilitated by France's quest for reducing industrial emissions and energy consumption. The increasing complexity of pipeline networks utilized for the transport of oil derivatives is likely to generate additional investments in performance-enhancing additives.

An extensive network of pipelines for industrial and petrochemical hubs drives Germany's demand for drag reducing agents. The country's focus on engineering promotes the application of advanced fluid dynamic solutions to improve energy efficiency as well as infrastructure reliability. Effort to modernize pipeline systems based on environmentally friendly principles drives demand for drag reducing agents in petroleum and specialty chemical applications.

BASF and other prominent German chemical firms are actively working in R&D to improve polymer performance in environments with shifting pressure and temperature conditions. Pipeline operators seeking the maximum performance of the pipelines in a rise in energy costs further demand stimulates the industry. Germany's long-term strategy involving sustainable production enhances the overall high-efficiency drag reducing formula long-term industry.

In Italy, the industry experiences steady but slower growth as a result of moderate investment in upstream oil and gas activities. Nevertheless, the utilization of drag-reducing agents is increasing in pipeline networks that transport refined products and chemicals to industrial areas. Italy's need for energy importation also calls for efficient management of pipelines in order to assure uninterrupted supply as well as savings in costs.

Domestic industries are served by European and multinational firms supplying specialized additives that are compatible with existing infrastructure. Applications of drag reducing agents for petrochemical shipping and municipal utility pipelines are new opportunities. As regulatory environments tighten on issues of energy efficiency, incremental infrastructure modernization is expected to drive growth during the forecast period.

South Korea registers good growth in the industry on the back of the country's advanced petrochemical sector and is reliant on efficient logistics. Industrial areas and high-pressure pipelines in refineries benefit considerably from drag-reducing technology. Focusing on performance improvement and industrialization led to increased usage of additive solutions that work toward friction reduction and lowering pump loads.

Key players such as SK Innovation and domestic chemical producers are involved in the application of customized drag reducing agents in complex pipeline systems. Growth is facilitated by demand for reduced energy consumption and lower maintenance frequency. Continued investment in infrastructure development and technology improvements increases the industry's potential over the forecast period.

Japan's industry is supported by industrial demand, and the aged pipeline infrastructure is in need of efficiency improvement. End-users are primarily petrochemical, manufacturing, and utility industries, particularly in densely populated urban regions. With an emphasis throughout the country on energy efficiency and operating reliability, drag reducing agents play a part in minimizing energy loss during fluid transportation.

Large Japanese corporations, e.g., Mitsubishi Chemical Group, help create and apply drag-reducing solutions in specialized pipeline systems. Polymer chemistry innovation and flow enhancement with limited domestic oil production strengthen industry power. The application scope will extend further to water and waste fluid management systems for industrial facilities.

China dominates the industry with the highest expected CAGR. Demand is spurred by extensive pipeline construction for crude oil, refined products, and natural gas to meet rapidly growing energy needs. With a focus on energy efficiency and environmental efficiency, the use of drag reducing agents is crucial for long-distance, high-capacity pipelines.

State-owned enterprises such as Sinopec and PetroChina, together with international players, are investing heavily in the domestic production of high-end chemical additives. Urbanization and industrial development further stimulate industry growth, creating a steady demand for pipeline efficiency technology. China's policy-driven infrastructure construction continues to drive strong opportunities for producers of drag-reducing agents.

The major drag-reducing projects sustain Australia's dragging agent industry, and the longline systems connect production facilities to coastal processing terminals within the nation. The emphasis on optimizing operating performance in challenging environments leads to increased application of drag reducing agents in crude and natural gas pipelines.

Industry participants include local affiliates of multinational chemical companies offering high-performance polymers that are designed for Australia's diverse pipeline environment. Rising energy exports, especially liquefied natural gas (LNG), provide stable demand for flow optimization technology. Maintenance-driven strategies also facilitate industry penetration, particularly in mature pipeline segments.

New Zealand's industry remains niche but gradually expanding, fueled by the need to enhance the efficiency of fluid transportation in single pipeline systems. Although operations remain relatively small compared with sector players, the use of drag reducing agents is becoming more common in the energy, water industry, and chemical sectors seeking low-cost flow solutions.

Global producers catering to minor industries offer specially tailored drag-reducing solutions suitable for low- to mid-volume pipelines. Regulatory focus on sustainability and conservation of energy goes together with the application of flow-promoting agents. Infrastructure upgrade schemes and process improvement in industries in the forecast period will most likely continue to ensure steady but moderate demand.

In 2025, the industry by product type is dominated by polymer-based DRAs, which account for a staggering 67.5% of the entire industry share. Surfactant-based DRAs follow suit with a 21.5% share, while others, including particulate-based agents, account for the balance.

Polymer DRAs are the most used drag-reducing agents because of their significant anti-mixing and flow improvement abilities in pipelines. They work primarily in long-distance pipelines carrying crude oil or refined products, especially where pressure drop and energy consumption are to be minimized. High molecular weight and high stretchability to align with the flow to reduce drag cause the conversion into oil and gas.

Companies like Baker Hughes, Innospec Inc., and Zoranoc Oilfield Chemical offer highly advanced polymer-based DRAs with specific formulations that meet the desired pipeline conditions. For example, there are polymer-based DRAs by Baker Hughes that operate in both upstream and midstream activities to permit their high performance and stability against varying temperature and pressure conditions.

Surfactant DRAs, which encompass 21.5% of the industry, are mainly designed for water-based fluid systems and will find their main application in multiphase flow conditions. The way they alter surface tension and modify flow behavior in conjunction with gas-liquid interaction systems is important for their low drag reduction efficiency relative to polymers.

Their relatively low costs and performance in certain flow regimes justify their use in some applications. Companies such as Halliburton and Liquid Power Specialty Products Inc. (LSPI) provide surfactant-based formulations optimized for specific oilfield and industrial applications.

Basically, the major drivers behind the success of DRA polymers are their superior performance characteristics and widespread application in energy infrastructure applications. At the same time, surfactants will continue to serve some applications with niche penetration based on cost or desirable special fluid dynamics.

In 2025, the industry by end-use is primarily led by the oil & gas sector, which stands at dominating 43%. The chemicals & petrochemicals segment follows in the second position with a massive 22.5% share. Therefore, these industries illustrated the ones where flow optimization in pipelines and systems is critical for operational efficiency.

The oil and gas sectors remain the largest consumers of DRAs, and they have a heavy reliance on pipeline transportation. DRAs are a must when anything is done to reduce frictional pressure loss across crude oil, refined product, and natural gas pipelines, therefore enabling operators to increase throughput with little or no investment in new pumping facilities. This saves energy, lowers operating costs, and increases your equipment's lifespan.

DRA formulations developed specifically for upstream, midstream, and downstream oil and gas operations are made available by leading companies, including Liquid Power Specialty Products Inc. (LSPI), Baker Hughes, and Nalco Champion (an Ecolab company). For example, LSPI specializes in widely used pipeline drag reduction solutions across North American oil transmission networks.

The majority uses the chemical and petrochemical industries DRAs, entirely within the oil and gas industry, with little lower than 22.5% to maximize the efficiency of transporting liquid chemical feedstocks and processed products. Pipelines in chemical plants and petrochemical complexes benefit from the reduced frictional losses with improved flow rates, especially regarding long or complex piping systems.

Some examples are companies like Schlumberger or Clariant, which providedrag-reducing agents tailored to this business with solutions ensuring the integrity of the fluids and system performance under the various compositions of chemicals and temperature ranges.

Such presence of these two end-use sectors strongly indicates the heavy reliance of DRAs on high-volume and continuous-flow industrials, where even small improvements in throughput efficiency can easily inspire huge savings and improved performance.

The industry is highly competitive, and the major players are focusing on product innovations, regional expansions, and strategic collaborations. Baker Hughes, Flowchem, and Innospec are great players in the industry who are focusing on providing advanced additive formulations geared to pipeline efficiency. These companies are rapidly increasing their coverage by creating alliances with oil and gas producers.

Additionally, investment in R&D is ensuring better polymer-based solutions for optimizing flow assurance. Lubrizol Specialty Products Inc. and NuGenTec ensure their stronghold in the industry through product diversification and customized chemical solutions. These companies focus on delivering environmentally friendly drag-reducing agents that comply with stringent pipeline safety regulations. Their strategies are based on partnerships with midstream operators and infrastructure service providers to provide pipeline throughput and operational efficiency better. They further consolidate their influence through regional expansions in North America, Europe, and the Middle East.

Strong regional players with an emerging footprint internationally are Sino Oil King Shine Chemical, Superchem Technology, and The Zoranoc Oilfield Chemical. The agencies are basically concerned about introducing low-cost formulations to penetrate pipeline operators in Asia-Pacific and Latin America. Providing scalable and fit adaptation to various fluid viscosity makes them a good alternative to world-renowned multinational brands. Strategic investment facilitation in local production facilities enhances the edges in penetrating such regions.

The industry is given due weightage by the China National Petroleum Corporation (CNPC) using internal and integrated supply chain methods and in-house chemical research. It is allowed to work completely within the oil and gas industry and economically competitively distributed drag-reducing agents in massive bowl pipelines due to the vertical integration method followed by CNPC. As such, continuing to extend in global markets like Africa and Asia indicates the company's strategic way of growth.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Baker Hughes | 20-25% |

| Flowchem | 15-20% |

| Innospec | 10-15% |

| Lubrizol Specialty Products Inc. | 8-12% |

| NuGenTec | 5-10% |

| Others (combined) | 25-30% |

| Company Name | Key Offering and Activities |

|---|---|

| Baker Hughes | Advanced polymer-based DRAs for crude and refined pipelines, optimizing flow efficiency and reducing energy consumption. |

| Flowchem | High-performance DRAs for oil and gas applications, focusing on improved flow assurance and pressure drop reduction. |

| Innospec | Specialty DRAs with customized formulations for crude oil, refined products, and water pipelines. |

| Lubrizol Specialty Products Inc. | Environmentally friendly DRAs with enhanced compatibility for various pipeline systems. |

| NuGenTec | Cost-effective, sustainable DRAs for global pipeline networks, ensuring compliance with industry regulations. |

Key Company Insights

Baker Hughes (20-25%)

Leading provider of high-efficiency DRAs, leveraging advanced polymer research and AI-driven flow optimization for major oil pipelines.

Flowchem (15-20%)

Strengthens industry position with global supply agreements and proprietary DRA solutions tailored for extreme temperature and pressure conditions.

Innospec (10-15%)

Focuses on eco-friendly DRA formulations and strategic partnerships with pipeline operators to expand its footprint in emerging industries.

Lubrizol Specialty Products Inc. (8-12%)

Invests in sustainable chemistry and regulatory compliance, offering low-impact DRAs for long-distance pipelines.

NuGenTec (5-10%)

Targets niche industries with tailored DRA solutions, emphasizing cost-effectiveness and adaptability for diverse fluid viscosities.

Other Key Players

The industry is estimated to be worth USD 749.5 million in 2025.

The industry is projected to reach USD 1.3 billion by 2035.

China is showing notable growth with a CAGR of 6.7%, supported by ongoing infrastructure expansion and energy sector developments.

Polymer-based drag reducing agents are the most widely used due to their superior efficiency in minimizing turbulence and improving throughput.

Key companies operating in this space include Baker Hughes, Flowchem, Innospec, Lubrizol Specialty Products Inc., NuGenTec, Oil Flux Americas, Sino Oil King Shine Chemical, Superchem Technology, The Zoranoc Oilfield Chemical, and China National Petroleum Corporation.

By product type, the industry is segmented into polymer, surfactant, and suspension/suspended solids.

By application, the industry is segmented into crude oil, multi-phase liquid, refined products, heavy asphaltic crude, and water transportation.

By end use, the industry is segmented into oil & gas, chemicals & petrochemicals, power & energy, agriculture, and others.

By region, the industry is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

Battery Materials Market: Growth, Trends, and Future Opportunities

Amidoamine Market Trend Analysis Based on Product, End-Use, and Region 2025 to 2035

Algaecides Market Assessment and Forecast for 2025 to 2035

Asia Neopentyl Glycol (NPG) Market Analysis and Forecast for 2025 to 2035

Polyunsaturated Fatty Acids Market Trends 2025 to 2035

Roofing Chemicals Market Size & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.