Downhole Tractor Market Share Analysis Outlook from 2025 to 2035

The global downhole tractor market is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.2%, reaching a valuation of approximately USD 4033.6 million by 2035. This growth is primarily driven by increasing industrialization and the expansion of oil and gas production activities across various regions.

| Attribute |

Details |

| Projected Value by 2035 |

USD 4033.6 million |

| CAGR during the period 2025 to 2035 |

5.2% |

The demand for downhole tractors is quite high in onshore applications in the Americas, East Asia, and the Middle East & Africa, especially for models offering a pull force between 500 to 1000 lbf. Regions like Europe, South Asia, and the Pacific prefer higher pull force tractors. Downhole tractors are one of the most significant tools in oil and gas applications, enabling operation in horizontal and deviated wells by conveying equipment to target zones.

Their application in production logging, pipe inspection, and cleaning is critical to maintaining well integrity and optimizing production. Technological advancements, including electrically driven systems, offer increased efficiency and control, adding to the market's growth.

The market is moderately consolidated by players that include Halliburton, Schlumberger, Baker Hughes, and Welltec. All of these companies are on the top in terms of innovation, working continuously on top-of-the-line downhole tractor technologies to satisfy rising industry requirements.

Explore FMI!

Book a free demo

Industry Landscape

| Category |

Industry Share (%) |

| Top 3 Players (Schlumberger, Halliburton, Baker Hughes) |

52% |

| Next 2 of 5 Players (Weatherford International, NOV Inc.) |

28% |

| Rest of the Top 10 |

20% |

The top three companies are recognized for their global presence, comprehensive service offerings, and strong client relationships. Halliburton, Schlumberger, and Baker Hughes invest a lot in research and development in order to introduce cutting-edge downhole tractor technologies. Companies such as Welltec and Weatherford follow them by focusing on niche markets and specialized downhole solutions, offering customized services to fulfill specific client requirements.

The market is a mix of consolidation by leading firms and fragmentation by smaller, specialized companies. This kind of structure encourages both competition and innovation that push towards the development of new technologies and solutions in response to the highly challenging issues with modern oil and gas extraction.

Segmental Analysis

By Configuration

- 4-Drive Downhole Tractors (38% Market Share): These tractors lead the market due to their high power, stability, and efficiency in long horizontal wells. They are preferred for deepwater and ultra-deepwater drilling operations. Schlumberger and Halliburton lead in high-performance 4-drive downhole tractors.

- 3-Drive Downhole Tractors: Utilizing improved traction and maneuverability in challenging well conditions, 3-drive tractors are found in great demand in mature fields with high-angle well interventions. Baker Hughes and Weatherford International are the dominating players in this category.

- 2-Drive Downhole Tractors: Across shallow wells and low-pressure reservoirs, these are found in immense demand as they require less force. Regional manufacturers, like NOV Inc, focus on lightweight and cost-effective 2-drive tractors.

By Force

- 1,000 to 2,000 lbf (42% Market Share): This category holds the largest market share due to its versatility in both offshore and onshore well intervention operations. Schlumberger and Baker Hughes specialize in high-force downhole tractors for deep well applications.

- 500 to 1,000 lbf: Such tractors are applied for use in medium-depth wells and complicated completions with a balanced need for power and mobility. Leaders in this class are Halliburton and Weatherford International.

- 2,000 to 3,500 lbf: Such tractors provide the maximum push force for ultra-deep and high-pressure well intervention. The two leaders of this class are NOV Inc. and Schlumberger.

- 250 to 500 lbf: These are used for lighter applications such as production logging and routine well maintenance. Weatherford International focuses on low-force downhole tractors for optimized well efficiency.

- Up to 250 lbf: These tractors are suitable for low-complexity interventions where minimal push force is required. Baker Hughes and regional players lead in entry-level downhole tractors.

By Application

- Onshore (60% Market Share): Most downhole tractor applications are onshore driven by intensive drilling activities and the need to have effective well interventions. Regions that are critical to this segment include North America and the Middle East.

- Offshore (40% Market Share): Offshore applications, though smaller in share, are crucial, especially in regions with significant offshore drilling activities. Companies are investing in specialized downhole tractors to address the unique challenges of offshore environments.

Who Shaped the Year?

Several key players contributed to market advancements in 2024

- Halliburton: Acquisition of a fresh portfolio of downhole cutting technology from UK-based well drilling contractor Westerton which supports their capacities on pipe recovery and intervention of any stage along the well cycle.

- Schlumberger: New electrically driven downhole tractor designed with more efficiency performance for complex wells

- Welltec: Next-generation coiled tubing downhole tractor, giving high efficiency, more reliability and the ability for longer well intervention periods.

- Baker Hughes: Developed a suite of downhole tractor services, coupled with real-time data analytics to optimize well intervention operations.

- Weatherford: Expanded its portfolio with mechanically driven downhole tractors specifically tailored for challenging well conditions.

Key Highlights from the Forecast

- 4-Drive Downhole Tractors Lead the Market: Catering to 38 percent of the market demand, it is more in preference for ultra-deepwater well intervention activities. Higher pulling forces and better complexities in well geometries necessitate their use in offshore and high-pressure wells.

- 1,000 to 2,000 lbf Force Category Dominates: This force range is ideal for interventions in deep and extended-reach wells with a market share of 42%. These tractors are a perfect balance of power, efficiency, and reliability, which minimizes equipment failure during critical well interventions.

- AI and IoT Integration Transform Downhole Operations: AI empowered automation and IoT enabled monitoring result in smart tractors down-hole. They bring about real time analytics, Predictive maintenance and adaptive path navigation reducing the overall operational risks as well as expenses.

- Energy-Efficient and Autonomous Downhole Tractors Gain Popularity: Battery-operated, remote-controlled, and low-energy designs are being prioritized to enhance sustainability. The push for carbon-neutral oilfield operations has driven companies to develop hybrid or electric-powered downhole tractors that reduce diesel dependency and greenhouse gas emissions.

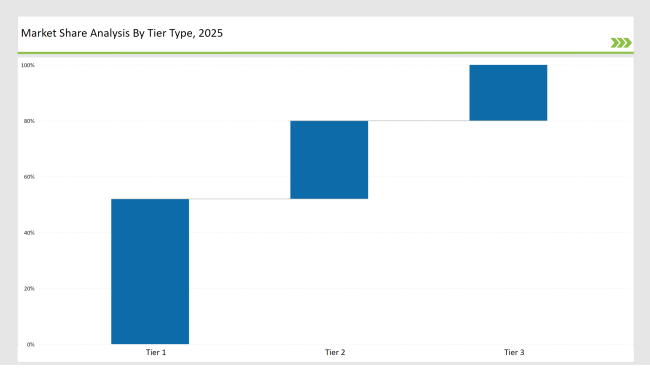

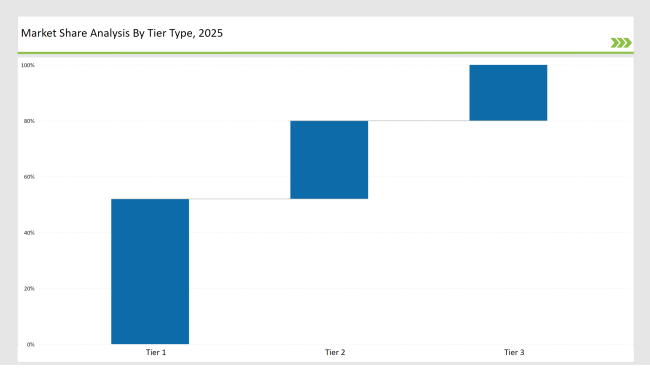

Tier-Wise Industry Classification

| Tier |

Examples |

| Tier 1 |

Schlumberger, Halliburton, Baker Hughes |

| Tier 2 |

Weatherford International, NOV Inc. |

| Tier 3 |

Regional and niche players |

Market KPIs

- Increased Demand for Autonomous and AI-Driven Downhole Tractors: With the adoption of AI-driven decision-making and machine learning-based well navigation, this is becoming an increasingly efficient activity with less human intervention.

- Growth in Deepwater and High-Pressure Well Interventions: The deepwater oil and gas projects are getting most momentum from the deepwater oil and gas projects in the Gulf of Mexico, North Sea, offshore Brazil, and others. High-power downhole tractors are being demanded.

- Rise of Hybrid Hydraulic-Electric Drive Technologies: Companies are investing in a hybrid drive solution combining hydraulic power with electric efficiency. Such technology conveys torque, better control, and better battery life.

- Expansion of Smart Sensing and Remote Monitoring Capabilities: IoT sensors, AI-based diagnostics, and cloud connectivity are enhancing real-time monitoring, failure prediction, and data-driven maintenance strategies.

Key Company Initiatives

| Company |

Initiative |

| Schlumberger |

Introduced autonomous AI-driven downhole tractors for ultra-deepwater well applications. |

| Halliburton |

Developed high-force downhole tractors for complex well geometries and long horizontal sections. |

| Baker Hughes |

Introduced electric-powered downhole tractors with low energy consumption and high efficiency. |

| Weatherford International |

Extended its product lineup of light downhole tractors for application in mature fields and shallow well operations. |

| NOV Inc. |

Emphasized hybrid drive technology, combining hydraulic and electric system integration to advance performance and ensure reliability. |

Recommendations for Suppliers

- Invest in AI-Driven Well Intervention Solutions: Suppliers will focus on developing autonomous and remotely controlled downhole tractors which will be utilizing AI-based adaptive navigation and in real-time diagnostics to enhance well intervention efficiency.

- Expand Hybrid Drive Technologies: The demand for hybrid hydraulic-electric downhole tractors is high, making it an investment area with potentially improved energy efficiency and emission control.

- Target Growth in High-Pressure and Extended-Reach Wells: Oil companies continue to drill farther and longer horizontal sections. Suppliers need to look at the development of 4-drive tractors as part of 'force-enhanced' solution for ultra-deepwater and high-pressure wells.

- Enhance Smart Sensor and Real-Time Data Capabilities: Companies should invest in downhole tractors with smart sensing, cloud-based monitoring, and predictive maintenance algorithms for reliability and performance.

Future Roadmap

By 2035, The future of the downhole tractor industry will be characterized by automation, AI-powered monitoring, and sustainable technologies.Downhole tractors will be completely autonomous, having real-time diagnostics and adaptive path navigation, minimizing operational risks and costs. Hybrid hydraulic-electric drive systems will increase energy efficiency, and cloud-based analytics will allow for predictive maintenance, thus extending the lifetime of equipment.

The industry will also focus on low-emission battery-powered solutions in its efforts to support global sustainability initiatives. With the growth of deepwater and ultra-high-pressure drilling, smart sensing and AI-driven decision-making strategies will become fundamental in optimizing well intervention strategies while maximizing overall efficiency.

Frequently Asked Questions

Which companies hold a significant share in the Downhole Tractor Market?

Schlumberger, Halliburton, and Baker Hughes collectively hold around 52% of the market share.

Which is the leading product segment in the Downhole Tractor Market?

4-drive downhole tractors lead the market, accounting for 38% of demand due to their efficiency in ultra-deepwater well interventions.

How much share do regional and domestic companies hold in the market?

Regional and niche players hold approximately 20% of the downhole tractor market share.

How is the market concentration assessed in the Downhole Tractor Market?

The market is moderately consolidated, with major global players accounting for a significant portion of market share.

Which application sector offers significant growth potential to market players?

High-pressure and extended-reach well interventions provide significant growth opportunities, driven by increasing deepwater exploration.