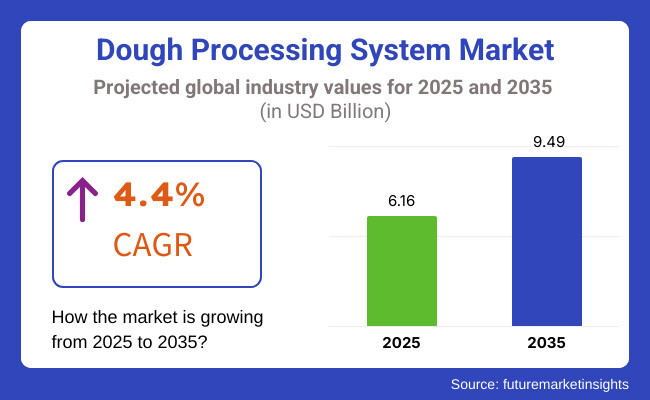

The market is estimated at USD 6.16 billion in 2025 and is expected to reach USD 9.49 billion by 2035, with a CAGR of 4.4%. In 2024, the dough processing systems industry was experiencing significant shifts owing to changing consumer behavior coupled with technological innovations and changes in the supply chain.

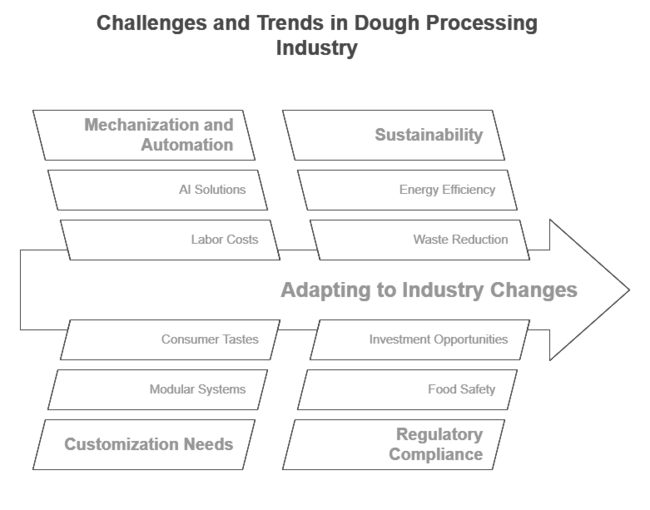

One important trend was the increasing adoption of automated processing systems by mid-sized bakeries and food processing companies. As labor costs rise and skilled workers remain scarce, companies are becoming more reliant on robotics and AI-based processing lines. Additionally, companies focus on energy-efficient processing equipment to minimize operational expenditures and comply with sustainability standards.

Another major trend witnessed in 2024 was the consolidation of the industry, where prime players participated through merger and acquisition activities to strengthen their technological capabilities and increase their footprint globally. India and China, key players in the Asia-Pacific region, saw rising investments in high-tech food processing plants due to urbanization and evolving food consumption habits.

Continued innovation in gluten-free and plant-based dough formulation will lead product development, while regulatory mandates and food safety controls will continue to feature high on manufacturers' agendas. As automation takes hold, companies that rightfully invest in smart processing technologies will emerge as industry leaders in a world prepared for greater efficiency.

Insights into Dough Processing Industry Research Survey: Future Industry Insights (FMI) assisted in conducting an in-depth survey of key stakeholders in the dough processing industry, including equipment manufacturers, bakery owners, food service providers, and supply chain experts.

The results also highlighted an abrupt movement towards mechanization, with more than 65% of respondents stating that investing in smart handling systems will be a top priority over the next five years. Increased labor costs and a shortage of workers were major challenges that drove the demand for AI and robotic solutions for dough processing, they said.

Another major takeaway was the increasing need for customized and flexible processing equipment. 69% of bakery and food manufacturers showed an interest in modular systems that can be converted to different dough formulations, such as gluten-free, organic, and plant-based. Experts pointed out that manufacturers have to be more nimble with their production capabilities, as consumer tastes are changing quickly.

Our audience also emphasized sustainability, with over 55% of participants discussing energy-efficient machinery and waste-reduction technologies as an event theme. Several respondents commented on increasing responsiveness to CO₂-neutral production lines and recyclable materials in packaging. Future investment opportunities also included regulatory compliance and automating food safety.

| Countries | Key Regulations & Impact |

|---|---|

| United States | Both FDA & USDA laws demand strict compliance with food safety (FSMA), hygiene levels, and allergen control in the flour processing plants. |

| United Kingdom | They need an automated system, in line with HACCP guidelines, to prevent contamination and ensure traceability. |

| France | The EU's strict food safety legislation, EC 852/2004, demands the use of innovative processing machinery to meet hygiene and sustainability metrics. |

| Germany | Concerning regulations for food contact materials and energy-saving processing technology, the German Federal Institute for Risikobewertung (BfR) has gained first place. |

| Italy | The Ministry of Health and FDA guidelines promote natural ingredients that are beneficial to clean-label processing trends and dough formulation. |

| Japan | The Japanese Food Sanitation Act mandates hygiene-centered automation, while incentives for energy efficiency bolster low-carbon processing technologies. |

| China | Stringent GB standards on food safety and urban plastic rates have resulted in a high demand for high-tech automated dough processing. |

| Australia & New Zealand | FSANZ regulations require management of allergens and traceability, while sustainability policies support water- and energy-efficient processing. |

| India | The laws of FSSAI emphasize hygiene, and the initiative "Make in India" aims to have the country make its dough processing equipment. |

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The industries continued to grow but suffered disruptions from COVID-19, labor shortages, and supply chain constraints. | The industry is projected to grow steadily as more bakeries adopt automation, integrate advanced processing solutions, and meet the rising demand for frozen and packaged bakery products. |

| Factors such as increasing labor costs and hygiene concerns further accelerated the adoption of automated dough processing systems. | It will become the industry norm for advanced robotics, Internet of Things (IoT) monitoring, and artificial intelligence (AI)- powered quality control. |

| Innovation in dough formulations was driven by consumer demand for gluten-free, organic, and clean-label products. | The industry is exploring alternative flour-based products to cater to health-conscious consumers. |

| Sustainability was growing, and companies were looking at energy-efficient machinery and waste reduction strategies. | Governments to enforce stricter environmental regulations, driving widespread adoption of eco-friendly processing technologies. |

| Consolidation in the industry accelerated with the larger players' acquisition of smaller firms, with the intent to enhance the product portfolio. | To increase efficiency and expand their global presence, fewer speculative mergers, alliances, and R&D investments should be made. |

Dough mixers are the largest industry segment of dough processing machines, as they are integral to industrial and commercial baking. High-capacity spiral and planetary mixers are necessary for larger production, while artisanal and specialty bakeries use smaller batch mixers. Dough dividers are a rapidly expanding portion, spurred by the need for precision and uniformity in mass production.

There has been an upswing in more sophisticated portioning technologies, such as ultrasonic and pressure-sensitive dividers. Dough sheeters and molders are also growing in adoption, notably for laminated pastry production and shaped dough applications. In high-volume facilities, automated sheeters featuring adjustable thickness control are becoming standard.

The bread segment continues to dominate the dough processing industry, owing to worldwide demand for pre-packaged and artisanal loaves. New formulations for gluten-free and whole-grain products are also transforming the available offerings. The pizza crust sector is witnessing rapid growth, supported by surging consumption of frozen pizza and the expansion of quick-service restaurants. Pre-formed and par-baked crusts are gaining significant traction in the industry.

Cakes and pastries also remain on the rise, as do laminating and shaping technologies, depending on the diversity of the products. The provision of cookies and biscuits is increasingly being automated to handle the variety, including wire-cut, rotary, and sheeted dough while catering to changing consumer snacking trends dominates this segment.

Demand for freshly baked goods continues to be the major driver for this industry, along with an increasingly popular demand for gluten-free and organic bakery products, both fresh and frozen. Whether it is a major pizza chain, a bakery, or any QSR (quick service restaurant) chain, the bulk of automation is happening.

Strict FDA and USDA regulations-especially those under the Food Safety Modernization Act (FSMA)-are driving manufacturers to invest in hygienic, efficient processing systems. Frozen pizza and pre-packaged baked goods have spurred demand for automated sheeters, mixers, and dividers as well, the company said. Energy efficiency equipment and sustainability initiatives are now becoming priorities for manufacturers.

Health-conscious consumers demand artisanal whole-grain bread, driving the UK dough processing industry. As noted, the move to plant-based diets has also increased demand for alternative formulations, including gluten-free and high-fiber ones. Automation is becoming increasingly important as a way to streamline bakery production, especially for mid-sized bakeries and food service providers.

With the Food Standards Agency enforcing stringent hygiene and allergen regulations, investments in advanced processing systems are seeing substantial growth. In the country, the frozen food segment, ranging from frozen pizzas to pastries, is on a high-growth trajectory; such growth is likely to create opportunities for aid in the high-speed dough processing bakery equipment in both the industrial and retail bakery segments.

With a long history of baking, France has a highly developed industry for both industrial and artisanal bakery products. Facilities specializing in croissants, baguettes, and other laminated products have created a strong demand for precision dough sheets and laminators. The government's focus on sustainability in food production has led to increased investment in energy-saving and waste-minimizing processing technologies.

EU food safety regulations, such as EC 852/2004, have reiterated the further necessity for automated processing systems. Frozen dough manufacturers and major bakery chains are also on the rise, capitalizing on advanced technologies to ensure product consistency and meet growing export needs.

Consumer demand for whole-grain and high-protein bakery products drives the German dough processing industry. The country's commitment to sustainability has created a boom in sales of energy-efficient equipment, including systems for processing dough. Producers in Germany are investing in computerized mixing and molding lines to improve consistency and reduce labor costs.

The Federal Institute for Risk Assessment (BfR) regulates food contact materials in a tense area, necessitating the use of easy-to-clean and hygienic processing equipment. The commercial frozen bakery industry remains steady and mature, with frozen bread, pretzels, and pizza crusts driving demand for advanced production lines.

Italy's dough processing industry is deeply rooted in its pizza and pasta culture, leading to high demand for pizza dough sheeters, mixers, and dividers. Many manufacturers are repurposing production lines to meet this demand.

The frozen pizza business has witnessed significant growth. In pastry production, Italian bakeries are also adopting automation as accuracy laminators become essential for premium desserts. Focusing on using natural ingredients and following the rules set by the Ministry of Health and the European Food Safety Authority (EFSA) leads to new clean-label dough recipes and gluten-free and organic process solutions.

Rising Western-style bakery and café culture boosts South Korea's dough processing industry. High-End Bread, Pastries, and Desserts: The growing demand for high-end bakery items is contributing to the widespread use of automated processing equipment. The Korea Food & Drug Administration (KFDA) applies strict hygiene standards, and manufacturers are inclined to invest in state-of-the-art processing equipment.

The government also supports smart factory projects, enabling bakeries to use AI-based quality inspection and IoT-based monitoring. Martins Frozen Bakery, which is witnessing significant growth, especially in frozen dough and pre-formed pizza bases, within foodservice outlets and convenience stores.

Japan's unique combination of Western and traditional bakery products drives the dough processing industry. Japan has a significant demand for precision dough processing equipment, particularly for high-end pastries, mochi bread, and convenience store bakery products. Industrial bakeries use automatic dividers, molders, and sheeters to meet the consistency and sanitation requirements of the Japanese Food Sanitation Act.

Japan's aging workforce has accelerated the trend toward robotic systems for dough processing. In addition, green industry trends are driving manufacturers to strive for energy-efficient, low-emission processing technology in bakery production lines.

The dough processing industry in China is growing dramatically due to urbanization and improved disposable incomes. The consumption of automated dough processing systems has increased because of the demand for Western-style baked foodstuffs like bread, pastries, and pizza.

Rigorous GB food safety standards are forcing manufacturers to enrich production plants with hygienic and high-speed processing technology. The frozen bakery industry is a rapidly emerging segment driven by busy consumers who are looking for convenience-enhancing solutions, such as packaged bread and ready-to-bake dough.

The demand for Chinese food service and bakery chains is expected to rise as AI-based dough processing machines become more advanced. As a result, companies are making significant investments in AI-based dough processing machines to enhance efficiency while maintaining high product quality.

The industry for organic and artisanal bakery items in Australia and New Zealand is experiencing a growing demand for dough processing. Things like the Food Standards Australia New Zealand (FSANZ) laws on allergen and traceability control have forced bakeries to adopt automated processing technology. As consumers look for convenience, the frozen dough industry is growing, leading to an increase in demand for sheeters and dividers.

Sustainability programs are gaining popularity, and producers are capitalizing on energy-efficient equipment. The demand for plant-based and gluten-free bread is encouraging the industry to adopt more advanced mixing and formulation technologies to cater to various dietary requirements.

The Indian dough processing industry is booming due to increased urbanization, laxer diets, and the expansion of the bakery and QSR industries. Frozen and packaged bakery items are witnessing increased demand, so automated sheeting and mixing machines are increasingly being used. Launched in October 2006, the Food Safety and Standards Authority of India (FSSAI) has tightened hygiene and quality requirements, triggering investments in new processing technology.

Even conventional flatbreads like roti and naan are being made in high volumes with the help of automated dough-processing solutions. The "Make in India" initiative is boosting local manufacturing, reducing reliance on foreign machinery, and encouraging technological innovations from India.

Dough Processing Industry: Important Industry Players. Here are some of the important industry players for dough processing.

GEA Group AG (20%-)

The GEA Group provides food processing technology, including dough processing equipment. Industrial and artisanal bakeries worldwide utilize its solutions for combining, dividing, and shaping dough.

Bühler Group (18%)

Bühler Group is a world-leading supplier of food processing solutions, including dough processing. The company ranks second globally in terms of advanced technologies and sustainability.

Ali Group (15%)

Ali Group, a global leader in food service and food processing equipment, is exploring ways to extend the shelf life of baked goods. VMI is a specialist in all the steps, from mixing and shaping to proofing dough and serving the results to commercial and industrial bakeries.

Middleby Corporation (12%)

Middleby Corporation is a leading manufacturer of food processing equipment, providing solutions for the bakery equipment industry. The company is known for its advanced technologies and best-in-class customer support.

Rheon Automatic Machinery Co., Ltd. (10%)

Rheon is a Japanese company that specializes in processing dough for breads, pastries, and pizza. Its products and innovations are well-known in the industry.

Other Players (25%)

Regional-based (smaller) players share the rest of the industry, with new exposure players that are now mainly targeting niche industries or specialized dough-handling solutions.

GEA Group Launches Energy-Efficient Freezer Packs

GEA Group is launching an energy-efficient series of dough mixers and dividers in response to the rising demand for sustainable food processing solutions. This allows the company to separate its business units and prepare for the industry shift towards more eco-friendly equipment.

Bühler Group's Acquisition

In October 2023, Bühler Group signed a deal to acquire a smaller dough processing equipment manufacturer. The acquisition will provide its customers with a more extensive product portfolio while helping the company strengthen its industry presence. It will also accelerate innovation and bring new solutions to customers.

Ali Group’s Forward-Looking Partnership

Ali Group formed a formal partnership with a major bakery chain to create personalized dough processing solutions for their company. This collaboration will accelerate growth and expand their industry reach.

Introduction of Automated Dough Processing Systems by Middleby Corporation

Middleby Corporation introduced a new line of automated dough processing systems to meet this growing demand for efficiency and consistency in bakery operations.

Expansion of Production Capacity at Rheon

In response to an increase in demand for dough-handling equipment in Europe, Rheon expanded its manufacturing capacity in the Region. Such a move will only fortify Rheon as an industry leader.

The dough processing system industry is part of the food processing equipment industry, which is one of the prominent segments of the global food & beverage manufacturing industry. Global population growth, rising disposable incomes in urban areas, and changing diets are directly shifting the industry.

As economies grow and consumers spend more on convenience and packaged foods, so does the need for efficient and automated dough processing solutions. Pressure from inflation and extremely volatile commodity prices, especially wheat, flour, and energy, affects manufacturing prices.

However, improvements in energy-efficient processing equipment help offset these rising costs. Labor efficiency shortages in developed economies are driving the surge in automation usage while emerging industries are building new food manufacturing facilities to cater to growing demand.

Geopolitical factors (such as tariffs and supply chain disruption) and trade policies also affect the sector. Strong food export industries like those of the USA, France, and Germany are pouring resources into advanced processing solutions to secure competitive advantages. Countries like India and China are witnessing fast-paced industrialization in food processing industries, given the surge in urban consumption.

Sustainability regulations, food safety regulations, and digitalization trends (e.g., incorporation of AI and IoT) will continue to define this industry's future, and therefore, manufacturers will need to prioritize compliance and efficiency.

Increased demand for convenience foods through automation and changing consumer preferences is driving the growth of the industry for dough processing systems. Innovations like AI-based mixing, IoT monitoring, and energy-efficient machines are revolutionizing the industry.

The rapid expansion of quick-service restaurants (QSRs), frozen bakery products, and plant-based bakery products is driving the demand for flexible and high-speed processing equipment. Sustainability is becoming a critical differentiator, with energy-efficient and waste-reducing solutions gaining momentum.

Companies that invest in recyclable materials, eco-friendly production lines, and carbon-neutral processing technologies will have a competitive advantage. Moreover, growth potential is also represented by emerging industries (India, China, and Southeast Asia), where urbanization is increasing and consumption of processed and packaged bakery products is widening. Pacts with strategic partners and mergers will also complement product portfolio expansion and geographic reach.

The industry is segmented into dough sheeters, dividers, mixers, and molders

It is fragmented into bread, pizza crusts, cakes & pastries, and cookies & biscuits

The industry is fragmented into North America, Eastern Europe, Western Europe, Japan, South America, Asian Pacific, Middle East, and Africa (MEA)

AI-based automation, IoT-based monitoring, and enhanced energy processing technologies are among the latest advancements.

Key users include bakeries, QSRs, frozen food manufacturers, and large-scale food producers.

Enterprises are looking for green materials, energy-efficient machines, and waste-reducing solutions to achieve sustainability targets.

Demand is propelled by changing consumer preferences, regulatory compliance, labor shortages, and advances in food production technology.

Asia-Pacific is witnessing the highest rate of adoption, especially in China and India, due to urbanization, increased disposable income, and a growing food industry.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2032

Table 2: Global Market Volume (MT) Forecast by Region, 2017 to 2032

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 4: Global Market Volume (MT) Forecast by Product Type, 2017 to 2032

Table 5: Global Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 6: Global Market Volume (MT) Forecast by Application, 2017 to 2032

Table 7: North America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 8: North America Market Volume (MT) Forecast by Country, 2017 to 2032

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 10: North America Market Volume (MT) Forecast by Product Type, 2017 to 2032

Table 11: North America Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 12: North America Market Volume (MT) Forecast by Application, 2017 to 2032

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 14: Latin America Market Volume (MT) Forecast by Country, 2017 to 2032

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 16: Latin America Market Volume (MT) Forecast by Product Type, 2017 to 2032

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 18: Latin America Market Volume (MT) Forecast by Application, 2017 to 2032

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 20: Europe Market Volume (MT) Forecast by Country, 2017 to 2032

Table 21: Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 22: Europe Market Volume (MT) Forecast by Product Type, 2017 to 2032

Table 23: Europe Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 24: Europe Market Volume (MT) Forecast by Application, 2017 to 2032

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 26: East Asia Market Volume (MT) Forecast by Country, 2017 to 2032

Table 27: East Asia Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 28: East Asia Market Volume (MT) Forecast by Product Type, 2017 to 2032

Table 29: East Asia Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 30: East Asia Market Volume (MT) Forecast by Application, 2017 to 2032

Table 31: South Asia Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 32: South Asia Market Volume (MT) Forecast by Country, 2017 to 2032

Table 33: South Asia Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 34: South Asia Market Volume (MT) Forecast by Product Type, 2017 to 2032

Table 35: South Asia Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 36: South Asia Market Volume (MT) Forecast by Application, 2017 to 2032

Table 37: Oceania Market Value (US$ million) Forecast by Country, 2017 to 2032

Table 38: Oceania Market Volume (MT) Forecast by Country, 2017 to 2032

Table 39: Oceania Market Value (US$ million) Forecast by Product Type, 2017 to 2032

Table 40: Oceania Market Volume (MT) Forecast by Product Type, 2017 to 2032

Table 41: Oceania Market Value (US$ million) Forecast by Application, 2017 to 2032

Table 42: Oceania Market Volume (MT) Forecast by Application, 2017 to 2032

Table 43: Middle East and Africa Market Value (US$ million) Forecast by Country, 2017 to 2032

Table 44: Middle East and Africa Market Volume (MT) Forecast by Country, 2017 to 2032

Table 45: Middle East and Africa Market Value (US$ million) Forecast by Product Type, 2017 to 2032

Table 46: Middle East and Africa Market Volume (MT) Forecast by Product Type, 2017 to 2032

Table 47: Middle East and Africa Market Value (US$ million) Forecast by Application, 2017 to 2032

Table 48: Middle East and Africa Market Volume (MT) Forecast by Application, 2017 to 2032

Figure 1: Global Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by Application, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2017 to 2032

Figure 5: Global Market Volume (MT) Analysis by Region, 2017 to 2032

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 9: Global Market Volume (MT) Analysis by Product Type, 2017 to 2032

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 13: Global Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 16: Global Market Attractiveness by Product Type, 2022 to 2032

Figure 17: Global Market Attractiveness by Application, 2022 to 2032

Figure 18: Global Market Attractiveness by Region, 2022 to 2032

Figure 19: North America Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 20: North America Market Value (US$ Million) by Application, 2022 to 2032

Figure 21: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 23: North America Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 27: North America Market Volume (MT) Analysis by Product Type, 2017 to 2032

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 31: North America Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 34: North America Market Attractiveness by Product Type, 2022 to 2032

Figure 35: North America Market Attractiveness by Application, 2022 to 2032

Figure 36: North America Market Attractiveness by Country, 2022 to 2032

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 38: Latin America Market Value (US$ Million) by Application, 2022 to 2032

Figure 39: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 41: Latin America Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 45: Latin America Market Volume (MT) Analysis by Product Type, 2017 to 2032

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 49: Latin America Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 52: Latin America Market Attractiveness by Product Type, 2022 to 2032

Figure 53: Latin America Market Attractiveness by Application, 2022 to 2032

Figure 54: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 55: Europe Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 56: Europe Market Value (US$ Million) by Application, 2022 to 2032

Figure 57: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 59: Europe Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 62: Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 63: Europe Market Volume (MT) Analysis by Product Type, 2017 to 2032

Figure 64: Europe Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 66: Europe Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 67: Europe Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 70: Europe Market Attractiveness by Product Type, 2022 to 2032

Figure 71: Europe Market Attractiveness by Application, 2022 to 2032

Figure 72: Europe Market Attractiveness by Country, 2022 to 2032

Figure 73: East Asia Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 74: East Asia Market Value (US$ Million) by Application, 2022 to 2032

Figure 75: East Asia Market Value (US$ Million) by Country, 2022 to 2032

Figure 76: East Asia Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 77: East Asia Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 78: East Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 79: East Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 80: East Asia Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 81: East Asia Market Volume (MT) Analysis by Product Type, 2017 to 2032

Figure 82: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 83: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 84: East Asia Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 85: East Asia Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 88: East Asia Market Attractiveness by Product Type, 2022 to 2032

Figure 89: East Asia Market Attractiveness by Application, 2022 to 2032

Figure 90: East Asia Market Attractiveness by Country, 2022 to 2032

Figure 91: South Asia Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 92: South Asia Market Value (US$ Million) by Application, 2022 to 2032

Figure 93: South Asia Market Value (US$ Million) by Country, 2022 to 2032

Figure 94: South Asia Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 95: South Asia Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 96: South Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 97: South Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 98: South Asia Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 99: South Asia Market Volume (MT) Analysis by Product Type, 2017 to 2032

Figure 100: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 101: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 102: South Asia Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 103: South Asia Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 104: South Asia Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 105: South Asia Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 106: South Asia Market Attractiveness by Product Type, 2022 to 2032

Figure 107: South Asia Market Attractiveness by Application, 2022 to 2032

Figure 108: South Asia Market Attractiveness by Country, 2022 to 2032

Figure 109: Oceania Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 110: Oceania Market Value (US$ Million) by Application, 2022 to 2032

Figure 111: Oceania Market Value (US$ Million) by Country, 2022 to 2032

Figure 112: Oceania Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 113: Oceania Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 114: Oceania Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 115: Oceania Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 116: Oceania Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 117: Oceania Market Volume (MT) Analysis by Product Type, 2017 to 2032

Figure 118: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 119: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 120: Oceania Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 121: Oceania Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 122: Oceania Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 123: Oceania Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 124: Oceania Market Attractiveness by Product Type, 2022 to 2032

Figure 125: Oceania Market Attractiveness by Application, 2022 to 2032

Figure 126: Oceania Market Attractiveness by Country, 2022 to 2032

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2022 to 2032

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2022 to 2032

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 131: Middle East and Africa Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 135: Middle East and Africa Market Volume (MT) Analysis by Product Type, 2017 to 2032

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 139: Middle East and Africa Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2022 to 2032

Figure 143: Middle East and Africa Market Attractiveness by Application, 2022 to 2032

Figure 144: Middle East and Africa Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dough Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Dough Based Premixes Market Size and Share Forecast Outlook 2025 to 2035

Sourdough Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Sourdough Market Analysis - Size, Share, and Forecast 2025 to 2035

Sourdough Market Share Analysis – Key Trends & Growth Forecast 2025-2035

Bread Dough Improver Market

Frozen Dough Market Analysis by type, distribution channel and region through 2035

UK Sourdough Market Analysis – Size, Demand & Forecast 2025-2035

Cookie Dough Market Analysis by Nature, Ingredients, Flavor, End Use, and Region Through 2035

Charting Winning Approaches in the Frozen Dough Market: A Competitive Perspective

USA Sourdough Market Growth – Demand, Innovations & Forecast 2025-2035

Yeastless Dough Market Growth - Innovations & Consumer Preferences 2025 to 2035

ASEAN Sourdough Market Trends – Demand, Growth & Forecast 2025-2035

Europe Sourdough Market Insights – Demand, Growth & Forecast 2025-2035

Shelf-Stable Dough Market

Australia Sourdough Market Outlook – Trends, Size & Forecast 2025-2035

Latin America Sourdough Market Report – Size, Share & Forecast 2025-2035

Refrigerated / Frozen Dough Products Market Size and Share Forecast Outlook 2025 to 2035

Bioprocessing Analytics Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bioprocessing Supplies Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA