Pet parents are seeking safety, convenience, and aesthetics through dog gates, doors, and pens, propelling the dog gates, doors, and pens market to gain momentum. Customers are focusing more on high quality, durable products that improve pets' comfort, security, as well as a sense of humane treatment. A smart pet door with automated entry, adjustable gate, and modularity in its pens is expanding the industry scale, mainly attributed to the trend of technology adoption and ecofriendly materials.

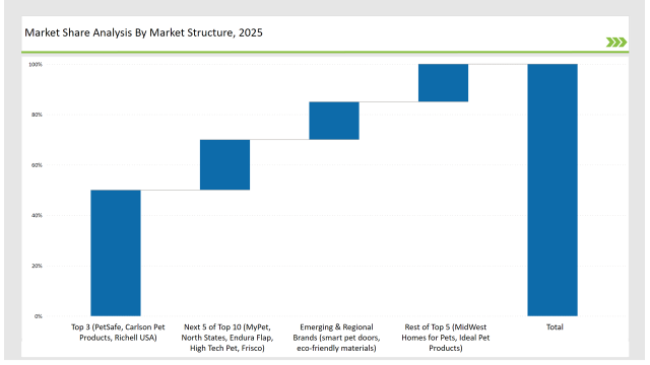

The leading brands, including PetSafe, Carlson Pet Products, and Richell, have a market share of 50% due to their strong brand recognition, variety of products, and retail presence. Independent and regional manufacturers account for 30% as they cater to niche markets with custom-designed pet enclosures. Emerging startups focusing on smart pet doors, eco-friendly materials, and AI-integrated pet containment solutions contribute 20% to the market.

Explore FMI!

Book a free demo

| Market Segment | Industry Share (%) |

|---|---|

| Top 3 (PetSafe, Carlson Pet Products, Richell USA) | 50% |

| Rest of Top 5 (MidWest Homes for Pets, Ideal Pet Products) | 15% |

| Next 5 of Top 10 (MyPet, North States, Endura Flap, High Tech Pet, Frisco) | 20% |

| Emerging & Regional Brands (smart pet doors, eco-friendly materials) | 15% |

The dog gates, doors, & pens market in 2025 is moderately concentrated, with the top players accounting for 35% to 50% of the total market share. Leading brands such as Carlson Pet Products, PetSafe, and Richell USA dominate the segment, while customizable and smart pet containment solutions add competitive diversity. This market structure reflects strong brand influence while allowing space for technological advancements in automated pet doors and space-efficient designs

E-commerce Platforms & Direct-to-Consumer Sales have the largest market share at 55%, driven by online shopping convenience, detailed product descriptions, and user reviews. Pet Specialty Retailers & Big-Box Stores account for 30%, offering in-store demonstrations and expert advice. Home Improvement & Hardware Stores hold 10%, catering to DIY pet owners looking for easy-to-install gates and doors. Finally, Veterinary Clinics & Pet Adoption Centers make up 5%, as professionals recommend containment solutions for pet safety.

Adjustable & Freestanding Dog Gates dominate the market with 40%, offering pet owners flexible containment solutions. Electronic & Smart Pet Doors represent 30%, integrating automated access and remote-control functionality. Heavy-Duty & Modular Pet Pens account for 20%, providing portable, durable solutions for indoor and outdoor pet management. Lastly, Eco-Friendly & Custom Pet Barriers make up 10%, catering to environmentally conscious consumers.

As customer preferences changed, market leaders and new entrants began to make strategic decisions that altered the dog gates, doors, and pens industry.

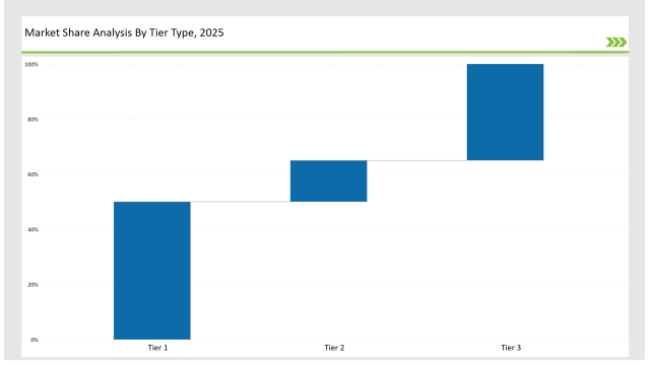

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | PetSafe, Carlson Pet Products, Richell |

| Market Share (%) | 50% |

| Tier Type | Tier 2 |

|---|---|

| Example of Key Players | MidWest Homes for Pets, Ideal Pet Products |

| Market Share (%) | 15% |

| Tier Type | Tier 3 |

|---|---|

| Example of Key Players | MyPet, North States, Endura Flap, High Tech Pet, Frisco |

| Market Share (%) | 15% |

| Brand | Key Focus Areas |

|---|---|

| PetSafe | AI-powered pet doors & RFID-enabled smart access |

| Carlson Pet Products | Heavy-duty, extra-wide gates for large breeds |

| Richell | High-end, wooden pet barriers for modern interiors |

| MidWest Homes | Foldable, travel-friendly pet pens |

| Emerging Brands | Energy-efficient, motion-sensing containment |

The dog gates, doors, and pens market is poised for continued expansion as a function of technological innovation, green trends, and shifting consumer buying behavior. Companies focused on integration in smart homes, the use of durable materials, and aesthetic design will propel the industry forward. Pet containment solutions of the future are intelligent, sustainable, and designed for modern pet owners.

Leading players such as PetSafe, Carlson Pet Products, and Richell collectively hold around 50% of the market.

Independent brands contribute approximately 15% of the market, catering to niche and specialized pet solutions.

Startups specializing in RFID and AI-powered pet doors hold about 10% of the market.

Online sales represent around 55% of the market, as pet owners prefer digital shopping for convenience

High for companies controlling 50%+, medium for 30-50%, and low for those under 30%.

Eyewear Market Analysis by Product Type, End Use, Sales Channel, Material Type, and Region

Perfume Market Analysis by Product Type, Nature, End-use, Sales Channel, and Region through 2035

BRICS Disposable Hygiene Products Market Analysis by Age Group, Product, Packaging, and Country through 2035

Air Freshener Market Analysis by Product Type, Application Type, Sales Channel, Fragrance Type, and Region from 2025 to 2035

Washing Machine Market Analysis by Various Materials, Thickness Capacity Type Through 2035

Luxury Handbag Market Analysis by Product Type, Material Type, and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.