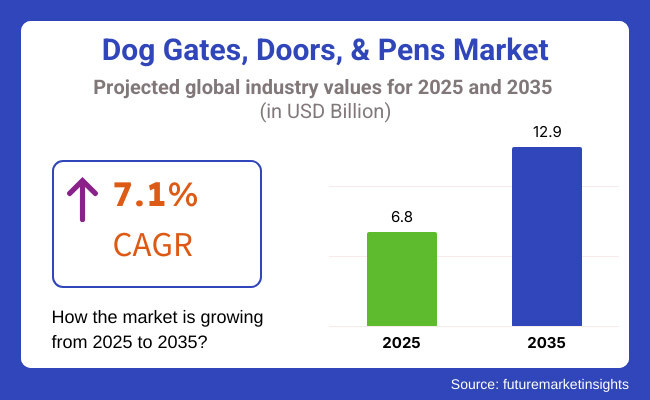

The Dog Gates, Doors, & Pens Market is set to witness significant growth from 2025 to 2035, driven by the increasing number of pet owners, rising concerns about pet safety, and innovations in pet containment solutions. The market is projected to grow from USD 6.8 billion in 2025 to USD 12.9 billion by 2035, reflecting a compound annual growth rate (CAGR) of 7.1% during the forecast period.

Several factors will fuel this growth, including the rising relinquishment of faves, an increase in smart and automated precious doors, and the growing demand for customizable and aesthetically pleasing pet enclosures.

Manufacturers will continue to concentrate on eco-friendly, durable, and easy-to-install products to feed to evolving consumer preferences. Also, advancements in detector-ground and electronic pet doors will further accelerate request expansion.

North America will dominate due to high pet power rates and demand for high- tech pet constraint products. Europe will concentrate on sustainable and smart pet gates, while Asia- Pacific will witness rapid-fire growth driven by adding civic pet relinquishment ande-commerce expansion.

Explore FMI!

Book a free demo

North America will lead the Dog Gates, Doors, & Pens Market due to the high pet power rate and demand for advanced pet constraint results. The rising trend of smart homes has led to increased relinquishment of automatic pet doors with RFID and microchip- grounded access.

Consumers in the USA and Canada prefer high- quality, durable, and aesthetically designed pet gates and pens that seamlessly integrate with home innards. also,e-commerce channels will continue to be a crucial motorist, with online retailers offering expansive product choices and customization options.

Europe will witness steady growth in the pet constraint request, primarily driven by sustainability enterprises and demand for smart pet doors. Consumers decreasingly seekeco-friendly,non-toxic accoutrements in pet gates and pens.

Germany, the UK, and France will be crucial requests where pet possessors prioritize automated results integrated with home security systems. The region's nonsupervisory drive for sustainable manufacturing will encourage brands to develop biodegradable and recyclable pet constraint products, icing long- term request growth.

The Asia- Pacific region will witness rapid-fire growth due to adding pet relinquishment rates in civic areas, particularly in China, Japan, and India. The expansion of middle- class homes and rising disposable inflows have led to lesser spending on pet care products.

Online retail platforms are playing a pivotal part in request expansion, with pet possessors seeking cost-effective yet innovative results. Original manufacturers will concentrate on furnishing affordable yet high- quality canine gates, doors, and pens to meet the growing demand.

The pet quadrangle request faces challenges like high costs of smart pet doors, complex installations, and sustainability enterprises. Varying precious sizes bear different product lines, while force chain dislocations impact pricing and vacuity. Growing competition demands invention and strong brand positioning to stand out.

The pet quadrangle request offers great openings for invention. Smart pet doors with RFID and Bluetooth enhance security and convenience. Eco-friendly accoutrements and customizable designs appeal to ultramodern consumers.

E-commerce expansion allows brands to reach global requests, while the rise of pet-friendly spaces boosts demand for portable enclosures. Investing in durable, rainfall- resistant out-of-door results can unleash new profit aqueducts.

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 10.80 |

| Country | China |

|---|---|

| Population (millions) | 1,419.3 |

| Estimated Per Capita Spending (USD) | 6.90 |

| Country | Germany |

|---|---|

| Population (millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 9.50 |

| Country | United Kingdom |

|---|---|

| Population (millions) | 68.3 |

| Estimated Per Capita Spending (USD) | 8.70 |

| Country | Japan |

|---|---|

| Population (millions) | 123.3 |

| Estimated Per Capita Spending (USD) | 7.40 |

The USA dominates the global dog gates, doors, and pens market, with premium pet safety solutions driving growth. Pet owners prefer smart pet doors with microchip access and weather-resistant gates. E-commerce platforms and specialty pet stores fuel demand, while customization and multi-functional pet enclosures gain popularity.

China’s USD 9.79 billion market thrives on increasing pet adoption and rising disposable income. Consumers favor high-quality, durable pet barriers, while smart pet doors gain traction. Urbanization and apartment living further boost demand for space-efficient dog pens.

Germany’s USD 798.95 million market benefits from a strong pet-friendly culture. Consumers prefer eco-friendly and adjustable pet barriers. Demand for high-tech pet doors with motion sensors grows, and veterinary recommendations influence buying choices.

The UK market, valued at USD 594.21 million, sees increasing adoption of safety-focused dog enclosures. Pet owners prioritize automated, energy-efficient pet doors. Subscription-based pet accessory services and DTC brands expand product accessibility.

Japan’s USD 912.42 million market grows as compact, apartment-friendly dog pens gain traction. Consumers seek foldable, lightweight barriers and automated smart pet doors. Retail chains and online marketplaces cater to demand for space-saving and aesthetic pet enclosures.

The dog gates, doors, and pens market is witnessing steady growth as pet owners prioritize convenience, safety, and home integration solutions for their pets. A survey of 250 respondents across North America, Europe, and Asia-Pacific highlights key trends shaping consumer preferences in this market.

Pet safety and home adaptability drive purchases, with 67% of dog owners considering safety as the primary factor when selecting gates, doors, and pens. Among urban pet owners, 58% prefer adjustable or retractable gates that seamlessly fit into different home layouts. Meanwhile, 45% of suburban and rural respondents prioritize durability and outdoor-friendly designs for larger breeds and multi-pet households.

Electronic and smart pet doors gain popularity, as 64% of respondents express interest in automatic and microchip-enabled doors that provide controlled access. Tech-savvy pet owners, particularly millennials (70%) and Gen Z (62%), prefer doors integrated with RFID tags or app-based monitoring systems. However, 45% of budget-conscious buyers still opt for traditional manual pet doors due to affordability.

Customization and aesthetic appeal influence buying decisions, with 55% of pet owners seeking gates and pens that match home interiors. Demand for wooden and transparent acrylic designs is rising, particularly in urban apartments (48%) and modern homes (50%). Meanwhile, foldable and portable pens attract 40% of respondents, especially those who travel frequently or live in compact spaces.

E-commerce dominates purchasing trends, with 68% of respondents preferring to buy dog gates, doors, and pens online due to wider selections and competitive pricing. Platforms like Amazon, Chewy, and regional pet-specialty websites lead sales, while 40% of respondents still prefer in-store purchases for product demonstrations and quality checks.

As pet owners seek smarter, safer, and aesthetically appealing solutions, the dog gates, doors, and pens market is expected to expand further. Brands can leverage technological innovations, customizable designs, and omnichannel retail strategies to capture growing consumer demand.

| Market Shift | 2020 to 2024 |

|---|---|

| Technology & Innovation | Brands introduced smart pet doors with microchip and RFID-enabled access control. Adjustable, pressure-mounted gates and modular pens gained popularity. |

| Sustainability & Circular Economy | Companies adopted eco-friendly materials such as bamboo, recycled plastic, and metal-free hinges. Modular and multi-use designs extended product lifespan. |

| Connectivity & Smart Features | IoT-enabled pet doors allowed remote access via mobile apps, voice-controlled operation, and integration with smart home systems. GPS-enabled gates improved pet safety. |

| Market Expansion & Consumer Adoption | Increased pet ownership and demand for home pet-proofing solutions fueled market growth. E-commerce and DTC (direct-to-consumer) sales surged. |

| Regulatory & Compliance Standards | Stricter pet safety regulations influenced the design of chew-resistant, non-toxic pet gates and doors. Transparent compliance labeling became key. |

| Customization & Personalization | Brands introduced adjustable, multi-panel gates and pens for different pet sizes. Custom-colored pet doors and DIY installation kits gained traction. |

| Influencer & Social Media Marketing | Pet influencers and trainers promoted safety-focused pet containment solutions. TikTok and Instagram drove viral trends in pet home setup ideas. |

| Consumer Trends & Behavior | Pet owners prioritized safety, durability, and ease of use. Demand for multi-functional, aesthetically pleasing pet enclosures increased. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology & Innovation | AI-powered pet doors adapt to pet schedules and security needs. Smart pens integrate biometric tracking for pet health monitoring and safety alerts. |

| Sustainability & Circular Economy | Zero-waste pet barriers with biodegradable components become industry standard. AI-driven sustainable material selection ensures durability with minimal environmental impact. |

| Connectivity & Smart Features | AI-integrated smart pet enclosures monitor pet behavior and adjust access levels. Blockchain ensures product traceability and transparency in sustainable sourcing. |

| Market Expansion & Consumer Adoption | Emerging markets experience growth with affordable, smart pet containment solutions. AI-driven consumer insights optimize product recommendations based on pet size, breed, and lifestyle. |

| Regulatory & Compliance Standards | Global safety standards mandate pet-friendly, durable materials with non-toxic coatings. Blockchain enhances compliance tracking and ethical sourcing verification. |

| Customization & Personalization | AI-powered pet gates personalize access settings based on pet activity. On-demand 3D printing allows real-time customization of pet enclosures and barriers. |

| Influencer & Social Media Marketing | Virtual influencers and metaverse-based pet parenting experiences reshape digital marketing. AR-powered product demos allow pet owners to visualize installations before purchase. |

| Consumer Trends & Behavior | Biohacking-inspired pet gates integrate wellness features such as stress-reducing enclosures. Consumers embrace AI-driven smart gates for automated pet access and safety. |

The USA dog gates, doors, and pens market is witnessing steady growth, driven by increasing pet ownership, rising demand for pet safety solutions, and advancements in smart pet doors. Major players include Carlson Pet Products, PetSafe, and Richell USA.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.4% |

The UK canine gates, doors, and pens request is expanding due to a growing pet population, adding focus on precious security, and demand for energy-effective pet doors. Leading brands include SureFlap, Babydan, and Doggy Mate.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.1% |

Germany’s canine gates, doors, and pens request is growing, with pet possessors emphasizing high- quality, durable, and customizable pet enclosures. crucial players include Trixie, Ferplast, and Karlie.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.3% |

India’s canine gates, doors, and pens request is witnessing rapid-fire growth, fueled by rising pet relinquishment, adding disposable inflows, and demand for affordable pet safety results. Major brands include Heads Up For Tails, Trixie, and Pawzone.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.9% |

China’s dog gates, doors, and pens market is expanding significantly, driven by increasing disposable incomes, demand for high-quality pet enclosures, and the rise of smart pet technology. Key players include Petkit, Xiaomi, and Ferplast.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.2% |

Pet owners seek adjustable and expandable dog gates to create safe indoor spaces for their pets. Pressure-mounted and hardware-mounted gates are in high demand, especially among urban households and apartments.

Smart dog doors with microchip or sensor-based access control are increasingly preferred for convenience and security. Pet parents opt for energy-efficient and weather-resistant models to enhance home integration.

Movable and foldable canine pens are gaining traction, particularly among pet possessors who travel constantly or bear out-of-door constraint results. Durable essence and heavy-duty plastic pens dominate the request due to their life and ease of use.

Online retail platforms drive deal growth by offering a wide range of customizable canine gates, doors, and pens. Abatements, product reviews, and direct-to-consumer brands enhance the availability and affordability of decoration pet constraint results.

The Dog Gates, Doors, & Pens Market is experiencing significant growth, driven by adding precious power and a heightened focus on precious safety and convenience. Manufacturers are constituting eco-friendly paraphernalia and smart technologies to meet evolving consumer demands. The request is characterized by a mix of established companies and arising players, all seeking to capture a share of this expanding sedulity.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Richell Inc. | 12-15% |

| Midwest Pet Products Inc. | 10-12% |

| Ware Pet Products | 8-10% |

| FurHaven Pet Products | 6-8% |

| Other Companies (combined) | 55-64% |

| Company Name | Key Offerings/Activities |

|---|---|

| Richell Inc. | Specializes in high-quality pet products, including dog gates, crates, and pens. Known for innovative designs and durable materials. |

| Midwest Pet Products Inc. | Offers a wide range of pet containment solutions, including metal dog crates, exercise pens, and gates. Focuses on affordability and functionality. |

| Ware Pet Products | Provides eco-friendly pet products, including wooden dog houses, pens, and gates. Emphasizes sustainability and natural materials. |

| FurHaven Pet Products | Known for comfortable pet accessories, including soft-sided gates and playpens. Combines functionality with pet comfort. |

Strategic Outlook of Key Companies

Richell Inc. (12-15%)

Richell Inc. leads the request with its focus on quality and invention. The company plans to expand its product line to include smart pet gates integrated with technology for enhanced pet safety and proprietor convenience.

Midwest Pet Products Inc. (10-12%)

Midwest Pet Products Inc. emphasizes affordability and functionality. The company aims to access arising requests by offering cost-effective results without compromising quality.

Ware Pet Products (8-10%)

Ware Pet Products focuses on sustainability, offeringeco-friendly pet constraint results. unborn strategies include adding the use of recycled accoutrements and promoting environmental responsibility among pet possessors.

FurHaven Pet Products (6-8%)

FurHaven Pet Products combines comfort with functionality in its immolations. The company plans to introduce customizable pet pens and gates to feed to individual pet needs and proprietor preferences.

Other Key Players (55-64% Combined)

Several other companies contribute to the Dog Gates, Doors, & Pens Market, focusing on niche segments and innovative solutions. Notable players include:

The Dog Gates, Doors, & Pens industry is projected to witness a CAGR of 7.1% between 2025 and 2035.

The Dog Gates, Doors, & Pens industry stood at USD 6.2 billion in 2024.

The Dog Gates, Doors, & Pens industry is anticipated to reach USD 12.9 billion by 2035 end.

North America is set to record the highest CAGR of 8.9% in the assessment period.

The key players operating in the Dog Gates, Doors, & Pens industry include Carlson Pet Products, PetSafe, Richell USA, MidWest Homes for Pets, and North States Industries.

Foot Care Product Market Analysis by Product Type, Distribution Channel and Region Through 2035

POU Water Purifier Industry Analysis In MENA: Trends, Growth & Forecast 2025 to 2035

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Tiffin Market by Product, Material, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.