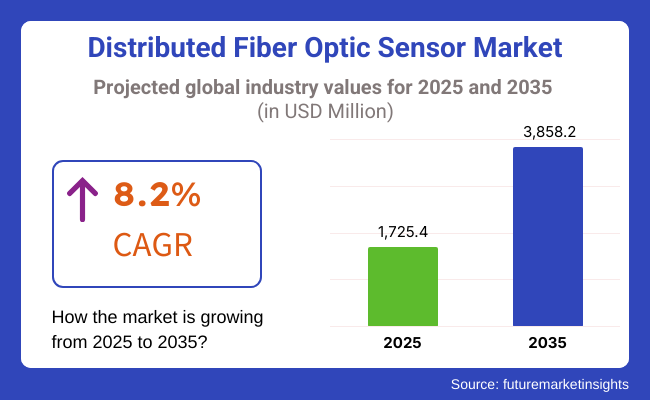

The globally distributed fiber optic sensor (DFOS) market is poised for consistent growth between 2025 and 2035, driven by increasing demand for real-time structural health monitoring, enhanced security, and critical infrastructure diagnostics. The industry size is projected to reach USD 1,725.4 million in 2025 and is expected to grow at a CAGR of 8.2%, reaching approximately USD 3,858.2 million by 2035.

The increasing demand for real-time monitoring solutions across industries like oil & gas, civil infrastructure, power and utilities, and transportation is driving the uptake of DFOS technology. DFOS systems have inherent benefits such as high sensitivity, extended range coverage, and immunity to electromagnetic interference, which are well-suited for mission-critical applications.

In addition, increased investments in smart city infrastructure, renewable energy infrastructure, and industrial automation are opening up new avenues for the adoption of DFOS. The growing integration of AI-based analytics and IoT-enabled monitoring platforms is increasing the accuracy and efficiency of fiber optic sensing systems, which is driving the growth. It is significantly driven by the increasing demand for advanced sensing solutions across major industries.

DFOS systems have broad usage in the oil & gas industry to monitor pipes, leak detection, and health monitoring of structures. In the power and utility industry, DFOS technology is enhancing power grid management with real-time temperature change information and fault detection. Bridge, tunnel, and railway civil infrastructure projects are increasingly using DFOS solutions for long-term structural health monitoring and early fault detection.

Apart from being expensive to deploy and install upfront, especially on big projects, it can be discouraging in cost-sensitive markets. Signal attenuation, data accuracy, and environmental interference problems can compromise sensor reliability and performance. Integration issues with legacy monitoring systems and data management packages are also a barrier to use in other sectors.

There are multiple opportunities for growth in new technologies and applications. The increasing need for smart grid infrastructure and green energy projects is creating new demand for real-time monitoring of power and fault detection technology. Urbanization programs and the development of intelligent transportation networks are expected to drive demand for traffic monitoring and structural diagnostics based on DFOS.

Explore FMI!

Book a free demo

The years 2020 to 2024 witnessed substantial expansion of the sales of distributed fiber optic sensors (DFOS), which was supported by a boost in the requirement for real-time monitoring, security for infrastructure, and evolving technology in data transmission.

Hospitals, the oil and gas sector, civil construction, and the defense department started utilizing DFOS systems increasingly in structural health monitoring, perimeter surveillance, and managing pipeline integrity. The technology offered real-time high-resolution measurements for temperature, strain, and vibrations across large lengths and made the possibility of enhanced early fault detection and predictive maintenance.

Enterprises pushed back through the creation of low-cost, plug-and-play DFOS platforms and incorporated AI-driven data analytics to make the system control process easier and more predictable.

From 2025 to 2035, the DFOS industry will transform as a result of improvements in AI-driven data analytics, quantum-driven sensing, and autonomous sensing platforms. AI-based platforms will scan huge data streams from DFOS systems in real time and make predictions on upcoming failures with higher accuracy. Quantum-based DFOS will possess higher sensitivity and range and be able to take precise measurements of microstrain and temperature gradients at longer distances.

DFOS will be applied to novel and new areas such as environmental monitoring, underwater surveillance, and smart city infrastructure. The result of sustainable development will be energy-efficient DFOS solutions that utilize cables manufactured from recycled content and reduced power signal processing.

Sophisticated cybersecurity technologies, like blockchain encryption of data, will protect sensitive monitoring data with secure and reliable system operation in defense and critical infrastructure systems.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Government control mandated stricter monitoring of safety regulations in oil & gas, railway, and structural health monitoring and thereby increased the demand for DFOS in crucial infrastructure. | Regulatory compliance models based on AI drive real-time surveillance, predictive alarm alerts for safety, and proactive hazard avoidance through automation to distributed sensing-reliant industries. |

| The energy industry heavily used DFOS for pipeline inspection, leak detection, and seismic activity monitoring for increased operational security. | AI-assisted DFOS facilitates real-time, self-correcting pipeline networks that recognize, forecast, and avert leaks, ensuring maximum energy transport efficiency. |

| Civil engineering construction applied DFOS to monitor bridges, tunnels, and dams in real time, augmenting predictive upkeep and safety. | AI-powered, autonomously self-sustaining infrastructure based on DFOS recognizes microstructural alteration without catastrophic failure and extends the asset lifespan. |

| Defense and border protection agencies utilized DFOS to detect intrusions and provide real-time situational awareness in high-risk regions. | Fiber optic security systems with embedded AI inherently connect with surveillance drones and predictive analysis to create adaptive security networks in real time. |

| Enhanced fiber coatings and optimized backscatter methods maximized sensing range, precision, and ruggedness in extreme environments. | Quantum-boosted DFOS technology supports ultra-high sensitivity sensing, transforming underground resource prospecting and high-precision structural monitoring. |

| DFOS-enabled fiber optic cables kept network integrity in check, minimizing downtime and increasing data center reliability. | AI-powered self-healing fiber networks continuously identify stress, environmental shifts, and cyber attacks, ensuring high-speed data transmission and cloud infrastructure optimization. |

| Research institutions and governments used DFOS in earthquake detection, landslide forecasting, and environmental hazard monitoring. | AI-augmented DFOS creates global sensor grids for early disaster warning systems, improving response times and minimizing environmental damage. |

| Cities incorporated DFOS into roadways, railroads, and tunnels to track traffic, identify accidents, and extend infrastructure lifespan. | DFOS systems in smart cities driven by AI facilitate predictive traffic management, real-time congestion re-routing, and autonomous infrastructure adjustments. |

| Factory floors applied DFOS for real-time monitoring of equipment, lowering downtime and boosting predictive maintenance. | AI-based DFOS enhances smart factories by allowing autonomous machinery adjustments, minimizing production inefficiencies, and providing real-time quality control. |

| Wind farms, solar power plants, and hydroelectric plants implemented DFOS for environmental and structural monitoring, increasing energy efficiency. | AI-based DFOS allows self-optimizing renewable energy systems to improve fault detection in wind turbines, solar panels, and energy storage facilities. |

The distributed fiber optic sensor (DFOS) industry is showing tremendous growth as it enjoys a great capacity for real-time monitoring, high sensitivity, and long-range vision. In the oil & gas industry, DFOS is implemented for pipeline monitoring, leak detection, and structural integrity assessment, while environmental durability and precision are the main focuses.

Civil engineering deployment of DFOS is concerned with the structural health of bridges, tunnels, and dams, where cost-effectiveness and scalability are two very important factors. Power & utilities are using DFOS for grid monitoring, fault detection, and power cable surveillance, with a requirement of high integration with IoT.

Within defense and security, proactive threat detection, border surveillance, and perimeter security are of the highest priority across the attention of high sensitivity and AI connectivity. In industrial surveillance, cost-effectiveness and scalability are the predominant factors, especially during the production process. To summarize, the increase in DFOS consumption is the result of a demand that is closely tied to predictive maintenance, the improvement in safety conditions, and automation in critical infrastructure.

| Company | Contract Value (USD Million) |

|---|---|

| Halliburton | Approximately USD 80 - 90 |

| Schlumberger (SLB) | Approximately USD 70 - 80 |

| Luna Innovations | Approximately USD 50 - 60 |

| Omnisens SA | Approximately USD 60 - 70 |

Distributed fiber optic sensors (DFOS) are the market facing most of the risks, which are technological risks mainly because of the complexity of fiber optic systems. Sensor calibration, signal attenuation, and environmental factors such as temperature fluctuations can affect the performance of the product. Companies are required to do research, and, in this way, they can come up with innovations to the product that will make it sensor accurate and more reliable. However, their operational costs will increase, and they will take more time in product development processes.

Enhancing Lensmaker's Equation capabilities of such fiber optic cables can make the product more expensive during manufacture, making it hard for new companies to enter this field easily. Apart from that, the high initial investment required for special installation technicians makes it a challenging solution compared to traditional ones. Another significant risk is the competition from other sensor technologies.

Classical electronic sensors and wireless monitoring systems are also being upgraded, which makes them cheaper than before. Suppose the DFOS programmers are not capable of overcoming the challenges by providing a higher performance, integration, and lower price. In that case, that is to say, if they do not create value for their customers, then they will likely face difficulties in fostering a competitive edge.

Distributed Temperature Sensors (DTS) are anticipated to account for about 35.5% of the global industry by 2025 due to increasing demand for real-time thermal monitoring in critical infrastructure. In the oil & gas industry, unique applications of DTS for wellbore monitoring, pipeline integrity management, and leak detection are also wide-ranging and significantly improving operational safety and efficiency. Moreover, power cable monitoring in smart grids and fire detection activities are key contributors to the growth.

The adoption of high-resolution fiber optic temperature sensing to improve both asset reliability and adherence to safety standards is being driven by major players such as AP Sensing, Schlumberger, and Halliburton. Distributed Acoustic Sensors (DAS), due to their increasing application in pipeline security, transportation safety, and seismic event tracking, will capture a 29.7% share by 2025. DAS is rapidly becoming the de facto technology to gain a fully scalable acoustic acquisition system, one that will effectively monitor long-range site activity in real-time to detect leaks and deter both intrusions and threats to critical infrastructure.

To improve safety measures, governments and energy businesses worldwide wastefully adopted DAS for perimeter security, border surveillance, and rail track monitoring. Key players such as OptaSense, Baker Hughes, and Silixa are focusing on AI-based acoustic analytics and advanced fiber optic sensing solutions, enhancing threat detection and predictive maintenance capabilities. The distributed fiber optic sensing market is expected to witness a major boost in growth with DTS (distributed temperature sensor) and DAS (distributed acoustic sensor) technologies driving the industrial automation, security, and environmental monitoring spaces as industries focus on resilient infrastructure and operational optimization.

Condition monitoring is expected to hold around 35.8% of the global share in 2025. Due to their ability to dissect long-distance pipelines, railways, or power transmission lines in real time, fiber optic sensing solutions are being massively adopted as they help decrease downtimes and boost operational efficacy. Distributed fiber optic sensors in the oil & gas sector help monitor for pipeline leaks, temperature changes, and physical stress before failures. That enables companies to prevent expensive events from happening. Fiber optic technology is being adopted on a large scale not just because it performs better but also because it will automate early-stage fault detection, raising the standards of safety across industries.

Companies like Schlumberger and Halliburton betting big on these innovative solutions, creating an ecosystem which will enable others to follow. Intrusion detection is likely to account for a share of about 33.9%. This growth is due to the growing demand for advanced real-time security services, including their applications in critical infrastructure, border security, and data center protection. A DAS-based system helps ensure perimeters, underground tunnels and facilities are high risk and accurately detects any unauthorized access, vibrations, or disturbances.

Governments, airports, and military organizations are developing AI-powered fiber optic security networks to boost their surveillance capabilities. Already, key drivers, such as OptaSense, Silixa, and Fotech Solutions, are working on the next generation of DAS security solutions that leverage machine learning and advanced acoustic analytics to provide real-time threat detection and situational awareness.

| Country | Projected CAGR (2025 to 2035) |

|---|---|

| The USA | 3.7% |

| The UK | 3.5% |

| France | 3% |

| Germany | 3% |

| Italy | 2.8% |

| South Korea | 3.2% |

| Japan | 3.1% |

| China | 3.8% |

| Australia | 3% |

| New Zealand | 2.5% |

The USA is projected to record a CAGR of 3.7% during 2025 to 2035. The reason being the extensive USA oil and gas sector, where leak detection and pipe monitoring becomes the necessity. Intelligent infrastructure and government security-related applications are also the drivers. Schlumberger and Halliburton are prominent vendors in designing next-generation distributed fiber optic sensing technology, which also supports adoption across diversified sectors.

Besides this, the use of fiber optic sensors in the aerospace, defense, and industrial automation industries is on the increase. Growing installations of renewable energy equipment and smart grids also propel growth. Owing to ongoing investments in R&D and technological advancements, the USA remains at the forefront of fiber optic sensing technologies, with ensured growth in the long term.

The UK is expected to grow with a 3.5% CAGR during 2025 to 2035. The nation's emphasis on smart city projects and infrastructure monitoring has been a predominant driver. Companies such as QinetiQ Group PLC are implementing fiber optic sensing technologies for defense, energy, and transportation markets, bettering their efficiency and performance.

Additionally, the offshore wind power installations of the UK rank as one of the key driving forces behind the demand for fiber optic sensors. Efficiency and operational integrity heavily depend on the sensors. The application of monitoring rails and tunnels is on a growth path at high speed; hence, the industry is achieving a phenomenal growth gradient.

The fiber optic sensor market for distributed sensors in France is expected to increase at a 3.0% CAGR between 2025 and 2035. The country's emphasis on industrial automation and smart infrastructure drives the use of fiber optic sensors. Major applications include oil and gas monitoring, rail security, and power grid optimization, with French organizations making aggressive investments in next-generation sensing technologies.

Moreover, the market for fiber optic sensors in disaster management and environmental monitoring is expanding. France's green energy push and carbon reduction policy support the use of fiber optic-based solutions in renewable energy strategies and smart grids. This strategic emphasis provides consistent growth.

Germany is expected to grow at a CAGR of 3% from 2025 to 2035. Industrial strength, especially in manufacturing, automotive, and energy industries, stimulates demand for sensing technology in Germany. Fiber optic sensors are installed by companies for predictive maintenance to provide improved efficiency and safety.

Germany's focus on green technology and infrastructure renewal is also propelling growth. The deployment of fiber optic sensors in wind farms, smart grids, and transport networks is supportive of the country's pursuit of technological advancement and sustainability, sustaining growth.

The market for Italy's distributed fiber optic sensors will grow at a CAGR of 2.8% from 2025 to 2035. Increased infrastructure development, especially in the transport and energy sectors, is driving demand for the sensors. Uses in railway monitoring, oil pipeline safeguarding, and industrial automation are pushing the industry forward.

Besides, the expanding renewable energy industry in Italy supports the expanded use of fiber optic sensors. The technology is found to be extensively useful for structural health monitoring of solar farms and hydroelectric plants. With the pace for sustainability accelerating, the use of fiber optic sensors is anticipated to increase consistently.

South Korea's industry is expected to grow at a 3.2% CAGR from 2025 to 2035. South Korea's dominance in smart infrastructure, advanced manufacturing, and electronics drives the demand for fiber optic sensing technology. Top South Korean firms use these sensors to integrate into city monitoring, semiconductor production, and industrial automation systems.

The South Korean government's thrust towards smart city growth and energy efficiency also stimulates growth further. Distributed fiber optic sensors also find significant applications in intelligent transport systems, seismology monitoring, and utility networks, promoting growth sustainably.

Japan's distributed fiber optic sensors market is expected to register a growth rate of 3.1% CAGR during the period from 2025 to 2035. Disaster resilience and infrastructure monitoring drive Japan towards enhanced use of fiber optic sensors. The applications range from earthquake monitoring and rail security to industrial automation.

Besides the automotive and precision manufacturing sectors, where Japan leads, sensor deployment for process enhancement as well as monitoring structure integrity provides the way. With the automation and sustainability challenges facing industries in the future, fiber optic sensing technologies will likely increase in demand.

China is projected to expand at a CAGR of 3.8% from 2025 to 2035. China's increasing industrialization and infrastructure development demand more fiber optic sensors for applications in the oil and gas, power, and transportation industries. Chinese industries are spending more on fiber optic technology to improve monitoring capacity and efficiency.

With the emphasis on the development of smart grids and high-speed rail networks, the government is still fueling growth even further. Distributed fiber optic sensors are used extensively for predictive maintenance and security monitoring that ensures reliability in countrywide critical infrastructure projects.

Australia will expand at a CAGR of 3% from 2025 to 2035. Australia's vast energy industry, oil & gas, and mining industries fuel high demand for such sensors. The fiber optic sensing technologies optimize pipeline surveillance, environmental monitoring, and structural integrity tests in bulk applications.

In addition, higher use of renewable energy and smart infrastructure development in Australia foster greater fiber optic sensor uptake. The technologies are pivotal to the simplification of solar and wind energy projects, and they underpin expansion within the next few years.

New Zealand is estimated to expand at a CAGR of 2.5% between 2025 and 2035. Green energy and environmental monitoring efforts in the country are favorable to the application of sensors in geothermal and hydropower operations. Fiber optic technology increases infrastructure resilience and readiness for disaster situations.

Apart from this, New Zealand's telecommunication and transport industries are applying fiber optic sensors to monitor and optimize the network as well as ensure safety. With the continuing growth of digital transformation, the adoption of fiber optic sensors is likely to increase progressively.

The industry is experiencing considerable growth with an increasing need for real-time monitoring of key sectors like oil & gas, infrastructure, defense, and healthcare. Such sensors offer accurate measurements of temperature, strain, and acoustic signals over long distances, thus playing a highly critical role in safety and structural health monitoring.

Firms are investing capital in higher technologies such as AI-driven data analytics and advanced fiber-optic signal processing in a bid to increase efficiency, reliability, and predictive maintenance services.

There is tough competition with established firms in fiber-optic technology alongside nascent sensor solution providers fighting for share. Industry leaders Schlumberger, Halliburton, and Yokogawa Electric Corporation control the marketplace, relying on their competence and R&D expenditures to maintain supremacy. It is the low-cost innovation and niche industries that the small vendors and new entrants are concentrating upon in a bid to establish a presence within the market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Schlumberger Limited | 20-25% |

| Halliburton Company | 15-20% |

| Yokogawa Electric Corp. | 10-15% |

| Luna Innovations | 8-12% |

| OFS Fitel LLC | 5-10% |

| Bandweaver Technologies | 4-8% |

| Other Companies (combined) | 30-38% |

| Company Name | Key Offerings/Activities |

|---|---|

| Schlumberger Limited | Fiber optic sensing solutions for oil & gas, pipeline integrity monitoring, and wellbore integrity testing. |

| Halliburton Company | Distributed acoustic and temperature sensing technologies for subsurface and well performance monitoring. |

| Yokogawa Electric Corp. | Industrial and structural health monitoring high-accuracy fiber optic sensors. |

| Luna Innovations | Advanced fiber optic sensing systems for aerospace, defense, and energy use. |

| OFS Fitel LLC | Specialty fiber optics and distributed sensing products for telecom and industrial use. |

| Bandweaver Technologies | Smart fiber optic sensing platforms for perimeter security and infrastructure monitoring. |

Key Company insights

Schlumberger Limited (20-25%)

Schlumberger is the industry leader in distributed fiber optic sensors using their cutting-edge sensing technologies exclusively focused on oil & gas exploration and production. With a push towards real-time monitoring, enhanced data analysis, and pipe protection, they have become industry leaders.

Halliburton Company (15-20%)

Halliburton dominates distributed acoustic and temperature sensing, mainly oil & gas. Halliburton is extending its wellbore integrity and reservoir monitoring solution with AI-powered analytics to optimize augmented operating efficiency.

Yokogawa Electric Corp. (10-15%)

Yokogawa dominates industrial automation and structural health monitoring with fiber optic sensing. Its advanced optical sensing technology allows for the early detection of faults in high-risk infrastructure projects.

Luna Innovations (8-12%)

Luna Innovations creates high-performance fiber optic sensing systems that find application in aerospace, defense, and renewable energy. Its new product development in distributed strain and temperature sensing also increases its competitive edge.

OFS Fitel LLC (5-10%)

OFS Fitel is a company that deals in specialty optical fiber solutions with a specific emphasis on distributed sensing for telecom and industrial solutions. Its research-based approach to fiber optic innovations also increases its leadership.

Bandweaver Technologies (4-8%)

Bandweaver Technologies is an infrastructure monitoring and perimeter security fiber optic sensing leader. Growth drivers are solution sets for oil & gas, smart city, and railway projects.

Other Key Players (30-38% Combined)

The remaining share is distributed among various global and regional providers, including:

The global distributed fiber optic sensor market is projected to witness a CAGR of 8.2% between 2025 and 2035.

The global distributed fiber optic sensor market stood at USD 1,725.4 million in 2025.

The global distributed fiber optic sensor market is anticipated to reach USD 3,858.2 million by 2035 end.

North America is set to record the highest CAGR during the assessment period, driven by increasing demand for advanced sensing technologies in infrastructure monitoring, oil & gas exploration, and security applications.

The key players operating in the global distributed fiber optic sensor market include Schlumberger Limited, Halliburton Company, Yokogawa Electric Corporation, OFS Fitel LLC, Luna Innovations Incorporated, Bandweaver, and others.

By sensor type, the segmentation is into distributed temperature sensors, distributed acoustic sensors, distributed pressure sensors, distributed strain sensors, and other sensor technologies.

By application, the segmentation is into condition monitoring, intrusion detection, power monitoring, leak detection, and other critical monitoring functions.

By industry, the segmentation includes oil & gas, civil infrastructures, industrial sectors, power & utilities, military & border security, transportation, and other specialized fields.

The report covers regions including North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa (MEA).

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.