Distributed Antenna Systems (DAS) Market Share Analysis Outlook From 2025 to 2035

The Distributed Antenna Systems market is growing rapidly as better wireless connectivity increases demand within both indoor and outdoor areas. Businesses, industries, and public venues look to implement DAS solutions to improve network coverage and capacity within commercial buildings, industrial facilities, public spaces, and residential complexes.

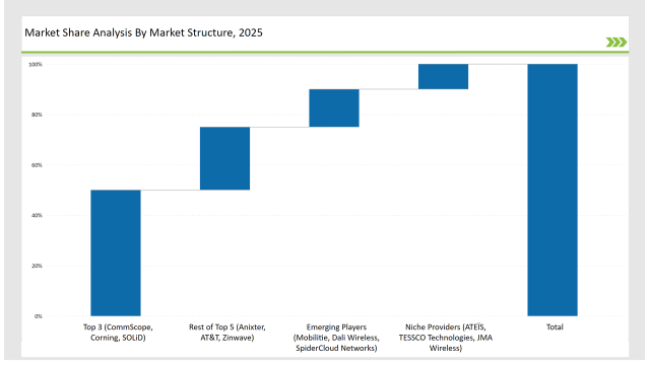

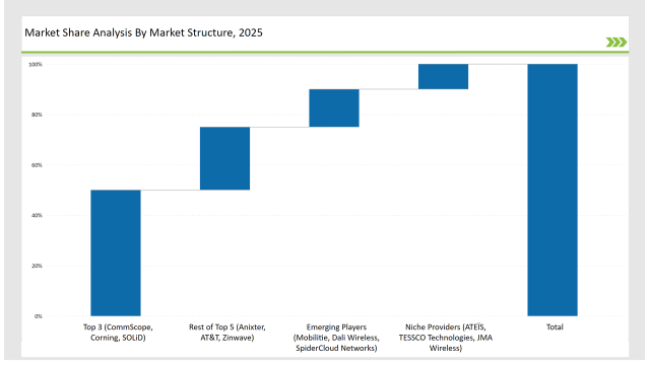

Leading vendors are enriching their portfolios with active, passive, and hybrid DAS solutions, utilizing advanced technologies like 5G, IoT, and Wi-Fi to cater to changing connectivity needs. By 2025, top players such as CommScope, Corning, and SOLiD will lead the market, collectively holding a 50% share. These companies deliver advanced DAS solutions that provide strong coverage, greater capacity, and effortless integration with other communication systems.

Other major vendors, including Anixter, AT&T, and Zinwave, will capture an additional 25%, focusing on large commercial buildings and public venues. Emerging players like Mobilitie, Dali Wireless, and SpiderCloud Networks will account for 15% of the market, specializing in small to mid-scale DAS deployments. Their focus on cost-effective solutions and tailored services makes them attractive to regional players.

Meanwhile, niche providers such as ATEÏS, TESSCO Technologies, and JMA Wireless will secure the remaining 10%, catering to specialized needs like rural coverage, regulatory compliance, and smaller-scale deployments. With connectivity demands rising, the DAS market is becoming more competitive, pushing vendors to innovate and refine their offerings to stay ahead.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category |

Industry Share (%) |

| Top 3 (CommScope, Corning, SOLiD) |

50% |

| Rest of Top 5 (Anixter, AT&T, Zinwave) |

25% |

| Emerging Players (Mobilitie, Dali Wireless, SpiderCloud Networks) |

15% |

| Niche Providers (ATEÏS, TESSCO Technologies, JMA Wireless) |

10% |

Market Concentration (2025 Assessment)

The DAS market is moderately consolidated with the top vendors controlling close to 50-60% of the market. While the large players like CommScope, Corning, and SOLiD control the big chunk at the high end and large-scale DAS, the mid-sized vendors are continuously pushing the boundaries into the cost-effective, modular, and scalable DAS solutions. The mid-size vendors are particularly poised to service the small to medium-sized enterprises, as well as rural areas and emerging markets.

Segment Analysis

By DAS Type

In terms of the DAS type, there are three major categories: Active Distributed Antenna Systems (DAS), Passive Distributed Antenna Systems (DAS), and Hybrid Distributed Antenna Systems (DAS). These types deploy differently and vary based on any additional scalability or cost structure required for network deployment.

- Active Distributed Antenna Systems (Active DAS) (45%): Active DAS systems are the most popular in the market because they can support high-capacity networks, such as those needed for 5G and enterprise environments. These systems rely on active components, like amplifiers, for the propagation of stronger signals over wider areas. Active DAS is the most appropriate in more complex and busy environments such as stadiums, airports, and huge commercial buildings. Active DAS is favored since it can easily manage the demand for capacity, improve signal quality, and ensure continuous connectivity for most large-scale applications of high performance.

- Passive Distributed Antenna Systems (Passive DAS) (30%): The use of passive DAS systems is quite widespread in applications where simplicity, low cost, and minimal maintenance are prime considerations. In this type of system, signals are distributed from a central location to various areas using passive components such as coaxial cables, splitters, and antennas, without amplifying the signal. Passive DAS solutions are used for smaller-scale deployments or environments where high-capacity demands are not major concerns. They are especially favored in indoor environments, including residential buildings, smaller offices, and rural areas where coverage can be provided effectively without the complexity of active components.

- Hybrid Distributed Antenna Systems (Hybrid DAS) (25%): A hybrid DAS solution combines both active and passive solutions to benefit both the systems. This kind of DAS is widely used in areas that demand a solution of both high-performance connectivity with cost-effective, scalable infrastructure. Hybrid DAS is applied in mid-sized to larger commercial buildings, healthcare facilities, and educational institutes, where a balance of both capacity and coverage is needed, but budget limitations or space requirements cannot accommodate the full active solution. Hybrid DAS provides customizable installations tailored for the location requirements and type of coverage required in the location.

By Application

DAS solutions are applied in both indoor and outdoor coverage scenarios, with each application addressing different types of network challenges.

- Indoor Coverage (60%): The largest application segment in the DAS market is indoor coverage, as there is a growing need for robust wireless connectivity within buildings. DAS solutions have become a necessity in a wide range of environments, including corporate offices, hospitals, airports, stadiums, and malls, with the rise of smart buildings, enterprise-level applications, and connected workplaces. The DAS for indoor solutions address the problem of signal strength when it comes to buildings with thicker walls, heavier traffic, and dense materials which block wireless signals. In addition, with rising mobile data usage, especially on 5G, providing faster internet and even smoother communication in the indoors becomes more critical than ever.

- Outdoor Coverage (40%): It designs DAS solutions for the most challenging outdoor space network or where there are outdoors with high outdoor venues and an increased capacity need for wireless communications. Environments include stadiums, highways, university campuses, and urban areas. The segment grows as people and institutions continue seeking reliable coverage of densely populated areas in cities and public places with large outdoor events. The growing demands of connecting autonomous vehicles, IoT devices, and smart cities will be greatly satisfied by means of outdoor DAS solutions that become increasingly necessary with the implementation of 5G.

Who Shaped the Year? (2024)

- CommScope: continued to lead with the launch of its next-gen Active DAS solutions, enhancing coverage and capacity for 5G networks.

- Corning: introduced hybrid DAS solutions optimized for large venues such as stadiums and universities, focusing on scalability and ease of deployment.

- SOLiD: made strides in expanding its Passive DAS solutions for rural and suburban areas, offering affordable and efficient solutions for smaller networks.

- Mobilitie: expanded its presence in the USA with cost-effective DAS deployments for mid-size public venues and universities.

- Zinwave: strengthened its position in the industrial sector by introducing a new line of hybrid DAS solutions for complex manufacturing environments.

Key Highlights from the Forecast

- 5G Integration: The rise of 5G is expected to drive significant growth in the DAS market, as businesses and operators require next-generation connectivity solutions for high-capacity and low-latency applications.

- AI and Automation: The incorporation of AI and automation in DAS management platforms will streamline network optimization and reduce operational costs for end users.

- Small Cells and IoT Integration: Integration with small cell technology and IoT devices will enhance the capabilities of DAS solutions, providing better network coverage and improving data transmission speeds.

- Edge Computing: Edge computing is anticipated to play a critical role in the future of DAS, especially in large-scale deployments where real-time data processing is essential.

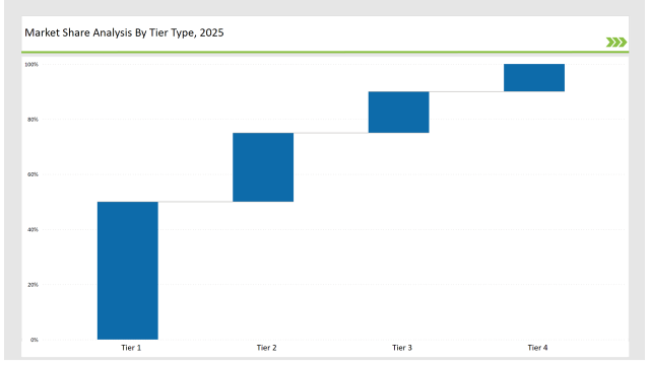

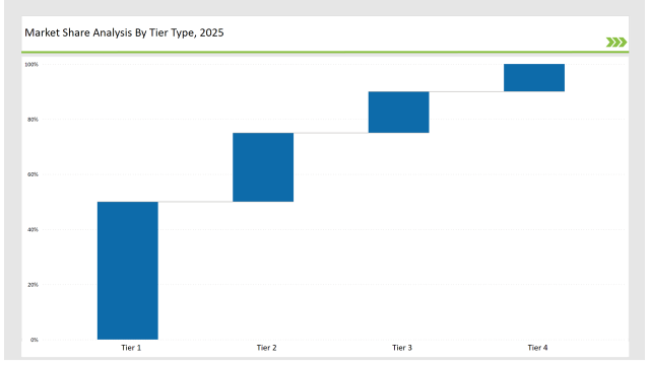

Tier-Wise Company Classification (2025)

| Tier |

Tier 1 |

| Vendors |

CommScope, Corning, SOLiD |

| Consolidated Market Share (%) |

50% |

| Tier |

Tier 2 |

| Vendors |

Anixter, AT&T, Zinwave |

| Consolidated Market Share (%) |

25% |

| Tier |

Tier 3 |

| Vendors |

Mobilitie, Dali Wireless, SpiderCloud Networks |

| Consolidated Market Share (%) |

15% |

| Tier |

Tier 4 |

| Vendors |

ATEÏS, TESSCO Technologies, JMA Wireless |

| Consolidated Market Share (%) |

10% |

Recommendations for Vendors

- Innovate with 5G Solutions: Focus on integrating 5G capabilities into DAS offerings to meet the increasing demand for high-speed wireless connectivity.

- Expand IoT and Edge Computing Integration: Develop solutions that support IoT devices and edge computing for real-time, low-latency communication.

- Embrace Cloud-Based Management: Offer cloud-based platforms for easier DAS management and optimization, providing customers with real-time analytics and network monitoring tools.

- Target Emerging Markets: Expand DAS offerings into emerging markets, particularly in Asia and Africa, where infrastructure demand is rising.

- Improve Cost-Effectiveness: Develop affordable DAS solutions for small and medium-sized deployments, catering to the growing demand in residential and smaller commercial environments.

Future Roadmap

Vendors are expected to continue refining their DAS offerings with a focus on 5G, edge computing, and IoT. Integration with smart city infrastructures, automation of network management, and AI-driven performance optimization will be key areas for growth. The expansion into emerging markets will be crucial for long-term success, with regional-specific adaptations needed to cater to local coverage and regulatory requirements.

Key Company Initiatives

| Vendor |

Key Focus |

| CommScope |

Next-gen Active DAS solutions, 5G deployment |

| Corning |

Hybrid DAS solutions for large venues |

| SOLiD |

Passive DAS solutions for rural and suburban areas |

| Mobilitie |

Cost-effective DAS solutions for public venues |

| Zinwave |

Industrial DAS solutions for complex environments |

| Anixter |

DAS product distribution and integration for enterprises |

Frequently Asked Questions

Which companies hold the largest market share in the DAS industry?

CommScope, Corning, and SOLiD lead the market, holding about 50% of the share.

What is the projected market concentration for 2025?

The market will be moderately consolidated with the top vendors controlling 50-60% of the market.

Why is Active DAS preferred over Passive DAS?

Active DAS is preferred for large-scale, high-capacity networks due to superior signal strength and coverage.

How does 5G impact the DAS market?

5G is driving growth in the DAS market by increasing demand for high-speed, low-latency coverage in urban areas and public venues.