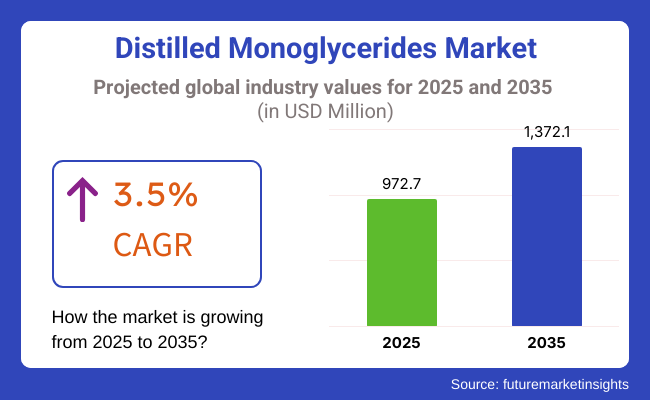

The global distilled monoglycerides market is projected to reach a value of USD 972.7 million in 2025. It is expected to expand to USD 1,372.1 million by 2035, reflecting a CAGR of 3.5% over the assessment period from 2025 to 2035.

The food, pharmaceutical, and cosmetic industries are the main sectors in which distilled monoglycerides are used as emulsifiers because of their special properties, such as stabilizing and texture-enhancing. These compounds are used to improve the consistency, shelf life, and quality of various products, such as being the missing link in a good cake, dairy, margarine, and frozen desserts.

The primary reason for the growth is the demand for processed and convenience foods. The growing sales are owed mostly to the progressive monoglyceride consumption in the food and beverage sector. For example, plant-based and non-GMO emulsion ingredients are in demand more as manufacturers look for the ones that provide the texture and stability required while keeping a clean label.

Moreover, the additional usage of monoglycerides in the pharmaceutical sector is contributing to the development of the industry, acting as solubilizers and bioavailability enhancers. The switch to healthier food has also disrupted the landscape, with low-fat and trans-fat-free products sought by consumers.

These monoglycerides not only allow for the removal of fat from the formula but also help to maintain the quality of the product, which is why they are so attractive to health-conscious consumers. The rise in the use of emulsifiers in plant-based dairy and gluten-free bakery products is another cause for the high demand.

However, the industry does not only have the challenges of rising raw material prices and the regulatory questions attributed to food additives. The use of oilseeds, such as palm and soybean oil, becoming scarce when producing monoglycerides goes against the steps to being an environmentally friendly company; therefore, manufacturers are forced to look into different sources. Also, the different local regulations that people need to comply with may bring inconvenience to the industry.

Nevertheless, the good part is that growth can still happen at these levels. The fact that there is a separate demand for emulsifiers in cosmetics and personal care products, where they are used in creams, lotions, and pharmaceutical ointments, helps to support expansion. Additionally, the growth of distilled monoglycerides functional aspects and their environmental sustainability are achieved by innovating in extraction and processing techniques.

Explore FMI!

Book a free demo

There was a steady growth between 2020 and 2024, fueled by growing demand in the food, beverage, personal care, and pharmaceutical sectors. Within the food industry, monoglycerides were extensively utilized as emulsifiers to enhance texture, shelf life, and consistency in baked foods, dairy products, and processed foods.

The clean-label and natural ingredient trend was a reason behind the increase in plant-based monoglycerides as a response to limited processing and transparency as demanded by the consumer. In the personal care industry, distilled monoglycerides were popularized for their stabilizing and hydrating properties in lotions, creams, and cosmetics.

They were also used in the pharmaceutical industry as excipients and drug emulsifiers for drug formulation improvement and bioavailability. Manufacturers focused on improving the functionality and quality of these monoglycerides through advancements in manufacturing processes such as molecular distillation and enzymatic manufacture.

Between 2025 and 2035, the industry is likely to get a boost with the increasing trend for functional food and nutraceuticals. Better functionality of products in low-calorie and low-fat food items will drive new product formulation.

Green, plant oil-based, renewable feedstock-derived monoglycerides and bio-based, sustainable ones will be gaining popularity as companies promote minimizing the impact on the environment. New technology trends, including artificial intelligence-formulated and precise processing, will upgrade the stability and functionality of these monoglycerides in subsequent applications.

Exemptions provided by regulatory preferences for natural emulsifiers and clean-label blends will also drive the growth further. Organic and natural products with these monoglycerides in the personal care industry will cater to the demand for health-focused and eco-friendly products.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Strong demand in the food sector for improving texture and increasing shelf life. | Greater application in functional foods and nutraceuticals. |

| Increased use of plant-based and clean-label products. | Increased growth in bio-based and sustainable monoglycerides. |

| Application in personal care products for stabilizing and emulsifying. | Food formulation and precision processing using AI. |

| Improved processing techniques (enzymatic synthesis, molecular distillation). | Regulatory aids for natural emulsifiers and green products. |

| Use in pharmaceuticals to enhance drug bioavailability and stability. | Industry demand for personal care products is organic and natural. |

The Global industry is growing consistently, driven mainly by demand from the food & beverage, pharmaceuticals, personal care, and plastics sectors. Distilled monoglycerides enhance processing and preservation, texture, and shelf life as a major emulsifier in processed foods, bakery products, and dairy substitutes. They are, therefore, a non-negotiable for the food industry.

In pharmaceuticals, such compounds are employed as stabilizers in the formulation of drugs, with stringent regulatory-compliant standards impacting buying decisions. The cosmetic industry enjoys the emollient and emulsifying properties of these monoglycerides, which propel them into cosmetics and skin-care formulations.

During the same period, the plastics and packaging industry employed these substances to promote material flexures and anti-stat characteristics. Growing consumer inclination for clean labels, ingredients, and sustainably sourced goods see producers turning out bio-based and non-GM replacements, reinforcing marketplace trends.

Globally, the industry is flourishing owing to the surge in demand in the food, pharma, and cosmetic industries. On the other hand, strict regulations on food emulsifiers and additives are posing compliance concerns. Enterprises must follow the new safety standards, obtain required authorizations, and ensure correct labeling to maintain consumer confidence and market acceptability.

Production cost and stability are being affected by supply chain problems, which include material shortages, the rise and fall of palm oil prices, and transportation shortages. The agri-commodity reliance makes the sector susceptible to weather changes and trade limitations. Entrepreneurs are recommended to channel their resources into diverse procurement and production of eco-friendly raw materials as a means to manage these threats

Consumers choose natural over synthetic additives in food, and this makes it hard for the market to survive. Perceptions regarding chemical-manufactured products and environmental conscience may deter purchase. Enterprises ought to be upfront, seek out plant-based substitutes, and redesign their advertisement techniques to win over health-focused customers.

Harsh competition from alternative emulsifiers and stabilizers, such as lecithin and polysorbates, creates the challenge of pricing and differentiation. Businesses can be competitive when they spend money on research and development with an accent on increased functionality, saving money, and broadening the use of products in other sectors.

Growth is driven by economic uncertainties, inconsistent demand in the key sectors, and modifying regulatory structures. Companies should ensure prolonged success by streamlining their production process, venturing into developing industries, and coming up with new formulations of products that will address the changing needs of the industry and consumers.

| Segment | Value Share (2025) |

|---|---|

| Food Grade (By Type) | 72.5% |

Food Grade accounts for 72.5% of the market share in 2025 and will dominate the distilled monoglycerides industry. This is primarily due to the increasing consumption of emulsifiers in products such as bakery, dairy, confectionery, and processed foods. Distilled monoglycerides (DMG) provide additional functionality, acting as emulsifiers, texture enhancers, and anti-staling agents.

They are known for improving the stability and quality of food products and shelf life. Food-grade monoglycerides are commonly used in baking, margarine, ice cream, and instant noodles, and leading manufacturers like Corbion, Kerry Group, and Danisco (part of IFF) supply them. Increasing demand for clean-label and plant-based emulsifiers is also helping to drive growth in this segment.

The industry-grade segment occupies a 27.5% share and is increasing demand in plastics, personal care, pharmaceuticals, and lubricants. In plastics, DMG is employed as an anti-static agent and as a dispersing agent in PVC and polymer processing.

In cosmetics and personal care, it serves as an emulsifier in lotions, creams, and hair products. Companies like BASF and Croda International offer industrial-grade DMG for applications in biodegradable packaging, pharmaceutical excipients, and textile processing.

The increasing demand for processed food products, clean-label emulsifiers, and sustainable industrial additives propels the entire industry. Food-grade DMG is witnessing healthy growth owing to regulatory approvals from the FDA and EFSA and growing applications in industry-grade DMG supported by innovative biodegradable and green chemicals.

| Segment | Bakery (By End Use) |

|---|---|

| Value Share (2025) | 38.2% |

Bakery is the foremost consumer of distilled monoglycerides (DMG), holding 38.2% of the share in 2025. DMG serves as an emulsifier (A), anti-staling agent, and dough conditioner C, all of which are essential to the production of bread, cakes, pastries, and other baked goods4. It improves the stability, texture , and shelf life of the dough and helps to prevent bread going stale too quickly.

Well-known food ingredient suppliers such as Corbion, Kerry Group, and Danisco (IFF) have gluten-specific DMG solutions for the bakery. This segment is driven by rising consumer demand for softer, longer shelf-life baked goods along with the growth of industrial for industrial baking.

The Oils and Fats segment occupies 14.5%, driven primarily by its applications in margarine, spreads, and frying oils. DMG serves as a stabilizer and emulsifier that contributes to a smooth, even texture without oil separation. It enhances spreadability and stability in margarine development. BASF and Palsgaard, for example, design tailored emulsifiers for the oils and fats sector, facilitating the manufacturing of healthier low-fat, trans-fat-free products.

The increasing inclination toward clean-label emulsifiers and functional food ingredients is further driving the demand in both segments. Increasing consumer preferences for healthy products, along with the regulatory approvals from the FDA and EFSA, is expected to have an impact on local industry dynamics.

| Countries | CAGR (2025 to 2035) |

|---|---|

| The USA | 3.5% |

| China | 4.0% |

| Germany | 3.2% |

| Japan | 3.0% |

| India | 4.5% |

| The UK | 3.3% |

| France | 3.1% |

| Italy | 2.9% |

| South Korea | 3.4% |

| Australia | 2.8% |

| New Zealand | 2.7% |

The USA distilled monoglycerides market is projected to have a CAGR of 3.5% over the forecast period of 2025 to 2035 due to a well-established food processing industry and increased use of clean-label products.

Increasing demand for non-GMO ingredients and natural ones has compelled companies to use distilled monoglycerides in dairy, bakery, and processed food to improve shelf life and texture. Pharmaceutical and personal care industries also add to growth with these emulsifiers, enhancing formulation stability and functionality.

In answer to this increasing demand, major USA-based companies like Cargill and ADM are investing in sustainable production and sourcing. R&D efforts center on enhancing functional properties to address consumer demand for healthier products. Food processor collaborations to develop customized emulsifier solutions have improved the competitive position.

China is anticipated to grow with a CAGR of 4.0% as a result of the increasing processed foods sector and urbanization. Demand has picked up because of the increased use of convenience foods to ensure product quality. In addition, increased awareness regarding food safety and food quality norms has pushed companies to use distilled monoglycerides to improve product consistency and ensure longer shelf life.

Chinese producers are expanding their manufacturing capacity and advancing their technical capabilities to compete with home and foreign standards. Local companies like Wilmar International are ramping up investments in high-tech emulsifier manufacture.

Procuring locally has also become a tactical step towards the improvement of cost-effectiveness, as well as supply chain steadiness. World integration has supported conformity to world quality certifications to enhance competitiveness in the marketplace.

Germany will grow from 2025 to 2035 at a CAGR of 3.2%, as German food processing technology is the base for driving markets with technological progress in innovation in food. The bakery and confectionery food sectors use high-quality emulsifiers to enhance food texture and stability and contribute to positively building the market. Also, consumers are in high demand, opting for plant and natural emulsifiers due to the growing consumer trend towards healthy food based on green processes.

German firms like BASF and Evonik are at the forefront of emulsifier technology. These companies spend significantly on R&D to create multifunctional and environmentally friendly emulsifiers that meet shifting industry demands. The stringent food safety laws in the country also push for the use of premium emulsifiers, meeting European Union standards and maintaining Germany's reputation in the global marketplace.

Japan is expected to register a CAGR of 3.0% during the coming decade. Japan's advanced food processing sector and stringent regulatory environment propel demand for high-quality emulsifiers. As Japan's bakery, dairy, and instant noodles sectors are concentrating on high-end food products, they employ distilled monoglycerides in large quantities to enhance texture and shelf life.

Japanese companies like Riken Vitamin and Taiyo Kagaku control emulsifier manufacturing. These companies believe in technological development and adhering to high safety standards. Furthermore, Japan's growing functional food industry, including fortified drinks and dietary supplements, has created new avenues for emulsifier uses, enabling the growth to persist.

India is expected to exhibit a CAGR of 4.5% with the rise of the food and beverages industry and the penchant of consumers for convenience foods. Bakery and confectionery are major demand drivers, driven by the benefits of urbanization and changing dietary preferences. The expanding application of emulsifiers in dairy and ice cream also stimulates growth.

Indian producers are also updating factories and utilizing newer technologies to improve product quality. Firms like Gujarat Ambuja Exports and Manishankar Oils have been continuously widening emulsifier ranges.

Ethical and sustainable raw material purchases are also becoming increasingly prevalent and in sync with developments in the world. Partnerships with international key leaders are also increasing, as these make learning transfer easier and enable the accomplishment of high-quality standards.

The UK will report a CAGR of 3.3% based on the growing demand for organic and clean-label food products. The trend of using natural food ingredients and plant diets has fueled the use of distilled monoglycerides in dairy foods, bakery, and processed food. The country's strict food regulation also ensures that emulsifiers are of good quality and safety standards.

Key leaders among UK-headquartered businesses like Tate & Lyle are at the forefront of emulsifier manufacturing with sustainable and innovative options. Organic emulsifiers, especially in artisan and premium food segments, are increasingly fashionable and are a main trend in the industry. Furthermore, speeding up R&D investment is fuelling product functionality in order to respond to changing consumer needs.

France is expected to register a growth at a 3.1% CAGR, with premium and specialty food being the top demand category. The developed bakery and dairy sectors in its economy are key users of emulsifiers as the latter demand high-performance solutions for product stability and texture enhancement. Furthermore, organic and clean-label products have impacted emulsifier consumption.

Players from France, such as Roquette and LECICO, are leading the growth predominantly through investment in innovative and plant-based emulsifier solutions. The expansion of high-end and specialty food products has additionally fuelled the demand for functional emulsifiers. European Union's stringent regulations also confirm that food processing uses emulsifiers with tight safety and sustainability criteria.

Italy is projected to advance at 2.9% CAGR as the bakery and confectionery sectors lead the demand. Since the country is known for its local cakes and traditional desserts, applications of high-end emulsifiers are necessary in order to make the final product smooth and consistent in texture. Industry growth also supports the dairy segment for the production of cheese and ice cream.

Italian companies like Corbion and Sime Darby Oils have enhanced their hold by focusing on sustainable ingredients sourcing and product innovation. The demand for gluten-free and plant-based versions has pushed manufacturers to develop niche-specific emulsifiers that address specific consumer requirements.

South Korea will expand at a CAGR of 3.4% due to the growth in food processing technology and rising demand for convenience food. The country's bakery and confectionery industries, which are developing at a fast pace, depend on emulsifiers to enhance product shelf life and quality. The rise in popularity of functional foods also generated new prospects for the use of emulsifiers.

South Korean players like CJ CheilJedang are investing in research and development to enhance high-performance emulsifiers. The country's strong regulatory environment guarantees product quality and safety, improving the usage of sophisticated emulsifier solutions. South Korea's established industry for processed food exports has also fueled the growth further.

Australia is expected to grow at a CAGR of 2.8%, and New Zealand at 2.7%. The strong plant food and dairy industries of both nations rely heavily on emulsifiers to improve product stability and texture. Hence, the demand for organic and non-GMO emulsifiers is fuelling the trend.

Players like Fonterra in New Zealand and Goodman Fielder in Australia dominate the market for emulsifiers. Increased demand for plant-based and clean-label food products has fuelled emulsifier formulation innovation. Moreover, the strict food safety regulations provide a guarantee of quality products, driving the ongoing growth.

The industry is robustly growing owing to the escalating demand in the food, pharmaceutical, and cosmetic sectors. These act as major emulsifying agents in providing textures, stability, and shelf life to various applications, wherein consumers gradually prefer clean-label and plant-based ingredients, making their mark in the industry trends.

The leading players include BASF SE, Kerry Group, Cargill, DuPont (IFF), and Palsgaard, who are focused on sustainability, product innovations, and increasing production capacities. Startups and niche suppliers are making custom formulations to cater to very specific industry requirements.

This shift towards nature and plants further evolves the scenario in terms of developing fresh sources for raw materials and processing improvements. For example, BASF SE has upgraded recent food production increase with rising customer demand for synthetic products.

At the same time, Kerry Group unveiled plant-derived monoglycerides that were developed for the increased vegan community. Cargill created application-oriented solutions to enhance bakery and dairy formulations without compromising performance versus sustainability expectations.

Strategic influences shape competition in various sectors: investments in R&D, sustainable sourcing initiatives, and regulatory compliance. Companies are strengthening supply chains and forming business partners with food manufacturers to have varied portfolios in the clean-label industry, including natural ingredient movement.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| BASF SE | 18-22% |

| Kerry Group | 14-18% |

| DuPont | 10-14% |

| Cargill, Inc. | 8-12% |

| Palsgaard A/S | 6-10% |

| Other Players (Combined) | 25-35% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| BASF SE | Increased capacity to produce monoglycerides with a strong emphasis on multi-industry and sustainable sourcing. |

| Kerry Group | Established customized plant-based monoglycerides to improve stability and texture in vegan and vegetarian food products. |

| DuPont | Focuses on functional monoglycerides for improved emulsification in dairy, bakery, and personal care applications. |

| Cargill, Inc. | Brought customizable monoglycerides for bakery and dairy with a focus on clean-label and sustainable options. |

| Palsgaard A/S | Expertise in plant-based emulsifiers with investments in non-GMO formulation ingredients and green manufacturing. |

Key Company Insights

BASF SE (18-22%)

Enhancing production capacity to support industry-driven sustainable sourcing and clean-label trends.

Kerry Group (14-18%)

It has unveiled a novel series of monoglycerides for a plant-based food product, riding on the trend of vegan and vegetarian food.

DuPont (10-14%)

Enhancing its line of emulsifiers with emphasis on improved functionality and stability during food and pharmaceutical applications.

Cargill, Inc. (8-12%)

Focuses on developing unique solutions for bakery and dairy applications customized around clean label innovations and ingredient performance.

Palsgaard A/S (6-10%)

Encouraging plant-based emulsifier usage along with a strong dedication to sustainability and non-GMO formulations.

The global distilled monoglycerides market is anticipated to grow at a CAGR of 3.5% from 2025 to 2035.

The global distilled monoglycerides market is projected to reach a market value of approximately USD 1,372.1 million by 2035.

The bakery segment is expected to be the fastest-growing segment, driven by increasing demand for emulsifiers to improve texture and shelf life in baked goods.

The growth is driven by increasing demand for clean-label emulsifiers, expanding applications in food and pharmaceuticals, and rising preference for sustainable and non-GMO ingredient sourcing.

Leading players in the market include BASF SE, Kerry Group, DuPont, Cargill, Palsgaard A/S, and Corbion N.V.

The segmentation is into food grade and industry grade.

The segmentation is into bakery, oils and fats, dairy, confectionery, frozen desserts, plastics, and others.

The market is segmented into sunflower, rapeseed, palm oil, and soybean oil.

The market is segmented into solid and liquid.

The market is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and The Middle East & Africa.

Liqueurs Market Analysis by Type, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast from 2025 to 2035

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

USA Bubble Tea Market Analysis from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.