The Disposable Respirators Market is valued at USD 2.9 billion in 2025. According to FMI's analysis, the disposable respirators industry will expand at a CAGR of 4.4% and reach USD 4.5 billion by 2035. Disposable respirators are protective gear that is crucial in preventing people from exposure to airborne pollutants, such as dust, microorganisms, and toxic particles. Their extensive application in industries like healthcare, construction, and manufacturing continues to fuel demand.

In 2024, the disposable respirators industry underwent a transformative surge, driven by strict workplace safety regulations and a mounting global interest in air purity. Demand was fueled by the healthcare and industrial sectors, which created pressure for innovation in ultra-fine filtration technology and ergonomic solutions that extended both protection and wearer comfort. As sustainability is becoming a core focus, manufacturers are seeking out biodegradable materials and environmentally friendly production processes to reduce the impact on environment. The convergence of efficiency, sustainability, and safety has transformed the industrial dynamics, opening door for quick expansion.

Moving forwards to 2025, the industry is poised for a significant growth, led by the regulatory compliance and integration with innovative and advanced respiratory solutions. Developed and upcoming materials ensure better breathability and filtration capabilities, redefining user experience. Furthermore, affordable innovations will accelerate the access to high-quality respiratory protection.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.9 billion |

| Industry Value (2035F) | USD 4.5 billion |

| CAGR (2025 to 2035) | 4.4% |

Explore FMI!

Book a free demo

The disposable respirators industry is charting upward, driven by stringent safety regulations and a growing worldwide awareness of airborne risks. State-of-the-art innovation in filtration technology and ergonomic fit are transforming protection, providing record levels of safety and comfort for healthcare workers, industrial staff, and frontline responders. With sustainability and intelligent innovation at the forefront, visionary producers ready to capitalize on green solutions and intelligent respiratory systems will control this high-stakes, fast-moving industry.

Innovate with Next-Generation Filtration & Intelligent Respiratory Technology

Invest in future-proof filtration material and intelligent respirator technology to improve efficiency, breathability, and real-time air quality detection. Industry pioneers in innovation will have a competitive advantage as regulation increases in intensity.

Align with Sustainability & Regulatory Paradigm Shifts

Evolve to changing environmental and health regulations by creating biodegradable, recyclable, and energy-efficient production solutions. Companies that actively adopt sustainability will achieve long-term customer confidence and regulatory acceptance.

Enhance Distribution & Strategic Partnerships

Increase global reach through strong supply chain networks, strategic partnerships with healthcare and industrial sectors, and online sales platforms. Utilizing partnerships and local manufacturing will reduce disruptions and unlock new revenue opportunities.

| Risks | Probability & Impact |

|---|---|

| Regulatory Overhaul & Compliance Burden - Governments globally are enforcing stringent workplace and environmental regulations, which could result in higher compliance costs and need to modify products. Non-compliance could result in significant penalties and limitations to sector access. | High Probability - Severe Impact |

| Raw Material Price Shocks & Supply Chain Disruptions - Inflationary pressures, trade restrictions, and geopolitical tensions are causing price volatility in essential components like filtration media and non-woven fabric. | Medium Probability - High Impact |

| Increasing Industry Competition & Brand Confusion - Swarms of inexpensive imports and replicas are flooding the marketplace, confusing customers and differentiating more difficult. Incumbents need to innovate or suffer as nimble, price-wars competitors gobble up share. | Medium Probability - Significant Impact |

| Priority | Immediate Action |

|---|---|

| Regulatory Disruption Preparedness | Establish a task force to monitor and proactively respond to changing global safety and sustainability requirements, maintaining first-mover status in compliance. |

| Supply Chain Shockproofing & Cost Mastery | Form strategic partnerships with other suppliers and invest in localized production centers to mitigate raw material price fluctuations and geopolitical chokepoints. |

| Tech-Driven Industry Domination | Accelerate the development of AI-driven respirators with real-time monitoring of air quality to reach the high-end segment and beat competition from low-priced alternatives. |

To stay ahead, companies must proactively embrace regulatory shifts, fortify supply chains, and accelerate innovation in smart and sustainable respirator technology. With mounting pressure on occupational safety and sustainability, achieving early compliance with changing regulations will be a differentiator instead of a cost.

Spends on AI-driven respirators and advanced filtration materials will not only attract premium pricing but also future-proof positioning in the industry. At the same time, diversification of supplier bases and setting up regional manufacturing centers will de-risk raw material price volatility and geopolitical concerns. The journey forward requires a vision of boldness, technology, and resilience-those who make timely decisions will lead, and the laggards will become obsolete.

N-series respirators will lead the industry for disposable respirators, fueled by higher filtration efficiency and increased adoption across healthcare and industrial sectors. With a growth CAGR of 4.2%, these respirators will experience increasing adoption, due to rigorous air quality regulations and rising awareness regarding workplace safety.

P-series respirators will grow gradually, especially across energy and heavy manufacturing industries, where protection from oil-based and non-oil particulates is essential. Projected to grow by 4.1%, their demand will increase as industries need long-term respiratory protection.

R-series respirators, for limited short-term use against oil-based particulates, will see moderate growth at 3.8% as industries value cost-saving, single-use respiratory protection. With advancements making respirators more breathable and comfortable, businesses investing in future-proof materials and intelligent filtration technology will enhance their industry position, addressing changing safety regulations and consumer trends.

Healthcare will drive the industry at a 4.2% CAGR as infection control precautions and increasing airborne disease risks trigger steady respirator demand. Construction will lead next, growing by 4.4%, pushed by increasing infrastructure developments and urbanization, raising workers' exposure to dust and pollutants.

Manufacturing will see stable growth at 4.2%, with heightened workplace safety requirements forcing industries to invest in respiratory protection. The energy industry, specifically oil and gas, will experience respirator uptake increase at 4.0%, as manufacturers prioritize employee safety against poisonous releases and dangerous particulates.

Transportation will be responsible for industry growth, increasing at 3.9%, as air pollution issues and protective equipment uptake in logistics and aviation gain momentum. Other sectors such as mining and chemical processing will experience a solid 3.8% CAGR, supporting the market's overall positive trend during the forecasted period.

The United States disposable respirators industry will experience steady growth, spurred by strict workplace safety standards and an increased emphasis on respiratory protection in healthcare and industrial applications. Growing concerns about occupational lung diseases and government initiatives to implement stricter air quality regulations will drive adoption.

Construction and energy industries will also play an important role, as hazardous working conditions of infrastructure projects and construction demand high-efficiency respiratory protection. Domestic manufacturing and on-shoring trends will also influence industry growth by lessening reliance on imports. FMI forecasts that the CAGR of the United States disposable respirators industry will be 4.5% from 2025 to 2035.

India's disposable respirators industry will see strong growth driven by accelerated levels of pollution, growing industrialization, and strict regulations by the government on safety in the workplace. As India goes through rapid urbanization, the demand from the construction and infrastructure segments will grow, and respirators will become a must-have for workers exposed to dust and harmful particles.

The growing healthcare industry, especially in metros and Tier-2 cities, will further enhance demand for quality respiratory protection in hospitals and labs. Price-conscious consumers will drive the industry for affordable yet efficient respirators, which will trigger innovations in affordable filtration technologies. FMI projects that the CAGR of the India disposable respirators industry will be 4.8% from 2025 to 2035.

China's disposable respirators industry will be defined by strict government regulations to enhance workplace safety in manufacturing, mining, and heavy industries. With increasing urbanization and continued industrial growth, high-filtration respirator demand will increase, especially in industries handling dangerous airborne pollutants. The nation's initiative towards self-reliance in manufacturing will fuel mass domestic production, lowering the reliance on imported brands.

The medical industry will also be a key driver in increasing demand as hospitals increase safety precautions against airborne pathogens. The availability of several local producers will also create stiff competition, which will result in constant product efficiency and affordability innovations. FMI is of the opinion that the CAGR of China’s disposable respirators industry will be 4.6% from 2025 to 2035.

The UK disposable respirators industry will grow steadily, driven by strict occupational safety laws and a robust healthcare industry. Increased emphasis on protecting workers in manufacturing and construction will drive demand for sophisticated respirators, especially in sectors handling toxic chemicals and airborne contaminants. Post-Brexit trade policies will affect supply chains, leading companies to increase domestic production and decrease dependence on imports.

Growing investment in healthcare facilities by the government will further increase the demand for top-class respiratory protection among medical professionals. Digitalization of PPE distribution will be a key driver, with online channels promoting accessibility and consumer awareness. FMI opines that the CAGR of the UK disposable respirators industry will be 4.2% from 2025 to 2035.

Germany's disposable respirators industry will experience steady growth, driven primarily by the nation's strict workplace safety regulations and focus on protecting workers. The automotive, manufacturing, and chemical sectors will continue to be significant users of high-efficiency respirators due to the stringent air quality requirements in manufacturing facilities.

Germany's industrial workforce aging will similarly fuel demand for further ergonomic and comfortable respirator designs. The availability of leading worldwide PPE companies as well as robust R&D capabilities will further spur technological evolution, further positioning Germany as a primary point of innovation within the industry. FMI forecasts that the CAGR of Germany’s disposable respirators industry will be 4.3% from 2025 to 2035.

The disposable respirators industry in South Korea will grow substantially led by its high-tech manufacturing industry and increased public health awareness of air pollution risks. The nation's emphasis on industrial safety and adherence to international health standards will fuel demand for high-quality respirators in construction, energy, and semiconductor manufacturing sectors.

With its image of technological advancement, South Korea will witness the introduction of smart respirators with integrated filtration sensors and real-time air quality monitoring. The increasing need for stylish yet practical protective equipment among urban consumers will also shape product design trends. FMI projects that the CAGR of South Korea’s disposable respirators industry will be 4.5% from 2025 to 2035.

Japan's disposable respirators industry will see steady growth owing to its rigorous workplace safety regulations and growing concerns about air quality. The medical sector will be a significant driver of demand, with hospitals and clinics increasing their protective gear against airborne infection. The construction sector will also see growing respirator use, driven by urban redevelopment schemes and government-imposed safety measures.

Japan's focus on technological superiority will also see the creation of respirators with inbuilt self-cleaning and antibacterial capabilities, increasing their lifespan and effectiveness. FMI is of the opinion that the CAGR of Japan’s disposable respirators industry will be 4.3% from 2025 to 2035.

France's disposable respirators industry will flourish as occupational safety standards continue to tighten in construction, healthcare, and manufacturing. The increasing focus on industrial hygiene and respiratory well-being will fuel demand for high-efficiency particulate respirators. In addition, heightened air pollution awareness, particularly in cities, will result in greater consumer adoption of personal protective equipment.

France's severe labor laws will make companies ensure respiratory safety compliance, adding further strength to demand. Expansion of domestic production capacities and innovation in ergonomically designed light-weight respirators will infuse industry with competitive strength. FMI forecasts that the CAGR of France’s disposable respirators industry will be 4.2% from 2025 to 2035.

Italy’s disposable respirators industry will gain momentum due to rising occupational safety awareness and strict European Union directives on workplace health standards. The country’s vast manufacturing and construction industries will be major consumers of high-filtration respirators, ensuring worker protection against airborne pollutants. The healthcare sector will also play a vital role in driving demand, especially in response to concerns over infectious disease outbreaks.

Italy’s luxury fashion and textile expertise may contribute to the development of stylish yet functional respirators, catering to a growing trend of fashionable PPE. The focus on sustainability will push companies to introduce reusable and biodegradable options, aligning with Italy’s environmental policies. FMI opines that the CAGR of Italy’s disposable respirators industry will be 4.1% from 2025 to 2035.

Australia and New Zealand’s disposable respirators industry will be driven by increasing climate change concerns and frequent wildfires, which contribute to deteriorating air quality. Public awareness of respiratory health will surge, leading to a rise in everyday respirator usage beyond industrial applications.

Sustainability will be a focal point, with governments advocating for recyclable and biodegradable respirators to reduce environmental impact. The rise of eco-tourism and outdoor recreational activities will also spur demand for lightweight, breathable respirators designed for prolonged wear. FMI projects that the CAGR of Australia and New Zealand’s disposable respirators industry will be 4.0% from 2025 to 2035.

(Surveyed Q4 2024, n=500 stakeholder participants evenly distributed across manufacturers, distributors, healthcare professionals, and industrial safety officers in the US, Western Europe, China, Japan, and India.)

Regional Difference:

Convergent and Divergent Views regarding ROI

Consensus:

Melt-blown Fabric: Preferred by 72% worldwide for its high filtration efficiency and breathability.

Variance:

Shared Challenges:

91% mentioned increasing material prices (melt-blown material up 25%, elastomeric parts up 19%) as a major industry challenge.

Regional Variations:

Manufacturers:

Distributors:

End-Users (Healthcare & Industrial Workers):

Alignment:

76% of worldwide manufacturers intend to invest in high-efficiency, environmentally friendly respirator technologies.

Divergence:

Conclusion: Variance vs. Consensus:

Universal Consensus: Workplace safety regulations, filtration efficacy, and cost factors are global concerns.

Principal Variances:

Strategic Insight:

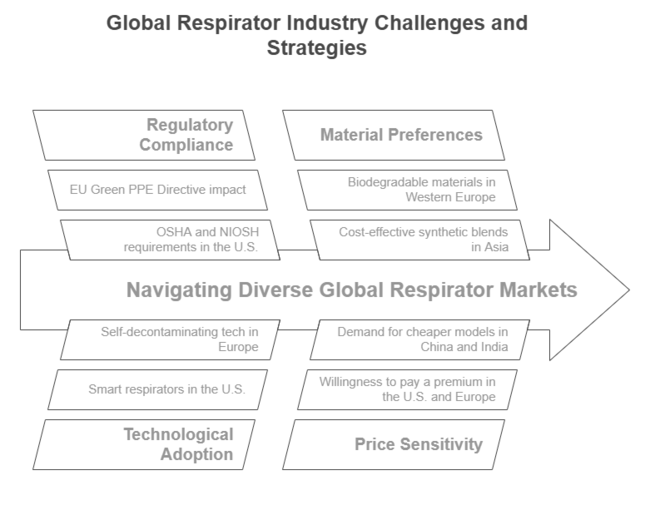

Disposable respirators industry needs region-wise adjustments-Western markets with premium innovation, price-driven production in Asia, and regulatory compliance as a global industry driver.

| Country | Government Regulations |

|---|---|

| United States | Compliance with NIOSH (National Institute for Occupational Safety and Health) standards is required by OSHA. In dangerous environments, employers are required to supply N95 or superior-rated respirators. FDA regulates medical-grade respirators. |

| India | Certification by BIS (Bureau of Indian Standards) is required for manufacture. Governmental subsidies encourage indigenous production to keep the country away from import reliance. Enforcers are strong during health emergencies. |

| China | GB 2626-2019 (KN-series) certification is mandated for use in the workplace. Government is strengthening its efforts against counterfeit PPE to ensure tighter safety compliance. |

| United Kingdom | UKCA (UK Conformity Assessed) marking has come in place of CE certification since Brexit. HSE (Health and Safety Executive) requires employers to comply with FFP2/FFP3 respirator standards. |

| Germany | EU-compliant EN 149 standard is in use (FFP1, FFP2, FFP3). Tighter worker safety regulations in high-risk sectors and tightening scrutiny of the sustainability of supply chains. |

| South Korea | MFDS (Ministry of Food and Drug Safety) governs KF-series respirators (KF80, KF94, KF99). Post-pandemic regulations promote domestic innovation in PPE technology. |

| Japan | JIS T 8151 certification is required for workplace respirators. Reusable models' preference results in government-supported incentives for eco-friendly PPE. |

| France | EU EN 149 compliance. Increased scrutiny on respirator imports to prevent counterfeits. Preference for biodegradable and reusable options. |

| Italy | EN 149 standards are applicable, but government policy prioritizes domestic production after COVID-19. The Ministry of Health strictly tests imported respirators. |

| Australia-New Zealand | AS/NZS 1716 certification is mandatory for workplace respirators. The government is tightening PPE supply chain control to ensure quality standards. |

The industry for disposable respirators is fragmented, with many global and local players. Major players are competing on competitive pricing, ongoing innovation, strategic alliances, and geographical expansion to gain higher market shares.

Leading players in the market for disposable respirators are involved in aggressive price strategies to tap price-sensitive consumers, spending on research and development to launch advanced products with increased comfort and filtering efficiency, forging strategic alliances to build distribution channels and access new sectors, and increasing manufacturing capabilities and making forays into new sectors to service increasing demand.

In March 2024, 3M increased its manufacturing capacity for N95 respirators to meet heightened worldwide demand, especially from the medical community. This increase was meant to provide a consistent supply of quality respirators during continuous health emergencies.

Moldex-Metric launched a biodegradable disposable respirator in September 2024, addressing the environmental impact of disposable PPE. With this launch, the company was at the forefront of green respiratory protection products.

In November 2024, Alpha Pro Tech bought a local PPE manufacturer to improve its supply base and diversify product lines in the disposable respirators segment. The move was as part of the company's plans to gain sector share and boost production capacity.

3M (~32%)

International N95 industry leader with strong healthcare & industrial market share.

Honeywell (~18%)

Core industrial safety & medical respirator competitor.

Kimberly-Clark (~11%)

Respected brand for professional-use disposable respirators.

Alpha Pro Tech (~7%)

PPE-specialized, recognized by NIOSH-certified N95 masks.

Moldex (~6%)

High-performance respirators for heavy industry specialists.

UVEX (~5%)

European leader in innovative respiratory protection technology.

Growing workplace health and safety regulations, increased pollution, and persisting health issues are propelling demand for superior respiratory protection.

Top players are adopting advanced filtration media, ergonomic solutions, and eco-friendly materials to enhance comfort, performance, and eco-friendliness.

Health care, construction, manufacturing, and mining industries still depend on disposable respirators because of occupational safety needs and regulatory enforcement.

Firms are creating biodegradable and recyclable respirators as a way of minimizing waste and complying with growing environmental regulations, particularly in Europe and North America.

Tighter environmental and safety regulations across the globe are compelling industries to achieve better certification levels and enhance product ingenuity.

N to Series, P to Series, R to Series

Transportation, Energy, Manufacturing, Construction, Healthcare, Others

North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa

Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

Air Quality Monitoring Equipment Market Growth - Trends & Forecast 2025 to 2035

Commercial Refrigeration Compressor Market Growth - Trends, Demand & Innovations 2025 to 2035

Dry Washer Market Insights - Demand, Size & Industry Trends 2025 to 2035

Airbag Control Unit Sensor Market Growth - Trends, Demand & Innovations 2025 to 2035

Automated Material Handling Systems Market - Market Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.