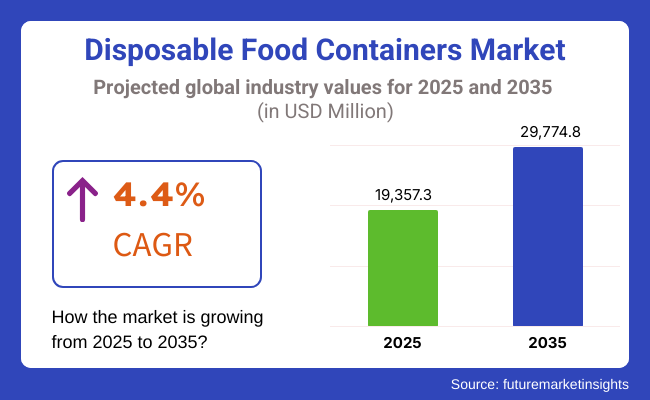

The market for disposable food containers is estimated to generate a market size of USD 19,357.3 million in 2025 and would increase to USD 29,774.8 million by 2035. It is expected to increase its sales at a CAGR of 4.4% over the forecast period 2025 to 2035. Revenue generated from disposable food containers in 2024 was USD 18,541.4 million.

Takeaway & online delivery will continue to hold over 44% of the disposable food containers market share in 2035. Online food ordering platforms like UberEats, DoorDash, and Zomato have gained prominence very quickly and command a growing larger share of the end-use market for takeaway and online food delivery. Through the consumer-friendly method of food delivery, restaurants, cloud kitchens, and fast-food chains are heavily investing in the sector with the use of good quality leak-proof heat-retaining containers.

Customers want their food to be fresh, warm, and suitably packed, driving demand higher for PP, PET, and paper-based packages. Many firms have turned rather optimistic towards bagasse, paperboard, and starch-based materials-based disposables.

Along with this, single-use plastic regulations are being implemented in many nations, which again leaves industries with no option but to opt for green alternatives. Consumer consumption patterns keep moving towards home deliveries and takeaways, and this sector will continue to grow, with a focus on sustainable and long-lasting solutions for food packaging that are also cost-effective.

The disposable food containers market will expand with lucrative opportunities during the forecast period, as it is estimated to provide an incremental opportunity of USD 11,233.4 million and will increase 1.6 times the current value by 2035.

Explore FMI!

Book a free demo

The below table presents the expected CAGR for the global disposable food containers market over several semi-annual periods spanning from 2024 to 2034.

| Particular | Value CAGR |

|---|---|

| H1 | 4.2% (2024 to 2034) |

| H2 | 4.6% (2024 to 2034) |

| H1 | 3.4% (2025 to 2035) |

| H2 | 5.4% (2025 to 2035) |

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 4.2%, followed by a slightly higher growth rate of 4.6% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 3.4% in the first half and remain relatively moderate at 5.4% in the second half. In the first half (H1) the market witnessed a decrease of 80 BPS while in the second half (H2), the market witnessed an increase of 80 BPS.

Food Delivery and Takeout Industry Growth

One of the leading forces driving the worldwide disposable food container market is rapid expansion in food delivery. Due to online food delivery systems such as Uber Eats, DoorDash, Zomato, and Deliveroo, cloud kitchens and restaurants are spending heavily on food containers that are not only durable but also leak-resistant and heatproof so that they could maintain the quality of the food during the transit.

The consumers now expect hygienic and convenient packaging, hence disposable food containers are a compulsion for home delivery and takeout. Lifestyle changes, hectic work schedules, and enhanced civilization have grown dependence on ready-to-eat foods, thereby further driving the market for single-use food containers.

Moving Towards Sustainable and Biodegradable Packaging

Due to increasing concern with the use of plastics and contamination, numerous markets and nations are establishing initiatives for environmentally friendly disposal of food packages. This can be seen because most of Europe, a few from North America, and the Asia-Pacific nations have implemented bans on single-use plastics to push food service entities to adopt biodegradable, compostable, and recyclable products. Innovations such as sugarcane bagasse, bamboo fiber, and molded pulp have been discovered to replace conventional plastic and Styrofoam packaging.

Additionally, green packaging is beginning to be requested by consumers, hence the brands are shifting their packaging practices by sustainability and corporate social responsibility (CSR) goals. With issues of enhancing environmental decrees becoming stringent and the green-minded consumer demands on the increase, the greater the sustainability option the global disposable food containers market adopts thus driving towards long-term growth.

High Costs of Sustainable Packaging Materials Affect the Market

Biodegradable and eco-friendly packaging is more expensive than traditional plastic packaging, this attribute cannot be ignored. Compostable and renewables, for instance, PLA (polylactic acid), sugar-cane fiber, and molded pulp, cost much higher in raw materials and require advanced production technologies, thereby resulting in outrageous prices. This imposed man-made constraints and excluded numerous little and medium-scale enterprises involved within the food business from making a life-altering decision towards adapting to sustainable packing.

Additionally, the biodegradable packing vessels are extremely dependent on particular wastage conditions, such as industrial composting plants, which are very far off from being realized in all parts. These cost limitations cut short the universal acceptability of these products, particularly in frugal markets, thereby inhibiting sustainable disposable food containers' expansion.

| Key Investment Area | Why It’s Critical for Future Growth |

|---|---|

| Leak-Proof & Heat-Resistant Designs | Improving heat and moisture resistance will provide improved performance for hot and cold foods, enhancing customer satisfaction. |

| Lightweight & Economical Solutions | Thinner, yet strength-effective containers will reduce raw material expenses while preserving structure and functionality. |

| Customization & Branding | Providing quality printing, embossing, and custom shapes will enable food companies to enhance their customer experience and brand identity. |

| Automation & High-Speed Production | Investing in productive manufacturing methods will make large-scale and affordable production available to address increasing demand from the takeaway and food delivery sector. |

| Sustainability & Eco-Friendly Materials | As single-use plastics continue to be banned, the investment in biodegradable, compostable, and recyclable materials (such as bagasse, PLA, paperboard) will assist in fulfilling regulatory and consumer requirements. |

The global disposable food containers market achieved a CAGR of 3.1% in the historical period of 2020 to 2024. Overall, the disposable food containers market performed well since it grew positively and reached USD 18,541.4 million in 2024 from USD 16205.7 million in 2020.

The market for disposable food containers had consistent growth from 2020 to 2024 due to mounting demand for food packaging convenience, the escalating trend of takeaway and food delivery, and a higher use of environment-friendly and biodegradable products.

| Market Aspect | 2020 to 2024 (Past Trends) |

|---|---|

| Material Trends | Mainly plastic (PP, PET, PS), aluminum, and paper containers. |

| Regulatory Environment | Enforcement of single-use plastics bans in most parts of the world, promoting environmentally friendly options. |

| Consumer Demand | Strong demand among fast-food companies, restaurants, and meal services for affordable, long-lasting packages. |

| Technological Innovations | Appearance of microwave-safe, heat-resistant, and light weight food packaging. |

| Sustainability Trends | Growing focus on recyclable and reusable food packaging to offset plastic waste. |

| Market Aspect | 2025 to 2035 (Future Projections) |

|---|---|

| Material Trends | Transition to biodegradable, compostable, and recyclable materials like bagasse, PLA, and molded fiber. |

| Regulatory Environment | More stringent international regulations fostering sustainable packaging, extended producer responsibility (EPR), and circular economy programs. |

| Consumer Demand | Increased uptake of plastic-free, PFAS-free, home-compostable packaging for foods which are well-insulated and leak-proof. |

| Technological Innovations | Bio-based, edible, and intelligent packaging with features of temperature and freshness indication. |

| Sustainability Trends | Principal driver of carbon-free manufacturing, zero-waste packaging solutions, and closed-loop recycling systems. |

| Factor | Consumer Priorities (2019 to 2024) & (2025 to 2035) |

|---|---|

| Cost & Pricing |

|

| Performance (Durability, Heat Resistance, Leak Proofing) |

|

| Aesthetics & Branding |

|

| Product Availability & Convenience |

|

| Reusability & Circular Economy |

|

| Factor | Manufacturer Priorities (2019 to 2024) & (2025 to 2035) |

|---|---|

| Cost & Pricing |

|

| Performance (Durability, Heat Resistance, Leak Proofing) |

|

| Aesthetics & Branding |

|

| Product Availability & Convenience |

|

| Reusability & Circular Economy |

|

The period 2025 to 2035 is projected to witness growth in the demand for disposable food packaging owing to rising uses in online food delivery companies and quick-service restaurants, intensified research in plastic-free and compostable packaging material, and tightened government regulations endorsing plastic-free and recyclable food containers.

Tier 1 companies comprise market leaders capturing significant market share in global market. These market leaders are characterized by high production capacity and a wide product portfolio. These market leaders are distinguished by their extensive expertise in manufacturing across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of series including recycling and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within tier 1 include Huhtamäki Oyj, Dart Container Corporation, D&W Fine Pack, DOpla SpA.

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market. These are characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include Gold Plast SPA, SOLIA Inc., Vegware Ltd, Lacerta Group Inc., South Plastic Industry Co., Ltd., ENPAK Eco-Friendly Food Container, Arafhat Plastics.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment. They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

| Region | 2019 to 2024 (Past Trends) |

|---|---|

| North America | High demand due to the rise in food delivery, takeout, and quick-service restaurants. |

| Latin America | Moderate market growth with rising urbanization and fast-food culture. |

| Europe | Leading market due to strict EU regulations on single-use plastics. |

| Middle East & Africa | Emerging market with rising demand from quick-service restaurants and food stalls. |

| Asia Pacific | Government-imposed bans on single-use plastics accelerating demand for alternatives. |

| Region | 2025 to 2035 (Future Projections) |

|---|---|

| North America | Shift toward fully compostable and biodegradable food containers. |

| Latin America | Expansion of local eco-friendly disposable container production. |

| Europe | Complete phase-out of non-recyclable disposable food containers. |

| Middle East & Africa | Government-driven initiatives for sustainable packaging solutions. |

| Asia Pacific | Growth in smart and temperature-sensitive packaging for better food preservation. |

The section below covers the future forecast for the disposable food containers market in terms of countries. Information on key countries in several parts of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe and MEA is provided. USA is expected to account for a CAGR of 3.3% through 2035. In Europe, Spain is projected to witness a CAGR of 4% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 3.3% |

| Germany | 2.9% |

| China | 5.3% |

| UK | 2.8% |

| Spain | 4.0% |

| India | 5.5% |

| Canada | 3.1% |

The USA disposable food product container market is valued up into billions of dollars with a rise in demand for biodegradable and compostable food containers as alternatives to plastic food containers. The concern and awareness of plastic pollution have compelled corporate America and consumers alike to consider biodegradable, paper-based, and plant-fiber food containers over plastic. Large food chain giants like McDonald's, Starbucks, and Chipotle have already made countless statements on reducing single-use plastics and entering sustainable packaging.

The rest of America-New York and California-are prohibiting Styrofoam containers forcing food service companies to invest in disposable food containers from paper, bamboo, and bagasse. The expansion of numerous new food delivery companies like Uber Meals and DoorDash is now generating demand for reusable and sustainable packaging that is compliant with regulations and consumer acceptable. Sustainability, having taken hold with the imagination now, will witness the USA disposable food container market expand.

Some of the major drivers pushing the disposable food container market are the strict environmental regulations and the plastic waste Reduction program implemented in Germany. The nation implements the EU policies on single-use plastics against non-recyclable food containers but in support of biodegradable ones. Foodservice outlets like restaurants, cafes, and takeaways are quickly turning to paper, cardboard, and compostable fiber food packaging to comply with these regulations.

Deposit-return and reusable food container systems are also on the rise in Munich and Berlin, leading the way for green packaging technology. Firm government policies and environmentally conscious consumers have therefore continued to generate a massive demand for environmentally friendly disposables in Germany.

The section contains information about the leading segments in the industry. In terms of material type, Polypropylene (PP) is being estimated to account for a share of 34% by 2025. By application, fresh food is projected to dominate by holding a share above 38.4% by the end 2025.

| Material Type | Market Share (2025) |

|---|---|

| Polypropylene (PP) | 34% |

Polypropylene (PP) due to its strength, thermal resistance, and affordability is the pillar of the disposable food container business. PP is widely employed in microwave packets, takeaway food boxes, and food storage as it will never deform even if exposed to a high temperature. PP material of the container is lightweight and reusable and is not prone to water, thus can be utilized in storing different kinds of foods such as hot foods and cold foods.

Compared to other plastics, it leaves a smaller environmental footprint as it is recyclable and has lower energy requirements for manufacturing. Its affordability and simplicity of manufacture further solidify PP offerings as first choice among restaurants and foodservice providers. As companies depart from non-recyclable plastics, polypropylene will be a leading option for eco-friendly food packaging.

| Application Segment | Market Share (2025) |

|---|---|

| Fresh Food | 38.4% |

Takeaway food segment always leads due to online food delivery companies and fast-food outlets further growing globally. Takeaway containers must be tough, leak-free, and heat-resistant, maintaining freshness and safety of food during transportation. Additionally, paper-based and bagasse containers are in fashion since consumers and governments now encourage any sustainable packaging-related products. The new expansion of QSRs and cloud kitchens is also increasing demand.

Therefore, the food takeaway business would still be the biggest user of disposable food packaging but growing at pace with growth in food delivery around the globe. More and more, there would be a focus on recyclable and biodegradable choices.

Key players of global disposable food containers industry are developing and launching new products in the market. They are integrating with different firms and extending their geographical presence. Few of them are also collaborating and partnering with local brands and start-up companies

Key Developments in Disposable Food Containers Market

| Manufacturer | Vendor Insights |

|---|---|

| Huhtamaki | An international supplier of renewable and recyclable packaging solutions on a sustainable path, producing large numbers of renewable and recyclable disposable food packaging containers. |

| Dart Container Corporation | A top producer of high-quality, single-use food and beverage packaging items, such as a range of disposable food containers. |

| Berry Global Inc. | Essays a broad portfolio of plastic packaging solutions, such as disposable food packaging, with a focus on sustainability and customer-driven solutions. |

| Amcor | Provides a wide range of packaging solutions, including disposable food packaging materials, with a combination of sustainability and innovation. |

| WestRock Company | Focused on paper and packaging solutions, delivering innovative and sustainable disposable food containers for a number of applications. |

Key Players in Disposable Food Containers Market

The global disposable food containers industry is projected to witness CAGR of 4.4% between 2025 and 2035.

The global disposable food containers industry stood at 18,541.4 million in 2024.

Global disposable food containers industry is anticipated to reach USD 29,774.8 million by 2035 end.

East Asia is set to record a CAGR of 5.5% in assessment period.

The key players operating in the global disposable food containers industry include Huhtamäki Oyj, Dart Container Corporation, D&W Fine Pack, DOpla SpA.

The disposable food containers market is categorized based on material into polypropylene (PP), polystyrene (PS), polyethylene terephthalate (PET), paper and paperboard, aluminum, bagasse, and starch-based materials.

The market is segmented by application into fresh food, food takeaway, and retail.

The end-use market includes restaurants and eateries, take-away and online delivery, catering services, and institutional use.

Key Countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East & Africa are covered.

Nitrogen Flushing Machine Market Report – Trends, Size & Forecast 2025-2035

Perfume Filling Machine Market Report – Trends, Demand & Industry Forecast 2025-2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

North America PET Blow Molder Market Growth - Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.