The disinfectant chemicals market is growth positive between 2025 and 2035, supported by the rise in health consciousness and demand for targeted hygiene regulations in healthcare as well as commercial establishments and the need for infection management.

They are important in reducing cross-contamination through surfaces, equipments, and closed-in locations of things such as activities including in hospitals, food processing units, public transport systems, and houses. The demand increased during the COVID-19 pandemic and continues to be high owing to increased hospitalization and pathogen control standards.

However, technological innovations concerning eco-friendly, non-toxic, fast-acting formulations of disinfectants are remodeling the competitive sphere. Active chlorine, quaternary ammonium compounds (quats), and alcohol still dominate, but hydrogen peroxide and bio-based alternatives are coming on strong.

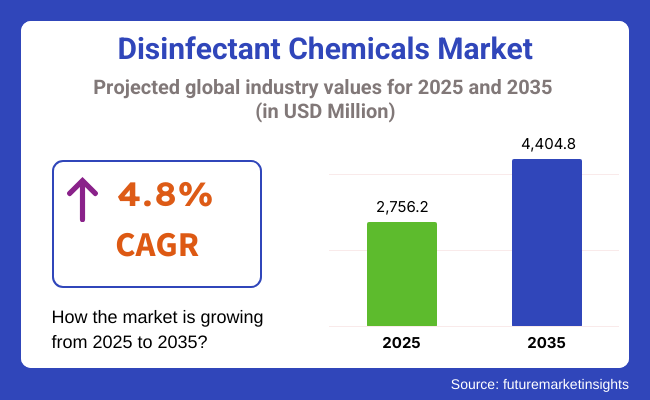

The global disinfectant chemicals market is anticipated to follow a common annual growth rate of 4.8%, increasing from USD 2,756.2 Million in 2025 to USD 4,404.8 Million in 2035, due to regulatory obligation & acceptance across sectors.

This report offers an analysis of the global disinfectant chemicals market, providing insights into how the demand for disinfectant chemicals has evolved over time and also what the market is being led into. Each of these chemicals is integral to the elimination of bacteria, viruses, and fungi throughout our homes, businesses, and health care facilities.

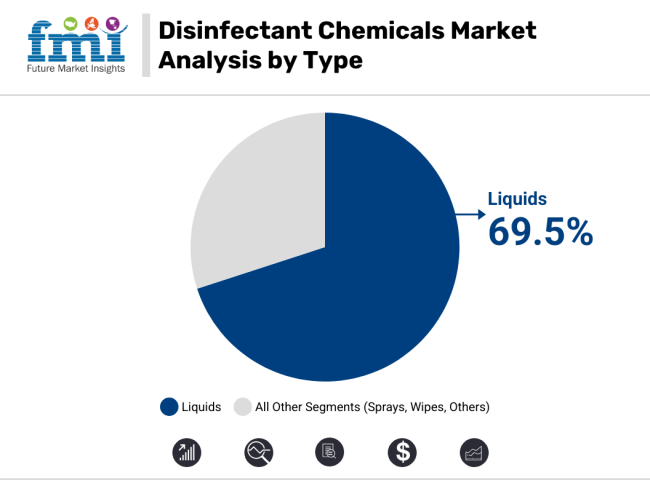

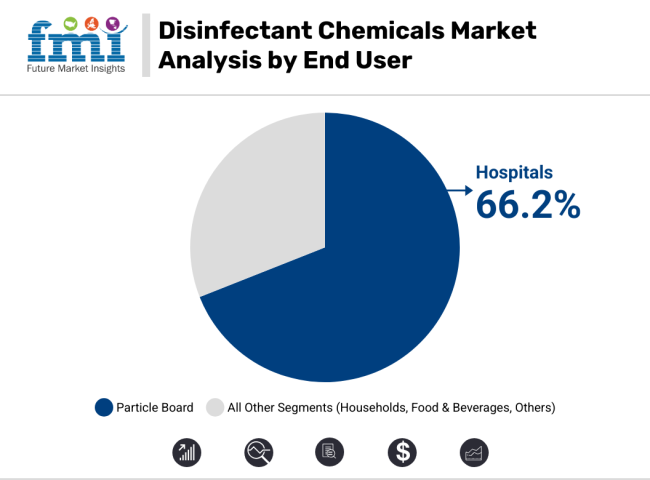

In terms of leading product types and user segment, the demand for liquid disinfectants and hospital application in health care settings is expected to account for the largest market share globally due to its multipurpose nature, broad-spectrum activity, and high penetration in infection control and public health procurement systems as well as protocols. These components guarantee rapid-stop microbial death while complying with strict public health laws.

Manufacturers of disinfectants are concentrated on formulating eco-friendly, non-corrosive, and skin-safe formulations suitable for use by institutional and home users. For large-surface disinfection, liquids are still the most versatile form, yet validated formulations in hospitals are necessary to prevent nosocomial infection.

Liquid disinfectants gain traction due to versatility, application coverage, and formulation compatibility

Liquid is the most widely used form of disinfectant chemicals for cleaning large surfaces, cleaning instruments, and cleaning high-touch surfaces in healthcare, commercial, and industrial environments. They can be mixed with water and have concentration adjustment and can be integrated in mop systems or dosing automatic devices which offers flexibility at multiple disinfection scenarios.

These liquid disinfectants may contain alcohols, quaternary ammonium compounds, or solutions of hydrogen peroxide and are generally fast-acting (short contact times) and can be used by wiping, soaking, or spraying. Institutional use is driven by their broad acceptance in protocols for hard-surface cleaning and compatibility with reusable medical equipment.

In foodservice, manufacturing, and institutional cleaning, liquid disinfectants are still paramount, because they are easy to store, widely available, and cost less per use. Sprays are becoming popular in consumer formats for this very reason, however liquids are still the most widely consumed form for professional-grade effectiveness.

Hospitals drive market use through strict sanitation protocols, antimicrobial compliance, and critical care environments

Hospital-acquired infection (HAI) is on the rise and stringent regulatory environment created by health authorities (Centers for Disease Control and Prevention (CDC), World Health Organization (WHO), etc.) has made hospitals the largest end-user segment for the disinfectant chemicals market.

Disinfectants are a key component in spaces like operating rooms, ICUs, outpatient clinics and diagnostic laboratories where pathogen control is important.Hospital-grade disinfectants are also designed to be effective on various microorganisms, including MRSA, C. difficile and SARS-CoV-2. These applications rely on proven formulations that offer rapid kill times, lower toxic hazards, and suitability for sensitive equipment and hard surfaces.

Apart from surface disinfectants, hospitals also employ disinfectants for surgical instruments, isolation wards and environmental fogging systems. Such a consistent demand fosters long-term procurement contracts and high turnover of their products for chemical suppliers.Although household use has jumped significantly since the pandemic, particularly in wipes and in aerosol sprays, hospitals are the primary force, as their disinfection needs are continuous, high-volume and compliance-driven.

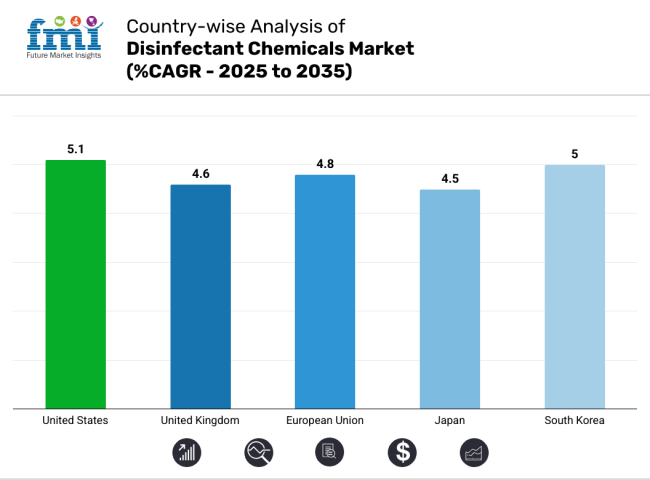

The USA accounts for the largest share in the North American disinfectant chemicals market, driven by stringent guidance from the CDC and EPA regarding disinfection practices, high health care expenditure, and a robust institutional cleaning industry. Quats, alcohol-based, and chlorine derivatives continue to see strong demand, with key end-use markets including hospitals, food services, and mass transit networks. Growth in eco-label-certified formulations is on the rise as well.

In Europe, a sustainability approach to disinfection is already showing results: ECHA, REACH and other regulations are compelling producers to adopt biodegradable alternatives and low-VOC methods. Countries including Germany, France, and the UK are leading the application of hydrogen peroxide and accelerated oxidizing agents in medical, industrial, and residential settings. Growth driven by cleanroom disinfection and infection prevention in eldercare and public facilities

Asia-Pacific is the fastest growing, fueled by increasing public hygiene campaigns, quickening hospital infrastructure addition in India, China and Southeast Asia. Demand is especially high in food safety, water treatment, and public sanitation. Government programs and private investments toward pandemic preparedness and antimicrobial infrastructure are bolstering the market growth.

Toxicity concerns, regulatory hurdles, and surface compatibility issues affect adoption

Tightened scrutiny through the lens of chemical toxicity is mounting in the market for air and surface disinfectants given the increased scrutiny over the long-term exposure to quaternary ammonium compounds, chlorine, and phenol-based disinfectants. Regional regulatory restrictions differ significantly, making it challenging to standardize formulations globally. Some chemicals can even corrode surfaces or degrade sensitive medical equipment, which limits their use in certain environments, he added.

Small-scale manufacturers and institutional buyers also struggle to assess efficacy claims owing to inconsistent labeling and non-harmonised testing protocols. In addition, increasing knowledge about indoor air quality is driving customers from strong-smelling or irritant-based formulations, putting pressure on legacy product lines to finetune with milder, safer chemistries.

Bio-based disinfectants, smart dispensing, and healthcare infrastructure create new growth frontiers

Vanguard opportunities exist in plant based disinfectants, green and certified chemical agents that have antimicrobial activity but do not possess environmental or human toxicity. Hydrogen peroxide, peracetic acid and electrolyzed water are increasingly being used in the pharmaceutical, food and hospitality industries. These alternatives are becoming more compliant with global safety certifications and provide wide-spectrum disinfection free from chemical residue.

Institutional hygiene management is getting revolutionized by smart dispensing systems integrated with IoT sensors, auto-dosing, and touchless applications. The increasing adoption of robotic disinfection procedures in hospitals and airports, coupled with higher demand from the pharmaceutical manufacturing sector, is contributing to the demand for high-throughput, rapid-action disinfectants. Advances in concentrated, multi-use formulas with a longer shelf life are also improving operational efficiency across sectors.

The COVID-19 pandemic led to an unprecedented surge in demand for disinfectant chemicals between 2020 and 2024. Households, institutions and transportation authorities ramped up their cleaning frequency. The scene was dominated by alcohol-based hand sanitizers, chlorine disinfectants and quats. These challenges in sustainability and product differentiation were compounded by an oversupply situation after the pandemic, health concerns over chemical exposure, and the environmental impact of excessive usage.

In Washington, 2025 to 2035 will usher in a new phase of the revolution that will focus on efficacy, safety and environmental impact when it comes to strategic disinfection protocols. Tailored formulations for critical sectors like pharmaceuticals, eldercare, and hospitality will drive growth.

Cleaning compliance monitoring powered by AI, robotic disinfection units programmed in advance and hygiene dashboards integrated into smart buildings could become standard. Innovation will increasingly be driven by sustainability, and green chemistry and circular packaging models will become new baseline differentiators.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Emergency approvals and safety relaxations |

| Consumer Trends | Panic buying and daily disinfection routines |

| Industry Adoption | Widespread in hospitals, transport, retail |

| Supply Chain and Sourcing | Overreliance on alcohol and chlorine producers |

| Market Competition | Led by multinational chemical firms |

| Market Growth Drivers | COVID-19 response, surface disinfection awareness |

| Sustainability and Impact | High chemical waste and VOC emissions |

| Smart Technology Integration | Manual spraying, basic fogging systems |

| Sensorial Innovation | Fragranced and bleach-based formulations |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter VOC, toxicity, and surface impact guidelines |

| Consumer Trends | Preference for long-term, safe, and eco-certified disinfection |

| Industry Adoption | Expansion into biotech, hospitality, pharma, and smart infrastructure |

| Supply Chain and Sourcing | Diversification toward hydrogen peroxide, botanical, and regional sources |

| Market Competition | Entry of green chemistry startups, hygiene robotics, and AI-based firms |

| Market Growth Drivers | Smart hygiene management, sustainable procurement, and institutional safety |

| Sustainability and Impact | Rise in biodegradable products, waterless sprays, and green certification |

| Smart Technology Integration | IoT-integrated dispensers, robotic sanitizers, and compliance dashboards |

| Sensorial Innovation | Skin-safe, fragrance-free, and non-residue antimicrobial innovations |

The demand from healthcare, food processing and institutional cleaning sectors are the key factors driving the USA disinfectant chemicals market. The COVID-19 pandemic permanently altered cleanliness expectations, driving up to eight times the use of quaternary ammonium compounds, hydrogen peroxide and chlorine-based disinfectants.

Hospitals and long-term care centers are moving toward the use of EPA-registered, broad-spectrum disinfectants for the sanitization of surfaces and equipment. Big producers in states including Ohio and New Jersey are boosting capacity and creating ready-to-use wipes and sprays of disinfectants. "The market is also being fueled by an increased level of hygiene in schools, airports and transportation hubs."

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.1% |

In the UK, the use of disinfectant chemicals is on the rise in hospitals, veterinary clinics and commercial kitchens.The NHS is further leading the charge on high-efficacy disinfectant adoption for infection control, with private health establishments iterating towards more eco-safe and low-residue formulations.

Schools and public buildings are pushing for biodegradable and alcohol-free disinfectants. This is propelling domestic manufacturers towards focused ranges on chlorine dioxide and peracetic acid blends to guide wide-spectrum microbial elimination. Brexit-induced regulations are also a boon for innovation and speedier product approvals for EU alternatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.6% |

Demand in the EU for disinfectant chemicals remains stable, largely due to protocols in the health sector, food safety regulations, and biosecurity requirements in agriculture. Germany, France and the Netherlands are the frontrunners in usage, primarily in dairy, meat processing, and clinical settings.

The Biocidal Products Regulation (BPR) is promoting cleaner formulations and harmonized product labelling. Chlorine derivatives, iodine and alcohol-based compounds are still common with new combinations with essential oils and silver ions taking market share. R&D of non-toxic, plant-based disinfectants and automated disinfection technologies are funded as part of EU interventions.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.8% |

The disinfectant chemicals market in Japan is driven by historical cultural preferences towards cleanliness and steady public health awareness. Alcohol-based sanitizers prevail in retail and health care settings, while quaternary ammonium compounds are widely used in food service and facility management.

Manufacturers are producing low-odor, quick-drying formulas featuring skin-friendly ingredients for frequent use. For emergency preparedness, now regulatory bodies like the Ministry of Health have expedited disinfectant registrations, to facilitate ease of use. Robotics-enabled surface disinfection and ultraviolet-activated chemical spraying are also making inroads in hospitals and public transit.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.5% |

Demand from healthcare institutions, food factories, and consumer goods sectors are boosting South Korea's disinfectant chemicals market. The government also imposes strict hygiene regulations in schools and childcare facilities, driving demand for safer and non-toxic disinfectants.

Products based on alcohol, hypochlorite, and benzalkonium chloride are prevailing, while innovations involving nano-silver and enzyme-based blends are emerging. Start-ups are making portable disinfection sprays, and public places are beginning to install automated spray booths. Domestic companies are increasing exports to the Middle East and Southeast Asia in response to growing regional demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

The potential is huge, and with the contamination crisis, the bad is about to be even more contagion at first, and later on the influx of disinfectant chemicals. Increasing use of quaternary ammonium compounds (quats), chlorine compounds, hydrogen peroxide, phenolics, and alcohol-based disinfectants drives the market.

Manufacturers are coming up with low-toxicity, biodegradable, broad-spectrum solutions that are effective, while not damaging the material. Trends from the pandemic have established new levels of disinfection protocols throughout both public and private spaces, even as companies improve formulations for delivery through spray, wipe, fogging and electrostatic systems.

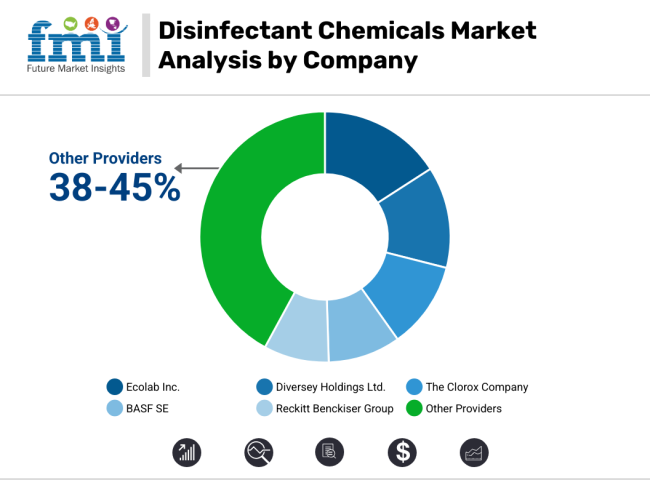

Market Share Analysis by Key Players & Disinfectant Chemical Providers

| Company Name | Key Offerings/Activities |

|---|---|

| Ecolab Inc. | In 2024, introduced biodegradable hospital-grade disinfectants for operating rooms in 2025, launched electrostatic-compatible surface disinfectants for food processing. |

| Diversey Holdings Ltd. | In 2024, upgraded Suma disinfectant line with broad-spectrum virucidal formulas in 2025, expanded into smart dispenser integration with AI-based dosage tracking. |

| The Clorox Company | In 2024, added fragrance-free healthcare wipes to its germicidal bleach platform in 2025, released botanical-based disinfectants under a new eco-label. |

| BASF SE | In 2024, developed peracetic acid-based industrial disinfectants for brewery and dairy sectors in 2025, commercialized bio-based quats for institutional use. |

| Reckitt Benckiser Group | In 2024, reformulated Lysol Pro solutions for low-residue applications in 2025, launched fogger-compatible disinfectants for transit and public facilities. |

Key Market Insights

Ecolab Inc. (14-17%)

Ecolab maintains market leadership with its comprehensive infection prevention portfolio spanning healthcare, hospitality, and industrial applications. In 2024, the company introduced biodegradable hospital disinfectants that meet EPA and EU standards for use in surgical suites.

By 2025, Ecolab launched food-grade surface disinfectants optimized for electrostatic sprayers, improving coverage efficiency in meat and produce facilities. With AI-enabled monitoring and traceability systems, Ecolab enables high-assurance disinfection with minimal product waste.

Diversey Holdings Ltd. (11-14%)

Diversey has strengthened its position in commercial and institutional sanitation by combining formulation science with smart dispensing technology. In 2024, it enhanced its Suma disinfectant range with improved virucidal performance and quicker contact times. In 2025, it deployed integrated dispenser systems with AI-based usage tracking and alerts for janitorial crews. Diversey’s presence in schools, retail, and hotels is reinforced by training programs and compliance reporting tools for facility managers.

The Clorox Company (9-12%)

Clorox continues to expand from consumer spaces into clinical and institutional disinfection. In 2024, it launched fragrance-free germicidal wipes specifically designed for sensitive healthcare environments. In 2025, it introduced plant-based disinfectants formulated without ammonia, bleach, or synthetic dyes expanding into green-certified cleaning. Its dual-brand strategy with both mainstream and eco-conscious products allows Clorox to capture a broad user base from hospitals to wellness spas.

BASF SE (7-10%)

BASF is a key supplier of active ingredients and tailored disinfectant blends for industrial users. In 2024, it launched peracetic acid solutions for hygienic plant cleaning in breweries and dairy production. In 2025, BASF commercialized next-gen quaternary ammonium compounds derived from renewable feedstocks, designed for institutional and veterinary applications. The company’s strength in chemical innovation allows it to tailor antimicrobial properties for specific surfaces, temperatures, and microbial profiles.

Reckitt Benckiser Group (6-9%)

Reckitt drives both consumer and professional hygiene innovations under the Lysol and Dettol brands. In 2024, it reformulated its Lysol Pro range to reduce streaking and residue in schools and office spaces. In 2025, Reckitt launched fogger-compatible disinfectants that meet new public transit sanitation protocols across Europe and Asia. Its digital platforms include QR-code-linked training for custodial staff and compliance documentation for regulators, ensuring end-to-end support for hygiene management.

Other Key Players (38-45% Combined)

Numerous regional suppliers, specialty disinfectant formulators, and bio-based chemical startups are contributing to innovation and market diversity. These include:

Table 01: Global Market Value (US$ Mn) Forecast by Region, 2017-2032

Table 02: Global Market Volume (Tons) Forecast by Region, 2017-2032

Table 03: Global Market Value (US$ Mn) Forecast by Product Type, 2017-2032

Table 04: Global Market Volume (Tons) Forecast by Product Type, 2017-2032

Table 05: Global Market Value (US$ Mn) Forecast by Activity, 2017-2032

Table 06: Global Market Volume (Tons) Forecast by Activity, 2017-2032

Table 07: Global Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 08: Global Market Volume (Tons) Forecast by Application, 2017-2032

Table 09: North America Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 10: North America Market Volume (Tons) Forecast by Country, 2017-2032

Table 11: North America Market Value (US$ Mn) Forecast by Product Type, 2017-2032

Table 12: North America Market Volume (Tons) Forecast by Product Type, 2017-2032

Table 13: North America Market Value (US$ Mn) Forecast by Activity, 2017-2032

Table 14: North America Market Volume (Tons) Forecast by Activity, 2017-2032

Table 15: North America Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 16: North America Market Volume (Tons) Forecast by Application, 2017-2032

Table 17: Latin America Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2017-2032

Table 19: Latin America Market Value (US$ Mn) Forecast by Product Type, 2017-2032

Table 20: Latin America Market Volume (Tons) Forecast by Product Type, 2017-2032

Table 21: Latin America Market Value (US$ Mn) Forecast by Activity, 2017-2032

Table 22: Latin America Market Volume (Tons) Forecast by Activity, 2017-2032

Table 23: Latin America Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 24: Latin America Market Volume (Tons) Forecast by Application, 2017-2032

Table 25: Europe Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 26: Europe Market Volume (Tons) Forecast by Country, 2017-2032

Table 27: Europe Market Value (US$ Mn) Forecast by Product Type, 2017-2032

Table 28: Europe Market Volume (Tons) Forecast by Product Type, 2017-2032

Table 29: Europe Market Value (US$ Mn) Forecast by Activity, 2017-2032

Table 30: Europe Market Volume (Tons) Forecast by Activity, 2017-2032

Table 31: Europe Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 32: Europe Market Volume (Tons) Forecast by Application, 2017-2032

Table 33: East Asia Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 34: East Asia Market Volume (Tons) Forecast by Country, 2017-2032

Table 35: East Asia Market Value (US$ Mn) Forecast by Product Type, 2017-2032

Table 36: East Asia Market Volume (Tons) Forecast by Product Type, 2017-2032

Table 37: East Asia Market Value (US$ Mn) Forecast by Activity, 2017-2032

Table 38: East Asia Market Volume (Tons) Forecast by Activity, 2017-2032

Table 39: East Asia Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 40: East Asia Market Volume (Tons) Forecast by Application, 2017-2032

Table 41: South Asia & Pacific Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 42: South Asia & Pacific Market Volume (Tons) Forecast by Country, 2017-2032

Table 43: South Asia & Pacific Market Value (US$ Mn) Forecast by Product Type, 2017-2032

Table 44: South Asia & Pacific Market Volume (Tons) Forecast by Product Type, 2017-2032

Table 45: South Asia & Pacific Market Value (US$ Mn) Forecast by Activity, 2017-2032

Table 46: South Asia & Pacific Market Volume (Tons) Forecast by Activity, 2017-2032

Table 47: South Asia & Pacific Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 48: South Asia & Pacific Market Volume (Tons) Forecast by Application, 2017-2032

Table 49: MEA Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 50: MEA Market Volume (Tons) Forecast by Country, 2017-2032

Table 51: MEA Market Value (US$ Mn) Forecast by Product Type, 2017-2032

Table 52: MEA Market Volume (Tons) Forecast by Product Type, 2017-2032

Table 53: MEA Market Value (US$ Mn) Forecast by Activity, 2017-2032

Table 54: MEA Market Volume (Tons) Forecast by Activity, 2017-2032

Table 55: MEA Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 56: MEA Market Volume (Tons) Forecast by Application, 2017-2032

Figure 01: Global Market Value (US$ Mn) by Product Type, 2022-2032

Figure 02: Global Market Value (US$ Mn) by Activity, 2022-2032

Figure 03: Global Market Value (US$ Mn) by Application, 2022-2032

Figure 04: Global Market Value (US$ Mn) by Region, 2022-2032

Figure 05: Global Market Value (US$ Mn) Analysis by Region, 2017-2032

Figure 06: Global Market Volume (Tons) Analysis by Region, 2017-2032

Figure 07: Global Market Value Share (%) and BPS Analysis by Region, 2022-2032

Figure 08: Global Market Y-o-Y Growth (%) Projections by Region, 2022-2032

Figure 09: Global Market Value (US$ Mn) Analysis by Product Type, 2017-2032

Figure 10: Global Market Volume (Tons) Analysis by Product Type, 2017-2032

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2022-2032

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2022-2032

Figure 13: Global Market Value (US$ Mn) Analysis by Activity, 2017-2032

Figure 14: Global Market Volume (Tons) Analysis by Activity, 2017-2032

Figure 15: Global Market Value Share (%) and BPS Analysis by Activity, 2022-2032

Figure 16: Global Market Y-o-Y Growth (%) Projections by Activity, 2022-2032

Figure 17: Global Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 18: Global Market Volume (Tons) Analysis by Application, 2017-2032

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 21: Global Market Attractiveness by Product Type, 2022-2032

Figure 22: Global Market Attractiveness by Activity, 2022-2032

Figure 23: Global Market Attractiveness by Application, 2022-2032

Figure 24: Global Market Attractiveness by Region, 2022-2032

Figure 25: North America Market Value (US$ Mn) by Product Type, 2022-2032

Figure 26: North America Market Value (US$ Mn) by Activity, 2022-2032

Figure 27: North America Market Value (US$ Mn) by Application, 2022-2032

Figure 28: North America Market Value (US$ Mn) by Country, 2022-2032

Figure 29: North America Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 30: North America Market Volume (Tons) Analysis by Country, 2017-2032

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 33: North America Market Value (US$ Mn) Analysis by Product Type, 2017-2032

Figure 34: North America Market Volume (Tons) Analysis by Product Type, 2017-2032

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2022-2032

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2022-2032

Figure 37: North America Market Value (US$ Mn) Analysis by Activity, 2017-2032

Figure 38: North America Market Volume (Tons) Analysis by Activity, 2017-2032

Figure 39: North America Market Value Share (%) and BPS Analysis by Activity, 2022-2032

Figure 40: North America Market Y-o-Y Growth (%) Projections by Activity, 2022-2032

Figure 41: North America Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 42: North America Market Volume (Tons) Analysis by Application, 2017-2032

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 45: North America Market Attractiveness by Product Type, 2022-2032

Figure 46: North America Market Attractiveness by Activity, 2022-2032

Figure 47: North America Market Attractiveness by Application, 2022-2032

Figure 48: North America Market Attractiveness by Country, 2022-2032

Figure 49: Latin America Market Value (US$ Mn) by Product Type, 2022-2032

Figure 50: Latin America Market Value (US$ Mn) by Activity, 2022-2032

Figure 51: Latin America Market Value (US$ Mn) by Application, 2022-2032

Figure 52: Latin America Market Value (US$ Mn) by Country, 2022-2032

Figure 53: Latin America Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2017-2032

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 57: Latin America Market Value (US$ Mn) Analysis by Product Type, 2017-2032

Figure 58: Latin America Market Volume (Tons) Analysis by Product Type, 2017-2032

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2022-2032

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2022-2032

Figure 61: Latin America Market Value (US$ Mn) Analysis by Activity, 2017-2032

Figure 62: Latin America Market Volume (Tons) Analysis by Activity, 2017-2032

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Activity, 2022-2032

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Activity, 2022-2032

Figure 65: Latin America Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 66: Latin America Market Volume (Tons) Analysis by Application, 2017-2032

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 69: Latin America Market Attractiveness by Product Type, 2022-2032

Figure 70: Latin America Market Attractiveness by Activity, 2022-2032

Figure 71: Latin America Market Attractiveness by Application, 2022-2032

Figure 72: Latin America Market Attractiveness by Country, 2022-2032

Figure 73: Europe Market Value (US$ Mn) by Product Type, 2022-2032

Figure 74: Europe Market Value (US$ Mn) by Activity, 2022-2032

Figure 75: Europe Market Value (US$ Mn) by Application, 2022-2032

Figure 76: Europe Market Value (US$ Mn) by Country, 2022-2032

Figure 77: Europe Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 78: Europe Market Volume (Tons) Analysis by Country, 2017-2032

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 81: Europe Market Value (US$ Mn) Analysis by Product Type, 2017-2032

Figure 82: Europe Market Volume (Tons) Analysis by Product Type, 2017-2032

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product Type, 2022-2032

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2022-2032

Figure 85: Europe Market Value (US$ Mn) Analysis by Activity, 2017-2032

Figure 86: Europe Market Volume (Tons) Analysis by Activity, 2017-2032

Figure 87: Europe Market Value Share (%) and BPS Analysis by Activity, 2022-2032

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Activity, 2022-2032

Figure 89: Europe Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 90: Europe Market Volume (Tons) Analysis by Application, 2017-2032

Figure 91: Europe Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 93: Europe Market Attractiveness by Product Type, 2022-2032

Figure 94: Europe Market Attractiveness by Activity, 2022-2032

Figure 95: Europe Market Attractiveness by Application, 2022-2032

Figure 96: Europe Market Attractiveness by Country, 2022-2032

Figure 97: East Asia Market Value (US$ Mn) by Product Type, 2022-2032

Figure 98: East Asia Market Value (US$ Mn) by Activity, 2022-2032

Figure 99: East Asia Market Value (US$ Mn) by Application, 2022-2032

Figure 100: East Asia Market Value (US$ Mn) by Country, 2022-2032

Figure 101: East Asia Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 102: East Asia Market Volume (Tons) Analysis by Country, 2017-2032

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 105: East Asia Market Value (US$ Mn) Analysis by Product Type, 2017-2032

Figure 106: East Asia Market Volume (Tons) Analysis by Product Type, 2017-2032

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2022-2032

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2022-2032

Figure 109: East Asia Market Value (US$ Mn) Analysis by Activity, 2017-2032

Figure 110: East Asia Market Volume (Tons) Analysis by Activity, 2017-2032

Figure 111: East Asia Market Value Share (%) and BPS Analysis by Activity, 2022-2032

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by Activity, 2022-2032

Figure 113: East Asia Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 114: East Asia Market Volume (Tons) Analysis by Application, 2017-2032

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 117: East Asia Market Attractiveness by Product Type, 2022-2032

Figure 118: East Asia Market Attractiveness by Activity, 2022-2032

Figure 119: East Asia Market Attractiveness by Application, 2022-2032

Figure 120: East Asia Market Attractiveness by Country, 2022-2032

Figure 121: South Asia & Pacific Market Value (US$ Mn) by Product Type, 2022-2032

Figure 122: South Asia & Pacific Market Value (US$ Mn) by Activity, 2022-2032

Figure 123: South Asia & Pacific Market Value (US$ Mn) by Application, 2022-2032

Figure 124: South Asia & Pacific Market Value (US$ Mn) by Country, 2022-2032

Figure 125: South Asia & Pacific Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 126: South Asia & Pacific Market Volume (Tons) Analysis by Country, 2017-2032

Figure 127: South Asia & Pacific Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 128: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 129: South Asia & Pacific Market Value (US$ Mn) Analysis by Product Type, 2017-2032

Figure 130: South Asia & Pacific Market Volume (Tons) Analysis by Product Type, 2017-2032

Figure 131: South Asia & Pacific Market Value Share (%) and BPS Analysis by Product Type, 2022-2032

Figure 132: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2022-2032

Figure 133: South Asia & Pacific Market Value (US$ Mn) Analysis by Activity, 2017-2032

Figure 134: South Asia & Pacific Market Volume (Tons) Analysis by Activity, 2017-2032

Figure 135: South Asia & Pacific Market Value Share (%) and BPS Analysis by Activity, 2022-2032

Figure 136: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Activity, 2022-2032

Figure 137: South Asia & Pacific Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 138: South Asia & Pacific Market Volume (Tons) Analysis by Application, 2017-2032

Figure 139: South Asia & Pacific Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 140: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 141: South Asia & Pacific Market Attractiveness by Product Type, 2022-2032

Figure 142: South Asia & Pacific Market Attractiveness by Activity, 2022-2032

Figure 143: South Asia & Pacific Market Attractiveness by Application, 2022-2032

Figure 144: South Asia & Pacific Market Attractiveness by Country, 2022-2032

Figure 145: MEA Market Value (US$ Mn) by Product Type, 2022-2032

Figure 146: MEA Market Value (US$ Mn) by Activity, 2022-2032

Figure 147: MEA Market Value (US$ Mn) by Application, 2022-2032

Figure 148: MEA Market Value (US$ Mn) by Country, 2022-2032

Figure 149: MEA Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 150: MEA Market Volume (Tons) Analysis by Country, 2017-2032

Figure 151: MEA Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 152: MEA Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 153: MEA Market Value (US$ Mn) Analysis by Product Type, 2017-2032

Figure 154: MEA Market Volume (Tons) Analysis by Product Type, 2017-2032

Figure 155: MEA Market Value Share (%) and BPS Analysis by Product Type, 2022-2032

Figure 156: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2022-2032

Figure 157: MEA Market Value (US$ Mn) Analysis by Activity, 2017-2032

Figure 158: MEA Market Volume (Tons) Analysis by Activity, 2017-2032

Figure 159: MEA Market Value Share (%) and BPS Analysis by Activity, 2022-2032

Figure 160: MEA Market Y-o-Y Growth (%) Projections by Activity, 2022-2032

Figure 161: MEA Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 162: MEA Market Volume (Tons) Analysis by Application, 2017-2032

Figure 163: MEA Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 164: MEA Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 165: MEA Market Attractiveness by Product Type, 2022-2032

Figure 166: MEA Market Attractiveness by Activity, 2022-2032

Figure 167: MEA Market Attractiveness by Application, 2022-2032

Figure 168: MEA Market Attractiveness by Country, 2022-2032

The overall market size for the disinfectant chemicals market was USD 2,756.2 Million in 2025.

The disinfectant chemicals market is expected to reach USD 4,404.8 Million in 2035.

The demand for disinfectant chemicals is rising due to heightened hygiene standards across healthcare environments, increasing incidence of hospital-acquired infections, and the growing importance of surface disinfection. Widespread use of liquid disinfectants and rising demand from hospital end-users are further accelerating market growth.

The top 5 countries driving the development of the disinfectant chemicals market are the USA, China, Germany, Japan, and India.

Liquid disinfectants and hospital end-users are expected to command a significant share over the assessment period.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA