Disconnect switches market globally is set to display a steady growth pace from 2025 through to 2035 based on the growing need for safe and reliable transmission of power, enhanced spending on renewable energy projects, and strict regulatory rules with emphasis on ensuring electrical safety.

Switch Disconnect Switch Disconnect switches, with their safety function to disconnect power circuits from maintenance or as emergency shutdown, become invaluable in various applications starting with industrial plants, utilities, and residential campuses. The grid modernization boom and connecting renewable power generation to the grid triggered additional fuel the Switch Disconnect market.

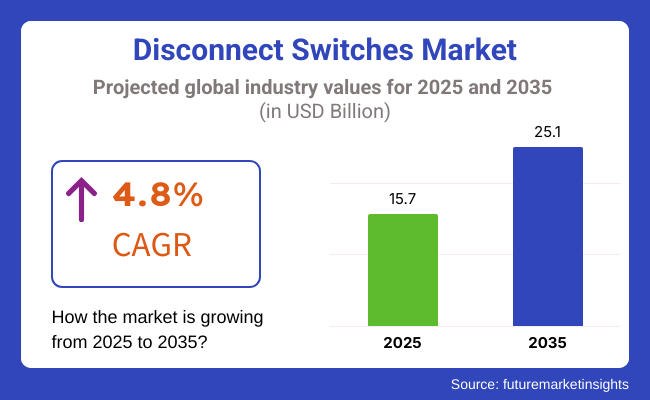

Disconnect switches market was around USD 15.7 Billion in 2025. It will be USD 25.1 Billion by 2035 with a 4.8% compound annual growth rate (CAGR). The reason behind this is that there is more infrastructure development, urbanization, and the need for efficient and secure electrical systems. The technological advancement in switch technology, such as smart disconnect switches with IoT technology and advanced monitoring features, is also driving the potential of the market.

Explore FMI!

Book a free demo

North America has a stronghold in the market for disconnect switches based on mature power infrastructure and ongoing evolution of developed grid systems. The USA and Canada are seeing mammoth investments in renewable energy installations, i.e., solar farms and wind farms, where disconnect switches hold the secret to system reliability and upkeep.

Apart from this, high security requirements of the region as well as adoption of advanced power delivery solutions also spurred mounting demand for smart disconnect switches. This apart from a growing concern for grid reliability to natural events and cyber threats.

Europe too is witnessing robust demand for disconnect switches owing to aggressive targets for grid modernization as well as renewables. Germany, the UK, and France are implementing high-volume renewable energy programs onto the power system, which have to have trustworthy disconnect solutions.

The European Union's stringent legislation for electrical security and energy performance has also made the world resort to high-performing disconnect switches. The rising popularity of the implementation of decentralized power systems such as microgrids and batteries for storage is also growing the market for innovative disconnect switch technology.

The Asia-Pacific region will see the highest growth in the market for disconnect switches due to the high pace of industrialization, urbanization, and infrastructure development in China, India, and Southeast Asia. Increasing power capacity in the region and mega-cap renewable power plants are boosting medium-voltage and high-voltage disconnect switch demand.

Apart from that, government efforts to accelerate rural electrification and the setting up of robust electrical infrastructure are making the market grow. More application of smart grid technology and the priority being given to energy efficiency also result in quick growth in the disconnect switches market in Asia-Pacific.

Challenge

High Management and Installation Cost and Adherence to Safety Standard

However, the growing Number of Industrial Automation companies provides a buoy to the disconnect switches market as they push the lower percentage of manual work being done and keeping machinery highly efficient to help survive in the competitive background. Disconnect switches play an important role in industries including power distribution, manufacturing and commercial facilities, where worker and equipment safety are paramount.

On the other hand, product development becomes more complicated, and the cost of certification rises with different regional safety regulations, e.g. IEC, NEC, OSHA, etc. Moreover, in high-voltage applications, installing disconnect switches typically specialized labour and costly infrastructure, leading to higher costs.

Designing modular and cost-efficient disconnect switches that are easier to install and compliant will help alleviate these challenges for manufacturers. By providing real-time remote monitoring and predictive maintenance tools, there is also the potential to provide additional improvements in operational efficiency and safety.

Opportunity

Expansion of Smart Grid Infrastructure & Integration of Renewable Energy

The rising acceptance of smart grid infrastructures, renewable energy projects, and industrial automation is expected to create lucrative opportunities for the Disconnect Switches Market. With the increasing need for a reliable power distribution, utilities and industrial operators are investing in intelligent switchgear solutions to enhance system efficiency and minimize the downtime.

IoT-connected Disconnect Switches, Diagnostic Treatment in Real Time and AI-Driven Fault Detection are redefining how energy is managed. The rise of solar and wind energy installations as well as the volatile loads they pose are, together, increasing the need for disconnect switches that not only have large electrical ratings but will also protect electrical networks. The next wave of innovation in this market will be driven by businesses that invest in digital connectivity, energy-efficient switch designs and intelligent monitoring systems.

The Disconnect Switches Market witnessed sustained growth from 2020 to 2024, supported by increased investments in modernization of electrical infrastructure, industrial automation, and grid reliability improvements. The transition to renewable energy sources also drove an increase in demand for disconnect switches capable of high-voltage applications.

However, challenges included supply chain disruptions, price volatility of raw materials, and complexities related to installation. To cater to the changing industry trends, manufacturers started to introduce smaller high-speed switches with better safety features and more efficiency.

Moving forward to 2025 to 2035, market growth will be driven by rapid digitalization, widespread implementation of smart switchgear, development of smart, digitally enabled solutions, integration with remote-controlled disconnect technologies, and remote operation advancements.

From AI-powered monitoring systems to self-diagnosing disconnect switches to cloud-based energy management platforms, the future of power distribution - both safety and efficiency - will be redefined. Furthermore, increasing focus on carbon-neutral power grids and sustainable energy storage solution will drive demand for eco-friendly disconnect switch with low energy operation and recyclable materials. In the coming decade, switchgear providers who embrace automation, sustainability, and increased connectivity will be the strength in the market.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Meets IEC, NEC and OSHA safety standards |

| Technological Advancements | High voltage disconnect switches driven by compact design |

| Industry Adoption | New applications in power distribution, industrial automation, and End of Line manufacturing |

| Supply Chain and Sourcing | Dependence on traditional switchgear manufacturing |

| Market Competition | Dominance of established electrical equipment manufacturers |

| Market Growth Drivers | Rising demand for reliable power distribution and grid modernization |

| Sustainability and Energy Efficiency | Initial implementation of energy-efficient switchgear |

| Integration of Smart Monitoring | Limited remote control and real-time fault detection |

| Advancements in Renewable Energy Applications | Use of disconnect switches in traditional grid networks |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | AI-powered regulatory compliance monitoring and smart switch diagnostics scalability |

| Technological Advancements | IoT-enabled, self-diagnostic, and AI-powered disconnect switches |

| Industry Adoption | Also sophisticated across smart grids, renewable energy systems, and remote-controlled electric utilities |

| Supply Chain and Sourcing | Shift towards localized production, sustainable materials, and supply chain diversification. |

| Market Competition | Growth of start-ups offering next-generation, cloud-integrated, and software-driven switch solutions. |

| Market Growth Drivers | Increased investment in smart energy management, predictive maintenance, and digital connectivity. |

| Sustainability and Energy Efficiency | Full-scale transition to carbon-neutral, recyclable, and ultra-low-energy disconnect switches. |

| Integration of Smart Monitoring | AI-based predictive failure analysis, cloud-integrated switch diagnostics, and automated safety mechanisms. |

| Advancements in Renewable Energy Applications | Increased deployment in distributed energy storage, micro grids, and hybrid power systems. |

The United States Removes switch market is expanding progressively, fueled by an upsurge in upgradation of smart gird, expanding demand from both the commercial and industrial divisions, and the widespread expansion of sustainable infrastructure. Investments in grid resilience and energy efficiency, led by the USA Department of Energy (DOE) and Federal Energy Regulatory Commission (FERC), are driving the demand for high-voltage disconnect switches.

The manufacturing industry, such as automotive, aerospace, semiconductors, etc., is a major consumer of disconnect switches for electrical safety of machinery and circuit isolation. Furthermore, the increasing deployment of solar and wind energy is increasing the demand for switchgear solutions in renewable energy projects.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.1% |

The demand for power distribution, industrial automation, and renewable energy integration is widening the United kingdom disconnect switch market. Help is on the way, as the United Kingdom has a powerful incentive to invest on smart grid technologies and high-efficiency electrical components: It's net-zero carbon-emission goals by 2050.

Advanced switchgear solutions are being more widely adopted in industrial and commercial sectors such as data centers factories and energy storage facilities. Moreover, the increasing number of offshore wind farms and distributed energy systems are the factors driving the demand for disconnect switches in energy transmission and storage segments.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.6% |

During the forecast period, 2023 to 2028, the European Union European Union Disconnect Switch Market is anticipated to develop at a steady pace, according to the report. Several European countries such as Germany, France, and Italy are at the forefront of grid modernization and smart energy solutions, which is expected to propel the demand for disconnect switches in electrical distribution and industrial applications.

The European Union’s Renewable Energy Directive and Industrial Safety Standards are driving the adoption of energy-efficient switchgear. Moreover, the growing installation of electric vehicle (EV) charging infrastructure is driving the demand for disconnect switches in smart charging stations.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.9% |

The Japanese disconnect switch market is upturning owing to increasing investment in grid modernization, renewable energy capacity expansion, and rising demand for industrial automation. The smart city initiatives of Japan and emphasis on energy efficiency are contributing to advanced electrical disconnect system adoption

Disconnect switches are used in both automotive and semiconductor industries, which rely on high-precision systems that require electrical circuitry protection because of their high precision systems. Japan’s expanding solar and hydrogen energy sectors are also driving demand for switchgear solutions in energy storage and transmission.

With ongoing technological propagation and rising deployment of energy structure, Japanese disconnect switch market would continue to grow steadily in future.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

Since your knowledge is only up to October 2023, south Korea is solidifying its own disconnect switch market. Korean Smart Grid Initiative which focuses on enhancing grid resilience and energy efficiency is stimulating demand for high-performance disconnect switches in power transmission systems.

One of the foremost driver is the electronics and semiconductor manufacturing sectors, such as Samsung and SK Hynix, which demand advanced electrical protection systems and consequently creating pivots for disconnect switches in high-precision applications. This is alongside new opportunities arising from the push for offshore wind and hydrogen energy in South Korea, which is creating new opportunities for switchgear solutions in renewable power infrastructure.

The South Korea disconnect switch market is also projected to grow due to the increasing industrial automation along with development of energy-efficient electrical components.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.8% |

Increase in adoption of power safety solutions for ensuring grid stability in energy infrastructure modernization is the major factor contributing to the growth of these segments in the market. Power management components such as circuit breakers are critical for circuit isolation, control of power distribution, and protection of the whole system to ensure it works correctly electrically and safely in industrial and commercial applications.

Medium voltage disconnect switches have become one of the most used categories of switchgear for electrical distribution networks by providing essential circuit isolation and load-switching functionality. Medium voltage disconnect switches serve a wide range of applications, from industrial plants to commercial buildings, unlike low voltage disconnect switches.

The growth of industrial automation and distributed power networks with integrated power management systems and smart grid solutions can be attributed to the increased adoption of medium voltage disconnect switches as manufacturing plants, data centres, and commercial buildings prioritize energy efficiency and the protection of their systems from damage. According to research, more than 60% of industrial facilities combine medium voltage disconnect switches into their power distribution systems, making the need for solid electrical isolation solutions high in demand in these markets.

The growing need for smart industrial activities, including power monitoring integrated with AI, load balancing in real time, and switchgear control automation, has intensified the market demand thus the medium voltage disconnect switches will gain more traction in the automation-driven industries.

Adoption has been further accelerated by the integration of predictive maintenance technologies, such as sensor-enabled disconnect switches with real-time fault detection and remote monitoring, enabling increased systems reliability and cost savings.

The launch of hybrid medium voltage disconnect switches with dual-mode functionality, assisting with backup power system transition, has been a major boost for the market ensuring greater customer flexibility for energy-dependent industries.

Increasing adoption of arc-resistant designs with improved personnel protection and reduced risk of electrical hazards has bolstered market growth by ensuring better adherence to major stringent safety regulations at industrial premises.

While medium voltage disconnect switches can enhance industrial safety, deliver automation compatibility and contribute to effective operational performance improvement, this sector has potential issues to address including intricate installation prerequisites, a high capital investment cost, and integration challenges with pre-existing electrical networks and systems. Nonetheless, the advent of intelligent medium voltage switchgear diagnosis using AI, potentially interoperable disconnect switches for a smart grid and cloud-based power management technologies is enhancing efficiency, flexibility and potential for automation, this bodes well for the long-term growth of the medium voltage disconnect switch supplies market.

High voltage disconnect switches are having substantial adoption in the market and this trend is prevalent in power utilities, transmission substations and industrial applications with development of high capacity switching technology for effective load isolation and fault protection system in the grid operators market. High voltage disconnect switches, on the other hand, cater to larger electrical systems, providing security for power grids and renewable energy sites.

The increasing requirement for grid digitalization, including substation automation, renewable integration, and transmission efficiency, is driving the adoption of high voltage disconnect switches, as utilities and energy organizations focus on system reliability and long run sustainability. Therefore, locking for high voltage disconnect switches for grid separation & maintenance are adopted by more than 55% of the power utilities, so we can say, there will be a huge demand for advanced grid management solutions to maintain them.

The growing need for renewable energy projects such as solar farms, wind power plants, and hydroelectric grids has increased the demand in the market, which further contributes to the widespread adoption of high voltage disconnect switches to control the flow of power efficiently.

With the advent of advanced remote monitoring technologies such as IoT-enabled switchgear solutions and AI-based fault diagnostics, adoption grew more to ensure enhanced power grid stability as well as predictive maintenance capability.

Development of gas-insulated and vacuum-based high voltage disconnect switches, low maintenance and eco-friendly designs, has optimized market growth ensuring greater sustainability in power transmission infrastructure.

In order to provide better reliability for high-voltage energy distribution networks, the adoption of high-speed mechanical disconnect switches that are integrated with advanced arc suppression mechanisms and high-performance insulation materials has thereby strengthened the market expansion.

While offering better power grid reliability, enhancing renewable energy integration, and having assets that achieve higher loads, the high voltage disconnect switch segment is not without its issues in terms of procurement costs, complex regulatory compliance requirements, and increasing maintenance demands associated with aging grid infrastructure. Using AI-powered grid automation, smart-sensor integrated switchgear, and hybrid energy storage-enabled switching solutions; higher efficiency, cost-effective, and resilient systems are being developed which guarantee the growth of high voltage disconnect switch solutions.

The industrial and utility are the key segments in the market as industries and power grid operators install disconnect switches to improve power safety, reduce downtime and upgrade utility energy infrastructure.

The industrial sector is one of the fastest-growing application segment within the global disconnect switches market due to their ability to provide reliable power isolation, load control, and electrical safety in high-demand manufacturing and processing environments. These industrial applications rely on high-capacity disconnect switches to accommodate changing power loads and emergency shutdown operations, unlike commercial applications.

Growing need for industrial automation and smart manufacturing, through robotics, IoT-based production system and digital twin technology certifications, has increased the use of disconnect switches, as manufacturing plants emphasize on electrical safety and operational reliability. Studies suggest that more than 65% of manufacturing plants use medium and high voltage disconnect switches to protect essential equipment, leading to strong industrial-grade power management solutions demand.

The growing number of initiatives around industrial energy efficiency, engendering renewable energy integration, hybrid power systems as well as peak load optimization, has reinforced market demand that will drive higher adoption of disconnect switches meant for load balancing and fault prevention.

The adoption of smart switchgear automation that enables remote-controlled switch operation, predictive fault analytics, among other benefits have further added to adoption, ensuring enhanced operational efficiency and cost savings to industrial power networks.

The demand for customized designs in disconnect switches for hazardous industrial environments has positively impacted market growth with the development of explosion-proof and corrosion-resistant products that cater to the safety compliance of industries processing volatile materials or engaging in high-temperature processes.

While industrial disconnect switches offer advantages in operational safety, automation compatibility, and energy management, high equipment costs, complex system integration, and increased demand for specialized electrical safety compliance remain challenges within the industrial disconnect switch segment. At the same time, innovations like AI-driven switchgear monitoring, advanced material designs and energy storage-integrated switching solutions are helping improve efficiency, reliability and regulatory compliance of industrial disconnect switch applications, which consistently push expansion in the market.

Due to the growing investments made by energy providers in advanced switchgear solutions for ensuring an uninterrupted supply of electricity and fault protection, strong market penetration has been observed in the utility sector with power generation, grid distribution, and transmission network management. Serving industrial applications, utility disconnect switches handle high-voltage grid loads and meet extreme environmental conditions to ensure power grid reliability.

The increasing demand for smart grid technologies with real-time power flow monitoring, AI-based demand forecasting, and power flow balancing have led to the increased adoption of the utility-grade disconnect switches as power companies turn to intelligent network management.

Evolving renewable energy integration, including offshore wind farms, solar PV systems, and hydroelectric instalments, has consolidated market demand to ensure higher adoption of disconnect switches in clean energy.

The arrangement of high-speed automatic switching mechanisms propelling adoption of self-healing grid tech and fault tolerant power routing has also been contributing to further adoption as they would help provide more resilience to the essentials against outages or grid disruptions.

While this segment is well positioned to benefit both from the need to improve the resiliency of the grid overall - as well as increased renewable energy adaptation and automated switching - it is beset by complex regulatory approvals, expensive infrastructure upgrades, and cybersecurity risks associated with smart grid-enabled operation. However, novel advancements in AI-powered grid protective measures, block chain-enabled energy transactions, and next-gen switchgear materials are enhancing efficiency and security, alongside future-proof sustainability, paving smooth ground for the yet-sustaining growth of the utility-based disconnect switch offerings.

The disconnect switches market is governed by the growing demand for industrial safety, electrical power distribution reliability, and renewable energy integration among utilities, manufacturing, commercial infrastructure, and data centers. Safety, efficiency and compliance are the three transformational areas that companies are focusing on AI driven monitor of switchgears, smart-grid compatibility as well as arc-flash protection technologies are in demand these days. Global electrical equipment manufacturers and specialized switchgear solution providers technological advancements in medium/high voltage disconnect switches, fusible disconnects, remote-operated switchgear etc.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Schneider Electric | 15-20% |

| ABB Ltd. | 12-16% |

| Siemens AG | 10-14% |

| Eaton Corporation | 8-12% |

| General Electric (GE Grid Solutions) | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Schneider Electric | Develops AI-powered smart disconnect switches, energy-efficient switchgear, and remote-operated industrial switch solutions. |

| ABB Ltd. | Specializes in high-voltage disconnect switches for grid reliability, renewable energy, and industrial applications. |

| Siemens AG | Manufactures digital switchgear with IoT integration, medium-voltage disconnects, and safety-enhanced arc-resistant solutions. |

| Eaton Corporation | Provides fusible and non-fusible disconnect switches for industrial control, power distribution, and smart grids. |

| General Electric (GE Grid Solutions) | Offers high-performance disconnect switches for transmission and distribution networks with real-time monitoring. |

Key Company Insights

Schneider Electric (15-20%)

As a prominent player in the disconnect switches sector, Schneider Electric specializes in smart power management by harnessing AI-driven industrial safety solutions and digitized switchgear technology.

ABB Ltd. (12-16%)

ABB provides high-voltage and medium-voltage disconnect switches, ensuring compliance with safety regulations and grid reliability.

Siemens AG (10-14%)

Siemens offers IoT-enabled switchgear solutions that enhance both power distribution safety and energy efficiency.

Eaton Corporation (8-12%)

Eaton designs smart power monitoring and industrial control equipment into high-performance fusible and non-fusible disconnects.

General Electric (GE Grid Solutions) (5-9%)

GE has been developing innovative disconnect switches for transmission and distribution systems that lead to improved stability of power grids.

Other Key Players (40-50% Combined)

Several electrical equipment manufacturers and industrial switchgear providers contribute to next-generation disconnect switch innovations, AI-driven grid automation, and sustainable power distribution solutions. These include:

The overall market size for Disconnect Switches Market was USD 15.7 Billion in 2025.

The Disconnect Switches Market is expected to reach USD 25.1 Billion in 2035.

The demand for the disconnect switches market will grow due to increasing investments in power infrastructure, rising adoption of renewable energy sources, growing industrial automation, and stringent safety regulations, driving the need for reliable electrical isolation and circuit protection solutions.

The top 5 countries which drives the development of Disconnect Switches Market are USA, UK, Europe Union, Japan and South Korea.

Industrial and Utility Segments Drive Market to command significant share over the assessment period.

Diaphragm Coupling Market Growth - Trends & Forecast 2025 to 2035

HID Ballast Market Growth - Trends & Forecast 2025 to 2035

Fluid Conveyance Systems Market Growth - Trends & Forecast 2025 to 2035

GCC Magnetic Separator Market Outlook – Growth, Trends & Forecast 2025-2035

United Kingdom Magnetic Separator Market Analysis – Size, Share & Forecast 2025-2035

Glass Door Merchandisers Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.