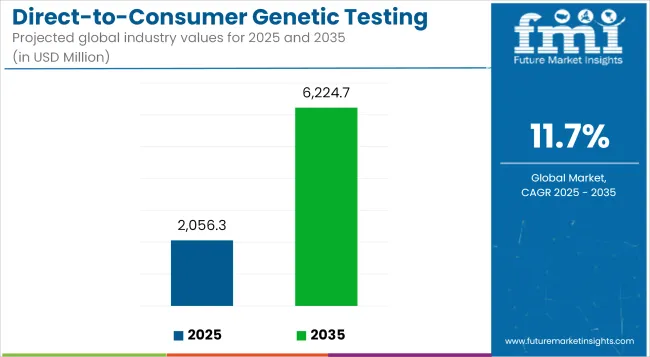

Direct-to-consumer genetic testing market will greatly witness huge growth between 2025 and 2035 as customers keep on requiring personal health information and genealogical studies. The market would be around USD 2,056.3 million in 2025 and USD 6,224.7 million in 2035 with a CAGR of 11.7% over the forecast period.

There are many drivers that are revolutionizing trends in this market. Growing consumer-directed care, enhanced sequencing technology, and greater emphasis on preventive medicine are fueling demand for over-the-counter genetic testing products.

Direct-to-consumer genetic testing is going mainstream with firms like 23andMe and Ancestry DNA teaching people about ancestry, inherited disease risk, and lifestyle-related genetic effects. But regulation and data privacy are leading the way, and they are forcing companies to keep tight security controls in place and comply with changing regulatory frameworks.

The category is a highly heterogenous group of tests that vary from ancestry tests, health and wellbeing genetic tests, carrier tests, and pharmacogenomics tests. The most popular category is ancestry testing, and MyHeritage and Living DNA, to name a few, are dominating millions of consumers globally. Genetic disease testing also catching up, through which one comes to know about the chances of falling ill with such diseases as Alzheimer's, diabetes, and some cancers.

Carrier screening is especially catching really high popularity among future parents for couples because it informs one whether they can pass on genetic disease to children or not. Pharmacogenomics screening is also turning out to be a successful weapon in the personalized medicine arsenal, where one can study how genes influence drug action and metabolism.

North America holds the largest market share in direct-to-consumer genetic testing due to strong consumer demand, a well-developed healthcare infrastructure, and the presence of market leaders such as 23andMe and AncestryDNA. The United States of America holds the biggest hold in the region, and rising adoption of genetic testing to discover ancestry and health information drive its growth. Rising awareness of precision medicine and other telemedicine services drive growth across the region.

Privacy law, the Genetic Information Nondiscrimination Act (GINA) excepted, is setting the tone for the business with customers' genomic information protected. Firms are spending enormity on end-to-end encryption as well as on cyber-security technology such that they can assure themselves of gaining consumers' confidence. Genetic data, which were previously used to give cover in well-being plans as well as for eating advice, are now highly desired by businesses like DNAfit and Helix to give gene-guided well-being advice.

Europe is a top direct-to-consumer genetic testing market, fueled by rising awareness of susceptibility to genetic diseases and robust demand for ancestry DNA testing. UK, Germany, and France are the market drivers. Market drivers such as GDPR (General Data Protection Regulation) are dominant market drivers that compel businesses to adopt open data-handling practices.

Interest in nutrigenomics - research into the influence of genes in the requirement for nutrients - is creating new possibilities for consumer marketplace businesses in Europe. DNAfit and Orig3n are selling consumers personalized diets and exercise plans based on genetic testing, a result of the region's increasing emphasis on disease prevention and health.

The Asia-Pacific is the most rapidly growing direct-to-consumer genetic testing market within the region, influenced by rising disposable income, rising levels of education among consumers, and rising levels of technology improvements. Drivers of industry growth in China, Japan, and India include major players like WeGene and MapmyGenome.

DNA ancestry testing is picking up pace in China as consumers are increasingly interested in knowing genetic origins and ethnicity. Prevention dominance and development of individualized medicine is propelling growth of India's genetic well-being testing. Market trends are to be guided by privacy of information and compliance concerns on the data, though. The companies have to survive judicial capriciousness and make genetic use ethical.

Challenge

Ethical and Data Privacy Challenges

Genetic data collection and storage are the industry's top concerns. Third-party unauthorized access, employer and insurer use, and data breaches are customers' top concerns. Further regulation, including the European GDPR and California Consumer Privacy Act (CCPA), is imposing compliance costs on genetic testing companies.

For the resolution of all these concerns, companies are choosing blockchain technology and best-in-class encryption practices so that information could be secured and transparent. Transparency in real life and proper consent to utilize information are the ongoing requirements.

Opportunity

Development of Personalised Medicine and Preventive Care

Genetic testing is one of the strongest forces driving the development of the market. Genetic information is making highly educated decisions regarding disease prevention, lifestyle treatment, and medication for physicians and patients. Pharms are working together with pharma firms to create pharmacogenomics opportunities through which drugs can be prescribed according to genetic traits.

Technological advances through artificial intelligence (AI) and machine learning are also making strong strides in the genetic test example to simplify, speed, and inferential of test outcomes. AI-driven technology is speeding up and improving genome sequencing, and for the personalized medicine solution, there is immense potential.

Direct-to-consumer genetic testing between the years 2020 to 2024 picked up as consumers became more impatient to find out about ancestry, health risk, and lifestyle compatibility. There was also demand generated due to the COVID-19 pandemic for individualized care and hence genetic test kits were on sale for immune monitoring and infectious disease susceptibility. Anxiety about privacy of genetic data prompted increased regulation and enforcement of use of tight control.

2025 to 2035 will be the industry's inflection period with breakthroughs in whole-genome sequencing, AI-based interpretation of genes, and enhanced interoperability with digital health platforms. The company will shift to ultra-personalized well-being products providing gene-based nutritional advice, exercise regimen, and emotional wellbeing. Ethical and regulatory aspects will be the most important aspect to ensure appropriate use of genetic data and define consumer trust.

The next decade will witness paradigm innovation in direct-to-consumer genetic screening, a central component of preventive medicine and personalized health care. Informational privacy, regulatory mandate, and innovation-driven entrepreneurship will characterize market development and shaping.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Regulatory policy differed significantly, ranging from tight regulation of genetic data privacy in some nations to hardly any in others. The FDA and EU regulators concentrated on verifying test reliability and preventing false or misleading information. |

| Technological Advancements | Technological innovations in next-generation sequencing (NGS) made the test more affordable through lowered costs. Companies launched polygenic risk scoring (PRS) for complex disorders. |

| Market Expansion | Market expansion came on the back of consumer interest in ancestry tests, health predisposition testing, and fitness-associated genetics. North America led the charge, while interest was picking up in Asia-Pacific. |

| Data Privacy & Security | Anxiety regarding misapplication of genetic information resulted in high-profile court cases and intervention by governments. Firms incorporated encryption methods and anonymized data for users in order to instill consumer trust. |

| Consumer Awareness & Adoption | Increased awareness among consumers of genetic predisposition tests resulted in increased adoption. Fears related to test precision and ethical factors constrained mass levels of trust. |

| Healthcare Integration | Limited compatibility with conventional healthcare systems. Physicians were still dubious of the clinical value of DTC genetic tests. |

| Product Innovations | Firms introduced wellness-oriented tests on nutrition, fitness, and skincare genetics. A few companies made whole genome sequencing affordable. |

| Market Growth Drivers | Consumer curiosity-driven growth, falling test prices, and celebrity endorsements. Mergers with ancestry databases enhanced revenue. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Governments around the world enforce strict genetic data protection regulations, focusing on user consent and openness. Regulatory schemes standardize approval procedures, eliminating misleading marketing tactics and guaranteeing test results reliability. |

| Technological Advancements | AI-powered genomic analysis tailors reports with greater predictive validity. Blockchain technology strengthens genetic data security, and CRISPR advancements make gene modification tests possible at home. |

| Market Expansion | Rising adoption of preventive healthcare drives growth. Growth gains momentum in the Asia-Pacific and Latin America regions, fueled by reduced costs and rising healthcare consciousness. Risk evaluations for chronic disease become more important. |

| Data Privacy & Security | Tougher privacy controls compel firms to improve security. Decentralized storage of data and blockchain-led consent models give consumers control of their genetic information. |

| Consumer Awareness & Adoption | Partnerships with health providers and education efforts boost trust and legitimacy. Improved marketing initiatives emphasize practical use, further spurring adoption. |

| Healthcare Integration | Genetic counselling is made routine through DTC tests. Doctors use consumer genetic information more and more in patient healthcare management, creating tailored treatments. |

| Product Innovations | Full-genome sequencing goes mainstream in DTC testing. Microbiome and epigenetic analysis are included with genetic testing for complete health information. |

| Market Growth Drivers | Driven by precision medicine, wearables integration, and increasing incidence of chronic diseases. Predictive analysis through AI adds to consumer demand. |

The United States leads the market for DTC genetic testing on the strength of a large customer base and favourable regulatory environment. Growing use of personalized medicine and consumer growing awareness drive the market momentum. Market leaders such as 23andMe and AncestryDNA are well-positioned at the top, on the strength of their massive databases of genetics and offering reports pertaining to ancestry, health, and pharmacogenomics.

During the coming few years, genetic risk screening for chronic conditions such as diabetes and cardiovascular disease will become increasingly popular. Greater cooperation among DTC genetic testing companies and telemedicine entities will make it easier for genetic counselling services to become streamlined. Government agencies such as the FDA will start imposing more stringent policies assuring test validity and protecting information security.

Increasing Need for Pharmacogenomics Testing: America is also trending towards pharmacogenomics with genetic information being employed to decide upon drug prescriptions so that therapy could be personalized. The National Institutes of Health (NIH) promotes activities such as genetic testing in the treatment of patients.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.1% |

The UK DTC genetic testing market is growing with National Health Service (NHS) efforts to support genomics-driven care. Having companies such as DNAfit and MyDNA paves the way for innovation in the lifestyle and wellness genetic testing market.

UK Biobank facilitates innovation in genetic research with outcomes made publicly available to support the validity of consumer genetic testing. However, strict GDPR guidelines for genetic data protection continue to inform business models and motivate firms to have robust data protection systems.

Emergence of Preventive Genetic Testing: Consumers increasingly demand predictive testing for genetic disease, and this creates demand for low-cost whole-genome sequencing. Second, the government promotes ethical marketing to avoid over claiming genetic susceptibility.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.7% |

The European Union is governed by robust consumer protection laws that impact the DTC genetic testing industry. Germany, France, and Italy are core markets, with mature biotech industries that foster genomics technology. The increasing popularity of personalized medicine in the EU generates demand for genetic testing services with applications being further enhanced for disease prevention and wellness management.

Regulatory Compliance & Innovation: European Union firms have to comply with the In Vitro Diagnostic Regulation (IVDR) so that they can make sound and accurate genetic tests. Meanwhile, genome sequencing is getting less expensive and DTC genetic testing is within affordable range for the consumer.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.3% |

Japan's DTC gene testing market is booming through strong customer demand for longevity and tailored healthcare. Genesis Healthcare and GeneLife are two of the leaders, providing ancestry, health risk, and nutrigenomics tests.

The focus on precision medicine by the government is added to expansion in genetic testing services. Japan's ageing population also increasingly resort to genetic intelligence in a quest to maintain control over their health.

Technological Developments in Genetic Screening: AI-backed analysis improves genetic reporting accuracy with actionable intelligence. Collaborations between healthcare organizations and biotech organizations propel the emergence of integrated genetic health platforms.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.9% |

South Korea's DTC genetic testing industry is growing at a neck-break pace due to the government's pro-biotechnology and precision medicine policy. Genoplan and Macrogen, among others, leverage AI to better interpret the accuracy of genetic reports and offer better health and wellness information.

Integration in Digital Health Ecosystems: South Korean technology-conscious citizens adopt genetic testing through smartphone applications and wearable technology. Consumers receive instant feedback on health, enabling them to modify lifestyles based on genetic information.

Government focus on data privacy and use of genetic testing for its legitimate purposes ensures that companies shift towards blockchain-consent models so that consumers do not lose faith.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.4% |

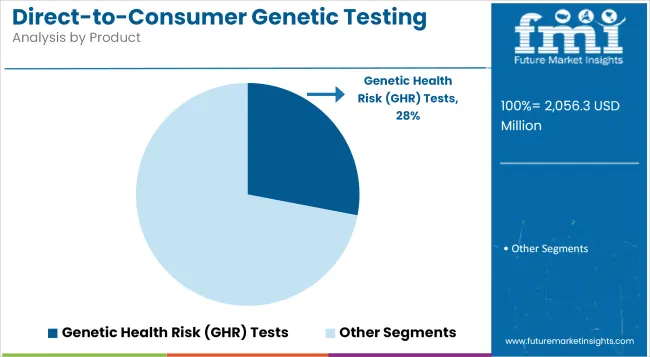

Genetic health risk (GHR) tests are the pioneers of direct-to-consumer genetic testing, spurred on by growing consumer desire to find out one's risk for diseases such as Alzheimer's, Parkinson's, and diabetes. Such firms as 23andMe have managed to sell the tests by offering consumers usable information on genetic risk and hence pro-activism care. The demand for the tests is also fueled by rising cases of lifestyle diseases and growing consumer health-consciousness.

Besides, regulatory clearances from bodies such as the FDA for direct-to-consumer genetic health risk tests have raised consumer trust and thus expanded acceptance. With increasing mainstreaming of personalized medicine, GHR tests are becoming increasingly popular, especially in North America and Europe, where healthy preventive habits are gaining significance.

Ancestry tests continue to be a top-performing segment of the direct-to-consumer genomic testing industry as people become more interested in tracing heritage and genealogy. AncestryDNA and MyHeritage are among the companies that have profited from this trend by providing large databases and sophisticated matching algorithms, allowing consumers to better map their ancestry.

Although privacy concerns of genetic information, the industry is in robust health with consumers eager to follow their ancestry from their roots back to ancestral origins. Expansion in the market is also driven by alliances among companies offering genetic tests and genealogical histories, which are broader in testing heritage. Demand for heritage tests is also high in North America with cultural diversity driving genetic heritage demand.

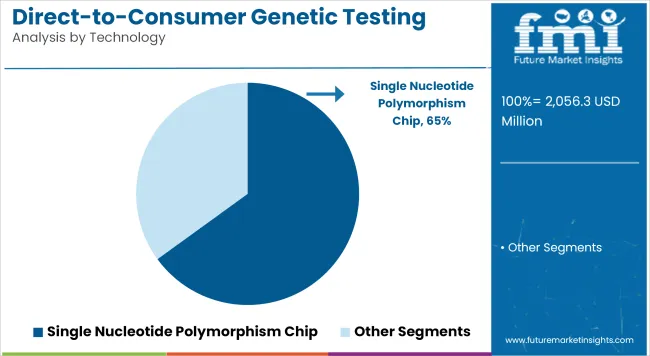

Single nucleotide polymorphism (SNP) chip technology is most commonly applied in direct-to-consumer genetic testing, mainly because it is cost-effective and offers detailed genetic information. It allows companies to test genetic markers associated with different traits, diseases, and ancestry at a reasonable price, thereby extending to more consumers.

Industry leaders 23andMe and AncestryDNA heavily use SNP chips to provide highly accurate reports at rapid turnaround. Advanced genetic profiling with whole genome sequencing (WGS) provides better insight into gene traits. Its ability to charge premium prices makes its penetration in the masses difficult. With technology advancement in sequencing and declining prices, WGS adoption in the future appears to be possible.

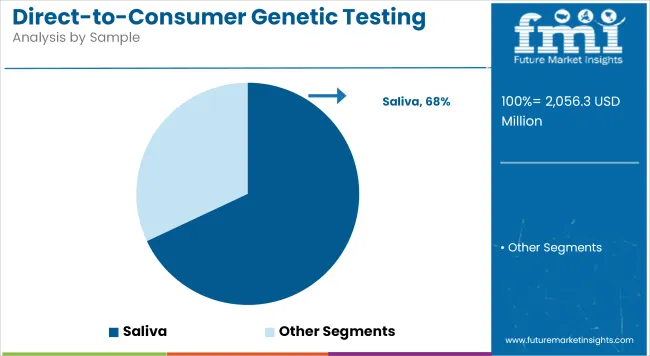

Saliva testing is the most common test used in direct-to-consumer genetic testing since it is painless, simple, and convenient to get a sample. All of the top companies, such as 23andMe, AncestryDNA, and MyHeritage, use saliva samples to harvest DNA, which is easy and convenient for consumers.

Saliva samples provide good DNA stability and yield, maintaining the accuracy of test results even with late storage and shipment. While blood and urine samples provide increased genetic data, they are not utilized on a wide scale in the direct-to-consumer industry due to professional support in sample collection. The ongoing embracement of saliva-based tests maintains its position as the top sample type in the market.

Online purchases are the leading form of delivery for direct-to-consumer genetic testing, capturing most of the market with the added advantage of home purchase. 23andMe and AncestryDNA, among other companies, use their website presence to provide customized reports, interactive tools, and convenient test kit shipping, attracting consumers who appreciate technology.

The increasing trend in e-commerce and internet health websites further stimulated online sales, particularly in North America and Europe. Retail pharmacies also continue to witness consistent growth because they sell genetic testing kits through their stores so that customers can buy them as per their choices. Hospital and specialty clinic institutional sales are ancillary in character but on the rise because medical practitioners include genetic testing as a part of tailored treatment programs.

The direct-to-consumer (DTC) genetic test industry is competitive and dominated by dominant worldwide industry players and potential new entrants leading the trend. The established companies in the industry invest enormous amounts on R&D to enhance the accuracy, price, and usability of tests.

The industry monitors technological innovation in genomic functions, regulatory concerns, and increasingly demanding customers seeking personalized healthcare information. Companies are distinguishing themselves through services such as ancestry analysis, health risk screening, carrier screening, and pharmacogenomics. The industry also has partnerships with medical professionals and pharmaceutical companies to develop additional applications of genetic information.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| 23andMe, Inc. | 25-30% |

| AncestryDNA | 20-25% |

| MyHeritage DNA | 10-15% |

| DNAfit | 5-9% |

| Living DNA | 3-7% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| 23andMe, Inc. | Provides ancestry and health-related genetic testing, offering FDA-approved genetic risk reports and drug response insights. Actively collaborates with pharmaceutical companies for genetic research. |

| AncestryDNA | Specializes in family history and ethnic composition analysis, leveraging one of the largest DNA databases. Expands into health-related genetic testing. |

| MyHeritage DNA | Offers genealogical and health-oriented DNA testing with a strong presence in European markets. Utilizes AI-driven tools for ancestry research. |

| DNAfit | Focuses on fitness and nutrition genetic testing, catering to health-conscious consumers. Uses personalized recommendations based on DNA analysis. |

| Living DNA | Provides deep ancestry analysis with regional breakdowns. Known for its detailed British and European heritage reports. |

Key Company Insights

23andMe, Inc. (25-30%)

23andMe dominates DTC genetic testing, providing information both related to ancestry as well as for medical use. 23andMe stands unique in delivering FDA-cleared health-risk reports for diseases like Parkinson's and risk for BRCA-associated cancer. 23andMe is partnered with companies like the massive drug manufacturers, GSK, for drugs with research derived from the enormous database of genetics. Foraying into specialty market niches for precision medicine as well as solutions consumer-sorted gives 23andMe an industry-leading contender.

AncestryDNA (20-25%)

AncestryDNA occupies a huge share in the market through its interest in genetic genealogy. It carries a humongous database of DNA and, as a result, provides extensively detailed analysis of family history as well as estimation of ethnicity. AncestryDNA recently branched into medical testing in terms of hereditary risk assessment tests. It regularly upgrades DNA matching technology so that ancestral lines and migration flows are more accurate.

MyHeritage DNA (10-15%)

MyHeritage DNA is a very strong contender, especially in Europe, for health and ancestry DNA testing. It has AI-driven genealogical search functions by which family trees can be rebuilt. The genetic health aspect of the firm includes inherited disease risk screening and polygenic risk scores that appeal to customers who are interested in advanced health information above and beyond ancestry.

DNAfit (5-9%)

DNAfit stands out in emphasizing fitness, diet, and lifestyle genetic testing. The organization offers personalized advice on exercise routines, dietary diets, and stress management based on genes. Its wellness brand alliances and corporate wellness programs have enabled its establishment in the health optimization business.

Living DNA (3-7%)

Living DNA is popularly known for its regional analyses of ancestry, particularly for British and European ancestry. It offers one of the most detailed ancestry reports available, involving tracing of maternal and paternal lineage. While its market share is not as large, it tends to appeal to niche customers looking for in-depth genetic ancestry analysis.

Other Key Players (20-30% Combined)

Beyond the major players, several companies collectively hold a substantial market share, contributing to innovation and affordability in genetic testing. These include:

The overall market size for direct-to-consumer genetic testing market was USD 2,056.3 million in 2025.

The direct-to-consumer genetic testing market is expected to reach USD 6,224.7 million in 2035.

The increasing consumer awareness regarding personalized healthcare, rising prevalence of genetic disorders, and advancements in genetic testing technology fuel the direct-to-consumer genetic testing market during the forecast period.

The top 5 countries which drive the development of direct-to-consumer genetic testing market are USA, UK, Germany, China, and Japan.

On the basis of test type, ancestry testing to command significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Sample , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Sample , 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Sample , 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 18: Western Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Sample , 2018 to 2033

Table 20: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 21: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 23: Eastern Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 24: Eastern Europe Market Value (US$ Million) Forecast by Sample , 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 26: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: South Asia and Pacific Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 29: South Asia and Pacific Market Value (US$ Million) Forecast by Sample , 2018 to 2033

Table 30: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 34: East Asia Market Value (US$ Million) Forecast by Sample , 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 36: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 38: Middle East and Africa Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 39: Middle East and Africa Market Value (US$ Million) Forecast by Sample , 2018 to 2033

Table 40: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Sample , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Sample , 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Sample , 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Sample , 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Product, 2023 to 2033

Figure 22: Global Market Attractiveness by Technology, 2023 to 2033

Figure 23: Global Market Attractiveness by Sample , 2023 to 2033

Figure 24: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Sample , 2023 to 2033

Figure 29: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Sample , 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Sample , 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Sample , 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 46: North America Market Attractiveness by Product, 2023 to 2033

Figure 47: North America Market Attractiveness by Technology, 2023 to 2033

Figure 48: North America Market Attractiveness by Sample , 2023 to 2033

Figure 49: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Sample , 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Sample , 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Sample , 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Sample , 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Sample , 2023 to 2033

Figure 74: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 78: Western Europe Market Value (US$ Million) by Sample , 2023 to 2033

Figure 79: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 80: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 85: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 86: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 87: Western Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 88: Western Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 89: Western Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 90: Western Europe Market Value (US$ Million) Analysis by Sample , 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Sample , 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Sample , 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 94: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 95: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 97: Western Europe Market Attractiveness by Technology, 2023 to 2033

Figure 98: Western Europe Market Attractiveness by Sample , 2023 to 2033

Figure 99: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 100: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 102: Eastern Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 103: Eastern Europe Market Value (US$ Million) by Sample , 2023 to 2033

Figure 104: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 110: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 111: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 112: Eastern Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 113: Eastern Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 114: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 115: Eastern Europe Market Value (US$ Million) Analysis by Sample , 2018 to 2033

Figure 116: Eastern Europe Market Value Share (%) and BPS Analysis by Sample , 2023 to 2033

Figure 117: Eastern Europe Market Y-o-Y Growth (%) Projections by Sample , 2023 to 2033

Figure 118: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 119: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 120: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 121: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 122: Eastern Europe Market Attractiveness by Technology, 2023 to 2033

Figure 123: Eastern Europe Market Attractiveness by Sample , 2023 to 2033

Figure 124: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 125: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 126: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 127: South Asia and Pacific Market Value (US$ Million) by Technology, 2023 to 2033

Figure 128: South Asia and Pacific Market Value (US$ Million) by Sample , 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 130: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 138: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 139: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 140: South Asia and Pacific Market Value (US$ Million) Analysis by Sample , 2018 to 2033

Figure 141: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sample , 2023 to 2033

Figure 142: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sample , 2023 to 2033

Figure 143: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 144: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 147: South Asia and Pacific Market Attractiveness by Technology, 2023 to 2033

Figure 148: South Asia and Pacific Market Attractiveness by Sample , 2023 to 2033

Figure 149: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 152: East Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) by Sample , 2023 to 2033

Figure 154: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 160: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 161: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 162: East Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 165: East Asia Market Value (US$ Million) Analysis by Sample , 2018 to 2033

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Sample , 2023 to 2033

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Sample , 2023 to 2033

Figure 168: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 169: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 171: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 172: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 173: East Asia Market Attractiveness by Sample , 2023 to 2033

Figure 174: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) by Technology, 2023 to 2033

Figure 178: Middle East and Africa Market Value (US$ Million) by Sample , 2023 to 2033

Figure 179: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 180: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 185: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 186: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 187: Middle East and Africa Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 188: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 189: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 190: Middle East and Africa Market Value (US$ Million) Analysis by Sample , 2018 to 2033

Figure 191: Middle East and Africa Market Value Share (%) and BPS Analysis by Sample , 2023 to 2033

Figure 192: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sample , 2023 to 2033

Figure 193: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 194: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 195: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 196: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 197: Middle East and Africa Market Attractiveness by Technology, 2023 to 2033

Figure 198: Middle East and Africa Market Attractiveness by Sample , 2023 to 2033

Figure 199: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 200: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Genetic Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Genetically Modified Food Market Analysis by Type, Trait, and Region through 2035

Genetic Cardiomyopathies Market

Genetic Leukemia Detection Testing Market

Cytogenetic Systems Market Size and Share Forecast Outlook 2025 to 2035

Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Bone Morphogenetic Protein Market Size and Share Forecast Outlook 2025 to 2035

Cellular Epigenetics Market

Molecular Cytogenetics Market Size and Share Forecast Outlook 2025 to 2035

Pre-Pregnancy Genetic Testing Market Size and Share Forecast Outlook 2025 to 2035

Point-Of-Care Genetic Testing Market

Cancer-focused Genetic Testing Service Market Analysis – Growth & Industry Insights 2024-2034

Preimplantation Genetic Testing Market Size and Share Forecast Outlook 2025 to 2035

Companion Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HSV Testing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA