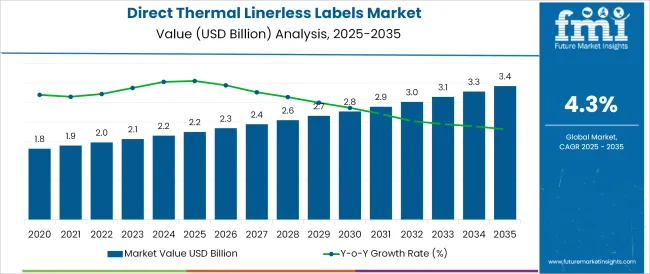

The Direct Thermal Linerless Labels Market is estimated to be valued at USD 2.2 billion in 2025 and is projected to reach USD 3.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

The direct thermal linerless labels market is experiencing notable growth, supported by increasing demand for waste reduction, automation compatibility, and eco-efficient packaging solutions. Unlike traditional labels, linerless variants eliminate the need for backing liners, thereby reducing material usage, storage costs, and production waste. Regulatory shifts promoting recyclable and low-footprint packaging are encouraging adoption across food, logistics, and retail industries.

Enhanced printing technologies, along with advancements in adhesive coatings and face-stock materials, have improved the print clarity, durability, and shelf-readiness of these labels. As e-commerce and cold chain distribution expand, the need for durable, smudge-resistant labeling has become more pronounced. Industry players are also investing in machinery retrofits and linerless-compatible printers to support large-scale implementation.

With the dual benefits of cost efficiency and environmental compliance, linerless labeling is being positioned as a strategic component of next-generation packaging systems.

The market is segmented by Printing Technology and End Use and region. By Printing Technology, the market is divided into Flexo Printing, Digital Printing, and Offset Printing. In terms of End Use, the market is classified into Food and Beverage Industry, Retail, Transport and Logistics, Warehouse and Distribution, Healthcare Industry, Industrial Manufacturing, and Electronic Industry.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

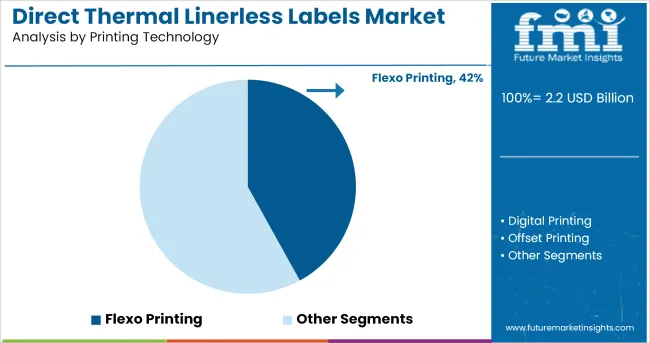

Flexo printing is projected to hold a 42.0% share of the total revenue in the direct thermal linerless labels market by 2025, making it the leading printing technology. This leadership is being driven by its ability to produce high-resolution, continuous print runs at high speeds, which aligns with the demands of linerless labeling lines.

Flexographic systems are compatible with a broad range of substrates and inks, including UV-curable and water-based formulations, enabling sharp, smudge-resistant label impressions.

The flexibility to print on pressure-sensitive and thermal-reactive coatings with minimal setup time has enhanced its adoption in high-volume packaging lines. In addition, improvements in plate-making automation and inline finishing options are making flexo systems more efficient and cost-effective.

As sustainability goals pressure brands to reduce waste and increase print speed-to-market ratios, flexo printing continues to serve as the dominant choice for producing linerless labels at industrial scale.

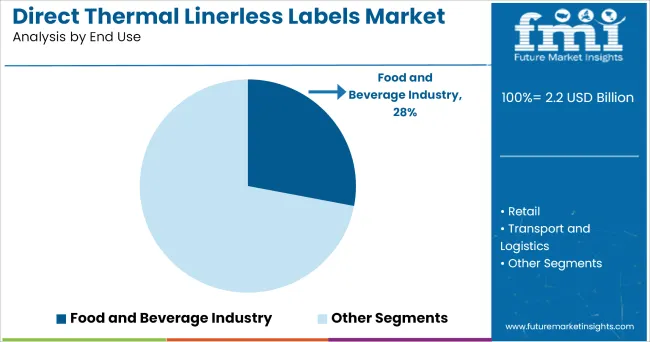

The food and beverage industry is expected to account for 28.0% of the revenue in the direct thermal linerless labels market by 2025, making it the leading end-use segment. This dominance is being attributed to the sector’s high packaging turnover, regulatory labeling requirements, and need for traceability and freshness indicators.

Direct thermal linerless labels support fast application speeds and reliable adhesion on various packaging materials including paperboard, plastic, and flexible film, which are widely used in food processing. Their resistance to moisture and temperature variation makes them ideal for cold chain logistics and refrigerated storage conditions.

Additionally, linerless formats contribute to packaging waste reduction and operational efficiency, both of which are top priorities for food manufacturers under growing sustainability pressure. With increasing SKU variation and demand for real-time printing and product tracking, the food and beverage industry continues to invest in linerless solutions to meet speed, compliance, and sustainability goals.

The world is switching over towards the biodegradable and environment-friendly packaging solution, and the trend towards flexible packaging and labelling is proliferating. Direct thermal linerless labels are considered the most economical and sustainable packaging solution.

The direct thermal linerless labels are simple and pressure-sensitive labels without liner. They are adhesive stickers made with a special realizing coating used to the face of the label, which helps to protect a roll without the adhesive stick to the label.

These release coating on the label surface creates barrier protection against the UV rays, chemicals, light, moisture, abrasion, and other harmful environmental conditions. These labels are the more innovative, better, and greener solution by reducing the waste creates a favourable environmental impact.

By eliminating the liners, the customer gets more labels per roll, requires fewer roll changes, and reduces the time to remove and dispose of the liners. Thus, the technological advancement for direct thermal linerless labels with solid self-adhesive, fast and clear printing creates a substantial demand.

The world is switching over towards the biodegradable and environment-friendly packaging solution, and the trend towards flexible packaging and labelling is proliferating. Direct thermal linerless labels are considered the most economical and sustainable packaging solution.

The direct thermal linerless labels are simple and pressure-sensitive labels without liner. They are adhesive stickers made with a special realizing coating used to the face of the label, which helps to protect a roll without the adhesive stick to the label.

These release coating on the label surface creates barrier protection against the UV rays, chemicals, light, moisture, abrasion, and other harmful environmental conditions. These labels are the more innovative, better, and greener solution by reducing the waste creates a favourable environmental impact.

By eliminating the liners, the customer gets more labels per roll, requires fewer roll changes, and reduces the time to remove and dispose of the liners. Thus, the technological advancement for direct thermal linerless labels with solid self-adhesive, fast and clear printing creates a substantial demand.

The direct thermal linerless labels are eco-friendly packaging due to less waste disposal translates into lower carbon emission and supports the lower carbon footprint. It reduces solid waste dumping by eliminating silicone dumping in the landfills and sustaining the “Green” zero waste initiative.

As the linerless labels do not comprise a liner at the back, it reduces industrial waste disposal, reduces the disposal cost, and increases productivity and safety at the workplace by removing the hazard of slippery silicone-based liners.

The direct thermal linerless labels positively impact the business operations by reducing the material cost, labour, and transportation saving, reducing the freight cost, reducing the storage space, and increasing operational efficiency. Thus the cost-effective, sustainable, convenient direct thermal linerless labels could generate considerable growth.

Increase in e-commerce business strongly driven by increase online shopping trend of consumers. The e-commerce packaging requires consignor and consignee details with the tracking system to safeguard the product during shipping.

The direct thermal linerless labels are barcode readable, scratch proof, waterproof, and the release coating creates barrier protection against harmful environmental factors. As the direct thermal linerless labels are convenient, easy to use, and effective packaging, it is beneficial in e-commerce packaging.

The rising supermarkets and hypermarkets create substantial demand for the direct thermal linerless labels while packaging the products containing the product’s information, manufacturing date, expiry date, and price tags. Even it is also helpful for inventory management for tagging the details of the products. Hence, the demand for direct thermal linerless labels could augment the market growth.

The direct thermal linerless labels, with their excellent resolution for barcode scanning and readability saving in waste disposal, greater operation efficiencies, create growth opportunities. By use of flexographic printing technology, the direct thermal linerless labels could expect high demand.

Flexo printing is the preferred process for direct thermal linerless label printing due to its vibrant specialties like higher production speed, excellent print quality, and quick job change-over. Flexo printing is a fast process due to the inks used are fast-drying water-based paints, not oil-based.

Additionally, flexographic printing is the most cost-effective, versatile, and efficient printing used on direct thermal linerless labels applied to cardboard boxes, packets, envelopes, price tags, product details, and consignor and consignee details during transportation.

Key players such as

Key Asian players such as

are actively involved in direct thermal linerless labels market for different applications.

The manufacturers involved in manufacturing direct thermal linerless labels adopt various strategies such as innovation and product launch to serve the increasing demand for the direct thermal linerless labels market.

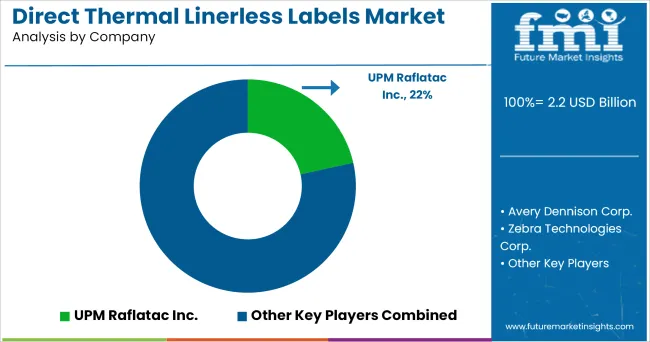

In January 2024, UPM Raflatac Inc. developed Linerless Opticut technology for each direct thermal linerless labels end use such as logistics, retailing, takeaway restaurants, etc. It provides excellent adhesives on the package and minimizes service time.

The direct thermal linerless labels are witnessing a growing preference in India due to the gradual shift of the manufacturers from conventional labels due to the saving in cost and increasing productivity. Many companies print the valuable information on the labels, which is helpful to the consumers for selection of the product could boost the sales of direct thermal linerless labels.

With the rising technological advancement in the printing technology in India, such as flexographic printing, screen printing, offset printing, digital printing, the direct thermal lineless labels expect substantial growth. Due to the rising trend of e-commerce and digitalization the online purchasing is grown extensively in India. Therefore, the direct thermal liners labels played a magnificent role in fast, secure, safe, easy, and convenient packaging delivery to the consumers.

The global direct thermal linerless labels market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the direct thermal linerless labels market is projected to reach USD 3.4 billion by 2035.

The direct thermal linerless labels market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in direct thermal linerless labels market are flexo printing, digital printing and offset printing.

In terms of end use, food and beverage industry segment to command 28.0% share in the direct thermal linerless labels market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA