The demand in direct thermal inks & coatings market is raising with increasing green, long-term durability, high-performance printing requirement. Companies in this sector developed the most superior and innovative kind of coatings, ink that prolongs print lifetime and withstand light fastness properties. In such aspects, environmental norms compliance in all manners improves its effectiveness & decreases costs that provide the possible usage.

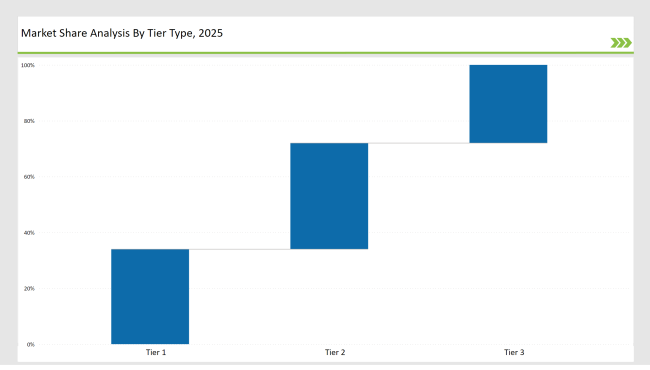

Tier 1 players, such as Ricoh, Oji Holdings, and Appvion, command 34% of the market through superior R&D, global distribution networks, and high-quality formulations.

Tier 2 companies, including Koehler Paper Group, Nakagawa Manufacturing, and Iconex, hold 38% of the market. These companies serve mid-sized businesses by offering cost-effective, high-performance direct thermal inks and coatings with regulatory compliance.

Tier 3 includes regional and niche players manufacturing tailored, eco-friendly coatings and specializing in a specific application; it constitutes 28 percent of the market. Here, localized supply chains and product variations are the focus with adaptive production techniques for industry-specific needs.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Ricoh, Oji Holdings, Appvion) | 18% |

| Rest of Top 5 (Koehler Paper Group, Nakagawa Manufacturing) | 10% |

| Next 5 of Top 10 (Iconex, Hansol Paper, Mitsubishi Paper Mills, Jujo Thermal, Kanzaki Specialty Papers) | 6% |

The direct thermal inks & coating market serves industries that demand high-resolution, durable, and cost-efficient printing solutions. Growth in logistics, retail, and pharmaceutical sectors is increasing demand for thermal printing technology.

Manufacturers are enhancing performance, sustainability, and efficiency in direct thermal inks and coatings.

Manufacturers are investing in AI-driven quality control, automation, and sustainable raw materials to stay ahead of the curve. Companies are improving durability, recyclability, and print clarity while making it more cost-effective. Innovations in BPA-free and phenol-free coatings are changing the face of industry standards.

Year-on-Year Leaders

Technology suppliers should focus on developing sustainable, high-durability, and automation-friendly solutions. Collaborating with raw material suppliers can accelerate product innovation and regulatory compliance.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Ricoh, Oji Holdings, Appvion |

| Tier 2 | Koehler Paper Group, Nakagawa Manufacturing |

| Tier 3 | Iconex, Hansol Paper, Mitsubishi Paper Mills, Jujo Thermal, Kanzaki Specialty Papers |

Leading manufacturers are enhancing product durability, reducing environmental impact, and expanding automation capabilities.

| Manufacturer | Latest Developments |

|---|---|

| Ricoh | Launched phenol-free thermal paper in March 2024. |

| Oji Holdings | Developed high-durability coatings for shipping labels in August 2023. |

| Appvion | Introduced eco-friendly thermal coatings in May 2024. |

| Koehler Paper Group | Expanded advanced image stability coatings in November 2023. |

| Nakagawa Manufacturing | Released low-energy thermal coatings for cost reduction in February 2024. |

| Iconex | Strengthened its product portfolio with durable retail label solutions. |

| Hansol Paper | Launched sustainable thermal paper solutions for food packaging. |

| Mitsubishi Paper Mills | Focused on water-resistant thermal coatings for logistics labels. |

The competitive landscape in the direct thermal inks & coating market is evolving as key players prioritize automation, sustainability, and durability to maintain a strong market position.

Companies will embrace AI-driven quality control to enhance the efficiency and sustainability of thermal coating. BPA-free and phenol-free coatings will become the norm, reducing environmental impact. Automation will streamline production, ensuring consistent print quality and faster output. More businesses will adopt durable and tamper-proof coatings for secure applications.

Smart labeling technology, such as color-changing coatings, will enhance authenticity verification. Regional manufacturers will expand their production lines to meet the rising demand for sustainable direct thermal coatings. E-commerce and logistics continue to be an important factor that fuels the demand for high-performance, long-lasting thermal coatings.

Leading players include Ricoh, Oji Holdings, Appvion, Koehler Paper Group, and Nakagawa Manufacturing.

The top 3 players collectively control 18% of the global market.

The market shows medium concentration, with top players holding 34%.

Key drivers include sustainability, automation, and durable print solutions.

Nitrogen Flushing Machine Market Report – Trends, Size & Forecast 2025-2035

Pan Liner Market Insights – Demand, Growth & Industry Trends 2025-2035

Perfume Filling Machine Market Report – Trends, Demand & Industry Forecast 2025-2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.