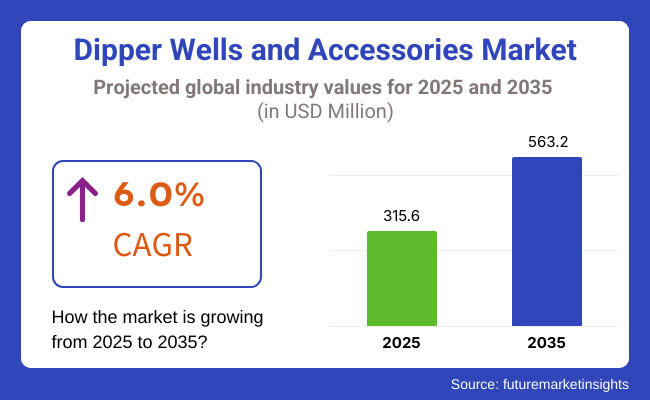

The dipper wells and accessories market will see a significant growth from 2025 to 2035 due to growing demand from food service establishments, coffee houses, ice cream parlors, and commercial food establishments. The market will be around USD 315.6 million in 2025 and is expected to reach USD 563.2 million by 2035 with a compound annual growth rate (CAGR) of 6.0% from 2025 to 2035.

Among the most notable of these is changing market trends. Among the most notable factors driving the changing market trends is the growth in the food service industry that is driving demand for clean-oriented accessories and equipment. Dipper well is an extremely important element since it provides a hygienic environment by flushing things like barista spoons and ice cream scoops on a daily basis to avoid cross-contamination.

Huge fast food places and specialty coffee shops like Baskin-Robbins and Starbucks use dipper wells for sanitation and company effectiveness. Besides, stricter health codes in restaurants and food establishments are driving expansion toward more sanitary solutions, which facilitate market uptake.

The market is divided into several classes of products such as regular dipper wells, hot dipper wells, and accessory kits such as faucet attachments and drain assemblies. Regular dipper wells are also employed on a daily basis by dessert restaurants and ice cream parlors to sanitize scoops between use.

Heat dipper wells, which avoid ice build-up development, are implemented in coffee houses for barista spoons and milk frothing machines. Adjustable flow regulators and self-closing faucets are increasingly needed fittings to optimize efficiency and water savings. Power and water-saving dipper wells are in great demand today with sustainability the food service industry buzzword.

Explore FMI!

Book a free demo

The North American market boasts one of the fastest-growing markets for the application of dipper wells and accessories due to the rapid growth of coffee house and fast food culture wherever it is. Food service markets mature in the USA and Canada where there are stringent sanitary codes that exist.

All restaurants such as McDonald's, Dunkin', and Tim Hortons use dipper wells to a large extent to meet the requirements of the health department as well as for the best flow-through efficiency. Besides, growing concern for water conservation has prompted companies to design water-conserving dipper wells with automatic shut-off to minimize water wastage.

Due to enhanced food safety practices by local health authorities and the FDA, North American food retailers are investing more funds in cleaner dipper well systems that are sustainable. The trend will continue to propel steady market growth in the region.

Europe leads the market share of dipper wells by a huge amount since France, Italy, and Germany all possess a pre-existing old and traditional café culture. Chains like Costa Coffee and individual speciality coffee houses are implementing heated dipper wells so that brewing equipment stays in clean and consistent condition. Italian and Spanish ice cream parlours also use such equipment to comply with EU food safety legislation and sanitation practices.

Since there are greater constraints on water use, European food equipment producers are considering low-flow dipper wells as ways of cutting operating expenses without compromising performance. There are other environmentally aware foodservice operations seeking recyclable stainless steel and energy-conserving components for dipper wells as ways of green business.

Asia-Pacific will witness the highest growth in dipper wells and accessories market through the rapid growth of quick-service restaurants, dessert cafes, and specialty coffee houses. China, Japan, South Korea, and India are all witnessing coffee culture expansion and chains like Starbucks, Luckin Coffee, and Blue Tokai are expanding their wings. Dipper wells are increasingly being utilized as such centers place greater emphasis on hygiene and convenience.

India and China ice cream markets are also driving market growth with more dessert parlors fitting dipper wells to enhance sanitation levels. Nevertheless, regulatory barriers in water conservation and sustainability are holding back manufacturers in the region from developing low-cost and sustainable dipper well solutions.

Challenge

Water Conservation and Waste Management

Conventional dipper wells continuously draw water, a cause of worry in excessive water use, especially in deserts. The aspect is leading regulatory agencies to impose strict measures on the use of water in food business activities. Businesses are compelled to come up with ways of addressing sanitation requirements and water conservation in a manner that they are economically feasible as well as regulation compliant.

Opportunity

Creating Water-Saving and Intelligent Dipper Wells

Technological innovation in dipper well technology holds the most promise for expansion in the market. Sensor-activated, flow-variable, and automated shut-off water dipper wells are being manufactured by companies so that wastage is prevented but not at the expense of sanitation. Internet of Things (IoT) smart dipper wells with monitoring capabilities are also entering the market that give restaurant owners a means to monitor usage of water and optimize it for higher efficiency accordingly.

Dipper well markets between 2020 and 2024 were growing continuously, and growth was mainly driven by the upsurge of quick-service restaurants, dessert restaurants, and coffee shops. The pandemic caused by COVID-19 heightened awareness towards sanitation, and restaurants began to use hygiene machinery. Industrial regulations also raised the pressure for using stricter sanitation protocols, further escalating demand for dipper wells.

Prior to 2025 to 2035, the industry will transform to be greener and technology-based solutions. Dipper wells to save water, smart monitoring systems, and utilization of ecologically sustainable materials will characterize the next phase of industrial growth. With consumer preference moving towards sustainability, food service outlets will be investing in dipper well systems that will be compatible with environmental conservation without compromising on sanitation requirements.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Regulatory authorities emphasized sanitation practices in foodservice establishments, and dipper wells were used more to prevent cross-contamination. |

| Technological Advancements | Manufacturers have created dipper wells with advanced thermal insulation that makes commercial kitchens more energy-efficient. |

| Sustainability Practices | The industry began employing sustainable materials in the production of dipper wells, as global trends focused on sustainability. |

| Design and Aesthetics | Adjustable dipper wells became popular, allowing companies to synchronize equipment with interior design, which enhanced customer experience. |

| Market Growth Drivers | Expansion of the foodservice industry, like cafes and ice cream parlors, increased demand for dipper wells to promote utensil sanitation. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Governments implement stricter water-saving regulations, and companies are compelled to produce dipper wells with automatic water controls to minimize wastage. |

| Technological Advancements | Interconnectivity using IoT technology provides an opportunity to monitor water use in real-time, enabling business organizations to make money savings while reducing waste. |

| Sustainability Practices | Principles of circular economy act as an impetus to extensive recycling schemes for dipper well parts, limiting environmental effect. |

| Design and Aesthetics | Streamlined minimalist appearance with touchless operation is the standard now, reflecting modern appearances and enhanced hygiene. |

| Market Growth Drivers | Growth of the hospitality industry, especially in the emerging markets, fuels demand for sanitary and effective kitchen appliances. |

United States tops the list with a dominant market share of the dipper wells and accessories market in the global market, largely due to the huge number of restaurants and hotels. The priority placed on high standards of sanitation and efficiency in the operations of the hospitality industry has made dipper wells an obligatory feature.

Also aiding the growth has been technological developments like smart dipper wells that come equipped with water-saving sensors. With home kitchens being renovated, there was strong residential demand for the products, which also helped drive market growth in the nation.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.0% |

There is steady market growth for dipper wells and accessories in the United Kingdom due to expansion in the foodservice sector and high hygiene standards. The expansion of coffeehouses, ice cream shops, and restaurants has brought forth a greater demand for dipper wells that can accommodate utensil sanitation.

Designers have since created models especially for the specific use of servicing such establishments with designs that may be engineered to suit the aesthetic demands of today's foodservice operations. Besides, increasing environmental awareness in the UK has promoted increased utilization of environmentally friendly material in dipper well production for the general benefit of eco-friendlier goals.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.0% |

The European Union dipper well and accessories sector has a solid emphasis on sustainability and innovation. Germany and France have been at the forefront in encouraging this trend by employing automated cleaning machinery in dipper wells in a bid to offer higher levels of cleanliness.

Moreover, the use of Internet of Things (IoT) technology in kitchen appliances has allowed companies to reduce water consumption, allowing companies to be viewed as meeting the environmental agenda of the EU. The hospitality and foodservice industries of EU member countries have also been market leaders since these companies require effective and efficient hygiene solutions in order to function.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.0% |

Japan's dipper wells and accessories business has expanded due to the country's focus on enhancing process efficiency and technology in the foodservice industry. Intelligent technology such as touchless operation and autonomous regulation of water supply has also been instrumental in the use of dipper wells to high-technology kitchens.

Japan also facilitates sustainability; whereby green products are used to manufacture dipper wells. Japan's multicultural culinary culture, where emphasis is put on hygiene and precision when preparing food, has also driven the need for good-quality dipper wells for restaurant and domestic use.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.9% |

South Korean market for dipper well and accessories has grown due to the high-growth foodservice market and application of innovative kitchen technologies in South Korea. Increased popularity of dessert houses, quick-service restaurants, and cafes has increased the demand for dipper wells in an effort to address high levels of hygiene.

The manufacturers have responded by designing more sophisticated models with focus on water conservation, thermal insulation, and overall efficiency. Besides, government incentives in taxation to promote conservation have encouraged the practice of sustainable principles in dipper well production regarding the national approach to the environment and sustainability in general.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.8% |

Dipper wells are the largest segment of the dipper wells and accessories market, with their role as food safety appliances in commercial restaurants. Dipper wells continuously recycle a stream of water to sanitize and store utensils like ladles, ice cream scoops, and spoons, isolating them from bacterial contamination between usage. They are used most often in quick-service restaurants, ice cream stores, and coffee shops, where utensils are heavily rotated.

Stainless steel dipper wells are the most widely used due to their corrosion-proof, durable nature, and health and safety compliance. High-end sanitation systems, particularly in North America and Europe, are driving the adoption of high-end dipper wells with water-saving characteristics that are technologically advanced. Such innovation like water flow control through the use of sensors for greater efficiency as well as water savings in foodservice is also emphasized by companies.

Faucets and water distribution piping are never in short supply, particularly in high-volume food service and health care applications where sanitation is an issue. Foot pedal and motion sensor faucets are becoming widely accepted in commercial food equipment and health care applications by minimizing hand contact and cross-contamination potential. Faucets that include integral filtration systems are also gaining popularity in hospital kitchens and institutional cafeterias in providing high levels of water quality.

In hotel and resort use, trendy temperature control faucets are the rage, catering to high-end service needs. Meanwhile, innovation in water supply devices, like smart water sensing and pressure management, are optimizing water savings and responding to sustainability goals in large commercial facilities.

Drain assemblies, the heart of dipper well units, are gaining popularity because of increased concern about efficient wastewater handling in foodservice and health care uses. Anti-clog technology and grease traps in high-flow drain assemblies are increasingly found in foodservice kitchens, reducing maintenance cost and helping regulatory compliance.

The implementation of environmentally sustainable solutions, such as water recycling drain systems, is also increasing, especially in places where there is strict water conservation law. This is very common in California, where restaurants and institutional food service are mandated to reduce water loss. Heavy-duty drain assemblies also widely exist in industrial food processing plants and hospital cafeterias.

The foodservice industry remains the most prevalent end-use application for dipper wells and accessories because of stringent sanitation needs and the need for efficient kitchen operation. Quick-service restaurants (QSRs) such as McDonald's and Starbucks use dipper wells for quick utensil sanitizing, so unbroken service does not have to be sacrificed at the cost of cleanliness. Full-service restaurants and catering operations also require quality faucets and water distribution systems in the name of kitchen efficiency and sanitation.

With the new phenomenon of cloud kitchens and delivery points, consumers have also upped demand for efficient yet space-saving sanitizing solutions. Players in the industry are fighting back by producing modular dipper wells and accessories that perfectly suit small commercial kitchen spaces, maximizing space usage without detracting from hygiene.

Dipper wells and accessories have a new customer market in hotels and resorts, which are seeking high-end properties, designer faucet design, and low-flow supply system. Luxury hotels desire good-looking and technologically advanced faucets that are commensurate with their luxury kitchen and bar ambience. Enormous complexes of resorts that have large-sized dining also require heavy-duty, low-maintenance dipper wells to mechanize food preparation activity.

Efforts at sustainability are impacting purchasing, and many hotels are investing in water-conserving faucets and drain assemblies through sustainable certification programs like LEED and Green Globes. Touchless dipper wells and smart water monitoring systems will gain increased popularity as the industry continues on its path towards automation and sustainability.

Hospitals, nursing homes, schools, and colleges are the significant end-use application of dipper wells and accessories, whose primary concern is safety and hygiene. In hospital food service, dipper wells are a key solution to eradicating cross-contamination in patient eating equipment handling with weak immune systems. Nursing homes and care facilities are also investing in hands-free faucets and low-flow water supply systems to accommodate improved hygiene procedures.

In institutional settings such as schools and colleges, hectic cafeterias require low-maintenance and strong dipper wells and drain assemblies to ensure food safety for students. Water-saving solutions are also being implemented in educational institutions to achieve sustainability goals, and thus there has been greater acceptance of green dipper well systems. With more stringent regulation of water conservation and sanitation, the need for advanced dipper wells and accessories will grow steadily in such industries, leading to further expansion in the market.

The dipper well and accessories business is a competitive marketplace, dominated by international manufacturers and a mix of local manufacturers to the food service and hospitality industries. Market leaders focus on product innovation, water conservation, and adhering to stringent health codes. The marketplace includes a mix of experienced manufacturers and new producers, all contributing to technological advancements and market expansion.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| T&S Brass and Bronze Works | 14-19% |

| Fisher Manufacturing | 10-15% |

| Krowne Metal Corporation | 8-13% |

| Advance Tabco | 5-9% |

| BK Resources | 4-8% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| T&S Brass and Bronze Works | Specializes in high-efficiency dipper wells with water-saving designs. Focuses on NSF-certified products for food safety compliance. |

| Fisher Manufacturing | Produces durable stainless-steel dipper wells with customizable accessories. Invests in water-efficient technology. |

| Krowne Metal Corporation | Offers modular dipper well systems tailored for restaurants and cafes. Emphasizes easy installation and maintenance. |

| Advance Tabco | Manufactures cost-effective dipper wells designed for large-scale food service establishments. Focuses on affordability and reliability. |

| BK Resources | Develops compact and ergonomic dipper wells for small commercial kitchens. Known for quick adaptability to diverse customer needs. |

Key Company Insights

T&S Brass and Bronze Works (14-19%)

T&S Brass and Bronze Works is a market leader in dipper wells and accessories featuring high-efficiency designs that reduce water consumption but not at the expense of sanitation levels. T&S Brass utilizes sophisticated flow control technology to minimize water loss to the lowest possible level. T&S Brass, with its leadership in Europe and North America, is involved in sustainable innovation-led products, meeting NSF and other health safety standards.

Fisher Manufacturing (10-15%)

Fisher Manufacturing is a recognized manufacturer of commercial food kitchen and beverage station stainless-steel dipper wells. Fisher is at the forefront of water conservation with the innovation of low-flow. Fisher also enjoys a good reputation for being extremely heavy-duty dipper wells and accessories that appeal to high-volume food service operations.

Krowne Metal Corporation (8-13%)

Krowne Metal Corporation sells modular dipper well systems for restaurants, bars, and coffee shops. The company focuses on easy installation and adjustable configurations to various kitchen arrangements. Krowne Metal is renowned for implementing friendly user designs that maximize operation efficiency in food preparation areas.

Advance Tabco (5-9%)

Advance Tabco is a dominant player in the dipper wells and accessories market with cost-effective solutions for mass food service operations. The company focuses on cost without compromising on quality, and thus its products are the first choice with price-conscious consumers. Advance Tabco's dipper wells have widespread usage in institutional food service like in schools and hospitals.

BK Resources (4-8%)

BK Resources is a new manufacturing company that specializes in designing mini and ergonomic dipper wells for small-sized commercial restaurants. It is described to be market-aware in adapting to changing market requirements and offering flexible solutions for various customers' specifications. BK Resources prioritizes product flexibility to make its dipper wells available in multiple configurations suitable for kitchen layouts.

Other Key Players (40-50% Combined)

Beyond these dominant players, several companies collectively hold a significant market share, contributing to innovation, cost optimization, and sustainability efforts. These include:

The overall market size for dipper wells and accessories market was USD 315.6 million in 2025.

The dipper wells and accessories market is expected to reach USD 563.2 million in 2035.

The increasing demand from foodservice establishments, growing emphasis on hygiene standards, and rising adoption of automated solutions fuel the Dipper wells and accessories market during the forecast period.

The top 5 countries which drive the development of dipper wells and accessories market are USA, Canada, Germany, UK, and China.

On the basis of product type, stainless steel dipper wells are expected to command a significant share over the forecast period.

Coffee Roaster Machine Market Analysis by Product Type, Capacity, Control, Heat Source and Application Through 2035

Indoor Smokehouses & Pig Roasters Market – Smoked Meat Processing 2025 to 2035

Vegetable Sorting Machine Market Analysis by Processing Capacity, Technology, Operation Type, Vegetable Type, and Region Through 2035

Automated Brewing System Market Analysis & Forecast by Product Type, Capacity, Mechanism, and Region through 2035

Brewing Boiler Market Analysis by Material Type, Application, Automation, and Region 2025 to 2035

Bakery Processing Equipment Market Analysis by Product Type, End User, Application & Region: A Forecast for 2025 and 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.