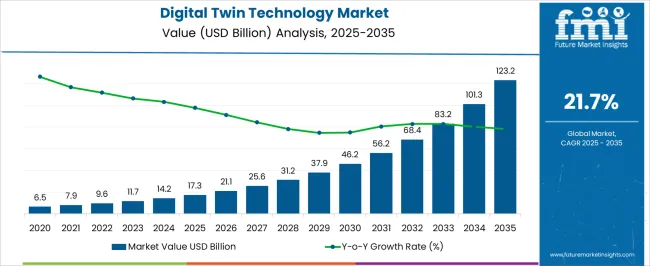

The Digital Twin Technology Market is estimated to be valued at USD 17.3 billion in 2025 and is projected to reach USD 123.2 billion by 2035, registering a compound annual growth rate (CAGR) of 21.7% over the forecast period.

| Metric | Value |

|---|---|

| Digital Twin Technology Market Estimated Value in (2025 E) | USD 17.3 billion |

| Digital Twin Technology Market Forecast Value in (2035 F) | USD 123.2 billion |

| Forecast CAGR (2025 to 2035) | 21.7% |

The digital twin technology market is advancing rapidly, driven by the increasing integration of data analytics, IoT platforms, and AI to simulate and optimize real-world systems. Industry publications and corporate briefings have emphasized its role in improving operational efficiency, reducing downtime, and enabling predictive maintenance across industries. The ability to create virtual replicas of assets and processes has transformed decision-making in manufacturing, urban planning, and healthcare by allowing real-time monitoring and scenario testing.

Investments from technology providers and industrial enterprises have accelerated innovation in digital twin platforms, particularly in cloud-based and edge computing solutions. Additionally, partnerships between software developers and OEMs have expanded implementation across industrial supply chains.

Looking forward, the market is expected to expand further as companies embrace Industry 4.0 principles, with applications spanning production optimization, energy management, and autonomous systems. Strong momentum is anticipated in manufacturing process planning and the automotive sector, reflecting the growing demand for efficiency, precision, and lifecycle management in these segments.

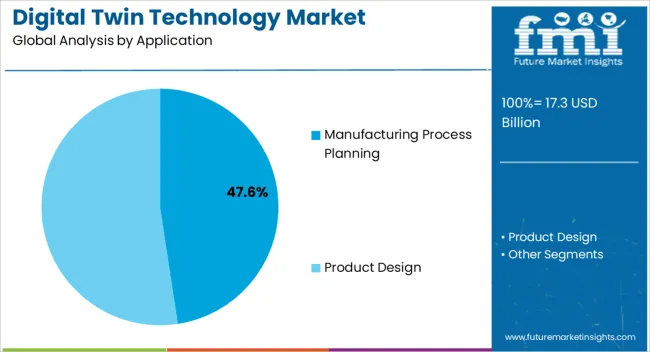

The manufacturing process planning segment is projected to contribute 47.60% of the digital twin technology market revenue in 2025, positioning it as the dominant application. This leadership has been reinforced by the growing reliance on digital twins to simulate, test, and optimize manufacturing workflows before physical implementation.

Enterprises have adopted digital twins to evaluate plant layouts, streamline assembly lines, and improve resource allocation, thereby reducing waste and operational costs. Reports from industrial technology forums have highlighted the use of digital twins in minimizing risks during product launches by identifying potential inefficiencies at the design stage.

Furthermore, the integration of AI-driven analytics and real-time data capture has enhanced decision-making accuracy, enabling continuous process improvement. The ability of digital twins to shorten time-to-market, improve flexibility, and support customized production runs has further strengthened their role in manufacturing. With the increasing complexity of global supply chains, the manufacturing process planning segment is expected to sustain its leadership as industries prioritize resilience and agility.

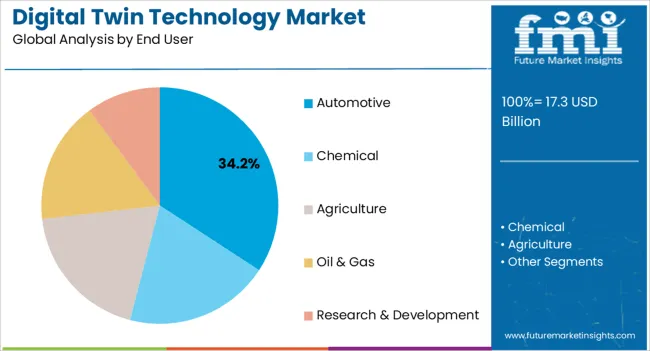

The automotive segment is projected to account for 34.20% of the digital twin technology market revenue in 2025, maintaining its leading position among end users. Growth of this segment has been driven by the adoption of digital twin solutions in vehicle design, prototyping, and lifecycle management.

Automotive companies have leveraged digital twins to simulate performance under varying conditions, optimize safety features, and enhance energy efficiency in electric and hybrid models. Press releases and annual reports from automotive manufacturers have highlighted the use of digital twins to reduce R&D costs and accelerate innovation in connected and autonomous vehicle technologies.

Additionally, digital twin platforms have been implemented in predictive maintenance of vehicles and optimization of production plants, reducing downtime and operational disruptions. As the automotive industry undergoes a transition towards electrification, sustainability, and smart mobility solutions, the role of digital twins in ensuring efficiency, regulatory compliance, and customer-centric design is expected to strengthen, reinforcing the segment’s leadership in end-user adoption.

The digital twin technology industry could benefit from the widespread use of the technology across various end-use industries. As a result, the digital twin technology market stands to benefit from its increasing prevalence in fields such as supply chain management, warehouse management, and smart city projects. The benefits of these technologies in coordinating the parts, boosting the operations, and improving the performance have attracted a lot of customers.

supply chain management, warehouse management, and smart city projects. The benefits of these technologies in coordinating the parts, boosting the operations, and improving the performance, have attracted a lot of customers.

Digital twin infrastructure has improved the offerings of the thriving automotive industry. It is also possible that the rising use of simulation software may help propel the digital twin technology market forward. Growth in the digital twin technology industry is forecast to skyrocket thanks to the increasing popularity of autonomous and connected vehicles, including amenities like electrification and shared mobility.

Increases in healthcare provision can be directly attributed to the pandemic. On the other hand, the digital twin process has proven useful in researching patients' medical records and creating realistic practice runs of their treatments. In addition, the construction industry is enhancing 3D models utilizing digital twin technologies for smart city projects in emerging economies. Moreover, the telecom industry embraces new solutions and modernizes its network infrastructure by adopting digital twin technology. The demand for digital twin technology can be predicted to increase for several reasons.

The integration of multiple IoT sensors and other digital technologies is the solution to developing the physical twin. However, there is an augmented security risk, compliance, and data protection with the increasing number of IoT sensors and programmable electronic devices deployed.

On the contrary, major corporations in the field are focusing on inventing innovative technology solutions to enhance their presence in the digital twin technology market share. Additionally, the strong growth for related technologies in the pharmaceutical and healthcare enterprises, increased usage of 3D printing technology, and the increasing proclivity to adopt IoT technologies across multiple industries are expected to drive such acceptance throughout the forecast timeframe.On the contrary, major corporations in the field are focusing on inventing innovative technology solutions to enhance their presence in the digital twin technology market share. Additionally, the strong growth for related technologies in the pharmaceutical and healthcare enterprises, increased usage of 3D printing technology, and the increasing proclivity to adopt IoT technologies across multiple industries are expected to drive such technology acceptances throughout the forecast timeframe.

| Countries | Details |

|---|---|

| North America | North America is the largest digital twin technology market, with 34.5%. Several end-users across industries in this area are investing in parts twin and product twin, which should fuel the worldwide digital twin technology market. The presence of Microsoft, Cisco, IBM, Oracle, etc., in this area, is likely to boost the global digital twin technology market. As market participants merge and form alliances to extend their client base and product offerings, demand for digital twin technology is set to rise. |

| Europe | Europe's digital twin technology market revenue is 21%. This is due to large investments in R&D by the automotive and manufacturing sectors and the biotechnology industry's anticipated expansion.Europe's digital twin technology market revenue is 21%. This is due to large investments in R&D by the automotive and manufacturing sectors and the biotechnology industry's anticipated expansion. This region's automotive and transportation industries are implementing this technology across processes, which is likely to grow the global digital twin technology market. This region also demands virtual twin technology.This region's automotive and transportation industries are implementing this technology across processes, which is likely grow the global digital twin technology market. This region also demands virtual twin technology. |

Manufacturers can better understand processes by considering multiple production parameters through the adoption of digital twin technology. These include digital maintenance tasks, equipment monitoring, and process optimization. Start-up companies are implementing innovations to improve the digital twin process landscape.

Introducing innovative and advanced products is encouraging companies to invest in the R&D of automation of processes and products, which are the result of intense competition among leading players. Improving customer engagement by using interactive automobile dashboards on websites, where customers can customize vehicles at their convenience, is being carried out by several automotive brands through the adoption of digital twin technology.

Key Market Participants of the Digital Twin Technology Market:

| Siemens Ltd. | It is a German multinational conglomerate corporation and Europe's largest industrial manufacturing company headquartered in Munich with branch offices abroad. |

|---|---|

| General Electric Company | It is an American multinational company. For more than 125 years, GE has invented the industry's future. Today, GE is best known for its work in the Power, Renewable Energy, Aviation and Healthcare industries. |

| TIBCO Software Inc. | It is an American business intelligence software company founded in 1997 in Palo Alto, California. It has headquarters in Palo Alto, California, and offices in North America, Europe, Asia, the Middle East, Africa and South America. |

| SAP SE | It is a German multinational software company based in Walldorf, Baden-Württemberg. It develops enterprise software to manage business operations and customer relations. The company is the world's leading enterprise resource planning software vendor. |

| Microsoft Corporation | It is an American multinational technology corporation that produces computer software, consumer electronics, personal computers, and related services headquartered at the Microsoft Redmond campus located in Redmond, Washington, United States.It is an American multinational technology corporation which produces computer software, consumer electronics, personal computers, and related services headquartered at the Microsoft Redmond campus located in Redmond, Washington, United States. |

Some of the recent developments in the digital twin technology market are

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 21.7% from 2025 to 2035 |

| The base year for estimation | 2025 |

| Historical data | 2020 to 2025 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors and trends, Pricing Analysis |

| Segments Covered | Application, End User, and Region. |

| Regional scope | North America; Western Europe, Eastern Europe, Middle East, Africa, ASEAN, South Asia, Rest of Asia, Australia and New Zealand |

| Country scope | United States.; Canada; Mexico; Germany; United Kingdom; France; Italy; Spain; Russia; Belgium; Poland; Czech Republic; China; India; Japan; Australia; Brazil; Argentina; Colombia; Saudi Arabia; UAE; Iran; South Africa |

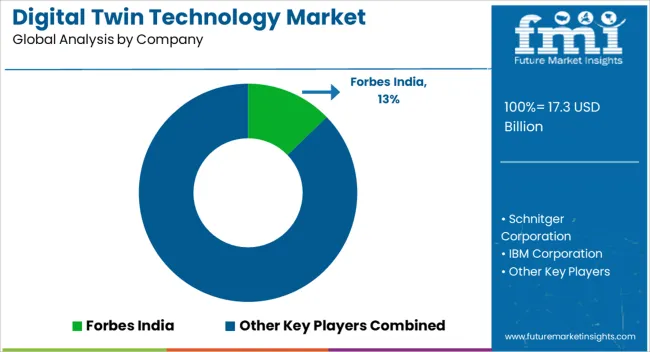

| Key companies profiled | Siemens Ltd., General Electric Company, Tibco Software Inc., SAP SE, Microsoft Corporation, Forbes India, Schnitger Corporation, IBM Corporation, Hexagon AB, AVEVA Group plc, Bosch Software Innovations GmbH, etc. |

| Customization scope | Free report customization (equivalent to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global digital twin technology market is estimated to be valued at USD 17.3 billion in 2025.

The market size for the digital twin technology market is projected to reach USD 123.2 billion by 2035.

The digital twin technology market is expected to grow at a 21.7% CAGR between 2025 and 2035.

The key product types in digital twin technology market are manufacturing process planning and product design.

In terms of end user, automotive segment to command 34.2% share in the digital twin technology market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital Twins Technologies Market Size and Share Forecast Outlook 2025 to 2035

Digital Twin In Logistics Market Size and Share Forecast Outlook 2025 to 2035

Digital Twin Packaging Line Market Size and Share Forecast Outlook 2025 to 2035

Electrical Digital Twin Market Growth – Trends & Forecast 2025 to 2035

Digital Hall Effect Gaussmeter Market Size and Share Forecast Outlook 2025 to 2035

Digital Group Dining Service Market Size and Share Forecast Outlook 2025 to 2035

Digital Pathology Displays Market Size and Share Forecast Outlook 2025 to 2035

Digital Rights Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Liquid Filling Systems Market Size and Share Forecast Outlook 2025 to 2035

Digital Transformation Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA