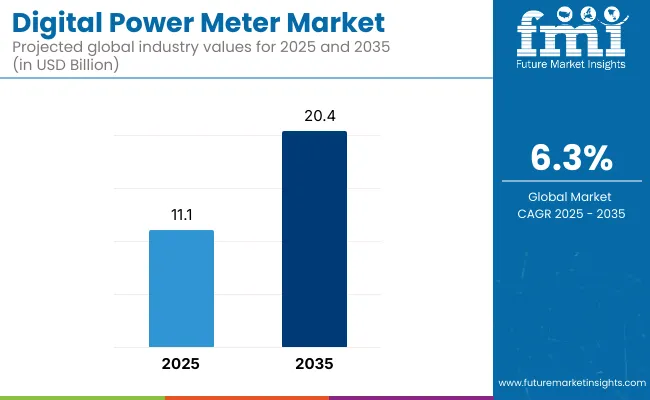

The Digital Power Meter Market is set to witness significant growth over the forecast period, driven by the increasing demand for energy efficiency, smart grid integration, and advancements in digital metering technology. With the rising global focus on sustainable energy management and regulatory mandates for smart metering solutions, the market is expected to expand steadily. In 2025, the market is projected to be valued at USD 11.1 billion, reaching approximately USD 20.4 billion by 2035, with a CAGR of 6.3% during the forecast period.

The Digital Power Meter Market is set to experience sustained growth as global demand for efficient energy management rises. The market seems to receive a boost from the rising trend of smart grid adoption, the growing investment in smart city projects, and government mandates for advanced metering infrastructure.

The increasing use of IoT-enabled digital meters and AI-based analytics solutions has led to the strengthening on grid specification and boost of efficiency. The digital metering is quickly becoming a part of the energy infrastructures of new or emerging economies. The digital power meter will be standardized globally due to manufacturers, offices, and houses' preference for energy savings.

Shifting to smart energy management solutions is a key driver to the digital power meter market. Utilities and industries are increasingly adopting digital power meters to improve real-time monitoring, reduce energy wastage and enhance grid reliability. IoT and cloud-based energy monitoring solutions' cooperation is a big part of digital power meters' improved overall performance as they are no longer just a detail but a major component of power distribution networks.

Support for smart metering systems has been strengthened by regulatory development in North America and Europe, which has resulted in increased adoption, while urbanization and industrialization in Asia-Pacific are the main drivers for the market. Moreover, the development of AI-based analytics, two-way communication capabilities, and remote monitoring functions are pushing the market as the competitor field is strengthening.

The North American market is on the rise because of significant government support for smart grids and advanced metering systems. The USA Department of Energy has realized the potential of smart meters in grid modernization efforts and is promoting their benefits to customers.

Utilities in the region are deploying Advanced Metering Infrastructure (AMI) to strengthen grid reliability, lessen power cuts, and allow for real-time energy consumption viewing for customers. Besides, Canada is pioneering in smart metering solutions, with a primary target to deal with the issue of sustainability and efficiency in power distribution. The trend of integrating IoT-enabled power meters is also positively affecting the market. However, the issue of data privacy and cybersecurity have to be dealt with before every utility is on board.

Europe is one of the primary players in the field of smart metering because of strict energy efficiency rules and climate change initiatives. The European Union’s Energy Efficiency Directive, which makes it mandatory for all member states to deploy smart meters, is at the forefront of fueling the market. Germany, France, and the UK have embraced digital meters to drive the uptake of renewables and to do a better job of demand-side management.

Need to achieve carbon neutrality by 2050 has also accelerated funding for smart grid projects. Also, The European Commission which calls for the interoperability of the grid and standardized smart metering protocols is promoting innovation in the industry. Nevertheless, market-expanding efforts related to the high implementation costs and infrastructure compatibility problems are necessary.

The Asia-Pacific area is being industrialized and urbanized quickly, which in turn is causing a significant increase in electricity demand. Countries like China, India, and Japan are stepping up smart metering deployment campaigns in order to enhance energy infrastructure and resolve the problem of transmission losses.

State Grid Corporation of China is pouring huge amounts into the digital power meters finding that grid reliability and efficiency could be improved. The primary target of India's Smart Meter National Program is to substitute old meters with digital ones which ensure correct billing and counteract theft.

Japan pursues a focus on energy security and strengthening grids, consequently, they require advanced metering solutions. However, the challenges faced are the affordability factor that is considered while deploying the solution and also the fact that the infrastructure is required to be upgraded in rural areas.

The digital power meter market in Latin America, Middle East, and Africa is picking up gradually, as the countries are channelling their attention to improving energy distribution efficiency. The Latin American nations, namely Brazil and Mexico, are those that have started implementing smart meters as a way out of energy losses as well as for enhanced billing accuracy.

The Middle East has set aside funds for smart technologies that are aimed at boosting the efficiency of high-energy consumption sectors like oil and gas. Africa is growing and this is particularly due to the call of governments pushing rural electrification and to better grid management.

The financial side aside, the present underdeveloped grid infrastructure lessens the available options for widespread deployment. But the rise in foreign investment in intelligent energy solutions will activate the market and increase penetration.

High Initial Costs and Infrastructure Upgrades

One of the major issues restraining the digital power meter market is the initial costs which more often than not, a huge burden on utilities. The majority of power distributors in developing regions are facing the challenge of financing necessary installations for the digital meters due to limited budgets.

It is not cheap to integrate energy grids with the smart metering infrastructure because this involves investment in communication networks, software, and workforce training which can be quite substantial. The financial constraints which come about as a result of systems' inefficiencies will be the major reasons for delay in the metering technology development and deployment in the regions which are most in need of solutions to upgrades of their systems.

Cybersecurity and Data Privacy Concerns

As digital power meters increasingly adopt IoT and cloud facilities, the questions regarding data privacy and security are on the rise. Digital meters, which can measure the consumption of power in real-time and transfer this data, have become a potential subject of interest for many cyber-criminals and people without authorization. Utilities need to strengthen their defenses with things like backup controls, file encryption systems and special data storage arrangements to keep their networks safe.

There's the need to comply with the regulations for the protection of personal data, like EU's GDPR and California's CCPA that make the market expansion even harder. Cash strapped but needing to meet the regulations on security and still be competitive, both production and utility sectors are in for a tough time.

Integration of AI And IoT for Advanced Analytics

With the new and the digital technologies, latent processes in the digital power meter industry are getting visible and coming to the surface. AI-based analytics performs so well in terms of predictive maintenance, anomaly detection, and energy optimization because they help utilities in their quest for operational efficiency.

The technology is IoT-based smart meters that provide automated readings, are remote-controlled, and give real-time feedback about consumption and thus, reduce manual work and improve billing accuracy. These developments create a niche for companies to provide customized solutions to the energy-intensive industries. The increasing utilization of AI-oriented energy management systems is likely to draw in more of the intelligent digital power meters.

Expansion in Emerging Markets and Smart City Projects

The accelerating trend being zero energy and the corresponding focus on smart city projects and grid modernization in developing markets is a fantastic growth facilitator for the digital power meter sector. Countries from Asia-Pacific, Latin America, and Africa are allocating funding for infrastructural smart projects, which include the digital metering system installation.

Projects such as India's Smart City Mission and Brazil's official roll-out of the national smart grid are the engines that drive demand for better power meters. Equally, the electrification of the rural and remote territories enables the digital meter manufacturers to spread their wings. As the national economies turn towards sustainable management of energy, we may see the demand for digital power meters, consequently, carçeetools, and equipment in developing areas shift abundantly.

The digital power meter market has seen substantial growth in 2020 to 2024, propelled by the unyielding demand for precise energy monitoring, smart grid development, and obligatory policies on energy efficiency. The use IoT-based metering solutions which allow implementation of greening solutions, besides, the awareness on energy economy has led to the boom in digital power meters.

The energies and the utilities companies have been the main players by carrying out the policies of energy waste reduction and enhancing grid resilience. Beyond the current transformation, the digital power meter market is envisioned to achieve another technological leap through the advances in artificial intelligence, real-time data analytics, and energy solutions that emphasize sustainability.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Environment | Smart meter installation was driven by the effort of governments all over the world through programs like the EU equipment smart grid Directive and the USA Smart Metering Program. The main policy agenda was energy efficiency and cutting carbon footprints. |

| Innovations | Digital meters using cloud-based analytics and Internet of Things (IoT) technologies, allow for remote energy monitoring as well as predictive maintenance. AMI (Advanced Metering Infrastructure) received the status of a standard in many areas. |

| Sectoral Demand | Despite the ever-increasing delivery prices and local environment regulations, utilities, manufacturing plants, and commercial spaces remain the most dominant sectors in the outline of market segmentation. |

| Green Coping & Circular Economy | Firstly we mostly wanted to cut down on manual errors, but through improving efficiency, and promotion of energy saving both at household and enterprise level. |

| Drivers of Growth | Among the main reasons for encouraging S- bindings were the government's aids, the growth in customers, and the need for energy consumption tracking. Improved smart grid technology supported the fast uptake. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Environment | Standards setting will mainly be the drivers of data privacy, interoperability, and real-time monitoring by which grid performance will be optimized. Renewed environmental regulations will necessitate old metering systems to be replaced with AI-centric solutions. |

| Innovations | AI-based diagnostics, blockchain for safety transaction, and 5G technology are the tools that will revolutionize digital power meters. Transmission speed will be faster as a result of edge computing. |

| Sectoral Demand | Totally new fields like smart cities, EV drivers, and distributed energy sources (solar, wind) will create growth opportunity and will therefore change the whole status of the market. |

| Green Coping & Circular Economy | Smart meter technology will shift to being carbon-neutral, standalone devices that use solar or wind energy will grow, and used metering components´ recycling will be getting better. |

| Drivers of Growth | Advances in AI, as well as the incorporation of digital twins in electricity management, will be the driving force in the future development of the smart-grid industry in developing countries. |

The market for USA digital power meters is enjoying a fantastic time due to the deployment of smart grids, the rising of energy efficiency initiatives, and government policies that promote the development of advanced metering infrastructure (AMI). The utilities are on boarding smart meters for the purpose of managing the grid better and thereby minimizing energy losses.

Further to this, the residential, commercial, and industrial sectors are the main reasons behind the overall uplifting phase in the market. The application of IoT and artificial intelligence in real-time monitoring has played a significant role in improving the market's prospect.

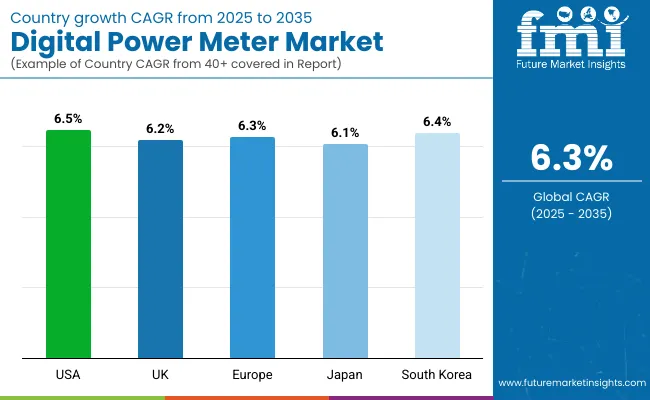

This segment of digital power meters in the USA is forecasted to expand at a CAGR of 6.5% between the years 2025 and 2035 primarily due to the continued funding of smart grid technology and regulatory measures supporting energy conservation.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.5% |

Smart metering is one of the UK introductions to the road of conversion and energy savings. The common peoples use of smart meters and the extra energy rules are the main two drivers for the growth of the metering market. The use of the meters in the residential and business sectors is also one of the reasons for the increase in sales.

The drive for the integration of renewable energy and the reduction of carbon emissions to zero is another very important factor in the metering market development. According to estimations, the UK digital power meter market will grow with the average annual growth rate (CAGR) of 6.2% ranging from 2025 to 2035, and the forecast will be affected by various factors including government measures and the increasing smart grid transition.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.2% |

The EU market is expanding due to strong regulatory frameworks like the Clean Energy Package and The European Union (EU) market is enjoying growth due to robust regulatory frameworks like the Clean Energy Package and the Energy Efficiency Directive. Nations such as Germany, France, and Italy are witnessing a high increase in smart meter installations, which are primarily driven by energy transition policies and decarbonisation targets.

The use of ultra-modern digital meters is additionally favoured by incentives for the realization of smart infrastructure projects. The digital power meter segment in the EU is believed to record a CAGR of 6.3% in the period of 2025 to 2035, in line with the region's ambition towards sustainability and the management of energy.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.3% |

The market for digital power meters in Japan is primarily motivated by the urgent need for energy security, the ongoing advancements in smart city technology, and the adoption of IoT-enabled meters. In a bid to restore reliability of electricity, Japan's utilities are racing to install smart meters that will also facilitate the development of renewables.

The all-out smart meter scheme run by the government is expected to significantly increase the market capacity. The Japanese digital power meter market projecting immense demand for infrastructure smart technologies and grid dependability is estimated to record a 6.1% CAGR during the key period of 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.1% |

South Korea has taken a step towards the digital transformation and smart grid technology in its energy sector. The government’s direction toward energy efficiency and the resultant urgency, especially in industry, have aligned perfectly with digital power meter adoption.

The fact that leading tech firms combining AI and IoT in metering solutions are also present besides the above correlation means that the sector has further expanded. The digital power meter market in South Korea is estimated to increase by a compound annual growth rate (CAGR) of 6.4% from 2025 to 2035, and will be favored by the launch of smart city and advanced energy monitoring technology.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.4% |

Three-Phase Power Meters Dominate Due to Industrial and Utility Demand

Three-phase digital power meters beat all the others to the largest market share of the power meter market tied mostly to the fact that they are commonly used in industrial and utility applications. With these meters, it is possible to monitor energy consumption with high accuracy, through the provision of real-time data analytics, and also improve load management, thus making them the basics of those industries that consume much energy.

The manufacturing, energy, and large commercial establishments that depend on three-phase meters technology for efficient power resource consumptions and preventing overload conditions, respectively. Besides it, the ongoing smart grid transition, and the whole renewable energy incorporation template, spur their introduction.

Continental governments are drawing up a list of the energy efficiency regulations, with the main aim to achieve this target. North America, Europe, and Asia-Pacific where industrial cores are making energy management a priority and the example of huge regional growth in these sectors.

Single-Phase Power Meters Maintain Relevance in Commercial and Residential Sectors

Single-phase digital power meters have their own substantial share, particularly in offices and residential applications. This equipment is widely used in enterprises, offices, and apartment buildings that have small energy consumption. They are very beneficial as they provide inexpensive energy monitoring, whereby users can analyse consumption patterns and ultimately make savings on their electricity bills.

The trends toward smart homes and the implementation of energy management IoT solutions are the main drivers for the growth of the demand for single-phase meters. The deployment and upgrading of power infrastructure in developing countries in the Asia-Pacific region, Latin America, and Africa, increase the number of meters. In spite of the three-phase meters in larger buildings, single-phase remains the most important for efficient power management at smaller scales.

Industrial Sector Leads Due to High Power Consumption and Efficiency Needs

The foremost user of digital power meters is the industrial sector which is primarily driven by the requirement for real-time monitoring, power quality analysis, and overall energy optimization. The manufacturing plants, oil refineries, and big factories utilize digital meters for the purpose of boosting operation efficiency and reducing wasted energies.

Digital metering of emissions and energy efficiencies is one of the front benefits of Industry 4.0, the business and automation, while industrial users are insisting on metering technology with longer range data transmission.

All over the world, countries and governing bodies are passing strict new efficiency energy mandates, which in turn necessitate the adherence of the industries to the digital power meters to avoid budget cuts. China, Germany, and the USA are among the countries leading in the use of digital power meters as part of their drive for industrial progress and energy savings.

Utility-Scale Segment Grows with Grid Modernization and Smart Metering Initiatives

The utility-scale line is surging ahead thanks to the double initiatives of energy enterprises and grid operators to turn toward smart grids and Demand response systems. Digital power meters are the lifeblood of the energy distribution networks in need of modernization, as they essentially create the path for real-time monitoring, automatic meter reading, and exact load management.

Governments such as in North America, Europe, and China are also backing the smart metering infrastructure to increase the reliability of the grids and cut down the energy losses. The integration of renewables such as solar and wind calls for intricate metering solutions for obtaining and keeping track of the generation and consumption. The development towards zero-carbon goals and sustainability plays the fundamental supporting role for the utility sector in carrying out the digital power meters’ actions.

The digital power meter market is experiencing dynamic progress, which is fueled by the rising number of energy-efficient initiatives, the smart grid infrastructure expansion, it is in this realm of digital metering that sensor technology, and in particular IoT, AI, and cloud-based solutions have made the most significant inroads.

The greater the sustainability consciousness, the more negative energy waste excessively planet Earth's ambiance. Less frequent yet gas centrality roll-up moves emphasize Oligopolistic tendencies when larger firms make key purchases of the promising emerging firms.

In parallel to this, national-level manufacturers are bringing in models that are not only affordable but also target-specific covering both industrial and residential settings. The number of applications for digital meters in industrial and commercial fields will highly increase, supported by the urgent need for the adoption of the smart energy management.

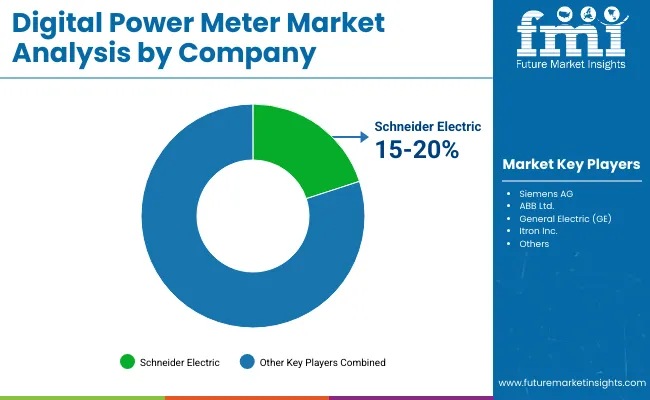

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Schneider Electric | 15-20% |

| Siemens AG | 12-16% |

| ABB Ltd. | 10-14% |

| General Electric (GE) | 8-12% |

| Itron Inc. | 5-9% |

| Other Companies | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Schneider Electric | Offers smart meters with IoT integration, AI-driven analytics, and cloud-based energy management for industrial and residential applications. Focuses on sustainability and energy efficiency. |

| Siemens AG | Develops advanced smart grid solutions with real-time data analytics, cybersecurity enhancements, and AI-powered energy optimization for utilities, industrial, and commercial applications. |

| ABB Ltd. | Provides high-accuracy digital power meters with cloud-based remote monitoring, predictive maintenance features, and industrial-grade reliability for large-scale energy management. |

| General Electric | Specializes in AI-driven smart metering solutions, integrating fault detection, automated energy management, and scalable solutions for utility and commercial applications. |

| Itron Inc. | Designs customizable digital meters with IoT and edge computing for real-time energy tracking, cost reduction, and efficiency improvements in utility and industrial sectors. |

Key Company Insights

Schneider Electric

Schneider Electric variant is an exemplary company which has a wide range of smart products for metering, including an Internet of Things (IoT) integration of the latest digital power meters. Schneider Electric wear their stress on efficiency and eco-friendliness in their competition by developing systems with the help of Artificial Intelligence that monitor the health of their analytical systems in a predictive way and provide real-time analytics.

Schneider Electric’s technology applicable to these fields is presented by industries, utilities, and commercial entities, which have all Gained from it by optimizing their power consumption. The smart grid brand Schneider Electric has grown due to the company being present in many countries, and thanks to the collaboration of the firms with which it has formed partnerships and by acquisitions.

They have continuously enhanced their market positioning by working with AI-driven monitoring solutions, which were their latest investments. Schneider Electric's development of the cloud-based energy management system and the cybersecurity aspects of the same, which are the main features of these innovations, has increased the digital power metering technology reliability, and hence, Schneider Electric is still a prominent player turning the smart energy switch to the top.

Siemens AG

Siemens AG to digital power meter sensor is a smart metering company with the best services and totally integrated cybersecurity to protect customers from different versions of an attack. The company’s smart grid solutions incorporate real-time data analytics, enabling efficient energy monitoring and control. Siemens has invested heavily in AI and IoT to improve predictive maintenance and system automation.

The digital power meters of Siemens are efficient energy cost-savers not only in industries but also in the commercial sector and electrical energy distributor companies. The market position of the company is unthreatened in any part of the world, mainly due to the associations made with the energy suppliers and the governments.

The company’s research and development activities are ever-present with the aim of creating the best meter and equipment setups in the world, with these being the most secure and most efficient, thus satisfying the demands of energy providers and supporting the company's leadership in sustainable products.

ABB Ltd.

ABB Ltd. provides high-speed and high-precision digital power meters targeted towards industrial and commercial markets. One of the focal areas of the firm is the development of the cloud-based metering solutions, which facilitate real-time energy tracking and remote management.

With ABB, users get metering systems that are fully reconfigured for performance and precision; the metre is designed to meet the needs of strict energy compliance applications, which are among the hardest to fulfil. With the rise of demand for smart metering technologies, the company has been entering new global markets such as Asia-Pacific and the Middle East, which are gaining popularity among the customers.

ABB has made the initial move towards this by the initial investment in AI diagnostics and predictive analytics, as it has become a leader in the area of power metering. The technology that advances will make the firm much more valuable and the partnerships that the firm has made with a technology company will develop the company even further.

General Electric (GE)

General Electric (GE) with its high-speed and AI digital power metering values the palette of opportunities for energy producers and distributers at the very high level, especially for water treatment plants and power stations. Their collaboration program is aimed at the introduction of large, smart metering systems in both utility and industrial customers. The GE digital power meters can be integrated with the smart grid giving advantages in both, automatic energy management and fault detection.

The growth paths of the company have varied in time, from the traditional sectors towards the service which is the most requested in developing countries - affordable and scalable solutions. Continuous investments in AI technologies that allow consumers to manage energy consumption will keep GE products on the leading edge of innovation. GE with its intelligence-infrastructure and sustainability focus remains a strong contender within the global digital power meter market.

Itron Inc.

The industry leader Itron Inc. has product lines of digital power meters which can fit both retail and industrial projects seamlessly and also, the open design for both utility and industry. The main goal of the enterprise is the usage of IoT and edge computing technologies to increase data analytics in real time and save energy. The company is upgrading its presence in the North American and European market with the help of utilities and governmental agencies through the collaborations they have set up.

With the new digital meters installed, the clients are now able to track their energy consumption in a more detailed manner, which helps them to take measures to optimize their energy usage and thus save costs. The company is developing the metering technology through innovation, making it user-friendly and scalable. With the investment in AI-based analytics, the company is able to provide energy monitoring systems that are more precise and can be tailored to the specific needs of different markets.

In terms of Phase, the industry is divided into Single Phase Power Meters, Three Phase Power Meters

In terms of End Use, the industry is divided into Industrial, Commercial, Utility Scale

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global Digital Power Meter market is projected to reach USD 11.1 billion by the end of 2025.

The market is anticipated to grow at a CAGR of 6.3% over the forecast period.

By 2035, the Digital Power Meter market is expected to reach USD 20.4 billion.

The Three Phase Power Meters segment is expected to dominate the market, due to its higher efficiency, accuracy in monitoring large-scale power systems, widespread use in industrial and commercial applications, and increasing demand for advanced energy management solutions.

Key players in the Digital Power Meter market include Schneider Electric, Siemens AG, ABB Ltd., General Electric, Itron Inc.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Digital Shipyard Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printer Market Size and Share Forecast Outlook 2025 to 2035

Digital Twins Technologies Market Size and Share Forecast Outlook 2025 to 2035

Digital Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

Digital Signature Market Size and Share Forecast Outlook 2025 to 2035

Digital Map Market Size and Share Forecast Outlook 2025 to 2035

Digital Credential Management Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Therapeutics and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA