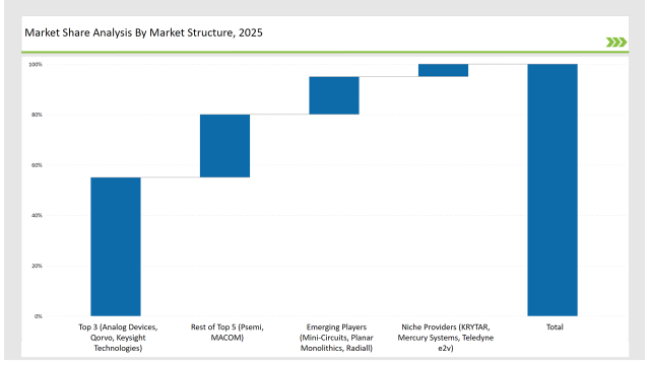

The Digital Phase Shifters market is experiencing steady growth due to increasing adoption in radar systems, satellite communication, and telecommunications. Key vendors such as Analog Devices, Qorvo, and Keysight Technologies dominate the market, collectively holding a 55% share with advanced phase shifting solutions, high-frequency performance, and integration capabilities. The second-tier players, including Psemi (formerly Peregrine Semiconductor) and MACOM Technology Solutions, account for 25%, focusing on mid-range, cost-effective digital phase shifters tailored for commercial applications. Emerging providers such as Mini-Circuits, Planar Monolithics, and Radiall comprise 15%, offering specialized solutions with custom phase shift requirements and application-specific designs. Niche vendors, including KRYTAR, Mercury Systems, and Teledyne e2v, hold 5%, addressing defense and aerospace-specific needs with high-precision phase shifter modules.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

| Category | Industry Share (%) |

|---|---|

| Top 3 (Analog Devices, Qorvo, Keysight Technologies) | 55% |

| Rest of Top 5 (Psemi, MACOM) | 25% |

| Emerging Players (Mini-Circuits, Planar Monolithics, Radiall) | 15% |

| Niche Providers (KRYTAR, Mercury Systems, Teledyne e2v) | 5% |

The Digital Phase Shifters market is moderately consolidated, with leading companies holding between 60-70% market share. Established players such as Analog Devices, Qorvo, and Keysight Technologies influence pricing, innovation, and industry standards, making market entry challenging for smaller firms.

The Digital Phase Shifters market is categorized based on bit size into 4-Bit, 5-Bit, 6-Bit, 8-Bit, and Others. Among these:

The market is segmented based on application into Telecommunication, Satellite Communication, and Radar.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

Key Trends Shaping the Future of the Digital Phase Shifters Market

Phase Shifter Technology Advances Through Modern Innovation

Recent developments in phase shifter technology have revolutionized radar and communication systems. Advanced digital phase shifters now incorporate sophisticated algorithms for real-time phase correction and adaptive beamforming. These systems excel at counteracting environmental interference, delivering stable and precise beamforming under challenging conditions. Defense and telecom sectors have embraced these enhanced solutions to strengthen radar capabilities, satellite communications, and next-generation wireless networks. The latest phase shifters automatically calibrate and adapt to changing signal conditions, leading to reduced latency, clearer signals, and improved data transmission for military surveillance, missile guidance, and telecommunications.

Gallium Nitride Transforms Phase Shifter Performance

The adoption of Gallium Nitride (GaN) technology has marked a significant breakthrough in phase shifter development. GaN-based systems demonstrate superior power efficiency, minimal insertion loss, and enhanced thermal management compared to traditional silicon alternatives. Industry leaders Analog Devices and Qorvo have made substantial investments in GaN solutions, particularly for military and aerospace applications. These robust components maintain reliable performance even in extreme conditions, making them essential for military radar operations, space missions, and advanced wireless networks.

5G Evolution Spurs Phase Shifter Development

The expansion of 5G mmWave infrastructure has created unprecedented demand for sophisticated digital phase shifters. These components prove essential for beamforming optimization and frequency control in modern networks. Leading manufacturers Qorvo and MACOM have introduced compact, energy-efficient phase shifters designed specifically for 5G systems. The technology enables superior network coverage while minimizing signal interference. This advancement supports critical infrastructure for smart cities, autonomous transportation, and industrial applications.

Satellite Systems Embrace Digital Phase Shifter Technology

The proliferation of Low Earth Orbit (LEO) and geostationary satellites has increased requirements for specialized phase shifters. Modern satellite systems depend on these components for precise beam steering and consistent data transmission. Industry specialists Keysight Technologies and Planar Monolithics have developed radiation-hardened variants capable of withstanding the harsh conditions of space. These robust components serve essential functions in space-based internet services, remote sensing operations, and satellite navigation systems.

Military Applications Drive Phase Shifter Excellence

Defense sector requirements continue to shape phase shifter advancement, particularly in phased array radar systems. Modern military operations rely on these components for surveillance, air defense, and electronic warfare capabilities. Notable manufacturers Teledyne e2v and Mercury Systems produce military-grade phase shifters engineered for battlefield durability. These advanced components enable simultaneous multi-target tracking and enhanced threat detection. The technology proves particularly valuable in electronic warfare applications, ensuring secure communications while countering signal interference. Ongoing defense modernization programs continue to drive innovation in digital phase shifter capabilities.

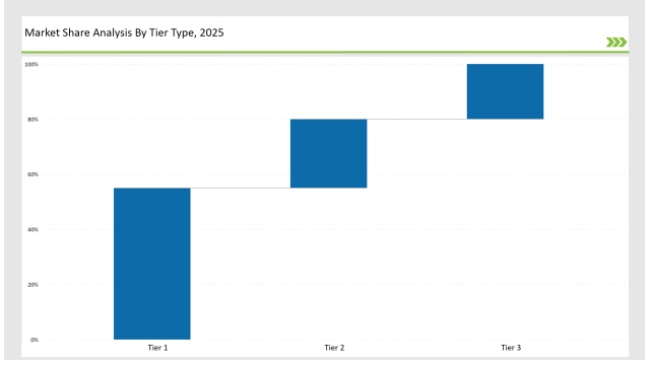

| Tier | Tier 1 |

|---|---|

| Vendors | Analog Devices, Qorvo, Keysight Technologies |

| Consolidated Market Share (%) | 55% |

| Tier | Tier 2 |

|---|---|

| Vendors | Psemi, MACOM |

| Consolidated Market Share (%) | 25% |

| Tier | Tier 3 |

|---|---|

| Vendors | Mini-Circuits, Planar Monolithics, Radiall, KRYTAR, Mercury Systems, Teledyne e2v |

| Consolidated Market Share (%) | 20% |

| Vendor | Key Focus |

|---|---|

| Analog Devices | Expanding high-frequency digital phase shifters for 5G and defense applications. |

| Qorvo | Developing GaN-based phase shifters for high-power applications. |

| Keysight Technologies | Advancing test and measurement solutions for phase shifters. |

| Psemi | Enhancing low-power, high-linearity digital phase shifters. |

| MACOM | Targeting IoT and 5G applications with cost-effective solutions. |

The market will witness increased adoption of AI-driven, GaN-based digital phase shifters to meet high-frequency telecom and defense needs. Investments in miniaturized, low-power phase shifters will drive 5G small cell and satellite deployment. Additionally, blockchain-based RF security solutions will enhance the cybersecurity of communication networks.

Leading vendors Analog Devices, Qorvo, and Keysight Technologies control 55% of the market.

Emerging players Mini-Circuits, Planar Monolithics, and Radiall hold 15% of the market.

Niche providers KRYTAR, Mercury Systems, and Teledyne e2v hold 5% of the market.

The top 5 vendors (Analog Devices, Qorvo, Keysight Technologies, Psemi, and MACOM) control 80% of the market.

AI-driven phase shifters are expected to enhance real-time beamforming, reduce signal loss, and improve efficiency, especially in 5G networks and defense applications.

Explore Electronics & Components Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.