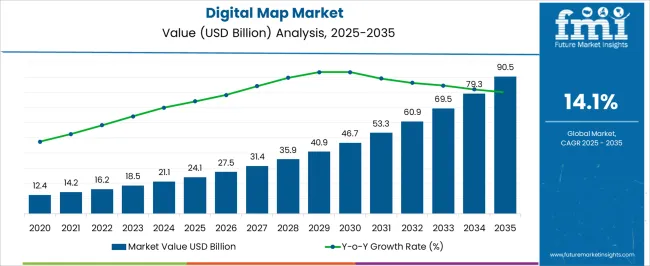

The Digital Map Market is estimated to be valued at USD 24.1 billion in 2025 and is projected to reach USD 90.5 billion by 2035, registering a compound annual growth rate (CAGR) of 14.1% over the forecast period.

| Metric | Value |

|---|---|

| Digital Map Market Estimated Value in (2025 E) | USD 24.1 billion |

| Digital Map Market Forecast Value in (2035 F) | USD 90.5 billion |

| Forecast CAGR (2025 to 2035) | 14.1% |

The digital map market is experiencing strong growth driven by increasing reliance on location based services, smart mobility solutions, and advanced navigation systems. Rising demand from sectors such as transportation, logistics, automotive, and urban planning has accelerated the adoption of real time and highly accurate mapping solutions.

Continuous improvements in satellite imaging, geospatial analytics, and AI integration are enhancing the precision and usability of digital maps across industries. The expansion of connected vehicles, smart cities, and infrastructure projects is further driving market adoption.

Regulatory support for digital transformation and investments in geospatial intelligence are also contributing to growth. The market outlook remains positive as the integration of cloud based platforms, 5G connectivity, and indoor mapping solutions continues to unlock new opportunities for efficiency, safety, and innovation in diverse applications.

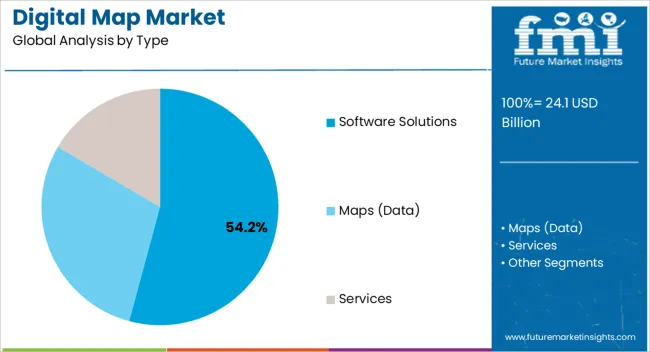

The software solutions segment is projected to represent 54.20% of total revenue by 2025 within the type category, making it the leading segment. Growth is being supported by the demand for advanced mapping software that delivers real time updates, predictive analytics, and integration with enterprise systems.

Software platforms provide customization, scalability, and compatibility with diverse devices, making them suitable for automotive navigation, logistics optimization, and location based marketing. Additionally, the rise of smart mobility and autonomous driving has increased reliance on sophisticated mapping software that ensures accuracy and safety.

As enterprises continue to adopt digital transformation strategies, software solutions remain central to driving operational efficiency and data driven decision making, consolidating their leadership in this market segment.

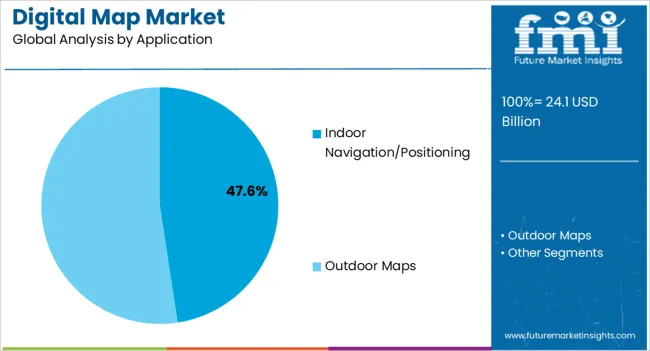

The indoor navigation and positioning segment is expected to account for 47.60% of total market revenue by 2025, positioning it as the dominant application area. This growth is being propelled by expanding use cases in retail, healthcare, airports, and large commercial complexes, where efficient navigation and asset tracking are critical.

The segment has benefited from advancements in Bluetooth beacons, Wi Fi triangulation, and sensor fusion technologies that enable precise indoor mapping. Increased adoption of smartphones and wearable devices has further strengthened demand for indoor positioning applications.

Enterprises are utilizing these solutions to enhance customer experience, streamline operations, and improve safety. As digital ecosystems evolve, indoor navigation and positioning continue to establish themselves as the key growth drivers within the digital map market.

Smartphones and tablets are becoming more advanced due to rapid technological change. Smartphones come with preloaded map software, which can locate points of interest. It has been widely reported that smartphone owners use mapping applications for navigation and driving assistance.

These users use Geographic Information System (GIS) applications and GPS technology to access comprehensive geo-referenced database information that helps them locate nearby restaurants, banks, cinema halls, and other landmarks. To capture accurate 3D spatial information, mobile computing devices are widely adopted in the digital maps market.

Digital maps are growing in popularity due to the increasing adoption of digital technology in data collection and analysis and the increasingly widespread use of digital maps in the industrial sector. As digital map technology providers face an increasingly competitive landscape, they are increasing their product portfolios and enhancing their technology to offer customers more detailed and user-friendly maps.

Motorized stations and GPS technology are used in the digital maps market as a substitute for the optical and mechanical instruments used previously for surveying. Increasing the coverage of remote areas and updating the technology on a real-time basis are the latest trends in digital maps.

Organizations and government agencies that rely on geospatial technologies and analytics are often unable to realize the full potential of these technologies. The lack of experienced professionals familiar with spatial data and related issues has created a problem for the growth of digital maps in the market.

Digital mapping solutions have faced problems with the inadequacy of knowledge and awareness, which has slowed their adoption, as a result of which they are still slow to be adopted in the market. It is, therefore, possible to encourage the market adoption and growth of the global digital maps market by fostering information flow through several channels, such as forums, blogs, seminars, and return on investment studies.

GPS and location mapping have become essential to mobile device users with the help of mobile computing devices. Users can gather information about places they visit frequently, such as their home and office locations.

Hackers can access user accounts using such information and personal details, such as passwords, IP addresses, or files, such as audio or video. Effective methods must be found to limit the dissemination of GPS information and protect the privacy of people who use their phones.

Additionally, GPS data is shared between applications and operating systems, posing a risk of data privacy violations. All these factors are hampering the growth of the market.

The market captured a valuation of USD 12.4 billion in 2020 and USD 24.1 billion in 2025, with a CAGR of 12.7% between 2020 and 2025. Increasing demand for digital images and transportation analysis in areas such as logistics and communications contribute to significant growth in this period.

The demand for improved user-friendly applications and the enhancement of business operations has contributed to the growth of digital maps in the market. With advances in GIS, map analytics, and real-time tracking systems, digital maps represent a potential part of various industries like automotive, mobile & internet, energy & power, logistics, government & utilities, real estate/construction, and others.

Massive fleets have become available to meet consumer demand for on-demand ride services and serve a more diverse delivery service fueled by e-commerce. As part of the mobility services category, moving packages and moving riders rely on efficient drivers who can coordinate multiple parties seamlessly in the real world. As a result, mobile operators rely on geospatial data and technologies from providers like Google Maps Platform to provide all of these features.

Growing demand for 5G technologies and continuous technological advancements in the IT sector has helped propel the growth of digital maps software solutions in the market. Software solutions are estimated to capture a share of 43.2% during the forecast period.

Increasing adoption of 3-D and 2-D views of geographic locations has increased market growth for software solutions. Various developers constantly compete to provide more detailed and comprehensive maps to consumers on the market to satisfy their customers' demands.

To gain significant financial benefits and added value, digital mapping tools, and software applications have seen an exponential increase in demand as companies of all sizes gain a greater understanding of the capabilities of these tools in the digital map market.

Many companies and businesses, both large and small-sized, in e-commerce, food, automation, etc., are competing in the marketplace to deliver products to customers on time.

As part of the infrastructure life cycle, digital maps play a significant role in the construction and engineering fields. Further, these solutions assist construction engineers in managing and sharing their data, creating reports, and visualizing the data they generate, so that the information can be analyzed and communicated with others. Maps can decrease network maintenance costs as well as improve safety measures.

Outdoor mapping dominates the market by securing a maximum share of 75.2% during the forecast period. Automotive is among the well-known verticals that rely on maps for navigation. In addition, many industries, such as logistics, travel, and transportation, make extensive use of navigation software applications. Innovative city initiatives promote the adoption of digital maps on a wide scale through integrated platforms, such as ride-sharing, traffic updates, route updates, and weather forecasts.

The constant development of automobiles has spurred the market for digital maps to grow. As a result of the increasing demand for autonomous vehicles in the market, the need for digital maps continues to rise. Market demand for weather reports, agricultural reports, and mining reports for government and private firms would also contribute to the market demand for outdoor maps.

Smartphone usage has risen dramatically over the past few years. With smartphones, including radio chips, users can access mapping services online and positional information by connecting to satellite navigation systems to find their location automatically.

For instance, people turn to map applications such as Google Maps for directions and location-based searches to find restaurants, banks, pharmacies, gas stations, and ATMs. These trends have been fueled by the growing popularity of smartphones in the market.

North America is expected to hold the maximum share of 24.4% globally by 2035. North America has become a significant market by increasing the adoption of advanced technology in the region, which is one factor favoring the market's growth.

Due to the early adoption of technological advancements and the high amount of Research and Development investment in this region, the United States digital map market is expected to account for a total share of 16.5% by 2035. In addition, the significant number of players operating in the digital map space across regions is estimated to further drive the market forward due to the presence of large automakers in this region and the employment of digital maps.

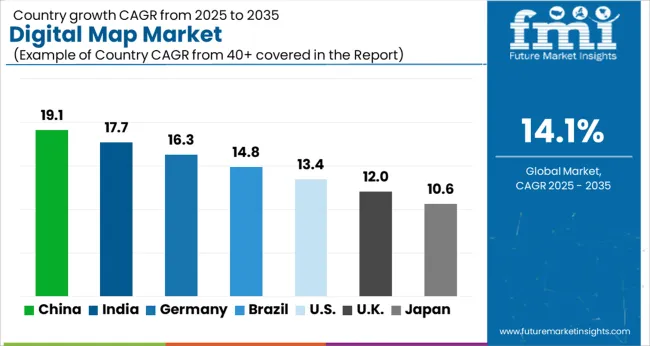

A rising trend in the development of automatic vehicles on the market has been a critical contributor to the growth of digital maps in this region. According to the forecast, Asia-Pacific is expected to grow significantly during the forecast period. During the forecast period, China is securing a CAGR of 16.7% in the global market.

The constant advancement of technology and the expansion of large IT firms in many developing nations have further created a demand for the digital maps market. A significant shift in technological adoption has occurred in countries including China, India, Japan, and South Korea in recent years.

The increasing adoption of digital maps in all these Asian countries is estimated to be influenced by increasing demand for e-commerce applications, mobile technology, logistic management, and monitoring of the environment. During the forecast period, India is projected to reach a market value of USD 1.4 billion with a CAGR of 18.7%.

Over the forecast period, Japan is projected to achieve a share of 7.1% in 2035. To handle their logistical demands for the fast movement of raw materials and goods, China and India are developing their road networks to counterbalance the logistic order. Further, the increasing demand for intelligent maps for use in automobiles is also contributing to the growth of the market in the region.

The International Geological Mapping Project (IGME 5000) is a major Europe-wide geological GIS map project that is managed and administered by the Federal Institute for Geosciences and Natural Resources (BGR) under the auspices of the Commission for the Geological Map of the World (CGMW).

BGR and its predecessors have maintained a long tradition of producing international geoscientific maps of Europe. During the forecast period, the digital maps market in the United Kingdom is expected to grow at a compound annual growth rate of 15.4%. The increased potential arising from the growing presence of automation market players has enhanced the use of digital maps.

Manufacturers can increase production and meet consumer demand through strategic partnerships, increasing their revenues and market share. Introducing new products and technologies is estimated to allow end-users to reap the benefits of new technologies. Expanding the company's production capacity is one of the potential benefits of a strategic partnership.

Other Essential Players in the Global Digital Map Market are:

Recent Developments in the Global Digital Map Market are:

| Attributes | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD billion for Value |

| Key Countries Covered | United States, United Kingdom, Japan, India, China, Australia, Germany |

| Key Segments Covered | Type, Application, Region |

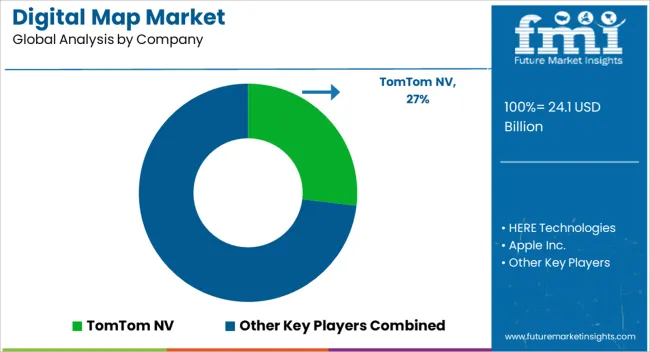

| Key Companies Profiled | TomTom NV; HERE Technologies; Apple Inc.; Alibaba Group; Navinfo Co., Ltd; INRIX Inc.; Baidu, Inc.; MapBox Inc.; Environmental Systems Research Institute (ESRI); Alphabet Inc. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global digital map market is estimated to be valued at USD 24.1 billion in 2025.

The market size for the digital map market is projected to reach USD 90.5 billion by 2035.

The digital map market is expected to grow at a 14.1% CAGR between 2025 and 2035.

The key product types in digital map market are software solutions, _web-based, _desktop, _mobile app, maps (data) and services.

In terms of application, indoor navigation/positioning segment to command 47.6% share in the digital map market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Digital Shipyard Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printer Market Size and Share Forecast Outlook 2025 to 2035

Digital Thermo Anemometer Market Size and Share Forecast Outlook 2025 to 2035

Digital Twins Technologies Market Size and Share Forecast Outlook 2025 to 2035

Digital Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

Digital Signature Market Size and Share Forecast Outlook 2025 to 2035

Digital Credential Management Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA