The digital LUX meter market will witness tremendous growth during the period 2025 to 2035, led by growing need for light intensity measurement solutions across industries such as electronics, healthcare, agriculture, and commercial. As smart lighting systems, LED technology, and workplace safety regulations gain popularity, the need for LUX meters of high accuracy is continuously on the rise.

The market will expand to USD 3.9 Billion in 2025 and USD 9.5 Billion by 2035, increasing at a CAGR of 9.2% during the forecast period. The growth is mainly attributed to the increasing demand for accurate lighting measurement in interior spaces, improvements in optical sensors, and stringent regulatory needs for workplace lighting.

The growth in photovoltaic power plants, film making, horticultural lighting, and energy-efficient architectural designs is also driving demand for digital LUX meters Additionally, the rise in industrial automation, integration of IoT-enabled lighting solutions, and the need for compliance with international lighting standards are supporting market expansion.

Furthermore, technological advancements such as wireless LUX meters, smartphone-integrated light sensors, and AI-powered brightness control systems are enhancing market potential. As governments emphasize energy conservation and sustainable lighting practices, the adoption of high-precision digital LUX meters is expected to surge in both residential and industrial applications.

Market Metrics

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 3.9 Billion |

| Market Value (2035F) | USD 9.5 Billion |

| CAGR (2025 to 2035) | 9.2% |

North America dominates the market for digital LUX meter with stringent light workplace standards, smart lighting technologies growing in uptake, and development of healthcare facilities. The markets are dominated in North America by the United States and Canada where lighting standards based on OSHA and ANSI push industries to install devices that continuously check and assure workplace illumination with perfect light values.

The increase in IoT-enabled lighting systems, increased investments in LED-based lighting solutions, and quick growth in commercial property are driving demand for digital LUX meters & analyzers. The availability of prominent manufacturers and sophisticated R&D centers in optical sensor technologies also enhances the regional market.

The increase in solar energy installations and urban lighting initiatives is also driving the growth of the market. Government campaigns for energy efficiency and sustainability are compelling businesses and homeowners towards precision lighting measurement equipment for energy saving and compliance.

Europe represents a large share of the market, with Germany, France, and the UK leading in energy-efficient building constructions, smart cities initiatives, and compliance with lighting rules under EU directives. Compliance with EN 12464 workplace lighting standards and EU initiatives toward sustainable urbanization are stimulating the demand for precision LUX meters.

Germany, being a global leader in industrial automation and renewable energy, has a high demand for LUX meters in automotive production, architectural lighting, and photovoltaic system efficiency measurements. France and the UK are also investing in LED street lighting schemes, energy audits, and photometric measurements in commercial areas, boosting the use of digital LUX meters.

In addition, Europe's burgeoning film industry and photography market that is based on accurate calibration of lighting is driving market expansion opportunities. The transformation towards environment-friendly, energy-conserving lighting technology is also assisting in regional market growth.

Asia-Pacific will have the fastest growth in the digital LUX meter market, supported by accelerating industrialization, increasing smart city project development, and technology progress in LED lights. China, India, Japan, and South Korea are top manufacturers and users of digital LUX meters, and demand for digital LUX meters is on the rise in the agriculture, automotive, and electronics industries.

China's increasing infrastructure development, smart home penetration, and large-scale photovoltaic power generation are driving the demand for lighting measurement instruments at a faster pace. The adoption of lighting safety standards in workplaces and homes is also driving market growth.

India's Make in India and Smart Cities Mission are driving the need for smart urban lighting systems, which necessitate precise brightness control solutions. Growth in greenhouse farming and precision agriculture is also fueling demand for LUX meters to enhance plant growth and yield.

Japan and South Korea, being leaders in technological innovation and LED technology, are concentrating on high-performance lighting systems, adaptive brightness control, and smart automation systems, generating a need for intelligent LUX measurement instruments.

The period between 2020 and 2024 witnessed a significant expansion of the market for digital LUX meters with growing awareness for lighting efficiency, safety in workplaces, and evolving LED technology. Commercial establishments, industries, and infrastructure developments came to depend increasingly on digital LUX meters for precise measurement of light intensity for compliance with regulation standards and improving energy consumption.

The transition to smart lighting solutions in commercial offices, workshops, and public areas triggered the use of LUX meters for light calibration, pushing demand for highly precise, portable, and wireless models. Governments and global regulatory agencies implemented stringent lighting standards, including those described by OSHA, IEC, and CIE, compelling enterprises to measure lighting levels in workplaces, hospitals, schools, and public places to avert occupational risks and improve visual comfort.

The increasing focus on energy saving and sustainability spurred industries to carry out lighting audits to replace existing lighting systems with high-efficiency LED and solar-powered lighting technologies.

The growth of smart buildings, energy-efficient city infrastructure, and human-centered lighting solutions further boosted market demand. Lighting designers, architects, and engineers used LUX meters more and more in their building automation systems to maximize indoor lighting for energy conservation, occupant health, and improved productivity. In industrial and commercial settings, inadequate lighting conditions caused fatigue, eye strain, and reduced efficiency, leading firms to invest in real-time light measurement technologies.

The LED revolution turned the industry around, and more digital LUX meters were required to check the brightness and color temperature of energy-saving illumination systems. Automotive, agriculture, and photo sectors also helped increase market growth, applying LUX meters to check vehicle interior lighting, regulate greenhouse lighting conditions, and provide accurate lighting in studios. In spite of the robust market growth, high cost of devices, unreliable calibration standards, and low consumer awareness in some areas posed challenges to large-scale adoption. But as technology evolved and producers came up with affordable models, the cost of digital LUX meters reduced, and they became more viable for small enterprises and research centers.

Between 2025 and 2035, the digital LUX meter industry will experience explosive change fueled by automation, wireless connectivity, and AI-based lighting control systems. With smart cities, smart lighting networks, and adaptive daylight harvesting gaining traction, the need for real-time, cloud-connected LUX meters will soar. These advanced devices will enable building managers, urban planners, and industrial engineers to automatically adjust lighting levels based on environmental conditions, occupancy patterns, and energy consumption data.

Additionally, industries will focus on precision lighting optimization, ensuring that both natural and artificial light contribute to energy savings, enhanced safety, and improved human performance. Sustainability will become a driving force behind the market as governments implement carbon-neutral regulations and energy-efficient lighting regulations, encouraging businesses to adopt AI-based lighting analytics into their setup.

As the demand for handheld and wearable LUX meters increases, the healthcare, aerospace, and emergency response industries will implement sophisticated real-time light measurement systems to maximize surgical lighting, aviation cockpit lighting, and rescue operations visibility.

The film and photography markets will increasingly incorporate intelligent LUX meters with digital cameras and lighting packages to ensure even illumination levels for broadcasting, live events, and professional filmmaking. Future-generation digital LUX meters will also include machine learning algorithms to forecast lighting trends, enhance LED calibration, and facilitate remote diagnosis for industrial applications.

The progress in 5G connectivity will drive the efficiency of cloud-based LUX meter solutions, where industries can store, analyse, and exchange light intensity data at multiple locations to enhance decision-making and energy optimization.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments introduced strict workplace lighting standards, enforcing compliance with OSHA, IEC, and WELL Building certification guidelines. Companies conducted regular lighting audits to ensure safety and energy efficiency. |

| Technological Advancements | LUX meters evolved with higher-precision sensors, digital data logging, and Bluetooth connectivity. Wireless handheld models gained popularity in commercial and industrial applications. |

| Applications in Industry | LUX meters were widely used in corporate offices, automotive manufacturing, agriculture, and film studios to ensure optimal light intensity and compliance with safety standards. |

| Adoption of Smart Testing Equipment | Engineers adopted Bluetooth and USB-compatible LUX meters for remote monitoring, easy calibration, and efficient data transfer. |

| Sustainability & Energy Efficiency | Businesses used LUX meters to replace outdated lighting with energy-efficient LED solutions and reduce electricity consumption. LEED and BREEAM certifications encouraged energy optimization in buildings. |

| Data Analytics & Predictive Maintenance | Historical illuminance data analysis allowed industries to fine-tune lighting designs, reduce operational costs, and comply with energy-saving initiatives. |

| Production & Supply Chain Dynamics | Global supply chain disruptions delayed LUX meter production. High import tariffs and limited manufacturing capacity affected market growth in some regions. |

| Market Growth Drivers | Growth was fuelled by energy audits, workplace safety regulations, and smart city projects. Industries upgraded lighting systems to meet modern efficiency standards. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Regulations will become stricter, mandating carbon-neutral lighting systems and AI-powered energy optimization tools. Governments will require IoT-enabled LUX meters to track and control urban lighting remotely. |

| Technological Advancements | AI-driven LUX meters will automate lighting adjustments based on occupancy, daylight levels, and energy efficiency goals. 5G connectivity and real-time cloud storage will enhance remote light monitoring. |

| Applications in Industry | Autonomous vehicles, AI-controlled greenhouses, and AR-based lighting systems will create new use cases for smart LUX meters in futuristic industries. |

| Adoption of Smart Testing Equipment | AI-driven LUX meters will be combined with cloud computing, IoT lighting systems, and smart daylight harvesting mechanisms to maximize energy consumption and well-being. |

| Sustainability & Energy Efficiency | AI-powered energy analytics will drive real-time lighting adjustments, ensuring sustainable light distribution in smart cities. Self-regulating lighting systems will reduce energy waste. |

| Data Analytics & Predictive Maintenance | AI-driven predictive lighting systems will automatically detect lighting inefficiencies and recommend optimizations, reducing carbon footprints and enhancing sustainability efforts. |

| Production & Supply Chain Dynamics | AI-driven supply chain management will optimize LUX meter production, ensuring steady availability. Sustainable materials and energy-efficient manufacturing will define future production models. |

| Market Growth Drivers | AI-driven lighting networks, real-time adaptive lighting, and autonomous smart buildings will shape future market expansion, making automated LUX meters a necessity. |

The United States digital LUX meter market is growing at a rapid pace, influenced by the rising need for energy-efficient lighting, workplace safety laws, and technology advancements in smart building. Digital LUX meters are applied across various industries including automotive, healthcare, movie making, horticulture, and construction to maintain appropriate lighting conditions and maximize energy usage.

One of the leading market drivers is the increasing usage of LED lights in commercial and residential areas. The USA Department of Energy projects LEDs to capture more than 80% of total lighting installations by 2030, leading to companies investing in LUX meters for measuring light intensity and maintaining industry standards.

The healthcare and hospitality industries also play a substantial role in driving market growth. Hospitals, laboratories, and hotels require proper lighting for patient treatment, safety, and guest comfort. Regulatory bodies like OSHA (Occupational Safety and Health Administration) and ANSI (American National Standards Institute) regulate workplace lighting standards, which further enhances the demand for precision LUX meters.

| Country | CAGR (2025 to 2035) |

|---|---|

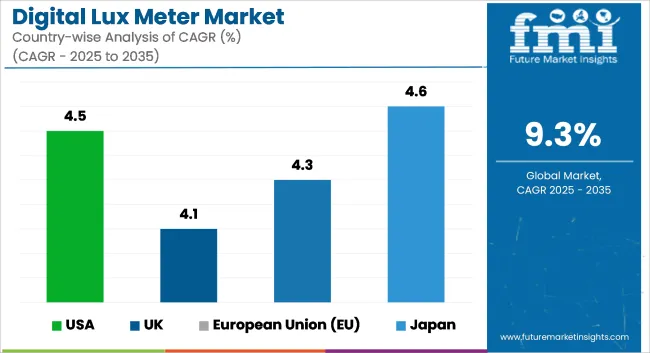

| USA | 4.5% |

The UK digital LUX meter market is developing because of stringent workplace lighting standards, green initiatives, and rising demand for smart lighting systems. Manufacturing, healthcare, horticulture, and photography industries lead the demand for high-accuracy digital LUX meters.

Increased energy-efficient lighting emphasis in commercial spaces has resulted from the UK government's promise of carbon neutrality by 2050. Indoor workplace lighting is addressed by the British Standard BS EN 12464-1, which requires compliance and energy audit through the use of LUX meters.

Another important driver is the horticulture industry. With the UK seeing a boom in indoor agriculture and greenhouse automation, LUX meters are employed to maximize plant growth by monitoring light intensity for produce such as lettuce, tomatoes, and medicinal herbs.

Also, architectural and interior lighting design businesses use LUX meters for the evaluation of light performance to ascertain that spaces are up to CIBSE (Chartered Institution of Building Services Engineers) standards.

The UK's television and film industry, valued at over £13 billion, also makes a market contribution. Lighting is essential to achieve production quality, and professional studios utilize digital LUX meters to ensure exact lighting conditions.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.1% |

The European Union's digital LUX meter market is fueled by environmental regulations, technological innovation in smart lights, and urbanization. Germany, France, and Italy are key drivers because of their robust manufacturing, automotive, and renewable power industries.

The EU Green Deal and Energy Efficiency Directive focus on minimizing energy use in buildings, creating demand for digital LUX meters in energy audits and lighting efficiency testing. As the EU requires all new buildings to be almost zero-energy (NZEB) by 2030, demand for precise light measurement equipment is increasing.

The motor vehicle industry, valued at €1.3 trillion, also contributes significantly. Motor vehicle producers employ LUX meters to perform tests on automobile lighting systems, dashboard lights, and headlights in order to meet EU automotive light standards (ECE Regulations 48 and 112).

Furthermore, demand is being spurred by the increasing adoption of smart cities and cloud-connected IoT solutions. Wireless LUX meters connected to the cloud are being implemented in streetlight automation, home automation, and industrial lighting management.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.3% |

Japan's market for digital LUX meters is expanding at a fast pace with the help of sophisticated industrial uses, high-tech production, and strict workplace lighting standards. Japan has a reputation for precision engineering and quality control, which stimulates demand for highly accurate LUX meters in electronics, automotive, and semiconductor production industries.

The semiconductor market worth more than USD 40 billion is a significant buyer of digital LUX meters. Lighting in clean rooms, production lines, and test facilities should be properly illuminated to ensure product integrity and avoid defects.

The automobile industry, where Toyota and Honda are some of the key players, also contributes to the economy. As Japan's EV growth accelerates, LUX meters are employed in vehicle light testing, interior lighting, and factory automation.

Japan is also at the forefront of smart city developments, with Tokyo and Osaka implementing IoT-based lighting systems that necessitate real-time monitoring of light intensity.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.6% |

South Korea's digital LUX meter market is witnessing considerable growth owing to the nation's technological developments, growth of smart manufacturing, and emphasis on energy efficiency. The electronics and semiconductor industries in South Korea, with a combined worth of more than USD 150 billion, are significant drivers, applying LUX meters in display production, chip manufacturing, and precision lighting uses.

The automobile sector, which manufactures more than 4 million cars every year, also depends on LUX meters for the quality check of headlamp and dashboard lights. With the emergence of autonomous and electric cars, maintaining perfect interior and exterior light performance has become essential.

Apart from this, the drive by South Korea towards developing smart cities and 5G infrastructure has translated into high demand for IoT-supporting LUX meters for smart street lighting control, office environments, and public infrastructure.

Educational institutions and the agricultural industry contribute a major percentage in the digital LUX meter market, as educational institutions and industries value accurate light measurement, energy efficiency, and environmental monitoring. Digital LUX meters are an essential tool for academic research, greenhouse cultivation, industrial safety, and lighting optimization, providing accurate illumination measurements across various applications.

Educational Institutions Use Digital LUX Meters for Research, Laboratory Tests, and Academic Training

Educational institutions have increasingly incorporated digital LUX meters into their educational curricula, laboratory procedures, and research work, as they provide reliable light measurement features and data-driven illumination analysis. Such institutions encompass universities, technical schools, and science labs, where students and researchers need to conduct accurate lighting evaluation tools in order to research photometry, physics, and environmental sciences.

Physics and optics labs employ digital LUX meters to investigate light intensity, reflection, refraction, and spectral distribution, making hands-on experiments in optical physics and photometric studies possible. Engineering, architecture, and environmental science academic programs also utilize LUX meters to examine building lighting efficiency, workplace lighting, and sustainable lighting design principles.

University and technical school research departments apply digital LUX meters to advanced photometric research, such as LED efficiency measurement, solar research, and light pollution measurement. With a focus on STEM education and sustainability efforts, educational institutions invest in precise LUX meters with wireless communication, data logging, and artificial intelligence-based analysis software.

Medical and biological sciences faculties also depend on LUX meters to research light exposure impacts on human health, circadian rhythms, and plant growth experiments, providing controlled light conditions in laboratory studies. Film and media studies programs also incorporate LUX meters to educate students in cinematography, photography, and stage lighting practices, providing the best light exposure in creative works.

Though they are very commonly used, digital LUX meters in academic institutions have some challenges with regard to budgeting, calibration needs, and equipment complexity. Nonetheless, improvements in easy-to-use interfaces, integration with mobile applications, and instant data analysis are improving educational availability, experiment reliability, and ease of operation, guaranteeing future market demand.

Agricultural Sector Depends on Digital LUX Meters for Greenhouse Agriculture, Horticulture, and Precision Farming

The agriculture industry has progressively embraced digital LUX meters to maximize light exposure, track crop growth conditions, and improve yield quality in greenhouse farming, horticulture, and vertical farming ventures. The meters accurately measure light intensity to ensure peak photosynthetic activity, plant growth, and resource conservation.

Greenhouse cultivation activities employ digital LUX meters to control artificial lighting systems, natural light penetration, and seasonal light fluctuations, maintaining uniform crop growth and optimizing yields. Farmers use LUX meters to measure PAR (Photosynthetically Active Radiation) levels, which enable them to decide on optimal lighting conditions for fruiting plants, vegetables, and flowering plants.

Nursery managers and horticulturists use LUX meters to determine light distribution on plant canopies, seed germination beds, and hydroponic farms, avoiding over-shading and patchy growth habits. With increasing controlled-environment agriculture (CEA), growers spend money on precision light monitoring equipment to enhance production efficiency and reduce energy use.

The livestock sector also gains from digital LUX meters since poultry growth rates, layer farm egg production, and dairy cattle productivity are all affected by adequate lighting conditions. Farmers utilize light intensity readings to design ideal barn lighting configurations to ensure lower stress levels, better animal welfare, and overall higher productivity.

Agricultural research centers use LUX meters to investigate light spectrum impacts on plant metabolism, stress reactions, and photoperiodic control measures, informing innovation in LED-based horticultural lighting systems. Smart farming technologies, as agriculture technology (AgTech) evolves, incorporate AI-driven light monitoring platforms so that farmers can make automatic light adjustments according to real-time crop requirements.

In spite of increasing agricultural light measurement demand, sensor calibration issues, environmental volatility, and the lack of awareness among farmers prevent LUX meter uptake in conventional farming societies. Nevertheless, novel wireless light sensing, IoT-compatible farm sensors, and affordable handheld LUX meters are enhancing the accessibility of technology, accuracy in measurements, and farm productivity to ensure ongoing market growth.

The market for digital LUX meters is growing as a result of growing demand for precise measurement of light in industry, business, and scientific applications. Businesses are addressing the need for high-accuracy sensors, real-time logging, and wireless connectivity to improve the monitoring of indoor and outdoor light conditions, workplace safety compliance, and energy efficiency measurements.

The market has global leaders and niche manufacturers with each one contributing to innovation in photometry, automation, and IoT-enabled smart lighting solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Extech Instruments (FLIR Systems Inc.) | 12-17% |

| Testo SE & Co. KGaA | 10-14% |

| Konica Minolta, Inc. | 8-12% |

| Hanna Instruments, Inc. | 7-11% |

| Lutron Electronic Enterprise Co., Ltd. | 5-9% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Extech Instruments (FLIR Systems Inc.) | Produces high-precision digital LUX meters with data logging and real-time monitoring. Focuses on industrial, commercial, and environmental applications. |

| Testo SE & Co. KGaA | Specializes in smart light intensity measurement tools with Bluetooth connectivity and automated data reporting for occupational safety. |

| Konica Minolta, Inc. | Manufactures advanced photometric instruments, integrating spectral analysis and high-sensitivity sensors for research and lighting design. |

| Hanna Instruments, Inc. | Develops portable and lab-grade digital LUX meters for agriculture, food production, and laboratory analysis. |

| Lutron Electronic Enterprise Co., Ltd. | Offers cost-effective and handheld light measurement devices optimized for commercial lighting assessment and energy efficiency studies. |

Key Company Insights

Extech Instruments (FLIR Systems Inc.) (12-17%)

Extech dominates the digital LUX meter industry with the supply of highly accurate light-measuring instruments coupled with sophisticated data logging features. The firm provides AI-based analysis and cloud-based storage solutions for maximizing real-time lighting environment monitoring.

Testo SE & Co. KGaA (10-14%)

Testo is an expert in smart and wireless LUX meters that serve occupational safety, lighting audit, and energy-efficient building management. Testo's Bluetooth-enabled meters and auto-reporting solutions position it at the forefront of precision photometry.

Konica Minolta, Inc. (8-12%)

Konica Minolta produces spectrally improved LUX meters for color temperature measurement, display calibration, and scientific research. The emphasis of the company on high-sensitivity optical sensors and laboratory-grade accuracy makes it a leading company in advanced photometry.

Hanna Instruments, Inc. (7-11%)

Hanna Instruments offers tough, portable digital LUX meters for industrial, agricultural, and environmental monitoring use. Its meters provide reliable performance under harsh conditions.

Lutron Electronic Enterprise Co., Ltd. (5-9%)

Lutron produces affordable and easy-to-use light meters, and it is a favorite among commercial lighting experts and energy advisors. Lutron specializes in high-value yet cost-efficient solutions for everyday lighting measurement requirements.

Other Key Players (45-55% Combined)

Several manufacturers contribute to cost-efficient digital LUX meters, specialized photometry tools, and industry-specific applications. These include:

The overall market size for Digital LUX Meter Market was USD 3.9 Billion in 2025.

The Digital LUX Meter Market is expected to reach USD 9.5 Billion in 2035.

The demand for digital LUX meters is expected to rise due to rapid technological advancements, increasing adoption in industrial and commercial lighting applications, and the growing need for accurate light measurement in photography, cinematography, agriculture, and smart city projects, where precision and efficiency are crucial.

The top 5 countries which drives the development of Welding Mechanical Seals Market are USA, UK, Europe Union, Japan and South Korea.

Research Centers are anticipated to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 12: Latin America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: Western Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 20: Eastern Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: South Asia and Pacific Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 28: East Asia Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 32: Middle East and Africa Market Volume (Units) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 3: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 4: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 8: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 11: Global Market Attractiveness by End Use, 2023 to 2033

Figure 12: Global Market Attractiveness by Region, 2023 to 2033

Figure 13: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 14: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 15: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 16: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 17: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 18: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 20: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 21: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 22: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 23: North America Market Attractiveness by End Use, 2023 to 2033

Figure 24: North America Market Attractiveness by Country, 2023 to 2033

Figure 25: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 26: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 27: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 28: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 29: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 30: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 32: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 33: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 34: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 35: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 36: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 37: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 38: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 39: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 40: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 41: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 42: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 43: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 44: Western Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 45: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 46: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 47: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 48: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 49: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 50: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 51: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 52: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 53: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 54: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 55: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 56: Eastern Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 57: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 58: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 59: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 60: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 62: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 63: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 64: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 65: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 68: South Asia and Pacific Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 69: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 70: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 71: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 72: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 73: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 74: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 75: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 76: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 77: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 78: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 79: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 80: East Asia Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 81: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 82: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 83: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 84: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 85: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 86: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 87: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 88: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 89: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 90: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 91: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 92: Middle East and Africa Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 93: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 94: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 95: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 96: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital Barometer Market Size and Share Forecast Outlook 2025 to 2035

Digital Tachometer Market Size and Share Forecast Outlook 2025 to 2035

Digital Power Meter Market Growth - Trends & Forecast 2025 to 2035

Digital Speedometer Market Growth – Trends & Forecast 2024-2034

Digital Potentiometer IC (Digipots) Market

Digital Thermo Anemometer Market Size and Share Forecast Outlook 2025 to 2035

Digital Hall Effect Gaussmeter Market Size and Share Forecast Outlook 2025 to 2035

Digital BBQ Tongs and Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Luxury Car Hoses Market Size and Share Forecast Outlook 2025 to 2035

Digital Group Dining Service Market Size and Share Forecast Outlook 2025 to 2035

Digital Pathology Displays Market Size and Share Forecast Outlook 2025 to 2035

Digital Rights Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Liquid Filling Systems Market Size and Share Forecast Outlook 2025 to 2035

Digital Transformation Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Luxury Travel Market Forecast and Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Luxury Wood Doors For Residential Interiors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA