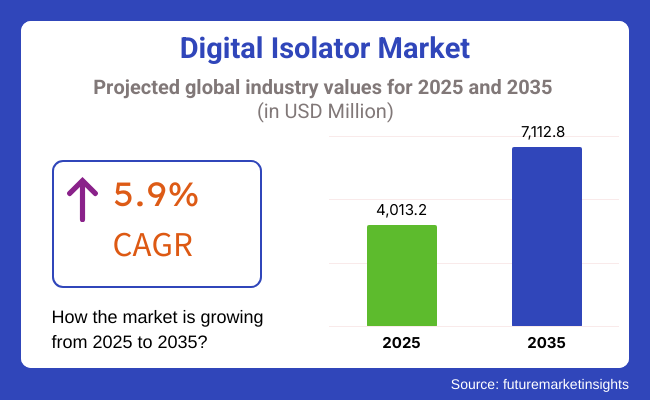

The digital isolator market is estimated to be worth USD 4,013.2 million in 2025 and are anticipated to reach a value of USD 7,112.8 million by 2035. Sales are projected to rise at a CAGR of 5.9% over the forecast period between 2025 and 2035.

The digital isolator market encompasses the global sector concentrating on the research, manufacture, and distribution of digital isolators -Integrated circuits that provide electrical isolation and high-speed data transmission simultaneously with the use of different circuit components. These devices are the advanced version of traditional optocouplers that replace JFET gate drivers, which are better in some aspects like speed, reliability, noise immunity, etc.

Digital Isolators hold a prominent position in protecting high voltages from sensitive electronic circuits, maintaining signal integrity, and preventing electromagnetic interference. The isolator network involves many sectors, such as industrial automation, automotive, consumer electronics, medical devices, telecommunications, and renewable energy systems.

The market is primarily influenced by the increased adoption of Industry 4.0 technology, electric vehicles, and advancements in power management systems. The safety regulations are increasing, and the demand for compact and energy-efficient electronic devices is renewing with marketing growth; these isolators are becoming a basic element in the design of modern electronics.

This industry is an area that undergoes constant growth and is driven to this extent by the increasing need for high-performance electronic systems in sectors such as the automotive industry, industrial automation, telecommunication, and renewable energy.

These isolators are faster, more reliable, and able to filter out noise better than other dramas of high voltage isolation, which involve an isolation device and optocoupler. Thus, these devices are suitable for applications that have to communicate strong data and are also under high voltage conditions.

The technological revolution of Industry 4.0, the promotion of electric vehicles, and the modernization of smart grid infrastructure are the cornerstones for the expansion of the market. In addition, safety directives stringent and compact energy-efficient devices demand are the impulses that manufacturers implant digital isolators into electronic devices.

North America and Asia-Pacific rule the market due to the production of advanced technologies and the presence of major manufacturers. As industries continuously evolve with the progress of automation and connectivity, it is expected that they will continue to grow strongly. Innovation will help firms improve their throughput by expanding their target area.

Explore FMI!

Book a free demo

The industry registered robust growth from 2020 to 2024 as demand for high-speed, trustworthy, and secure data transfer picked up pace in industrial automation, telecom, and automotive industries. Industry 4.0 expansion and intelligent manufacturing also increased the adoption of these isolators to protect against signal loss and integrity attacks in noisy conditions.

Global growth of electric (EV) and hybrid electric vehicles (HEVs) requires applying these isolators to improve power inverter and battery management system (BMS) performance and reliability. Advances in magnetic and capacitive isolation technologies boosted signal transmission integrity and speed with lower power consumption and latency. Companies concentrated on building low-power and lower-profile devices to cope with increased demand for miniaturization in consumer electronics and IoT.

The industry will be dominated by the transition to 5G and next-generation wireless communication networks in the subsequent years 2025 to 2035. Applications of renewable energy, such as solar and wind, will propel the demand for isolators of high voltage that can handle tough environmental conditions.

Machine learning and artificial intelligence will enable real-time monitoring and predictive maintenance of the isolators, improving reliability and reducing downtime. In-built fault detection and self-healing integrated isolation products will be a reality, allowing autonomous systems and smart infrastructure.

Emerging trends in edge computing and quantum computing will require higher data rate processing and less noise interference with greater signal isolation. Sustainability and energy efficiency will continue to be the driving factors, with vendors using green materials and low-power designs to address regulatory needs and environmental concerns.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increasing application in industrial automation, automotive, and consumer electronics for high-reliability signal isolation. | Depth of application in quantum computing, AI-based automation, and high-voltage EV use cases driving next-gen isolator innovation. |

| IEC 60747 and UL approval for higher insulation and safety. | Stricter regulatory landscapes with a focus on immunity to electromagnetic interference (EMI) and cyber-physical attacks. |

| Migration away from optocouplers and towards capacitive and magnetic coupling for increased speed and integration. | Mass-volume use of materials like GaN and SiC to provide greater performance in high-power devices. |

| First applications for industrial automation and robotics driven by AI for noise-immunity data transfer. | Complete autonomous systems with pre-calibrated isolators by AI for real-time diagnostics and self-repair. |

| Improved microcontroller compatibility, FPGA, and SoC to achieve seamless integration. | Creation of plug-and-play isolator modules to facilitate easy system design in most applications. |

| Increased use in Industry 4.0 applications, such as motor control, power supply, and renewable energy systems. | Innovation leadership for intelligent grids, predictive maintenance, and strongly interconnected industrial environments. |

| First mover in secure data transmission through edge computing and big data analytics. | AI-assisted predictive real-time analytics at the edge to increase system uptime and minimize downtime. |

| Early adoption within edge devices for data integrity preservation and signal isolation in hostile environments. | AI-based edge processing with ultra-low latency isolators that enable real-time control for autonomous use cases. |

| Industrial automation expansion, increasing EV adoption, and the need for high-performance data communication. | The rapid pace of AI, IoT, and quantum technology deployments is driving demand for high-speed isolators. |

| Highly expensive advanced isolator solutions and complexity in multi-system integration. | Cost savings from mass production and modular configurations, with greater emphasis on cybersecurity for data integrity. |

There is a rapid growth in this industry, fueled by factors such as growing demands for high-speed, energy-saving, and high-reliability isolation solutions across industries. These isolators form the backbone of industrial automation by providing secure data communication between low-voltage and high-voltage systems, providing safety in operations.

In the automotive market, the expansion of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) has fuelled the requirement for high-voltage isolation to offer safety and efficient power handling.

These isolators are being applied in consumer electronics for tiny, energy-conservative designs at the expense of cost and performance. The medical industry implements these isolators in diagnostic equipment, patient monitoring, and medical imaging, where safety standards, compliance, and reliability are essential.

At the same time, the telecommunication industry utilizes these devices in 5G base stations and networking gear, focusing on electromagnetic interference (EMI) resistance and high-speed data transfer. As industries move towards miniaturization, energy efficiency, and enhanced safety, the industry for digital isolators is also expected to sustain growth.

The global industry is witnessing remarkable growth on account of an urgent requirement for rapid data transfer as well as industrial automation, automotive, and healthcare systems' greater safety. Nonetheless, compliance with the stringent standards regarding electromagnetic interference (EMI) and insulation is a big challenge for manufacturers. To enter the industry, companies must bear the cost of advanced testing and certifications.

Production on stability and sales price has been affected by supply chain vulnerabilities, such as a shortage of semiconductor parts and fluctuating costs of raw materials. Key suppliers and regional trade restrictions provide further supply chain difficulties. Companies should try to reduce the risks associated with suspension of supply by diversifying their supplier networks and exploring local manufacturing options.

The industry is under tremendous pressure due to rapid technological advancements and the introduction of alternative isolation technologies such as optocouplers and capacitive isolators. The most pertinent strategy is to deal with the environmental and social responsibility of the cogeneration process in the heat and power sector because it is at the core of the innovation of the process and the product.

In order to ensure their competitiveness, manufacturers should aim to be the best in their field by being the most innovative, the most efficient in power, and the most cost-effective, alongside providing the best service.

Both digital isolators have become a major part of connected systems like IoT and industrial automation, and at the same time, they face the challenge of cybersecurity threats. System safety and reliability can be compromised by exposure to unauthorized access and data breaches. Companies are recommended to enforce strict security measures and make use of encryption while communicating over the network, which will protect sensitive information and make them compliant with the industry rules.

The section contains information about the leading segments in the industry. Data rate with 25 Mbps to 75 Mbps is likely to hold a share of 32.5% in 2025. By Channel, the 6 channel segment is estimated to grow at a CAGR of 6.3% during the forecasted period.

| Data Rate | Share (2025) |

|---|---|

| 25 Mbps to 75 Mbps | 32.5% |

The industry is segmented by data rate into three segments: less than 25 Mbps, 25 Mbps to 75 Mbps, and More than 75 Mbps. The 25 Mbps to 75 Mbps segment carries 32.5% of the share, with increased penetration mainly due to the acceptance of the same in fields like industrial automation, motor control, and medical devices.

Moderate speed data transmission with robust isolation to prevent signals from floating stray is needed for these applications for robust performance. Texas Instruments and Analog Devices dominate this segment with isolators such as the TI ISO77xx series and ADuM240x series, which are often utilized in PLLC systems, motor drives, and medical imaging equipment.

Over 75 Mbps is the largest segment and holds 33.5%, driven by high-speed data communication, automotive electronics, and advanced industrial equipment. This allows fast data transfer along with higher electromagnetic interference (EMI) immunity in applications such as electric vehicle (EV) powertrains, high-speed serial buses, and high-frequency switching power supplies.

Leading the way are Silicon Labs and Broadcom with Si86xx and HCPL series isolators for real-time control systems, automotive battery management systems (BMS), and 5G network infrastructure. Booming Industry 4.0, rising EV adoption, and demand for high-speed, low-power isolation solutions across several industries are expected to fuel the growth.

| Channel | CAGR (2025 to 2035) |

|---|---|

| 6 channel | 6.3% |

On the basis of channel, the segmentation is into two channels, four channels, six channels, and 8 channels. By the type of segment, the 6-channel segment is expected to hold the largest share at 27.0% in 2025 and 6.3% in the estimated CAGR from 2025 to 2035.

The growth is driven by its wide use in industrial automation, power electronics, and automotive applications, where many signal paths need to be isolated. For example, Analog Devices' ADuM4166 and Texas Instruments' ISO776x series provide high-speed data transmission isolation with improved safety features, making them suitable as digital isolators for battery management systems (BMS), motor drives, and industrial communication interfaces.

Following closely is the 8-channel segment, capturing 20.9% in 2025 with the highest estimated CAGR of 6.6%. In response to these demands, HDD offers high-density isolation solutions for renewable energy systems, high-performance computing, medical equipment, and other applications that require isolation for multiple data lines.

Silicon Labs (replace with Si86xx series), Broadcom (replace with HCPL-0874), and others have been building new chips targeting the need for small, high-channel-count isolators in applications ranging from smart grids to 5G infrastructure and high-speed industrial communication networks.

Strong growth of 6- and 8- 8-channel segments reinforces that the industry is transitioning towards more optimal power management capable of delivering miniaturization and stacking of electronic systems as a result of Industry 4.0, electric vehicles, and high-speed networking innovations.

| Countries | CAGR (2025 to 2035) |

|---|---|

| The USA | 11.1% |

| Germany | 9.7% |

| The UK | 9.4% |

| France | 9.1% |

| Italy | 8.8% |

| South Korea | 10.5% |

| Japan | 9.9% |

| China | 13.2% |

| Australia | 8.5% |

| New Zealand | 8.2% |

The USA industry for digital isolators is expected to register a CAGR of 11.1% during the period 2025 to 2035. The country is a leader in technology advancements, with top semiconductor companies like Texas Instruments, Analog Devices, and Silicon Labs leading the charge.

Industry 4.0, smart manufacturing and industry automation drive the use of digital isolators. Secondly, the USA is a hub of electric vehicle (EV) technology, where such goods are used in inverters and battery management systems. The industry is further fueled by government policies supporting renewable energy and smart grid programs.

Telecommunications, aerospace, and healthcare industries also play a crucial role in sales. High-speed, noise-immune isolation solutions are needed due to the demands of data centers and 5G networks, which increase demand. Medical device sales are also driven by the increasing adoption of digital isolators in diagnosis machinery and patient monitoring machinery. Emphasizing safety needs and technological innovation, the USA will be the most significant driver in applications.

The German industry for digital isolators is expected to clock a CAGR of 9.7% in the forecast years 2025 to 2035. Dominantly propelling industrial automation and auto technology, Germany heavily relies on factory automation, robots, and electric vehicle technology on these isolators.

Key leaders like Infineon Technologies and Siemens supply quality inputs in semiconductor and automation technology, rendering the industry robust. The extensive application of high-end engineering tools and adoption of Industry 4.0 in the country propel the need for enhanced isolation solutions to manufacturing processes.

Aside from that, Germany's renewable energy industry of solar and wind energy requires these isolators to enable efficient power conversion systems. Rising smart grid projects and charging stations for electric vehicles also account for industry expansion. Government schemes supporting sustainable energy and digitalization are propelling Germany to become an excellent digital isolator market.

The UK digital isolator market will achieve a 9.4% CAGR from 2025 to 2035. Industrial automation, telecommunication, and the growth of medical devices in the nation fuel premium isolation technology demand. UK companies, including ARM Holdings, spur semiconductor technology. EV solutions and autonomous car solutions applications are on the rise in the automotive segment. Government policy initiatives in digitalization and smart manufacturing propel the growth.

Besides, the UK is also a trendsetter in the development of medical technology. Development in the renewable energy industry and usage of smart grid solutions also increases the demand for isolation solutions. As there is continuous investment in high-technology industries and the building of infrastructures, UK is anticipated to increase at a consistent rate.

France's digital isolator market is anticipated to register a growing CAGR of 9.1% from 2025 to 2035. France's emphasis on power electronics, industrial automation, and aviation fuels the growth. STMicroelectronics is among the industry giants with a robust presence in the semiconductor segment that fuels innovation for digital isolation technology. France's automotive sector, particularly EV production, also holds more promise for more demand for isolators in battery management and high-voltage applications.

In addition, French initiatives in promoting renewable energy and other intelligent grid projects are among the areas where the isolators can be used. High-performance isolation products get support from the growth of the nation's aerospace industry in electronic control units and avionics-government initiatives towards green power and digitalization position France as a key industry for digital isolators.

Italy is expected to grow at a rate of 8.8% CAGR over the forecast period of 2025 to 2035. Italy possesses a well-developed industry base where the industries are functioning in automation, automobile, and renewable energy industries. Power electronic and industrial equipment giants drive the demand for isolators in protection and control applications. A growing Italian EV industry also fulfills the demand for sophisticated isolation solutions for electric powertrains and charging systems.

Other than this, the Italian renewable industry, the solar power industry, is supported by isolators for energy conversion and grid integration. Italy's medical technologies sector is also expanding, and this raises the need for isolation components within diagnostic and therapeutic equipment. With constant pressure to become further digital and dependent on renewable energy, Italy is a suitable industry for these isolators.

South Korea will expand at a 10.5% CAGR between 2025 and 2035. The dominance of South Korea in semiconductor technology and consumer electronics drives the need for high-performance isolators. Samsung and SK Hynix dominate the semiconductor technology sector as top manufacturers, and the impact of the companies drives the industry. Further growth is driven by the increasing application of automation in the manufacturing process and EV production.

Furthermore, the country's development of South Korea's 5G network infrastructure and smart cities also drives communications and power systems' demand for next-generation isolators. The country's promotion of electric mobility and clean energy is another stimulus for this sector. South Korea, given its focus on technological advancements and industrial automation, is still a good market for these isolators.

Japan is expected to have a CAGR of 9.9% from 2025 to 2035. As a global leader in electronics and industrial automation, Japan has a strong demand in the fields of robotics, factory automation, and automotive sectors. Toshiba and Renesas Electronics are prominent companies that are actively involved in building semiconductor technology. Focus on high-reliability components and precision manufacturing within the nation is fueling the industry expansion.

The transition of renewable energy by Japan and the expansion of EV infrastructure also propel the augmented usage of digital isolators. Medical electronics is also one of the segments driving the industry, as Japan is persistently improving diagnostics and monitoring devices. Japan is a robust market with its highly developed network of technology.

Australia will grow at a CAGR of 8.5% between 2025 and 2035. The growth is driven by the nation's focus on smart grid installation, industrial automation, and renewable power. Solar and wind power project investments drive energy conversion and power management applications. Demand is spurred by increasing development in high-tech areas such as electric mobility and telecommunications.

The New Zealand market is forecast to achieve a CAGR of 8.2% from 2025 to 2035. New Zealand's renewable energy sources, such as hydropower and wind power, are the main factors motivating the application of these isolators. Demand for high-performance isolation products is driven by industrial automation and smart grid modernization.

Growth is happening at a very fast rate because the demand for power-efficient, high-speed, and secure isolation technology is growing at a rapid rate in all industries like telecommunication, industrial automation, automotive, and consumer electronics. These isolators have numerous advantages over conventional optocouplers, such as improved circuit protection, high data transfer, and less power consumption.

As businesses develop into automation, electrification, and intelligent technologies, companies are spending more on the newest digital isolation solutions to be capable of responding to changing needs.

Texas Instruments is one of the market leaders, utilizing its long semiconductor heritage to design high-performance isolators with extensive industrial and automotive applications. Analog Devices is right behind, delivering accurate isolation solutions for demanding applications in medical, instrumentation as well as power management applications.

Broadcom is one of the market leaders in the industrial and communications sector, offering robust and high-speed isolators for sophisticated systems. Silicon Laboratories is a market leader in high-speed digital isolation, while other target markets are consumer and industrial.

NXP Semiconductors serves automotive and industrial markets, where its forte is embedded processing and isolation. Besides these market leaders, other players are also driving growth in the market. These are application-specific and custom isolation technology niche players, which are inducing competition and innovation in the market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Texas Instruments | 20-25% |

| Analog Devices | 18-22% |

| Broadcom | 15-20% |

| Silicon Laboratories | 10-15% |

| NXP Semiconductors | 8-12% |

| Other Companies (combined) | 26-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Texas Instruments | Offers a wide range of isolators with reinforced isolation, high data rates, and robust performance for industrial and automotive applications. Focuses on enhancing signal integrity and minimizing power consumption. |

| Analog Devices | Provides high-speed isolators with advanced iCoupler® technology. Specializes in solutions for industrial automation, healthcare devices, and power systems. Invests heavily in R&D for next-gen isolation technologies. |

| Broadcom | Delivers optocoupler-based isolators designed for high-voltage applications. Targets renewable energy, automotive, and telecommunications sectors. Focuses on enhancing insulation performance and reliability. |

| Silicon Laboratories | Known for its Si86xx isolators, providing robust performance in industrial automation, motor control, and power supply applications. Pioneers in integrating isolation with wireless connectivity. |

| NXP Semiconductors | Offers high-performance isolators optimized for automotive, IoT, and smart grid applications. Emphasizes safety and compliance with industry standards. |

Key Company Insights

Texas Instruments (20-25%)

Texas Instruments leads the digital isolator market with its extensive product lineup tailored for automotive and industrial applications. The company continuously invests in R&D to improve isolation performance while reducing power consumption. Recently, TI introduced next-generation isolators designed to support higher data rates and stricter safety standards, reinforcing its leadership in high-voltage environments.

Analog Devices (18-22%)

Analog Devices holds a strong market position, largely due to its iCoupler® technology, which enhances isolation without compromising speed or performance. The company focuses on industrial automation and medical device applications, where safety and precision are critical. Analog Devices’ ongoing research into improving isolation for high-frequency environments positions it as a frontrunner in technological advancements.

Broadcom (15-20%)

Broadcom capitalizes on its expertise in optocoupler technology to offer isolators for high-voltage and high-reliability applications. The company targets renewable energy, automotive electrification, and communications infrastructure. Broadcom’s focus on insulation performance and robust design makes its products highly sought after in mission-critical applications.

Silicon Laboratories (10-15%)

Silicon Laboratories differentiates itself through its focus on integrating wireless communication capabilities with isolation technology. Its Si86xx series has become popular in industrial automation and power supply applications. Silicon Labs' push toward combining isolation with IoT connectivity aligns with the growing demand for smart industrial systems.

NXP Semiconductors (8-12%)

NXP Semiconductors focuses on delivering high-performance isolators tailored for automotive, smart grids, and IoT applications. The company’s strategy revolves around ensuring compliance with strict safety standards and enhancing data integrity in connected systems. NXP’s recent investments in expanding its automotive solutions portfolio further strengthen its market position.

Other Key Players (26-35% Combined)

The global Digital Isolator industry is projected to witness a CAGR of 5.9% between 2025 and 2035.

The global Digital Isolator industry stood at USD 4,013.2 million in 2025.

The global Digital Isolator industry is anticipated to reach USD 7,112.8 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 6.9% in the assessment period.

The key players operating in the global Digital Isolator industry include Texas Instruments, Analog Devices, Broadcom, Silicon Laboratories, and others.

In terms of Data Rate, the segment is categorized into Less than 25 Mbps, 25 Mbps to 75 Mbps, and More than 75 Mbps.

In terms of Channels, the segment is classified into two channels, four channels, six channels, and eight channels.

In terms of Vertical, the segment is categorized into Industrial, Healthcare, Automotive, and Others.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East and Africa (MEA) have been covered in the report.

Catenary Infrastructure Inspection Market Insights - Demand & Forecast 2025 to 2035

Category Management Software Market Analysis - Trends & Forecast 2025 to 2035

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Residential VoIP Services Market Insights – Trends & Forecast 2025 to 2035

Border Security Technologies Market Growth - Trends & Forecast 2025 to 2035

ATM Outsourcing Services Market Analysis by Service Type, ATM Deployment, and Region - Growth, Trends, and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.