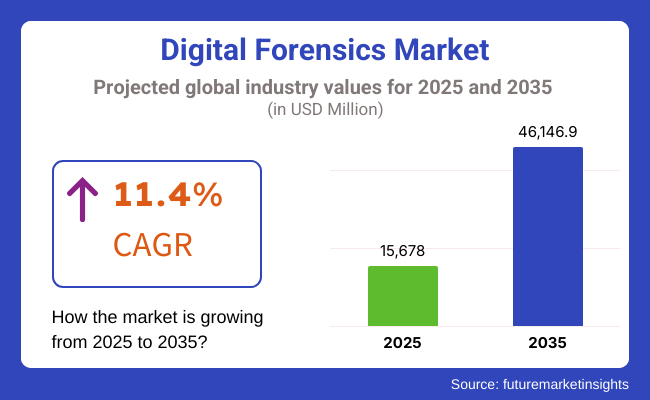

The global sales of Digital Forensics are estimated to be worth USD 15678.0 million in 2025 and anticipated to reach a value of USD 46146.9 million by 2035. Sales are projected to rise at a CAGR of 11.4% over the forecast period between 2025 and 2035. The revenue generated by Digital Forensics in 2024 was USD 14,073.60 million. The market is anticipated to exhibit a Y-o-Y growth of 10.2% in 2025.

The market refers to the technologies, tools, and services used to investigate, analyze, and recover data from digital devices to identify cybercrimes, frauds, and security breaches. The process consists of the forensic examination of servers, computers, mobile devices, networks, and cloud environments to identify and extract evidence that is admissible in a court of law.

Digital forensics is a core function in a range of sectors ranging from cybersecurity and law enforcement to corporate investigations and regulatory compliance and is also vital in the detection and prevention of data purging, data obstruction, data tampering, unauthorized access and entified cyber threats.

This is fueled by an increase in cyberattacks, more stringent data protection laws globally and heightened use of digital evidence in diverse forms of court litigation. Some of these include computer forensics, network forensics, mobile forensics and cloud forensics, wherein demand is driven by the end-use sectors such as government, BFSI, healthcare and IT. As AI, automation, and block chain based forensics evolve, so does the efficacy of digital forensic solutions.

The increasing number of cybercrimes, growing adoption of cloud computing, and various regulatory compliance requirements around the globe are the major factors driving the growth of the Digital Forensics Market. Government, BFSI, healthcare, IT and organizations across segments are investing in digital forensic solution to investigate security undulations, data fraud and insider threats.

The growth of the market is attributed to emerging forensic tools powered by AI, machine learning and block chain, enabling more accurate and efficient investigations. Demand from North America dominates territory due to stringent cyber security legislation and high rates of cybercrime, followed by Europe and Asia-Pacific, driven by advancing digitalisation and rising cyber threats.

The different applications of the forensics solution include Application forensics, computer forensics, Network forensics, mobile forensics, and cloud forensics, and there is increasing demand for managed forensic services. The growing focus on digital security among companies will further boost the market, which can also be observed integrating real-time analytics, automation, and cross-platform forensic capabilities.

Explore FMI!

Book a free demo

The below table presents the expected CAGR for the global Digital Forensics market over several semi-annual periods spanning from 2025 to 2035. In the first half H1 of the year from 2024 to 2034, the business is predicted to surge at a CAGR of 9.8%, followed by a slightly higher growth rate of 10.6% in the second half H2 of the same year.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 9.8% (2024 to 2034) |

| H2, 2024 | 10.6% (2024 to 2034) |

| H1, 2025 | 11.4% (2025 to 2035) |

| H2, 2025 | 11.6% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035 the CAGR is projected to increase slightly to 11.4% in the first half and remain relatively moderate at 11.6% in the second half. In the first half H1 the market witnessed a decrease of 80 BPS while in the second half H2, the market witnessed an increase of 20 BPS.

Surge in Cybercrime and Sophisticated Cyber Threats Driving Demand for Digital Forensic Solutions

Digital forensic solutions are focused on increasing cybercrime, such as ransomware attacks, financial fraud, and information leaks. However, organisations across industries and sectors are targeted by cybercriminals that are utilising increasingly sophisticated techniques such as deepfake fraud, social engineering and zero-day exploits.

Digital forensics is increasingly being adopted by law enforcement agencies and enterprises to detect, investigate, and respond to cyber threats, while maintaining data integrity. Moreover, the explosion of IOT and connected devices has led to the attack surface being broadened, whilst so called forensic experts are now investigating security events across an increasing number of endpoints.

It is expected that market growth is being driven by the increasing demand for proactive threat intelligence, real-time forensics, and forensic automation tools, as organizations work to improve their cybersecurity posture and prevent both financial and reputational damage.

Stringent Data Protection Regulations and Compliance Requirements Boosting Digital Forensic Adoption

With the rise of the cyber threat landscape, governments and regulatory agencies are mandating strict data protection laws around the globe to protect sensitive information against cyber threats and data leaks.

Widespread regulations such as GDP (General Data Protection Regulation), CCPA (California Consumer Privacy Act), HIPAA compliant (Health Insurance Portability and Accountability Act) and PCI-DSS (Payment Card Industry Data Security Standard) require organizations to include forensic investigation capabilities to comply with compliance obligations.

Failure to comply with such laws results in heavy penalties and lawsuits, leading organizations to implement digital forensics solutions that offer round-the-clock monitoring network activity, detect breaches, and perform post-incident investigations.

The rising number of litigation applications associated with digital evidence has, in turn, driven the demand for forensic tools used to collect, preserve and analyze digital data to be presented in a court of law. With increasing regulatory scrutiny, Enterprises and law enforcement agencies are lining up digital forensics solutions to ensure compliance and secure critical business and consumer information.

Increasing Adoption of Cloud-Based and AI-Powered Digital Forensic Solutions for Enhanced Investigation

As more and more organizations are adopting cloud computing the demand for cloud forensic tools has also increased helping investigators to track down malicious activities, unauthorized access, and compromised data in the cloud environments. Traditional forensic techniques are challenged with handling large volumes of digital evidence, resulting in the implementation of AI-based forensic solutions aimedat improving the speed and accuracy of investigations.

AI-driven automation allows rapid anomaly detection, predictive threat analysis and deep forensic analysis from large volumes of data. Cloud-based forensic platforms offer scalability, remote accessibility, and seamless integration with security operation centers (SOCs) while conducting digital investigations without geographical limitations.

Additionally, new blockchain forensic techniques are being developed to help ensure that digital evidence is tamper-proof. In fact, the increasing dependence on AI, machine learning and automation in digital forensics is changing the market as digital forensic investigation has become more robust, economical, and trustworthy across various industry verticals.

Growing Challenges in Encryption and Data Privacy Hindering Digital Evidence Collection

The growing usage of end-to-end encryption, secure messaging, and other technologies focused on privacy is making digital forensic investigations more difficult. However, features such as encrypted messaging apps, zero-knowledge encryption, and privacy-focused operating systems severely restrict what forensic specialists can recover as essential digital evidence in cybercrime cases.

Moreover, new data privacy laws limit access to user data, posing legal challenges to law enforcement and enterprises looking to carry out forensic analysis. As consumer privacy becomes increasingly top of mind, technology providers are responding with tougher encryption techniques that make it nearly impossible for forensic analysts to retrieve information without strong user consent.

The prevalence of decentralized digital platforms, encrypted storage, and anonymous browsing tools adds to this challenge for law enforcement agencies to retrieve digital evidence. This constrains law enforcement agencies, cyber security firms, and enterprises' ability to perform in-depth forensic investigations, leading to the emergence of new forensic methodologies that address the rights to data privacy and security and compliance requirements.

The global Digital Forensics industry recorded a CAGR of 10.6% during the historical period between 2020 and 2024. The growth of Digital Forensics industry was positive as it reached a value of USD 14,073.60 million in 2024 from USD 9138.3 million in 2020.

Digital Forensics Market is projected to grow from USD 585 million in 2020 to USD 1,745 million by 2024. The rising wave of cyberattacks, especially ransomware and data breaches, has enabled forensic solutions to gain higher adoption in government, BFSI, and IT sectors. The growth of smartphones and cloud storage also added demand for mobile forensics and cloud forensics, respectively. But encryption barriers and other legal complications complicated evidence-gathering.

Moving forward, digital forensics be in high demand in 2025 to 2035 as AI-powered forensic tools, blockchain-based evidence authentication, and cloud-driven forensic solutions will continue to surpass traditional forensic approaches. Specifically, investigators will be needed to analyze data from a wider range of endpoints.

Moreover, investigation speed and accuracy will be enhanced by real-time forensic analytics and automation. With the high growth rate for cybersecurity and digital evidence management systems and the increasing investments in these systems, it is predicted to grow at a higher CAGR.

Tier 1: Tier 1 customers are devouring the digital forensics market - comprehensive forensic suites, AI-driven tools, and massive enterprise-wide deployment all in one sentence. IBM Corporation, FireEye (Trellix) and OpenText Corporation are some of the market leaders providing end-to-end digital forensics solutions for cybercrime investigations, incident response, and regulatory compliance.

Their solutions are used by governments, financial institutions, and large enterprises around the world because of their high accuracy, automation, and AI-driven threat detection. Cloud forensic platforms by the mentioned companies allow for remote investigations.

Supported by massive R&D spend, smart acquisitions, and state of the art forensic AI capabilities, they set the benchmark in the industry. They are able to capture a large portion of the enterprise and government forensics market because of their global reach and established reputations.

Tier 2 Cisco Systems, Magnet Forensics, and Paraben Corporation fall into Tier 2, specialized forensic tools for law enforcement, military, and corporate cybersecurity teams. Cisco is concentrated on network forensics, where it can leverage its capabilities in the cybersecurity infrastructure, whereas Magnet Forensics provides the best-in-class tools to recover and analyze digital evidence that can be used in legal proceedings.

IOT Device Analysis and Mobile Forensics- Paraben Corporation caters to niche markets such as Law Enforcement and Private Investigation firms. These players might not have the same enterprise reach as Tier 1 companies but do have a strong market presence in their respective forensic segment. With their skills in network traffic analysis, malware forensics, and digital evidence management, these professionals are becoming key figures in the ever-developing world of cybersecurity.

Tier 3 arecompanies such as Cellebrite, Exterro, Oxygen Forensics, and LogRhythm that focus on the niche forensic market. Cellebrite is one of the world’s most prominent mobile forensics companies, used by dozens of law enforcement agencies worldwide to suck data out of smartphones and analyze it. Exterro pairs forensic solutions for legal and compliance professionals with capabilities to streamline e-discovery and regulatory investigations within organizations.

Dec. LogRhythm: Security Intelligence provider; forensic solution for analyzing the threats on the network While the Tier 1 and Tier 2 players dominate the forensic market, Tier 3 (or boutique) forensic providers have lower market shares, but play the most important role in those niche forensic industries that require technology solutions, with a focus on the forensic innovation.

The section below covers the industry analysis for the Digital Forensics market for different countries. The market demand analysis on key countries in several countries of the globe, including USA, Germany, UK, China and India are provided.

The united states are expected to remains at the forefront in North America, with a value share of 61.7% in 2025. In South Asia & Pacific, India is projected to witness a CAGR of 12.2% during the forecasted period.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 9.5% |

| Germany | 8.4% |

| UK | 9.9% |

| China | 11.6% |

| India | 12.2% |

North America dominates the digital forensics market segment as it is being the leading market for this industry due to the high volume of cybercrime cases, linear regulatory requirements, and sophisticated cyber security infrastructure in the region.

Digital forensic solutions are an invaluable tool not only for preventing cybercrimes but also for executing costly forensic investigations should preventative measures fail and a crime has already taken place, with federal agencies, law enforcement and enterprises investing heavily in these solutions to protect against ransomware attacks, data breaches and insider threats. Compliance with these committee regulations like CLOUD Act, HIPAA, and CCPA, requires organizations to perform forensic investigations.

Also, the availability of prominent cybersecurity and forensic technology service providers fuelling the market growth. Businesses and government agencies are looking for more AI-based forensic automation, blockchain-based evidence verification, and cloud forensics. The USA has an advanced IT ecosystem, deploying 5G at the fastest rate, and growing IoT adoption across industries, which subsequently increases the demand for real-time digital forensics solutions.

Rising Cyberattacks leading to corporate investment on Cybersecurity alongside rigid data protection laws to grow Germany Digital Forensics Market. The General Data Protection Regulation (GDPR) imposes strict rules on data security, requiring organizations to utilize forensic tools to meet legal obligations.

In an era of industrial cyber espionage, financial fraud and state-sponsored cyber threats, German companies and law enforcement agencies increasingly trust digital forensics as a means of proactive monitoring and cybercrime detection.

Forensic solutions are crucial for sensitive data security in automotive, manufacturing, and BFSI sectors, and the country is also a leader in these sectors. Moreover, the use of AI-driven cybersecurity tools, network forensics, and real-time threat analysis is increasing, as organizations look to improve their digital forensic capabilities.

With growing digitalization, rising cyber threats, and government-motivated cybersecurity activities, India has become an emerging market for digital forensics. Smartphone, cloud computing, and fintech services have become prevalent tools, but they're also causing a massive rise in cyber fraud, data breach, and identity theft, which creates a demand pressure for forensic solutions.

Hackers target sensitive data, and the Indian government has been taking steps to build a robust cyber security framework by launching initiatives like CERT-In (Indian Computerss Emergency Response Team) and the National Cyber Security Policy, which has led to an increase in the adoption of forensic technology.

Moreover, as digital banking, e-commerce, and online transactions continue to grow in numbers, they generate the need for instant fraud detection and forensic auditing. India is also expected to emerge as a key growth market for digital forensic solutions, with increasing investments in AI-driven forensic automation, cloud-based digital forensics, and mobile device investigations.

The section contains information about the leading segments in the Digital Forensics industry. By End User, the Government and Law Enforcement segment has holding the share of 23.3% in 2025, By Component, the Digital Forensics Services segment is estimated to grow at a CAGR of 12.0% during the forecasted period.

| End User | Share (2025) |

|---|---|

| Government and Law Enforcement | 23.3% |

The largest market share of Digital Forensics Market happens to be Government and Law Enforcement, as a result of the rising need to fight cybercrimes, digital fraud, and national security threats. Computer, mobile, and network forensics are heavily used by law enforcement agencies, intelligence organizations, and regulatory bodies to investigate cyber incidents, terrorist activities, financial fraud, and organized crime.

Text of the next generation printer, forensic lab, investigation tools to AI, digital evidence processing in real time, By implementing it, the nations of the world are promoting development in the field of national security, which focuses on developing national security and cyber defense capabilities. Legislation requiring data protection, monitoring, and digital investigations also drives the forensic adoption.

With the complexity of cyber threats increasing, government agencies are still prioritizing forensic automation, blockchain-based evidence authentication, and cross-border cybercrime investigations to maintain their position as dominant players in the Digital Forensics Market.

| Component | CAGR (2025 to 2035) |

|---|---|

| Digital Forensics Services | 12.0% |

Digital Forensics Services is projected to be the fastest-growing segment of the Digital Forensics Market during the forecast period due to the growing complexity of cyber threats, shortage of forensic expertise, and an increasing number of outsourced forensic investigations. Be it BFSI, Healthcare, or IT, Organizations are not looking at managed forensic services, incident response teams, or forensic consulting firms for efficient handling of cyber investigations.

Real-time digital evidence analysis, malware forensics, forensic audits of mobile devices, and Internet of Things (IoT) forensic capabilities are examples of service providers that help improve cybersecurity for enterprises without having to invest heavily in equipment or in-house solutions, especially for pioneering organizations.

Furthermore, the increasing utilization of AI-powered forensic automation, use of blockchain for securing digital evidence integrity, and forensic-as-a-service (FaaS) models is fostering the market growth. With the growing sophistication of cyberattacks, businesses and law enforcement agencies are increasingly turning to specialized digital forensic service providers to shorten the turnaround time for forensic investigation at low cost and with a legally-disciplined approach.

The Digital Forensics Market is experiencing intense competition, with prominent players concentrating on AI-based forensic automation, cloud-based investigations, and enhanced threat intelligence solutions. Some of the prominent players in the market are IBM Corporation, OpenText Corporation, FireEye (Trellix), and Cisco Systems with wide-ranging forensic suites, analytical solutions powered by AI, and enterprise-grade solutions.

Mid-tier players such as Magnet Forensics, Cellebrite, and Paraben Corporation focus on providing mobile forensics, e-discovery, and network forensics for law enforcement and private investigation firms. Emerging vendors like Oxygen Forensics and Exterro specialize in niche forensic applications, blockchain-based evidence authentication, and forensic-as-a-service (FaaS).

The industry is seeing strong competition leading to ongoing investment in R&D, collaboration and acquisitions, with companies widening their WAF portfolios to meet increasing cyber threats, regulatory compliance needs, and the proliferation of digital transformation across verticals.

Recent Industry Developments in Digital Forensics Market

The global Digital Forensics industry is projected to witness CAGR of 11.4% between 2025 and 2035.

The global Digital Forensics industry stood at USD 15678.0 million in 2025.

The global Digital Forensics industry is anticipated to reach USD 46146.9 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 12.4% in the assessment period.

The key players operating in the global Digital Forensics industry include IBM Corporation, FireEye, Inc. (Now Trellix), OpenText Corporation, Cisco Systems, Inc., Magnet Forensics Inc. and others.

In terms of Type, the segment is categorized into Computer Forensics, Mobile Device Forensics, Network Forensics, Database Forensics, and Cloud Forensics.

In terms of Component, the segment is classified into Digital Forensics Hardware, Digital Forensics Software, and Digital Forensics Services.

In terms of End User, the segment is distributed into Government and Law Enforcement, Legal Services Firms, Military and Defense, IT and Telecom, BFSI, and Others.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & pacific, Middle East and Africa (MEA) have been covered in the report.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.