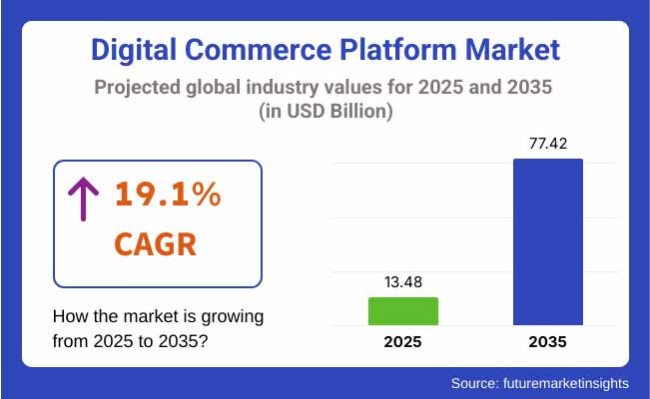

The global sales of Digital Commerce Platform are estimated to be worth USD 13.48 billion in 2025 and anticipated to reach a value of USD 77.42 billion by 2035. Sales are projected to rise at a CAGR of 19.1% over the forecast period between 2025 and 2035. The revenue generated by Digital Commerce Platform in 2024 was USD 11320.0 million. The market is anticipated to exhibit a Y-o-Y growth of 18.2% in 2025.

A digital commerce platform is a software solution that allows businesses to transact online, manage digital storefronts, and optimize end-to-end e-commerce operations. These platforms combine product catalog management, payment processing, order fulfillment, customer engagement, and analytics to improve online shopping experiences. In the age of omnichannel retailing, digital commerce platforms facilitate fluid transactions taking place between websites and mobile apps, social media, and marketplaces.

Automation, personalization, and operational efficiency are enhanced with advanced technologies such as AI, machine learning, and cloud computing. Companies from the retail, fashion, electronics, B2B, and other sectors use these solutions to maximize the digital channels for selling their products. With the growing requirement for seamless purchasing processes, secure transaction gateways, and scalable systems, the global adoption of digital commerce platforms is on the rise, making digital commerce platforms a key pillar of contemporary e-commerce.

With the booming adoption of e-commerce, integrated personalization based on AI and smooth omnichannel retail experiences, the global digital commerce platform market is growing at an accelerated pace. As companies, businesses, and services transition to digital-first and search-first strategies, these platforms are essential when it comes to managing the online storefronts, payments, logistics, and customer engagement.

Cloud-based solutions allow to scale up without incurring vast hardware costs, and most API-driven architectures can integrate easily with third-party services such as Postmark, Mailgun, Stripe. Trends such as mobile commerce, subscription-based business models, and social commerce also helps to scale the market. Plus, security improvements and AI fraud detection are boosting consumer confidence. Major players are constantly pushing forward with AI, big data and automation to improve user experience.

North America and Asia-Pacific are the top two contributors towards the growth of Global Digital Payment Industry, while the emerging economies are anticipated to witness a surge in demand owing to rise in internet penetration and digital payments. As organizations focus on digital transformation, the global need for strong, expandable, and AI-integrated commerce solutions remains high.

The below table presents the expected CAGR for the global Digital Commerce Platform market over several semi-annual periods spanning from 2025 to 2035. In the first half H1 of the year from 2024 to 2034, the business is predicted to surge at a CAGR of 17.9%, followed by a slightly higher growth rate of 18.5% in the second half H2 of the same year.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 17.9% (2024 to 2034) |

| H2, 2024 | 18.5% (2024 to 2034) |

| H1, 2025 | 19.1% (2025 to 2035) |

| H2, 2025 | 19.7% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035 the CAGR is projected to increase slightly to 19.1% in the first half and remain relatively moderate at 19.7% in the second half. In the first half H1 the market witnessed a decrease of 60 BPS while in the second half H2, the market witnessed an increase of 60 BPS.

Growing Adoption of AI and Machine Learning for Personalized Customer Experiences.

The growing application of Artificial Intelligence (AI) and machine learning (ML) over digital commerce platforms is propelling the market growth. Using AI-powered personalization, businesses can analyze customer behavior, predict future preferences, and personalize product offerings to individuals, which can improve engagement and conversion rates.

Machine learning algorithms is used to automate pricing strategies, inventory optimization and fraud detection activity which considerably increases the efficiencies. Chatbots, virtual assistants: AI-powered chatbots and virtual assistants reduce response times and lead to higher customer satisfaction.

The rise of e-commerce is intensifying the need for real-time, data-driven insights, driving the adoption of AI-integrated systems. AI and ML advancements will keep driving innovation and growth in the digital commerce platform market, as MAU and MWU grow and businesses work to create better personalization and user experience.

Rapid Growth of Mobile Commerce and Social Media Integration in Online Shopping.

Mobile devices and social media platforms have revolutionized the digital commerce landscape and opened new avenues for growth. This is going to drive demand for mobile-friendly commerce solutions because consumers are doing more of their shopping online on their smartphones. IntroductionMobile commerce software enables simple purchases, push notifications, and single-click payments.

Moreover, the fusion of social media apps such as Instagram, Facebook, and TikTok with electronic commerce has transformed the way we shop online. As an important example, companies use live shopping, influencer marketing, and in-app purchases in the workplace social commerce tool to engage users and generate sales. This trend of mobile-first and social commerce strategies is driving the need for mobile optimized digital commerce platforms that are scalable across different industries.

Expansion of Omnichannel Retailing and Seamless Integration Across Sales Channels.

Omnichannel retailing is the latest trend that is pushing the growth of digital commerce platform market as organizations are keen to provide a seamless and consistent shopping experience across different touchpoints. Consumers want seamless experiences between physical stores, websites, mobile apps, and third-party marketplaces.

Real-time inventory syncing, promotions across channels and flexible fulfillment options (like buy online, pick up in-store [BOPIS]) are integrated in digital commerce platforms. Retailers are looking to build backend operations with cloud-based and API-driven solutions as well. As the need for a seamless shopping experience rises, omnichannel capabilities have become a priority for brands searching to strengthen customer loyalty and engagement, thereby driving market growth.

Cybersecurity Threats and Data Privacy Concerns Impacting Consumer Trust

The growing incidents of cyberattacks, data breaches, and fraudulent transactions act as a major restraint for the expansion of a digital commerce platform market. With thousands of sensitive customer information like payment details and personal data readily available, businesses are hot targets for the criminals. This challenges rising fraud detection complexity, as well as increasingly sophisticated cybersecurity assaults for digital commerce platforms.

In addition, Data Protection regulations such as GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act) require organizations to comply leading to operational costs as they must take several steps to ensure compliances.

Each security failure erodes consumer trust leading to revenue and reputation loss. In fact, cybersecurity issues are a constant hurdle to market expansion since businesses need to invest in things like cutting-edge encryption, AI-backed fraud prevention, and compliance frameworks to mitigate risks.

The global Digital Commerce Platform industry recorded a CAGR of 18.5% during the historical period between 2020 and 2024. The growth of Digital Commerce Platform industry was positive as it reached a value of USD 11320.0 million in 2024 from USD 5626.0 million in 2020.

The Digital Commerce Platform Market witnessed substantial growth from 2020 to 2024, driven by the burgeoning e-commerce sector, rising internet penetration rates, and the surge in online shopping habits accelerated by the COVID-19 pandemic. This resulted in a greater adoption of cloud-based and AI-driven commerce platforms. Mobile commerce, omnichannel solutions, and AI-powered personalization were in high demand, leading to revenue growth.

As we move into the future, digital commerce platforms demand will surge with an even faster growth rate post 2025 and till 2035, thanks to AI-driven automation, blockchain-based secure transactions, and metaverse commerce integration.

Headless commerce, API-first architectures, and real-time data analytics will see increasing adoption during the forecast period further enhancing user experiences. As the world moves towards social commerce, voice-assisted shopping, and hyper-personalized marketing, businesses will focus even more on digital commerce platforms allowing sustained long-term growth and a higher global market penetration.

Tier 1: Shopify, Adobe (Magento Commerce), Salesforce (Commerce Cloud), SAP Commerce Cloud. With their enterprise-grade & comprehensive digital commerce solutions, scalability options, growing client base, cutting-edge technology, these companies are leading the market for digital commerce platforms. Shopify and Magento dominate mid-market and SMB while Salesforce and SAP serve large enterprises.

With AI-powered automation, omnichannel capabilities and cloud-based scalability, these platforms are great for retailers with a global reach. The well-designed ecosystem and third-party integrations, along with regular innovation, mean they are adopted widely among organizations of all sizes. Additionally, they enable headless commerce, API-first architectures, and AI-driven personalization, cementing their place as market leaders.

Tier 2: BigCommerce, Oracle Commerce Cloud, WooCommerce (Automattic), IBM Sterling Commerce Many of these platforms offer scalable digital commerce solutions with strong customization capabilities. BigCommerce targets mid-market and enterprise customers with a headless commerce, API-driven approach. B2B and B2C solutions: At the higher end, Oracle and IBM target larger enterprises with an integrated solution for AI, cloud infrastructure and automation.

WooCommerce continues to power WordPress-based commerce (and serves small and medium businesses in an open-source fashion). While these players have solid positioning in their markets, they do not yet enjoy the broad adoption enjoyed by Tier 1 players due to niche focus or elevated complexity to implement.

Tier 3: VTEX, Elastic Path. These companies are industry-specific, have headless commerce, and cloud-native architectures. VTEX provides composable commerce solutions to Latin American and emerging markets. Elastic Path specializes in API-first and microservices-based commerce for businesses, with a focus on those needing modular and flexible solutions.

Yes, these players are building up fast, but they continue to struggle with global market penetration, enterprise adoption, and above all, competing their integrations with ecosystems of huge players. Yet, this unprecedented approach puts them one step ahead as competing disruptors in the digital commerce market.

The section below covers the industry analysis for the Digital Commerce Platform market for different countries. The market demand analysis on key countries in several countries of the globe, including USA, Germany, UK, China and India are provided.

The united states are expected to remains at the forefront in North America, with a value share of 65.6% in 2025. In South Asia & Pacific, India is projected to witness a CAGR of 20.8% during the forecasted period.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 17.5% |

| France | 16.9% |

| UK | 16.3% |

| China | 19.6% |

| india | 20.8% |

The increasing high penetration of the internet in the US, along with the widespread adoption of advanced AI-driven personalization tools all deeply integrated into the various systems the US retains a stronghold in the world of the Digital Commerce Platform Market while guaranteeing that the consumers will always prefer the website with a seamless and simple online experience.

With cloud-based platforms and headless commerce taking over, the e-commerce landscape in the USA is more evolved than ever, with major retailers and D2C brands also benefiting from AI-powered automation. Meanwhile, the needs are fueled further by the rise of “subscription” based commerce models like Amazon Prime, along with a slew of businesses powered by Shopify.

Meanwhile, omnichannel retail strategies, such as buy-online-pick-up-in-store (BOPIS) and mobile commerce, are transforming consumer shopping behaviors. After the significant expansion of the e-commerce space in the United States, it has become an innovative space for the most promising technologies related to digital retail, including AI-driven analyses, digital payment systems, and multi-level blockchain-based transactions, which are all continuing to receive significant investments.

France Has Rapid Growth Rate Of O2O (Online To Offline) With Its High Smartphone Penetration, Advanced Logistics Network, And Supported Digital Transformation Process From The Government Among other technologies, the French are embracing AI-powered e-commerce solutions, automated customer engagement tools and headless commerce architectures.

Secure digital payment systems including PSD2-compliant open banking and contactless transactions improve consumer trust toward online shopping. Other influential factors supporting market expansion include government regulatory frameworks like data privacy (GDPR) and ethical AI usage in e-business.

In luxury e-commerce and omnichannel retail, France is also at the top, where brands are utilizing virtual try-ons, AI-driven personalization, in-store digital experiences, and other tech-related integrations. The expansion of cross-border commerce and marketplaces helps to stimulates demand for digital commerce platforms.

India's digital commerce landscape is one of the most dynamic in the world, driven by widespread internet access, rising smartphone use, and government-backed digital projects such as Digital India and UPI (Unified Payments Interface). Mobile-first commerce platforms, the prominence of regional languages and AI-enabled personalization are driving e-commerce adoption waves across both urban and rural areas.

To meet digital consumers, small and medium-sized businesses (SMBs) are turning to cloud-based commerce solutions. The boom in social commerce, live shopping and influencer-led marketplaces are also changing online retail. Then international and local players, such as Flipkart, Amazon India and Reliance JioMart, are heavily investing in AI-powered logistics, last-mile delivery and hyper-personalized shopping experiences, making India a high growth emerging market in digital commerce.

The section contains information about the leading segments in the Digital Commerce Platform industry. By Component, the Digital Commerce Platform Solutions segment has holding the share of 61.3% in 2025. By Enterprise Size, the Small and Medium Enterprises (SMEs) segment is estimated to grow at a CAGR of 20.2% during the forecasted period.

| Component | Share (2025) |

|---|---|

| Digital Commerce Platform Solutions | 61.3% |

With the increasing adoption of cloud-based, AI, and API-first e-commerce platforms, Digital Commerce Platform Solutions account for the largest share of revenue in the market. Industry Common Integrations: Businesses across niches require end-to-end solutions that integrator with payment gateways, CRM, ERP, and Marketing Automation platforms. This market is driven by Legal Issues, increasing demand for Omni channel capabilities, growing mobile commerce, and headless commerce architectures.

Big corporations are focused on scalable, customizable and secure platforms that improve customer experience while simultaneously working for backend processes automation. The growth of AI-enabled personalization, real-time analytics, and fraud detection solutions solidify the graces of digital commerce platform solution, thereby raising the growth of the market. As businesses keep investing in solid e-commerce infrastructures, with advancements in automation, cybersecurity, and data-driven insights, this segment is expected to hold its dominance.

| Enterprise Size | CAGR (2025 to 2035) |

|---|---|

| Small and Medium Enterprises (SMEs) | 20.2% |

Cloud-based, cost-effective solutions, digital transformation, and increasing mobile commerce adoption in SMEs are driving it with the highest CAGR in Digital Commerce Platform Market. From a capital investment perspective, SME's are fast adopting low-code/no-code e-commerce platforms like Shopify, Woo Commerce, and Big Commerce to get awful to the internet.

Social commerce, influencer-led sales, and Direct to Consumer (DTC) models are also enabling SMEs to grow their businesses faster. Moreover, flexible pricing models, AI-powered automation, and integrations with payment solutions have made it easier for businesses to adopt digital commerce platforms.

The growing preference for online shopping with the added convenience propels market growth along with various government stimuli in favor of SME digitization and cross-border trade. With the continued integration of digital payments, logistics, and customer engagement, the SME segment is projected to be a core consumer of re-envisioning the market at a global level.

The Digital Commerce Platform Market is intensely competitive, with global tech giants, niche e-commerce solution providers, and up-and-coming start-ups all pushing the envelope. Enterprise and mid-market segments are well served by companies like Shopify, Adobe Commerce (formerly known as Magento), Salesforce Commerce Cloud, SAP Commerce Cloud, Oracle Commerce Cloud, which provide scalable, AI-driven, multi-channel solutions.

BigCommerce, Woo Commerce, and VTEX focus on SMEs and app-specific e-commerce use cases, made possible thanks to their cloud-native, API-first, and headless commerce traits. With the acceleration of AI-based automation, the emergence of blockchain payments and the integration of social commerce, the competition is heating up.

Players set themselves apart with advanced personalization, seamless integrations with third-party tools and real-time analytics. Meanwhile, as mobile commerce, AI and omnichannel retailing continue to grow, the market leaches are always upgrading their cybersecurity, automation and cross-border commerce capabilities to stay ahead.

Recent Industry Developments in Digital Commerce Platform Market

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 13.48 billion |

| Projected Market Size (2035) | USD 77.42 billion |

| CAGR (2025 to 2035) | 19.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and Thousand platform licenses for volume |

| Components Analyzed (Segment 1) | Digital Commerce Platform Solutions (Digital Commerce Platforms, e-Commerce APIs), Digital Commerce Platform Services (Design & Implementation, Consulting, Support & Maintenance) |

| Enterprise Sizes Analyzed (Segment 2) | Small and Medium Enterprises (SMEs), Large Enterprises |

| End-use Industries Analyzed (Segment 3) | Food & Beverages, Fashion & Apparels, Health & Beauty, Electronics, Automotive, Home & Furniture, Media & Entertainment, Others |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players Influencing the Market | Shopify, Adobe (Magento Commerce), Salesforce (Commerce Cloud), SAP Commerce Cloud, BigCommerce, Oracle Commerce Cloud, WooCommerce (Automattic), IBM Sterling Commerce, VTEX, Elastic Path |

| Additional Attributes | Accelerated digital transformation, Rise of headless commerce, Platform integration with AI and cloud-native services |

| Customization and Pricing | Customization and Pricing Available on Request |

In terms of Component, the segment is categorized into Digital Commerce Platform Solutions (Digital Commerce Platforms, e-Commerce APIs), and Digital Commerce Platform Services (which further includes Design & Implementation, Consulting, and Support & Maintenance).

In terms of Enterprise Size, the segment is distributed into Small and Medium Enterprises (SMEs) and Large Enterprises.

In terms of End-use Industry, the segment is classified into Food & Beverages, Fashion & Apparels, Health & Beauty, Electronics, Automotive, Home & Furniture, Media & Entertainment, and Others.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & pacific, Middle East and Africa (MEA) have been covered in the report.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Business Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Enterprise Size , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Business Type, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Enterprise Size , 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Business Type, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Enterprise Size , 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 18: Europe Market Value (US$ Million) Forecast by Business Type, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Enterprise Size , 2018 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 21: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 23: South Asia Market Value (US$ Million) Forecast by Business Type, 2018 to 2033

Table 24: South Asia Market Value (US$ Million) Forecast by Enterprise Size , 2018 to 2033

Table 25: South Asia Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by Business Type, 2018 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by Enterprise Size , 2018 to 2033

Table 30: East Asia Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 31: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Oceania Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 33: Oceania Market Value (US$ Million) Forecast by Business Type, 2018 to 2033

Table 34: Oceania Market Value (US$ Million) Forecast by Enterprise Size , 2018 to 2033

Table 35: Oceania Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 36: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: MEA Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 38: MEA Market Value (US$ Million) Forecast by Business Type, 2018 to 2033

Table 39: MEA Market Value (US$ Million) Forecast by Enterprise Size , 2018 to 2033

Table 40: MEA Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Component, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Business Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Enterprise Size , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Business Type, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Business Type, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Business Type, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Enterprise Size , 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Enterprise Size , 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Enterprise Size , 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 21: Global Market Attractiveness by Component, 2023 to 2033

Figure 22: Global Market Attractiveness by Business Type, 2023 to 2033

Figure 23: Global Market Attractiveness by Enterprise Size , 2023 to 2033

Figure 24: Global Market Attractiveness by End-use Industry, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Component, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Business Type, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Enterprise Size , 2023 to 2033

Figure 29: North America Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Business Type, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Business Type, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Business Type, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Enterprise Size , 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Enterprise Size , 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Enterprise Size , 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 46: North America Market Attractiveness by Component, 2023 to 2033

Figure 47: North America Market Attractiveness by Business Type, 2023 to 2033

Figure 48: North America Market Attractiveness by Enterprise Size , 2023 to 2033

Figure 49: North America Market Attractiveness by End-use Industry, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Component, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Business Type, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Enterprise Size , 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Business Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Business Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Business Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Enterprise Size , 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Enterprise Size , 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Enterprise Size , 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Component, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Business Type, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Enterprise Size , 2023 to 2033

Figure 74: Latin America Market Attractiveness by End-use Industry, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) by Business Type, 2023 to 2033

Figure 78: Europe Market Value (US$ Million) by Enterprise Size , 2023 to 2033

Figure 79: Europe Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 80: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 85: Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 86: Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 87: Europe Market Value (US$ Million) Analysis by Business Type, 2018 to 2033

Figure 88: Europe Market Value Share (%) and BPS Analysis by Business Type, 2023 to 2033

Figure 89: Europe Market Y-o-Y Growth (%) Projections by Business Type, 2023 to 2033

Figure 90: Europe Market Value (US$ Million) Analysis by Enterprise Size , 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Enterprise Size , 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Enterprise Size , 2023 to 2033

Figure 93: Europe Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 94: Europe Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 95: Europe Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 96: Europe Market Attractiveness by Component, 2023 to 2033

Figure 97: Europe Market Attractiveness by Business Type, 2023 to 2033

Figure 98: Europe Market Attractiveness by Enterprise Size , 2023 to 2033

Figure 99: Europe Market Attractiveness by End-use Industry, 2023 to 2033

Figure 100: Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 102: South Asia Market Value (US$ Million) by Business Type, 2023 to 2033

Figure 103: South Asia Market Value (US$ Million) by Enterprise Size , 2023 to 2033

Figure 104: South Asia Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 105: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: South Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 110: South Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 111: South Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 112: South Asia Market Value (US$ Million) Analysis by Business Type, 2018 to 2033

Figure 113: South Asia Market Value Share (%) and BPS Analysis by Business Type, 2023 to 2033

Figure 114: South Asia Market Y-o-Y Growth (%) Projections by Business Type, 2023 to 2033

Figure 115: South Asia Market Value (US$ Million) Analysis by Enterprise Size , 2018 to 2033

Figure 116: South Asia Market Value Share (%) and BPS Analysis by Enterprise Size , 2023 to 2033

Figure 117: South Asia Market Y-o-Y Growth (%) Projections by Enterprise Size , 2023 to 2033

Figure 118: South Asia Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 119: South Asia Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 120: South Asia Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 121: South Asia Market Attractiveness by Component, 2023 to 2033

Figure 122: South Asia Market Attractiveness by Business Type, 2023 to 2033

Figure 123: South Asia Market Attractiveness by Enterprise Size , 2023 to 2033

Figure 124: South Asia Market Attractiveness by End-use Industry, 2023 to 2033

Figure 125: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 127: East Asia Market Value (US$ Million) by Business Type, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) by Enterprise Size , 2023 to 2033

Figure 129: East Asia Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 137: East Asia Market Value (US$ Million) Analysis by Business Type, 2018 to 2033

Figure 138: East Asia Market Value Share (%) and BPS Analysis by Business Type, 2023 to 2033

Figure 139: East Asia Market Y-o-Y Growth (%) Projections by Business Type, 2023 to 2033

Figure 140: East Asia Market Value (US$ Million) Analysis by Enterprise Size , 2018 to 2033

Figure 141: East Asia Market Value Share (%) and BPS Analysis by Enterprise Size , 2023 to 2033

Figure 142: East Asia Market Y-o-Y Growth (%) Projections by Enterprise Size , 2023 to 2033

Figure 143: East Asia Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Component, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Business Type, 2023 to 2033

Figure 148: East Asia Market Attractiveness by Enterprise Size , 2023 to 2033

Figure 149: East Asia Market Attractiveness by End-use Industry, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: Oceania Market Value (US$ Million) by Component, 2023 to 2033

Figure 152: Oceania Market Value (US$ Million) by Business Type, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) by Enterprise Size , 2023 to 2033

Figure 154: Oceania Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 155: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: Oceania Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 160: Oceania Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 161: Oceania Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 162: Oceania Market Value (US$ Million) Analysis by Business Type, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Business Type, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Business Type, 2023 to 2033

Figure 165: Oceania Market Value (US$ Million) Analysis by Enterprise Size , 2018 to 2033

Figure 166: Oceania Market Value Share (%) and BPS Analysis by Enterprise Size , 2023 to 2033

Figure 167: Oceania Market Y-o-Y Growth (%) Projections by Enterprise Size , 2023 to 2033

Figure 168: Oceania Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 169: Oceania Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 170: Oceania Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 171: Oceania Market Attractiveness by Component, 2023 to 2033

Figure 172: Oceania Market Attractiveness by Business Type, 2023 to 2033

Figure 173: Oceania Market Attractiveness by Enterprise Size , 2023 to 2033

Figure 174: Oceania Market Attractiveness by End-use Industry, 2023 to 2033

Figure 175: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 176: MEA Market Value (US$ Million) by Component, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) by Business Type, 2023 to 2033

Figure 178: MEA Market Value (US$ Million) by Enterprise Size , 2023 to 2033

Figure 179: MEA Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 180: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 185: MEA Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 186: MEA Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Business Type, 2018 to 2033

Figure 188: MEA Market Value Share (%) and BPS Analysis by Business Type, 2023 to 2033

Figure 189: MEA Market Y-o-Y Growth (%) Projections by Business Type, 2023 to 2033

Figure 190: MEA Market Value (US$ Million) Analysis by Enterprise Size , 2018 to 2033

Figure 191: MEA Market Value Share (%) and BPS Analysis by Enterprise Size , 2023 to 2033

Figure 192: MEA Market Y-o-Y Growth (%) Projections by Enterprise Size , 2023 to 2033

Figure 193: MEA Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 194: MEA Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 195: MEA Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 196: MEA Market Attractiveness by Component, 2023 to 2033

Figure 197: MEA Market Attractiveness by Business Type, 2023 to 2033

Figure 198: MEA Market Attractiveness by Enterprise Size , 2023 to 2033

Figure 199: MEA Market Attractiveness by End-use Industry, 2023 to 2033

Figure 200: MEA Market Attractiveness by Country, 2023 to 2033

The global Digital Commerce Platform industry is projected to witness CAGR of 19.1% between 2025 and 2035.

The global Digital Commerce Platform industry stood at USD 13.48 billion in 2025.

The global Digital Commerce Platform industry is anticipated to reach USD 77.42 billion by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 20.5% in the assessment period.

The key players operating in the global Digital Commerce Platform industry include Shopify, Adobe (Magento Commerce), Salesforce (Commerce Cloud), SAP, Commerce, Cloud, BigCommerce and others.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA