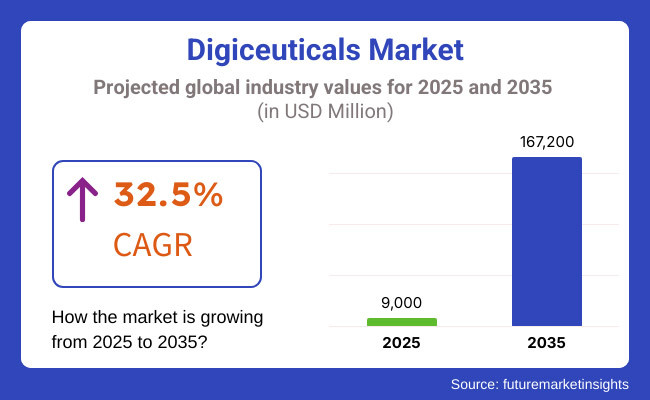

The digiceuticals market is projected to experience robust growth during the period 2025 to 2035, as the adoption of digital therapeutics continues to rise, along with increased endeavours in the development of AI-based healthcare solutions, and investments towards telemedicine and remote patient monitoring. Market Value and Growth with Change Data The market was valued at USD 9,000 million in 2025 and is projected to reach USD 167,200 million by 2035, reflecting an expanding CAGR of 32.5% in the forecast period.

The digiceuticals market is witnessing strong growth owing to the rising prevalence of chronic disorders along with the increasing demand for personalized and tech-driven healthcare solutions. However, with the incidence rate of chronic diseases such as diabetes, cardiovascular diseases, and mental health disorders rising exponentially, the opportunity presented by digital therapeutics (DTx) emerges as a beneficial device that you can reach out as a means of in enhancing patient care, going beyond the treatment to help close the adenine between treatment compliance as well as reducing healthcare spending.

Moreover, the emergence of artificial intelligence (AI), machine learning, and block chain has changed the market to allow data-oriented treatment modification, more secure management of patient data, and uninterrupted remote monitoring. Market growth is also being driven by regulatory approvals of digital therapeutics, as governments and healthcare organizations acknowledge their promise in enhancing patient outcomes.

While these innovations have made strides forward, the industry must grapple with significant challenges such as data privacy, regulatory complexities, and lack of reimbursement structures for digital therapeutics. While it can be efficient, the collection and storage of sensitive health data leads to cybersecurity risk-space, requiring strong compliance measures and security solutions.

Compounding the issue, disparate regulations globally make universal adoption challenging, and limited insurance coverage puts many digiceuticals out of reach of most patients. To overcome these hurdle, stakeholders are increasing investments in cybersecurity and building standardization for regulatory compliance as well as collaborations with healthcare practitioners to integrate digital therapies into traditional treatment frameworks. This work is imperative to the sustainability and accessibility of digiceuticals in the future of healthcare

Metric Overview

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 9,000 million |

| Market Value (2035F) | USD 167,200 million |

| CAGR (2025 to 2035) | 32.5% |

With the rising emphasis on AI-powered diagnostics, patient engagement platforms, and wearable health tracking solutions, the digiceuticals market as a whole is expected to experience a surge in growth in the next ten years. Driven by constant innovation, strong investor support, and a developing healthcare infrastructure, the sector is set for transformative and widespread growth.

Explore FMI!

Book a free demo

North America leads the digiceuticals industry, with the USA and Canada being major contributors to growth as they already have prompting healthcare infrastructure, high use of digitals and government policy favouring digital therapeutics. Chronic disease management, mental health solutions, and remote patient monitoring focus in the region are also expected to drive the market.

And these developments are accelerated by tech giants and pharmaceutical companies investing heavily into bringing digiceutical solutions to market. The market growth is restrained by stringent FDA approvals, data privacy concerns, and reimbursement complexities. To maximize treatment efficacy and bolster regulatory acceptance, companies are increasingly leveraging AI-driven personalized therapies and collecting real-world evidence.

Countries such as Germany, the UK and France are big markets for digiceuticals, which are seeing increasing levels of adoption alongside a strong regulatory landscape across Europe. In the European Union (EU), digital therapeutics (DTx) have been progressively recognized and promoted by the European Medicines Agency (EMA) and national health authorities, particularly in areas such as chronic disease management, mental health disorders, and rehabilitation programs.

EU's strategy to support the development of the ecosystem for digital health. Moreover, the EU digital health ecosystem is facing numerous challenges such as the fragmented regulation of digital technologies across member states and the threat posed by cybersecurity risks to the growth of the market. More and more companies are working together with care providers and insurers to incorporate digiceuticals into patient treatment programs.

Asia-Pacific is expected to commendably grow in the digiceuticals market due to increased usage of smartphones in the region, supportive government initiatives in the field of digital healthcare, and an increasing prevalence of chronic diseases. Countries including China, Japan, South Korea, and India are aggressively implementing digital therapeutics to enable remote patient consultation, mental health solutions and diabetes management.

Despite this massive potential for growth within the market, varying regulations in different regions of the world, restrictive reimbursement policies, and a lack of knowledge among the patient population have surfaced as barriers of adoption. However, rise in spending on telemedicine, Artificial Intelligence (AI)-based health applications and creative collaborations between technology companies and healthcare providers are boosting market growth in the region.

Challenges

Regulatory Uncertainty and Approval Complexities

The regulatory environment is complex and fragmented across various regions, which is one of the major challenges that the digiceuticals market faces. Digiceuticals-digital therapeutics used for disease management and treatment occupy a different zone than traditional pharmaceuticals, one that lies somewhere between software, medical devices, and drugs.

The FDA (USA), EMA (Europe), and MHRA (UK) are all still developing approval processes, potentially slowing the introduction of new solutions in the market. Also, clinical validation, compliance with data security, and approval for reimbursement add financial and operational challenges for the developers.

Opportunities

Growing Adoption of AI and Personalized Digital Therapeutics

As AI, machine learning, and real-time analytics take hold, digiceuticals are transforming mental health, chronic disease management, and neurological disorders. Dynamic, personalized digital therapeutics that analyse patient behaviour and dynamically adjust therapy are gaining traction.

The increasing utilization of telehealth, smartphone-based disease management, and digital biomarkers creates a compelling opportunity for companies that have invested in AI-driven, personalized therapy solutions. The move towards value-based healthcare models is further driving demand for digital therapeutics greater patient outcomes and reduced hospital visits.

From 2020 to 2024, the Mental Health Apps, CBT Solutions, and Chronic Disease Management's growth was the fastest to grow in the digiceuticals market. The COVID-19 pandemic quickly accelerated the acceptance of remote patient monitoring and AI-driven behavioural therapy solutions, although regulatory uncertainty and reimbursement challenges limited widespread connectivity and led to some hesitance in uptake.

AI powered, FDA-approved digital therapeutic applications will fast become standard practice from 2025 to 2035. The applications will be clinical in focus, especially with respect to dermatology, neurology, cardiology and metabolic disease. Progress in areas like wearable-integrated therapeutics and blockchain-secured patient data (in which the patient's own data is used to store clinical information) as well as decentralized clinical trials will propel the evolution of digiceuticals. The market will be further broadened by partnerships between biotech firms, AI companies, and healthcare providers, leading to greater acceptance in terms of both accessibility and regulation.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Unclear regulatory frameworks for digiceuticals |

| Technological Advancements | AI-powered mental health and chronic disease apps |

| Industry Adoption | Early adoption by mental health and diabetes care |

| Supply Chain and Sourcing | Limited partnerships between tech and pharma |

| Market Competition | Start-ups leading innovation, pharma companies lagging |

| Market Growth Drivers | COVID-19-driven demand for remote patient monitoring |

| Sustainability and Energy Efficiency | Focus on cloud-based, digital-only solutions |

| Consumer Preferences | Demand for app-based mental health and wellness |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Standardized global guidelines for digital therapeutics |

| Technological Advancements | AI-driven personalized therapy, digital biomarkers, and VR-based therapy |

| Industry Adoption | Widespread integration across neurology, cardiology, and cancer care |

| Supply Chain and Sourcing | Deep collaboration between biotech, AI, and healthcare firms |

| Market Competition | Pharma-tech partnerships dominating the market |

| Market Growth Drivers | AI-based drug optimization, VR-based therapies, and telehealth expansion |

| Sustainability and Energy Efficiency | Blockchain-secured, energy-efficient digital platforms |

| Consumer Preferences | Preference for personalized, AI-driven digital therapy solutions |

The global digiceuticals market is led by the United States, where the rapid adoption of digital therapeutics, increasing healthcare digitization, and strong regulatory support from agencies such as the FDA create a favourable environment. The country is one of the well-structured ecosystems for digital health solution with high penetration of smart devices, wearables and AI-based medical applications.

Digital therapeutics companies like Pear Therapeutics and Akili Interactive are broadening their addresses from mental health and chronic disease management to neurological problems and beyond. The increasing integration of digiceuticals with electronic health records (EHR) and telehealth platforms is also driving the growth of the digiceuticals market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 33.1% |

The UK digiceuticals market that is growing swiftly with the backing of the National Health Service (NHS) encouraging digital health solutions. Digital therapeutics are gaining traction, with increased demand for remote patient monitoring, mental health applications and chronic disease management tools. Plus, government-backed initiatives such as the NHS Apps Library and regulatory progress are helping ensure that safe, evidence-based digital treatments are adopted. Moreover, the increasing collaborations between pharma firms and health-tech start-ups are facilitating market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 31.5% |

European Union

Additionally, the market in the European Union is expanding significantly, which can be attributed to increased spending on the development of digital health, strict regulatory frameworks, and a growing acceptance of mobile health applications. Germany, France, and Sweden lead the way, most prominently in the case of Germany’s Digital Healthcare Act (DVG), which permits doctors to prescribe digital health applications that are covered by insurance. Rising applications of AI-based diagnostics, mental health treatments, and chronic disease management systems would further fuel the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 31.8% |

An ageing population, high smartphone penetration and government initiatives to encourage digital healthcare solutions are helping to grow Japan’s digiceuticals market. Digital therapeutics are growing in demand, including for diabetes management, cognitive health, and rehabilitation programs. Japanese technology conglomerates and pharmaceutical firms are joining forces to create advanced healthcare applications powered by artificial intelligence. Canada also features a solid regulatory framework for digital health solutions, which aids in fuelling market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 32.0% |

With cutting-edge digital connectivity, 5G infrastructure, and AI-enabled healthcare capabilities, South Korea has an excellent opportunity of becoming the next digiceutical seedbed. Also, in the country, multiple billions of dollars of money have flowed into a wide range of digital health start-ups, especially in mental health, chronic disease management, and rehabilitation therapy. The growth of the national healthcare programs, supported by government initiatives helping integrate digiceuticals therein, contributes to the growth of this market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 32.4% |

The digiceuticals market is expanding rapidly as digital health solutions are adopted more widely for the management of chronic conditions and behavioural health issues. Digiceuticals or digital therapeutics are clinically validated thermal software-driven interventions to treat different diseases.

These emerging technologies utilize mobile applications, wearable devices, and medical-grade digital platforms to provide digital therapeutic interventions with personalization, increasing patient compliance and improving health outcomes. With an increasing focus on preventive care and remote patient monitoring in healthcare systems worldwide, the demand for digiceuticals is increasing.

The efficacy of digiceutical solutions has also improved dramatically over recent years due to the growing sophistication of artificial intelligence (AI) and machine learning, as well as real-time analytics. Moreover, rising regulatory approvals and the integration of digital therapeutics into the conventional healthcare systems are bestowing momentum in growth of the market.

Pharma companies, technology companies, and healthcare providers are working together to offer innovative digital therapies to improve patient care making sure these therapies are evidence-based, non-invasive, and can quickly scale to large patient populations. As healthcare costs continue to rise, the focus of the industry is beginning to shift towards value-based care, which means that the digiceuticals market is likely to experience steady growth over the next few years.

Among the use segment, smartphones and medical device systems are emerging as the two main categories based on their availability and advanced therapeutic abilities.Smartphones are increasingly important enablers of the digiceuticals ecosystem, with mobile health applications developed for disease management, mental health therapy, and behavioural interventions.

We also have chronic condition management (CCM) apps, which offer features like real-time tracking of vitals, personalized coaching, and data analysis using AI to assist patients manage chronic conditions like diabetes, substance abuse, and respiratory diseases. The global smartphone penetration is at an all-time high, and as a result, the app-based digiceuticals are highly convenient, easy to use (the data can be received and interpreted remotely), and cost-effective, making them top grassroots level solutions preferred by both patients and healthcare providers. Moreover, digiceuticals that do not require smartphones are compatible with wearables and even cloud-based health systems to facilitate and personalize data-driven treatment methods.

They can be in the form of health solutions and connected medical devices that are FDA-approved to provide digital and connected therapeutic systems for patients in need of precision medicine to promote healthcare for complex disease conditions. These systems are made up of sensor-enabled devices, AI-driven diagnostics, and remote monitoring tools that offer actionable insights to healthcare professionals.

Digiceuticals are most valuable for chronic diseases like diabetes and pulmonary diseases when you need continuous data flow and automated intervention. Eventually, as the evolving regulatory frameworks adopt and endorse digital therapeutics, we can anticipate a broader adoption of medical device-based digiceuticals.

The growing integration of digiceuticals into diabetes management and substance abuse, both of which highlight the importance of digital therapeutic approaches, drives the application segment of the digiceuticals market. Diabetes management is, thus far, one of the most successful applications of digiceuticals; mobile apps and wearables enable continuous glucose monitoring, medication reminders and lifestyle coaching for patients.

Digital therapeutics complement self-management approaches to empower patients to control blood sugars with tailor-made interventions. Artificial Intelligence-based systems for insulin management, virtual consultations, and predictive analysis are revolutionising diabetes treatment, minimising hospital visits and increasing patient adherence. As digiceuticals become increasingly integrated with electronic health records (EHRs) and telemedicine platforms, their place in diabetes care is only being solidified.

Another fundamental driver of digiceutical adoption is substance abuse treatment, and digital therapeutics can provide users recovering from addiction with a novel and stigma-free intervention. Smartphone apps and wearables deliver therapeutic solutions, including cognitive behavioural therapy, mindfulness training, and remote counselling, giving patients the ability to seek treatment on their watch, so to speak, on their time, from anywhere.

AI-enabled support ecosystems identify relapse triggers, provide real-time behavioural coaching and establish links with the healthcare professionals and peer support groups. As the opioid crisis and other substance abuse disorders become serious public health issues, digiceuticals offer scalable, effective, evidence-based solutions to treat these conditions.

With further clinical validation and regulatory approvals, the digiceuticals market will grow as digital therapeutics become more mainstream. Using digiceutical platforms to treat patients, the ailment of the future will include smart and big data integrated with the patients so this treatment can be more efficient than ever before.

The digiceuticals market is expected to witness a significant growth owing to rising demand for digital therapeutics, artificial intelligence-based healthcare solutions, and personalized medicine. Market momentum is further propelled by the growth in chronic disease management solutions, mental health apps, and regulatory-approved digital therapies. We are witnessing the emergent cross-industry focus on potentially disruptive treatment solutions and adherence to all registries and regulatory frameworks to capture market share. Wearables, remote patient monitoring, and AI analytics are all changing the digital therapeutics landscape.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Pear Therapeutics | 18-22% |

| Omada Health | 12-16% |

| Click Therapeutics | 10-14% |

| Akili Interactive | 8-12% |

| Big Health | 5-9% |

| Other Companies (Combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Pear Therapeutics | Pioneer in prescription digital therapeutics (PDTs) for addiction recovery and mental health management. |

| Omada Health | Provides digital behavioural change programs for diabetes, hypertension, and mental health. |

| Click Therapeutics | Develops mobile-first digital therapeutics for depression, schizophrenia, and chronic pain management. |

| Akili Interactive | Specializes in FDA-approved video game-based therapy for cognitive disorders such as ADHD. |

| Big Health | Focuses on evidence-based digital mental health solutions, including insomnia and anxiety treatment. |

Key Company Insights

Pear Therapeutics (18-22%)

The market leader to date is Pear Therapeutics and its FDA-approved PDTs (prescription digital therapeutics). Its lead products, reSET and reSET-O, are for substance use disorders; Somryst specifically treats chronic insomnia. The transaction further reinforces the company's pipeline in neurology and mental health disorders.

Omada Health (12-16%)

Omada Health is a world leader in digital lifestyle interventions, including behavioural coaching programs for diabetes prevention; obesity management; and hypertension. Their AI-driven platform provides personalized healthcare delivery for chronic conditions.

Click Therapeutics (10-14%)

Targeting widespread mental health problems, Click Therapeutics is a leading mobile-oriented software platform to deliver prescription digital therapeutics through the integration of neuroscience and behavioural cognitive interventions. Their collaborations with pharmaceutical giants assist their market expansion.

Akili Interactive (8-12%)

Akili Interactive disrupted the field by creating video game-based cognitive therapy. Its first video game therapy for children with ADHD, called Endeavour Rx, is the first of its kind approved by the FDA. We're starting to expand this into neurological disorders and cognitive decline.

Big Health (5-9%)

Big Health empowers people to be their mental best through digital therapies based on the principles of cognitive behavioural therapy (CBT) to address insomnia and anxiety cheap, clinically validated and no drug solution. Their solutions, Sleepio and Daylight, are widely deployed in corporate wellness programs.

Additional Contenders (35-45% Combined)

Many emerging players are developing innovative solutions using AI, behavioural analytics, and real-world evidence. Notable companies include:

The overall market size for the digiceuticals market was USD 9,000 million in 2025.

The digiceuticals market is expected to reach USD 167,200 million in 2035.

The digiceuticals market is expected to grow at a CAGR of 32.5% during the forecast period.

The demand for the digiceuticals market will be driven by the increasing adoption of digital therapeutics, advancements in AI-driven healthcare solutions, and growing investments in telemedicine and remote patient monitoring. Technological innovations and regulatory support will further contribute to market expansion.

The top five countries driving the development of the digiceuticals market are the USA, China, Germany, Japan, and the UK.

Cold Relief Roll-On Market Analysis by Application, Distribution Channel, and Region through 2035

At-Home Micronutrient Testing Industry Share, Size, and Forecast 2025 to 2035

Bleeding Control Tablets Market Analysis - Growth, Applications & Outlook 2025 to 2035

Burn Matrix Devices Market Insights - Size, Share & Industry Growth 2025 to 2035

Chlorhexidine Gluconate Dressing Market Outlook - Size, Share & Innovations 2025 to 2035

Chloridometer Market Report Trends- Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.