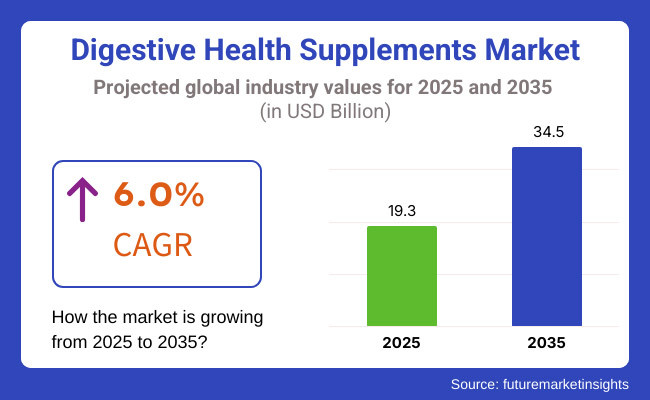

The digestive health supplements market is projected to reach USD 19.3 billion in 2025 and is on the verge of growing globally. Demand will grow at a CAGR of 6.0% between the predicted years 2025 to 2035 and the market size will be worth USD 34.5 billion in 2035.

Growth in demand is primarily driven by growing consumer interest in gut health, preventive medicine, and rising rates of digestive ailments such as bloating, acid reflux, and irritable bowel syndrome (IBS). As a result, the industry for probiotic, prebiotic, and enzyme-supplement products is receiving a lot of attention in international markets.

Digestive health supplements are contending for that serious peak wellness space in consumers’ lives, seeking natural, effective, and scientifically elite ways to improve gut health. Increasing knowledge of the gut microbiome and its influence on general health has led to changes in diet and the consumption of functional supplements.

Nestlé Health Science, as well as competitors Danone and Bayer AG, are broadening their product offerings with new formulae, acquisitions, and investments in research. We also see significant growth with products that address whole digestive health, including fiber, enzymes and gut-supportive organisms.

Rising demand for organic and plant-based supplements is among the major factors responsible for the growth of this industry. In addition, consumers are increasingly opting for clean-label products free from synthetic additives, GMOs and artificial preservatives. Companies like Garden of Life and Renew Life are capitalizing on this trend by offering probiotic and fiber-rich formulas, catering to evolving consumer demands.

The changing glint of e-commerce and the emergence of the direct-to-consumer (DTC) model are transforming the landscape, allowing us, the likes of Seed and Ritual, to offer subscription-based probiotic supplements that give assurance of consistent customer retention and engagement.

While the outlook is positive, the digestible health supplements industry is pursued by various challenges, such as stringent regulatory environments, the cost of product development, and industry saturation. Companies must adopt local and international food safety guidelines, demonstrating proof of product efficacy and consumer protection. Moreover, the rising popularity of diets, such as fermented foods and high-fiber diets, poses a threat to solution-based supplements.

Furthermore, low-quality and counterfeit probiotic products threaten consumer trust and long-term industry stability.

Trends in the personalized nutrition industry provide new opportunities for stakeholders within the field. The fusion of AI-driven gut microbiome analysis and customized supplement recommendation is accelerating, enabling companies to develop precision-targeted supplements. Investments in clinical research and partnerships with healthcare professionals are also boosting brand credibility and consumer trust.

In addition, advances in probiotic delivery systems through microencapsulation technology are improving supplement efficacy through better absorption and stability. With an ever-growing interest in digestive health, companies prioritizing innovation, transparency, and sustainability will undoubtedly lead the way in this booming industry.

Explore FMI!

Book a free demo

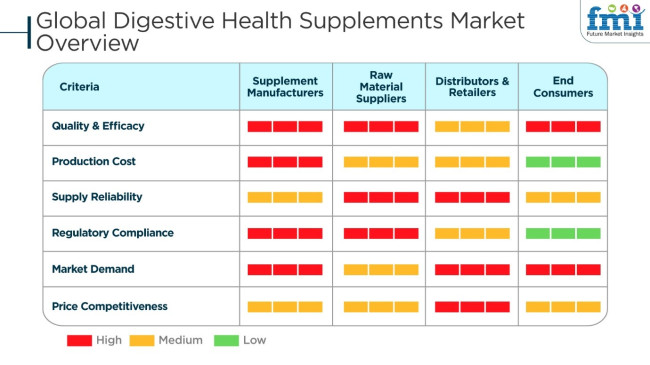

The industry is growing robustly with growing consumer interest in gut health, expanding digestive disorders, and the move toward preventive care. Manufacturers target superior ingredients like probiotics, prebiotics, enzymes, and fiber to formulate effective products under strict regulation. Raw material suppliers focus on consistency and purity to meet the growing demand for natural and organic materials.

Online and offline retailers and distributors focus on product availability, stability of shelf life, and competitive prices to address growing consumer demand. Consumers want supplements that ease digestion problems, promote gut microbiome balance, and facilitate the absorption of nutrients, thereby propelling the trend for clean-label, allergen-free, and clinically tested products.

The trend is also led by plant-based foods, functional foods, and personalized nutrition food and beverages, and digestive health supplements become part of modern wellness routines.

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and the current year (2025) for the global industry. This analysis reveals crucial shifts in performance and indicates revenue realization patterns, providing stakeholders with a clearer vision of the industry's growth trajectory over the decade.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 5.4% |

| H2 (2024 to 2034) | 6.0% |

| H1 (2025 to 2035) | 5.5% |

| H2 (2025 to 2035) | 6.2% |

The first half of the year (H1) spans from January to June, while the second half (H2) includes the months from July to December. In the first half (H1) of the decade from 2025 to 2035, the industry is projected to grow at a CAGR of 5.4%, followed by a marginally higher growth rate of 6.0% in the second half (H2).

Moving into the subsequent period, from H1 2026 to H2 2035, the CAGR is expected to increase to 5.5% in the first half and maintain a steady 6.2% in the second half. In H1, the sector experienced an increase of 10 BPS, while in H2, the industry recorded a 20 BPS gain, indicating a strong trajectory toward sustained expansion.

The global sales of the digestive health supplements have increased at a CAGR of 5.4% in 2020 to 2024. The growth rate for the sales of digestive supplements is expected to accelerate to 6.0% CAGR between 2025 and 2035 because of the increasing interest among consumers about gut health. The increasing occurrence of bloating and acid reflux has boosted demand for special types of supplements. Customers are becoming more active and focusing on maintaining their digestive health.

The industry is based on the difference in attitudes relating to the new approaches of clean-label and plant-based formulation. The health of the gut microbiome is related to a person's immunity. An increasing number of people have become aware of this fact, thereby increasing demand across various age groups, which ranges from young to old.

Moreover, it has contributed to consumer trust in the innovations that have come about in the design of supplements, such as multi-strain probiotics and customized digestion solutions.

Digital marketing and e-commerce play a crucial role in penetrating the industry with direct-to-consumer brands widening their base. Subscription-based offers and personalized suggestions rendered via supplements contribute to industry expansion. An increase in consumption awareness coupled with product availability is expected to leave the global industry for digestive health supplements in a stable trajectory of growth throughout the forecast period.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growing consumer knowledge on gut health and its relationship to overall wellness, propelling demand for probiotics, prebiotics, and fiber supplements | Increased emphasis on the gut microbiome and personalized nutrition, fueling more sophisticated formulations for targeted digestive health requirements |

| Probiotic supplements lead the market, with robust demand from yogurt, capsule, and powder-based products | Synbiotics (probiotics + prebiotics) and postbiotics have broader applications, extending gut health benefits and product innovation |

| North America and Europe as primary markets with stable demand fueled by healthy-minded consumers and policy support | Healthy industry growth in Asia-Pacific and Latin America attributable to growing awareness, urbanization, and lifestyle changes |

| Modest scientific evidence for benefits on digestive health with continued investigations in gut-brain and gut-immune relations | Robust clinical substantiation and regulatory authorizations for broadened health benefits reinforcing consumer trust |

| Supply chain interference impacting probiotic strain availability and raw material supply | Enhanced fermentation technology, local sourcing models, and diversified supply chains for better product availability and stability |

| R&D targeted at enhancing survival rates of probiotics and stability during storage and consumption | Expanded research on next-generation probiotics and microbiome-modulating ingredients for greater digestive health efficacy |

| Increasing demand for clean-label, organic, and plant-based digestive health supplements | Increasing popularity of sustainable packaging, carbon-neutral manufacturing, and responsibly sourced ingredients to meet environmentally aware consumer values |

The digestive health supplements business is globally operated at risk affected by the regulatory compliance matters, the raw material supply and industry changes, conflicting producer and consumer interests, and industry competition.

The biggest regulatory challenge is that digestive health supplements are classified as dietary supplements in different parts of the world. Such agencies as USA FDA, EFSA, which works in Europe, and FSSAI in India give out stringent requirements regarding ingredient safety, labeling, health claims, and clinical evidence. Non-compliance can cause the products involved to be recalled, penalties imposed, as well as damage to the manufacturer's reputation.

The raw material availability is somewhat related to discarding due to probiotics, prebiotics, digestive enzymes, and fiber compounds being the main components of digestive supplements. Disruptions in the supply chain, agricultural production, and climate change can all lead to the extent of fluctuation of prices and the sources that are at risk of being exhausted.

The consumers' interests firstly evolve towards more natural, organic, and plant-based supplements. The brands insisting on innovation or changing formulations based on trending topics, i.e. the gut microbiome field and personalized nutrition, shall be in a serious danger of industry massacre.

The price of raw materials is a key contributor to product costs, and supply chain problems can complicate the situation. Distributing low transportation costs, ingredient elapses, and barriers to international trade can impact the stocks, thus initiating delays in the delivery and higher costs.

The industry area is indeed highly competitive with both the well-known companies and new enterprises gaining industry share with the right drugs, branding, and formulation innovation. Newer companies highlighted on the specific data of clinical validation, sustainability, or unique formulations are more likely to do well in today`s growing global industry while the old ones that seem to maintain their original products would lose success.

Probiotics account for roughly 42% of the global industry share, as increasing consumer awareness about gut microbiome health propels the industry. Popular strains backed by science are Lactobacillus and Bifidobacterium, which are connected to digestion, immunity, and the balance of gut flora. Key brands, including Danone (Activia), Nestlé (Garden of Life), and Procter & Gamble (Align), are expanding with multi-strain formulations tailored to a range of health needs.

Growing cases of constipation, bloating, and acid sulphurization continue to augment the growth of the probiotics industry, along with the robbery of probiotic functional foods and beverages. Additional sales have been contributed via e-commerce that offers clinically validated alternatives. This is supported by sustained investment in probiotic innovation.

Prebiotics constitute an estimated 26% of the global industry, fueled by growing awareness of gut microbiome support and the broader category of digestive wellness. Unlike probiotics, which are the health-promoting microorganisms themselves, prebiotics are non-digestible fibers that ferment in the colon and increase the populations of microorganisms in the gut, assisting the good bacteria.

Industry leaders like BENEO (Orafti Inulin) and Cargill (Fibersol-2), are developing new innovative prebiotic formulations to stimulate fiber consumption and gut health benefits.

With the rising prevalence of gastrointestinal diseases, obesity, and metabolic disorders, consumers are seeking inulin, fructooligosaccharides (FOS), and galactooligosaccharides (GOS) as supplements or through functional foods. The rising prevalence of prebiotic fortified beverages, dairy, and ough foods has contributed to the growing industry penetration of prebiotic ingredients.

Honaletics expects demand for its prebiotic to be high due to increasing research into its use in mental health and immune modulation, said Carlos Vane and Paul Nicolas of the company.

By form type, capsules were the leading segment of the global industry, with a share of almost 38% in overall sales, owing to their high bioavailability, longer shelf life, and convenience in consumption. Some of the top brands in the probiotics and enzymes space like Nature's Bounty, Culturelle, and Renew Life have advanced formula capsules with delayed release and enteric coating for stomach acid survival.

Capsugel (Lonza) and ACG Group created plant-based cellulose capsules that replace gelatine-based alternatives as consumer demand rises for clean-label and vegan options. "Across a spectrum of tailored formulations, we are seeing traction with single-strain and multi-strain probiotics, enzyme complexes, and prebiotic blends.

Likewise, the e-commerce boom and preference for clinically validated, premium supplements continue to drive capsule sales, leading other formats in the digestive health category.

Tablets represent an estimated 29% of the worldwide industry and are seen as an affordable option that provides accurate dosing in a shelf-stable format. Firms, including NOW Foods, Schiff (Digestive Advantage), and Solgar, are developing gummy, fast-melting, and coated tablet formulations to improve flavor and absorption.

The demand for new formulations, particularly in the prebiotics and the enzyme supplements segment, for the effervescents and chewable tablets is expected to rise through 2023 as they are easy to digest and can be eaten on the go. Such alternative products include sugar-free and flavored probiotic tablets from companies like Jamieson and Swisse to appeal to health-conscious consumers.

In the digestive health segment, tablets are a key player-a awareness of the industry top player in several mass-market and drug and pharmacy retail lanes, Fallar opened, which continuous advances in compression technology and bioavailability.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

| China | 7.9% |

| India | 4.5% |

| Japan | 3.8% |

The USA is a leader in the global industry for digestive health supplements, with a forecasted CAGR of 6.5% from 2025 to 2035. Increasing consumer understanding of gut health and its role in well-being has contributed to industry expansion.

The rising prevalence of digestive disorders like irritable bowel syndrome and gastroesophageal reflux disease has increased the demand for probiotics, prebiotics, and enzyme-based supplements. Product development and delivery innovations continue to attract health-conscious customers.

Expanding e-commerce platforms have also increased accessibility, making these supplements more widely available. The presence of industry participants and positive regulatory conditions support industry growth. FMI believes that the USA industry is set to grow at 5.4% CAGR during the research period.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Growing Consumer Awareness | More consumers recognize the value of gut health to overall wellness. |

| Higher Incidence of Digestive Disorders | More consumers seek out probiotics and enzyme-based supplements. |

| Product Innovation | Better formulations and innovative delivery systems enhance efficacy. |

| More Online Shopping | Online platforms increase convenience and accessibility. |

The Chinese industry is growing fast and is anticipated to reach a CAGR of 7.9% in the forecast period of 2025 to 2035. Growing health awareness and the rising prevalence of digestive disorders due to urbanization fuel growth. Consumers are looking for herbal and natural supplements which align with traditional Chinese medicine practices.

Government support for the health supplement industry and aggressive growth in high-speed online distribution channels have also boosted product availability. Local players continue R&D expenditure to launch new products, and international brands are making an entry through strategic alliances. Increasing the disposable incomes of China's growing middle class further supports the increase in industry growth.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| Transition to Natural Supplements | Traditional Chinese medicine influences consumer behavior. |

| Government Policies | Policy initiatives strengthen the health supplement industry. |

| E-commerce Expansion | Online platforms increase the availability of digestive supplements. |

| Emerging Middle-Class Demand | Rising disposable incomes encourage supplement purchases. |

Food culture, urban life, and a rise in gastrointestinal diseases have boosted demand for digestive health products. Prebiotics and probiotics are finding their way into everyday diets by consumers because they are believed to provide several health advantages. Ayurveda drives industry demand, and high-end demand is present for natural and herbal supplements.

Incentives by the government for wellness and preventive care and the growth of the nutraceuticals business have given healthy industry conditions to grow. Increased accessibility through digital channels makes the products available to urban and rural customers.

FMI considers the Indian industry to grow at 4.5% CAGR over the study period.

Growth Drivers in India

| Key Drivers | Details |

|---|---|

| Increasing Health Consciousness | Shoppers adopt digestive supplements for better well-being. |

| Ayurvedic Influence | Traditional medicine boosts the demand for herbal supplements. |

| Government Health Campaigns | Preventive healthcare programs encourage supplement adoption. |

| E-commerce Development | Online platforms widen industry reach. |

There is a high demand for quality, evidence-based digestive health products, especially from age groups. Probiotic, prebiotic, and enzyme-rich functional foods are tolerated as a part of a normal diet.

Japan's dependence on imports of digestive health supplements from the USA and EU has helped to give its industry a premium character. R&D in domestic companies focused on enhanced probiotic functionality and bioavailability of supplements. Growth in specialty health store outlets and pharmacy-based retailing of supplements also supports industry growth.

According to FMI. The Japanese industry for digestive health supplements is anticipated to register a 3.8% CAGR during the forecast period.

Growth Drivers in Japan

| Key Drivers | Details |

|---|---|

| Aging Population | Older consumers prioritize digestive health. |

| Scientific Research in Probiotics | R&D enhances the bioavailability and efficacy of probiotics. |

| Premium Supplement Industry | Japan imports high-quality digestive supplements. |

| Growing Health Retail Chains | Pharmacy-led distribution increases availability. |

The industry for digestive supplements is growing rapidly. Gut health becomes the target of most consumers because it is fundamental for a well-rounded, healthy life. It also fuels awareness of probiotics, prebiotics, and digestive enzymes, thus raising the bar for the manufacturing of research-driven formulations, functional ingredients innovation, and personalized nutrition.

Leading players such as Amway, Bayer AG, Pfizer Inc., and Nestlé Health Science dominate the industry, leveraging extensive distribution networks, clinical research, and strategic acquisitions to expand their digestive health portfolios. These firms are working on probiotics, enzyme blends, and fibre-based supplements supported by solid science for how they can help meet consumer needs for immune support as well as health for the gastrointestinal tract.

Competition among start-ups and niche brands is made with a lot of clean labels- or organic- or strain-specific types of probiotic formulations engineered to heal the gut microbiome. Sustainability and regulatory compliance are the key industry factors, with companies adopting eco-friendly packaging, transparent sourcing, and pretty much strict adherence to the evolving health standards.

Competitive advantage will be up for grabs in this dynamic industry for brands that embrace innovation, scientific validation, and consumer education.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Amway Corp | 10-15% |

| Bayer AG | 8-12% |

| Pfizer Inc. | 6-10% |

| Nestlé Health Science | 6-9% |

| Herbalife Nutrition Ltd. | 5-8% |

| Other Players | 45-60% |

| Company Name | Key Offerings/Activities |

|---|---|

| Amway Corp | Dominates the industry with personalized nutrition solutions and probiotic-based digestive supplements. |

| Bayer AG | Offers science-backed digestive health products, including probiotics and fiber supplements. |

| Pfizer Inc. | Expanding its consumer health segment with innovative gut health formulations. |

| Nestlé Health Science | Invests in research-driven probiotic and prebiotic formulations for digestive wellness. |

| Herbalife Nutrition Ltd. | Specializes in dietary supplements, focusing on herbal and natural digestive health solutions. |

Key Company Insights

Amway Corporation (10-15%)

Dominant in the dietary supplements category and offering probiotic and gut health solutions based on personalized wellness.

Bayer AG (8-12%)

Excellent ranges of digestive health supplements that provide trust to consumers through clinical research.

Pfizer Inc. (6-10%)

Strengthening its presence within the wellness segment through innovative gastrointestinal health supplements.

Nestlé Health Science (6-9%)

Engages in scientist-backed probiotic and prebiotic formulations to help with digestive disorders.

Herbalife Nutrition Ltd. (5-8%)

Offers herbal-based digestive health supplements targeting weight management and gut health.

Other Key Players (45-60% Combined)

Kirin Holdings

In August of the year 2024, Kirin Holdings bought the controlling stake in supplement maker Fancl to stay away from the unhealthy financial crisis occasioned by the dwindling alcohol industry and broaden its reach into the health sector.

Coca-Cola

Coca-Cola expects to finish the prebiotic soda manufacturing with the brand name 'Simply Pop' after completion by February 2025, so many flavors of strawberry and pineapple mango are prebiotic fiber and vitamins fortified.

PepsiCo

For spring 2025, the company set its sights on releasing its very own prebiotic soda. With this product, PepsiCo steps into a burgeoning industry for gut health with beverages that include prebiotic fibers and have been said to support digestive health.

The industry is slated to reach USD 19.3 billion in 2025.

The industry is predicted to reach a size of USD 34.5 billion by 2035.

Key companies include Amway Corp, Bayer AG, Pfizer Inc., DSM N.V., Lonza Group Ltd., The Bountiful Company, NOW Foods, Herbalife Nutrition Ltd., Alimentary Health Limited, and Nestlé Health Science.

China, slated to grow at 7.9% CAGR during the forecast period, is poised for the fastest growth.

Probiotics are being widely used.

By product type, the industry is segmented into prebiotics, probiotics, enzymes, and others.

By form, the industry is segmented into capsules, tablets, powder, and others.

By distribution channel, the industry is segmented into offline channel and online channel.

By region, the industry is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

Food Grade Lubricant Market Analysis by Base Oil Type, Product Type and Application Through 2035

Yeast Extract Market Analysis by Type, Grade, Form, and End Use

USA Bubble Tea Market Analysis from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.