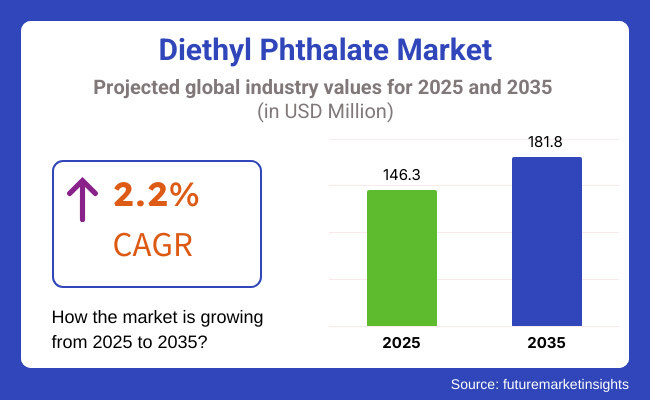

The diethyl phthalate market is likely to grow moderately during the forecast period, 2025 to 2035, attributed to growing demand for plasticizer, cosmetics and personal care and pharmaceutical applications. In 2025 the market was valued at USD 146.3 million and in 2035 is projected to be worth USD 181.8 million, according to a CAGR of 2.2% during the respective years.

Supporting this growth are a number of factors, the increasing use of diethyl phthalate (DEP) in coatings, adhesives, and fragrances, plus growing applications in cellulose-based plastics. Moreover, increasing transitions towards safer plasticizers along with technological advancements in DEP alternatives are providing the momentum for market growth.

However, other factors such as environmental concerns, stringent regulations toward phthalates and increasing demand for bio-based plasticizers is hindering the market growth. Due to these issues, industry actors are more toward sustainable formulations, regulatory compliance, and R&D in alternative plasticizers.

Over the next decade, the diethyl phthalate market would be affected by trends such as growing emphasis on green plasticizers, increase in demand for DEP in niche applications, and new techno advancements in greener Ingredients for packaging materials. Yet market slow but steady growth is expected to continue, driven by constant reformulation innovations, partnerships with key stakeholders in different industries, and compliance with significant forward-looking regulations.

Explore FMI!

Book a free demo

Diethyl phthalate market in North America accounts for a significant share, due to its growing usage in personal care products, cosmetics, and plastic. The United States and Canada are major contributors with a strong chemical manufacturing base and rising demand for flexible plastics in the packaging and automotive sectors.

On the other hand, regulations on phthalates by FDA, EPA and other agencies are acting as a restraint in the growth of the market. In North America, companies are working to develop bio-based plasticizers and diethyl phthalate alternatives to meet changing government and consumer regulations around environmental and safety standards while still delivering the same performance consumers expect from these chemicals.

Leading producers and consumers cluster in Germany, France, and the UK, making Europe a major player in the diethyl phthalate market. The region has robust pharmaceutical, cosmetic and plastics industries, which are driving the market. The industry must move to safer substitutes, as REACH implementation is strict, and consumers are becoming increasingly aware of the potential health risks associated with these phthalates.

Plastics manufacturers in various European Countries are undertaking heavy research development to develop sustainable plasticizers, along with innovative formulations which can comply with stringent regulatory requirements. Increased demand for eco-friendly packaging and biodegradable plastic also drives the change towards alternatives.

Asia Pacific is the fastest growing region in diethyl phthalate market, owing to the growing industrial and consumer goods sectors within China, India, Japan and South Korea. Diethyl phthalate is in demand due to the rapidly growing cosmetics, plastic manufacturing, and pharmaceutical industries across the region.

Although the market is quickly growing, concerns surrounding the risk of phthalate exposure, along with an increase in restrictions in developed nations, could curtail demand over the long-term. Nonetheless, companies are investing in technology, processes, and product innovation to comply and secure their place in the future marketplace.

Challenges

Regulatory Restrictions and Health Concerns

Industry research indicates that one of the key impediments to the growth of the diethyl phthalate (DEP) Market includes intensifying regulations due to health and environmental concerns. DEP is commonly used as a plasticizer in consumer products, personal care products, and industrial applications, although regulations have tightened in many areas over concerns regarding its impact on human health and the environment.

Government bodies like the European Chemicals Agency (ECHA) and the USA Environmental Protection Agency (EPA) are clamping down on phthalate use in cosmetics, pharmaceuticals and plastics. This may have potential to restrain market growth and compel manufacturers to look for alternative plasticizers, thus augmenting costs and challenges in production.

Opportunities

Growing Demand in Emerging Economies

The increasing demand for diethyl phthalate in emerging economies is an opportunity despite regulatory challenges. Rapid industrialization and rising demand for DEP in plastic production, coatings, and fragrance formulations are observed in Asia-Pacific, Latin America, and Africa.

Furthermore, increasing cosmetic and personal care germination in different nations coupled with the remarkable growth of these industries in countries namely India, China and Brazil are escalating the market demand of DEP as a solvent and fixative for perfumes and lotions. The evolving market is expected to thereby, forward the upper hands to the companies which are investing heavily in these high-growth regions, as well as innovating bio-based alternatives.

The diethyl phthalate market faced regulatory limitation from 2020 & 2024 and a movement towards eco-friendly products contributed to its fluctuations. Though demand for DEP remained stable in the production of cosmetics, printing inks, and pharmaceuticals, sustainability issues prompted manufacturers to explore alternative formulations and greener production processes. Disruptions in supply chains and volatility in the prices of raw materials also shaped market dynamics.

2025 to 2035: A slow shift from phthalates to bio-based plasticizers along with tighter environmental regulations. This, in turn, will spur innovation for sustainable, non-toxic plasticizers, with firms moving to renewable feedstock’s and biodegradable options. Long term market outlook will hinge on advancements in green chemistry and adherence to regulatory compliance.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Increasing restrictions on phthalates |

| Technological Advancements | R&D in alternative plasticizers |

| Industry Adoption | DEP still widely used in cosmetics and coatings |

| Supply Chain and Sourcing | Raw material price fluctuations |

| Market Competition | Presence of traditional chemical manufacturers |

| Market Growth Drivers | Demand from cosmetics and plastic manufacturing |

| Sustainability and Energy Efficiency | Initial investment in greener production methods |

| Consumer Preferences | Use of DEP in personal care and industrial coatings |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Strict bans and shift toward non-toxic plasticizers |

| Technological Advancements | Growth in bio-based and biodegradable plasticizers |

| Industry Adoption | Gradual transition to eco-friendly alternatives |

| Supply Chain and Sourcing | Focus on sustainable and renewable feedstock’s |

| Market Competition | Rise of eco-conscious chemical companies |

| Market Growth Drivers | Growth in green chemistry and sustainable alternatives |

| Sustainability and Energy Efficiency | Large-scale adoption of environmentally friendly processes |

| Consumer Preferences | Shift toward non-toxic, eco-friendly ingredients |

The United States leads the global diethyl phthalate (DEP) market backed by a solid industrial sector, especially cosmetics, personal care and plastics production. Market growth is primarily driven by the increasing demand for DEP in the manufacture of perfumes, coatings, and cellulose-based plastics. But pressure from regulators on phthalate use, especially from agencies such as the USA Environmental Protection Agency (EPA) and Food and Drug Administration (FDA) is moving manufacturers into alternatives to plasticiser. Even amidst stricter regulations, the presence of large chemical companies and continuous improvements in the formulation mix result in stable market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 1.9% |

The United Kingdom diethyl phthalate market is moderately growing on account of its demand in fragrance, pharmaceutical and coatings industries. As concerns about plasticizers grow and environmental agencies impose regulatory restrictions on their use, the market is making a clear move toward bio-based solutions.

However, the ongoing application of DEP in non-banned areas, including but not limited to personal care products and inks, is maintaining demand. Also, the demand for safer plasticizer formulations is driving the future market trends in the region.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 1.7% |

The diethyl phthalate market is regulated in the European Union and is governed by the European Chemicals Agency (ECHA) and the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) policy. However, many industries are now slowly replacing DEP with safer alternatives, which, in turn, is restricting the growth of overall market over the middle forecast period.

That said, there is still a need for cellulose in specific applications, such as coatings, cellulose-based plastics, and several pharmaceutical recipes. An increased focus on sustainability is also leading to the development of eco-friendly plasticizers, which could change the future of the DEP market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 1.6% |

Japan's diethyl phthalate market is stable and finds application in cosmetics, packaging, and industrial solvent. Despite government regulations and consumer preferences decreasing the usage of DEP in some applications, demand remains in niche markets like inks, coatings, and adhesives. Japan has a well-established chemical industry with much focus on R&D, and companies there are developing alternatives to phthalate plasticizers that could shape the long-term market landscape as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 1.8% |

DEP market in South Korea is driven by the cosmetics, personal care, and flexible packaging industries. As DEP acts as a solvent used in fragrance formulations, the presence of prominent beauty and personal care brands households the demand for DEP. But increasing awareness of health risks posed by phthalates is hastening the switch to safer alternatives. This is because bio-based plasticizer production has expanded, and regulatory efforts acknowledge the potential for making a bigger impact over the coming years.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 1.9% |

The diethyl phthalate market is growing at a faster pace with considerable growth rates over the last few years and is estimated to grow in the forecasted period. Diethyl phthalate (DEP), which is a colourless and odourless liquid that is mainly used in making a plasticiser which is used to make plastics such as polyvinyl chloride more flexible and harder. It also acts as a solvent and binder in many consumer and industrial products. The growth of market is driven by DEP's rising use in personal care products, pharmaceutical formulations, and industrial applications.

Key Manufacturers are focusing on developing high-purity DEP formulations for compliance with changing regulatory standards and environmental concerns. Larger focus on sustainable and bio-based alternatives, has also led to innovations in production processes. In addition, new chemical synthesis and purification techniques are kata-by-kata to improve product quality and consistency. DEP is a versatile solvent used across various sectors, and the market is likely to grow at a steady pace in the coming years with the increasing adoption of DEP across industries.

By grade type, high purity diethyl phthalate (≤ 99%) has reigned both on performance and regulatory compliance and has emerged as the most lucrative segment. Diethyl Phthalate is a high-purity grade (< 99%) used in demanding applications where stringent quality control and low impurities are required.

This is the preferred grade for the pharmaceutical and cosmetic industry that is highly concerned with purity and safety. DEP is used as a solvent in perfumes, common care, and coatings to achieve the most effective formulation stability and duration. As consumers are becoming increasingly concerned about product safety and regulatory authorities are imposing stricter guidelines, the demand for high-purity DEP is also rising in international markets.

Industrial-grade DEP is also used in a number of applications including polymer processing, adhesives and specialty coatings. Although this portion is still relevant today, manufacturers are slowly transitioning to high-purity formulations to address industries that demand improved product performance and regulatory compliance issues.

Diethyl phthalate market application segment is mainly driven by plasticizer and solvent application of DEP owing to its chemical stability and property of enhancing flexibility. Plasticizers, a type of chemical added to plastics and other materials to increase their flexibility and utility, holds a major share in the DEP market. Common uses include improving the elasticity and workability of cellulose acetate, polyvinyl acetate and other polymer-based products.

DEP plasticizers are utilized extensively in industries like automotive, construction and packaging for improving the strength and performance of plastic components. Increasing plasticizer demand in the end-user industries will drive by the need for lightweight and flexible materials.

Additionally, solvent applications are also fuelling the growth of the diethyl phthalate market, wherein it is currently utilized in cosmetics, pharmaceuticals, and coatings. DEP is widely used as a highly effective solvent for preparation of fragrances, nail polishes and aerosol sprays. Furthermore, its applications in pharmaceutical coatings, as well as ink formulations further highlight its versatility. The rising demand for high quality personal care products and pharmaceuticals is expected to supplement the demand for DEP in the solvent applications.

With evolving regulatory standards and the demand from various industries for high-performance chemical solutions, the diethyl phthalate market will likely continue to expand. The market trajectory in the coming years will be characterized by continuing developments in sustainable production methods, along with increasing DEP demand from the primary industrial sectors.

The Diethyl Phthalate (DEP) market is anticipated to grow in the forecast, owing to the increasing demand from cosmetics & personal care, plasticizers, pharmaceuticals, and other industrial applications. The continued prevalence in the market can be attributed due to wide use of DEP as solvent, fixative, and plasticizer in end-user industries.

Moreover, booming demand for flexible plastics, fragrances, and coatings is fuelling sector growth. The future of the coatings industry is influenced by advances in chemical formulations, regulatory compliance measures, and sustainable alternatives. To remain competitive, market participants are working on improving production efficiencies, implementing environmentally friendly processes, and complying with strict environmental regulations.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Eastman Chemical Company | 20-25% |

| Merck KGaA | 15-20% |

| Thermo Fisher Scientific | 12-16% |

| Alfa Aesar | 8-12% |

| Tokyo Chemical Industry (TCI) | 5-9% |

| Other Companies (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Eastman Chemical Company | Leading supplier of high-purity diethyl phthalate, widely used in plasticizers, coatings, and personal care applications. |

| Merck KGaA | Specializes in pharmaceutical-grade DEP, used as a solvent in drug formulations and industrial applications. |

| Thermo Fisher Scientific | Offers analytical and laboratory-grade DEP for scientific research and industrial testing. |

| Alfa Aesar | Provides customized chemical formulations of DEP for specialized industrial and research applications. |

| Tokyo Chemical Industry (TCI) | Supplies high-quality DEP for cosmetics, coatings, and industrial solvents. |

Key Company Insights

Eastman Chemical Company (20%-25%)

Eastman Chemical Company is a dominant player in the diethyl phthalate market, with emphasis on providing high performance plasticizers and industrial grade DEP solutions. To meet new environmental standards and evolving international regulations, the company focuses substantially on research and development as well as sustainable manufacturing practices.

Merck KGaA (15-20%)

Merck KGaA is a major manufacturer of high-purity, pharmaceutical-grade DEP, with commercial-grade formulations suitable for drug development and biomedical use.

Thermo Fisher Scientific (12-16%)

Analytical grade DEP is manufactured, sold, and distributed by the Thermo Fisher Scientific Company that has several research laboratories and industrial testing laboratories to their name. They are a leader in the scientific research segment due to their expertise in precision chemical formulation.

Alfa Aesar (8-12%)

Balanced by the niche industrial and research markets serviced through custom DEP formulations by specialty suppliers such as Alfa Aesar. The focus on chemical purity and customization further strengthens the market position.

Tokyo Chemical Industry (TCI) (5- 9%)

Tokyo Chemical Industry (TCI) serves DEP applications in coatings, cosmetics, and industrial solvents, including high-quality product-consistency for specialty chemical applications.

Additional Key Contributors (30-40% Total)

The players in the diethyl phthalate market has been implementing various strategies to meet rising demand, these strategies include investment in research and development of innovative formulations, regulatory compliance, and manufacturing abilities. Notable companies include:

The overall market size for the diethyl phthalate market was USD 146.3 million in 2025.

The diethyl phthalate market is expected to reach USD 181.8 million in 2035.

The diethyl phthalate market is expected to grow at a CAGR of 2.2% during the forecast period.

The demand for the diethyl phthalate market will be driven by rising demand in plasticizers, cosmetics, personal care, and pharmaceutical applications. Expanding consumer goods industries and ongoing innovations in formulation techniques will also support market growth.

The top five countries driving the development of the diethyl phthalate market are the USA, China, Germany, India, and Brazil.

LATAM Road Marking Paint & Coating Market Analysis by Material Type, Marking Type, Sales Channel, and Region Forecast Through 2035

Refinery and Petrochemical Filtration Market Analysis by Filter Type, Application, End-User and Region 2025 to 2035

Plastic Market Growth Analysis by Product, Application, End Use, and Region 2025 to 2035

Industrial Oxygen Market Report - Growth, Demand & Forecast 2025 to 2035

Medical Grade Coatings Market Trends – Demand, Innovations & Forecast 2025 to 2035

Fertilizer Additive Market Report – Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.