The global dietary supplement packaging market is estimated to account for USD 12.1 billion in 2025. It is anticipated to grow at a CAGR of 5.8% during the assessment period and reach a value of USD 21.5 billion by 2035.

| Attributes | Description |

|---|---|

| Estimated Global Dietary Supplement Packaging Market Size (2025E) | USD 12.1 billion |

| Projected Global Dietary Supplement Packaging Market Value (2035F) | USD 21.5 billion |

| Value-based CAGR (2025 to 2035) | 5.8% |

The market for dietary supplement packaging is affected by various factors that influence prices. New technologies, such as automation and smart tools, can make machines more expensive but also improve efficiency and accuracy, making them worth the cost for manufacturers.

There is also a growing demand for eco-friendly packaging, which encourages manufacturers to create equipment that can work with recyclable and biodegradable materials, affecting prices. Custom options, such as special filling systems for powders, capsules, or liquids, can also change the overall cost of the equipment.

Manufacturers want packaging solutions that are flexible, efficient, and sustainable. Investing in advanced packaging equipment can save money in the long run by improving production efficiency, reducing waste, and extending product shelf life. However, the initial costs can be high, so companies need to carefully consider their production needs, budget, and long-term goals when choosing packaging equipment.

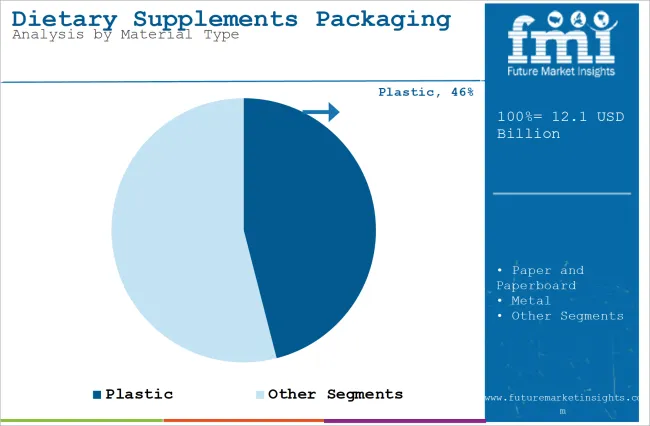

Plastic Segment Leads Fueled by Cost-effectiveness

| Attributes | Details |

|---|---|

| Top Material Type | Plastic |

| Market Share in 2024 | 46% |

By material type, the market is divided into plastic, metal, and paper and paperboard. The plastic segment held 46% market share in 2024.

Plastic is a cost-effective packaging material that is affordable to produce, helping manufacturers keep their production costs low. This is important for both large companies and smaller brands that want to stay competitive in the market. Additionally, plastic is lightweight and strong, offering great protection for dietary supplements during shipping and storage. Its durability prevents damage to products like pills, powders, and soft gels.

Moreover, the material is versatile and can be shaped into various sizes and designs, allowing manufacturers to create packaging that fits different dietary supplements, such as bottles, pouches, and blister packs. Plastic containers, especially when sealed well, also protect against moisture, air, and contaminants, which is essential for keeping dietary supplements stable and effective, as exposure to the environment can harm their quality.

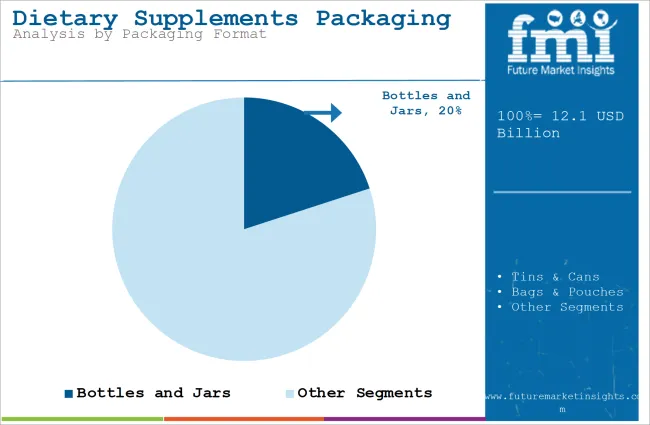

Easy to Use of Bottles and Jars to Augment Product Uptake

By packaging format, the market is divided into bottles and jars, tins & cans, bags & pouches, sachets, blisters, and others. The bottles and jars segment held 20% market share in 2024.

| Attributes | Details |

|---|---|

| Top Packaging Format Type | Bottles and Jars |

| Market Share in 2024 | 20% |

Bottles and jars, especially those made from plastic or glass, are more durable than other packaging types such as bags or flexible pouches. This strength makes them great for protecting dietary supplements during transport and handling, ensuring that the products stay safe and intact until they reach consumers.

These containers also make it easy to store larger amounts of dietary supplements, which means consumers do not have to buy them as often. Additionally, the clear labels on the packaging help with portion control, showing how much to take per serving and making it easier for people to manage their intake.

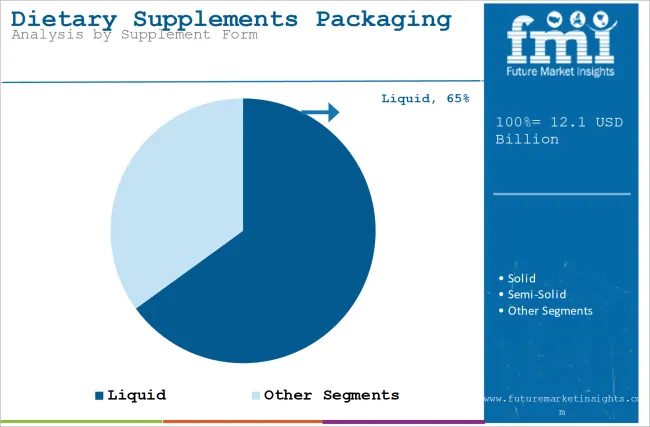

Ease of Use of Liquid Supplements to Generate Sales

By supplement form, the market is divided into liquid, solid, and semi-solid. Liquid supplements are easy to take and absorb quickly, often available as juices or syrups, which are great for those who do not like pills. Additionally, they are more affordable as compared to solid supplements. Owing to this factor, they have gained huge traction, leading to higher demand for dietary supplement packages.

| Import/Export Activity | Details |

|---|---|

| Imports (USA) | 29,072 shipments recorded from March 2023 to February 2024, showing a 100% growth in activity. |

| Exports (USA) | Increased demand for dietary supplements, leading to higher export volumes in markets such as Europe and Asia. |

| Packaging Materials | Major materials include plastic bottles, aluminum containers, and flexible pouches, widely sourced from Asia. |

| Key Countries for Imports | China, Germany, and India are significant sources of packaging materials. |

| Key Export Markets | Countries such as the UK, Canada, and Australia are key destinations for USA dietary supplement packaging. |

The dietary supplement packaging market has been significantly shaped by import and export trends. The USA has witnessed an increase in imports, with over 29,000 shipments recorded from March 2023 to February 2024, reflecting a high demand for packaging solutions to meet the rising consumption of dietary supplements.

A substantial increase in import activity (by 100%) highlights the growing reliance on international suppliers, particularly from countries such as China, Germany, and India, which supply materials such as plastic and aluminum packaging used in supplement containers.

In terms of exports, the USA has experienced a rising trend in the exportation of dietary supplement packaging to regions such as Europe, Australia, and Canada. This global expansion reflects the increased demand for packaging solutions that meet stringent regulatory standards while catering to the wellness-driven market worldwide. The dietary supplement packaging market is benefiting from the growth of the nutraceutical industry, driven by the increasing focus on health and wellness, further accelerating international trade in this sector.

Bullishness in Dietary Supplements Industry

Consumers are increasingly interested in health and wellness, especially since the COVID-19 pandemic. This has led to a higher demand for dietary supplements, with people wanting products that are effective and easy to use. As a result, there is a growing need for packaging that is convenient and user-friendly, such as containers that are easy to open and single-serve options that can be taken on the go.

Additionally, many consumers are concerned about the environment and prefer eco-friendly packaging. Companies are responding by using recyclable and biodegradable materials to attract these environmentally conscious buyers.

Steep Packaging Costs May Hamper Demand

High packaging costs for advanced options, like eco-friendly materials, can be a challenge for small and mid-sized manufacturers striving to make profits. These companies may struggle with the added expenses of specialized packaging.

Additionally, strict regulations and standards for dietary supplement packaging vary by region, making it complicated and costly for manufacturers to comply. This can be especially difficult for companies looking to expand internationally, as meeting these requirements can take a lot of time and effort.

Smart Packaging to Witness Momentum

Smart packaging is also becoming more popular, incorporating technology like QR codes for tracking products and tamper-evident seals to ensure safety. Some packaging also helps consumers to check product authenticity or receive health tips, creating a more personalized experience with the help of smartphones.

With busy lifestyles, consumers prefer convenient and portable packaging solutions. Options like single-serve packets and compact bottles are in demand, making it easier for people to use products on the go. Additionally, there is a trend toward minimalist and visually appealing packaging designs, which help brands stand out and build customer loyalty through simplicity and elegance.

Rising Demand for Convenient Packaging

A key trend in dietary supplement packaging is the growing need for convenience and portability. Consumers want packaging that suits their busy lives, such as single-serve packets, small bottles, or blister packs.

This demand comes from the desire for easy-to-carry supplements that are quick to use and do not need much preparation. As a result, manufacturers are working on packaging that is lightweight, strong, and convenient for different situations, whether at work, traveling, or after exercising.

The USA accounted for a value share of 18.7% in 2024. In recent years, more people in the USA have become focused on health and wellness, leading to a higher demand for dietary supplements.

This shift has created a need for packaging that keeps products safe, is convenient, and is easy to use. Consumers are looking for packaging that fits their busy lifestyles, such as single-serve packets and portable bottles, making these options increasingly popular.

Additionally, there is a growing emphasis on sustainability, with consumers wanting eco-friendly packaging that is recyclable or biodegradable.

This demand is encouraging manufacturers to adopt more sustainable practices, driving innovation in the packaging industry. The rise of online shopping has also contributed to this growth, as packaging must be designed to protect supplements during shipping and ensure they arrive safely to customers.

Germany

Germany accounted for a value share of 6.7% in 2024. Germans are increasingly focused on leading healthy lifestyles, which includes proper nutrition and physical well-being. This awareness has led to more people using dietary supplements, creating a demand for packaging that keeps products safe, convenient, and effective.

Additionally, the country is committed to sustainability, with consumers and businesses prioritizing eco-friendly packaging options such as recyclable and biodegradable materials. This push for sustainable practices is encouraging manufacturers to come up with innovative packaging solutions, helping to grow the market.

Germany also has strict regulations for dietary supplements, particularly concerning packaging materials and labeling. These rules ensure that packaging meets safety standards, giving consumers confidence and transparency about the products they buy. The need to comply with these regulations drives continuous improvement and innovation in packaging solutions, ensuring that they remain safe and effective.

UK

The UK is expected to grow at a CAGR of 2.1% over the forecast period. The country has strong regulations for dietary supplements, especially regarding labeling and packaging standards. These rules ensure that products are safe and accurately represented, creating a need for high-quality packaging that meets legal requirements.

This regulatory framework helps build consumer confidence, driving demand for packaging that complies with these standards. As a result, manufacturers must focus on creating reliable and safe packaging solutions to meet these expectations.

Japan

Japan has a rapidly aging population, and many people are looking for ways to stay healthy as they get older. Dietary supplements, including vitamins and minerals, are becoming more popular as individuals seek to support their well-being. This rising demand for supplements is leading to a need for packaging that keeps products safe and convenient to use.

Japanese consumers also value convenience, so packaging that makes it easy to consume and store supplements is highly sought after. On-the-go options such as single-serve packs and easy-to-open containers are becoming popular, reflecting the fast-paced lifestyles of many people. Additionally, Japan is known for its technological advancements, which are influencing the packaging industry to create more innovative and functional solutions.

Key Companies

Several key players are adopting various growth strategies and there is a tough competition in the market. An increasing demand for dietary supplements and innovative packaging solutions encourages this competition. Some of the prominent players and their strategies include:

Amcor: Amcor is a leading company in packaging solutions, providing options such as flexible pouches and bottles for dietary supplements. They focus on sustainability by creating eco-friendly packaging and expanding into emerging markets in Asia and Latin America.

Gerresheimer: Gerresheimer specializes in high-quality packaging for dietary supplements, including glass and plastic containers. They use advanced technology, like smart packaging, to improve consumer engagement and are increasing production to meet rising demand in the health sector.

Berry Global: Berry Global offers a range of packaging solutions, such as bottles and jars, for dietary supplements. Their focus is on innovation and customer needs, creating packaging that enhances shelf life and convenience while also using sustainable materials to lessen environmental impact.

Several startups are making waves in the dietary supplement packaging market, offering innovative solutions to meet the growing demand for convenient, eco-friendly, and high-quality packaging. Here are some notable startups and their key growth strategies:

NoPo (No Plastic): NoPo creates biodegradable and compostable packaging for dietary supplements, focusing on sustainability. They use plant-based materials and work with eco-friendly brands to meet the growing demand for green packaging.

EcoPack: EcoPack specializes in recyclable and reusable packaging for dietary supplements. They collaborate with major brands to create circular packaging solutions that reduce waste and appeal to environmentally conscious shoppers.

Greenbox: Greenbox offers smart packaging with RFID technology and interactive labels. Their innovative approach allows consumers to engage with products through mobile apps, enhancing user experience and product security.

SustainaPack: SustainaPack uses renewable and plant-based materials to create eco-friendly packaging for dietary supplements. They partner with brands to help meet sustainability goals and invest in research to improve biodegradable materials.

Tuber Packaging: Tuber Packaging develops eco-friendly packaging that reduces plastic use by using paper-based and plant-based alternatives. They design minimalistic solutions and partner with e-commerce platforms to support small to medium-sized supplement companies.

By material type, the market is segmented into plastic, paper and paperboard, and metal.

By packaging format, the market is segmented into bottles and jars, tins & cans, bags & pouches, sachets, blisters, and others.

By supplement form, the market is segmented into liquid, solid, and semi solid.

The market is segmented into North America, Latin America, Western Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The market value in 2024 was USD 12.1 billion.

The market is predicted to reach a size of USD 21.5 billion by 2035.

Some of the key companies include Assemblies Unlimited, CarePac, Comar, and others.

North America is a prominent hub for dietary supplement packaging manufacturers.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dietary Fiber Gummies Market Size and Share Forecast Outlook 2025 to 2035

Dietary Supplement Market Insights - Growth & Demand 2025 to 2035

Dietary Fiber Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Pet Dietary Supplement Companies

Food Dietary Fibers Market Size and Share Forecast Outlook 2025 to 2035

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Korea Dietary Supplements Market Analysis by Ingredients, Form, Application, and Region Through 2035

UK Pet Dietary Supplement Market Growth – Trends, Demand & Forecast 2025-2035

USA Pet Dietary Supplement Market Insights – Size, Share & Industry Growth 2025-2035

Analysis and Growth Projections for Insoluble Dietary Fiber Business

ASEAN Pet Dietary Supplement Market Report – Demand, Growth & Trends 2025-2035

Europe Pet Dietary Supplement Market Trends – Growth, Demand & Outlook 2025-2035

Veterinary Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

Demand for Dietary Supplements in EU Size and Share Forecast Outlook 2025 to 2035

Australia Pet Dietary Supplement Market Analysis – Size, Share & Forecast 2025-2035

North American Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Dietary Supplements Market Analysis by Ingredients, Form, Application, and Country Through 2025 to 2035

Intestinal Health Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

Dog Intestinal Health Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA