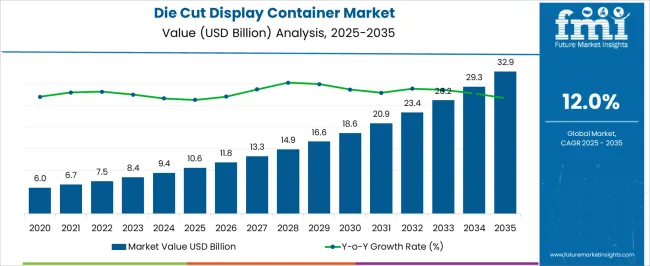

The Die Cut Display Container Market is estimated to be valued at USD 10.6 billion in 2025 and is projected to reach USD 32.9 billion by 2035, registering a compound annual growth rate (CAGR) of 12.0% over the forecast period.

| Metric | Value |

|---|---|

| Die Cut Display Container Market Estimated Value in (2025 E) | USD 10.6 billion |

| Die Cut Display Container Market Forecast Value in (2035 F) | USD 32.9 billion |

| Forecast CAGR (2025 to 2035) | 12.0% |

The die cut display container market is experiencing dynamic growth, propelled by increasing demand for retail-ready packaging solutions that offer both functionality and brand visibility. As brands focus on point-of-sale impact and consumer engagement, die cut containers are being adopted widely across sectors for their structural versatility and visual appeal. Manufacturers are leveraging digital workflows, automated die cutting technologies, and sustainable substrates to produce containers that align with retailer specifications while reducing environmental impact.

The shift toward recyclable and biodegradable materials is encouraging the use of paper-based options that support circular packaging goals. Additionally, the rise of omnichannel commerce and SKU diversification has increased the need for customized display formats that offer quick setup, product protection, and aesthetic consistency.

Emerging trends such as low-ink printing and water-based coatings are supporting sustainability benchmarks, while innovations in folding design and strength optimization are enhancing shelf performance. These developments collectively point toward continued growth in this packaging format across high-volume and specialty retail environments.

The market is segmented by Material Type, Printing Type, and End Use and region. By Material Type, the market is divided into Paperboard and Plastic. In terms of Printing Type, the market is classified into Offset/Litho Printing, Metallic Printing, Pantone Matching System, and Premium Screen Printing. Based on End Use, the market is segmented into Food, Beverages, Stationery, Pharmaceuticals, Cosmetics & Personal Care, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

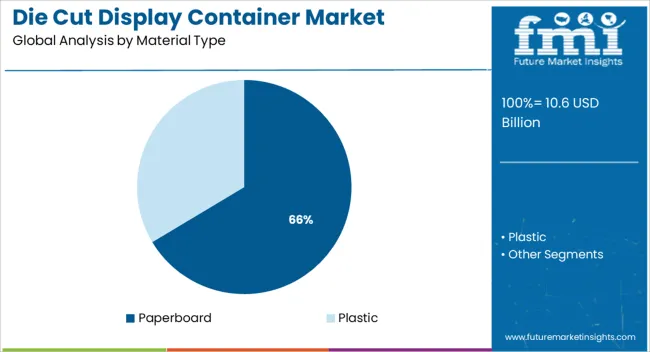

Paperboard is expected to hold a leading 66.4% share of the material type segment in 2025, driven by its lightweight, cost-effective, and sustainable characteristics. Its ease of die cutting and compatibility with various finishing techniques make it ideal for producing intricate container designs that are both sturdy and visually engaging.

Paperboard supports high-resolution printing and accommodates a wide range of folding structures without compromising strength, which is essential for retail-ready displays. Its recyclability and biodegradability align with the growing demand for environmentally responsible packaging, especially in food and consumer goods sectors.

Brand owners are increasingly selecting paperboard to meet retailer sustainability criteria while maintaining visual impact on shelves. The material's wide availability, low carbon footprint, and adaptability to mass production have reinforced its position as the material of choice for die cut display containers across global markets.

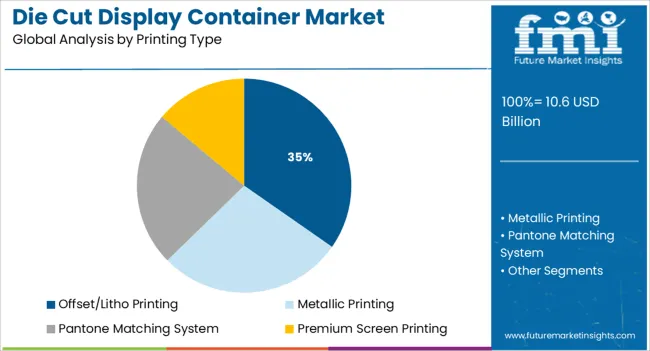

Offset litho printing is projected to account for 34.7% of revenue in the printing type segment in 2025, establishing it as the most preferred technique for high-quality die cut displays. This prominence stems from its ability to produce crisp, detailed graphics that enhance shelf presence and brand recognition.

Offset printing provides excellent color fidelity and consistency across large volumes, making it suitable for national and international campaigns that require uniform visual output. It is especially favored for its ability to handle complex artwork and specialty finishes like matte varnishes or gloss coatings, which are often used to create premium packaging aesthetics.

Additionally, offset printing is cost-effective at scale and supports a wide range of substrates including coated paperboard, further enhancing its applicability. The growing emphasis on premium visual merchandising in sectors such as food, beverage, and cosmetics continues to reinforce the relevance and adoption of this printing method.

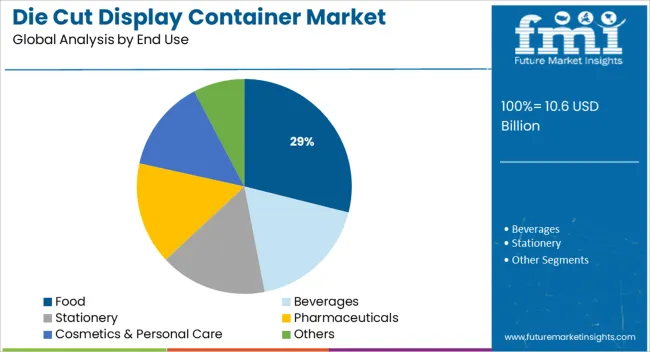

The food industry is projected to capture 28.9% of market revenue in 2025 within the end use category, making it the dominant segment. This growth is attributed to the increasing use of die cut display containers in retail environments for snacks, baked goods, ready-to-eat items, and promotional food products. These containers are valued for their ability to serve dual roles as both packaging and merchandising tools, streamlining in-store setup and reducing labor requirements.

The rise of convenience shopping and grab-and-go formats has increased demand for packaging solutions that provide easy access, hygiene, and strong brand messaging. Die cut displays are also being designed to meet food safety regulations, including contact-safe coatings and structurally reinforced formats for perishables.

Retailers are prioritizing ready-to-display packaging to enhance operational efficiency and shelf appeal, further driving adoption in the food sector. The segment’s share is expected to remain robust as food brands continue to invest in visually differentiated and retail-compliant packaging.

Packaging industry has evolved itself form meeting the basic requirement of transferring goods from one place to another and a defining factor towards the sale of the product. From being incorporating the modern technological advancement to improved packaging solution, the demand for aesthetically pleasing packaging solution results in the expansion and growth of the global die cut display container market.

Die cut display container is a type of packaging solution that not only protect the product but also attract customer attention. If a product is going to sit on the store shelf, it has to sell itself with a glance. Die cut display container can promote the product and act as similar as counter display for brochures or credit application form or a standup floor display for larger items.

Getting attention on a counter along with the availability of competitors is hard, therefore, die cut display container is the most effective way to get noticed by the potential customer. Die cut display container are equipped with intricate designs and shaped that enhance the protection and functionality of the packaging. Each container is unique and custom build to fit the packaging needs.

It help the product to stand out from the crowd, high light product features, increase the effectiveness of in-store promotion, build brand awareness, and increase brand value.

These die cut display container are available in matte and gloss finish with special effect of embossing, debossing, silver heat foiling and golden heat foiling. It act as an added value to the product which not only improves the shelf presence but also helps in achieving maximum consumer appeal and increasing sales

One of the important factors contributing towards the growth of the global die cut display container market is the rampant evolution in the retail sector. Die cut display container is considered as a modern retail packaging solution and is expected to develop along with the progression of hypermarket and supermarket.

Manufacturer and retailers are gaining huge traction towards die cut display container as it help to reduce cost in terms of providing safety to the product due to re-usable feature which essentially drive the growth of the global die cut display container market.

Adding to this, the increasing disposable income among the middle class income group, face paced lifestyle and increasing consumption of packaged food is expected to drive the growth of the retail ready packaging market which is relatively the high contributing factor towards the growth of the global die cut display container market.

However, the restraining factor towards the growth of the global die cut display container market is the requirement of the spacious platform where single die cut display container kept, whereas in other form of packaging the product can be kept on one another in order to utilize the space properly. Another factor that obstruct the growth of the global die cut display container market is the recurring cost on the printing of die cut display container when the color, logo, or design change.

Furthermore, another reason that is expected to hinder the growth of the global die cut display container market is the non-reusable feature towards other types products. Adding to this, major issue that the global die cut display container market is expected to face is that the container is re-cycled for a limited amount of time and after expiry, there fibre will get weak and they need to be dumped, which contribute towards the increasing waste issues.

Geographically, the global die cut display container market is segmented into North America, Latin America, Europe, Asia Pacific (APAC) and Middle East Africa (MEA). The global die cut display container market is expected to witness a stable CAGR over the forecast period of 2020-2025.

Moreover, North America is expected to be the largest die cut display container market due to the increasing consumption of packaged foods in the global die cut display container market.

Apart from this, the extensive development of the retail sector in the emerging economies such as India China is expected to further boost the sales of the global die cut display container market which essentially increase the BPS of Asia Pacific region by the end of the forecast period of 2020-2025.

Some of the major players identified across the global die cut display container market are RFC CONTAINER COMPANY, INC., Visy Glama Pty Ltd, Packaging Source, Inc., Dallas Container Corp., Cactus Corrugated Containers Inc., Fastbox Ltd, Deline Box Company, Fitzpatrick Container Company, Michigan Box Company and Tyoga Container Company, Inc.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geography, technology and applications.

The global die cut display container market is estimated to be valued at USD 10.6 billion in 2025.

The market size for the die cut display container market is projected to reach USD 32.9 billion by 2035.

The die cut display container market is expected to grow at a 12.0% CAGR between 2025 and 2035.

The key product types in die cut display container market are paperboard and plastic.

In terms of printing type, offset/litho printing segment to command 34.7% share in the die cut display container market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Diesel Parking Heater Market Size and Share Forecast Outlook 2025 to 2035

Diesel Power Engine Market Size and Share Forecast Outlook 2025 to 2035

Diethyl Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Diesel Particulate Filter Market Size and Share Forecast Outlook 2025 to 2035

Diesel Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Diesel Powered Portable Conventional Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Diesel Electric Powered Hybrid Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Powered Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Dietary Fiber Gummies Market Size and Share Forecast Outlook 2025 to 2035

Diesel-Fired Portable Inverter Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel Fired Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel-Fired Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Die Cast Toys Market Size and Share Forecast Outlook 2025 to 2035

Dietary Supplement Market Insights - Growth & Demand 2025 to 2035

Diesel Fueled Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Dietary Fiber Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Die Cart Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Diethanolamine Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA