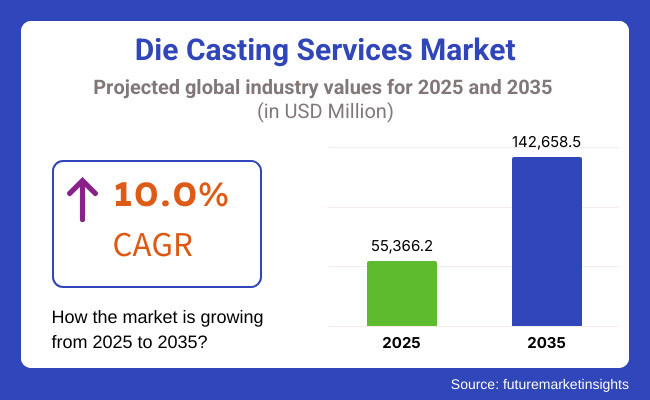

The die casting services market is expected to grow with a significant rate in the forecast period of 2025 to 2035. The die casting services market is estimated to have been USD 55,366.2 million in 2025 and reach USD 142,658.5 million by 2035. The market is expected to grow with a compound annual growth rate (CAGR) of 10.0% in the forecast period.

Several factors this growth, such as the increasing trend towards lightweight materials, developments in die-casting technologies, and growing use of aluminium and magnesium alloys in various production processes. Castings will also be supplied on-demand using the latest technologies such as automation and Industry 4.0 driven casting solutions.

However, some of the main issues that persist are high initial setup costs, changing raw material costs, and regulation of emissions from the environment. To tackle these challenges, industry stakeholders concentrate on cost-effective and compliant solutions for casting (and recycling) of sustainable end-products through energy-efficient processes.

Rising development of lightweight automotive components, rapid prototyping and high-precision casting solutions are projected to drive the global die casting services market in the next decade. With material science, automation and process optimization being so advanced now, the industry is sure to see more growth and innovation.

Explore FMI!

Book a free demo

The die casting services market is segmented into North America, Latin America, Europe, Asia Pacific, and Middle East & Africa, out of these regions, North America is the leading market for die casting services& contributed mainly by United States and Canada. The region's strong automotive, aerospace and industrial manufacturing landscapes underpin demand for precision die casting& solutions. Die casting processes are& further enhanced with technological advancements, the implementation of automation, and simulation software improving both production efficiency and product quality.

While high labour costs, stringent environmental regulations, and supply& chain disruptions restrain the market growth. The companies in North America are emphasizing lightweight composites, sustainable production techniques, and mergers and acquisitions for a competitive advantage& and to keep up with changing industry guidelines.

Die casting services demand is high in the Europe region, with Germany, France, and& Italy among the leading countries engaged in producing high-precision cast components. Market growth is also driven by the region's dynamic automotive industry and the rising demand for& electric vehicles (EVs). This urge toward lightweight vehicle components would lead to further& adoption of advanced die casting technologies.

Producers are& also up against tough environmental rules and energy use issues. In contrast, European manufacturers are adopting sustainable die casting, using environmentally conscious practices such as vacuum-assisted castings and recycled aluminium to meet regulatory requirements while increasing& sustainability.

Asia pacific is the fastest growing market of die casting services largely due to rapid industrialization& and increase in automotive production in countries such as China, India, Japan and South Korea. The region& is also a centre for cheap manufacturing, convenient raw materials access and government initiatives to enhance local industrialisation.

While the outlook for growth remains strong, the dynamics of the market are affected by several factors including& volatility in raw material prices and production quality issues in certain emerging markets. But automation, process standardization, and advanced die casting are helping companies fortify their market& presence and adhere to international quality standards.

Challenges

High Initial Investment and Maintenance Costs

The high capital investment associated with establishing die casting& facilities is a major restraint for the die casting services market. Investing in& and maintaining such complex die casting machinery, molds and automation systems is beyond the financial reach of many organizations. Financial constraints have rendered many small and mid-sized manufacturers unable to modernise& plant with efficient, high-tech die casting technologies. And, the operational costs continue to increase with more frequent mold replacements& and maintenance needs. That said to remain competitive firms need& to juggle cost control with tech advancements and partnership or financing solutions to alleviate capex burdens.

Opportunities

Rising Demand from Automotive and Aerospace Industries

The highest availability of lightweight materials in the automotive and aerospace industries& is one of the major opportunities for the die casting industry. As the popularity of fuel-efficient and electric vehicles (EVs) surges, automakers are looking to aluminium and magnesium die casting to drop overall vehicle weight while ensuring structural& integrity. Likewise, sectors such as aerospace utilize precision die casting& to manufacture intricate, lightweight parts. HPDC/advanced alloys is a technology where companies who invest during these cool down phases will be able to& have a better competitive technology while other industries focus on efficiency, sustainability, and performance.

Between 2020 and 2024, die casting automation and the adoption of& Industry 4.0 technologies improved production efficiency and quality control in the die casting market. Market growth deceleration from pandemic-driven supply chain constraints;& recovery with near-term EV production and infrastructure buildouts finishing plants improved their& alloy compositions to maximize performance, while manufacturers emphasized digital twin technology and real-time process monitoring.

For 2025 to 2035, we will look more towards sustainability and recyclable material& and energy-efficient die casting process. The future will see a mass adoption of mold manufacturing automation using 3D printing, AI-based& quality inspections, and low-carbon footprint production methods.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Emission reduction and workplace safety regulations |

| Technological Advancements | Rise of automation and real-time monitoring |

| Industry Adoption | Automotive and aerospace sector demand growth |

| Supply Chain and Sourcing | Raw material price fluctuations |

| Market Competition | Dominance of large-scale manufacturers |

| Market Growth Drivers | Demand for lightweight automotive components |

| Sustainability and Energy Efficiency | Use of recycled aluminium and magnesium |

| Consumer Preferences | Demand for durable, cost-effective parts |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Strict sustainability and circular economy mandates |

| Technological Advancements | AI-driven quality control and 3D-printed molds |

| Industry Adoption | Expansion into medical devices and renewable energy |

| Supply Chain and Sourcing | Shift toward regional supply chains and local sourcing |

| Market Competition | Rise of specialized, high-precision die casting firms |

| Market Growth Drivers | Growth in EVs, aerospace, and sustainable manufacturing |

| Sustainability and Energy Efficiency | Carbon-neutral die casting and waste reduction |

| Consumer Preferences | Preference for eco-friendly, high-performance components |

With a well-established automotive, aerospace and industrial machinery sector, the United States is also expected to dominate& the die casting services market. Demand for lightweight & high-strength components is driving the increased use of die casting as a preferred manufacturing& method for component manufacturing, especially for aluminium & magnesium alloys.

The trend in the direction of fuel efficiency and sustainability is additionally propelling the usage of& advanced die casting approaches such as high-pressure die casting and vacuum-assisted die casting. Moreover, automation and Industry 4.0 technologies are improving precision and efficiency, which is& contributing to the continuous expansion of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 9.8% |

The United Kingdom die casting services market& is supported by its strong automotive manufacturing industry, with a special focus on electric vehicle (EV) components. Growing& phase of vehicle efficiency due to lightweight material utilization is creating need for aluminium and zinc die casting.

Moreover, developments in precision casting fundamentals and government initiatives for sustainable manufacturing is accelerating& the market growth as well. The increasing adoption& of additive manufacturing integration and specialized foundries are likely to drive steady growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 9.3% |

Die casting services in the European Union (Germany, France, Italy, etc.) remain another& largest market. Leading automotive manufacturers are strongly present in this assessed industry, and stringent EU regulations related to emissions and fuel efficiency are anticipated to drive demand for lightweight& metal components.

Another significant contributor is the aerospace and& industrial machinery sector, requiring high-precision die casting solutions. Furthermore, advancements in alloy compositions and recycling& technologies are also transforming the market, with a focus on sustainable and high-performance solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 9.6% |

The technological automotive and electronics industries of Japan support its die casting& services market. The country’s leading manufacturers& are focusing on high-precision casting techniques to produce lightweight and durable components, primarily for hybrid and electric vehicles.

Increasingly common adoption of automation and& robotic integration in die casting foundries is improving not only production efficiency but also product quality. The commitment of Japan to sustainability is also helping to promote research in green die casting processes and is expected to positively contribute to the growth of the market in& the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 9.4% |

The South Korean die casting services sector is experiencing yoga as its automotive& and consumer electronics industries continue to grow. Key growth drivers include the rising demand for precision-engineered metal components in conjunction with an increase& in the production of EVs.

The advancements in die casting technologies are further facilitated by the& government's focus on smart manufacturing and industrial automation. Moreover, Korean manufacturers invest in& high-pressure die casting (HPDC) and vacuum die casting techniques to improve product durability and lower production costs.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 9.5% |

The die casting services market is experiencing significant growth, driven by the increasing demand for metal components in& various industries such as automotive, aerospace, electronics, and consumer goods. Die casting is a precise and efficient manufacturing process that allows for high-volume production of complex metal parts, providing& strengths, durability, and light weight. Factors such& as the growing use of aluminium and magnesium alloys in manufacturers and improvements in die casting technologies have driven the growth of the market.

Hence manufacturers are now emphasizing on making improvements in die casting processes to maximize efficiency, cut down the& production cost, and reduce the material wastage. The use& of automation, computer-aided design (CAD), and simulation software to optimize die casting operations is also helping to enhance productivity and quality of products. The market’s& future is also being shaped by sustainability initiatives, including the use of recycled metals and energy-efficient furnaces. Since the key sectors are looking for lightweight and high performance parts, the die& casting services market is ready for ongoing growth.

High-pressure and the gravity die casting are the leading product types, owing to their wide usage across the& industrial vertical.Such precision has made it popular among automotive and& electronics industries with a usage of high-pressure die casting (HPDC) to manufacture intricate yet lightweight components. HPDC injects molten metal at high velocity and pressure into a steel mold, enabling fast production cycles and& lower post-processing requirements. If& you are looking for the most complished process to manufacture engine blocks, transmission housings, electronic enclosures (i.e. complex components) this process is for you. The power train shift towards EVs substantially& increases demand for high-pressure die casting as OEMs pursue lightweight designs for improved battery efficiency and performance.

Another major segment is gravity die casting (GDC), & which is usually suitable for applications where mechanical properties and structural integrity are of significance. It uses gravity& to fill the mold cavity rather than applying high pressure as in high-pressure die casting, thus decreasing turbulence and porosity in the final product. This makes it the method of choice for aerospace and defence components, along with& high-strength automotive parts like wheels and cylinder heads. The demand for gravity die casting is anticipated to rise, owing to growing needs by manufacturers to produce quality castings with fewer defects and better durability.

Automotive and electronics industries that depend on die-cast components for their efficiency and& performance would be the engine for the application segment of die casting services market. The automotive industry accounts for the largest share of die casting services and& is increasingly demanding lightweight materials and better energy efficiency.

Aluminium die casting is& increasingly being adopted in EV powertrains as it reduces components which increases efficiency. Some of the key automotive applications are engine parts, gearbox& housings, suspension components, and structural components of EVs. The growing& demand for electric mobility is also further fuelling advancements in the design of precision die-cast components, enabling manufacturers to meet the requirements for improved battery efficiency and aerodynamics.

Additionally, the electronics industry is another key factor feeling the die casting services market,& as it enables the production of durable parts. The perfect heat dissipation& and electromagnetic shielding characteristics of die-cast Mg and Al parts ensure their extensive application in consumer electronics, telecommunications equipment, and industrial electronics. As 5G networks, smart& devices, and IoT-enabled products become more widespread, so does the need for high-quality die-cast enclosures and heat sinks.

The die casting services& market is expected to grow in the coming years, as industries adopt lighter weight, high strength materials and novel manufacturing techniques. The global automotive and aerospace composite materials market is expected to demonstrate substantial growth during the next several to come on the motto of technological advancements, & sustainability trends, and rising demand for advanced composite materials across various sectors.

Die casting services market& is rising significantly as a cause of growing demand. In parallel, & the trend for lightweight components with high fuel efficiency and high-performance materials has provided impetus for the adoption of die casting processes. The composition of alloys, automation and simulation software advancement& will increase the efficiency of production, lower waste, and improve casting accuracy.

Participants in the market, are investing in sustainable manufacturing processes such as use of recyclable metal and energy-efficient& die casting technology. Rising focus on precision engineering and& mass production capabilities, along with cost-effectiveness are accelerating market growth.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Dynacast International | 18-22% |

| Endurance Technologies | 12-16% |

| Gibbs Die Casting | 10-14% |

| Ryobi Limited | 8-12% |

| Nemak | 6-10% |

| Other Companies (Combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Dynacast International | Specializes in precision die casting solutions, offering multi-slide and conventional die casting for automotive, medical, and electronics industries. |

| Endurance Technologies | Provides high-pressure die casting for automotive and industrial applications, focusing on lightweight alloy innovations. |

| Gibbs Die Casting | Offers aluminium and magnesium die casting solutions, emphasizing sustainable and automated production processes. |

| Ryobi Limited | Manufactures high-performance die-cast components for automotive powertrains and structural applications. |

| Nemak | Specializes in lightweight aluminium die casting solutions for electric vehicle (EV) components and structural automotive parts. |

Key Company Insights

Dynacast& International (18-22%)

The die casting services market& is dominated by Dynacast International, which offers advanced multiple slide die-casting and precision engineered components for many industries. They have made significant investments& in high-speed automation and smart manufacturing solutions, ensuring superior casting accuracy and efficiency.

Endurance Technologies & (12-16%)

With an industry-leading position in automotive die casting, Endurance Technologies is held well to get advanced lightweight materials and alloy technologies that meet fuel& efficiency and environmental standards.

Gibbs Die Casting (10-14%)

Gibbs Die Casting specializes in aluminium and magnesium alloy components, incorporating automated processes and robotic technologies to enhance production efficiency.

Ryobi Limited (8-12%)

The predecessor company of Ryobi Limited was Ryobi& Die Casting Co. , Ryobi Die Casting specializes in high-performance die-cast products, specifically for powertrain and chassis applications in the automotive industry.

Nemak (6-10%)

Nemak is a global leader in lightweight structural die casting, primarily serving the electric vehicle market, with a focus on high-strength aluminium solutions.

Other& Main Players (35-45% Total)

Key stakeholders in die casting services market involve a range of start-ups& to large-scale establishments working on production advancements including innovative alloy compositions, automation-led production lines, and eco-friendly die casting techniques. Among& other big companies are:

The overall market size for the die casting services market was USD 55,366.2 million in 2025.

The die casting services market is expected to reach USD 142,658.5 million in 2035.

The die casting services market is expected to grow at a CAGR of 10.0% during the forecast period.

The demand for the die casting services market will be driven by rising demand from the automotive, aerospace, and industrial machinery sectors. Advancements in manufacturing technologies and increased focus on lightweight materials will also contribute to market growth.

The top five countries driving the development of the die casting services market are the USA, China, Germany, Japan, and India.

Foot Care Product Market Analysis by Product Type, Distribution Channel and Region Through 2035

POU Water Purifier Industry Analysis In MENA: Trends, Growth & Forecast 2025 to 2035

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Tiffin Market by Product, Material, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.