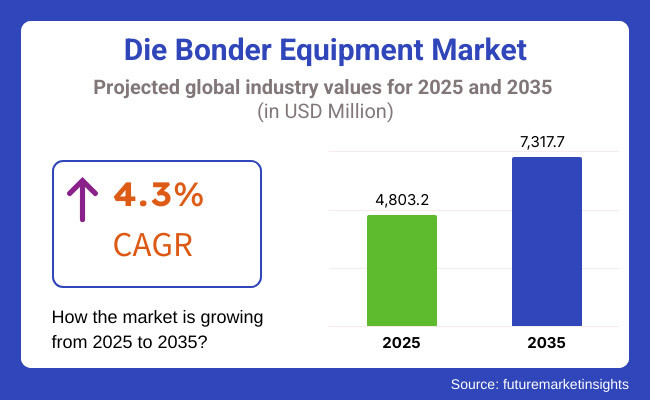

The Die Bonder Equipment Market is projected to witness steady growth over the next decade, driven by increasing demand for advanced semiconductor packaging solutions. The market is expected to grow from USD 4,803.2 million in 2025 to USD 7,317.7 million by 2035, reflecting a CAGR of 4.3% during the forecast period.

The surge in demand for high-performance electronic devices, advancements in miniaturization, and the increasing adoption of 5G technology are key drivers propelling market expansion. The rise of automation in semiconductor manufacturing and innovations in die bonding technologies are enhancing production efficiency, further fueling market growth.

The Die Bonder Equipment Market is gaining traction due to the growing demand for high-performance semiconductor packaging in various industries, including telecommunications, consumer electronics, and automotive. The market is extending by the rapidly miniaturization of semiconductor chips, which calls high-efficiency and precision bonding techniques.

\Forward-looking, the trend towards heterogeneous integration-the combination of different semiconductor components in a single package-is driving the adoption of more advanced die bonding solutions.

Besides, chiplet-based architectures and 3D packaging technologies are the most recent trends expected to boost the market outlook, thus making die bonder equipment a fundamental element in semiconductor manufacturing. The industry's transition toward full automation and AI-driven bonding solutions is further cementing the market's long-term growth potential.

The die bonder equipment sector is going through revolutionary advancements as a result of the ongoing semiconductor devices' increased complexity. The necessity to produce smaller and more robust electronic components in the consumer electronics, automobile and telecommunication sectors is powering the acceptance of more advanced die bonding techniques.

AI and robotics integration in die bonding tools is being observed by the industry, promoting precision, maximizing yield rates and throughput. The wide 5G infra and IoT devices are being provided with high-density semiconductor packaging solutions, marking the turning point for the introduction of the advanced die bonder equipment.

The growing interest in packaged semiconductor solutions is significantly affecting the die bonder equipment market. Technologies like hybrid bonding and thermos-compression bonding are bringing down interconnect density and power consumption in semiconductor devices, thus enhancing efficiency and power.

Furthermore, the increase in the met averse, cloud computing, and AI-powered systems is enlarging the market for high-bandwidth memory (HBM) and high-performance computing (HPC) chips, which are respectively needed by the advanced die bonding techniques.

Manufacturers of semiconductors are making considerable investments in R&D for upgrading equipment due to the next generation bonding techniques which are a further push to the market growth. The growing cooperation between semiconductor manufacturers and equipment suppliers is thought to be an added factor in enhancing technology, thus leading to the low-cost high-yield production.

Explore FMI!

Book a free demo

North America remains a vital market for die bonder equipment, strongly supported by the technological developments and the government measures targeting to maximize domestic semiconductor production. The USA CHIPS Act, which promotes semiconductor manufacturing and R&D with substantial funding, is on the way to initiating the die bonding technology investments.

The presence of major semiconductor manufacturers, research institutions, and AI-powered start-ups in Silicon Valley and other tech clusters is a further contributor to the need. The region is now the stage for the further development of 5G infrastructures, driverless cars, and AI-driven data centers, which are all based on advanced semiconductor packaging.

The high degree of on shoring inrupsom semiconductor production in the USA would therefore also lead to the increased demand for burning high-precision die bonding equipment.

The European die bonder equipment market is on its way up due to the region's powerful automotive sector, especially in Germany, where the adoption of semiconductor technology for electric vehicles (EVs) and advanced driver assistance systems (ADAS) is rapidly growing. The European Union’s aim to cut its dependency on Southeast Asian semiconductor suppliers has made it possible for the particular investments in semiconductor foundries to come about.

The region is reaping the benefits of industrial automation and robotics as well, which is the semiconductor field with the major focus on high-standard chips due to accurate die bonding techniques. Besides, the growing popularity of energy-efficient semiconductors dedicated for renewable energy applications is increasing the roadmap for growth. The European states are also funding semiconductor R&D activities, like the European Chips Act, therefore, paving the way for a greater demand for advanced die bonder equipment.

Asia-Pacific is the largest global die bonder equipment market area, which accounts for the most country locations of chip manufacturers such as China, Taiwan, South Korea, and Japan. Furthermore, due to the changes in the electronics sector, industrial issues are well-put and the market for advanced semiconductor packaging is imploding further. Taiwan's TSMC, South Korea's Samsung, and China's SMIC are inundated with funding, but are not limited to, differentiations, innovations, and development.

These developments in technology pave the way for local production of semiconductor equipment, which is being backed by the government. Also, with the rising use of electric vehicles (EVs) and high-performance computing (HPC) chips, the demand for high-precision die bonding solutions is being continued all over the sectors.

The die bonder equipment market is also experiencing steady growth in other parts of the world, namely Latin America, the Middle East, and Africa. The Middle East is diversifying its economy through high-tech industries, thereby leading to investments in the semiconductor sector. For instance, Brazil and Mexico are raising the automotive market as well as consumer electronics, semiconductors that come with local production.

In Africa, there is a shift towards the use of technology and mobile infrastructures which is increasing demand for semiconductors. Global semiconductor players are revaluating their strategies due to the geopolitical tensions which cause risk and are instead opting for a broad-based supply chain, which entails which will initialize new semiconductor assembly and package plants in the emerging economies.

High Cost and Capital-Intensive Nature

The most significant challenge in the die bonder equipment market is the initial investment cost, which is high, and the capital needed to be used, which is operationally heavy with respect to advanced semiconductor packaging. Die bonding machines, particularly the fully automated ones and the AI-integrated, are capital-intensive and therefore, it can become difficult for smaller companies to enter into markets.

Besides, the equipment gets older and so do the operational expenses with maintenance work and software updates that occur. The development rate of technology, however, also requires equipment manufacturers to keep up with investment burdens from forcing frequent reconfiguration of the plant's process.

The mixed architecture issue and chiplet-based designs that demand ultra-precise and tailored bonding solutions at an instance make cost-effective production nearly impossible. Firms are forced to seek other ways such as forging alliances, and automation of production processes to ensure their business stays afloat.

Supply Chain Disruptions and Geopolitical Tensions

The die bonder equipment market suffers significantly from the global concerns and semiconductor availability as well as geopolitical tensions. Trade restrictions, particularly those between the USA and China, drove uncertainty in semiconductor equipment exporting, which affected the global production.

Raw materials such as silicon wafers and bonding adhesives have had shortages that have led to delays in production timelines whereas logistical issues and fluctuating raw material prices encumber the operational areas of semiconductor manufacturers.

The shifting operations of the on shoring regional trend in production disrupts traditional supply chain networks and this could force a reconfiguration of the manufacturing process. Mitigating these risks and managing continuous market growth with the help of diversified sourcing options will secure the stable supply chain.

Advancements in AI and Automation

The lopsided development of die bonder equipment and the leap in technology caused by the introduction of AI and machine learning is increasing the need for efficiency and accuracy. AI-powered die bonding machines are now able to self-monitor themselves and correct defects in material resulting in higher yield rates and less wastage.

Also, the burgeoning trend of automated optical inspections (AOI) and predictive maintenance equipment is driving increased reliability, decreased downtime and improved process efficiency. AI-oriented systems can be designed with multiple bonding schemas, like flip-chip bonding and thermocompression bonding, enhancing their versatility.

Their AI has developed to accommodate modal programmability shear in semiconductor devices automation, which will have a strong bearing on the enhancing of the technologies. The technological shift is expected to leverage the massive investment that the industry will put in the next-generation die bonder equipment.

Emerging Markets and 3D Packaging Innovations

The incorporation of 3D semiconductor packaging technologies into the die bonder equipment market is a remarkable potential for growth. 3D-stacked ICs, fan-out wafer-level packaging (FOWLP), and hybrid bonding techniques are efficiently utilizing clinical design while minimizing size, and power, thus, revealing the technology capable of supporting a trend like 3D VLSI integration.

These technologies are unlocking fresh opportunities of high-speed, advanced, and automated bonding machines that could be utilized in the future bonded and assembled of electronics. Furthermore, the newly created markets in the Middle East and Latin America are quickly digitalizing and developing, thus, increasing the need for local semiconductor packaging and assembly.

Local governments in these regions are also providing incentives for semiconductor manufacturing which together are paving the way for expanding the bonding equipment market. These factors position the industry for sustained expansion in untapped markets.

Introduction The die bonder equipment market experienced significant growth from 2020 to 2024, driven by increasing demand for semiconductor devices across various industries, including consumer electronics, automotive, and telecommunications. Miniaturization of electronic components, advancements in automation, and the rising adoption of 5G and IoT technologies further contributed to market expansion.

Looking ahead to 2025 to 2035, the market is expected to evolve with the integration of artificial intelligence (AI) and machine learning in die bonding processes, leading to higher precision and efficiency. Sustainability efforts, such as the push for lead-free bonding and environmentally friendly manufacturing, will shape future market trends. The expansion of advanced packaging technologies, including chiplet architectures and heterogeneous integration, will further drive demand for advanced die bonder equipment.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with RoHS and REACH regulations, focus on eliminating hazardous substances |

| Technological Advancements | Bansi of ultra-fast, fully automated die production machines, as well as technology that consolidates performance and productivity |

| Industry-Specific Demand | Consumer electronics, automotive, and telecom sectors had a great deal of demand for this product |

| Sustainability & Circular Economy | Handle the initial steps to go lead-free by the use and subsequently cutting of hazardous waste |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Arguing sustainability beyond the line through stricter rules and more eco-conscious manufacturing processes |

| Technological Advancements | Placement of AI and machine learning, and leading innovations in the form of 3D stacking technology |

| Industry-Specific Demand | Quantum computing, mobile networks as well as AI were the topmost sectors in terms of item utilization |

| Sustainability & Circular Economy | Broad application of recyclable materials and energy-efficient devices together with their widespread appropriateness |

The USA die bonder equipment market is showing a positive trend with a projected growth rate of 4.7%, which is mainly motivated by the CHIPS Act that aims to support the USA semiconductor manufacturing sector. The AI, high-performance computing, and 5G sectors are the main drivers of advanced semiconductor packaging solutions, which are in high demand as a result of these industries.

The transition of the automotive industry from traditional fuel cars to electric and self-driving vehicles significantly stimulates the requirement for high-precision bonding gear. The situation is further enhanced by the top semiconductor companies which are now looking into the innovative hybrid packaging, this rise in die bonders equipped with ultra-fast and ultra-precise capabilities is directly attributed to it.

Besides, the partnerships between the semiconductor firms and the research institutes are the ones that lead to the development of the technology, that is bonding is one, therefore, the market is growing. The USA government’s intent on cutting back on the use of Asian semiconductor supply chains is another factor that encourages home market equipment investments, which in turn, makes it the die bonding technology key market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.7% |

UK die bonder equipment market is expected to increase at a yearly rate of 3.9%, primarily due to the semiconductor R&D investments and post-Brexit industrial strategies. The Focus is to the countries strengthen its semiconductor ecosystem. Resilience and high-performance computing are to the main aspects of this process.

The AI and quantum computing sectors in the UK are becoming primary driving forces, and they ask for advanced chip packaging methods even more than before. The necessity of greener and energy-saving semiconductor production is stimulating the market for the new generation of die bonding tools.

One of the reasons is the government’s-growing emphasis on locally produced chips. Partnerships between universities and tech companies further help market progress. The UK automotive industry in particular in the EV and power electronics businesses is an additional factor driving the high-precision bonding technology demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.9% |

According to the predicted estimates, the die bonder equipment market in the European Union will flourish with a 4.2% Compound Annual Growth Rate (CAGR). The primitive factor of this development is European Chips Act directed at promoting semiconductor self-sufficiency and technological leadership.

The pioneering countries in the area are Germany, France, and the Netherlands that are engaged in huge investments in semiconductor research and development thus causing the demand for advanced die bonding equipment to quicker grow. The push for the adoption of environmentally friendly die bonding equipment is emblematic of the EU's commitment to green semiconductor manufacturing, which goes hand-in-hand with the production of energy-efficient machines.

Automotive, above all, the EV sector, is the primary driving force of \b the market, as the demand for high-performance semiconductor packages grows. The fact that Europe is dotted with semiconductor foundries and packing firms guarantees the fact that die bonding technology will be in good shape all over Europe.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.2% |

The die bonder equipment market in Japan is expected to show compound annual growth rate (CAGR) of 3.8%, basically due to the semiconductor miniaturization and dense packaging high-tech advance. Japan is a high-precision engineering stronghold that is bolstering its position with the increase in demand for AI chips, automotive semiconductors, and quantum computing components.

The electronics sector in Japan is still at the forefront of innovation in consumer electronics and industrial automation, the increasing demand for high-precision die bonding solution is the result. The cooperation of microchip makers and research institutes in Japan further leads to market growth as it is.

The government also plays a role in domestic semiconductor chip production initiatives and the substitution of foreign supply chains which create further requirements for the cutting-edge bonding equipment in turn for application especially for the next generation of semiconductors.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.8% |

The die bonder equipment market in South Korea is among the fastest-growing and is increasing at a CAGR of 5.1%. The market is mostly run by Samsung Electronics and SK Hynix leading the way in global semiconductor production. Demand for the high-precision die bonding equipment is mainly exercised by the government incentives in semiconductor R&D and the strong position of South Korea in the memory chip manufacturing sector.

The boom of investment in hi-tech chip packaging technologies is driven by the newly achieved milestones in sectors like 5G, AI, and supercomputers. No other country in the world is as good in the 3D chip stacking and advanced packaging techniques, as South Korea is, further increasing the requirement of new die bonding solutions.

The semiconductor production equipment market is strongly promoted by the realities of the local supply chain and manufacturing infrastructure, highlighting South Korea as a key regional player in technology and product development.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

Fully Automatic Die Bonder Equipment Dominates Due to High Precision and Efficiency

Fully automatic bonders for die are leading the market, as they are characterized by exceptional precision, speed, and automation. These systems are vital in the manufacturing of high-volume semiconductors, which can be placed accurately with almost zero mistakes.

Packaging technologies are now advanced, such as flip-chip and 3D stacking; hence, the need for these machines has stepped over. The integration of AI and machine vision has further improved operational efficiency, which has less waste and higher yield rates.

The primary customers are Integrated Device Manufacturers (IDMs) and Outsourced Semiconductor Assembly and Test (OSAT) companies. The booming market of miniaturized electronics, which contains elements like 5G and IoT sensors chips, is because of this strong demand. The Asian region, especially China and Taiwan, has a large share due to its semiconductor manufacturing hub and dynamic technological advancement.

Semi-Automatic Die Bonders Maintain Market Presence Despite Rising Automation

Semi-automatic die bonders occupy a significant share of the market even in the era of rising automation, especially in mid-scale and specialized semiconductor assembly lines. The machines are fully semi-autonomous as they don't need to be manually controlled, which provides flexibility in the prototype development and low-to-medium production.

The aerospace, medical electronics, and specialized industrial applications sectors, need the adaptability and cost-effectiveness of their preferred semi-automatic systems. Operator intervention is required in these systems and therefore they differ from these models. For example, high-speed mass production is not suitable for them.

Existing labor markets, like those in Southeast Asia and Eastern Europe, have implemented the semiconductor industry which has led to a more skilled workforce and more efficient products. While the automation trend is on the rise, the semi-automatic segment still has a place for applications that require accuracy and controlled throughput.

Integrated Device Manufacturers (IDMs) Drive Market Growth with In-House Assembly

Integrated Device Manufacturers (IDMs) dominate the end-use segment as they control the entire Integrated Device Manufacturers (IDMs) take the lead in the end-use segment, as they have the whole semiconductor manufacturing process under their wing, from design to the packaging phase.

The major players like Intel, TSMC, and Samsung are making heavy investments in die bonding technologies in their efforts to boost production efficiency and to maintain the highest degree of quality control. The cutting-edge devices require equipment corresponding with the technological sophistication such as AI chips and HPC components that demand the most advanced die hard.

The automation of operations is achieved mostly by installing such systems, although it would be less complicated a case with just pitch applications used. The trend of vertical integration is further strengthening the market, as the IDMs are looking for ways to cut down on their assembly costs through reliance on third-party assembly. North America and South Korea are the key players with huge investments in semiconductor factories, thus, they are the primary drivers of market growth.

Outsourced Semiconductor Assembly and Test (OSAT) Companies Remain Key Consumers

OSAT Companies are the most important actors regulating the trajectory of the die bifurcation equipment market, as they have the duty of assembling semiconductor circuits and optimizing those circuits for companies that do not have their own fabrication plant. The main OSAT firms such as ASE Group, Amkor, and JCET are known for acquiring new equipment, particularly advanced die bonding through which they respond to the increasing market demand.

The among i wafer complexity and heterogeneous integration, OSATs need both odd fully automatic systems and semi-automatic systems. The development of the semiconductor packaging industry in China, Malaysia, and Vietnam has given a significant impetus to the OSAT sector's adoption of die bonder equipment. In the meantime, design houses that prioritize cash saving over every other factor, lean on OSAT providers for their important role in semiconductor supply. This drives the continuous investment in the novel die bonding technologies.

The Die Bonder Equipment Market is highly significant in semiconductor packaging, primarily driven by the need for miniaturization, 5G connectivity, and increasing performance. Fast growth is the result of advancements in flip-chip, hybrid bonding, and micro-LED applications. Major industries include consumer electronics, automotive, telecommunications, and industrial automation.

APAC led the market, where China, Taiwan, and South Korea are major semiconductor hubs. Automation, AI-driven precision bonding, and sustainable manufacturing processes are reshaping the competitive landscape. Mergers, acquisitions, and consequent market consolidation were often called and have been the result of companies striving for increased productivity and reduced production costs. The higher need for quality depend forwarding solutions will lead to continuous improvements and investments in this field.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| ASM Pacific Technology | 18-22% |

| Kulicke & Soffa Industries | 14-18% |

| Besi (BE Semiconductor Industries) | 10-14% |

| Shinkawa Ltd. | 7-10% |

| Panasonic Smart Factory Solutions | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| ASM Pacific Technology | Offers high-speed, precision die bonding for advanced packaging applications. Strong presence in APAC. |

| Kulicke & Soffa Industries | Specializes in flip-chip and hybrid bonding solutions. Focus on cost-effective, automated processes. |

| Besi (BE Semiconductor Industries) | Develops high-performance die bonder equipment for high-volume production. Strong in European markets. |

| Shinkawa Ltd. | Provides advanced wire bonding and die attach solutions for semiconductor packaging. |

| Panasonic Smart Factory Solutions | Offers fully automated die bonding systems for high-throughput applications. |

Key Company Insights

ASM Pacific Technology

Semiconductor packaging machinery concepts are run by ASM Pacific Technology, a world leader in the field, which implements high-speed and high-precision die bonding. The firm is heavily focused on artificial intelligence and digital twin technology for automating production processes and enhancing efficiency.

The company is a leading player in the APAC area, especially in China and Taiwan, where the semiconductor manufacturing industry is flourishing. ASM Pacific Technology aims to widen its range of products with mini-LED and micro-LED applications, beyond that, the company also studies sustainable manufacturing and material efficiency.

The usage of robotics and high-tech inspection systems is slated by the company to boost both product quality and yield. Through strategic partnerships with semiconductor giants, the company garners top market position and influences significantly in the die bonder equipment niche.

Kulicke & Soffa Industries

Semiconductor assembly solution sharks give their hand at hybrid bonding, flip-chip bonding, and advanced wire bonding through Kulicke & Soffa Industries. AI is a particular automation, predictive maintenance, and machine learning-based process optimization for the finance sector of the industry. It is the no-cost and high-quality bonding solutions that have won the trust of the larger semiconductor manufacturers in the company.

Kulicke & Soffa is a company that has a solid presence in North America and Asia, and that collaborates with the main semiconductor foundries. It aims to be environmental friendly by lowering energy usage in its production operations. The recent entry into the underserved sectors, primarily Southeast Asia, confirms abundant expansion and the desire to be global.

Besi (BE Semiconductor Industries)

Besi is a supplier in die attach technology being a European leader, and it offers high-volume and high-reliability semiconductor packaging services. Consequentially, the enterprise emanates energy-efficient and sustainable production, thus diminishing waste and maximizing resource efficiency. Besi, a European company, is embarking on North American expansion while addressing the increasing need for AI, automotive, and high-performance advanced packaging technologies.

The company is launching next-gen hybrid bonding solutions, which are the most efficient and precise development yet. The foci of R&D revolve around automation, digital transformation, and machine learning to drive operational efficiencies. The company’s strong ties with worldwide semiconductor manufacturers are an avenue for growth and market developments.

Shinkawa Limited

Shinkawa Ltd. is the primary player in semiconductor packaging specializing in advanced wire bonding and die attach solutions. This company is a pioneer of R&D and they are devising new die bonding technology that offers improved speed and precision. Shinkawa is honing its focus on high-reliability applications particularly in the areas of 5G, automotive, and IoT markets.

The firm is working on AI-driven defect detection and automated process control to boost yield rates. The company is expanding its manufacturing nadars to meet the increased demand from customers and is focusing on R&D efforts in Asia and North America. Shinkawa stands out for solving very specific customer needs with product negotiations that are tailored exclusively to particular sectors.

Panasonic Smart Factory Solutions

Panasonic Smart Factory Solutions offers a comprehensive range of fully automated die bonding machines for high-speed applications. The company fuses machine learning and predictive maintenance technologies to jazz up process efficiency. Eco-friendly protocols and energy conservation are the main motives behind the investigation of environmentally friendly production techniques, which Panasonic is also focusing on.

Panasonic is leveraging its robotics and factory automation expertise and is increasing its role in semiconductor manufacturing. Waste management and energy consumption are also dealt with alongside the introduction of green production processes.

The emphasis is on smart manufacturing solutions, therefore, operational efficiency is going to be raised and besides that, the ongoing needs of semiconductor manufacturers are going to be answered worldwide.

What is the estimated market size of the global Die Bonder Equipment market for 2025?

The market is anticipated to grow at a CAGR of 4.3% over the forecast period.

By 2035, the Die Bonder Equipment market is expected to reach USD 7,317.7 million.

The Fully Automatic segment is expected to dominate the market, due to its high precision, faster throughput, reduced labor costs, advanced automation, increasing demand in semiconductor packaging, and ability to handle complex, high-volume production with minimal errors.

Key players in the Die Bonder Equipment market include ASM Pacific Technology, Kulicke & Soffa Industries, Besi (BE Semiconductor Industries), Shinkawa Ltd., Panasonic Smart Factory Solutions

In terms of Product Type, the industry is divided into Manual, Semi-automatic, Fully Automatic

In terms of End Use/User, the industry is divided into Integrated Device Manufacturers (IDMs), Outsourced Semiconductor Assembly and Test (OSAT)

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

Diaphragm Coupling Market Growth - Trends & Forecast 2025 to 2035

HID Ballast Market Growth - Trends & Forecast 2025 to 2035

Fluid Conveyance Systems Market Growth - Trends & Forecast 2025 to 2035

GCC Magnetic Separator Market Outlook – Growth, Trends & Forecast 2025-2035

United Kingdom Magnetic Separator Market Analysis – Size, Share & Forecast 2025-2035

Glass Door Merchandisers Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.