Global demand for diamond core drilling is also increasing rapidly with the growth in the construction sector, rising mining activities, and technological advancements in drilling. According to the study, the Compound Annual Growth Rate (CAGR) of the market is predicted to be approximately 5.2%, with sales reaching USD 2.5 billion by 2035.

Boart Longyear, Schlumberger, and Atlas Copco are some of the major competitors that rely on their experience in durable, high-performance drilling equipment. The leaders are keen on technological innovation, launching automated and hybrid models, expanding their product lines, and enhancing after-sales services. All these strategies are aimed at satisfying customer needs while improving efficiency in operations.

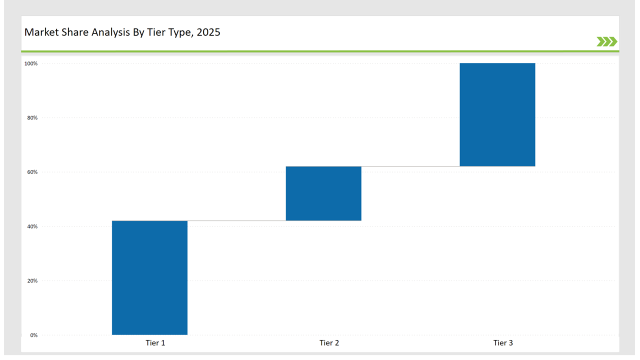

The market is divided with top companies holding approximately 45% of the market share, while the remaining 55% is shared between regional and niche players. Companies are focusing on creating specialized solutions for different end-use sectors such as construction, mining, and environmental services.

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 2.5 billion |

| CAGR during the period 2025 to 2035 | 5.2% |

Explore FMI!

Book a free demo

| Category | Industry Share (%) |

|---|---|

| Top 3 Players (Boart Longyear, Schlumberger, Atlas Copco) | 42% |

| Rest of Top 5 (Sandvik, Epiroc) | 20% |

| Rest of Top 10 | 38% |

Market is moderately concentrated, with Tier-I firms concentrating on high-end diamond core drilling equipment. Competition in the market is provided by Tier-II and Tier-III firms focusing on cost-competitive and niche solutions to regional needs.

Hand-held drills comprised 30% of total market share. These are small and suitable for small-scale activity including geological surveys and construction work. This segment is mainly dominated by companies such as Boart Longyear, as this offers innovative handheld solutions. 70% of the market share is held by rig-operated drills, mainly used in big-scale drilling operations in mining and construction. The sort of drill provides more power and drilling capacity, ensuring that it will do a better performance for deep and complex drilling tasks. The leading companies are Schlumberger and Atlas Copco, with their high-performance and reliable systems, for rig-operated segment.

Stitch drilling is 25% of the market as companies such as Epiroc are utilizing this for mining and geotechnical surveys. Underwater diamond drilling constitutes 15% of the market, and Boart Longyear and Atlas Copco dominate offshore drilling solutions. Surface drilling is a huge segment representing 40% of the market, which is critical for mining and construction operations, while underground drills contribute 20% and concentrate on deep exploration in mining.

The market share held by the construction industry is at a high level with 60%. Exploration of new mineral deposit discoveries and deep drilling spur the demand for diamond core drilling in the mining industry. The mining industry takes the second-largest share with 40% as they employ diamond core drilling for the precise and efficient excavation of foundations, tunnels, and utilities. Drilling in environmental and water well applications also forms a significant percentage of the market, particularly for environmental surveys and water resource explorations.

Boart Longyear

By 2024, Boart Longyear had solidified its leadership edge with handheld and rig-operated drilling equipment innovation. The company stretched out further product lines to hybrid and automated drilling systems into the mining and construction industries. Boart Longyear used knowledge of core drilling technology and increased the efficiency of its operations through its equipment while keeping a strong pace of growth and market leadership.

Schlumberger

Schlumberger was still at the top leaders in diamond core drilling markets through 2024. Its thrust was on innovation for automation and digital drilling technologies. The company also launched its high precision tools for deep drilling in mining and geotechnical applications. Its investments in sustainable drilling technologies allowed Schlumberger to open environmental and water well drilling.

Atlas Copco

The company maintained its position in the diamond core drilling market through comprehensive drilling solutions for mining and construction operations. This was because of a cutting edge technology like IoT integration and automation in the drilling equipment making it more competitive.

| Tier | Examples |

|---|---|

| Tier 1 | Boart Longyear, Schlumberger, Atlas Copco |

| Tier 2 | Sandvik, Epiroc |

| Tier 3 | Regional and niche players |

| Company | Key Focus |

|---|---|

| Boart Longyear | The company launched automated and hybrid drilling systems to enhance efficiency in mining and exploration. |

| Schlumberger | Schlumberger introduced advanced precision drilling tools equipped with real-time data monitoring to improve operational efficiency. |

| Atlas Copco | Atlas Copco focused on increasing drill power and versatility with advanced rig-operated systems. |

| Sandvik | Sandvik rolled out new drill bits that improve performance and reduce wear in mining operations. |

| Epiroc | Epiroc developed eco-friendly drilling solutions for both surface and underground applications. |

The diamond core drilling market is expected to continue expanding due to ongoing technological advancements and increased demand from industries like mining, construction, and environmental surveying. Companies will need to focus on product innovation, geographic expansion, and service excellence to stay ahead in this competitive market. North America and Europe will remain key markets, but the growing demand in Asia-Pacific and Latin America will play an increasingly important role in shaping the market’s future growth.

Boart Longyear, Schlumberger, and Atlas Copco command a significant portion of the market share.

Rig-operated diamond core drills dominate the market, accounting for a larger share compared to hand-held drills.

Regional and domestic players hold approximately 20% of the total market share.

The market is moderately concentrated, with Tier-I players commanding a significant portion of the market.

The construction industry offers significant growth prospects due to ongoing exploration and extraction activities.

GCC Countries Centrifugal Pumps Market Growth - Trends & Forecast 2025 to 2035

Japan Centrifugal Pumps Market Growth - Trends & Forecast 2025 to 2035

USA Centrifugal Pumps Market Growth - Trends & Forecast 2025 to 2035

UK Centrifugal Pumps Market Growth - Trends & Forecast 2025 to 2035

Germany Centrifugal Pumps Market Growth - Trends & Forecast 2025 to 2035

Russia Centrifugal Pumps Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.