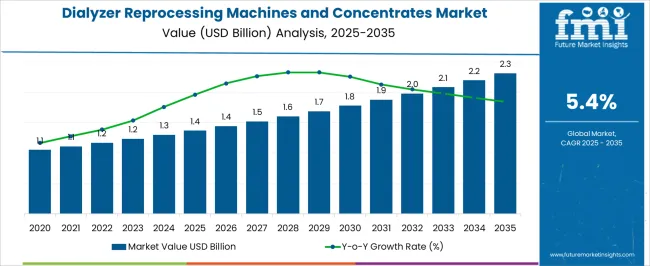

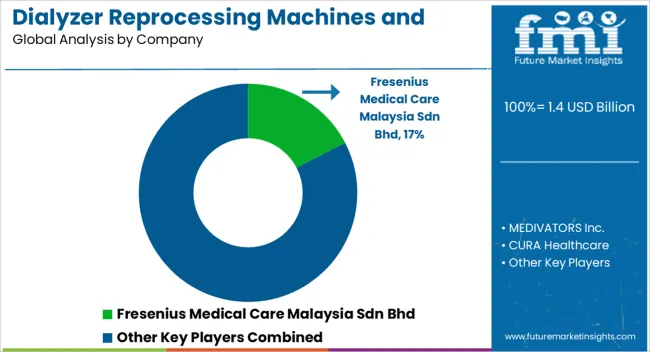

The Dialyzer Reprocessing Machines and Concentrates Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

The dialyzer reprocessing machines and concentrates market is expanding steadily due to rising incidences of chronic kidney diseases and the increasing need for cost-effective dialysis solutions. Demand growth is being reinforced by advancements in automated reprocessing technologies and continuous improvements in concentrate formulations that enhance treatment safety and efficacy. Market participants are focusing on optimizing production capacity, ensuring regulatory compliance, and improving operational efficiency to address growing global demand.

The shift toward hospital-based dialysis care and government initiatives promoting better renal healthcare infrastructure are supporting sustained market penetration. In emerging economies, greater access to dialysis centers and adoption of modern reprocessing systems are accelerating expansion.

The future outlook is shaped by the integration of smart reprocessing technologies, stricter hygiene standards, and continued investment in high-purity concentrates These factors collectively contribute to higher treatment consistency, cost efficiency, and reliability, ensuring long-term market growth and strengthened presence across healthcare facilities.

| Metric | Value |

|---|---|

| Dialyzer Reprocessing Machines and Concentrates Market Estimated Value in (2025 E) | USD 1.4 billion |

| Dialyzer Reprocessing Machines and Concentrates Market Forecast Value in (2035 F) | USD 2.3 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

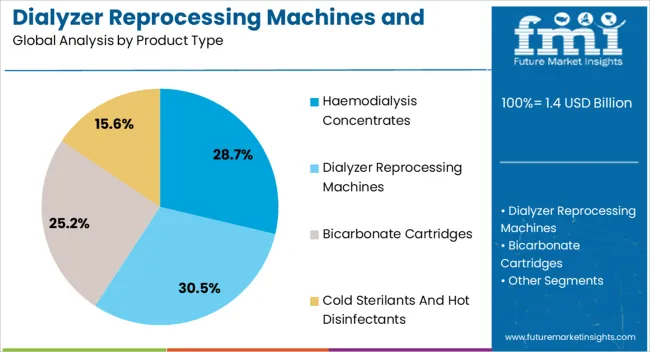

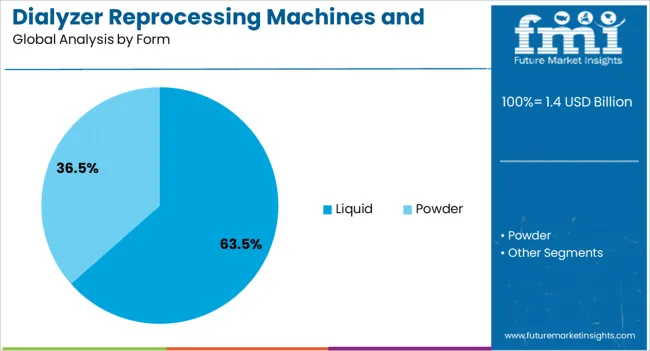

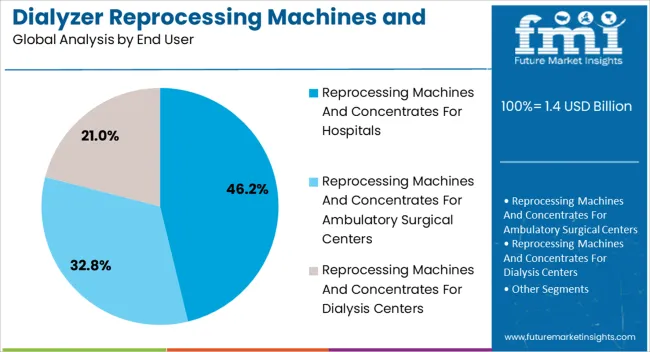

The market is segmented by Product Type, Form, and End User and region. By Product Type, the market is divided into Haemodialysis Concentrates, Dialyzer Reprocessing Machines, Bicarbonate Cartridges, and Cold Sterilants And Hot Disinfectants. In terms of Form, the market is classified into Liquid and Powder. Based on End User, the market is segmented into Reprocessing Machines And Concentrates For Hospitals, Reprocessing Machines And Concentrates For Ambulatory Surgical Centers, and Reprocessing Machines And Concentrates For Dialysis Centers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The haemodialysis concentrates segment, accounting for 28.70% of the product type category, has remained dominant owing to its critical role in maintaining electrolyte balance and supporting efficient blood purification. Consistent adoption has been driven by its reliability, cost-effectiveness, and compatibility with a wide range of dialysis systems.

Technological advancements in concentrate formulation and automated dosing systems have enhanced treatment precision and patient safety. Manufacturers have focused on producing sterile, high-purity solutions to meet stringent healthcare standards, which has improved trust among dialysis providers.

The segment’s steady demand is further supported by the global rise in end-stage renal disease cases and the expansion of dialysis care networks As hospitals and clinics continue to prioritize effective and safe haemodialysis procedures, this segment is expected to sustain its leading position over the forecast period.

The liquid segment, representing 63.50% of the form category, has led the market due to its ease of handling, faster preparation time, and direct usability in clinical environments. Its dominance has been driven by operational convenience, reduced dilution errors, and enhanced sterility during dialysis procedures.

Healthcare facilities prefer liquid concentrates for large-scale operations, where efficiency and time management are crucial. Continuous improvements in packaging and dispensing technologies have minimized contamination risks and extended shelf life, strengthening user confidence.

The segment’s growth is also supported by increased production automation and optimized logistics, ensuring consistent supply across hospital and clinic networks As dialysis demand rises globally, the liquid form is expected to maintain its market leadership, supported by its proven reliability and practical application benefits.

The reprocessing machines and concentrates for hospitals segment, holding 46.20% of the end user category, has emerged as the leading contributor due to the increasing integration of advanced reprocessing systems within hospital dialysis units. Adoption has been driven by the need for infection control, resource optimization, and compliance with hospital hygiene standards.

Hospitals have been focusing on implementing automated systems that ensure consistent cleaning, sterilization, and concentrate preparation, minimizing operational downtime. The segment benefits from hospital-driven procurement cycles, government healthcare funding, and the presence of trained personnel.

Expanding hospital infrastructure in emerging regions and strategic collaborations with dialysis equipment manufacturers are further enhancing accessibility With a focus on improving patient outcomes and operational sustainability, hospitals are expected to continue dominating demand for reprocessing machines and concentrates throughout the forecast period.

Automated and Quality Care for Patients to be a Key Trend

Increasing automation, increased efficiency, and improved safety features in dialyzer reprocessing machines are driving the dialyzer reprocessing machines and concentrates market.

Dialyzer producers are concentrating on developing devices that can reprocess dialyzers quickly and effectively, lowering the possibility of contamination and reducing the need for human involvement.

Healthcare facilities focus on reducing expenditures without sacrificing the quality of care for their patients. Dialyzer reprocessing machines provide an affordable alternative to disposable dialyzers by enabling hospitals and dialysis facilities to reuse the dialyzers several times.

The increasing prevalence of end-stage renal disease (ESRD) and chronic kidney disease (CKD) has led to the increasing requirement for dialyzer reprocessing equipment and concentrates. With an aging population and diseases such as diabetes and hypertension on the rise, dialysis demand is expected to increase further.

Innovative Devices to Push Demand for Dialyzer Reprocessing Machines and Concentrates

As care models shift to value-based models, medical professionals are encouraged to prioritize treatments that are economical, efficient, and effective. As part of a value-based healthcare model, dialysis reprocessing offers a cost-saving solution without compromising patient care.

Comprehensive instruction and training programs are conducted for the safe operation of dialyzer reprocessing equipment and concentrates. Manufacturers provide healthcare professionals with training services, educational materials, and certification programs to ensure safe and efficient reprocessing procedures.

Residential dialysis is a trend that presents producers with an opportunity to create dialyzer reprocessing equipment. Companies may be able to secure a significant share of the growing home dialysis market by providing convenient and easy-to-use solutions.

A sophisticated dialyzer reprocessing equipment with improved automation, safety features, and efficiency can be created by manufacturers. Businesses can stand out from competitors by investing in cutting-edge reprocessing technology to attract healthcare providers.

Training and Cross-contamination are likely to Hamper Demand

Government regulations on dialyzer reprocessing practices and standards for safe reuse and following protocols for recycling medical equipment are major problems.

The efficiency and safety of recycled dialyzers may be questioned by patients and healthcare professionals, regardless of the possible cost savings. The development of highly automated and safe reprocessing machines for dialyzers can be challenging.

Lack of efficient and secure reprocessing procedures and training will hamper dialyzer reprocessing machines and concentrates market. Healthcare infrastructure restrictions may prevent dialyzer reprocessing equipment and concentrates from being widely adopted in some areas, especially those with limited resources.

The global dialyzer reprocessing machines and concentrates market registered a CAGR of 5% during the historical period between 2020 and 2025. The market for dialyzer reprocessing machines and concentrates grew positively and reached a value of USD 1.4 million in 2025.

Reusing a dialysis machine carries a risk of infection and pyrogenic responses. Reusing dialyzers has not been associated with a significant increase in morbidity. The safety of the reprocessing technique is guaranteed by adhering to suggested standards and criteria.

In order to reduce the risk of chemical and microbiological exposure during reprocessing, it is recommended that the operator wears appropriate protective gear during the procedure. Regularly testing and inspecting the dialyzer reuse procedure will also ensure its safety and efficacy.

Reusing dialyzers in dialysis centers requires adherence to stringent regulations established by groups like the Association for the Advancement of Medical Instrumentation (AAMI). These guidelines include measures to guarantee the reprocessing process's quality and safety.

The demand has shown a noteworthy movement toward more ecologically friendly method. Companies are developing devices that use less water and chemicals, as well as concentrates that produce as little trash as possible.

This trend is in line with the healthcare industry's larger emphasis on environmentally friendly solutions, which is being pushed by regulatory restrictions and growing environmental effect awareness.

A country-level forecast of dialyzer reprocessing machines and concentrates is provided in the following section. An overview of key countries is provided, including those in North America, Asia, and Europe.

In North America, Canada is predicted to remain the leader, with a CAGR of 4.4% through 2035. According to projections, South Korea will have a CAGR of 6.6% by 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 3.9% |

| Canada | 4.4% |

| Germany | 4.5% |

| United Kingdom | 4.8% |

| China | 5.8% |

| South Korea | 6.6% |

Investing in healthcare infrastructure and services may lead to more widespread use of dialysis reprocessing machines and other advanced medical technologies in South Korea.

Modernizing and expanding healthcare facilities may find a home for reprocessing technology. A growing awareness of the environment and the need to reduce medical waste could encourage South Korea to reprocess more dialyzers. Reprocessing dialyzers not only cuts down on medical waste but also helps be more sustainable.

South Korea has a reputation for strong technological capabilities and innovation across a range of industries, including healthcare. This could result in the development of advanced dialyzer reprocessing equipment with enhanced efficiency, security, and automation.

As a result of these developments, healthcare facilities will be able to offer cutting-edge dialyzer reprocessing solutions, which will accelerate market expansion.

Affluent nations such as the United Kingdom have seen an increase in chronic kidney disease (CKD). This has increased demand for dialysis therapies, including devices that reprocess dialysis waste and dialyzer concentrates.

Dialysis centers benefit from dialyzer reprocessing devices that allow dialyzers to be reused after appropriate sterilization. Due to the fact that the overall operating costs of dialysis providers are reduced through lower dialysis treatment costs, both patients and healthcare providers can afford dialysis.

Healthcare companies are increasingly focusing on sustainability with reprocessing dialyzers. As a result of reusing dialyzers, less medical waste is produced, which contributes to environmental conservation efforts. In the United Kingdom, the Medicines and Healthcare Products Regulatory Agency (MHRA) is responsible for the regulation of medical devices.

It also oversees supplies and equipment used for dialysis. A manufacturer must adhere to the rules and guidelines established by the Medical Device Regulation Authority (MHRA) before their products can be marketed or used in the United Kingdom.

Dialysis services have been in high demand in recent years due to a noticeable rise in chronic kidney diseases and other renal diseases in the United States.

It is anticipated that the United States market will be significantly shaped by the presence of major dialyzer reprocessing machine and concentrate companies, as well as a highly established healthcare infrastructure.

In the United States, dialysis centers are regulated by the Centers for Medicare and Medicaid Services (CMS). A list of rules and specifications has been set by CMS to govern the reuse of dialyzers and bloodlines for hemodialysis therapy.

It is important to adhere to certain rules and guidelines when reusing dialyzers. The dialyzers and bloodlines that can be used for different patients can generally be reused, with the exception of those who are positive for Hepatitis B in their blood tests.

According to the regulations of the Food, Drug, and Cosmetic Act, dialysis devices must be labeled to indicate that they can be reused more than once.

A brief overview of the industry's major segments is provided in this section. In terms of product type, the hemodialysis concentrates segment held a share of 71.7% in 2025. By form, the liquid segment accounted for a market share of 50.3% in 2025.

| Segment | Hemodialysis Concentrates (Product Type) |

|---|---|

| Value Share (2025) | 71.7% |

Hemodialysis concentrates are expected to lead the market during the forecast period. The hemodialysis concentrates market share in 2025 was 71.7%. A hemodialysis concentrate assists in the process of making dialysate, which is used for removing wastes and extra fluid from the blood.

The cost of pre-made dialysate solutions is generally higher than that of concentrates. In order to save costs without compromising patient care, medical organizations are turning to concentrates.

Concentrates reduce medical waste when compared to single-use dialysate solutions. As concentrates are packaged in smaller quantities, transportation costs are lower, and packaging waste is reduced. As healthcare institutions become more concerned about sustainability, concentrates are becoming more popular as an environmentally friendly option.

| Segment | Liquid (Form) |

|---|---|

| Value Share (2025) | 50.3% |

A dominant share of 50.4% was held by the liquid segment of the global dialyzer reprocessing machines and concentrates market. Over the forecast period, liquid has been predicted to maintain its leading position in the market. Reprocessing a dialyzer in liquid form is more convenient and user-friendly.

Concentrated liquid is formulated to safely and effectively clean and disinfect dialyzers, removing pollutants and pathogens so the dialyzers' safety and integrity can be preserved. In healthcare settings where space may be limited, liquid concentrates tend to take up less space in storage than powder forms.

A liquid dialysate concentrate offers easier handling and less logistics than ready-to-use liquid dialysate concentrates, which simplifies the reprocessing workflow and reduces the workload of medical personnel.

In addition to being cost-effective, liquid concentrates can be efficient because of their efficient usage, low waste, and potential cost savings from handling and storing them.

Manufacturers of dialyzer reprocessing machines and concentrates are expanding their product portfolios in order to reach a wider range of international markets. Building long-term relationships with customers requires technical support, maintenance, and training.

In order to improve customer satisfaction and loyalty, companies invest in service infrastructure, which ensures their products are reliable and up-to-date.

Strategic partnerships and collaborations are being formed by many companies with dialysis centers, healthcare facilities, and other stakeholders for the purpose of expanding their market reach.

Increasing the reach and penetration of products in new geographical areas is often accomplished by forming joint ventures, signing distribution agreements, and obtaining licensing agreements.

As key players in dialyzer reprocessing machines and concentrates market strive to gain a stronger market position, they use acquisitions and mergers as a strategy for consolidating the market.

The acquisition of smaller companies or the merger with rivals can increase companies' competitiveness by expanding their product portfolios, accessing new technologies, and acquiring new customers.

Industry Updates

MEDIVATORS Inc.- The company plans to expand its automated reprocessing machines with improved features to improve efficiency and safety. To further promote the adoption of their products, they may also establish strategic alliances with healthcare organizations.

CURA Healthcare- CURA Healthcare offers medical imaging equipment and critical care equipment that are known for their innovation. The broader health sector may benefit from their products and technologies, even if they are not specifically related to dialyzer reprocessing.

The industry is segregated into dialyzer reprocessing machines, haemodialysis concentrates, acetic acid based concentrates, citric acid based concentrates, bicarbonates based concentrates, calcium-free based concentrates, potassium free based concentrates, bicarbonate cartridges and cold sterilants and hot disinfectants

Based on the form type, the industry is classified into liquid and powder.

In terms of end users, the industry is further classified into reprocessing machines and concentrates for hospitals, reprocessing machines and concentrates for ambulatory surgical centers, and reprocessing machines and concentrates for dialysis centers.

Key countries of North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, and the Middle East and Africa are covered.

The global dialyzer reprocessing machines and concentrates market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the dialyzer reprocessing machines and concentrates market is projected to reach USD 2.3 billion by 2035.

The dialyzer reprocessing machines and concentrates market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in dialyzer reprocessing machines and concentrates market are haemodialysis concentrates, _acetic acid based concentrates, _citric acid based concentrates, _bicarbonates based concentrates, _calcium-free based concentrates, _potassium free based concentrates, dialyzer reprocessing machines, bicarbonate cartridges and cold sterilants and hot disinfectants.

In terms of form, liquid segment to command 63.5% share in the dialyzer reprocessing machines and concentrates market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Endoscope Reprocessing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Endoscope Reprocessing Device Market – Trends & Forecast 2025-2035

Color Concentrates Market

Cheese Concentrates Market Size and Share Forecast Outlook 2025 to 2035

Omega-3 Concentrates Market Size and Share Forecast Outlook 2025 to 2035

Ketchup Concentrates Market Analysis by Nature, Product Type, Distribution Channel and Region through 2035

Fragrance Concentrates Market Size and Share Forecast Outlook 2025 to 2035

Vegetable Concentrates Market Growth - Nutrient-Dense Foods & Industry Demand 2025 to 2035

USA Omega-3 Concentrates Market Report – Trends, Demand & Outlook 2025-2035

Soft Drinks Concentrates Market Trends - Growth & Forecast

Emulsifiable Concentrates Market Size, Growth, and Forecast 2025 to 2035

Europe Omega-3 Concentrates Market Insights – Growth, Demand & Forecast 2025-2035

Prothrombin Complex Concentrates Market Trends and Forecast 2025 to 2035

Enzyme-Enabled Cold-Brew Concentrates Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA