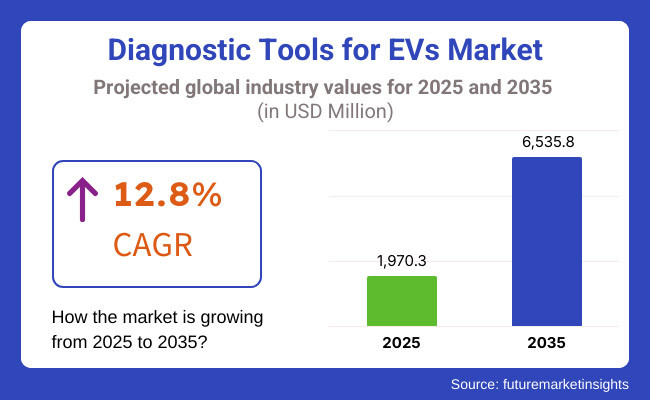

The diagnostic tools for EVs market is projected to experience significant growth from 2025 to 2035, the reason being the rapid increasement in the ownership of electric vehicles (EV), developments in automotive diagnostics and demand for cost-efficient battery monitoring systems. The market was valued at USD 1,970.3 million in 2025 and is expected to be USD 6,535.8 million in 2035, with a CAGR of 12.8% during the forecast period.

Some of the reasons fuelling this growth. The growing EV sales, stringent emission regulations, and higher complexity of the EV powertrains augment the need for advanced diagnostic tools. Moreover, the adoption of cloud-based diagnostics, AI-powered fault detection, and remote vehicle monitoring systems are also driving the market growth.

Despite this positive outlook, challenges such as the high costs of advanced diagnostic systems, lack of technical expertise in emerging markets and cybersecurity threats including the risk of connected diagnostic systems remain potential challenges of the connected diagnostics market.

To mitigate these issues, OEMs and automotive service organizations (ASOs) are making significant investments in over-the-air (OTA) diagnostic capabilities, predictive maintenance technologies, and easy-to-use diagnostic software to improve EV servicing, minimize downtime, and improve overall lifecycle management strategies.

Over the next decade, the diagnostic tools for EVs Market will be influenced by an increased focus on EV fleet maintenance, the integration of AI-driven diagnostic tools, and the expansion of the EV service network. As long as we increase the use of real-time data analysis, wireless diagnostics systems, and the health of EV batteries that are crucial to the industry, the future of EV will remain bright.

Explore FMI!

Book a free demo

North America is the largest market for EV diagnostic tools, due to the rapid adoption of electric vehicles (EVs) in the USA and Canada. The growth of the market can be attributed to the enhanced availability of EV Manufacturers, the ever-increasing stringent regulations for emissions, and various government incentives for adopting EV.

Even more importantly, however, is the inevitable complexity of EV powertrains, battery management systems, and myriad electronic components driving demand and pressure for advanced diagnostic tools. The increase of connected car technologies and artificial intelligence (AI)-driven diagnostics in the region bolsters the market potential.

Also, factors like the initial adoption costs of diagnostic tools and compatibility issues related to the models of EV made, act as hindrances to the widespread adoption of the product in the market. Companies are focusing on cloud-oriented diagnostics and real-time monitoring solutions as well as fault detection using AI so as to enhance expense and accuracy.

Germany, the UK, France, and the Netherlands have acknowledged Europe as a prominent market for EV diagnostic tools, which is a bushiness towards electric vehicles. The growing adoption of advanced diagnostic solutions in the region is attributed to stringent CO2 emission guidelines, increased government support, as well as a developed charging infrastructure.

As EV fleets grow, the need for predictive maintenance and remote diagnostics to be able to service these vehicles is growing. Nonetheless, difficulties including regulatory complexities and the high cost of integrating advanced diagnostic systems affect growth.

Innovation in the EV diagnostic service space has companies concentrating on creating new diagnostic platforms that can be standardized, performing over-the-air (OTA) software updates and inventing diagnostic tools backed by AI analytics to enhance the performance and reliability of EVs.

The Asia-Pacific region is expected to be the fastest-growing market for diagnostic tools for EVs owing to the growing penetration of electric vehicles in China, Japan, South-Korea, and India. Government measures encouraging EV adoption, along with a rapidly growing automotive sector, fuel demand for advanced diagnostic technologies.

Inefficiencies in service infrastructure and disparate EV standards across countries are major bottlenecks, even amid strong market growth. But the investments in smart diagnostic solutions, IoT-based vehicle monitoring, and AI-driven fault detection are transforming the market.

Two wheeler, three wheeler, and four wheeler manufacturers in the EV space will be working with companies to expand their capabilities further in the region to enable diagnostics and ensure trouble-free vehicle maintenance.

Challenges: Complexity of EV Diagnostics and Lack of Standardization

One of the key challenges in the diagnostic tools for EVs Market is the complexity of diagnosing EVs in comparison to traditional internal combustion engine (ICE) vehicles. Compared to the past, EVs employ more advanced battery management systems, power electronics, and software-driven controls where fault detection and repair are now more complex than traditional technology.

Besides, the lack of a uniform diagnostic procedure from different EV manufacturers introduces compatibility challenges for universal diagnostic tools. This lack of standardisation makes servicing more complicated and costlier for workshops and fleet operators. Addressing this challenge must be an industry-wide effort to deliver harmonised diagnostic standards and multi-brand capable diagnostic solutions.

Opportunities: Integration of AI and Remote Diagnostics in EV Maintenance

The increasing adoption of AI-driven predictive diagnostics and remote monitoring systems presents a significant opportunity in the EV diagnostics market.

Preparing for breakdowns based on predictive maintenance in summary, an if-anomaly-is-detected predictive maintenance system ensures the safety of electric vehicles before a breakdown occurs, using advanced AI algorithms to measure near-limit behaviour in real time, including battery degradation, powertrain inefficiencies, and software malfunctions.

Moreover, remote diagnostic tools enable automakers and service providers to issue over-the-air (OTA) software updates and use predictive maintenance to minimize downtime and repair costs. In an evolving market, everything equips the company pursuing AI-powered Analytics, cloud-based diagnostic platforms, and IoT-enabled EV monitoring solutions with a significant advantage.

The growing deployment of EVs around the globe has also led to a greater need for advanced diagnostic software and battery health monitoring tools between 2020 and 2024.

Manufacturers using iOS & Android apps keep proprietary diagnostic platforms, while third-party service providers (typically small companies) faced difficulties due to limited access to EV manufacturers' on-board data. Nevertheless, connected vehicle technologies along with AI-based analytics increased fault detection accuracy as well as optimized maintenance efficiency.

By 2025 to 2035, Artificial Intelligence-based diagnostics, cloud-based remote monitoring and blockchain-based maintenance records will be on the market. As autonomous EVs and vehicle-to-grid (V2G) integration become more mainstream, sophisticated diagnostic tools will be necessary to manage the multidirectional energy flows and predict failures.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Emphasis on battery health reporting requirements |

| Technological Advancements | Growth in proprietary diagnostic software and tools |

| Industry Adoption | Early adoption by EV manufacturers and fleet services |

| Supply Chain and Sourcing | Dependence on automaker-specific tools |

| Market Competition | Dominated by OEM-specific diagnostic tools |

| Market Growth Drivers | Rising EV sales and demand for efficient servicing |

| Sustainability and Energy Efficiency | Focus on battery life extension and recycling |

| Consumer Preferences | Demand for fast and accurate diagnostics |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter mandates for standardized EV diagnostics and data access |

| Technological Advancements | AI-driven predictive diagnostics and remote monitoring solutions |

| Industry Adoption | Widespread use in independent workshops and roadside assistance |

| Supply Chain and Sourcing | Open-source, multi-brand compatible diagnostic platforms |

| Market Competition | Expansion of AI-powered third-party diagnostic providers |

| Market Growth Drivers | Increased focus on predictive maintenance and fleet optimization |

| Sustainability and Energy Efficiency | AI-optimized energy management and V2G diagnostics |

| Consumer Preferences | Preference for remote diagnostics and automated self-healing EVs |

The demand for EV diagnostic tools in the United States is on the rise as EV technology is becoming well-used and the EV charging infrastructure is growing. As automakers pour investments into battery-powered vehicles and government incentives promote greater EV adoption, interest in advanced diagnostic systems has grown.

These tools can help for example determine foibles with battery performance, electric drivetrains, and software integration, maximizing efficiency and life of the vehicle. The increasing adoption of connected vehicles and AI-based predictive maintenance solutions is also driving the growth of the market, enabling remote diagnostics and real-time performance monitoring.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 12.8% |

The UK is becoming a major player in the EV diagnostic tools market as the government embraces strict emissions regulations and commits to ban internal combustion engines. As more EVs roll off production lines and into driveways, the need for tools to detect faults, monitor battery health and analyse software has grown.

Automakers and service centers are utilizing AI and cloud-based platforms to forecast problems in advance and keep those EVs in operation. As charging stations are set up more and more, that simply adds to the appeal of high level diagnostic solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 12.1% |

The EV diagnostic tools market in the European Union (EU) countries such as Germany, France, and the Netherlands is growing at a faster pace as they have stringent emissions policies, high adoption of EVs, and extensive government support.

The growing presence of top-tier EV manufacturers and software companies is stimulating real-time diagnostic solutions, predictive analytics, and cloud-based maintenance platforms. Also, vehicle manufacturers are now investing in smart diagnostic tools possessed by the vehicle in order to ensure the battery efficiency, increase the vehicle life and optimize the energy usage achieving the EU demands for a carbon neutral future.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 12.5% |

Japan has a solid automotive industry, and is home to sophisticated battery technology, leading to increasing demand for EV diagnostic tools. As major automotive manufacturers such as Toyota and Nissan extend their line of EV vehicles, comprehensive diagnostic solutions need to be in place.

Japanese companies are adopting analytics powered by AI and diagnostic tools enabled by IoT to improve vehicle performance and predictive maintenance. Compared to petrol and diesel driven cars, bikes and trucks with exact underlying cause for bringing cars with serious reduction in emissions, towards sustainable mobility, the government endeavours and also next-generation battery technologies development are expected to drive the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 12.3% |

Hyundai and Kia are leading the charge in South Korea's transition to zero-emission mobility. With the nation placing strong focus on smart infrastructure and battery technology innovation, the need for advanced EV diagnostic tools is anticipated to rise.

AI, big data and cloud computing to develop real-time monitoring systems to support EV batteries, the integration of powertrains and the integration of software. The market expansion is being buoyed by government EV adoption incentives and a rapidly growing charging network.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 12.4% |

The global diagnostic tools for EVs market is fast developing as the adoption of electric vehicle (EV) is increasing around the globe. With EV technology advancing, so too has the need for precise and effective diagnostic tools.

Such tools are extremely important, maintaining vigilance on vehicle performance, fault detection, and timely maintenance of the vehicle. Increasing trend towards connected and autonomous vehicles are further propelling the demand for advanced diagnostic solutions. As artificial intelligence, cloud computing and remote diagnostics make strides, manufacturers are incorporating smarter technologies into EV diagnostic tools.

Governments and regulatory authorities are also cracking down on vehicle safety and environmental compliance, which is encouraging automakers and service providers to implement more efficient diagnostic equipment. The automotive industry moves towards sustainability, the diagnostic tools for EVs market will grow at a significant growth rate over the forecast period.

Based on the tool type, professional diagnostic and OEM diagnostic tools are the dominant categories propelling market growth.

Automotive technicians and repair shops often use professional diagnostic tools to perform a deep analysis of EV components. These tools give detailed information about battery health, motor efficiency, regenerative braking systems and on-board electronics.

The soaring complexity of EV powertrains and electronic control systems in general now mandates the use of professional diagnostic equipment to provide accurate troubleshooting and preventive maintenance. Software updates over the air and connectivity, these pieces of equipment are evolving into intelligent instruments, capable of remote diagnostics and real-time data analysis.

While OEM diagnostic tools are produced by original equipment manufacturers for complete analysis corresponding to unique EV brands and models. Automotive manufacturers provide proprietary diagnostic and service tools to their own service centers to assure accurate fault detection and integration with vehicle software.

These tools enable firmware updates, sensor recalibration, and deep debugging, giving authorized service centers a competitive advantage. OEM tools are cementing their place in the EV service landscape with the growing adoption of brand-specific diagnostic solutions that maintain EV performance and life in the field.

The diagnostic tools for electric vehicles market is segmented based on application such as vehicle tracking, repair & maintenance, which are essential for ensuring the safety and effectiveness of electric vehicles.

Vehicle tracking applications use diagnostic tools to help monitor an EV's real-time location, energy consumption, and battery status. Advanced tracking systems have gained traction among fleet operators, ride-sharing companies, and logistics providers to ensure optimal utilization of vehicles thereby improving operational efficiency.

With its ability to integrate GPS and telematics with EV diagnostics, predictive maintenance is possible, which reduces the chances of an unexpected breakdown and contributes to the overall reliability of the vehicle.

Repair & maintenance applications are a significant segment where diagnostic tools are used in identifying and resolving mechanical and electronic malfunctions. Because EV powertrains and battery systems are different from those found in conventional vehicles, you will need different maintenance, so diagnostics and work will have to be different, too.

Innovations in repair, such as cloud-based diagnostic systems, AI-powered predictive analytics, and AR-enabled repair assistance, are transforming maintenance processes, minimizing service downtime, and enhancing repair accuracy. Additionally, the surge of remote diagnostics and OTA (Over the air) updates is increasing the impact of the EV maintenance solutions.

As the EV landscape continues to change, so also will the need for sophisticated diagnostic equipment. The diagnostic tools for EVs market is set to grow continuously with increasing technological progress, rising interoperability, and environmentally friendly mobility.

The market is also seeing a trend toward next-generation diagnostic solution investments among the manufacturers and service providers to make the solutions more efficient, quicker, and vehicle performance checks possible, making the market future-ready.

The automotive industry is one of the fastest-growing sectors with rising demand for low-emission vehicles, leading to the growth of the diagnostic tools for EVs market. With growing complexities in EV systems, including integrated battery management systems, regenerative braking, and advanced electronic controls, the necessity for specialized diagnostic tools has grown.

Market trends are being shaped further due to the transition towards wireless diagnostics, artificial intelligence (AI)-powered predictive maintenance (PM), and cloud-based analytics. Moreover, government incentives to promote EV adoption and expanding charging infrastructure is driving the development of more advanced solutions for fault detection and repair.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Bosch Automotive Service Solutions | 18-22% |

| Snap-on Incorporated | 14-18% |

| Launch Tech Co., Ltd. | 12-16% |

| Autel Intelligent Technology Corp. | 10-14% |

| Denso Corporation | 8-12% |

| Other Manufacturers & Regional Brands (Combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Bosch Automotive Service Solutions | Offers comprehensive EV diagnostic systems, including OBD-II scanners, battery analysers, and software-based fault detection. |

| Snap-on Incorporated | Develops high-precision diagnostic tools with AI-driven fault detection, widely used in automotive service centers. |

| Launch Tech Co., Ltd. | Provides affordable yet advanced diagnostic tools, featuring wireless connectivity and remote vehicle monitoring. |

| Autel Intelligent Technology Corp. | Specializes in multi-function EV diagnostics, battery health monitoring, and smart repair solutions. |

| Denso Corporation | Focuses on OEM-grade diagnostic tools and predictive maintenance software, integrated with real-time performance analytics. |

Key Company Insights

Bosch Automotive Service Solutions (18-22%)

Bosch, with its powerful diagnostic devices and cloud-based analytics platform, is an industry leader in Diagnostic Tools for EVs Market enabling more efficient vehicle servicing and trouble shooting.

Snap-on Incorporated (14-18%)

This prevents downtime and aids in monitoring the health of the vehicle, and Snap-on is a significant player for its scanning tools that help technicians quickly diagnose and repair EVs.

Launch Tech Co., Ltd. (12-16%)

Cost effective diagnostic tools that support wireless updates and remote diagnostics will continue to gain traction with Launch Tech.

Autel Intelligent Tech. Corp. (10%-14%)

Autel leverages its battery-centric diagnostic tools to measure battery health accurately and predict the remaining lifespan of the EV batteries.

Denso Corporation (8-12%)

Denso began developing its own diagnostic product line for OEM use cases with real-time analytics, diagnostic sensors, and predictability based on AI.

Other Significant Contributors (25-35% Combined)

Regional absolute EV diagnostic tools manufacturers are coming into the picture with specialized End-of-Line Manufacturing Insight and Smart Fault Detection Insight in EVs, along with cost-effective and easy-to-use scanning algorithms. Emerging players include:

The overall market size for the diagnostic tools for EVs market was USD 1,970.3 million in 2025.

The diagnostic tools for EVs market is expected to reach USD 6,535.8 million in 2035.

The diagnostic tools for EVs market is expected to grow at a CAGR of 12.8% during the forecast period.

The demand for the diagnostic tools for EVs market will be driven by the increasing adoption of electric vehicles, advancements in vehicle diagnostics technology, the growing need for predictive maintenance solutions, government initiatives promoting EV adoption, and the expansion of EV charging infrastructure.

The top five countries driving the development of the diagnostic tools for EVs market are the USA, China, Germany, Japan, and South Korea.

Sales of Used Bikes through Bike Marketplaces Market- Growth & Demand 2025 to 2035

Engine Tuner Market - Growth & Demand 2025 to 2035

Truck Bedliners Market Outlook- Trends & Forecast 2025 to 2035

Start Stop System Market Growth – Trends & Forecast 2025 to 2035

Motorcycle Lead Acid Battery Market - Trends & Forecast 2025 to 2035

Automotive Door Guards Market - Market Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.