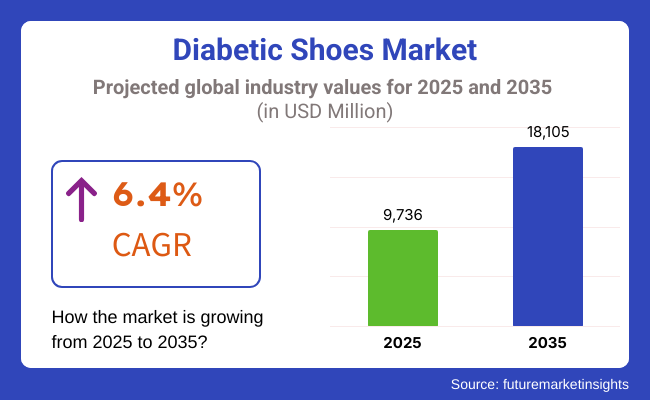

In the coming years the diabetic shoes products market is expected to reach USD 9,736.0 million by 2025 and is expected to steadily grow at a CAGR of 6.4% to reach USD 18,105.0 million by 2035. In 2024, diabetic shoes have generated roughly USD 9,150.4 million in revenues.

Diabetic shoes are special types of shoes which are used for protecting the feet of diabetic people. These shoes protect against ulcers, blisters, and infections which are caused due to poor circulation or nerve damage.

The rising prevalence of diabetic shoes among growing diabetic population significantly attributes to the growth of the market. Growing awareness among diabetic population and healthcare professionals with regards to the complications associated with the disease further anticipate the growth of the market.

Emphasis of manufacturers towards development of comfortable or fashionable diabetic shoes propels its market surge. Therefore, increase in number of diabetes patients across the globe implies more demand for diabetic footwear, resulting in a very convenient and vital way of foot-care management.

Foot care has drawn attention as a preventive measure worldwide due to the increasing prevalence of diabetes. Increasing numbers of people are now living with diabetes, and this has prompted doctors to advocate for foot care to prevent complications such as ulcers and subsequent amputations. These concerns have now been amplified by the recent pandemic COVID-19, which has made many patients take extra care in looking after their feet by preventive care.

Recent advances in the technology of diabetic footwear with increased comfort, durability, and aesthetics have made such footwear more appealing and available. Advanced materials and design breakthroughs improved the functionality and usability of diabetic shoes. In addition, growth in insurance coverage for diabetic footwear has lowered out-of-pocket costs for patients and all these factors combined to propel diabetic shoe uptake during this era.

Explore FMI!

Book a free demo

The rising incidence and the increased awareness of global diabetes, foot care issues regarding its prevention, and the trend in securing increased numbers of individuals who report diagnosis of diabetes-related foot disease compel medical professionals to pay greater attention to foot health and prevention against complications such as ulcers and amputations. It has made patients aware that in preventive medicine, there is no way to run from the feet.

Modern technology has offered diabetic footwear great advancements in fitness, durability, and even aesthetic appeal resulting in wider desirability and more affordable prices. These types of innovations, together with those on advanced materials, further give an avenue for better efficacy and usability of the shoes to be manufactured. A further insurance expansion for diabetic shoes reduced costs that burden patients out-of-pocket expenses. All these factors contributed to the overall increase in diabetes shoes during this period.

Advancements in manufacturing of diabetic shoes technologies play an important role in its market growth. Companies are adding comfort, style, and utility, while adding features such as cushioning, arch support, and moisture-wicking properties, which make diabetic shoes a much more attractive proposition in the first place and tempt patients to wear them more often.

Preventive medicine has increasingly found a favor with European health systems and governments, including coverage for diabetic footwear. In most European countries, reimbursement schemes for diabetic shoes have been introduced, enhancing their availability and affordability.

Furthermore, diabetes campaigns together with education programs on proper foot care all support the usage of diabetic shoes among patients. All these pointers, coupled with better product lines, have led to an increase in the demand for diabetic shoes in Europe..

The increase in diabetes due to urbanization, dietary issues, and lack of exercise significantly attribute to the growth of the market in the region. This has made diabetes prevention more focused, especially in foot care. The health provider and the patient are becoming aware of most of the complications under diabetes, especially of foot infections and ulcers. This has led to the emergence of an increasing demand for diabetic shoes.

Another convincing reason is the increased awareness created by organized health awareness activities and health campaigns launched by the health institutions and the government. More people are now aware that wearing diabetic-friendly shoes is a key preventive measure against diabetic foot disease.

There has also followed innovation-oriented technology in diabetic footwear which has enhanced their functionality and comfort and also their appearance in style. Qualities like cushioning, breathability, and sleek designs are making them apprised.

Lastly, in most of the Asia Pacific countries, the growing health insurance coverage has reduced the amount that some diabetic shoes have mostly been acquired at high costs. Awareness improvement combined with better designs and affordability are making diabetic shoes continuously popularizing the region.

Challenges

Lack of Medical Standardization in Manufacturing of Diabetic Shoes hinders its Adoption in the Market

Diabetic shoes encounter various challenges in their common adoption. One of the challenges is their price, especially in places whose health-care systems may not subsidize them fully, rendering them less affordable to low-income groups. There is little in the way of awareness in most developing countries regarding the effectiveness of diabetic shoes in the prevention of more serious foot problems such as ulceration and infections, thus hindering their use.

Furthermore, cultural preferences act as hindrance-the traditional shoe is favored over specialty shoes. Moreover, a huge number of younger diabetics do not agree to wear diabetic shoes owing to their idea of them as being "special" shoes, a pair they feel is not fashionable enough. A couple of extra challenges for both patients and manufacturers alike is to find a pair of well-fitting shoes that actually meet medical standards and fit an individual's personal style.

Opportunities

Growing Awareness on Understanding the Importance of Preventative Foot care and its Complication create New Business Opportunities for the Market Players

With increasing diabetic populations, cosmetic psychologism is being discovered by increased numbers of people concerning the value of preventive foot care, thus presenting more potential markets, especially in developing nations where awareness levels are increasing.

The creativity can be flexible among the manufacturer to converge on trendy designs that are as comfortable to wear, targeting a new market of the young style-savvy crowd marrying medical utility to personal aesthetics.

Increased health insurance coverage in most countries, however, looks to make diabetic shoes accessible and affordable; preventive healthcare, given increasing governmental push, is creating a congenial environment for marketing diabetic footwear. E-commerce is also easing manufacturers' access to consumers across the globe, thus widening market prospects and enhancing acceptance.

The market for diabetic shoes has exploded and is primarily the product of the increasing worldwide incidence of diabetes and the growing awareness about foot-care in diabetics. Owing to the high-tech materials used nowadays-extras cushioning, breathable lining, antimicrobial finish-the companies have made more efforts to focus on comfort and durability.

Challenges such as ulcers and infections are typical diabetic foot complications that such technological advancements can address. Custom fitted shoes, with the help of advanced 3D scanning technology, are gaining popularity as they cater to people with different foot shapes and conditions.

The greater focus on preventive care has health professionals directing their patients to actually start seeking specialized shoes. A wider coverage by insurance will enhance accessibility and affordability of diabetic shoes for many more individuals, in turn fueling the growth of the market without interruption.

There are quite a few exciting trends popping up in the diabetic shoe space. One of these innovations is smart shoes, interwoven with sensors that keep tabs on foot health, identify pressure shifts, and even monitor temperature changes to help diabetics better track potential complications. Another trend on the rise is the making of diabetic shoes that combine their medical purpose with high fashion.

Shoe companies are creating lines with chic, hip silhouettes that entice the youth without sacrificing necessary comfort. E-commerce has equally been a disruptive force in the market, widening access to diabetic shoes with a variety of options.

With sustainability as a hot button, industries are starting to use eco-friendly materials to appeal to the environmentally conscious consumer. Finally, the market demand for general diabetes care aligns well with the growth of diabetic shoe sales, thus making the latter an integral part of any comprehensive medical program.

Diabetes shoes have become popular in the health care system because of their increasing incidence as well as growing consideration of foot health among diabetes patients. These shoes can provide support, cushioning, and protection against causes of recurrent foot problems, with ulcers and infections being important associated conditions with diabetes.

Another advantage of diabetic shoes is that theirs is the long-term investment. Initially, they might cost more than the average shoes, but given their durability and reuse, it proves to be a wise expense in the long term. Clinics, hospitals, and payers are all recognizing their value, thus freeing these shoes for more needy patients.

Moreover, technological advancements are part of the largest crucial factors that improve the market. Smart shoes with sensors monitor foot health and can be styled and comfortable for consumers. Thus, diabetic shoes evolve to treat their patients better using these trends. With preventive measures as well as sustainability emphasized in developing such shoes, being a medical necessity does not suffice as a definition; it is now regarded as part of lifestyle and hence the health management of diabetes.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Authorities enforce stricter compliance with foot care guidelines and patient safety regulations. |

| Technological Advancements | Companies integrate smart shoe technology with sensors to monitor foot health. |

| Consumer Demand | Consumers demand more diabetic shoes as awareness of foot complications increases. |

| Market Growth Drivers | Healthcare providers emphasize preventive care and the management of diabetic foot complications. |

| Sustainability | Manufacturers focus on eco-friendly materials and production methods for diabetic shoes. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Regulatory bodies will implement even stricter standards for quality, safety, and sustainability. |

| Technological Advancements | The industry will introduce AI-powered shoes that offer personalized foot care and real-time health tracking. |

| Consumer Demand | More consumers will adopt diabetic shoes, focusing on comfort, style, and medical benefits. |

| Market Growth Drivers | The demand for diabetic shoes will surge with the aging population and expanding healthcare coverage. |

| Sustainability | The industry will fully shift to sustainable manufacturing and disposal practices for footwear. |

Market Outlook

The prevalence of diabetes in the United States has increased tremendously, while diabetic shoes are globally more sought after for preventing foot complications. At the same time, increasing awareness of foot health in diabetes patients and manifestation of preventive care in the daily lives of the people in the USA is aiding the promotion and use of diabetic shoes.

They are indeed witnessing action toward making these options more sustainable in terms of production interfaces so as to comply with the health-focused notion embraced by recent healthcare initiatives in the USA.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.9% |

Market Outlook

However, diabetic footwear has become a key focus of discussion in the UK as part of holistic diabetes management. According to the National Health Service (NHS), foot health is one of the modules of care under diabetes, whereby there is growing awareness of special shoes being important in minimizing the occurrence of foot ulcers and subsequent complications.

Furthermore, there is a government commitment to reducing future healthcare costs by preventive measures, which should eventually improve availability and reimbursement for diabetic shoes. Sustainability, in terms of designs as well as materials, is becoming paramount for the adoption of these shoes against the backdrop of the nation's green healthcare initiative.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.3% |

Market Outlook

In India, the fast growth in diabetes cases, especially among the urban population, is favoring a high demand for diabetic shoes. Almost the entire population being diabetic, there is slowly becoming an awareness among the people regarding the significance of specialized foot care to avoid ulcers and nerve damage. The government initiative in enhancing the availability of diabetes treatment and making the people more aware is paving the way to create awareness for wearing proper shoes.

And, as urban incomes are rising, there is no doubt that the people are more willing to spend on good-quality diabetic shoes. Increased focus on preventive care and foot care is leading to a general acceptance of such products, placing diabetic shoes into the mainstream. Improved healthcare access and increased attention to well-being are all predicted to see the Indian diabetic shoe market grow in the years ahead.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.7% |

Market Outlook

Rising diabetic incidences among old people are one of the very important reasons influencing the upsurge for diabetic shoes. With increasing knowledge of foot care for diabetes, Chinese consumers are now seeking specialist footwear to prevent complications. The government has rolled out a host of health programs to better treat diabetes, thus putting diabetic shoes to penetrate as far as possible in the country.

Improved healthcare infrastructure together with the focus on increasing preventive care has accentuated the need for proper foot protection among Chinese citizens. The budding middle class in urban areas is another market driving factor as people are spending more on high-end footwear to address their health concerns. Demand for comfortable, functional, and durable diabetic shoes is expected to continue its upward trajectory in years to come.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.1% |

Market Outlook

The demand for diabetic footwear is stimulated in Japan by an accelerating aging population and rising awareness regarding diabetic complications. Considering the country has one of the highest shares of the elderly population, foot health should be a serious consideration. Under the preventive health scheme, Japanese consumers have significantly become active in their health maintenance and search for diabetic shoes to prevent foot ulcers and amputation.

Shoe technology has advanced into a new stage, making shoes more comfortable and supportive for patients with diabetes. Furthermore, sustainability and health product awareness in Japan have exponentially increased the demand for more sustainable and yet durable diabetic shoes. As more people become aware of the long-term benefits of buying diabetic shoes, the market will grow steadily in some years.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.1% |

The Perfect Blend of Comfort, Support, and Practicality aid Strolling Shoes to hold Dominant Position in the Market

Walking shoes make the best choice now when it comes to selecting diabetic shoes because it has the best combination of comfort, support, and function. When diabetic patients suffer from neuropathy or poor circulation, ideally, their shoe has to prevent injury or hurt to the feet. Stroll shoes are specifically designed to give good means of cushioning, take the pressure off, and hug snugly around, minimizing the risk of sores or foot ulcers.

They are light and can facilitate healthy walking; thus they can be regularly worn, whether for running errands or enjoying a stroll in the park. This match between comfort and functionality is what turns walking shoes into the number one footwear choice for active lifestyles while protecting the feet according to their unique life styles.

Growing demand for Stylish yet Functional footwear aid Dress Shoes to Grow at Higher Rate

The primary cause of the increase of demand for dress shoes by diabetic patients is because people are seeking both fashion and comfort. In earlier times, diabetic dress shoes were more functional than fashionable, but those days are gone. Modern diabetic dress shoes are now made with serious considerations, including additional cushioning and a soft inner lining, as well as comfortable soles.

Those features are giving comfort to the wearer while still maintaining that fashion look. Patients are now able to wear shoes that actually look great both for work and formal occasions, but at the same time provide some level of protection for their feet. So, more people choosing these shoes will find what they seek in them due to proving they could become confident and chic with care for their foot health.

The Personalized Shopping Experience Provided by Footwear Specialty Stores aid it to Hold Highest Market Share

The personalized shopping experience that Footwear Specialty Stores offer is difficult to surpass; hence, diabetic shoe sales are mostly dominated by this avenue. Selling something more than a shoe, these stores offer consultation on how to choose the right footwear for the patient's unique foot health needs. Diabetic patients especially value the help given within the shop to ensure that their shoes meet all necessary conditions for fit, comfort, and support.

Because the right footwear plays an extremely important role in avoiding complications such as foot ulcers, being able to try shoes on and get advice from experienced personnel is usually the foremost choice for many. To build confidence in customers' choice of footwear, these stores have a great selection of orthotic-friendly shoes.

The Convenience and Accessibility Provided by Online Retailers aid it to gain Traction in the Market

Convenience is the basis for the above-average growth rate evident mostly for online retailers in diabetic shoes. Here the customer has the advantage of purchasing from the comfort of his own home, comparing different styles, and enjoying a tremendous variety of diabetic shoes that he might not be able to purchase from a local shop.

With e-commerce now being the preferred mode of shopping since the onset of the pandemic, consumers also have enhanced facilitation to spot a good bargain, check ratings and opinions of past customers, and have the shoes delivered at their doorstep. With easy returns and the possibility of virtual fittings, it is convenient now for a person to identify a diabetic shoe that fulfills the desired requirements without ever entering a shop.

The diabetic shoe market is waxing strong, against the background of established manufacturers and new entrants with innovative features and designs. The competition seems to be heating up, with all sorts of brands out there launching their own range of footwear from the orthotic shoe range up to the trendy-style functional ones. With sustained demand for enhanced comfort and utility, manufacturers have since been engaged in upgrading their own products to achieve better patient outcomes.

Through competition-driven innovation, in addition to the burgeoning e-commerce field, a huge overhaul of the market has been taking shape, facilitating access to and custom needs for diabetic shoes to suit the different demands of a given consumer. The diabetic shoes market thus has a bright prospect, as uptake is growing globally.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Drewshoe | 32.5% |

| Orthofeet Inc. | 20.6% |

| DARCO International, Inc. | 17.0% |

| Clearwell Mobility Company | 6.8% |

| Other Companies (combined) | 23.0% |

| Company Name | Key Company Offerings and Activities |

|---|---|

| DJO, LLC | DJO, LLC, a pioneer in diabetic shoes, places great emphasis on comfort, stability, and protection of the foot. The company implements innovative cushioning technologies and materials to minimize pressure points to suit the demands of the diabetic patient. The latest products now feature shoes with greater arch support, breathability, and fashion-forward designs appealing to those consumers who care about comfort but want to look great. |

| Drewshoe | Drewshoe specializes in customized diabetic shoes designed to be comfortable and user-friendly. Their newest designs have orthotic-minded insoles, added depth, and adjustable straps for individualized fit. Further, Drewshoe is focusing on new designs that enhance diabetic foot care while giving fashion-conscious alternatives for casual wear. |

| Orthofeet Inc. | Orthofeet Inc. brandished a considerable status in the diabetic shoe business with ergonomic designs for relieving very common diabetic foot ailments. New launches in 2024 had the anatomical arch support, cushion insoles, and non-binding uppers to allow optimal blood circulation. They are further maintaining diversity by including more styles so that diabetic shoes can become fashionable without compromising health features. |

| DARCO International, Inc. | DARCO International remains a top brand respected for its emphasis on post-surgical footwear, especially for diabetic patients. DARCO has innovated its shoe offerings with advanced technologies such as air-cell cushioning and therapeutic soles. The new line of products of DARCO is designed to provide maximum comfort and protection for diabetic patients having any foot complications. DARCO continues to expand its distribution and marketing networks worldwide. |

| Clearwell Mobility Company | Clearwell Mobility has designed diabetic shoes that address both medical and aesthetic considerations. Their shoes include cutting-edge orthotic insoles and pressure-relief properties to avert sores and ulcers. In 2024, the company expanded its collection to include more fashionable, daily wear shoes that meet the distinct needs of diabetic patients without sacrificing appearance or comfort. |

Key Company Insights

DJO, LLC: DJO, LLC emphasizes diabetic footwear solutions for comfort and foot protection. The state-of-the-art technologies for cushioning and support in the shoes address diabetic patients' needs, ensuring foot management with comfort during daily activities.

Drewshoe: Drewshoe remains innovative through its suppliers of adjustable orthopedic-friendly shoes to fit varied foot conditions, thus bringing comfort and protection to diabetics.

Orthofeet Inc.: Orthofeet Inc. became a significant supplier of diabetic shoes based on orthotic-friendly designs. These shoes used anatomical arch support and cushion insoles so that diabetes would feel relief.

DARCO International, Inc.: DARCO International is a major provider of diabetic therapy footwear that is directed toward postoperative diabetic shoes for persons with diabetic foot complications. Due to its focus on foot protection, pressure relief, and comfort, it is established at the very top of mind of healing patients with diabetic foot complications.

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. They include:

The overall market size for diabetic shoes market was USD 9,736.0 million in 2025.

The diabetic shoes market is expected to reach USD 18,105.0 million in 2035.

Increase in number of people suffering from diabetes and other footware wound complications anticipates the growth of the market.

The top key players that drives the development of diabetic shoes market are Drewshoe, Orthofeet Inc., DARCO International, Inc., and Clearwell Mobility Company

Strolling shoes segment by product is expected to dominate the market during the forecast period.

Dress Shoes, Running Shoes, Strolling Shoes and others

Outpatient and Inpatient

Men and Women

Narrow, Medium, Wide and Others

Direct Sales, Footwear Specialty Stores, Medical & Healthcare Centers, Online Retailers, Mono-brand Stores, and Other Sales Channel

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.