The diabetic retinopathy market is expected to grow at a steady rate during the forecast period of 2025 to 2035 as globally the prevalence of diabetic patients is increasing due to changing lifestyles and diet, improving awareness regarding the early diagnosis and treatment of the disease and on-going advancements in the field of ophthalmic system.

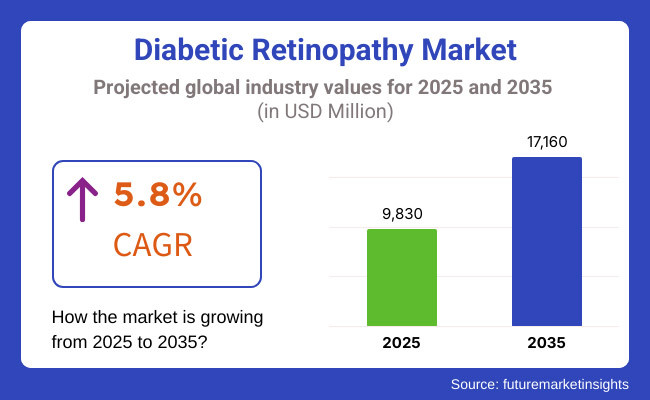

The value of the market was USD 9,830 million in 2025, and is predicted to reach USD 17,160 million by 2035, achieving a compound annual growth rate (CAGR) of 5.8% in the forecast period, 2025 to 2035.

There are a number of factors driving this growth. This is largely owing to the growing prevalence of diabetes, the increasing acceptance of anti-VEGF therapies, and the emergence of artificial intelligence (AI)-based diagnostic devices. In addition, the industry growth is also being accelerated by government initiatives towards diabetic retinopathy screening, advancements in laser treatments and developing healthcare infrastructure.

However, significant challenges including high treatment costs, inadequate access to specialized eye care in developing areas, and patient non-compliance to conventional screenings continue to prove the leading obstacles limiting market growth.

The disease burden is vast, which is why primary players are focusing on telemedicine based retinal screening, biologic drug development, and public health campaigns to manage the disease better and improve the quality of life in patients.

Various factors such as Increasing focus on early-stage diabetic retinopathy detection, AI-powered retinal imaging along with development of long-acting therapeutics as well as detection methodologies is anticipated to boost the diabetic retinopathy market during the forecast period.

As innovation continues in the areas of laser treatments, biologics, and combination therapies, we expect the industry to continue to experience robust growth and more convenient access to sight-saving therapies.

Explore FMI!

Book a free demo

The high market share for diabetic retinopathy in North America is largely attributed to the availability of a sufficient number of diabetes patients in USA and Canada. Market growth is mainly driven by advanced healthcare infrastructure in the region, rising awareness towards early diagnosis and availability of new treatment options such as anti-VEGF therapy and laser treatment.

Supportive government initiatives and reimbursement policies around diabetic eye care contribute to increased uptake. Market growth, however, is hindered by issues such as the high cost of advanced treatment and disparities in healthcare access between population segments. On the other hand, companies are concentrating on research and development to come up with cost-effective and minimally invasive treatment solutions.

German, UK, and French countries are at the forefront of diabetic retinopathy market growth in Europe with the highest patient population and healthcare advances. Factors such as the growing aging population and rising prevalence of diabetes drive the demand for early detection and effective treatment.

Treatment availability and pricing are impacted by strict regulatory policies and reimbursement frameworks. Yet the launching of the free national screening programs as well as the emergence of novel ophthalmic imaging technologies will stimulate the market. By investing in AI-powered diagnostic solutions and proprietary combination therapies, companies facilitate improved patient outcomes.

The Asia-Pacific region is the fastest-growing market for diabetic retinopathy, which is propelled by the increasing population of diabetes in China, India, and Japan. Market growth is majorly attributed to the rising awareness of diabetic eye diseases, its rising access to healthcare, and the effective diagnostic abilities.

While there is a large potential market, problems still exist for some remote locations where healthcare access is limited and understanding of diabetic retinopathy is still missing. But gaps are being filled by government initiatives to promote diabetic healthcare and the advent of telemedicine solutions.

Treatments can be obtained at low cost, and companies are working towards making them available in developing economies through partnerships and developing awareness.

Challenges: High Cost of Advanced Treatment and Limited Accessibility

A major restraint in the diabetic retinopathy market is the high treatment cost of anti-VEGF therapy, laser photocoagulation, and vitreoretinal surgery. Access to these treatments remains a challenge to many patients, particularly in low-middle income (LMI) and developing countries, both of which are hindered by economic and healthcare resource limitations.

Furthermore, lack of awareness and insufficient screening programs often prevent early diagnosis and require continuous monitoring of these high-risk patients. It contributes to the necessity for government and private sector partnerships aimed at making healthcare affordable, increasing early detection initiatives, and improving access to affordability treatment options.

Opportunities: Advancements in AI-driven Diagnosis and Personalized Medicine

In the modern age, technological innovations specifically in AI are propelling the realm of diabetic retinopathy detection and management. Automated retinal imaging analysis with AI-based screening tools can provide early diagnosis, enhancing detection rates and decreasing the workload for ophthalmologists.

Moreover, personalized medicine characterized by targeted therapies and gene-based treatments is providing new avenues for effective and individualized treatment approaches. Market leaders will emerge from companies paying attention to AI-fueled diagnostic solutions and precision medicine.

From 2020 to 2024, there was a rise in the utilization of anti-VEGF injections, advancements in laser therapy procedures, and the use of telemedicine to monitor patients remotely. Yet clear challenges remained: Adherence to treatment, affordability, and disparities in access to care persisted as major roadblocks.

Emerging from the sector, governments, and healthcare enterprises, with an emphasis on early screening programs and public awareness drives, focused on improving the ability to manage the disease.

As we consider the future from 2025 to 2035, AI-driven retinal screening, breakthroughs in gene therapy, and new regenerative medicine strategies will usher in the next era of diabetic retinopathy treatment. Advanced wearable biosensors for continuous glucose measurement and early detection of retinal changes, will further transform the patient care approach.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Emphasis on drug approvals and clinical trials |

| Technological Advancements | Growth in anti-VEGF therapy and laser treatments |

| Industry Adoption | Expansion of telemedicine and remote monitoring |

| Supply Chain and Sourcing | Dependence on pharmaceutical supply chains |

| Market Competition | Dominated by pharmaceutical companies |

| Market Growth Drivers | Increased prevalence of diabetes and vision loss |

| Sustainability and Energy Efficiency | Adoption of eco-friendly medical imaging solutions |

| Consumer Preferences | Preference for minimally invasive treatments |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter guidelines for AI-driven diagnostics and precision medicine |

| Technological Advancements | AI-based screening, gene therapy, and regenerative medicine |

| Industry Adoption | Integration of AI-powered diagnostics in primary care |

| Supply Chain and Sourcing | Increase in localized biologics manufacturing and AI-driven tools |

| Market Competition | Rise of AI-driven healthcare start-ups and biotech firms |

| Market Growth Drivers | Advancements in personalized medicine and early intervention |

| Sustainability and Energy Efficiency | Expansion of low-cost, AI-driven diagnostic technologies |

| Consumer Preferences | Demand for preventive, AI-integrated, and home-based monitoring |

The United States diabetic retinopathy market is expected to grow at a significant rate during the forecast period due to high prevalence of diabetes and rising geriatric population. With millions of Americans suffering from diabetes and increasing demand for treatment options including anti-VEGF therapies, laser, and corticosteroids, the diabetes market is growing.

The increasing government-led diabetic eye care initiatives and expansion in ophthalmology-based research funding are some factors further contributing to the market growth. Moreover, technical innovation in the diagnostic tools such as Artificial Intelligence retinal screening and optical coherence tomography (OCT) is expected to a boost early detection rates, resulting better treatment efficacy and thus upping market opportunities.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.5% |

The diabetic retinopathy market is steadily rising in the UK owing to a rising population of diabetes along with a rise in awareness regarding early screening programs. The National Health Service (NHS) plays an important part in providing free eye screening (for diabetic retinopathy) for patients with diabetes to detect potentially sight-threatening eye conditions and treat them in good time.

The growth of the market is also influenced by advances in retinal imaging technologies, and the growing demand for the use of intravitreal injections. In addition, governmental measures to leverage AI solutions for diagnostic capabilities in clinical settings and boost patient outcomes are expected to drive the demand for new treatment methods.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.0% |

Diabetic retinopathy is on the rise in countries like Germany, France, and Italy in the European Union, given better lifestyles and the enormous diabetic population. State-funded healthcare programs and nationwide diabetic screening initiatives have also helped in early diagnosis and management of the disease.

Firms are also focusing on new disease-modifying potential therapy agents, like sustained-release implants and gene therapy that will overhaul the market scenario. The growth and introduction of telemedicine and AI-driven analysis are also accelerating market growth by providing access to specialized ophthalmology care.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.3% |

The Japanese DR market is expanding at a rapid pace, which is primarily due to rapidly growing old population with diabetes comorbidity. The government scheme with national health policies for regional diabetic screenings and stepwise strategies to manage early-stage patients who would ultimately end up with visual impairment.

Advanced diagnostic techniques like ultra-wide field retinal imaging and AI-assisted detection are catching hold in the country. Also, the Japanese pharmaceutical companies are leading in the development of next-generation ophthalmic drugs and minimally invasive treatment options, which is expected to drive the market during the forecast period.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.2% |

On the other hand, South Korea is anticipated to show good growth in the diabetic retinopathy market owing to the high prevalence of diabetes and rising investments in the healthcare infrastructure. The country’s health care system encourages early detection with routine eye screenings and AI-backed diagnostics.

In addition, South Korea is an emerging center for clinical research in ophthalmology, driving the quick adoption of new treatment solutions like stem cell therapy & advanced laser treatment. Government proactive initiatives to spread awareness and treat diabetes positively supports the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.2% |

As the presence of diabetic retinopathy expands alongside the creating rate of diabetes, and moreover developing insight towards compensating and early discovery of views concerning the ailment the diabetic retinopathy market can penetrate into inventive mending progress.

Diabetic retinopathy (DR) is one of the most prevalent complications of diabetes and presents as a retinal microvascular disorder associated with diabetes; it is a leading cause of visual impairment and blindness worldwide. This market growth is driven by the advancement of diagnostic technologies, increased access to treatment, and in the uptake of innovative therapeutic options.

The growing implementation of telemedicine, screening using artificial intelligence based retinal screening, and personalised treatment strategies further revolutionise the care of diabetic retinopathy.

In the wake of the discovery, healthcare providers are now focusing on being proactive and preventative in managing the condition. The increasing diabetic population worldwide will further fuel the demand for diabetic retinopathy market effective treatment options, leading to an increased growth trend.

The diabetic retinopathy market is segmented based on type: proliferative and non-proliferative diabetic retinopathy which leads to the demand for advanced type treatment solution.

The most advanced stage of the disease, proliferative diabetic retinopathy (PDR), is marked by pathological retinal neovascularization. Gestational Diabetes Mellitus (GDM) the risk of vision loss due to complications such as haemorrhage and retinal detachment is substantially increased for this stage.

Consequently, early intervention is crucial, resulting in increasing adoption of therapies like anti-VEGF injections, laser therapies and vitrectomy procedures. There is also increasing interest in exploration of novel therapies, such as gene therapy and targeted biologics, as research is undertaken.

Triggers of NPDR is an early stage of diabetic retinopathy, in which the vessels in the retina become weak and develop micro aneurysms that leak fluid. NPDR can advance to more serious stages if not managed, though it does not directly lead to immediate loss of vision.

The increasing focus on early detection, lifestyle changes, and drug management drives the market for effective therapies to prevent progression to more significant diabetic eye disease like proliferative diabetic retinopathy. AI-powered diagnostic tools are allowing healthcare professionals to improve screening and monitoring, and this is further fuelling market growth.

Segmented by Management: This part of the management segment of the diabetic retinopathy market covers treatment options, such as anti-VEGF therapy, intraocular steroid injection, laser surgery and vitrectomy.

Anti-VEGF therapy is now one of the mainstays for the treatment of diabetic retinopathy arising in patients, particularly for those presenting with macular edema. Vascular endothelial growth factor (VEGF) inhibitors such as ranibizumab, aflibercept, and bevacizumab are antiangiogenic agents that block VEGF action to stop abnormal blood vessel growth and leakage in RVO.

OCT-based therapy demonstrated robust efficacy in preserving vision and slowing disease progression and has been increasingly adopted by providers and patients. Further studies of long-acting formulation and depot implants will likely improve treatment compliance and efficacy.

Solo, or anti-VEGF refractory patients are often treated with intraocular steroid injections. Corticosteroids reduce inflammation and vascular leakage for patients with diabetic macular edema. These steroid injections not only provide tighter disease control, but have a more favourable safety profile, with higher intraocular pressure (IOP) and lower rates of cataract formation. Personalized medicine approaches and combination therapies further optimize therapy outcomes.

Laser treatment, specifically panretinal photocoagulation (PRP) is still an important treatment option for proliferative diabetic retinopathy patients. This procedure works to shrink abnormal blood vessels and prevent complications such as retinal detachment.

Besides, advancements in laser technology such as micro pulse and pattern scanning laser therapy have improved the accuracy of treatment by minimizing collateral damage to adjacent tissues. The demand for laser surgery is increasing at an all-time high on a global scale with the availability of advanced laser systems.

For patients with severe proliferative diabetic retinopathy complicated by vitreous haemorrhage or retinal detachment, vitrectomy (surgical treatment) may be warranted. Vitrectomy aids in the restoration of vision in patients at advanced disease stages by excising the vitreous gel and repairing retinal damage.

Minimally invasive surgery and advances in vitreoretinal instrumentation are driving the growing adoption of vitrectomy procedures. Furthermore, investigation on regenerative medicine and stem cell therapies provides hope for should offer exciting future perspectives in very advanced cases of diabetic retinopathy.

The prevalence of diabetes is increasing along with the awareness of diabetic eye complication, which will create the opportunity for the diabetic retinopathy market. Innovations in Disease Management: The striking power of next-generation technologies novel techniques for early diagnosis, personalized medicine, and innovative treatment solutions can be addressed through this market and thereby the market is expected to see constant growth in the coming few years.

The diabetic retinopathy market is growing rapidly, driven by rising incidence of diabetes, technological advances in diagnostic imaging, and increasing awareness of early detection of disease. The governments are also taking initiatives for healthcare and the increasing geriatric population and the high growth of healthcare infrastructure in developing countries are also driving the market.

Due to growing demand for effective management for diabetic retinopathy, leading participants are focusing on the development of alternative treatments for the management of diabetic retinopathy, which includes anti-VEGF drugs, corticosteroids, and laser therapy. Additionally, the AI-loaded diagnostic and telemedicine solutions are showing the way for better detection and approachability towards timely treatment.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Roche | 20-24% |

| Novartis | 16-20% |

| Bayer AG | 12-16% |

| Regeneron Pharmaceuticals | 10-14% |

| Alimera Sciences | 6-10% |

| Other Companies (Combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Roche | Offers Lucentis (Ranibizumab), an anti-VEGF therapy for diabetic retinopathy and diabetic macular edema (DME). |

| Novartis | Provides Beovu (Brolucizumab), an advanced anti-VEGF treatment that reduces fluid leakage in the retina. |

| Bayer AG | Develops Eylea (Aflibercept), a widely used anti-VEGF drug for reducing vision loss due to diabetic retinopathy. |

| Regeneron Pharmaceuticals | Specializes in innovative monoclonal antibody therapies for retinal diseases, including diabetic retinopathy. |

| Alimera Sciences | Focuses on sustained-release corticosteroid implants (Iluvien) to control diabetic macular edema. |

Key Company Insights

Roche (20-24%)

With its first-in-class anti-VEGF drug, Lucentis, Roche holds a leading position in the Diabetic Retinopathy Market, where high efficacy preventing disease progression has been shown. Additionally, its focus on personalized medicine and AI-driven diagnostic solutions creates a compelling value proposition.

Novartis (16-20%)

Beovu, a novel anti-VEGF therapy that offers longer treatment intervals with improved patient compliance, is a stronghold company contender.

Bayer AG (12-16%)

Bayer's Eylea is now a standard therapy for diabetic retinopathy, supported by strong clinical efficacy and widespread use worldwide.

Regeneron Pharmaceuticals (10-14%)

Regeneron is also expanding its monoclonal antibody-based drug pipeline with a focus on ophthalmology to expand diabetic retinopathy therapy.

Alimera Sciences (6-10%)

The long-term corticosteroid therapy by Alimera Sciences with a sustained drug-release system, Iluvien, decreases the need for frequent injections.

Significant Other (25-35% Combined)

Many small and emerging players and biotech and pharmaceutical companies on the market include those who are working on gene therapy, regenerative medicine and the AI-based diagnostic company. Here are a few prominent players:

The overall market size for the diabetic retinopathy market was USD 9,830 million in 2025.

The diabetic retinopathy market is expected to reach USD 17,160 million in 2035.

The diabetic retinopathy market is expected to grow at a CAGR of 5.8% during the forecast period.

The demand for the diabetic retinopathy market will be driven by the increasing prevalence of diabetes, advancements in diagnostic technologies, rising awareness about early detection and treatment, improved healthcare infrastructure, and the growing adoption of innovative therapies.

The top five countries driving the development of the diabetic retinopathy market are the USA, China, India, Germany, and Japan.

Automated Sample Storage Systems Market Growth - Trends & Forecast 2025 to 2035

SPECT Scanning Services Market Growth - Trends & Forecast 2025 to 2035

Preventive Medicine Market Growth - Trends & Forecast 2025 to 2035

Hadron Therapy Market Growth - Trends & Forecast 2025 to 2035

Wound Irrigation Systems Market Growth – Trends & Forecast 2025 to 2035

Western Europe Medical Recruitments Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.