Dextrose Monohydrate Market expects consistent growth between 2025 and 2035 because the food and beverage alongside pharmaceutical sectors alongside animal feed industries are increasing their product requirements.

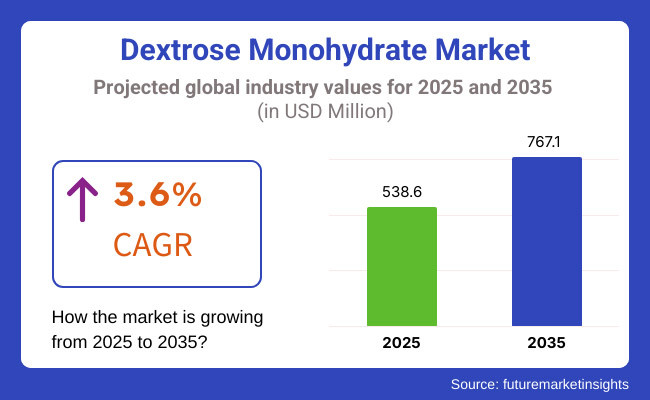

The crystalline form of glucose titled dextrose monohydrate operates as a primary compound for making sweeteners and serving as an energy supplement and a fermentation processing agent. The Dextrose Monohydrate Market will show growth from 2025 to 2035 based on a 3.6% compound annual growth rate (CAGR) which will increase market value up to USD 767.1 million.

The market expands because consumers are choosing natural sweeteners and functional food ingredients. Due to its strong solubility and stability characteristics dextrose monohydrate finds increasing use in pharmaceutical applications for intravenous infusion solutions and pharmaceutical tablets.

Market expansion growth results from increasing consumer requirements for concentrated animal feed programs that require high amounts of energy. The commercial growth of dextrose monohydrate encounters limitations from both shifting raw material costs and consumer apprehension toward excessive sugar intake. Manufacturers work on creating low-calorie options along with methods to boost production output because of these market hurdles.

The Dextrose Monohydrate Market segments according to application and end-use industry because food and beverage industries together with pharmaceutical companies and animal nutrition industry demand more products. Food manufacturers utilize dextrose monohydrate for sweetening drinks while also utilizing it to increase substance volume and start yeast growth during fermentation.

Industrial use of dextrose monohydrate by the bakery and confectionery sector involves both textural improvement and longer shelf time preservation. The pharmaceutical field uses dextrose monohydrate in intravenous hydration solutions together with oral rehydration salts and drug formulations because of its fast absorption and energy benefits.

Explore FMI!

Book a free demo

The North America region accounts for the largest share in the dextrose monohydrate market owing to increasing demand from the food, pharmaceutical, and animal feed industries in the region. Consumption of dextrose based sweeteners is increasing in processed food and energy drinks in the United States and Canada regions.

The pharmaceutical industry in the region depends on dextrose monohydrate to produce intravenous fluids and medicinal applications, ensuring the steady growth of dextrose monohydrate market.

Health-conscious consumers want natural and low-calorie sweeteners, leading manufacturers to invent alternative formulations. Government policies regarding sugar content drive market and product strategies to support the formulation of sugar-reduction tactics without compromising product functionality. Although, there is an increasing concern regarding sugar consumption, continuous R&D activities are supporting the region's market growth.

Demand for dextrose monohydrate is stable in Europe, especially in food processing and pharmaceutical endpoints. Many countries including Germany, the United Kingdom, and France dominate the market because of the advanced food production infrastructure and regulatory focus on the high quality of ingredients. Dextrose monohydrate is also used in bakery and confectionery products for preservation.

Market trends may shift as sustainability initiatives and stricter sugar consumption guidelines take place, which results in manufacturers looking into alternative formulations. Stable demand is projected for the pharmaceutical industry in Europe, which offers dextrose monohydrate as injectable solutions and dietary supplement. Product innovation and application expansion of functional foods hold the market afloat against public health concerns.

The dextrose monohydrate market in the Asia-pacific region is growing at a prominent rate owing to growing demand from sectors such as food and pharmaceuticals as well as animal nutrition. In China, India, and Japan, market expansion is led by rising food processing activity and the pharmaceutical industry.

China is also the largest producer of dextrose monohydrate commercialized production, due to its high availability of raw materials and access to large-scale production capabilities. As the healthcare sector expands in India, there is an increasing demand for dextrose based nutritional supplements and intravenous fluids.

Increasing livestock farming in Southeast Asia is supporting the adoption of dextrose monohydrate in the formulation of animal feed. Further developments in refining units and product diversification hold potential for market forces across the region, despite regulatory hurdles and price fluctuation.

Challenge: Fluctuating Raw Material Prices and Regulatory Constraints

Industrial production of dextrose monohydrate depends mainly on corn starch because raw material price changes appear due to environmental factors and logistical problems and international trade policies. Manufacturers face uncertain costs because changes in corn production levels influence both supply and prices in the market.

Trial facilities for food safety and pharmaceutical regulations compel businesses to spend significant resources on quality assessment and testing alongside certification expenses. Manufacturers who want to enter new markets face meeting the changing global standards for regulation as their primary challenge.

Opportunity: Growing Demand in Food, Pharmaceuticals, and Animal Nutrition

The rising market demand for dextrose monohydrate throughout food and beverage sectors creates an attractive growth possibility. Manufacturers use dextrose monohydrate as a primary sweetening component in both energy drinks and confectionery products and sweeteners so its market demand continues to increase.

The pharmaceutical industry depends on dextrose monohydrate for developing intravenous fluids and oral rehydration solutions to increase its market penetration. Animal feed manufacturers depend on dextrose monohydrate as an animal-friendly carbohydrate ingredient which supports its manufacturing demand in the agricultural industry.

The market appeal increases due to innovative production methods of non-GMO and organic dextrose which focus on meeting the needs of health-conscious consumers and premium product segments.

From 2020 to 2024, the dextrose monohydrate market witnessed stable demand, especially from the food, beverage, and pharmaceutical industries. Increased awareness regarding health and rising consumption of glucose-based energy supplements is expected to augment growth for glucose-based energy supplements, while advancements within global healthcare is expected to create a plethora of opportunities within pharmaceutical applications.

Production at this stage is disrupted by supply chain challenges and price volatility in raw materials. Manufacturers turned their attention toward production efficiency and sustainable sourcing in an effort to reduce risk.

The market will experience this transition between the years 2025 and 2035 as consumers will prefer sustainable and organic dextrose over conventional options due to the clean label trends. The new fermentation technology will increase production efficiency and decrease dependency on conventional corn-based feedstock’s.

This is again increasing the scope of its use in industrial applications including biodegradable packaging and bioplastics. The formulation of personalized nutrition and functional foods will also contribute to the increasing demand for customized dextrose-based products that cater to specific dietary needs.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance costs increased because of food safety regulations and pharmaceutical standards. |

| Technological Advancements | Production relied on traditional corn starch hydrolysis methods. |

| Food and Beverage Applications | Dextrose is commonly used in sweeteners, energy drinks and confectionery products. |

| Industrial and Bioplastics Applications | Limited industrial usage, primarily in adhesives and fermentation processes. |

| Supply Chain and Sourcing | Dependence on corn starch led to price fluctuations and supply challenges. |

| Consumer Preferences | Health-conscious consumers sought natural and low-calorie sweeteners. |

| Market Growth Drivers | Growth driven by food processing, pharmaceutical demand, and global urbanization. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter sustainability regulations will encourage non-GMO and organic dextrose production. |

| Technological Advancements | Fermentation-based and alternative carbohydrate sources will enhance production efficiency. |

| Food and Beverage Applications | The demand for low-calorie, functional and personalized nutrition solutions will fuel innovation in this space. |

| Industrial and Bioplastics Applications | Growth in biodegradable packaging, bioplastics, and sustainable industrial applications will expand market scope. |

| Supply Chain and Sourcing | Diversification into cassava, wheat, and alternative plant-based sources will stabilize supply chains. |

| Consumer Preferences | Clean-label, organic, and sustainably sourced dextrose products will gain traction. |

| Market Growth Drivers | Expansion fuelled by sustainable production, functional foods, and industrial diversification. |

The USA dextrose monohydrate market is anticipated to expand at a steady rate, owing to application within food & beverage, pharmaceuticals & animal feed segments. An increase in demand for low-calorie sweeteners and energy-boosting ingredients in processed foods and sports nutrition products is one of the primary factors driving the growth of this market. Demand is also being fuelled by the growing adoption of natural sugar alternatives in the confectionery and bakery applications.

The pharmaceutical industry accounts for another major segment of the dextrose monohydrate market as it is used as an intravenous source of energy in medical treatments as well as an excipient to prepare drug formulations. The USA biofuel industry also drives market growth, where dextrose is a major feedstock in ethanol production.

As manufacturers focus on clean-label and plant-derived ingredients, production plants are heavily investing in corn-derived dextrose monohydrate, ensuring an uninterrupted market surge.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.8% |

The UK dextrose monohydrate market is showing positive trends over the years and will grow more during the forecast period due to its diverse usage in sports nutrition, bakery, and pharmaceutical industries. Demand for low-calorie and natural sweeteners is driven by an increasingly health-conscious consumer base, leading to dextrose being harnessed as preferred ingredient in sugar-free food products and sugar-reduced food items.

The pharmaceutical and intravenous nutrition sectors are also growing, thus propelling industry demand. In addition, with increasingly strict government regulations on sugar consumption, food manufacturers are investigating for this type of products dextrose-based alternatives for use in beverages and functional foods.

Moreover, the growing livestock and poultry industries are contributing to the increasing use of dextrose monohydrate in the formulation of animal feed, which is anticipated to boost the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.5% |

Segments analysis of the European Union dextrose monohydrate market: The European Union dextrose monohydrate market is classified into the industries such as Food, Pharmaceutical, and Fermentation. The market in Germany, France and Italy is driven by the high demand for bakery, confectionery and dairy applications using dextrose as sweetener and fermentation substrate.

The market growth is being driven by a shift in the food manufacturing industry to make the move away from traditional sucrose as a sweetening agent, to dextrose-based sweeteners, as companies come to terms with changing regulations under the EU Sugar Reduction Strategy.

In addition, in Europe there is a growing bioethanol industry that uses dextrose monohydrate as fermentation feedstock. The growing pharmaceuticals industry is also acting as a driver for the market’s upward momentum, due to the wide range of applications of dextrose in IV solutions and medical formulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.7% |

With growing applications in health supplements, medical formulations, and functional food products, the demand for dextrose monohydrate is on the rise in Japan. Dextrose is a key ingredient for lesser-known pharmaceutical and IV fluids, which have been in higher demand among the country’s aging population.

Other than that, the dextrose-based sweeteners are being used to bring sugar-reduced and functional food products in Japan which becomes one of the reasons paving the way for emerging sugar alternatives for food processing.

The market is driven by specific applications of dextrose, especially in the bio-based chemical industry, where it is used as a substrate in fermentation processes. The adoption of biofuel in ethanol manufacturing is also being promoted by sustainable production efforts.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.6% |

South Korea dextrose monohydrate market is growing with increasing demand filled in confectionery, dairy and processed food. Dextrose's market share is driven by the increasing knowledge of sugar substitutes, especially in the sphere of sports and energy beverages, where it is used as a natural sweetener.

The pharmaceutical industry is another major driver of the industry since the drug and intravenous fluids formulation include dextrose broadly. Furthermore, it is being used as a core component in bio-based chemical and pharmaceutical production within the bio-manufacturing and fermentation industries.

This rise in demand for fermented-grade dextrose in ethanol production is further buoyed by the growth of South Korea's biofuel sector as a result of progressive government sustainability policies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.6% |

Food Grade Dextrose Monohydrate dominates the market as it is widely used by manufacturers in food and beverage industry as a sweetener, bulking agent, and fermentation substrate.

It is indeed important in food product formulations due to its high solubility and stability (Dextrose Monohydrate is preferable for food processors as it not only prolongs the shelf life of the product, but also offers an almost instant source of energy, which is especially important in products like energy drinks, bakery products and confectionery products.

The increasing consumer preference for natural sweeteners has driven the adoption of food grade dextrose monohydrate, as it can serve as an alternative to sucrose and artificial sweeteners. Health-conscious consumers prefer products using less artificial ingredients with clean labels, which has led to manufacturers reformulating their recipes using dextrose monohydrate.

It is also widely utilized for fermentation processes in the brewing and dairy industries. With the world over moving towards healthier, more functional ingredients, the market for food-grade dextrose monohydrate is growing in various industries.

Dextrose Monohydrate (Medical Grade) to See Robust Growth, Amidst Improved Indulgence in Pharmaceutical Applications

The medical-grade dextrose monohydrate market is to be bolstered by the of IV (intravenous) solutions, pharmaceutical formulations, and therapeutic operations. This grade is used by hospitals and healthcare providers for parenteral nutrition, as well as energy supplementation and rehydration therapies.

Single, well-defined content with high purity and a narrow composition range guarantees safe medication, making it an essential treatment for cases of hypoglycaemia, dehydration, and post-surgical recovery.

Medical Grade Dextrose Monohydrate is included in various drug formulations by pharmaceutical companies to ensure improved bioavailability and efficacy of the drug during manufacturing. Moreover, the growing popularity as a carrier for both oral and injectable drugs has increased the experience in the medical market.

Moreover, the growing incidence of chronic diseases, surging hospitalizations, and increasing healthcare infrastructure have been on the rise to augment the demand for high-quality medical-grade dextrose monohydrate.

This segment continues to make up for the majority contribution to growth in its market as advanced medical care and nutrition becomes the demand of the day in the world Food-grade dextrose monohydrate leads the market, with bulking agent, sweetener, and fermentation substrate widely utilized by the food and beverage industry.

The high solubility and stability find application as an important ingredient in many food formulations, ensuring uniformity and texture. Dextrose monohydrate is favoured by food processors as this product offers shelf life enhancement and an immediately accessible energy resource which is very advantageous in energy drinks, bakery and confectionery products.

Due to the increasing demand for natural sweeteners, food-grade dextrose monohydrate has also seen an upsurge in usage as a replacement for sucrose and artificial sweeteners. Health-aware consumers demand items with clean labels and fewer artificial ingredients, driving manufacturers to reformulate recipes with the use of dextrose monohydrate.

The application of fermentation processes in brewing and dairy industries also adds to its widespread application. With a global trend shift for food toward healthier and more functional alternatives, the demand for food-grade dextrose monohydrate market has been forecasted to grow across all sectors.

Dextrose Monohydrate - A Giant Companion for Medications: Medical Grade Dextrose Monohydrate Sown Market Developments with Growing Deployments

Its importance in administering intravenous (IV) solutions, and a major pharmaceutical formulations, and therapeutic applications has largely driven growth for medical-grade dextrose monohydrate. This grade is relied upon by hospitals and health providers for parenteral nutrition, energy supplementation and rehydration therapies.

Its superior purity, composition control, and safe administration has made it a staple in the treatment of several disorders including hypoglycaemia, dehydration, and post-surgical recovery.

This dextrose monohydrate medical grade is added to drug formulations by pharmaceutical companies to improve bioavailability and enhance the stability of the drug. Furthermore, its use as a carrier for oral and injectable healthcare medicine has fuelled its demand in the medical domain.

The demand for dextrose monohydrate are bolstered further by the worsening of chronic diseases, increase in hospitalization incidents, and brewery of healthcare infrastructure. This segment continues to be a powerful engine of market growth as the world leverages medical treatments and nutrition to thrive.

Bakery and confectionery industry holds majority market share in dextrose monohydrate market due to increasing consumption of bakery products, chocolates and candies. One such product is made from dextrose monohydrate, which helps add sweetness, and softens doughs while providing a uniform texture. In confectionery applications, it is essential for maintaining the freshness of products and preventing crystallization to achieve the right texture and mouthfeel.

Dextrose monohydrate is often added to baked products by manufacturers to speed up yeast fermentation to enhance both the rise and texture uniformity of the dough. The fast energy delivery of Rice syrup also makes it a popular option for use in cereal bars and energy-rich sweets.

With the growing consumer trend towards low-calorie and reduced-sugar products, dextrose monohydrate becomes an interesting approach to reformulate products without compromising taste. Moreover, the growing global bakery and confectionery industry further promotes a surging demand for this multi-purpose flavouring type, underpinning its market position.

Beverage Industry Expands as Functional and Energy Drinks Gain Popularity

One of the major consumers of dextrose monohydrate is the beverage market, where it is used due to its highly soluble, energy-boosting properties. Dextrose monohydrate is used in energy drinks, sports drinks, and flavoured milk products as a rapid source of carbohydrate to improve hydration and replace glycogen. As such, it is a staple in formulating performance-based drinks for the athletic body and active consumer due to its instant metabolic energy supply.

Aside from candy products, soft drink manufacturers employ dextrose monohydrate as one way to balance sweetness and improve mouthfeel in both carbonated and non-carbonated drinks. The beverage industry is responding to consumers who are increasingly seeking healthier alternatives to high-fructose corn syrup and artificial sweeteners, engaging in products reformulated with dextrose monohydrate for a more natural aesthetic.

Meanwhile, growth of functional drinks with the inclusion of vitamins, minerals, and probiotics have also played a role in the ingredient's adoption. As the voucher market continues to see growth amid a booming wellness culture, dextrose monohydrate retains a leading presence with regards to the evolving beverage market.

The competition in the dextrose monohydrate market operates through essential international suppliers and specialized domestic manufacturers producing starch-based sweeteners. The widespread use of dextrose monohydrate occurs in various industries including food and beverage segments and pharmaceuticals as well as animal feed because it functions as a sweetener while boosting energy and serving to enhance food textures.

Leading companies in the market concentrate on manufacturing high-purity solutions coupled with cost-effective processing methods alongside sustainable raw material acquisition. The market consists of conventional starch and glucose producers alongside developing suppliers that serve targeted applications.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cargill, Incorporated | 18-22% |

| Archer Daniels Midland Company (ADM) | 15-19% |

| Ingredion Incorporated | 12-16% |

| Tereos Group | 8-12% |

| Roquette Frères | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cargill, Incorporated | Produces high-purity dextrose monohydrate for food, pharmaceutical, and industrial applications, focusing on sustainable raw material sourcing. |

| Archer Daniels Midland Company (ADM) | Manufactures dextrose-based sweeteners and fermentation solutions, emphasizing cost-effective production and product consistency. |

| Ingredion Incorporated | Specializes in starch-based dextrose products for food processing, confectionery, and energy supplements, with a focus on clean-label formulations. |

| Tereos Group | Develops high-quality dextrose monohydrate for food and beverage formulations, offering customized solutions for various industries. |

| Roquette Frères | Provides pharmaceutical-grade and food-grade dextrose monohydrate with strict quality standards for global distribution. |

Key Company Insights

Cargill, Incorporated (18-22%)

Cargill has emerged as the market leader in dextrose monohydrate with high-purity products for the food, pharmaceuticals, and industrial markets. The group's sustainable sourcing of raw materials and innovative refining ensures its market leadership in the field.

Archer Daniels Midland Co (ADM) (15% to 19%)

ADM / dextrose-based sweeteners & fermentation solutions.ADM manufactures dextrose-based sweeteners and fermentation solutions with a focus on efficiency, cost-effectiveness and a consistent high quality product for food and beverage manufacturers.

Ingredion Incorporated (12-16%)

Ingredion produces dextrose products based on starch and serves customers in the confectionery, bakery, and energy supplement sectors. It focuses on clean-label and non-GMO solutions.

Tereos Group (8-12%)

Tereos provides food-grade dextrose monohydrate to the food and beverage industry, and can offer tailored formulations to fit specific ramifications of the food market.

Roquette Frères (5-9%)

Roquette supplies food and pharmaceutical dextrose monohydrate with stringent compliance with all the global quality and safety standards.

Other Main Players (30-40% Combined)

Pricing scenarios and unique perspectives towards diverse industries are offered by other players in the dextrose monohydrate market:

The overall market size for Dextrose Monohydrate Market was USD 538.6 Million in 2025.

The Dextrose Monohydrate Market is expected to reach USD 767.1 Million in 2035.

The growing demand from the food and beverage industry, increasing utilization in pharmaceuticals and healthcare applications, and rising adoption in animal feed formulations fuel the Dextrose Monohydrate Market during the forecast period.

The top 5 countries which drives the development of Dextrose Monohydrate Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of Food Grade Dextrose Monohydrate to command significant share over the forecast period.

Liqueurs Market Analysis by Type, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast from 2025 to 2035

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

USA Bubble Tea Market Analysis from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.