The global dewatering pump market is anticipated to grow at a CAGR of 2.2% during the forecast period and is expected to reach USD 9,945.8 million by 2035. Increasing construction activities, urban infrastructure development, mining operations, and industrial wastewater management require high-performance dewatering pumps.

Dewatering pumps are an integral part of construction sites and underground tunnels, as well as industrial plants. The demand for efficient pumps with better monitoring systems and hybrid pump technologies is high to achieve higher efficiency and sustainability in their operations. Environmental regulations and improved corrosion-resistant materials have also been a precursor to the development of new products.

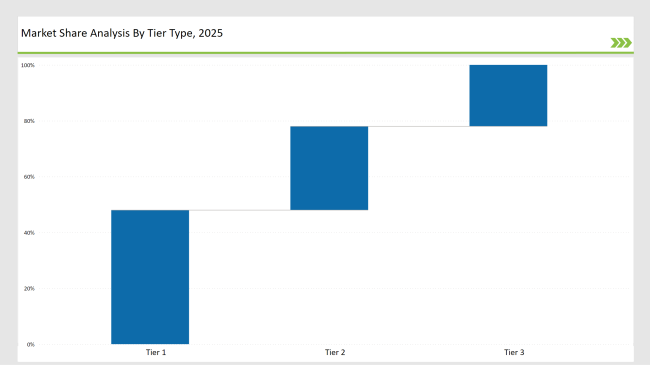

The market is around consolidated, being dominated by Tier 1 players occupying around 48% share with prominent players like Xylem Inc., Sulzer Ltd., Grundfos, Ebara Corporation, and KSB SE & Co. KGaA. By product type, the category of sludge pumps leads at 38%, and under capacity, the 10 to 50 HP class leads at 42% demand for these pumps, which largely service heavy-duty industrial and municipal applications.

| Attributes | Details |

|---|---|

| Estimated Value (2035) | USD 9,945.8 million |

| Value-based CAGR (2025 to 2035) | 2.2% |

Explore FMI!

Book a free demo

| Category | Industry Share (%) |

|---|---|

| Top 3 Players (Xylem Inc., Sulzer Ltd., Grundfos) | 35% |

| Next 2 of 5 Players (Ebara Corporation, KSB SE & Co. KGaA) | 35% |

| Rest of the Top 10 | 30% |

The market is fairly consolidated, with leading firms investing in IoT-driven pump monitoring, energy-efficient motors, and sustainable material innovations to enhance pump longevity and performance.

Several key players contributed to market advancements in 2024

| Tier | Examples |

|---|---|

| Tier 1 | Xylem Inc., Sulzer Ltd., Grundfos |

| Tier 2 | Ebara Corporation, KSB SE & Co. KGaA |

| Tier 3 | Regional and niche players |

| Company | Initiative |

|---|---|

| Xylem Inc. | Released AI-based smart dewatering pumps for construction and industrial use. |

| Sulzer Ltd. | Has expanded its series of high-performance slurry pumps for mining as well as the power industry |

| Grundfos | Developed self-clearing sludge pumps with efficient energy consumption. |

| Ebara Corporation | Launched highly lightweight drainage pumps for municipal application in flood defense. |

| KSB SE & Co. KGaA | Focussed on the hybrid pump range with automatic condition monitoring. |

The world of dewatering pumps would have changed much by 2035. Innovation in energy efficiency, IoT connectivity, and smart automation are just a few of the factors that would redefine the dewatering pump industry. These innovations will usher in a high level of efficiency, cost-effectiveness, and environmental friendliness in dewatering operations.

As demand for more sustainable solutions increases, AI-based dewatering systems will come to play a key role in optimizing the performance of pumps, changing operations in real-time, and predicting future maintenance needs. This will develop operational efficiency, reduce downtime, and increase the lifespan of equipment, thereby decreasing long-term costs for industries that rely on such systems.

The use of green products to create dewatering pumps which reduce negative effects to the environment during pumpings in conduction with world environmental requirements and other equipment are prolonged to maintain predictably.

Predictive maintenance technologies applied on this piece of equipment, prior to it worsening up to when one calls in emergency breakdown services for repairing to leave in its unprepared breaks downs, increase longevity and reliability.

Low-carbon, energy-saving dewatering solutions are going to find more focus on the part of governments and industries; they would realize the significance beyond operational efficiency-the importance in a disaster response context and environmental protection.

They are going to become essential tools in managing water when it floods a place to mitigate the adverse effects of climate change. That is going to propel the pump industry toward further advanced and sustainable dewatering by 2035.

Xylem Inc., Sulzer Ltd., Grundfos holds significant share in the dewatering pump Market.

Sludge pump is the leading product type in the Dewatering Pump Market.

The regional and domestic companies hold around 30% share in the market.

Market is fairly consolidated, representing top 10 players commanding significant share in the market.

10 to 50 HP offers significant growth potential to the market players.

Automated Material Handling Systems Market - Market Outlook 2025 to 2035

Industrial Vacuum Evaporation Systems Market Analysis - Size & Industry Trends 2025 to 2035

Industrial Temperature Controller Market Analysis - Size & Industry Trends 2025 to 2035

Condition Monitoring Service Market Growth - Trends, Demand & Innovations 2025 to 2035

Ice Cream Processing Equipment Market Growth - Trends, Demand & Innovations 2025 to 2035

Power System Simulator Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.