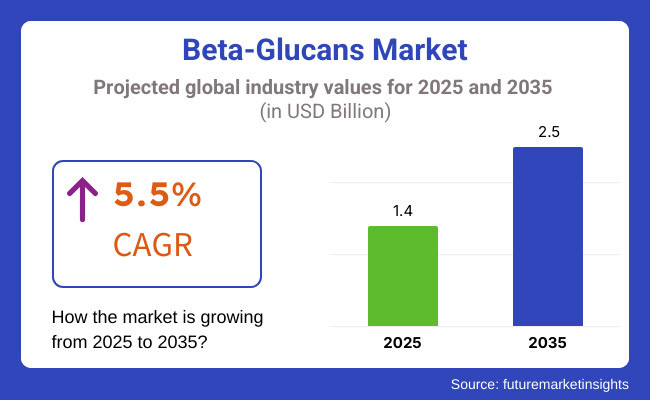

The global beta-glucans market is projected to reach USD 1.4 billion by 2025. The industry is poised to depict a 5.5% CAGR from 2025 to 2035, reaching USD 2.5 billion by 2035.

The industry is expected to exhibit strong expansion, driven by growth in consumer interest in functional and immune-stimulating ingredients. Manufacturers employ strategies such as product innovation, capacity expansion, and strategic alliances to enhance their market position. This is because there is a growing demand for natural and plant-based ingredients in the food, nutraceutical, and pharmaceutical industries.

Among others, Kerry Group, DSM Tate, and Lyle are meeting growing demand by increasing production capacity. By introducing new process technologies to enhance yield, purity, and product quality, the firms are also establishing manufacturing units in high-growth areas to improve efficiency in their supply chains and secure steady supplies of raw materials. This regional expansion strategy enables manufacturers to reduce logistics expenses while serving a broader consumer base.

Among the most significant factors driving the industry for beta-glucans is the growing demand for immune-boosting and plant-based ingredients among consumers. As consumers become increasingly aware of the immune-modulating and health-enhancing properties of beta-glucans, the addition of these compounds to dietary supplements, functional foods, and dermatology products is on the rise.

As a result, companies are augmenting their product lines with premium-quality beta-glucans from oats, yeast, and mushrooms to complement the requirements of diverse applications. This product differentiation aligns with health-oriented trends and establishes a brand identity.

Further growth of the beta-glucan industry is expected to trend toward expansion of the consolidated industry as producers focus on technological progress and strategic cooperative initiatives. The dominant players in the beta-glucans market are focusing on establishing their presence in this emerging industry through local development, innovation, and sustainability.

Accordingly, increasing consumer knowledge about beta-glucans benefits for health will maintain investment in product differentiation and new processing technologies, which will promote further growth in the industry during 2035.

Explore FMI!

Book a free demo

The industry is emerging at a rapid pace, driven by increased knowledge about gut well-being, immunity-boosting, and heart health. Players focus on qualitative raw material procurement from sources such as oats, barley, yeast, and mushrooms to achieve bioavailability as well as functional effectiveness. Processors are concerned with the stability of formulations, solubility, and regulatory compliance, particularly in applications such as food, nutraceuticals, and pharmaceuticals.

Distributors emphasize effective management of the supply chain and pricing to provide constant availability in global markets. The food and beverage, dietary supplement, and cosmetics markets demand end-use clean-label, high-purity beta-glucans to develop functional products. Some major drivers for the industry are consumer demand for plant-based, high-fiber, and immune-supporting ingredients.

With changing lifestyles, consumers are turning toward functional foods, fortified beverages, and natural cosmetics, with beta-glucans gaining increased usage in gluten-free products, cholesterol-reducing formulas, and anti-aging cosmetics, thereby driving industry growth. Sustainability, organic certification, and scientific proof are becoming major purchase drivers defining the future of this industry.

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and the current year (2025) for the global beta-glucans market. This analysis highlights key shifts in growth trends and reveals revenue realization patterns, enabling stakeholders to assess the industry's trajectory over the forecast period.

| Particular | Value CAGR |

|---|---|

| 2024 to 2034 (H1) | 4.9% |

| 2024 to 2034 (H2) | 5.5% |

| 2025 to 2035 (H1) | 5.1% |

| 2025 to 2035 (H2) | 5.8% |

The first half of the year (H1) spans from January to June, while the second half (H2) covers July to December. The industry is projected to experience steady growth over the forecast period, with incremental gains in the compound annual growth rate (CAGR). In the initial half (H1) of the decade, from 2025 to 2035, the industry is expected to expand at a compound annual growth rate (CAGR) of 4.9%, followed by a rise to 5.5% in the second half (H2). Moving forward, from H1 2034 to H2 2035, the CAGR is forecasted to increase to 5.1% in H1 and remain strong at 5.8% in H2.

Localized Ingredient Sourcing and Market-Specific Adaptation

The global industry is witnessing a shift toward localized ingredient sourcing and market-specific adaptation to cater to diverse regional demands. Manufacturers are strategically modifying formulations to align with regional dietary preferences and regulatory frameworks. In North America, oat-derived products are preferred due to their association with heart health benefits. In contrast, yeast-derived variants are gaining traction in the Asia Pacific for their immune-boosting properties.

Additionally, regulatory compliance requirements vary, pushing companies to develop country-specific certifications and labeling. This trend is also fostering collaborations with local suppliers, ensuring a sustainable supply chain while reducing transportation costs.

Companies are leveraging regional marketing strategies to highlight products’ health benefits specific to local consumer concerns, such as digestive wellness in Europe and metabolic health in Latin America. This adaptation strategy is crucial for long-term industry penetration, as it enables brands to resonate better with culturally diverse consumer bases while maintaining regulatory compliance.

Application-Based Pricing Modulation and Value Addition

Pricing dynamics in the industry are evolving as manufacturers adopt application-based pricing models to enhance industry competitiveness. The functional food segment, where products serve as key health-boosting ingredients, commands a premium pricing strategy due to rising demand for immunity-enhancing and cholesterol-lowering products.

In contrast, industrial applications, such as animal feed and cosmetics, operate in price-sensitive markets, necessitating cost-effective production strategies. To maintain profitability, companies are offering differentiated pricing based on concentration levels, purity, and extraction methods. High-purity products, such as those designed for pharmaceutical applications, are priced significantly higher than those used in general food applications.

Subscription-based pricing models are also emerging in the nutraceutical sector, allowing consumers to access beta-glucan supplements through recurring purchase models. These pricing variations ensure competitive positioning while catering to different consumer affordability levels, ultimately driving broader adoption of products across diverse sectors.

Sustainable Harvesting and Ethical Ingredient Sourcing

Sustainability is playing a pivotal role in shaping the industry, with manufacturers prioritizing ethical sourcing and eco-friendly production techniques. There is a growing emphasis on traceability, ensuring that raw materials, such as oats and yeast, are harvested using sustainable agricultural methods with minimal environmental impact.

Brands are actively working toward achieving carbon-neutral operations, reducing waste, and optimizing water usage in beta-glucan extraction processes. Ethical sourcing certifications, including organic, non-GMO, and fair trade, are becoming key differentiators in consumer purchasing decisions.

Additionally, partnerships with sustainable farms and regenerative agriculture programs are strengthening supply chain transparency. As consumers become more environmentally conscious, brands that incorporate sustainability commitments into their narratives are gaining industry share. This shift towards ethical ingredient sourcing is not only improving brand loyalty but also positioning products as a responsible choice for health-conscious and sustainability-driven consumers.

A growing consumer preference for functional, immunity-boosting ingredients has been a key driver of growth for products in the food, nutraceutical, and pharmaceutical industries. As people become educated about the health benefits associated with products, they can be more effectively incorporated into foods, nutraceuticals, and cosmetics.

Many consumers favor products targeting immune system health, gut health, and general wellness. Additionally, with research being conducted to show that products lower cholesterol and improve metabolic wellness, they are being increasingly accepted.

In response to these trends, manufacturers are innovating in the ways products are extracted, increasing their production capacities, and forming strategic partnerships to strengthen their supply chains. As strong demand continues to emerge, they strengthen their branding and education initiatives to attract health-conscious consumers. This constant growth rate tends to make products a preponderant functional ingredient within the ongoing global health and wellness landscape.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Heightened demand in dietary supplements and functional foods | Broader acceptance as a standard component in conventional foods as a result of enhanced consumer awareness |

| The most important use is for immune-stimulating and cholesterol-lowering uses | Use will be realized in gut wellness, diabetes care, and weight control |

| Beta-glucans in oats and barley dominated | Heightened interest in beta-glucans produced from yeast and mushrooms to serve targeted health objectives |

| North America and Europe dominate beta glucan consumption | Asia Pacific is exhibiting high growth on account of the growing demand for natural and functional ingredients |

| Moderate scientific evidence in favor of health claims | Clinical validation and regulatory approvals boosting industry credibility |

| Supply chain constraints influencing production scalability | Enhanced extraction technologies and diversified sourcing strategies fortifying supply |

| Regulatory emphasis on labeling and nutritional claims | Tighter global standards and broader health benefit certifications are increasing consumer confidence |

The risks that confront the industry are many, but most of them are not only supply chain challenges, but also regulatory compliance, price volatility, technological limitations, and shifting consumer preferences.

The concern of raw material availability is a crucial issue as products are usually derived from origins such as oats, barley, yeast, and fungi. Environmental or climatic changes, pests damaging crops, and global supply chain disturbances can all affect the manufacturing capacity of certain crops, hence leading to price surges or shortages.

Compliance with legal requirements is another major source of risk, given that the products are often used in food, nutraceuticals, pharmaceuticals, and cosmetics. The approval processes from the FDA, EFSA, and other local bodies responsible for food safety can slip up by taking longer than expected. Additionally, claims made on the labels of products that primarily involve immune-boosting and cholesterol-lowering functions must be supported by scientific and legal documentation.

The industry experienced price fluctuations caused by a conflict between demand for additives and ingredients, as well as competition from alternative dietary fibers. If costs associated with production increase due to raw material unavailability or high extraction technology expenses, companies may be unable to maintain a competitive price level.

Technological difficulties in extraction, purification, and enhancement of bioavailability might have a negative impact on the efficiency of beta-glucan production. Corporations that take a plunge in piecing together cutting-edge processing techniques may get an advantage, but those that are resistant to change could be at risk of losing their industry share.

Brands such as Biothera, Kemin, and Lesaffre produce yeast-derived beta-glucan products that target gut health, immune support, and heart health, as cardiovascular diseases and compromised immunity increase. Additionally, the pet nutrition industry utilizes yeast products in functional pet foods to enhance the immune systems of dogs and cats. Thus, a multitude of health benefits provided by them bolster their adoption in a diverse array of food products.

Soluble beta-glucan is most commonly recognized for its cholesterol-lowering and cardiovascular benefits. This is due to the fact that soluble beta-glucan forms a gel-like compound in the digestive system, which traps cholesterol molecules and facilitates their excretion from the body.

This reduces total cholesterol levels, and more importantly, LDL cholesterol, which is also known as "bad" cholesterol. Consequently, soluble products are heavily researched and incorporated in food products and dietary supplements for use in heart health, with health claims validated by many scientific studies.

Products are used in the health and dietary supplements industry more than any other sector. Threats from private labels and the genericization of plant protein supplements permeate the category. Still, the expansion of e-commerce distribution further lends momentum to this dominance, alongside growing consumer awareness around preventive health, immunity, and cardiovascular health. A growing focus on managing chronic diseases like cardiovascular diseases, diabetes, and low immunity is boosting demand for beta-glucan-based dietary supplements.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 7.8% |

| Germany | 8.0% |

| China | 9.5% |

| Japan | 7.2% |

| UK | 7.5% |

Rising consumer awareness of the health benefits of products is driving industry growth, particularly in immune function and cholesterol reduction. The food and beverage sector incorporates these natural ingredients into cereals, supplements, and functional foods in line with the demand for health-oriented ingredients.

Advances in extraction technology enhance productivity, efficiency, product quality, and potential applications. The strong nutraceutical industry and research into additional potential applications further support industry development. FMI believes the USA industry will expand at 7.8% CAGR over the forecast period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Rising Demand for Functional Foods | Higher demand for healthy food products raises the volume of consumption. |

| Technical Advancements in Extraction | Better processing techniques improve quality and access. |

| Growing Nutraceutical Industry | Nutrition, health, and dietary supplements apply these products to address customer demand. |

| Increased Consciousness of Health Advantages | Consumers are aware of their immunity and cholesterol regulation functions. |

According to FMI, the German industry is poised to expand at a compound annual growth rate (CAGR) of 8.0% from 2025 to 2035. Due to the nation's long history of functional and natural foods, consuming products across various applications is less difficult.

Natural products are the preferred choice of consumers for addressing health concerns, resulting in a growing demand in the pharmaceutical and nutraceutical industries. Government encouragement toward research on dietary fibers and their advantages further boosts industry growth. Research institutions and industry players join hands, encouraging innovation that leads to new applications in other product lines.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| Healthful Industry for Natural Foods | Customers prefer clean-label and health-focused products. |

| Government Support for Research | Policies promote scientific research in dietary fibers. |

| Expansion in Nutraceutical Uses | Such compounds become increasingly popular in functional foods and supplements. |

| Shift of Consumers Towards Preventive Health | Growing demand for immunity-enhancing and cholesterol-lowering products. |

The Chinese industry is expected to grow at a compound annual growth rate (CAGR) of 9.5% between 2025 and 2035, according to FMI. Higher health awareness and disposable incomes compel consumers toward functional foods and supplements. Products, particularly those derived from mushrooms, are highly sought after in traditional Chinese medicine, which reflects the growing trend for natural health products.

The product lines of food and beverage manufacturers are expanding, targeting a health-conscious consumer base. Government efforts to incorporate natural products into healthcare and nutrition also drive industry growth.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Increasing Disposable Income | Increased purchasing ability implies greater demand for high-quality health products. |

| Growing Interest in Functional Foods | People consciously look for immune-enhancing and well-being-promoting ones. |

| Government Initiatives Towards Nutrition | Regulations promote the use of natural ingredients in food and health products. |

Japan's industry is expected to expand at a CAGR of 7.2% during 2025 to 2035, cites FMI. The country's mature health and wellness sector generates demand for dietary fibers such as beta-glucans, which stimulate the immune system and cardiovascular well-being.

The functional food industry, especially in beverages, dairy, and bakery, more often leverages these chemicals to meet consumers' demands for health-supporting foods. The robust R&D culture is the reason behind continuous innovation in product form and delivery systems, and driving industry growth.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Sophisticated Functional Food Business | These chemicals become more trendy in dairy products, beverages, and bakery. |

| Good Consumer Perceptions of Health Value | Customers are increasingly willing to adopt ingredients that support immune and cardiovascular health. |

| Investment in Research and Development | Companies invest in focusing on applications for products. |

| Nutraceuticals Growth | Moderate-sized industry for dietary supplements based upon these ingredients. |

Growing consumer interest in clean-label and natural health products drives industry growth. The nation's advanced functional food industry incorporates products into a wide range of products, including bakery foods, cereals, and dietary supplements. Regulatory agencies encourage R&D in the health food sector, and businesses respond by innovating and diversifying their product lines. FMI predicts the UK industry will grow at 7.5% CAGR throughout the study period.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Clean-Label Food Demand on the Rise | Consumers are opting for minimally processed ingredients and natural ingredients. |

| Government Supporting Innovation | Government policies support the innovation of functional foods through research. |

| Functional Food Market Growing | The ingredients are used in cereals, baked foods, and dietary supplements. |

| Preventative Health Focus Growing | Heart health and immune benefit products are the consumer's preference. |

Major companies such as Cargill, Koninklijke DSM N.V., Kerry Group, Tate & Lyle, and Biotec BetaGlucans AS are focusing on high-purity beta-glucan formulations intended for applications in nutrition, pharmaceuticals, and personal care. To address changes in regulatory standards over time, these companies are utilizing strategic acquisitions, partnerships, and R&D initiatives to offer diverse product offerings.

Emerging innovators and small-scale providers are introducing a range of bioactive ingredient solutions, clean-label endorsements, and plant-based alternatives. Sustainability has inevitably transformed a mainstream value proposition into a vital competitive driver today, with consumers increasingly preferring eco-friendly extraction methods, traceable supply chains, and non-GMO sourced ingredients.

The expansion in demand for scientifically validated high-efficacy products will only add to the market challenges. Thus, companies will need to emphasize strategic planning in their market positioning to remain strong in this rapidly growing industry.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cargill Inc. | 20-25% |

| Koninklijke DSM N.V. | 15-20% |

| Kerry Group Plc. | 10-15% |

| Tate & Lyle Plc. | 8-12% |

| Biotec BetaGlucans AS | 5-8% |

| Other Providers | 15-25% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cargill Inc. | Offers oat-based and yeast-derived products for food, beverages, and nutraceuticals, with a strong focus on sustainability. |

| Koninklijke DSM N.V. | Develops beta-glucan-based immune health solutions, emphasizing clinically proven formulations for dietary supplements and functional foods. |

| Kerry Group Plc. | Supplies high-purity products for gut health, immunity, and sports nutrition, integrating them into clean-label ingredient solutions. |

| Tate & Lyle Plc. | Focuses on soluble fiber and beta-glucans for heart health, weight management, and sugar reduction in food and beverage applications. |

| Biotec BetaGlucans AS | Specializes in yeast-derived products for immune enhancement, particularly in pharmaceutical and nutraceutical formulations. |

Key Company Insights

Cargill Inc. (20-25%)

A known leader in beta-glucans, using a global supply chain and sustainable sourcing to cater to the increasing demand for functional foods.

Koninklijke DSM N.V. (15-20%)

Focus on scientifically backed immune health solutions to develop a reputation as a trusted name in nutraceuticals.

Kerry Group Plc. (10-15%)

Innovation in gut health and sports nutrition by customizing beta-glucan solutions for health-conscious consumers.

Tate & Lyle Plc. (8-12%)

Builds its presence in functional ingredients by combining beta-glucans into fiber-enriched heart-healthy food products.

Biotec BetaGlucans AS (5-8%)

Advanced player in the yeast-derived products focusing on pharmaceutical and luxury nutraceutical applications.

Other Key Players (15-25% Combined)

The industry is slated to reach USD 1.4 billion in 2025.

The industry is predicted to reach USD 2.5 billion by 2035.

China, expected to grow at a CAGR of 9.5% during the forecast period, is poised for the fastest growth.

Key companies include Tate & Lyle Plc., Koninklijke DSM N.V., Garuda International Inc., Cargill Inc., Kerry Group Plc., Ceapro Inc., Biotec BetaGlucans AS, Super Beta Glucan, and Alltech Life Sciences.

Yeast-derived beta-glucans are being widely used.

By source, the market is segmented into yeast, cereal, barley, oats, and others.

By functionality, the market is segmented into insoluble beta-glucan and soluble beta-glucan.

By application, the market is segmented into bakery products, food & beverages, cosmetics & personal care, dairy & frozen products, health & dietary supplements, and others.

By region, the market is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

Liqueurs Market Analysis by Type, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast from 2025 to 2035

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

USA Bubble Tea Market Analysis from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.