During the period from 2025 to 2035 the market for Desiccant Wheels will experience mild expansion because producers from multiple sectors continue to seek powerful dehumidification technologies.

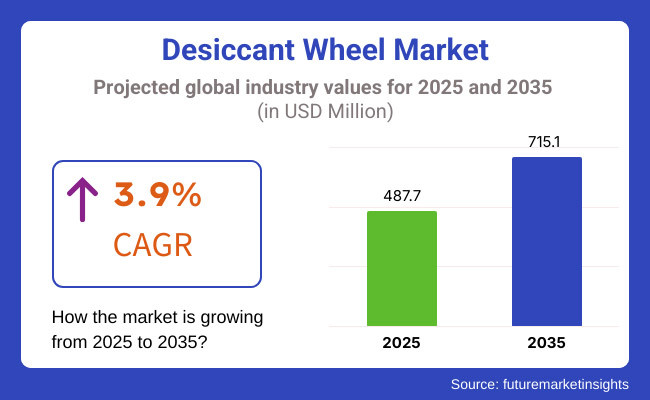

Portable dehumidifying systems based on desiccant wheels function as crucial regulatory components for commercial and industrial buildings and HVAC ventilation systems. The market is projected to grow at a 3.9% CAGR from 2025 to 2035 which will increase the market value from USD 487.7 million to USD 715.1 million.

The market experiences continuous expansion because industries maintain rising concerns regarding air quality and need energy-efficient solutions for climate control. The exact control of humidity serves as a critical requirement for all manufacturing sectors of pharmaceuticals food processing electronics to protect products from moisture-related damage.

The market for desiccant wheels maintains positive growth because worldwide acceptance of energy recovery ventilators (ERVs) and sustainable building practices increases. Demand expansion for desiccant wheels challenges the market due to both their costly starting outlay and cumbersome maintenance requirements. Research on desiccant wheels concentrates on producing cutting-edge materials alongside power-saving wheels to optimize functionality and cost-effectiveness.

The Desiccant Wheel Market includes material type and application categories due to rising demand from commercial, industrial and residential sectors. The three main materials consist of silica gel together with molecular sieve and activated alumina. Silica gel leads the market because it effectively absorbs moisture and appears in HVAC systems together with industrial drying operations.

Molecular sieve desiccant wheels perform exceptionally well in environments with low humidity thus becoming optimal for pharmaceutical and electronics manufacturing. Activated alumina desiccant wheels show maximum strength combined with high heat tolerance which benefits hot temperature drying operations.

Explore FMI!

Book a free demo

The desiccant wheel market in North America is driven by increasing awareness regarding indoor air quality and strict regulations on humidity control in various industries including pharmaceuticals and food.

The USA and Canada spend money on energy-efficient HVAC systems, which increases the demand for desiccant wheels in commercial and residential end-users. There is also growing adoption of ERVs (Energy Recovery Ventilators), which combine the capabilities of a heat recovery ventilator with desiccant technology to provide even better climate control.

Advancements in desiccant materials and energy recovery solutions support market growth. Though high installation cost still stands as a challenge, the presence of governmental incentives urging energy efficient building solutions shall only accelerate its adoption across North America.

Germany, the United Kingdom, and France are prominent in the European desiccant wheels market. Strict regulations regarding indoor air quality and energy efficiency in the region encourage the industries to invest in advanced dehumidification systems. Desiccant wheels are ever more prevalent in the pharmaceutical and food processing sectors in Europe where demanding humidity control.

The region's manufacturers act to sustain the presence of the world with the development of environmentally-friendly desiccant materials and energy-efficient de-humidification technology. The increasing adoption of green building initiatives and smart systems for heating, ventilation, and air conditioning (HVAC) also boost market expansion. The need for reliable solutions for humidity control sustains the market expansion in Europe despite economic fluctuations.

Asia-Pacific ranks as the fastest growing market for desiccant wheel, as growing urbanization coupled with rapid industrialization and high demand for energy-efficient climate control solutions remain pivotal to the regional growth trajectory. The market is fuelled by countries like China, India, and Japan, where manufacturing industries need to control moisture in order to protect sensitive equipment and products from damage.

China tops the region in terms of desiccant wheel adoption owing to the growing HVAC industry of the country coupled with government efforts to drive energy efficiency. As pharmaceutical production and food storage facilities expand, they are increasingly turning to desiccant dehumidification to meet their moisture control needs.

The strong concentration on high-tech manufacturing and environment sustainability in Japan boosts the market growth as well. Geographically, while adoption will still remain constrained by cost barriers in developing countries, smart HVAC systems and green building initiatives will promote long-term growth across the Asia-Pacific region.

Challenge: High Initial Investment and Maintenance Costs

Desiccant wheels form a key component of dehumidifiers in the industrial and commercial sector. However, their insufficient initial investment and maintenance costs represent a major hurdle to overcome. Special types of silica gel and molecular sieves must be used in these systems to absorb moisture, resulting in higher production costs. Routine maintenance must also be performed to keep the equipment running effectively, since efficiency declines over time as the equipment becomes saturated with water.

Many small-sized industries are reluctant to adopt a desiccant wheel system as it is heavy on the pocket, so they prefer conventional cooling-based dehumidification methods. It poses manufacturers with the challenge of developing effective implementations that don’t cost too much energy and can therefore be more market accessible.

Opportunity: Rising Demand for Energy-Efficient Humidity Control Solutions

The desiccant wheel market finds powerful potential from expanding demand for power-efficient climate control techniques. High-moisture levels require strict humidity control from industries which produce food along with pharmaceuticals and electronic components in order to sustain product quality while stopping deterioration.

Hybrid dehumidification systems with low-energy regenerators have brought improvements in both operational efficiency and energy consumption reduction. The addition of smart monitoring systems enables businesses to track their equipment performance in real-time which allows better scheduling of maintenance activities. The implementation of desiccant wheels as sustainable dehumidifiers will intensify due to government initiatives for energy-efficient industrial solutions.

The growing awareness regarding energy-efficient dehumidification between 2020 and 2024 also contributed to steady desiccant wheel market growth. Businesses including food storage, pharmaceuticals, and data centres implemented desiccant wheels to keep controlled humidity levels.

But the cost of materials and the difficulty of integrating the systems into legacy HVAC systems made widespread adoption slow. Rotor coatings and new desiccant materials making moisture absorption capacity and system life even better.

From 2025 to 2035, the market will start to see a transition towards automated and AI-powered desiccant wheel technologies that enhance humidity management according to environmental settings. Synthetic alternatives will be replaced with eco-friendly desiccant materials.

Modular and compact desiccant wheels will enable applications in residential and small commercial air conditioning. In addition, waste heat recovery technology will further improve regeneration efficiency as desiccant dehumidification becomes the most cost-effective and sustainable option.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Energy efficiency policies encouraged adoption, but cost barriers limited expansion. |

| Technological Advancements | Improved rotor coatings and high-performance desiccant materials enhanced efficiency. |

| Industrial Applications | Food processing, pharmaceuticals, and electronics manufacturing relied on desiccant dehumidification. |

| Market Adoption Barriers | High initial investment and maintenance costs deterred small businesses. |

| Environmental Sustainability | Efforts to improve energy efficiency in HVAC systems gained traction. |

| Smart System Integration | Basic monitoring systems provided operational insights but lacked automation. |

| Market Growth Drivers | Growth fuelled by food safety regulations, pharmaceutical demand, and industrial expansion. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter industrial energy standards will drive demand for low-energy desiccant wheel systems. |

| Technological Advancements | AI-driven and automated humidity control systems will optimize energy use and performance. |

| Industrial Applications | Expansion into residential, small-scale commercial, and renewable energy storage sectors will increase adoption. |

| Market Adoption Barriers | Cost-efficient modular designs and waste heat recovery technology will lower operational costs. |

| Environmental Sustainability | Eco-friendly desiccant materials will replace synthetic alternatives, reducing carbon footprint. |

| Smart System Integration | IoT-enabled smart sensors will offer real-time humidity adjustments and predictive maintenance alerts. |

| Market Growth Drivers | Sustainability initiatives, AI integration, and energy-efficient dehumidification technologies will drive future market growth. |

Growing demand for energy-efficient humidity control solutions in industrial, commercial, and residential applications is bolstering the growth of desiccant wheel market in the United States. Increasing demand for energy efficient HVAC systems in commercial spaces, pharmaceutical plants, and food processing facilities is one of the key growth factors.

Stringent guidelines from the Environmental Protection Agency (EPA) and the Department of Energy (DOE) are driving the industries to implement high-performance dehumidification technologies, which is subsequently driving the adoption of the market.

These newer requirements are also driving the rapid expansion of data centres and semiconductor manufacturing in the USA as well, that have critical humidification needs. Also, desiccant wheels are increasingly used in cold storage facilities and indoor air quality management, which, in turn, is further aiding the expansion of the market.

As more focus is placed on sustainable and low-energy approaches, advances in rotary desiccant technologies as well as hybrid dehumidification systems are beginning to take centre stage.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.1% |

Roughly a half of all desiccant wheels are used in applications including datacentre, cleanroom and healthcare facilities, which is driving the growth over the UK desiccant wheel market. The UK government and the European Union have set stringent environmental policies for business and as a result they are investing in energy-efficient air handling and dehumidification systems.

The market is being further supported by the growing pharmaceutical and biotechnology industries, where precise control of moisture is essential for drug production and storage. Moreover, the growing need for improving indoor air quality in commercial buildings is also emerging as a key driver in the market. The expansion of the market in the UK is supported by the development of technology, including the use of smart desiccant wheels with automatic humidity regulation.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.8% |

The European Union desiccant wheel market is also expected to gain moderate growth owing to various regulatory requirements laid out for energy efficient HVAC systems in various industries within the region. Rising focus on energy conservation and sustainability is also highlighted to foster the adoption of desiccant-based dehumidification solutions across various regional markets, as exhibited in European nations such as Germany, France, and Italy.

Strict building energy codes and industrial emission regulations across the region are pushing the business community to switch to low-energy and high-efficiency moisture control systems. The demand for the market is also powered by the development of food processing, pharmaceutical manufacturing, and electronics in the EU. Moreover, the government's supportive incentives for green buildings and sustainable HVAC solutions will increase the adoption of desiccant wheel in air handling system.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.0% |

Japan desiccant wheel market is anticipated to grow on the back of high efficiency air management systems in industrial and commercial applications. However, demand for advanced desiccant dehumidifiers is increasing with the deployment of smart manufacturing and energy efficient HVAC system solutions.

Market growth is attributed to the electronic, automotive and pharmacy industries that need heavy humidity control. Japan’s goal of achieving carbon neutrality by 2050 and development of sustainable technologies are also inducing the use of low-energy desiccant wheels in buildings and factories. Also, breakthroughs in the fields of compact and hybrid dehumidification technology are placing Japan at the forefront of advanced state of climate control technology implementations.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

South Korea desiccant wheel market is experiencing a positive growth in its market mainly due to the growing demand of efficient and advanced humidity control solutions from various industrial and commercial applications. Its strong semiconductor and battery manufacturing sectors are driving demand for high-precision moisture control systems.

This, along with the government focus on energy efficiency and green building standards, is prompting the industries to incorporate desiccant wheels in modern HVAC systems. Moreover, increasing awareness regarding indoor air quality management in residential and healthcare sectors is contributing to the market growth. The use of AI-integrated and IoT-enabled humidity control systems will further drive the growth in the coming years.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.9% |

Segment Analysis of the Desiccant Wheel Market Silica Gel Desiccant Wheel Segment to Dominate the Desiccant Wheel Market in the Coming Years due to High Moisture Absorption and Regeneration Efficiency Due to the high adsorption capacity of such wheels, they are used in industrial dehumidification applications to maintain controlled humidity in few of the industry types.

The broad range of temperatures in which silica gel can maintain moisture control makes it a popular choice for air handling systems, climate-controlled storage, and other process drying applications.

Silica gel-based desiccant wheels have witnessed rapid adoption in industries with stringent humidity requirements such as food processing, pharmaceuticals, and electronics manufacturing. Industry Expert: Due to its non-toxic and chemically stable nature, it, too, has its own advantages in some fields where air quality, space environment, and product's stability are primary concerns.

Moreover, improvements in energy efficient regeneration methods in silica gel desiccant wheels have made it a greener technology that suits with increasing need for eco-friendly and cost effective moisture management solutions. The silica gel desiccant wheel market will grow as industries shift towards high-performance dehumidification.

Molecular sieve desiccant wheels account for a major share of the desiccant wheel market, owing to their efficiency and selectivity in moisture absorption. Boasting a very open matrix, these wheels are capable of moisture removal to within an extremely narrow range, making them ideal for any process that demands ultra-low humidity conditions.

Molecular sieves adsorb very efficiently more moisture than other desiccants even at extremely high temperature variables, which is why they finding high utility in aerospace, pharmaceutical and specialty chemical applications.

Molecular sieve desiccant wheels can remove water molecules with exceptionally high precision while ensuring that airflow and temperatures remain stable, making them ideal for use in industries that require this type of advanced moisture removal solution. It helps to avoid drug degradation from too much moisture, which ensures stability.

In a similar fashion, chemical processing plants utilize molecular sieves to ensure optimal production environments for moisture-sensitive formats. As the demand for high-precision humidity control continues to increase, molecular sieve desiccant wheels are still the preferred solution for advanced industrial applications.

The pharmaceutical industry occupies a significant share of the desiccant wheel market as increase in asset efficiency contributes to sustained growth where strict humidity control is required during drug manufacturing, storage, and packaging.

Excess moisture can also degrade active pharmaceutical ingredients (APIs), decreasing the efficacy and shelf life of drugs. Desiccant wheels are efficient and effective because they help eliminate high humidity levels, which helps you comply with GMP and FDA compliance measures.

Pharmaceutical-manufacturing entities use desiccant wheels as part of HVAC systems, cleanrooms, and storage areas must avoid process contamination and ensure product stability. These systems also bettered air quality, limited microbial growth and improved consistency in drug formulation.

Moreover, the increasing need for temperature as well as humidity-sensitive biologics, vaccines, and specialty medications is expected to augment the demand for effective dehumidification solutions. This growth indicates the importance of desiccant wheels as the pharmaceutical companies try to catch up with the production demands while bringing in the climatic control for their processes.

With the growing importance of moisture management in food handling, the food industry has become one of the major end-user in the global desiccant wheel market. Provides anti mold effect and prevents spoilage and quality loss of perishables due to humidity. In food manufacturing settings, desiccant wheels are important for effectively dehumidifying an environment that needs product quality to be preserved long-term which leads to greater quality consistency.

Desiccant wheels are built into drying chambers, cold storage facilities and processing lines by food manufacturers to improve efficiency and meet regulations. For example, industries that produce dairy, confectionery, and snack food often maintain controlled humidity to avoid antithesis of sugar crystallization, powder caking, and microbial contamination.

Also, developments in energy-efficient desiccant wheel technology have facilitated sustainability programs in the food industry by minimizing energy use and overhead costs. The advent of stricter food safety standards worldwide has further accelerated the demand for desiccant wheels in food processing applications, making them even more critical to the industry.

Global desiccant wheel market is a competitive one owing to the presence of numerous global HVAC and air treatment technology companies. Desiccant wheels, or rotary dehumidifiers, are essential for industrial, commercial and residential applications with exact humidity control requirements.

Major players are focusing on high-efficient desiccant materials, energy-saving regeneration technologies, and eco-friendly dehumidification system. The market comprises of some notable HVAC manufacturers as well as niche air treatment solution providers specialized in the pharmaceutical, food processing, and electronics manufacturing sectors.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Munters Group | 20-25% |

| Bry-Air (A Division of Pahwa Group) | 15-19% |

| Seibu Giken Co., Ltd. | 12-16% |

| NovelAire Technologies | 8-12% |

| Proflute AB | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Munters Group | Develops high-efficiency desiccant wheels with energy-saving regeneration technology for industrial and commercial dehumidification. |

| Bry-Air (A Division of Pahwa Group) | Specializes in custom-engineered desiccant dehumidification systems for pharmaceutical, food processing, and cleanroom applications. |

| Seibu Giken Co., Ltd. | Produces advanced desiccant wheels using high-performance silica gel and molecular sieve technology for precise moisture control. |

| NovelAire Technologies | Offers hybrid desiccant dehumidification solutions with integrated energy recovery systems for sustainable climate control. |

| Proflute AB | Manufactures industrial-grade desiccant rotors with superior moisture adsorption capabilities for HVAC and air treatment applications. |

Key Company Insights

Munters Group (20-25%)

Munters' dehumidification systems consists of the market-leading desiccant wheel which provides high efficiency solutions for industrial and commercial humidity control. It improves the dehumidification performance through its energy-saving regeneration systems.

Bry-Air (A Division of Pahwa Group) (15-19%)

Bry-Air is an active manufacturer of desiccant dehumidification systems for pharmaceutical, food processing, and cleanroom environments. Represents this in its precision moisture control solutions.

Seibu Giken Co. Ltd. (12-16%)

Seibu Giken off ers high-performance desiccant wheels using state-of-the-art silica gel and molecular sieve technology for maximum humidity control.

NovelAire Technologies (8-12%)

NovelAire develops hybrid desiccant dehumidification systems with integrated energy recovery, making them ideal for sustainable climate control applications.

Proflute AB (5-9%)

Proflute manufactures industrial-grade desiccant rotors with superior moisture adsorption, catering to HVAC and air treatment sectors worldwide.

Other Key Players (30-40% Combined)

Several other companies contribute to the desiccant wheel market by offering cost-effective and innovative moisture control solutions across various industries:

The overall market size for Desiccant Wheel Market was USD 487.7 Million in 2025.

The Desiccant Wheel Market is expected to reach USD 715.1 Million in 2035.

The rising demand for energy-efficient dehumidification solutions, increasing adoption in industrial and commercial HVAC systems, and growing emphasis on air quality control fuel the Desiccant Wheel Market during the forecast period.

The top 5 countries which drives the development of Desiccant Wheel Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of Silica Gel Desiccant Wheels to command significant share over the forecast period.

Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

Air Quality Monitoring Equipment Market Growth - Trends & Forecast 2025 to 2035

Composting Equipment Market Growth - Trends, Demand & Innovations 2025 to 2035

Airbag Control Unit Sensor Market Growth - Trends, Demand & Innovations 2025 to 2035

Domestic Booster Pumps Market Growth - Trends, Demand & Innovations 2025 to 2035

Condition Monitoring Service Market Growth - Trends, Demand & Innovations 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.