The desiccant dehumidifiers market is anticipated to be valued at USD 614.97 million in 2025. It is expected to grow at a CAGR of 3.7% during the forecast period and reach a value of USD 884.39 million in 2035.

In 2024, the desiccant dehumidifiers market witnessed steady growth, driven by rising demand in industries with strict humidity control needs, including pharmaceuticals, food processing, and electronics manufacturing.

Growing demand, among others, for silica gel dehumidifiers has also been attributed to the shift toward energy efficiency and environment-friendly solutions. This coupled with cold storage expansion and logistics networks continues to fuel the demand for such factors as maintaining optimum humidity levels for perishable goods.

Different geographical regions have seen different trends, with the tropical and colder climates showing the greatest adoption because of moisture-related equipment failures. On the developed side, retrofitting projects of industrial plants are incorporating such systems for better sustainability compliance. The rental and temporary segment also has growth, particularly in the construction and emergency response areas.

Growth stability is to be expected in 2025 onward as smart dehumidification technology continues to advance and these systems are more commonly found across data centers and commercial spaces. There will also be more forceful manufacturers toward a tighter definition in energy efficiency, based on sustainability laws. Emerging regions in the Asia-Pacific and Latin America will strengthen new demand, while IoT-enabled monitoring systems, along with technological integration, will shift the future of desiccant dehumidification solutions.

Key Metrics

| Metric | Value |

|---|---|

| Estimated Market Size in 2025 | USD 614.97 Million |

| Projected Market Size in 2035 | USD 884.39 Million |

| CAGR (2025 to 2035) | 3.7% |

Explore FMI!

Book a free demo

(Survey conducted Q4 2024, n=500 participants across manufacturers, distributors, industrial end-users, and facility managers in North America, Europe, Asia-Pacific, and Latin America)

Regional Variance

Regional Insights

Regional Breakdown

Investment Priorities by Region

The desiccant dehumidifiers market is undergoing a transformation driven by energy efficiency, smart technology adoption, and customization needs. While developed industries are focusing on automation and sustainability, emerging regions prioritize affordability and reliability. As demand grows, businesses must align their strategies with regional trends and evolving regulations.

| Countries/Region | Regulations & Certifications Impacting the Industry |

|---|---|

| United States |

|

| European Union |

|

| China |

|

| Japan |

|

| South Korea |

|

| India |

|

| Australia |

|

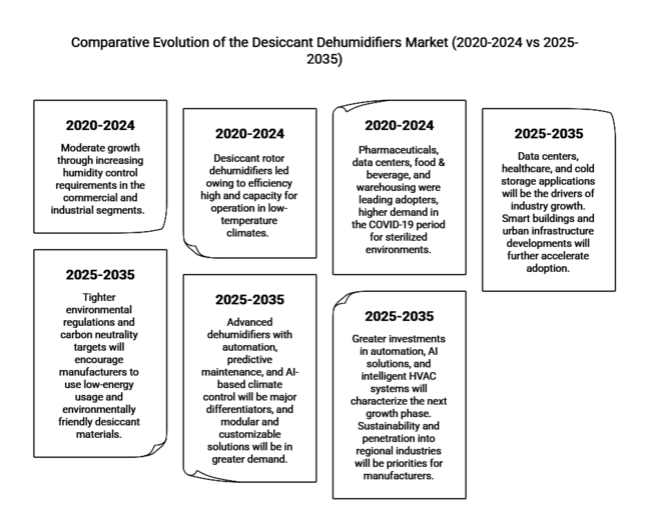

| 2020 to 2024 (Industry Performance & Trends) | 2025 to 2035 (Future Projections & Growth Drivers) |

|---|---|

| The desiccant dehumidifiers market displayed moderate growth through increasing humidity control requirements in the commercial and industrial segments. Regional differences were the CAGR continued at ~3.5%, steady. | Growth will be steady with a forecasted CAGR of 3.7% globally, driven by technological innovation, energy-efficient technology, and compliance with regulations. |

| Desiccant rotor dehumidifiers led owing to efficiency high and capacity for operation in low-temperature climates. Industrial, commercial applications prompted most sales. | There will be the ongoing dominance of desiccant rotor dehumidifiers but IoT-based and AI-based models will increase their foothold, leading to improved operational efficiency and remote monitoring. |

| Pharmaceuticals, data centers, food & beverage, and warehousing were leading adopters, higher demand in the COVID-19 period for sterilized environments. | Data centers, healthcare, and cold storage applications will be the drivers of industry growth. Smart buildings and urban infrastructure developments will further accelerate adoption. |

| North America and Europe dominated the industry because of strict regulations on humidity control. Asia-Pacific recorded high growth because of industrialization and growing investments in the pharmaceutical sector. | Asia-Pacific will lead, driven by expanding e-commerce warehouses, semiconductor businesses, and state-supported manufacturing expansion. North America and Europe will grow but more slowly. |

| The government mandated tough humidity control regulations in the pharma, food processing, and HVAC sectors. Energy-efficient dehumidifiers were encouraged by sustainability regulations. | Tighter environmental regulations and carbon neutrality targets will encourage manufacturers to use low-energy usage and environmentally friendly desiccant materials. |

| Conventional manual control dehumidifiers were very common, with less integration of IoT. Portable and rental dehumidifiers became more popular. | Advanced dehumidifiers with automation, predictive maintenance, and AI-based climate control will be major differentiators, and modular and customizable solutions will be in greater demand. |

| Supply chain disturbances, volatile raw material costs, and the upfront cost made adoption widespread among small enterprises and households difficult. | Energy cost volatility, price competition pressures, and technology adjustment costs will continue to test industry players. Relief may come in the form of government incentives for energy efficiency, though. |

| Large corporations undertook R&D spending on energy-saving models, whereas mergers and acquisitions enabled enlargement of manufacturing capabilities. | Greater investments in automation, AI solutions, and intelligent HVAC systems will characterize the next growth phase. Sustainability and penetration into regional industries will be priorities for manufacturers. |

The desiccant rotor dehumidifier is the leading product type and expected to grow at a CAGR of 3.5% for forecasted period 2025 to 2035. Their industry share is due to the effectiveness in moisture removal along with energy savings and industry usage versatility.

Unlike refrigerant systems, desiccant rotor dehumidifiers work at very low temperatures and humid conditions, thus being useful for applications such as pharmaceutical manufacturing, data centers, and cold storage.

These systems maintain a constant humidity in the commercial and industrial space using an extremely efficient absorption and removal of moisture from the air supplied by a continuously rotating desiccant wheel. Modular design and scalability also allow the integration of these systems into HVAC systems in businesses to optimize air quality and lower maintenance costs, even as compliance with sector regulations such as in the food processing and healthcare industries further drive the demand.

The commercial sector takes the lead in application, with a CAGR increase of 3.4% from 2025 to 2035. High adoption occurs in pharmaceuticals, hotels, data centers, and warehouses, which need precise moisture control. Humidity levels have to be controlled in pharmaceutical production facilities to avoid degradation of drugs, whereas warehouses and storage centers require dehumidification systems to avoid damage to goods due to moisture.

Data centers are another major user of humidity-controlled environments to prevent failures of their equipment due to condensation and corrosion. Besides, hotels, spas, and restaurants are among the users in the hospitality industry that will be eventually integrating these systems to condition their indoor spaces to desirable temperature limits while assisting in the prevention of mold growth.' Urbanization and expansion in commercial space constructions globally will raise the demand for efficient dehumidification solutions in public spaces, shopping centers, and entertainment venues.

The USA is poised for steady growth in humidity control solutions, with an estimated CAGR of 4.1% from 2025 to 2035, surpassing the global average of 3.7%. This growth is fueled by rising demand in industrial applications, particularly in pharmaceuticals, food storage, data centers, and cleanrooms.

The USA EPA's Energy Star program and ASHRAE standards (90.1 & 62.1) are pushing manufacturers toward energy-efficient models, creating a strong demand for sustainable dehumidification solutions.

Additionally, disaster recovery and mold prevention are key drivers, as extreme weather events and humidity-related damage continue to impact residential and commercial properties. Construction sites and temporary humidity control services are witnessing a surge in demand for portable solutions.

The presence of leading HVAC and air quality solution providers in the USA further strengthens industry growth. However, high initial costs and maintenance expenses may slow adoption in small and medium-sized enterprises (SMEs).

Nevertheless, the increasing integration of IoT-enabled dehumidification systems for remote monitoring and predictive maintenance is expected to enhance adoption. The USA is expected to remain one of the most lucrative regions, with strong technological advancements and regulatory backing shaping future expansion.

The UK is forecasted to grow at a CAGR of 3.5% from 2025 to 2035, slightly below the global average. Industrial applications, commercial real estate, and data center expansion largely drive the demand. The UK’s Ecodesign and Energy Labelling Regulations, along with its Net Zero targets for 2050, have made energy-efficient solutions a priority, prompting increased investment in low-energy humidity control systems.

The UK’s damp climate and strict building regulations necessitate effective humidity control solutions, particularly in residential basements, heritage sites, and indoor swimming pools. Additionally, pharmaceutical, food processing, and logistics industries continue to rely on high-performance solutions to maintain compliance with stringent humidity standards.

Despite the growing demand, Brexit-related trade complexities have affected supply chains, leading to fluctuating product prices. Additionally, rising electricity costs pose a challenge to businesses adopting high-powered dehumidification solutions. However, government incentives for energy-efficient HVAC solutions and increased demand for rental humidity control services are expected to keep industry growth stable.

The UK remains a strong hub for premium dehumidification systems, with continued advancements in smart humidity control technologies and carbon-reducing innovations driving long-term expansion.

France is expected to register a CAGR of 3.3% from 2025 to 2035, slightly below the global average. The demand for industrial humidity control solutions is rising, particularly in winemaking, food processing, and pharmaceuticals, where humidity control is essential. Strict EU environmental policies, such as the Eco-design Directive, are pushing manufacturers to adopt energy-efficient systems that align with sustainability goals.

One of the key growth drivers is the increasing application of humidity control solutions in historical buildings, museums, and archives. The French government actively funds preservation efforts, ensuring demand for high-performance dehumidifiers in these settings. Additionally, urbanization and rising real estate developments are supporting the adoption of dehumidification systems in commercial and residential properties.

However, high product costs and economic uncertainties may impact overall expansion. French manufacturers are responding by introducing rental models and portable dehumidifiers, catering to seasonal demand in construction and event management. As France strengthens its energy efficiency policies, manufacturers focusing on IoT-driven, automated dehumidification systems are expected to gain a competitive advantage.

Germany is projected to grow at a CAGR of 3.9% from 2025 to 2035, driven by the country’s strict energy efficiency policies and industrial demand. Germany’s industrial sector-particularly automotive, pharmaceuticals, and food storage-accounts for significant adoption, as factories and warehouses require precise humidity control.

The EU’s Eco-design Directive and REACH compliance regulations have made sustainability a priority, encouraging German manufacturers to invest in low-energy, high-performance humidity control solutions. Additionally, data centers and semiconductor manufacturing are seeing increased demand for specialized dehumidification systems to maintain optimal air conditions.

Despite strong industry performance, high manufacturing and energy costs pose challenges for local companies. However, Germany’s engineering expertise and focus on automation have led to the rapid adoption of smart dehumidification solutions, integrating IoT, AI-based monitoring, and predictive maintenance. Expansion is expected to continue, driven by technological innovation and stringent efficiency standards.

Italy is forecast to expand at a CAGR of 3.4% from 2025 to 2035. The country's hot and humid climate, particularly in southern regions, drives high demand for industrial and residential humidity control solutions. The wine, food processing, and pharmaceutical industries are major adopters, as they require strict moisture control for product preservation.

The Italian government’s energy efficiency incentives encourage businesses to invest in sustainable HVAC solutions, driving demand for low-energy humidity control systems. Additionally, cultural heritage preservation efforts in historical buildings and museums have led to steady growth in demand for precision humidity control solutions.

However, economic volatility and high import taxes pose challenges, making rental and temporary dehumidification solutions increasingly popular. As the Italian construction sector continues to recover, demand for portable, high-performance dehumidifiers is expected to strengthen overall adoption.

South Korea is anticipated to expand at a CAGR of 3.6% from 2025 to 2035. The country’s booming semiconductor and electronics manufacturing industries require precise humidity control, fueling strong demand for industrial-grade dehumidifiers.

The Korea Energy Efficiency Label and Standard (KEELS) Program mandates high-efficiency dehumidification systems, driving innovation in smart, IoT-integrated devices. Additionally, rising commercial and residential real estate developments have increased the adoption of compact and modular dehumidifiers.

Despite strong growth prospects, fluctuating import duties on HVAC components present supply chain challenges. However, government incentives for eco-friendly technologies and rising consumer awareness of indoor air quality are expected to support sustained expansion.

Japan is projected to grow at a CAGR of ~3.2% from 2025 to 2035, slightly below the global average due to saturation in industrial applications. However, increasing adoption of smart homes and aging infrastructure maintenance are expected to drive steady demand. High humidity levels, frequent typhoons, and seasonal temperature variations make dehumidification essential in residential, commercial, and industrial settings.

The Japanese Industrial Standards (JIS) for HVAC systems enforce strict humidity control measures, particularly in pharmaceuticals, electronics, and food processing sectors. Additionally, the country's aging infrastructure, including museums, archives, and historical buildings, has created a demand for precision humidity control to prevent material degradation.

Japan’s rapid adoption of IoT-enabled appliances is also shaping industry trends. AI-driven dehumidification systems with automated controls and real-time humidity monitoring are becoming popular in smart home ecosystems.

However, high product costs and limited domestic manufacturing pose challenges, leading to increased imports from China and South Korea. Despite this, government incentives for energy-efficient appliances and growing awareness of indoor air quality solutions are expected to support long-term expansion.

China is forecast to expand at a CAGR of ~4.5% from 2025 to 2035, outpacing the global average due to strong industrialization, climate conditions, and government policies. The manufacturing, pharmaceutical, and logistics sectors require high-performance humidity control solutions, driving increased adoption of industrial dehumidification systems.

China’s National Energy Efficiency Standards for HVAC systems have pushed manufacturers to develop eco-friendly, low-energy dehumidifiers, aligning with the country’s carbon neutrality goals for 2060. Additionally, severe air pollution and high humidity levels in coastal regions are fueling demand for air purification and dehumidification combined systems.

China is also emerging as a key exporter of humidity control solutions, with local manufacturers producing cost-effective, high-volume units for industries. However, rising raw material costs and supply chain disruptions pose challenges. Additionally, foreign HVAC brands face competition from domestic manufacturers, leading to price-sensitive industry dynamics.

The rise of smart factories and AI-powered climate control systems is expected to drive the next phase of growth. Government-backed industrial modernization initiatives, such as Made in China 2025, will further support technological advancements and innovation in humidity control solutions.

As of 2024, the desiccant dehumidifiers market has seen significant activity, with key players implementing strategies to strengthen their industry positions. Companies such as Bry-Air (Pahwa Group), Munters, Honeywell International Inc., Seibu Giken DST, Trotec GmbH, and Condair Group have been at the forefront of innovation and expansion.

These companies have focused on enhancing product efficiency, expanding their geographic reach, and leveraging advanced technologies to meet the growing demand for energy-efficient and sustainable dehumidification solutions. The industry is estimated to reach USD 614.97 million by 2025, with a projected growth of USD 884.39 million by 2035, reflecting a CAGR of 3.7% during the forecast period.

One of the notable developments in 2024 is Munters' strategic acquisition of a smaller competitor to bolster its portfolio in the industrial dehumidification segment. This move, confirmed by a press release on Munters' official website, aims to consolidate its industry presence and expand its technological capabilities.

In terms of industry share, Honeywell International Inc. continues to dominate North America, driven by its strong distribution network and reputation for reliability. Honeywell holds a 20% industry share, making it one of the largest players in the industry.

Meanwhile, Seibu Giken DST has made significant inroads in the Asia-Pacific region, particularly in Japan and South Korea, by offering customized solutions for high-precision manufacturing environments. Trotec GmbH has focused on expanding its presence in Europe, with a particular emphasis on the healthcare and construction sectors.

In early 2024, the company announced a partnership with a leading European HVAC manufacturer to integrate advanced moisture control systems into smart building solutions. This collaboration aims to address the increasing need for climate control in energy-efficient buildings. Trotec holds an estimated 10% industry share, with its innovative solutions gaining traction in Europe.

The Condair Group has also been active, launching a new service platform in 2024 that offers predictive maintenance and remote monitoring for industrial dehumidification solutions. This initiative is designed to enhance customer satisfaction and reduce downtime, particularly in critical applications like data centers and museums. Condair accounts for 8% of the industry, with its focus on service-oriented solutions setting it apart from competitors.

Growing industrial applications, stricter humidity control requirements, energy efficiency regulations, and increasing adoption in pharmaceuticals, food processing, and data centers are major drivers.

Advanced dehumidification systems excel in low-temperature and low-humidity environments, making them ideal for cold storage, pharmaceuticals, and industrial drying processes. At the same time, refrigerant-based units work better in warmer, high-humidity conditions.

Key industries include pharmaceuticals, food and beverage, warehousing, data centers, electronics manufacturing, healthcare, and commercial buildings, where precise moisture control is essential.

Innovations such as IoT integration, real-time monitoring, AI-driven efficiency optimization, and eco-friendly moisture-absorbing materials are enhancing performance, energy savings, and automation capabilities.

Regulations focused on energy efficiency, indoor air quality, and industrial safety are pushing businesses to invest in advanced humidity control solutions that comply with evolving standards.

The industry is segmented into desiccant rotor dehumidifiers, desiccant wheel dehumidifiers, desiccant cartridge dehumidifiers, and desiccant packet dehumidifiers.

In terms of application, the sector is segmented into commercial, residential, industrial, healthcare, food and beverage, pharmaceuticals, warehousing and storage, data centers, and others.

The industry is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

Commercial Refrigeration Compressor Market Growth - Trends, Demand & Innovations 2025 to 2035

Dry Washer Market Insights - Demand, Size & Industry Trends 2025 to 2035

Composting Equipment Market Growth - Trends, Demand & Innovations 2025 to 2035

Airbag Control Unit Sensor Market Growth - Trends, Demand & Innovations 2025 to 2035

Automated Material Handling Systems Market - Market Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.