Manufacturers are expecting steady market development during the 2025 to 2035 time period because consumers want footwear which balances durability with style. The rugged construct of desert boots serves various consumer groups including those who seek fashion-oriented choices as well as wilderness participants.

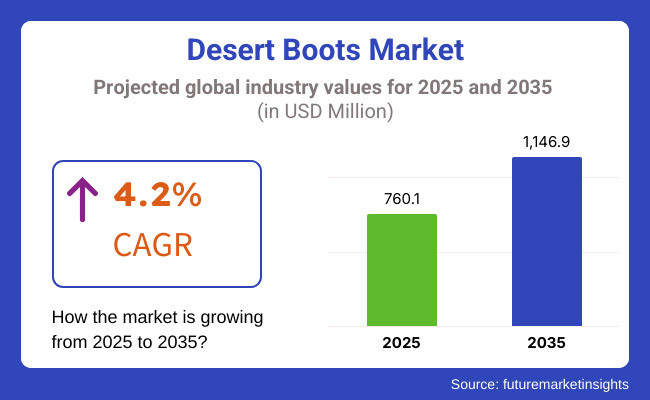

The industry projection shows that the market value will increase from USD 760.1 million in 2025 to USD 1,146.9 million by 2035 at a compound annual growth rate (CAGR) of 4.2%. Market growth becomes evident because people increasingly choose casual and utility footwear as their preferred option.

Desert boots provide consumers with needed features of comfort and durability and weather-resistance which makes them an excellent footwear choice for both city use and outdoor activities. The market demands sustainable materials and lightweight designs and comfort technology improvements because consumers want better products.

Changing raw material prices together with competition from other casual footwear types restricts market growth in the coming years. Companies address barriers by developing innovative designs as well as environmentally friendly production practices and strategic marketing approaches to expand consumer reach.

Desert Boots Market are designed as per material type segment as well as end-user preference segment with strong demand from fashion retailers, military personnel and outdoor adventurers. The main material types consist of leather, suede, and synthetic textiles.

It is preferred by Premium consumers because, while leather desert boots provide durable outsoles and a classic aesthetic. The presence of a single word, 'suede' in a sentence captures the softer tone texture element with a fashion lifestyle quality. Synthetic options are inexpensive and lighter weight, making them appealing to budget-minded shoppers and warmer weather climates.

Explore FMI!

Book a free demo

The desert boots market across North America accounts for a significant share owing to the presence of premium footwear brands and a high demand for stylish yet functional boots among consumers.

A wide range of use evolving into military, adventure, and fashion in desert boots, thus steady adoption in United States and Canada. Quality materials and craftsmanship are highly prized by consumers, leading to demand for high-end leather and suede offerings.

Marketplace and DTC strategies increase channel penetration. There is also an increasing preference for sustainable and ethically made footwear, which affects consumer choices. The unremitting design innovations and focused marketing allow the market to grow at some extent even in the presence of challenge from sneakers and casual wear.

The United Kingdom, Germany, and France are among the countries with large demand for desert boots are in Europe. The region’s fashion-savvy consumers also help to further entrench the penetration of desert boots across both casual and semi-formal wear. Specifically, the UK has a historic connection with desert boots and is thus a leading market for the same.

Demand for ethically sourced materials and eco-friendly production methods is driven by sustainability initiatives and eco-conscious consumers. They make them in Europe and focus on quality with well-crafted and heritage designs, which attracts consumers looking for quality, durability, etc. Despite stiff competition with other footwear segments, the market will receive a boost from the continuing trend of casual yet stylish fashion styles.

Emerging economies in the Asia-Pacific region reported the fastest growth in desert boots market owing to rising disposable income, increasing trend of urbanization, and high demand for western fashion trends.

The regions are constantly transforming the market as the young population prefers trendy and functional shoes. The rise of e-commerce allows for markets to be more accessible through online platforms, allowing premium and international brands to be more available to the consumer.

Warmer climates call for lightweight and breathable desert boots so material and design innovations emerge in response to the demand. Although affordability is still an important driver in the region, the growing middle-class population and increasing brand consciousness support a steady market growth.

Challenge: Market Saturation and Counterfeit Products

The desert boots industry is highly competitive, as many established and new companies offer similar products. Market saturation has placed pressure on prices and, in turn, made it harder for premium brands to generate profits while competing again budget alternatives.

Also, fake desert boots are abundant in the market which tarnishes brand image and results in loss of business for the original producers. Such imitation products are made from cheaper quality materials little do the customer know which devastates the consumer trust and raises doubt on durability as well.

The dilemma is moving to establish authentic products through factor which requires innovation, building brand and delivering better customer engagement, while addressing the counterfeit market which is auspicious these days.

Opportunity: Expanding Demand for Durable and Fashionable Footwear

Desert Boots Market Opportunity Due to the growing consumer preference towards multi-functional, long-lasting and fashion item footwear, the desert boots market has a big growth opportunity. Desert boots are in demand among consumers who prefer a combination of functionality with fashion and are looking for footwear to wear in casual and outdoor settings.

Improvements in eco-friendly materials, ergonomic designs, and waterproofing technologies referenced in, contributing to greater comfort and durability, will appeal to a wider range of consumers.

The advent of e-commerce and direct-to-consumer (DTC) sales channels also increases market reach; with DTC, brands can engage customers anywhere in the world. Manufacturers can innovate and differentiate their offerings, as demand continues to rise for premium, handcrafted, and eco-friendly shoes.

The period 2020 to 2024 saw a resurgence in demand for desert boots, as increasing fashion trends leaned toward rugged, classic footwear. Brands launched eco-friendly leather, sustainable production methods to keep up with shifting consumer demand.

Nevertheless, disruptions in the supply chain and varying costs of raw materials created headwinds for the manufacturers. E-commerce was instrumental in sales generation, with roles for digital marketing and influencer partnerships increasing brand awareness.

The market will evolve in the 2025 to 2035 era towards giving consumers a choice of personalized footwear solutions where they select their designs according to their needs based on fit, material, colour, applications, and pricing.

More extreme weatherproofing options paired with lightweight materials will improve desert boots, as they will become increasingly fit for very harsh environments. With environmental concerns on the rise, the use of biodegradable materials and sustainable production methods will become more mainstream. Block chain technology will also be utilized for ensuring authenticity and preventing counterfeiting.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Environmental policies promoted using more sustainable materials in shoe manufacturing. |

| Technological Advancements | Brands introduced recycled leather and synthetic alternatives to reduce environmental impact. |

| Consumer Preferences | Demand for classic, durable footwear remained strong, with sustainability gaining traction. |

| Retail and E-Commerce | E-commerce sales surged due to digital marketing and influencer partnerships. |

| Supply Chain and Production | Production costs were affected by raw material price volatility and disruptions to logistics. |

| Counterfeit Market Impact | Counterfeit desert boots affected brand reputation and reduced authentic sales. |

| Market Growth Drivers | Growth fuelled by urban fashion trends, rising disposable incomes, and global brand expansion. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | More stringent environmental policies will lead to the mainstreaming of biodegradable and responsibly sourced materials. |

| Technological Advancements | AI-driven customization tools and smart footwear technology will enhance product innovation. |

| Consumer Preferences | Personalization, lightweight materials, and multi-purpose outdoor designs will define consumer trends. |

| Retail and E-Commerce | Brands will explore direct-to-avatar fashion, virtual retail spaces and other means to enable better online shopping experiences. |

| Supply Chain and Production | Supply chains will become local and ethical, reducing global exposure. |

| Counterfeit Market Impact | Block chain-based product authentication and unique serialization techniques will curb counterfeiting. |

| Market Growth Drivers | Expansion will accelerate with sustainable fashion movements, smart footwear, and digital retail innovation. |

The United States desert boots market is growing as consumers demand durable, stylish, all-terrain footwear. The market has been bolstered by an increase in outdoor recreation, military use, and casual fashion. Leading brands are zeroing in on lightweight, breathable and weatherproof designs, appealing to both the practical and the sartorial.

The increasing focus on sustainable or environmentally friendly materials like vegan leather and recycled rubber soles are also shaping buying behaviour. Moreover, the rise of e-commerce platforms and direct-to-consumer retail strategies have increased market accessibility. Increasing interest in tactical and work boots along with the presence of international and domestic strong brands are expected to propel the overall market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.4% |

In the UK, desert boots, inspired from military styles, are gaining traction, with interest for luxury construction, clothing and casual wear growing too. Desert boots are becoming increasingly used, in urban and rugged environments due to their versatility and comfort.

Some of the best in the game are investing in premium suede and leather choices, and meanwhile, water-resistant coats and ergonomic soles are all on the table.

Market growth is also being supported by the UK’s strong fashion and lifestyle sector, as well as growing demand for heritage and handcrafted footwear. There are also those looking for environmentally friendly desert boots, driven by sustainability efforts, like carbon-neutral production processes.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.1% |

The European Union desert boots market has also been growing steadily over the past few years, due to the increasing demand for both stylish and functional footwear in multiple consumer segments. Germany, France and Italy dominate the market, due to the presence of robust fashion industries, increasing demand for premium leather products, and rising focus on sustainable footwear in these countries.

The changing consumer lifestyles and the growing preference for outdoor activities have thus boosted the demand for durable and lightweight boots. Strict EU regulations regarding sustainable manufacturing practices are also having brands turn to sustainable materials and ethical sourcing practices. In addition, online retail channels continue to expand, providing consumers across Europe with greater access to desert boots, which bodes well for future market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.3% |

The blisteringly-fast expansion of Japan’s desert boots market is something of a phenomenon, and one that is an also reflection of the popularity of heritage fashion, casual work wear and functional outdoor footwear. Quality craftsmanship, durability, and minimalist designs are valued by the country’s consumers and are driving the popularity of desert boots as a go-to option for casual and outdoor wear.

Japanese brands are blending old-world craftsmanship with new-world technology, making desert boots that are waterproof, lightweight, and sustainable. Moreover, with the increasing impact of international fashion trends and streetwear culture, the market has continued to grow at a high pace. Increasing disposable expenditure along with demand for premium products secures Japan dominant position in the Asia-Pacific desert boots market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.2% |

With the influence of Western fashion trends, outdoor lifestyle choices and sustainable footwear innovations, the South Korean desert boots market is blooming. Given the wide variety of local and international players the market is heavily biased towards premium desert boots produced from advanced materials.

The unique desert boots become more accessible through the lively e-commerce and retail landscape found in South Korea, with online stores providing customized, limited-edition, and designer collaborations.

Moreover, the surge in adventure tourism and hiking culture is contributing to the market as consumers are swaying towards rugged yet stylish footwear. The government’s focus on environmentally friendly and ethical manufacturing practices is also shaping consumer preferences toward sustainable desert boots.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.2% |

Flat desert boots dominate the market with unmatched comfort, versatility, and durability that suits a wide range of consumer groups. With a short heel height, these boots provide the most support to the foot, making them perfect for everyday wear.

Their lightweight materials and ergonomic design promote mobility, ensuring that users stay comfortable even after hours of wear. Or have flat desert boots: As they go well with casual and semi-formal attire, they are at a close distance to becoming the mainstay in any fashionista's wardrobe.

The popularity of such trendy and comfortable boots is helping to fuel sales of flat desert boots, especially among city-working professionals and outdoor lovers. Manufacturers integrate cushioning technologies and moisture-wicking fabrications to enhance the wearer's experience.

And sustainability issues have prompted brands to offer environmentally friendly options, made with recycled leather and biodegradable soles. As comfort and fashion forge ahead together, flat desert boots is among the top segment, appealing to a broader consumer demographic base looking for functional and stylish shoes.

The most popular footwear, lace-up desert boots, catches on better with durable construction and features like a custom fit.

Their adjustability, rugged style, and excellent durability have made lace-up desert boots very popular. Unlike slip-on or buckle types, lace-up boots provide an adjustable fit that increases ankle support, allowing use for either rugged outdoor or casual use. Consumers Love These Boots because they’re Easy to Style, Transitioning from Work to the Weekend

The booming adoption of lace-up desert boots by adventure seekers and military personnel has propelled growth in the market. Rugged terrain, rugged boots: these boots are made for rugged tasks, with better grip and stability to excel in extreme conditions.

Style-savvy shoppers also like lace-up boots for how they can up an everyday ensemble but still be practical. Lace-up desert boots were designed and manufactured in many advances of water-resistant materials and sole designs; continue to fortify what has become a widely-shared best practice for consumers on foot.

With the more and more tendency to blend sustainability with urban chic, the demand for men’s desert boots had become an emergent for the market. Balanced with rugged functionality and sophisticated style, these boots are an absolute staple for anything from cocktails to outdoor adventures. Their versatility means men can wear them with jeans, chinos, or suits and this will resonate with a broad market.

Sales in the category have been buoyed by an ongoing trend toward casual work wear and outdoor lifestyle preferences. As such, many brands are leaning into new approaches to lightweight materials and increased cushioning for all-day comfort.

Also, the growing demand for sustainable fashion has prompted producers to seek out environmentally friendly materials like vegan leather and recycled rubber soles. As men’s fashion continues to shift toward minimalism and functional style then naturally, desert boots remain a staple in footwear collections and, therefore, a stronghold in the market.

Men’s and Women’s Segment Moves Forward as Interest Grows in Stylish, Practical Footwear

Women’s desert boots and the perfect combination of looks and toughness, making them a great option for anyone looking for a boot to wear on multiple occasions. You can find such boots also heeled, flat and in many other models based on your taste.

The athleisure and smart casual movement has also led to a surge in popularity for women’s desert boots, as they fit into a host of everyday looks. Modern manufacturers have adapted feminine designs with sleeker silhouettes, bold colours, and embellishments to be on trend with the current fashion.

The growing demand for sustainable and cruelty-free options has given rise to vegan-friendly footwear. This segment of the market continues to grow and innovate despite the ever vibrant footwear market as more and more women are looking for durable, comfortable and stylish boots.

Desert boots market the desert boots market is a competitive sector, which consists of the global players and niche manufactures offering desert boots for various designs and styles, as well as desert boots functional and durable in nature. Perfect for rugged terrain, extreme weather, or just an everyday stylish look, these boots have it all.

Leading brands emphasize premium materials ranging from suede and leather to rubber soles, combining cutting-edge design elements with improved comfort and durability. The industry is populated with consumer footwear brands across military and outdoor utility footwear brand with a strong heritage as well as emerging brands vying for the same fashion-oriented audience.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Clarks | 18-22% |

| Timberland LLC | 14-18% |

| Dr. Martens | 10-14% |

| Red Wing Shoes | 8-12% |

| Wolverine World Wide, Inc. | 5-9% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Clarks | The pioneer of desert boots, offering premium suede and leather designs with a focus on comfort and timeless style. |

| Timberland LLC | Produces rugged desert boots with waterproofing and anti-fatigue technology for outdoor and casual wear. |

| Dr. Martens | Offers fashionable yet durable desert boots with iconic air-cushioned soles and premium leather construction. |

| Red Wing Shoes | Manufactures handcrafted desert boots with oil-tanned leather and slip-resistant soles for durability. |

| Wolverine World Wide, Inc. | Specializes in high-performance desert boots with moisture-wicking and shock-absorption features. |

Key Company Insights

Clarks (18-22%)

Clarks: creator of the modern desert boot featuring quality suede and crepe sole construction the brand is still at the forefront of casual and heritage-inspired footwear.

Timberland LLC (14-18%)

Timberland’s stability and waterproof desert boots have anti-fatigue technologies designed for rocky urban environments as well as nature, making them a lifestyle pair that is practical in many ways.

Dr. Martens (10-14%)

Dr. Martens desert boots: Stylish desert boot with air-cushioned soles and premium leather for a blend of durable and fashionable appeal.

Red Wing Shoes (8-12%)

Red Wing specializes in handmade, oil-tanned leather desert boots with slip-resistant soles, withstanding harsh conditions for years to come.

Wolverine World Wide Inc. (5% to 9%)

Taking a performance-oriented approach to its desert boots, Wolverine offers moisture-wicking linings and shock-absorption features for added comfort.

Other Players (35-45% Combined)

Some other brands are also providing stylish and functional desert boots as well, catering to different consumer preferences:

The overall market size for Desert Boots Market was USD 760.1 Million in 2025.

The Desert Boots Market is expected to reach USD 1,146.9 Million in 2035.

The rising popularity of durable and stylish footwear, increasing demand for outdoor and military applications, and growing fashion trends fuel the Desert Boots Market during the forecast period.

The top 5 countries which drives the development of Desert Boots Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of Flat Desert Boots to command significant share over the forecast period.

Anti-Pollution Skin Care Market Trends - Growth & Forecast 2025 to 2035

Disease Resistant Mask Market Analysis - By Type, Material, End-User, Distribution Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Tissue Towel Market Analysis - Trends, Growth & Forecast 2025 to 2035

Korea Men’s Skincare Market Analysis - Size, Share & Trends 2025 to 2035

Japan Men’s Skincare Market Analysis - Size, Share & Trends 2025 to 2035

Japan Wall Décor Market Analysis by Base Material, End Use, Product Type, Sales Channel, and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.