The Dermatology Lasers Market will demonstrate substantial expansion from 2025 to 2035 because advanced aesthetic and medical laser treatments gain increasing market demand. Dermatology lasers function as an essential tool for medical professionals who need to treat skin issues such as acne scars and pigmentation conditions and vascular conditions as well as aging skin.

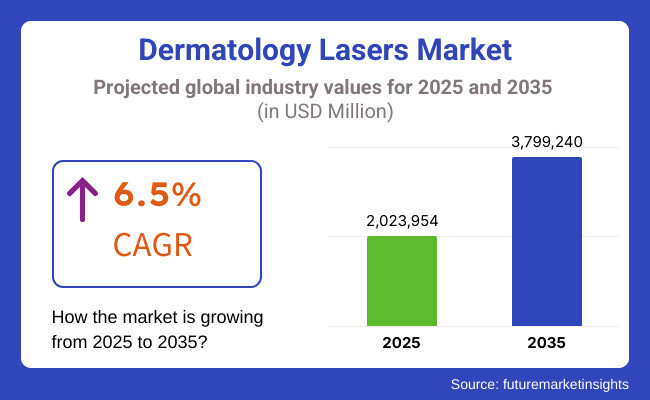

The Dermatology Lasers Market forecast reveals behaviour patterns through which its value will escalate from USD 2,023,954 million in 2025 to USD 3,799,240 million in 2035 at a CAGR of 6.5%.

Market growth lifts from the increasing rate of skin disorders and from expanding interest in invasive cosmetic practices. Medical laser technology now offers three primary devices such as fractional lasers alongside picosecond lasers and diode lasers which optimize both patient care and clinical performance.

Non-surgical aesthetic practices drive clinics and hospitals to adopt dermatology lasers as their technology preference increases. The market faces barriers for growth due to both laser device prices being high and technical maintenance difficulties. The manufacturing industry aims to resolve these problems by developing economical portable laser systems which provide superior performance.

The Dermatology Lasers Market divides into two segments regarding laser type and application because dermatology clinics along with hospitals and medical spas demonstrate rising demand. The market divided its laser types into three main sections: ablative lasers, non-ablative lasers, and fractional lasers.

The skin's outer layers get eliminated through ablative laser treatments which provide successful deep wrinkle and sun damage treatment and eliminate scars. The penetration level of non-ablative lasers reaches deep skin layers while preserving the surface undamaged which makes them optimal for stimulating collagen production and pigmentation therapy.

Fractional lasers unite medical attributes from ablative and non-ablative lasers through their application for precise skin regeneration and restoration. The two biggest skin applications consist of skincare rejuvenation together with scar treatment because patients actively pursue reliable skin improvement solutions.

Laser treatments used for vascular lesion correction and hair removal continue to expand their market share because patient demand increases. Steady technological improvements have made dermatology lasers vital for aesthetic medicine because they enhance the safety measures while improving treatment results.

Explore FMI!

Book a free demo

North America is leading the dermatology lasers market with a high volume of cosmetic dermatology clinics, advanced technology, and higher consumer expenditure in aesthetic procedures. There is a rising demand for laser treatments, including non-invasive skin tightening, pigmentation, and acne scars, in the USA and Canada.

Taking into consideration that the regulatory landscape of the region encourages the use of advanced laser devices with higher safety and efficacy.

The rise in popularity of medical spas and outpatient aesthetic operations is propelling the adoption of dermatology laser. Further, the market is driven by continued research and development in laser-based skincare solutions. Even if laser devices are expensive, market growth is driven by innovation and consumer interest.

Europe is the largest regional market for dermatology lasers, with Germany, the UK, and France as the key contributors for the high growth of the sector. The region has a high adoption of laser-based dermatology treatments, especially for the treatment of anti-aging and scar reduction and pigmentation disorders. In European countries, strict regulations are in place to provide a guarantee of the quality and clinical validation of the laser systems used in medical aesthetics.

Notably, Germany hosts a significant number of dermatology laser research volcanos, and manufacturers are producing active laser technologies for aesthetic and medical purposes. Market growth is powered by the increasing preference for minimally invasive procedures and the rising number of investments in dermatology clinics. Moreover, the rising patient awareness about the effectiveness of laser treatments is further contributing to the regional market growth.

The Asia-Pacific dermatology lasers market is rapidly expanding due to greater awareness of healthcare among the people and rising disposable incomes, as well as booming medical tourism. States like China, Japan, South Korea, and India also see a lot of demand for the laser treatment as the popularity of aesthetic dermatology increases.

However, the advanced cosmetic industry in South Korea acts as a major growth factor for the market as Korean clinics use high-end laser techniques for treating skin problems. Laser treatments are gaining substantial traction in countries such as China and India, with high demand for pigmentation correction and hair removal.

The available low treatment cost and locally manufacturing affordable laser device considerably segmented the market. Despite ongoing challenges over pricing, the continued development in the field of laser technology as well as increasing government interest in aesthetic medicine represents a compelling growth case for the region.

Challenge: High Costs and Regulatory Barriers

Dermatological lasers use sophisticated optical and heat technologies to treat a range of skin problems, such as acne scars, pigment lesions, and hair removal. The use of laser systems, on the other hand, is expensive in terms of initial investment and operational cost, making such procedures a challenge for dermatology clinics and aesthetic centres.

However, due to high initial investments and recurring operating costs, numerous small-scale practices find it challenging to acquire top-notch laser systems. The highly regulated nature of the medical industry and the stringent standards imposed on medical laser devices further adds difficulty for companies seeking to enter the market, requiring extensive safety testing and clinical validation.

Such regulations typically impose longer timeframes for product approvals, stalling technological prowess and scaling opportunities.

Opportunity: Rising Demand for Aesthetic and Non-Invasive Procedures

The growing demand for non-invasive cosmetic procedures is a significant growth factor for the dermatology laser market. They are requesting advanced laser-based solutions for skin rejuvenation, tattoo removal, and wrinkle reduction, as treatment is efficient and has little downtime.

Medical tourism also contributes to growing demand; patients travel to specialized clinics where cutting-edge dermatological laser procedures have become more standard. Moreover, dynamic improvements in fractional and picosecond laser devices are also available, giving high accurate treatment with minimal pain and reduced downtime.

Increasing adoption rates are predestined due to advances in technology making lasers more cost-effective and efficient in the end-user markets, especially in developed and emerging markets.

For the Dermatology laser market (2020 to 2024), the market experienced moderate growth due to the increasing preference for aesthetic procedures and the advancements in laser technology. Laser hair removal and skin resurfacing/scar reduction, for instance, saw a dramatic surge in demand in urban areas.

Despite the great effectiveness of the premium laser systems, their cost and the regulatory complexity inhibited availability in some regions. Companies were solely engaged in the development of versatile, multi-wavelength laser systems for wider disease coverage.

Between 2025 and 2035, we will move further up to AI-assisted laser systems that will be able to optimize treatment protocols, based on skin analysis in real time. The use of at-home dermatology lasers (both portable and home-use) will likely increase due to the convenience of treatments being done from the comfort of one’s home.

Ultra-short pulse and hybrid laser technologies enable precision in advanced dermatological procedures. As well as, the demand for eco-friendly and energy-efficient laser devices will lead to innovations in sustainable dermatology treatments.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Medical laser devices had to undergo extensive clinical validation, resulting in long approval times. |

| Technological Advancements | Fractional and picosecond laser systems improved treatment precision and recovery times. |

| Consumer Preferences | Demand for laser hair removal and scar reduction treatments increased in dermatology clinics. |

| Aesthetic and Medical Applications | Lasers were mostly used for cosmetic procedures, such as skin resurfacing and tattoo removal. |

| Cost and Accessibility | High costs of advanced lasers limited accessibility in smaller clinics. |

| Environmental Sustainability | Dermatology lasers are energy-consuming, which represents a cost in the operating cost of the Dermatology unit. |

| Market Growth Drivers | The surge in aesthetic awareness, urbanization, and medical tourism is driving growth. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Streamlined regulatory frameworks will accelerate product approvals, supporting faster technological adoption. |

| Technological Advancements | AI-driven lasers with real-time skin analysis will personalize treatments for enhanced outcomes. |

| Consumer Preferences | More dermatology lasers for home use will emerge, giving consumers access to high-quality affordable, convenient professional skin care. |

| Aesthetic and Medical Applications | Dermatology lasers will branch into wound healing, pigmentation correction and vascular treatments. |

| Cost and Accessibility | More affordable, portable, and energy-efficient laser devices will increase adoption in emerging markets. |

| Environmental Sustainability | Advancement in low-power, green, carbon-neutral laser technologies will promote sustainability in aesthetic treatments. |

| Market Growth Drivers | AI, personalised skincare & tech integrations are pushing the expansion. |

The market for dermatology lasers in the United States is witnessing vigorous growth owing to the rising popularity of non-intrusive cosmetic procedures and innovative laser techniques in dermatology centres.

Increasing awareness about aesthetic procedures, tattoo removal, hair reduction, and skin revitalization is driving the growth of the market. Moreover, skin disorders, which have further increased the acceptance of fractional CO2, Nd: YAG, and diode lasers to treat these skin ailments has augmented the growth of the medical and cosmetic dermatology market.

With advancements in technology like the picosecond lasers and artificial intelligence-guided laser devices that are getting introduced in the medical field, now we can treat with the utmost precision and maximum effect. USA Food and Drug Administration (FDA) regulatory approvals in this regard have also encouraged innovation activities in laser resurfacing and pigmentation correction technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.7% |

The UK dermatology lasers market is driven by the growing popularity of aesthetic laser treatments as well as the increasing need for skin rejuvenation and anti-aging procedures. With increased consumer awareness, and access to advanced dermatology technologies, clinics are experiencing a boom in laser treatment services for acne/scars, pigmentation and vascular lesions.

Furthermore, guidelines laid out by the Medicines and Healthcare products Regulatory Agency (MHRA) protect the patient and allow clinics to use FDA and CE-approved laser machines. A growing network of dermatology and aesthetic clinics in the country is further driving market adoption.

Furthermore, the demand for customized laser solutions is growing in the UK due to technological improvements in non-ablative and fractional laser treatments, lifting the country to top consideration in the European dermatology lasers market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.4% |

The European Union dermatology lasers market is witnessing robust growth, driven by the increasing adoption of advanced laser technologies in cosmetic dermatology and medical treatments. Countries like Germany, France, and Italy lead the market due to their strong healthcare infrastructure, high disposable incomes, and growing aesthetic consciousness.

The increasing occurrence of skin conditions, such as melanoma and psoriasis, has driven the need for high-precision laser devices in dermatological therapies. Laser devices must be approved by the European Medicines Agency (EMA) and the local health authorities to ensure safety and effectiveness.

The growth of medical spas and laser therapy clinics, as well as new technological developments in pulsed dye lasers and Q-switched lasers also contribute toward an increase in the market growth. As such, the EU market is evolving quickly, with a considerable swing in the direction of non-invasive laser procedures.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.6% |

Growing consumer demand for skin brightening, scar reduction and other anti-aging solutions are fuelling growth in the Japanese dermatology lasers market. With its history of laser-based skincare innovations, picosecond laser, erbium laser for hyperpigmentation correction, acne scar, and skin tightening are the most commonly-used methods.

As the population ages, demand for wrinkle-reducing, collagen-stimulating laser treatments has exploded. Moreover, the stringent regulatory system in Japan enables standard safety and efficacy for laser devices, thereby leading to stronger consumer confidence. Rising eminence for medical aesthetics and laser-based beauty treatments precipitate the demand for this market making Japan as one of leader in dermatological innovations.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.5% |

Demand for aesthetic laser-based treatments, along with the presence of advanced and innovative skincare technology are among the key factors driving the market expansion of dermatology lasers in South Korea. There is a booming cosmetics industry in South Korea and globally consumers are seeking out minimally-invasive treatments for acne scars, pigmentation and skin tightening.

As a leading centre for laser-based skin rejuvenation treatments, with a strong medical aesthetics industry and an ever-growing number of dermatology and beauty clinics, South Korea is the driving force in this fast-growing market.

Increasing demand for international travel for medical treatments, including dermatology laser devices, along with supportive government initiatives to facilitate medical tourism, are expected to position the market in high growth path. Moreover, the nation's ongoing innovations in fractional and picosecond laser technologies are raising the bar for laser dermatology uses.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.5% |

Being versatile and enabling highly precise treatment for a wide variety of skin conditions, diode lasers are leading the dermatology lasers market. They emit light at different wavelengths, making them suitable for treating hair removal, vascular lesions, and skin rejuvenation.

Their ability to penetrate deep into the skin with minimal damage to surrounding tissue makes these devices very appealing for many medical and cosmetic procedures. This also combines to make them one of the most popular tools in dermatology- for both dermatologists and patients, since diode lasers are less painful and require less downtime.

An increasing need for non-invasive cosmetic procedures has enhanced the use of diode lasers in aesthetic medicine. Diode laser systems are increasingly integrated into clinics and hospitals due to their high efficacy in treating pigmented lesions, acne scars, and wrinkles.

Improvements in cooling technologies and pulse modulation improve patient safety and comfort while undergoing procedures. Technological innovations that work towards refining laser precision as well as efficiency show no sign of stopping, and the diode laser segment of the dermatology lasers market remains a key contributor in this space.

CO2 lasers are widely recognized in the dermatology industry today and known for delivering superior results for skin resurfacing and scar revision. These lasers produce high-energy light that vaporizes layers of damaged skin, stimulating collagen production and tissue renewal.

CO2 lasers thus successfully treat deeper lines, acne scars, and skin laxity, leading to their ubiquitous use in dermatological and cosmetic use. Combining precise ablation while stimulating the renewal of skin is their presence now in clinics and medical spas around the world.

CO2 lasers are preferred by dermatologists for severe photo damage, skin irregularities, and benign lesions. The use of fractional CO2 laser technology has extended the potential for enhanced safety and patient recovery through the delivery of fractional treatment zones, preserving adjacent architecture.

As consumer interest in anti-aging and skin revitalization treatments continues to grow, CO2 lasers remain in high demand. The use of AI-assisted laser control combined with live skin analysis systems work to improve treatment outcomes and solidify CO2 laser-derived systems' continued leadership position in the dermatology market.

This has resulted in a wider interest among their patients as ablative lasers are used to accomplish skin resurfacing treatments by removing the outer skin surface. CO2 and Er: YAG equipment are examples of these lasers that accurately vaporize damaged skin tissue, creating collagen production and new cell growth; Ablative lasers are popular for deep wrinkles, acute acne scars, and hyperpigmentation, and serve as a solid foundation in dermatological and aesthetic settings.

Their ability to provide meaningful improvement in skin texture and tone has led to their use in medical clinics and cosmetic centres. Recent technological developments with fractional laser have transformed ablative procedures with shorter downtime at equivalent benefits.

By affecting small areas of the skin, fractional ablative lasers promote faster healing and reduced side effects. Investments in newer generation systems, with faster and more tailored parameters that enable greater accuracy and less significant discomfort have aided the spread of ablative devices, with the market due to continue growing as demand for effective anti-aging solutions rises.

Ablative lasers are a crucial part of skin rejuvenation and corrective dermatology, everything aesthetic medicine keeps expanding. Non-ablative lasers are increasingly gaining popularity in dermatology lasers market. Non-ablative lasers, on the other hand, stimulate collagen production in deeper layers without harming the outer layer.

This technology is widely used to address fine lines, mild acne scars and skin discoloration, and it has become a go-to method of choice for patients who want gradual results that look natural with little downtime. Non-invasive cosmetic surgical procedures have become increasingly desirable, leading dermatology clinics and medical spas to the increased utilization of non-ablative lasers.

Different types of lasers, such as diode and Nd: YAG systems, can provide prolonged skin rejuvenation results with a lower risk of complications. Moreover, improvements in laser cooling and pulse duration minimization have improved the comfort and safety of patients.

As consumers place more and more emphasis on achieving the balance of effective treatments that fit seamlessly into their lives, non-ablative lasers are set to remain at the forefront of dermatological aesthetics for years to come.

Data Bridge Market Research report offers a comprehensive analysis of the dermatology lasers market containing a detailed description, competitive scenario, and various other facts and figures, the significant aspects, which are influencing the growth of the dermatology lasers market. Several key players are at the forefront with advanced laser technologies, including hair removal, skin resurfacing, tattoo removal, as well as vascular lesion treatments.

You are all trained up on secrets like the innovations in fractional lasers, picosecond lasers G and diode lasers, as more companies come to market, brand new products are improving precision, safety, and efficacy. The market encompasses global medical device manufacturers and successful dermatology technology companies, all looking to grow their portfolios and enhance patient outcomes.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cynosure (Hologic, Inc.) | 18-22% |

| Lumenis Ltd. | 15-19% |

| Cutera, Inc. | 10-14% |

| Candela Corporation | 8-12% |

| Fotona d.o.o. | 5-9% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cynosure (Hologic, Inc.) | Develops advanced laser systems for hair removal, skin rejuvenation, and body contouring. Leading innovator in picosecond and fractional laser technologies. |

| Lumenis Ltd. | Specializes in aesthetic and surgical lasers, focusing on CO₂ and IPL-based solutions for skin resurfacing and acne treatment. |

| Cutera, Inc. | Offers high-performance laser platforms for vascular treatments, tattoo removal, and skin revitalization. Known for its Nd:YAG and RF micro needling innovations. |

| Candela Corporation | Produces laser and energy-based systems for dermatology and aesthetic procedures, with a strong presence in vascular and pigmentation treatments. |

| Fotona d.o.o. | Develops multi-application laser systems using Er:YAG and Nd:YAG technologies for non-invasive skin tightening and ablative resurfacing. |

Key Company Insights

Cynosure (Hologic, Inc.) (18-22%)

Cynosure is the market leader in laser platforms for aesthetic and medical dermatology, world-class technology. State-of-the-art picosecond and fractional laser technology increases the precision and effectiveness of treatments.

Lumenis Ltd. (15-19%)

Lumenis defines the field of IPL and CO₂ laser skin resurfacing and acne therapy solutions. The devices available at its store provide good safety and effectiveness for dermatological uses.

Cutera, Inc. (10-14%)

Cutera primarily focuses on the use of Nd:YAG and RF micro needling lasers, for non-invasive vascular treatments, and skin rejuvenation, as well as tattoo removal.

Candela Corporation (8-12%)

Candela is an energy-based dermatology company that has a strong reputation in both vascular lesions and pigmentation. Her devices are used at cosmetic clinics around the world.

Fotona d.o.o. (5-9%)

Dental World: Fotona’ s Er:YAG and Nd:YAG lasers are multi-application, ablative and non-ablative laser systems, providing versatility with applications in medical aesthetics.

Other Key Players (35-45% Combined)

Several other companies contribute to the dermatology lasers market with innovative and cost-effective solutions, focusing on laser-based skin care advancements:

The overall market size for Dermatology Lasers Market was USD 2,023,954 Million in 2025.

The Dermatology Lasers Market is expected to reach USD 3,799,240 Million in 2035.

The increasing prevalence of skin disorders, rising demand for aesthetic procedures, and advancements in laser technology fuel the Dermatology Lasers Market during the forecast period.

The top 5 countries which drives the development of Dermatology Lasers Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of Diode Lasers Dominate to command significant share over the forecast period.

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Analysis by Product, Testing Methods, End User, and Region - Forecast for 2025 to 2035

Procalcitonin (PCT) Assay Market Analysis by Component, Type, and Region - Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.