A transformation in the Depth Sensing Market will occur between 2025 and 2035 because more industries begin utilizing depth sensing technology for consumer electronics and automotive applications and healthcare and industrial automation systems.

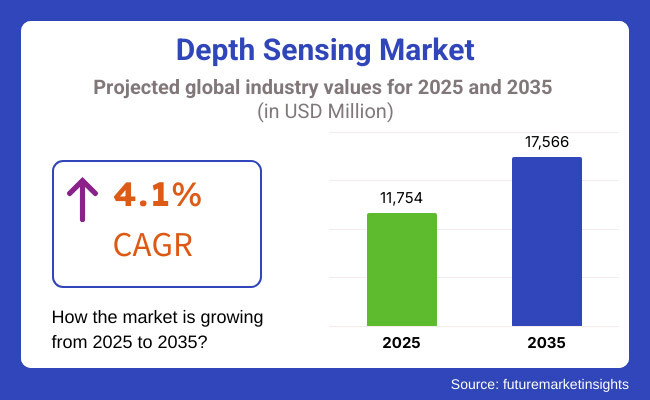

Through depth sensing technology devices acquire enhanced spatial capability which enables their execution of facial recognition and gesture tracking and object detection features. Market analysts reveal that depth sensing technology will grow significantly between 2025 and 2035 to reach USD 11,754 million initially before expanding to USD 17,566 million while maintaining a 4.1% CAGR.

The market experiences growth because smartphones and augmented reality applications require increasing 3D sensing functionality. Depth sensing continues to gain adoption within the automotive industry as a component for autonomous driving systems together with advanced driver-assistance systems (ADAS).

Depth sensing finds use in both healthcare imaging systems and industrial robotics applications to achieve better precision and operational efficiency. Market adoption remains limited by two key challenges involving production expenses along with calibration difficulties. These manufacturing difficulties push companies to pursue sensor precision advances and production expense minimization for making depth sensors more affordable.

Depth Sensing Market features segments across technology and application domains and receives substantial market demand from consumer electronics and automotive industries and industrial automation applications. The market features three core technological components: structured light in addition to time-of-flight (ToF) systems and stereo vision systems.

The depth-acquisition mechanism of structured light technology through projected patterns makes this method the top choice for implementing facial recognition and biometric authentication systems.

AR/VR devices and robotic systems find Time-of-flight sensors regarding distance calculations through light pulse analysis extremely useful due to their high precision measurement capabilities. The stereo vision technology combines several cameras to detect depth which serves essential purposes in industrial applications and automotive safety systems.

The main application segment for depth sensing technology consists of consumer electronics because smartphones and gaming consoles are becoming more advanced with depth capabilities. The automotive sector maintains close monitoring of depth sensors for use in both ADAS applications and autonomous vehicles.

Industrial robotics along with healthcare facilities create increased demand because depth sensors improve both medical imaging accuracy and robotic visual capabilities. New technological progress will secure depth sensing as an essential component for both smart devices and autonomous systems.

Explore FMI!

Book a free demo

The North America depth sensing market is majorly driven by the region being a substantial early adopter of depth sensors in various applications including consumer electronics, autonomous vehicles, and industrial application.

Countries like the United States, and Canada, invest heavily in advanced imaging technologies, thus driving the demand for high-performance depth sensors. Additionally, the region has a lot of research and development actions due to which a lot of innovations in AI-powered depth sensing solution are also developed in the region.

The depth sensing market in Europe is one of the largest, driven by demand from Germany, the United Kingdom, and France. This region's automotive industry is also a major adopter of depth sensing for autonomous drive and safety. Automakers in the European region utilize stereo vision and time-of-flight sensors in ADAS to improve vehicle navigation and hazard detection.

The rising need from industrial automation and healthcare sectors also contributes to the growth in the region. Depth sensing allows robotics manufacturers to improve the precision with which they control their robotic machines.

Market growth is driven by the surge in 3D sensing technology in smartphones, AR/VR applications, and gaming consoles. Automotive manufacturers based in Japan and South Korea provide integrated depth sensing for enhanced vehicle safety capability.

Also, industrial automation sectors of China and India are adopting depth sensors for improved accuracy in robotic movements. While high costs and calibration complexities do provide threats to this market, advancement in technology and large-scale production continues to drive growth in the market in this region.

Challenge: High Costs and Complex Integration

These depth sensing technologies - LiDAR, structured light sensors, time-of-flight (ToF) cameras, and the like - rely on quite complex components, which leads to a very costly development and integration. The high cost of hardware development, calibration and software processing are major barriers to adoption for many budget-sensitive industries.

Moreover, the integration of depth sensing systems into consumer electronics, automotive, and industrial application presents a high degree of challenge and demands for both hardware and software teams to work seamlessly in a collaborative environment. The market penetration is however not as widespread as efficacious because of issues with compatibility across devices and environments.

Opportunity: Expanding Applications in AI, Robotics, and Augmented Reality

There is significant growth potential due to rising demand for depth-sensing solutions in AI-driven applications. Self-driving cars depend on accurate depth perception to drive without crashing, and the AR and VR industries are building out depth sensors to enhance user experience.

Significant improvement in object recognition, precision in movements, etc. robotics-based applications, as well. In healthcare, depth sensing is investigated for non-invasive diagnostics, motion tracking, and surgical guidance. Depth-sensing technology will see widespread adoption in multiple industries as production costs go down, and the miniaturization progresses.

However, from 2020 to 2024 the depth sensing market grew and adopted quickly in smartphone facial recognition, autonomous vehicles, and gaming applications. AI-based imaging and LiDAR-style spatial mapping multiplies depth accuracy, operationalizing the idea in practice in the real world.

High costs and power consumption, however, limited adoption in cost-sensitive sectors. The automotive sector, in particular, was at the forefront of developing and using depth-sensing ranging exploits, mention automotive LiDar in driver assistance systems or autonomous navigation.

From 2025 to 2035 AI mussel tracing using depth sensing in real time for more accurate and efficient spatial recognition. Improving compact low-energy depth sensors will propel wearables and IOT adoption.

The trend to low-power high-precision depth cameras will fuel innovation in mobile and smart home applications. The advances in next-generation LiDAR systems featuring longer range and higher resolution will transform industries like industrial automation, security, and urban planning.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Depth sensing gained traction in facial recognition and automotive safety regulations. Privacy concerns limited adoption in some regions. |

| Technological Advancements | LiDAR, ToF, and structured light improved depth accuracy but remained costly and power-intensive. |

| Consumer Electronics Integration | Smartphones and gaming consoles adopted depth-sensing cameras for facial recognition and gesture control. |

| Automotive Industry Impact | LiDAR adoption grew in autonomous vehicles, but cost limitations restricted mass deployment. |

| Industrial and Robotics Applications | Robotics and automation relied on depth sensing for object detection and spatial mapping. |

| Environmental Sustainability | Depth sensors required significant energy for processing, impacting battery efficiency. |

| Market Growth Drivers | Growth driven by facial recognition, AR/VR, and autonomous vehicle investments. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Governments will introduce stricter regulations on data privacy and LiDAR use in surveillance while encouraging innovation in autonomous mobility. |

| Technological Advancements | AI-powered depth sensing will enhance real-time processing efficiency, and miniaturization will enable low-power applications. |

| Consumer Electronics Integration | Smart home devices, AR glasses, and next-gen wearables will feature ultra-compact depth sensors for enhanced user interaction. |

| Automotive Industry Impact | Next-gen LiDAR with higher efficiency and affordability will drive widespread adoption in electric and autonomous mobility. |

| Industrial and Robotics Applications | AI-integrated depth sensors will enhance robotic vision, improving efficiency in logistics, healthcare, and manufacturing. |

| Environmental Sustainability | Energy-efficient depth sensors and eco-friendly LiDAR components will reduce environmental impact. |

| Market Growth Drivers | Expansion fuelled by smart cities, industrial automation, and AI-driven depth perception solutions. |

Emerging industries like robotics and healthcare are also contributing to this growth, as depth sensing technologies find applications in consumer electronics, automotive, and robotics. One of the main drivers of this growth is the introduction of 3D depth-sensing technologies in smartphones, AR (augmented reality) devices and self-driving cars.

Notable players in the depth sensors market such as Apple, Microsoft, and Intel are pushing innovations in structured light, time-of-flight (ToF), and stereo vision-based depth sensing solution further improves the market landscape.

The automotive industry is a significant part of the property, with LiDAR and 3D depth cameras increasingly becoming more important to ADAS and self-driving technology.

The demand for high-precision depth sensors is also driving commercial applications for depth-sensing applications in biometric authentication, industrial automation, and medical imaging. Act investing in AI-backed depth perception systems further strengthens that USA advantage, driving progress in robotics and smart surveillance technologies as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.3% |

Steady growth in the UK depth sensing market can be attributed to a growing demand for LiDAR and 3D imaging solutions in various verticals such as automotive, defence, and consumer electronics. With depth sensing technology allowing for more advanced applications such as facial recognition and AR/VR in smartphones and gaming consoles, the demand for it has only accelerated its rollout.

Due to vehicle infrastructure laws put in place by the government due to the UK government’s mission to encourage autonomous vehicle testing and smart infrastructure development, LiDAR based mapping and navigation solutions in the UK are focused on this area.

Moreover, the increasing implementation of robotic systems with advanced AI-based depth perception is encouraging market growth; particularly in the logistics, healthcare, and security surveillance industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.0% |

The primary growth factors for the European Union depth sensing market drawback the extensive deployment of 3D sensing technologies in automotive, industrial automation, and smart consumer product sectors; consequently, these latest combined analytics and AI designs to offer 3D sensing, depth sensors in order to precisely discern various objects.

Germany, France, and Italy are at the forefront of deploying their depth-sensing capabilities for self-driving applications, robotic automation, and biometric security. The automotive industry, one of the EU’s key economic drivers, is pushing LiDAR and ToF depth sensing innovations, particularly in advanced driver-assistance systems (ADAS) and autonomous navigation.

The use of depth-sensing solutions is also developing in sectors such as consumer electronics (smartphones, gaming consoles, AR/VR) In addition, the European Commission initiatives towards digital transformation and integration of AI is driving investments in depth perception technologies for smart surveillance and industrial automation applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.2% |

Japan depth sensing market is growing as a result of activities in robotics, smart imaging, automotive. Leveraging the country’s technology leadership in AI-driven robotics and 3D sensing technologies, stereo vision, and structured light and LiDAR-based depth sensing solutions will be adopted.

One of the major market drivers for depth-sensing LiDAR systems is the Japanese automotive market which is investing heavily in autonomous vehicle technology. Moreover, India's booming gaming and AR/VR industry has given rise to demands for real-time depth perception in entertainment applications.

Furthermore, the increasing integration of depth sensors in the industrial manufacturing, security systems, and smart city projects is driving demand for depth sensors in the market, and Japanese firms are leading the way in deploying high-resolution three-dimensional (3D) sensing systems to improve accuracy and efficiency

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

Due to adoption projected way to grow the South Korean depth sensing market, the demand for 3D imaging, LiDAR, and ToF sensors for smartphones, automotive, and industrial automation in South Korea, this will drive the South Korean depth sensing market.

There are also several high-precision depth sensors required for navigation, obstacle detection, and ADAS in the automotive sector, this demand is increasing exponentially in electric, autonomous vehicles. In addition, the growth of the AR/VR and gaming industry is driving the demand for sophisticated depth-sensing solutions, which further enhance the immersive experience.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.1% |

2D imaging systems dominate the depth sensing market, as many advanced 3D imaging and object detection technologies are dependent on these systems. This approach uses structured light and time-of-flight (ToF) technology to accurately measure depth, something that is essential for applications in robotics, automotive and in augmented reality (AR).

Active depth sensors emit infrared signals and detect their reflections, creating high-resolution 3D maps that improve accuracy in fields such as navigation, facial identification and industrial automation.

Active depth sensing is a critical element in the automotive industry, particularly in the domains of autonomous vehicles and advanced driver-assistance systems (ADAS). While also enhancing obstacle detection, lane departure warnings, and collision avoidance mechanisms.

Moreover, active depth sensing is being introduced in consumer electronics including smartphones and gaming consoles to provide users with facial recognition, gesture control, and augmented immersive experiences. As industries develop more automation solutions and intelligent deep sensing capabilities powered by artificial intelligence, the need for the active depth sensing technology is expected to grow, securing market leader status.

Passive Depth Sensing Gains Traction with Advancements in Image Processing

Passive depth sensing has gained popularity over the years as a method of obtaining depth information without an external light source. This approach formed on stereo images and common computational algorithms is broadly used in settings where ambient light conditions are adequate for estimating depth.

In comparison with an active depth sensor, passive methods require less power and fewer hardware components, thus making them more suitable for battery-driven mobile devices like, smartphones, drones and AR headsets.

Booming deployment of passive depth sensor technology in various end-use industries such as medical imaging, security surveillance and smart home applications has contributed to market growth.

Apps also use this technology for non-invasive diagnostic imaging in hospitals and motion tracking during rehabilitation therapy. Passive depth sensors also enhance facial recognition and behavioural analytics for smart security systems, allowing for more reliable access control and threat detection.

Market dynamics market trends passive depth sensing technology market continues to be the preferred choice for various industries due to its cost-effectiveness, a trend that is further validated by trends seen with advancements in neural networks and image processing, which facilitate the optimization of depth estimation accuracy.

Stereo viewing provides a virtual approach for replicating the workings of the human Eye for precise depth calculation which has transformed it as the dominant technology in the depth-supporting field. Stereo vision uses the analytic graduation in differences between two images captured from different angles to create 3D maps in real time, making it is invaluable in robotics, machine vision and industrial applications.

Its utilization of dual-camera systems and no requirement for external lighting sources makes it a cost-effective solution for industries with a need for integrity depth measurement.

It would also have applications in robotics for autonomous navigation, object recognition, and manipulation tasks, allowing machines to interact with their environments and each other in a natural manner. Industrials segment utilises stereo vision solution for quality assurance, defect detection, and automation of assembly lines to enhance higher productivity and precision.

Stereo vision also improves depth perception in AR applications in consumer electronics, resulting in a richer user experience. The stereo vision technology has captured a substantial share in the depth sensing market, and its economical availability potentially enables leading-edge systems across industrial applications.

With High-Speed Depth Sensing, Time-of-Flight (ToF) Technology Disrupts Traditional Solutions

Time-of-flight (ToF) technology has transformed the depth sensing market, offering high speed and high accuracy depth measurements. ToF sensors create real-time 3D maps via the time it takes for a light pulse to bounce off an object and return to the sensor, making them indispensable for automotive, healthcare, and smart device applications.

Precision on the order of millimetres in the depth world enabled ToF Technologies in gesture recognition, augmented reality, and LiDAR enabled navigation. Within the automotive sector, ToF sensors enhance ADAS capabilities, including by augmenting night vision, pedestrian detection, and blind-spot monitoring.

Healthcare applications leverage ToF-based depth sensing for non-contact patient monitoring, posture analysis, and even 3D body scanning used for prosthetics and rehabilitation. The consumer electronics sector embeds ToF sensors in mobile devices and gaming systems for improved biometric recognition and spatial awareness in AR-based gaming.

Now, as industries move towards more AI-powered automation and a greater prevalence of precision-driven applications, ToF tech goes above and beyond and acts as the catalyst that is redefining what is possible in the domain of depth sensing, opening up the door for innovation and growth in the sector.

In the fast-moving depth sensing market basic competition stems from important global companies together with technological innovation groups. The 3D sensing solutions market features specialized companies which use structured light together with time-of-flight (ToF) and stereo vision technology.

Depth sensing solutions provide power to applications which include augmented reality (AR) and robotics as well as autonomous vehicles together with facial recognition and industrial automation systems.

The pursuit of higher depth camera precision together with AI processing capabilities and smaller sensor sizes enables leading companies to enhance market penetration. Both large semiconductor corporations along with newer companies that develop niche depth-sensing technologies participate in the market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Sony Corporation | 18-22% |

| Intel Corporation | 14-18% |

| Apple Inc. | 12-16% |

| Qualcomm Technologies, Inc. | 8-12% |

| Infineon Technologies AG | 5-9% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Sony Corporation | Develops ToF-based depth sensors for smartphones, AR/VR devices, and automotive applications, emphasizing high accuracy and low power consumption. |

| Intel Corporation | Produces RealSense depth cameras using stereo vision and LiDAR for robotics, drones, and industrial automation. Focuses on AI-driven depth perception. |

| Apple Inc. | Integrates structured light and ToF sensors in Face ID and LiDAR scanners, enhancing AR applications and spatial computing capabilities. |

| Qualcomm Technologies, Inc. | Offers Snapdragon-powered depth sensing solutions with AI enhancements for mobile devices, autonomous navigation, and security. |

| Infineon Technologies AG | Manufactures 3D ToF sensors for automotive, industrial, and consumer electronics, ensuring precise real-time depth detection. |

Key Company Insights

Sony Corporation (18-22%)

Sony dominates the depth sensing market with ToF-based sensors used in smartphones, AR/VR, and automotive sectors. Its high-resolution sensors offer superior accuracy and energy efficiency, making them a preferred choice for premium applications.

Intel Corporation (14-18%)

Intel’s RealSense cameras utilize stereo vision and LiDAR for robotics, industrial automation, and drones. The company focuses on AI-enhanced depth perception and compact sensor integration.

Apple Inc. (12-16%)

Apple integrates depth sensing in Face ID and LiDAR scanners, enhancing AR experiences and spatial computing. Its innovations drive the adoption of structured light and ToF technologies in consumer electronics.

Qualcomm Technologies, Inc. (8-12%)

Qualcomm provides Snapdragon-powered depth sensing with AI enhancements, supporting mobile devices, autonomous systems, and security applications. Its solutions focus on high efficiency and real-time processing.

Infineon Technologies AG (5-9%)

Infineon specializes in 3D ToF sensors for automotive, industrial, and consumer electronics, ensuring high-precision depth detection. Its sensors play a key role in autonomous navigation and smart devices.

Other Key Players (35-45% Combined)

Several other companies contribute significantly to the depth sensing market, focusing on innovation, cost optimization, and new application development. These include:

The overall market size for Depth Sensing Market was USD 11,754 Million in 2025.

The Depth Sensing Market is expected to reach USD 17,566 Million in 2035.

The rising adoption of depth sensing technology in facial recognition, augmented reality (AR), robotics, and automotive applications fuels the Depth Sensing Market during the forecast period.

The top 5 countries which drives the development of Depth Sensing Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of Active Depth Sensing to command significant share over the forecast period.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.